Middle East and Africa CBTC Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9832

October 2024

87

About the Report

Middle East and Africa CBTC Market Overview

- The Middle East and Africa CBTC (Communication-Based Train Control) market is valued at USD 150 million. This market is driven primarily by large-scale rail modernization projects across the region, including expanding urban transportation networks, particularly metro systems. Significant investments by governments in countries like Saudi Arabia, the UAE, and Egypt have accelerated the adoption of CBTC systems, which offer efficient and safe train operations by reducing headways and increasing rail network capacity

- The Middle East dominates the market, with countries like Saudi Arabia, the UAE, and Egypt leading the adoption of CBTC technology due to their robust rail infrastructure projects. Saudi Arabias Vision 2030, which includes extensive railway expansion in cities like Riyadh and Jeddah, as well as the UAEs focus on modernizing the Dubai Metro, are prime examples of this dominance. North Africa, particularly Egypt, also plays a significant role in the regions CBTC market due to its efforts in upgrading the Cairo metro and plans to extend the network further. These countries focus on smart transportation solutions and government-backed rail projects makes them key players in the CBTC market.

- National transport plans in countries like South Africa, Egypt, and Saudi Arabia emphasize the importance of smart transportation projects. In 2023, Egypt announced the implementation of smart transportation networks as part of its $25 billion national infrastructure plan, including CBTC systems for major cities. These national plans highlight the strategic importance of modern rail systems in urban mobility and economic development.

