Middle East and Africa Drone Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD1835

November 2024

99

About the Report

Middle East and Africa Drone Market Overview

- The Middle East and Africa Drone Market was valued at USD 2.5 billion in 2023, driven by the growing adoption of drone technology across various sectors including defence, agriculture, and logistics. The market is experiencing rapid growth due to the increasing demand for surveillance and security operations, as well as advancements in drone technology.

- Key players in the Middle East and Africa Drone Market include DJI, Parrot SA, AeroVironment Inc., Boeing, and Elbit Systems. These companies are leading innovations in drone capabilities, focusing on enhancing flight time, payload capacity, and autonomous operation.

- The UAE and Israel are leading countries in the drone market within the region, with strong government support for drone technology adoption in both civilian and military applications. Their strategic focus on defense and security is a contributor to market growth.

- In 2023, DJI launched its latest enterprise drone, the Matrice 300 RTK, equipped with enhanced AI capabilities and advanced imaging technology, such as its advanced AI features, 6 Directional Sensing & Positioning, IP45 rating, and compatibility with various payloads.making it a key player in the commercial drone sector in the Middle East and Africa.

Middle East and Africa Drone Market Segmentation

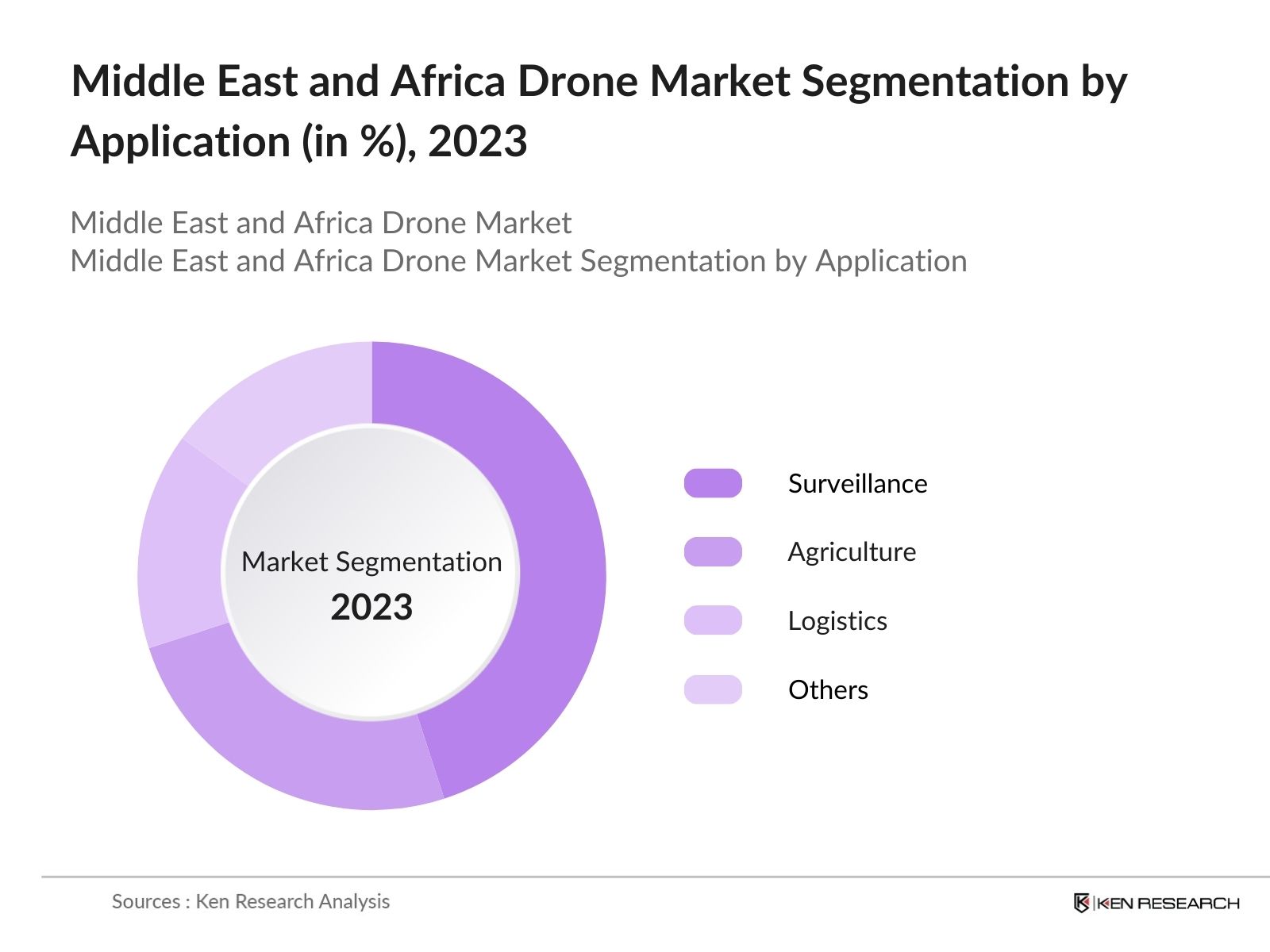

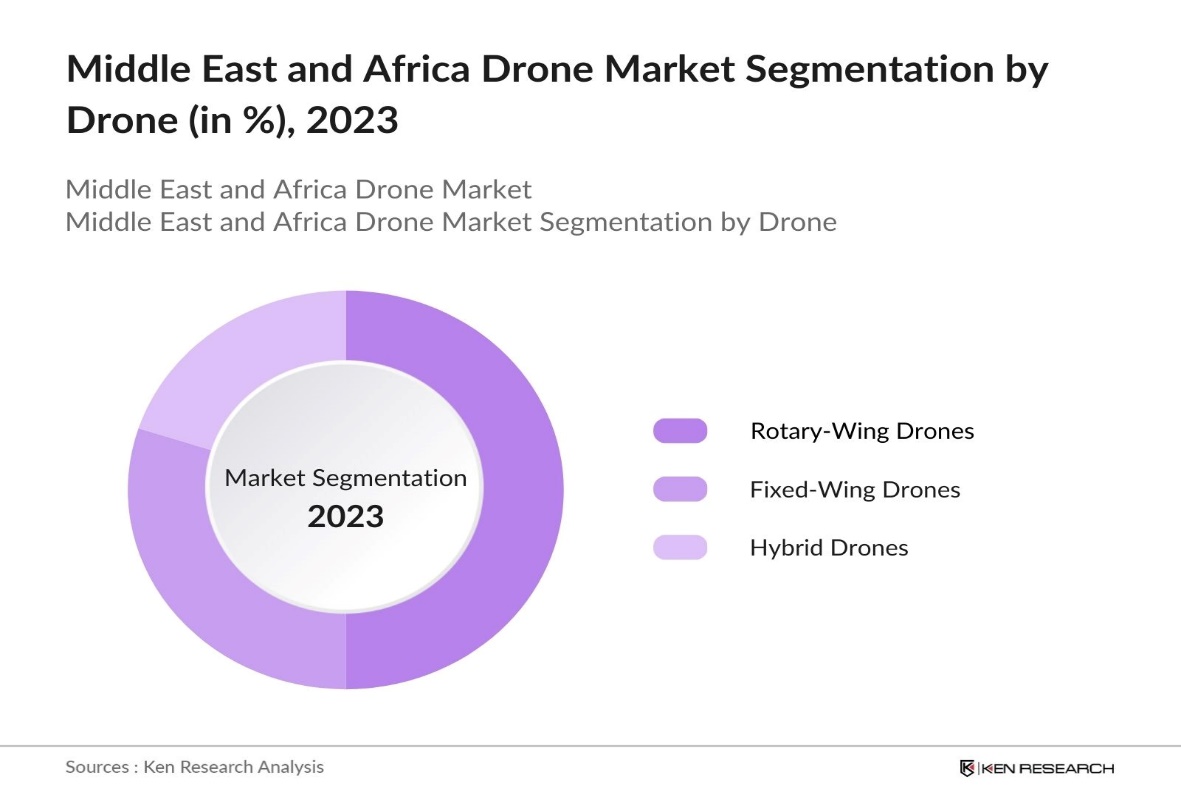

The Middle East and Africa Drone Market can be segmented based on application, drone type, end-user industry, capacity range, and region:

