Middle East and Africa Blower Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD4931

November 2024

96

About the Report

MEA Blower Market Overview

- The MEA blower market is valued at USD 1.03 billion, driven by investments in infrastructure development, particularly in the oil & gas, petrochemical, and water treatment industries. The region's rapid urbanization and industrial expansion, particularly in countries like Saudi Arabia and the UAE, contribute to the increasing demand for blowers across multiple sectors. Government initiatives aimed at improving energy efficiency and reducing carbon emissions further fuel market growth. The expansion of industrial manufacturing capabilities across the region is another contributing factor to the growing market size.

- Saudi Arabia, the UAE, and Egypt are dominant in the MEA blower market due to their substantial investments in oil and gas refineries, petrochemical plants, and water treatment facilities. Saudi Arabias strategic focus on Vision 2030, which aims to diversify its economy, and the UAEs industrial investments to position itself as a hub for energy and infrastructure projects, drive blower demand. Additionally, Egypts emphasis on improving its industrial and energy infrastructure is solidifying its market dominance in North Africa.

- Governments in the MEA region has set ambitious emissions reduction targets that are directly influencing blower technology. Saudi Arabias pledge to reach net-zero emissions by 2060 has triggered stricter emissions standards across industrial sectors. In 2023, the region saw the introduction of new regulations requiring industrial plants to install blowers that limit CO2 emissions, particularly in oil refineries, according to the Saudi Green Initiative.