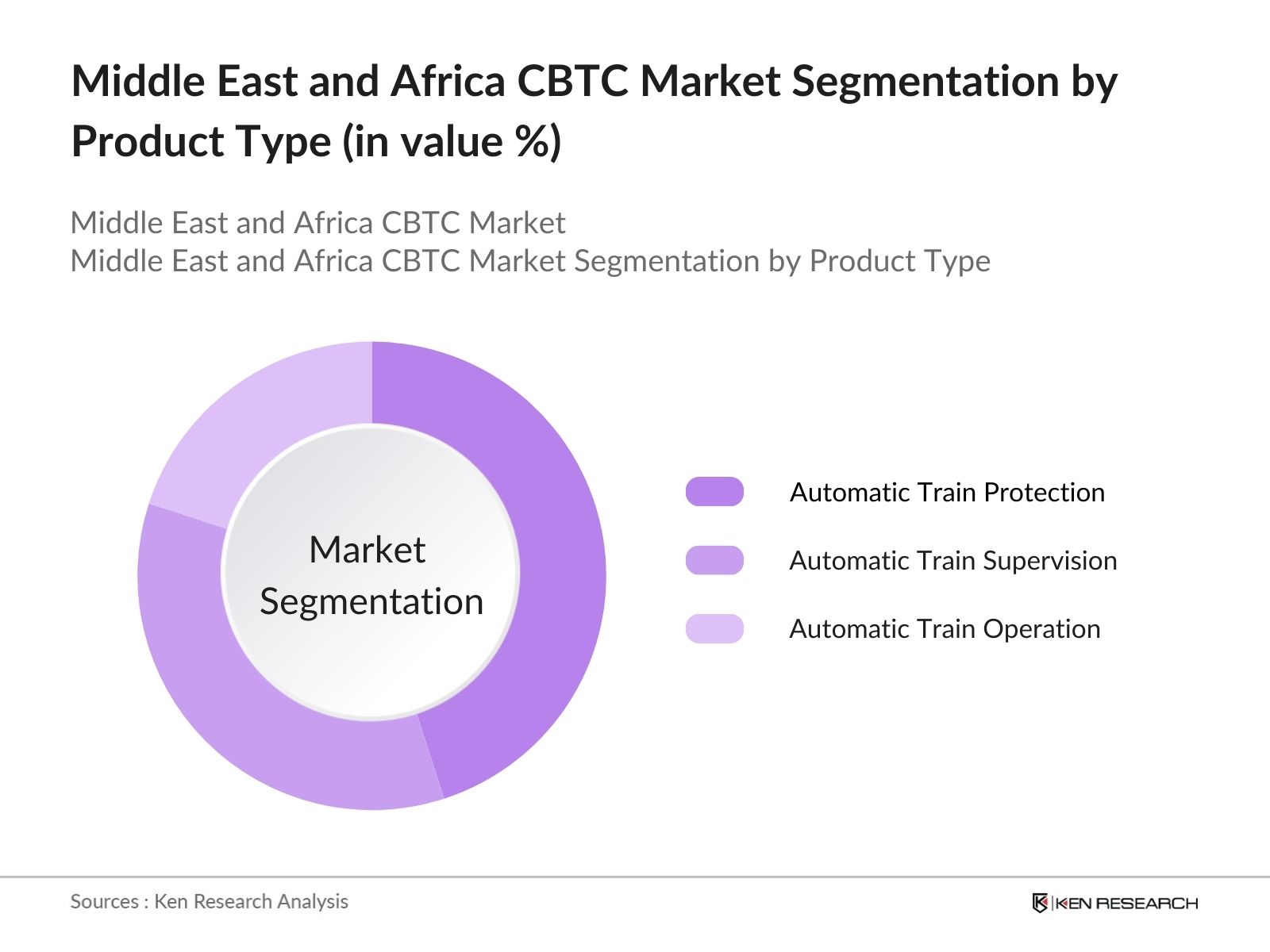

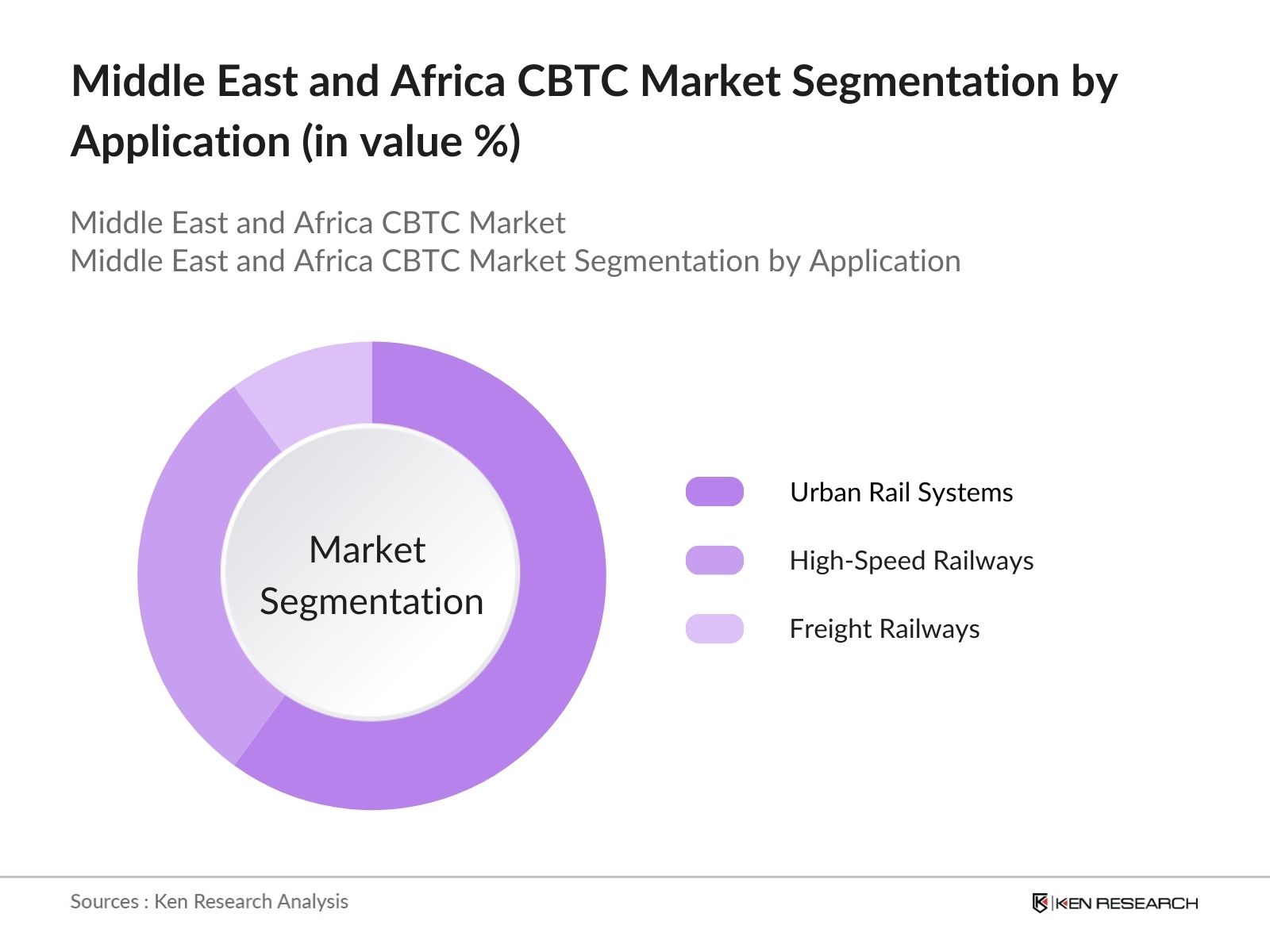

Middle East and Africa CBTC Market Segmentation

The Middle East and Africa CBTC market is segmented by product type and by application.