- By Application: The market is segmented into surveillance, agriculture, logistics, and others. In 2023, surveillance held the dominant market share, driven by the regions focus on security and defense operations. The advanced capabilities of drones in monitoring and reconnaissance have made them indispensable for national security.

- By Drone Type: The market is segmented into fixed-wing, rotary-wing, and hybrid drones. In 2023, rotary-wing drones accounted for a significant share due to their versatility and ability to hover, making them ideal for inspection and surveillance tasks across various industries.

- By Region: The market is segmented into UAE, Israel, Saudi Arabia, South Africa, and Nigeria. The UAE and Israel dominated the market in 2023, driven by robust government initiatives and investments in drone technology for both civilian and military purposes.

Middle East and Africa Drone Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

DJI |

2006 |

Shenzhen, China |

|

Parrot SA |

1994 |

Paris, France |

|

AeroVironment Inc. |

1971 |

Simi Valley, USA |

|

Boeing |

1916 |

Chicago, USA |

|

Elbit Systems |

1966 |

Haifa, Israel |

- DJI.: In August 2022, The Drone Centre, a leading DJI Enterprise dealer in the Middle East, introduced two innovative drone solutions: the DJI M30 Series and DJI Zenmuse H20N. These advanced drones are designed to meet the region's growing demand for cutting-edge aerial technology, offering enhanced capabilities for commercial, industrial, and security applications, and aiming to attract a broader customer base.

- Boeing: In 2023, Boeing announced the potential inclusion of its MQ-28 drone in the U.S. Air Force's arsenal. This development signifies a strategic move that could enhance Boeing's collaboration opportunities within the defense sector, including potential applications in the Middle East and Africa.

Middle East and Africa Drone Market Industry Analysis