MEA Blower Market Segmentation

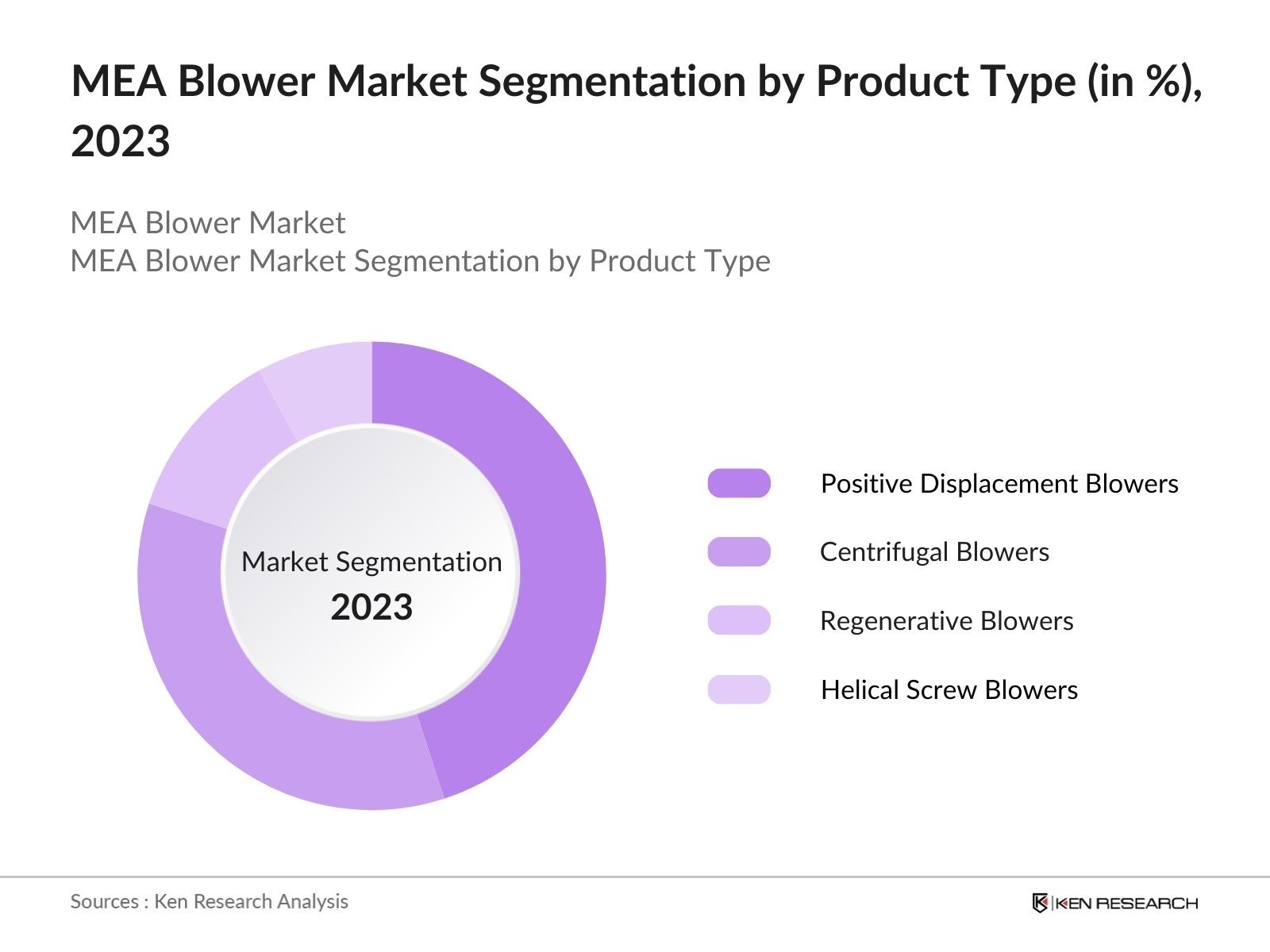

By Product Type: The market is segmented by product type into positive displacement blowers, centrifugal blowers, regenerative blowers, and helical screw blowers. Positive displacement blowers dominate the market share due to their wide usage in high-pressure applications, including oil & gas and water treatment plants. These blowers are preferred for their reliability in continuous operations and ability to handle varying pressures, making them essential in industrial applications where consistent airflow is critical.