- By Product Type: The market is segmented by product type into Automatic Train Protection (ATP), Automatic Train Supervision (ATS), and Automatic Train Operation (ATO). Among these, Automatic Train Protection (ATP) has a dominant market share due to its critical role in ensuring the safety of train operations. ATP systems prevent train collisions by automatically controlling the speed and enforcing braking. The necessity of these safety features, especially in congested urban environments and new high-speed rail projects, has led to a growing demand for ATP systems. Additionally, regulatory bodies in the region mandate stringent safety protocols, further driving the adoption of ATP in both greenfield and brownfield projects.

- By Application: By application, the Middle East and Africa CBTC market is segmented into Urban Rail Systems (Metro Systems, Light Rail Transit), High-Speed Railways, and Freight Railways. The Urban Rail Systems segment holds a dominant share of the market, particularly because of the expansion of metro and light rail systems in cities like Dubai, Riyadh, and Cairo. Urbanization in these cities has led to increased demand for reliable, high-capacity urban rail services. CBTC systems play a key role in meeting these demands by improving the efficiency and safety of these rail networks. These systems allow for more frequent trains and better control, which is crucial in densely populated urban areas. Furthermore, government initiatives for smart city projects further bolster the adoption of CBTC in urban rail systems.

Middle East and Africa CBTC Market Competitive Landscape

The Middle East and Africa CBTC market is highly competitive, with a mix of global giants and regional players. The market is dominated by established companies with a strong foothold in rail technology and infrastructure. Companies like Siemens Mobility, Alstom SA, and Bombardier Transportation have secured large-scale contracts for CBTC installations in major rail projects across the region. Their extensive experience and technological leadership make them preferred choices for CBTC projects, ensuring reliable and innovative solutions. Additionally, local governments often partner with these firms due to their ability to meet stringent safety and regulatory requirements, further solidifying their market dominance.

|

Company |

Establishment Year |

Headquarters |

Revenue from Rail |

Government Contracts |

Installed Base |

R&D Investments |

Technology Leadership |

Local Partnerships |

|

Siemens Mobility |

1847 |

Munich, Germany |

||||||

|

Alstom SA |

1928 |

Saint-Ouen, France |

||||||

|

Bombardier Transportation |

1942 |

Berlin, Germany |

||||||

|

Thales Group |

1893 |

Paris, France |

||||||

|

Hitachi Rail STS |

1881 |

Genoa, Italy |

Middle East and Africa CBTC Market Analysis

Growth Drivers

- Urbanization and Population Growth: The Middle East and Africa (MEA) region is experiencing rapid urbanization, with cities like Cairo, Lagos, and Johannesburg leading in population growth. Cairos population, for example, has surpassed 20 million in 2023, increasing the demand for efficient transportation solutions. This surge in urbanization has created a significant need for modern rail systems, particularly Communication-Based Train Control (CBTC) systems, which can increase the frequency of trains and reduce congestion. Governments across the region are focusing on addressing transportation issues by upgrading urban rail infrastructure to manage the growing populations.

- Government Initiatives towards Smart Transportation (Metro projects, Rail modernization): Governments in the Middle East and Africa have been actively investing in metro projects and rail modernization initiatives. The Egyptian government has allocated over $20 billion for new metro lines in Cairo by 2025. Similarly, South Africa has invested around $3.5 billion into the modernization of its rail system through the Passenger Rail Agency of South Africa (PRASA). These investments are aimed at improving rail network efficiency, safety, and automation, making CBTC systems crucial in achieving these objectives.

- Increasing Investments in Rail Infrastructure (Public-Private Partnerships, Multilateral Bank Investments): The rail infrastructure in the Middle East and Africa is benefitting from both public and private sector investments. Countries like Saudi Arabia have launched public-private partnerships (PPP) to enhance their rail networks, with over $22 billion committed to railway projects such as the Riyadh Metro. Additionally, multilateral banks like the African Development Bank (AfDB) have allocated over $1.5 billion for rail infrastructure projects in Sub-Saharan Africa, including CBTC systems to improve operational efficiency and reduce delays.