Growth Drivers:

- Rising Demand for Surveillance and Security: The increasing need for advanced surveillance and security solutions in the Middle East and Africa, driven by geopolitical tensions and security concerns, is a significant growth driver. Countries in the region are increasingly investing in surveillance technologies, including drones, facial recognition, and social media monitoring, as governments seek to maintain stability and control amid rising conflicts. In 2023, the UAEs defense signed various partnerships with different countries, highlighting the importance of drones in national security.

- Expansion of Commercial Drone Applications: The commercial use of drones has expanded rapidly across the Middle East and Africa, particularly in sectors such as logistics and infrastructure inspection. Companies are increasingly leveraging drone technology to streamline delivery processes, enabling faster and more efficient transportation of goods across challenging terrains and congested urban areas.

- Increased Adoption of Drones in Agriculture: The adoption of drones in the agricultural sector has seen a substantial rise across the Middle East and Africa, driven by the need for precision farming solutions. In Morocco, the use of drones by agricultural workers has helped farmers make informed decisions for improving crop water efficiency and yields. The Third Eye project, which uses recreational drones equipped with near-infrared sensors and tailored software, has resulted in a 41% increase in crop production, a 9% reduction in total water use, and a 55% increase in water productivity. This investment is part of a broader trend where drones are being used to enhance agricultural productivity and sustainability, contributing significantly to the market's growth.