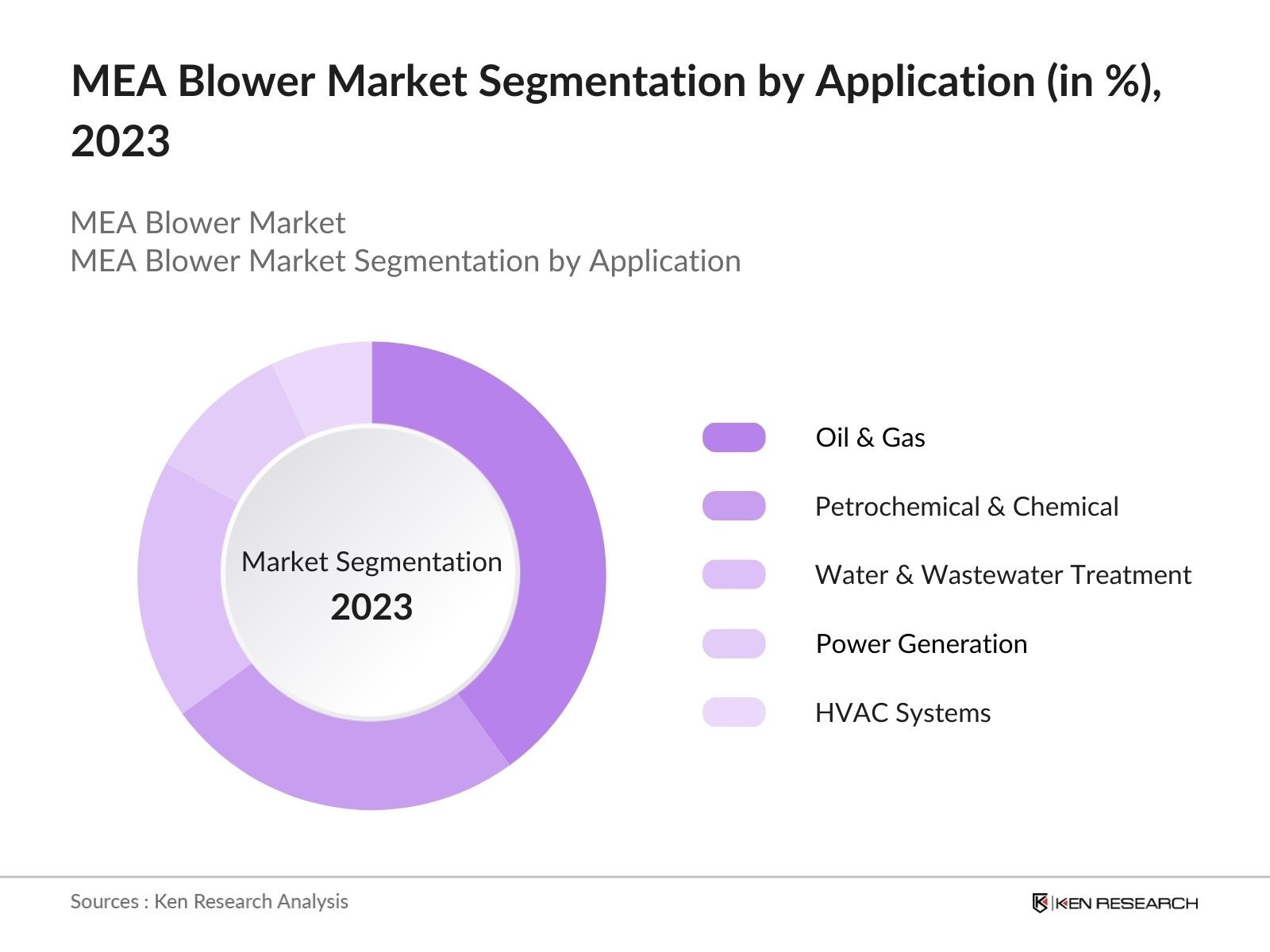

By Application: The market is further segmented by application into oil & gas, petrochemical & chemical, water & wastewater treatment, power generation, and HVAC systems. The oil & gas sector dominates this segmentation due to the heavy use of blowers in refining and processing activities. Blowers in this sector ensure efficient ventilation, cooling, and air handling during extraction, refining, and transportation processes, making them indispensable to the oil & gas industry in the region.

MEA Blower Market Competitive Landscape

The MEA blower market is highly competitive, with a few major international and regional players leading the market. These companies have consolidated their positions by offering energy-efficient, reliable, and technologically advanced products. The major players in the market often collaborate with regional players to enhance their distribution networks and provide localized solutions. The competition is driven by factors such as product innovation, energy efficiency, and service reliability. Companies like Gardner Denver and Atlas Copco dominate the market by consistently offering high-performance blowers tailored to the specific needs of industrial clients across sectors.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Range |

Global Presence |

R&D Investment |

Certifications (ISO 9001, etc.) |

|

Gardner Denver |

1859 |

Milwaukee, USA |

||||||

|

Atlas Copco |

1873 |

Stockholm, Sweden |

||||||

|

Howden Group |

1854 |

Renfrew, Scotland |

||||||

|

Kaeser Kompressoren |

1919 |

Coburg, Germany |

||||||

|

Aerzen Group |

1864 |

Aerzen, Germany |

MEA Blower Industry Analysis

Growth Drivers

- Industrial Growth: The Middle East and Africa (MEA) region has seen a strong industrial growth trajectory driven by key sectors such as oil and gas, petrochemicals, and manufacturing. In 2022, oil production in Saudi Arabia reached approximately 10.6 million barrels per day, according to the International Energy Agency (IEA). With increasing investments in petrochemical plants and refinery expansions, the demand for blowers in these sectors is expected to remain steady. For instance, Qatars $10 billion investment in its North Field Expansion project further highlights the robust industrial activity in the region.

- Urbanization and Infrastructure Development: Urbanization and rapid infrastructure development across the MEA region have created a substantial demand for air systems like blowers in construction projects. In 2023, Saudi Arabia's urban population accounted for over 84% of the total population, according to World Bank data. This has driven the demand for residential, commercial, and industrial building infrastructure, creating opportunities for the blower market in HVAC systems and construction applications. Mega projects like Saudi Arabia's Neom city (worth $500 billion) further contribute to the growing infrastructure needs.

- Government Initiatives for Energy Efficiency: Governments across the MEA region are promoting energy efficiency through various regulatory frameworks. In 2022, Saudi Arabia introduced the National Energy Efficiency Program, targeting energy consumption reductions in industrial operations, which include air systems like blowers. This program supports upgrading older systems to energy-efficient models that comply with standards like ISO 50001. In the UAE, the Green Economy for Sustainable Development initiative also prioritizes reducing energy consumption across sectors, further driving the demand for energy-efficient blowers.

Market Challenges

- High Operational Costs: Blowers in industrial settings require maintenance and energy input, which can drive up operational costs. In the MEA region, the average energy consumption per unit in industrial blowers remains a challenge, particularly in areas like oil refineries, where blowers operate continuously. The IEA reported that industrial energy use in Saudi Arabia accounted for 28% of total energy consumption in 2022, highlighting the high energy demands of these sectors. This makes operational costs a crucial factor affecting market expansion.