Market Challenges

- High Capital Investments (Infrastructure costs, Training requirements for workforce): The implementation of CBTC systems in the Middle East and Africa faces significant challenges due to high capital costs. A single metro line outfitted with CBTC technology in the UAE, for example, can cost over $300 million in infrastructure alone. Furthermore, the need for specialized workforce training adds an additional burden, with estimates suggesting that training costs for rail operators can exceed $5 million per project. This makes CBTC adoption a costly venture, particularly in developing economies.

- Regulatory and Technical Challenges (Regulatory harmonization across regions, System compatibility): The lack of regulatory harmonization across the Middle East and Africa has presented challenges in the deployment of CBTC systems. Different countries have varying technical standards for rail infrastructure, making cross-border projects complex. For instance, rail operators in Kenya and Uganda have struggled to integrate CBTC technology due to differing national rail safety regulations. Additionally, ensuring compatibility between legacy systems and modern CBTC systems remains an ongoing challenge for older rail networks in these regions.

Middle East and Africa CBTC Market Future Outlook

Over the next five years, the Middle East and Africa CBTC market is expected to show significant growth driven by continued government investment in rail infrastructure, urbanization, and the growing demand for efficient transportation solutions. The shift towards smart cities and the integration of advanced rail technologies, such as IoT and autonomous train operations, will further accelerate the adoption of CBTC systems. Countries in the region will continue to rely on CBTC technology to modernize existing networks and expand their urban rail systems, particularly in regions like the UAE, Saudi Arabia, and Egypt.

Market Opportunities

- Expansion into Emerging Economies (Growing demand in Sub-Saharan Africa, New urban metro systems): Sub-Saharan Africa presents a significant opportunity for the expansion of CBTC systems as urban metro projects are on the rise. For instance, Nigeria has committed $1 billion to the development of the Lagos Rail Mass Transit, which includes CBTC technology. Countries such as Ethiopia and Tanzania are also investing heavily in urban metro systems as part of their infrastructure development plans, creating a fertile ground for CBTC expansion across emerging economies.

- Technology Advancements in Automation (Integration of AI and IoT with CBTC systems): The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technology with CBTC systems is revolutionizing rail transportation in the region. In the UAE, for instance, Dubais metro has incorporated AI-powered predictive maintenance, reducing downtime by 30% in 2024. IoT sensors are now widely used to monitor train performance and track conditions in real-time, which significantly enhances the efficiency and safety of operations. Such technological advancements provide tremendous opportunities for upgrading existing CBTC systems.

Scope of the Report

|

|||||||||

|

By Technology |

|

||||||||

|

By Application |

|

||||||||

|

By Deployment Type |

|

||||||||

|

By Region |

North East West South |

Products

Key Target Audience

Rail Operators and Service Providers

Communication-Based Train Control Technology Providers

Rail Infrastructure Developers

Government and Regulatory Bodies (Ministry of Transport, Transport Regulatory Authorities)

Investors and Venture Capitalist Firms

Public-Private Partnership Participants

Banks and Financial Institutes

Urban Planning and Smart City Initiatives

International Financial Institutions (World Bank, African Development Bank)

Companies

Players Mention in the Report:

-

Siemens Mobility

Alstom SA

Bombardier Transportation

Thales Group

Hitachi Rail STS

CRRC Corporation Limited

CAF Group

Mitsubishi Electric Corporation

Wabtec Corporation

Nokia Networks

Schneider Electric

Ansaldo STS

Huawei Technologies

ABB Group

GE Transportation

Table of Contents

1. Middle East and Africa CBTC Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East and Africa CBTC Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (CBTC installations, Major contract awards, Technological advancements in automation)

3. Middle East and Africa CBTC Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Population Growth (Middle East & Africa Specific Transportation Needs)

3.1.2. Government Initiatives towards Smart Transportation (Metro projects, Rail modernization)

3.1.3. Increasing Investments in Rail Infrastructure (Public-Private Partnerships, Multilateral Bank Investments)

3.2. Market Challenges

3.2.1. High Capital Investments (Infrastructure costs, Training requirements for workforce)

3.2.2. Regulatory and Technical Challenges (Regulatory harmonization across regions, System compatibility)

3.2.3. Maintenance and Upgradation Issues (Maintenance of legacy systems, Skilled workforce shortages)

3.3. Opportunities

3.3.1. Expansion into Emerging Economies (Growing demand in Sub-Saharan Africa, New urban metro systems)

3.3.2. Technology Advancements in Automation (Integration of AI and IoT with CBTC systems)

3.3.3. Increased Government Spending (Funding from local governments and international development banks)

3.4. Trends

3.4.1. Integration with Smart City Initiatives (Smart rail corridors, Connected mobility solutions)

3.4.2. Autonomous Train Operations (ATO) (Level of automation advancements in CBTC systems)

3.4.3. Collaboration between Rail Operators and Technology Providers (Strategic alliances, Knowledge sharing platforms)

3.5. Government Regulation

3.5.1. National Transport Plans (Smart transportation projects)

3.5.2. Compliance Requirements for Safety and Security (International rail safety standards)

3.5.3. Public-Private Partnerships and International Funding Support (World Bank, African Development Bank investments)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Rail operators, technology providers, integrators, government agencies)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Middle East and Africa CBTC Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Automatic Train Protection (ATP)