Challenges:

- Regulatory Hurdles and Airspace Restrictions: One of the significant challenges in the Middle East and Africa Drone Market is the regulatory environment. Different countries in the region have varying regulations regarding drone usage, leading to complexities for companies operating across borders. In 2023, Nigerias Civil Aviation Authority imposed stricter regulations on drone flights in urban areas, citing safety concerns. These regulatory hurdles can delay the deployment of drone services and increase compliance costs for operators.

- Technical Challenges in Drone Integration: Integrating drones into existing workflows, particularly in sectors like logistics and infrastructure, poses technical challenges. In 2023, South African companies reported difficulties in integrating drones with legacy systems, which led to operational inefficiencies and increased costs. These challenges are often related to software compatibility and the need for specialized training, which can slow down the adoption of drones in these industries

Government Initiatives:

- Saudi Arabias Vision 2030 Drone Strategy: As part of its Vision 2030, the Saudi Arabian government launched a comprehensive drone strategy in 2023 aimed at integrating drones into various sectors, including security, agriculture, and logistics. The strategy focuses on supporting drone technology development and encouraging foreign companies to establish manufacturing facilities within the country. This initiative is designed to position Saudi Arabia as a central hub for drone innovation in the region, fostering growth and technological advancement across multiple industries.

- UAEs National Drone Program: In 2023, the UAE government introduced the National Drone Program, which seeks to enhance the countrys drone capabilities for both civilian and military applications. The program includes regulatory reforms, financial incentives, and investments in drone infrastructure, with a particular focus on urban areas like Dubai and Abu Dhabi. This initiative is part of the UAEs broader goal to establish itself as a global leader in drone technology, driving innovation and expanding the use of drones across various sectors.

Middle East and Africa Drone Market Future Market Outlook

The Middle East and Africa Drone Market are expected to witness substantial growth during the forecast period of 2023-2028, driven by advancements in drone technology, increased adoption in commercial and defense sectors, and supportive government policies.

Future Market Trends:

- Advanced Autonomous Drones for Industrial Applications: By 2028, the market will witness a shift towards advanced autonomous drones designed for industrial applications. These drones will be equipped with AI-driven analytics and real-time decision-making capabilities, enabling them to perform complex tasks such as pipeline inspections, mining operations, and infrastructure monitoring with minimal human intervention. The adoption of these advanced drones is expected to be driven by the regions growing industrial sector and the need for efficient, cost-effective solutions.

- Expansion of Drone Logistics Networks: The drone logistics networks in the Middle East and Africa are expected to expand rapidly over the next five years, particularly in urban areas like Dubai, Tel Aviv, and Johannesburg. By 2028, these networks will cover thousands of routes, providing efficient and reliable delivery services for e-commerce, healthcare, and emergency supplies. The expansion will be supported by continued government investment in drone infrastructure and the development of standardized regulations across the region.

Scope of the Report

|

By Drone |

Fixed-Wing Rotary-Wing Hybrid |

|

By Application |

Surveillance Agriculture Logistics Others |

|

By Region |

UAE Saudi Arabia Israil South Africa Others |

|

By End-User |

Defense Agriculture Logistics Others |

|

By Capacity Range |

Below 20 kg 20-50 kg Above 50 kg |

Products

Key Target Audience:

- Defense and Security Agencies

- Agricultural Companies

- Logistics and Delivery Companies

- Drone Manufacturers

- Government and Regulatory Bodies (UAE Ministry of Energy and Infrastructure, Saudi Ministry of Defense)

- Investors and Venture Capitalists

- Banks and Financial Institutions

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Key Players Mentioned in the Report:

- DJI

- Parrot SA

- AeroVironment Inc.

- Boeing

- Elbit Systems

- General Atomics

- Northrop Grumman

- Thales Group

- BAE Systems

- Textron Inc.

- Leonardo S.p.A.

- Israel Aerospace Industries

- SAAB AB

- Denel Dynamics

- UAVOS Inc.

