Middle East and Africa Gaming Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD3167

December 2024

85

About the Report

Middle East and Africa Gaming Market Overview

- The Middle East and Africa Gaming Market is valued at USD 600 million, driven primarily by increased internet penetration, the proliferation of smartphones, and the rising demand for online gaming platforms. Governments in the region have recognized the potential economic benefits of this growing market, leading to investments in infrastructure that support eSports, mobile gaming, and game development. Major gaming events and the launch of local game development studios are contributing to market growth, with the region becoming a key player in the global gaming industry.

- The dominant cities and countries in this market include Saudi Arabia, the UAE, Egypt, and South Africa. These regions have witnessed a rapid rise in gaming due to strong governmental support, increased disposable income, and a young, tech-savvy population. Additionally, the cultural inclination towards competitive eSports in the UAE and Saudi Arabia, coupled with significant investments in gaming infrastructure, positions them as dominant players in the Middle East gaming sector. In Africa, South Africa stands out due to its advanced technological infrastructure and growing interest in mobile gaming.

- Nigerias government has launched an ambitious National Broadband Plan, which aims to provide broadband access to over 70% of the population by 2025. The increase in broadband penetration is expected to enable wider access to online gaming services, especially in urban and semi-urban areas. In 2024, Nigeria already had over 150 million internet users, and the governments initiative is expected to bring millions more online, creating a larger user base for gaming platforms.

Middle East and Africa Gaming Market Segmentation

By Game Type: The Middle East and Africa gaming market is segmented by game type into online games, mobile games, console games, and PC games. Recently, mobile games have held a dominant market share under the game type segmentation, primarily due to the increased affordability and accessibility of smartphones across the region. Platforms like iOS and Android have seen significant growth, with titles like PUBG Mobile and Free Fire experiencing widespread popularity. The convenience of mobile gaming has led to its prominence, especially in African countries where console penetration remains lower.