- Competition from Low-Cost Alternatives: The blower market in MEA faces competition from low-cost alternatives produced in regions like Asia. With economies of scale and cheaper labor costs, manufacturers in China and India can provide lower-cost blowers that meet basic operational requirements. This price competition puts pressure on regional manufacturers, particularly for industries like manufacturing, which seek to minimize capital expenditure. Import data from the UAE shows a steady increase in blower imports from low-cost manufacturing regions, putting a strain on local suppliers.

MEA Blower Market Future Outlook

Over the next five years, the MEA blower market is expected to experience growth, driven by continuous investments in infrastructure, increased oil & gas production, and the expansion of industrial water treatment facilities. The market will also benefit from the adoption of energy-efficient and low-maintenance blowers, as regulatory bodies across the region are increasingly emphasizing sustainable practices. Moreover, the rise of smart manufacturing and industrial automation will further drive the demand for advanced blower systems, especially those integrated with digital monitoring capabilities.

Future Market Opportunities

- Technological Advancements in Blower Designs: The demand for high-efficiency blowers with advanced digital monitoring systems is growing in the MEA region. Innovations like variable speed drives (VSD) and real-time monitoring systems are helping reduce energy consumption in industries like petrochemicals. In 2023, the Saudi Aramco plant integrated digital monitoring into its blower systems, optimizing energy use by 15%, according to the Kingdoms Ministry of Energy. Such technological improvements are creating opportunities for businesses in the blower market.

- Growing Demand for Industrial Automation: The growth of smart manufacturing is driving the adoption of automated blower systems across industries. In the MEA region, automation is playing a key role in sectors like oil refining and water treatment. According to a report by the Saudi Ministry of Industry and Mineral Resources, automation increased by 25% across major industrial sectors in 2023. This shift towards automated processes includes the use of smart blowers that can self-regulate and reduce energy consumption, making it a key market opportunity.

Scope of the Report

|

Product Type |

Positive Displacement Blowers Centrifugal Blowers Regenerative Blowers Helical Screw Blowers |

|

Application |

Oil & Gas Petrochemical & Chemical Water & Wastewater Treatment Power Generation HVAC Systems |

|

Technology |

Single-Stage Technology Multi-Stage Technology Variable Speed Drives |

|

Pressure Range |

Low Pressure (Below 0.35 bar) Medium Pressure (0.351 bar) High Pressure (Above 1 bar) |

|

Region |

GCC (Saudi Arabia, UAE, Qatar) North Africa (Egypt, Morocco) Sub-Saharan Africa |

Products

Key Target Audience

Oil & Gas Companies

Petrochemical Plants

Water Treatment Plants

HVAC System Integrators

Power Generation Companies

Banks and Financial Institutes

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Energy Efficiency Center, UAE Ministry of Energy and Infrastructure)

Industrial Automation Companies

Companies

Major Players

Gardner Denver Holdings

Atlas Copco

Howden Group

Kaeser Kompressoren

Aerzen Group

Ingersoll Rand

Tuthill Corporation

Hitachi Industrial Equipment Systems

Spencer Turbine Company

Shandong Zhangqiu Blower

United Blower

Everest Blowers

Shaangu Group

Neumatica SA

ABC Blower Co.

Table of Contents

1. MEA Blower Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Blower Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Blower Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Growth (Oil & Gas, Petrochemical, Manufacturing Sectors)

3.1.2. Urbanization and Infrastructure Development

3.1.3. Government Initiatives for Energy Efficiency (Regulatory Incentives)

3.1.4. Rising Demand for Clean Air Systems (Environmental Regulations)

3.2. Market Challenges

3.2.1. High Operational Costs (Maintenance and Energy Consumption)

3.2.2. Competition from Low-Cost Alternatives

3.2.3. Environmental Compliance Challenges

3.3. Opportunities

3.3.1. Technological Advancements in Blower Designs (High-Efficiency Blowers, Digital Monitoring)

3.3.2. Growing Demand for Industrial Automation (Smart Manufacturing)

3.3.3. Expansion of HVAC and Water Treatment Facilities (Infrastructure Development)

3.4. Trends

3.4.1. Integration with IoT and Smart Control Systems

3.4.2. Increasing Use of Blowers in Renewable Energy Applications (Wind, Solar)

3.4.3. Focus on Noise and Vibration Reduction in Blower Systems

3.5. Government Regulations

3.5.1. Energy Efficiency Standards (ISO 50001, Local Energy Standards)

3.5.2. Emissions Reduction Targets (CO2 Reduction)

3.5.3. Industry-Specific Guidelines (Oil & Gas, Mining)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. MEA Blower Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Positive Displacement Blowers