Table of Contents

1. Middle East and Africa Drone Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Valuation and Historical Performance

1.4. Key Market Trends and Developments

1.5. Market Segmentation Overview

2. Middle East and Africa Drone Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East and Africa Drone Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Surveillance and Security

3.1.2. Expansion of Commercial Drone Applications

3.1.3. Government Initiatives and Regulatory Support

3.2. Challenges

3.2.1. Regulatory and Safety Concerns

3.2.2. High Initial Costs

3.2.3. Technical Challenges in Drone Integration

3.3. Opportunities

3.3.1. Emerging Markets for Drones

3.3.2. Investment in R&D and Innovation

3.4. Trends

3.4.1. Advancements in Autonomous Drones

3.4.2. Integration with IoT and Big Data

3.5. Government Initiatives

3.5.1. UAE Drone Regulation Expansion 2023

3.5.2. Israel Defense Drone Program

3.5.3. South Africa Drone Technology Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Middle East and Africa Drone Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Surveillance

4.1.2. Agriculture

4.1.3. Logistics

4.2. By Drone Type (in Value %)

4.2.1. Fixed-Wing

4.2.2. Rotary-Wing

4.2.3. Hybrid

4.3. By End-User Industry (in Value %)

4.3.1. Defense

4.3.2. Agriculture

4.3.3. Logistics

4.4. By Capacity Range (in Value %)

4.4.1. Below 20 kg

4.4.2. 20-50 kg

4.4.3. Above 50 kg

4.5. By Region (in Value %)

4.5.1. UAE

4.5.2. Israel

4.5.3. Saudi Arabia

4.5.4. South Africa

4.5.5. Nigeria

5. Middle East and Africa Drone Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. DJI

5.1.2. Parrot SA

5.1.3. AeroVironment Inc.

5.1.4. Boeing

5.1.5. Elbit Systems

5.1.6. General Atomics

5.1.7. Northrop Grumman

5.1.8. Thales Group

5.1.9. BAE Systems

5.1.10. Textron Inc.

5.1.11. Leonardo S.p.A.

5.1.12. Israel Aerospace Industries

5.1.13. SAAB AB

5.1.14. Denel Dynamics

5.1.15. UAVOS Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Middle East and Africa Drone Market Competitive Landscape Analysis

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Middle East and Africa Drone Market Regulatory Framework

7.1. UAE Drone Regulation Expansion 2023

7.2. Israel Defense Drone Program

7.3. Compliance Requirements and Certification Processes

8. Middle East and Africa Drone Market Future Outlook (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

8.3. Future Market Segmentation

8.3.1. By Application (in Value %)

8.3.2. By Drone Type (in Value %)

8.3.3. By End-User Industry (in Value %)

8.3.4. By Capacity Range (in Value %)

8.3.5. By Region (in Value %)

9. Middle East and Africa Drone Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Middle East and Africa drone market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Middle East and Africa drone market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple essential drone companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from drone companies.

Frequently Asked Questions

01 How big is the Middle East and Africa Drone Market?

The Middle East and Africa Drone Market was valued at USD 2.5 billion in 2023, driven by increasing demand for surveillance, agricultural applications, and logistics solutions across the region.

02 What are the challenges in the Middle East and Africa Drone Market?

Challenges in the Middle East and Africa drone market include regulatory hurdles across different countries, high operational and maintenance costs, and technical difficulties in integrating drones into existing workflows. These factors can limit market expansion and increase compliance costs.

03 Who are the major players in the Middle East and Africa Drone Market?

Key players in the Middle East and Africa drone market include DJI, Parrot SA, AeroVironment Inc., Boeing, and Elbit Systems. These companies lead the market due to their technological advancements and strategic partnerships in the region.

04 What are the growth drivers of the Middle East and Africa Drone Market?

The Middle East and Africa drone market is driven by the rising adoption of drones in agriculture, increased demand for security and surveillance operations, and the expansion of commercial drone applications in logistics and infrastructure inspection.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.