4.1.2. Automatic Train Supervision (ATS)

4.1.3. Automatic Train Operation (ATO)

4.2. By Application (In Value %)

4.2.1. Urban Rail Systems (Metro Systems, Light Rail Transit)

4.2.2. High-Speed Railways

4.2.3. Freight Railways

4.3. By Technology (In Value %)

4.3.1. Moving Block CBTC Systems

4.3.2. Fixed Block CBTC Systems

4.4. By Deployment Type (In Value %)

4.4.1. Greenfield Projects

4.4.2. Brownfield Projects

4.5. By Region (In Value %)

4.5.1. South

4.5.2. North

4.5.3. East

4.5.4. West

5. Middle East and Africa CBTC Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Mobility

5.1.2. Alstom SA

5.1.3. Bombardier Transportation

5.1.4. Thales Group

5.1.5. Hitachi Rail STS

5.1.6. CRRC Corporation Limited

5.1.7. CAF Group

5.1.8. Mitsubishi Electric Corporation

5.1.9. Wabtec Corporation

5.1.10. Nokia Networks

5.1.11. Schneider Electric

5.1.12. Ansaldo STS

5.1.13. Huawei Technologies

5.1.14. ABB Group

5.1.15. GE Transportation

5.2. Cross Comparison Parameters (Technology leadership, Market presence, Regional deployment, Revenue from rail transportation, Government contracts, Innovation in automation, R&D investments, Installed base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East and Africa CBTC Market Regulatory Framework

6.1. Rail Safety Regulations (Certification processes, compliance with International Union of Railways - UIC)

6.2. Compliance Requirements (Local and regional rail transport regulations)

6.3. Certification Processes (CBTC system certifications for safety and interoperability)

7. Middle East and Africa CBTC Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East and Africa CBTC Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Type (In Value %)

8.5. By Region (In Value %)

9. Middle East and Africa CBTC Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in our methodology involves constructing a comprehensive ecosystem map covering the major stakeholders in the Middle East and Africa CBTC market. We utilize secondary data sources, including government reports and industry databases, to identify key variables influencing the market, such as rail infrastructure projects and urbanization trends.

Step 2: Market Analysis and Construction

In this step, we gather and analyze historical data on market size, installation base, and revenue generation from CBTC systems across the region. By examining the deployment of CBTC technologies in various countries and cities, we are able to assess market penetration and future growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through extensive interviews with industry experts, including rail operators, government officials, and technology providers. These consultations provide critical insights into the operational and technical challenges facing the CBTC market and help refine our projections.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from both primary and secondary sources to produce a detailed, accurate analysis. We collaborate directly with CBTC technology providers and rail operators to verify the accuracy of our findings and ensure that the final report offers actionable insights for stakeholders.

Frequently Asked Questions

1 How big is the Middle East and Africa CBTC Market?

The Middle East and Africa CBTC market is valued at USD 150 million, driven by large-scale urban rail projects and government investments in transportation infrastructure.

2 What are the challenges in the Middle East and Africa CBTC Market?

Challenges in Middle East and Africa CBTC market include high infrastructure costs, regulatory hurdles, and the need for skilled workforce for maintenance and system integration. The lack of standardized regulations across the region also poses a challenge.

3 Who are the major players in the Middle East and Africa CBTC Market?

Key players in Middle East and Africa CBTC market include Siemens Mobility, Alstom SA, Bombardier Transportation, Thales Group, and Hitachi Rail STS. These companies dominate the market due to their technological leadership and extensive experience in rail projects.

4 What are the growth drivers of the Middle East and Africa CBTC Market?

Growth drivers in Middle East and Africa CBTC market include government-backed urbanization projects, increasing investments in smart transportation, and the growing need for efficient and safe rail systems in congested cities across the region.

5 What is the future outlook of the Middle East and Africa CBTC Market?

The Middle East and Africa CBTC market is expected to grow significantly in the coming years, fueled by ongoing rail infrastructure developments, technological advancements, and the region's focus on smart city initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.