4.1.2. Centrifugal Blowers

4.1.3. Regenerative Blowers

4.1.4. Helical Screw Blowers

4.2. By Application (In Value %)

4.2.1. Oil & Gas

4.2.2. Petrochemical & Chemical

4.2.3. Water & Wastewater Treatment

4.2.4. Power Generation

4.2.5. HVAC Systems

4.3. By Technology (In Value %)

4.3.1. Single-Stage Technology

4.3.2. Multi-Stage Technology

4.3.3. Variable Speed Drives

4.4. By Pressure Range (In Value %)

4.4.1. Low Pressure (Below 0.35 bar)

4.4.2. Medium Pressure (0.351 bar)

4.4.3. High Pressure (Above 1 bar)

4.5. By Region (In Value %)

4.5.1. GCC (Saudi Arabia, UAE, Qatar)

4.5.2. North Africa (Egypt, Morocco)

4.5.3. Sub-Saharan Africa

5. MEA Blower Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Gardner Denver Holdings

5.1.2. Atlas Copco

5.1.3. Kaeser Kompressoren

5.1.4. Howden Group

5.1.5. Aerzen Group

5.1.6. Ingersoll Rand

5.1.7. Tuthill Corporation

5.1.8. Hitachi Industrial Equipment Systems

5.1.9. Spencer Turbine Company

5.1.10. Shandong Zhangqiu Blower

5.1.11. United Blower

5.1.12. Everest Blowers

5.1.13. Shaangu Group

5.1.14. Neumatica SA

5.1.15. ABC Blower Co.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Regional Presence, Manufacturing Capability, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. MEA Blower Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Emission Regulations and Compliance

6.3. Certification Processes and Approvals

7. MEA Blower Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Blower Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Pressure Range (In Value %)

8.5. By Region (In Value %)

9. MEA Blower Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key variables and mapping out the ecosystem of stakeholders within the MEA blower market. This process involves desk research and data collection from secondary sources such as industry reports, proprietary databases, and government publications, ensuring a comprehensive understanding of the markets landscape.

Step 2: Market Analysis and Construction

Historical data from the blower market is analyzed to establish market growth patterns and the interplay between product demand and industrial sectors. This step includes evaluating market penetration rates across the MEA region, with a focus on sector-specific adoption of blower technology.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses formed during the initial analysis, interviews with industry experts are conducted. These insights are gathered through telephone interviews (CATIS) with professionals from leading companies in the blower industry, providing real-time feedback on market dynamics and operational challenges.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data and insights into a cohesive report. The accuracy of the findings is cross verified through further interactions with industry professionals and experts in blower technology to ensure the validity and reliability of the market forecasts and growth drivers.

Frequently Asked Questions

01. How big is the MEA Blower Market?

The MEA blower market is valued at USD 1.03 billion, driven by infrastructure investments in oil & gas, petrochemicals, and water treatment sectors. Industrial growth and regulatory focus on energy efficiency are key factors fueling demand.

02. What are the challenges in the MEA Blower Market?

Challenges in the MEA blower market include high operational costs, stringent environmental regulations, and the emergence of low-cost alternatives. Companies need to innovate to meet efficiency and compliance standards.

03. Who are the major players in the MEA Blower Market?

Key players in the MEA blower market include Gardner Denver, Atlas Copco, Howden Group, Kaeser Kompressoren, and Aerzen Group. These companies maintain dominance due to their robust product portfolios, technological innovation, and strong regional presence.

04. What are the growth drivers of the MEA Blower Market?

Key growth drivers in the MEA blower market include industrialization, increased infrastructure development, particularly in oil & gas and water treatment sectors, and government regulations pushing for energy efficiency and emission reductions.

05. Which product types dominate the MEA Blower Market?

Positive displacement blowers lead the MEA blower market due to their reliability in high-pressure industrial applications, particularly in the oil & gas and water treatment sectors. Their ability to handle varying pressures makes them essential for continuous operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.