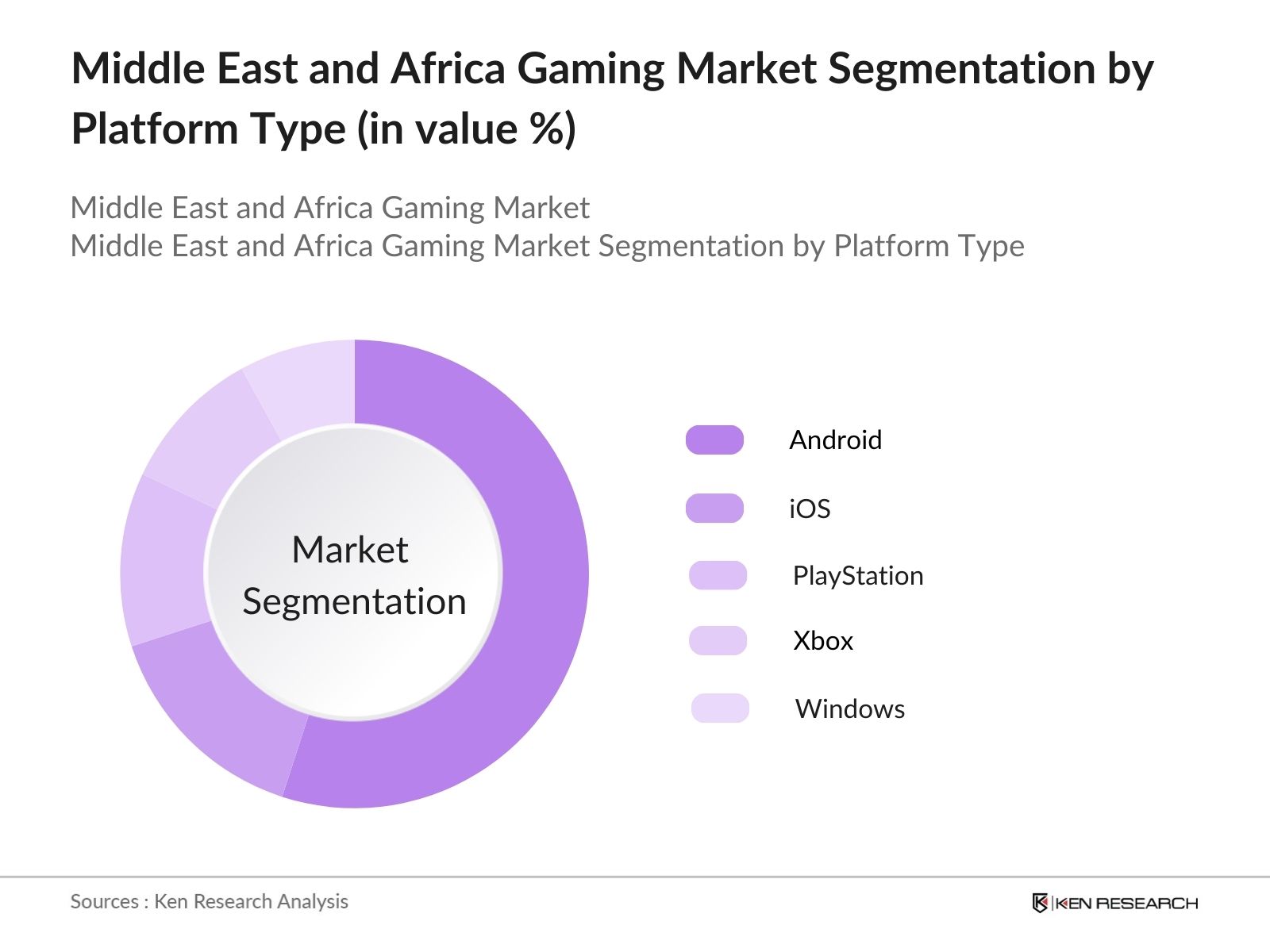

By Platform Type: The Middle East and Africa gaming market is further segmented by platform type into iOS, Android, PlayStation, Xbox, and Windows. Android has emerged as the leading platform in the region due to the high adoption of affordable smartphones. The prevalence of low-cost mobile devices in countries like Nigeria and Egypt has led to Android dominating the mobile gaming sector. Furthermore, the flexibility of Android's open-source ecosystem allows for diverse game development and monetization strategies, further strengthening its market position.

Middle East and Africa Gaming Market Competitive Landscape

The Middle East and Africa Gaming Market is characterized by a mix of regional and international companies. Global giants like Tencent and Sony have made significant inroads, while local players are leveraging regional preferences to capture niche segments. The competitive landscape is marked by increasing investments from both domestic and international firms, with a focus on expanding the eSports ecosystem and developing localized content.

| Company Name | Year of Establishment | Headquarters |

Production Capacity |

Mining Operations |

Supply Agreements |

Revenue |

Technological Innovation |

Environmental Initiatives |

Global Presence |

|---|---|---|---|---|---|---|---|---|---|

| Tamatem Games | 2013 | Amman, Jordan |

- |

- |

- |

- |

- |

- |

- |

| Kiro'o Games | 2013 | Yaoundé, Cameroon |

- |

- |

- |

- |

- |

- |

- |

| Maliyo Games | 2012 | Lagos, Nigeria |

- |

- |

- |

- |

- |

- |

- |

| Kagiso Interactive | 2010 | Durban, South Africa |

- |

- |

- |

- |

- |

- |

- |

| Ubisoft Abu Dhabi | 2011 | Abu Dhabi, United Arab Emirates |

- |

- |

- |

- |

- |

- |

- |

Middle East and Africa Gaming Market Analysis

Growth Drivers

- Expansion of Internet Connectivity: The Middle East and Africa region is experiencing rapid internet infrastructure growth, driven by government-backed initiatives. For instance, Egypt's "Digital Egypt" strategy aims to increase the number of broadband connections to over 20 million by 2025. This expansion in internet access has already resulted in over 500 million internet users across the region in 2024, particularly in countries like Nigeria, South Africa, and Kenya. This broader internet penetration is a key factor in enabling the proliferation of online and mobile gaming in these areas, thus significantly driving market growth.

- Increased Smartphone Usage: In 2024, the Middle East and Africa reported over 600 million active smartphone users, with markets such as Saudi Arabia, the UAE, and Nigeria showing strong growth. The affordability and accessibility of smartphones have made gaming more accessible to a wider audience. This surge in smartphone adoption has increased mobile gaming activities, particularly in countries where the younger population, comprising nearly 60% of the region's total population, is highly engaged with mobile apps and games. This is expected to further enhance the gaming market as mobile gaming platforms expand.

- Investment in eSports Infrastructure: Saudi Arabia has invested $38 billion in the gaming and eSports industry as part of its broader Vision 2030 strategy to become a global gaming hub. These funds are allocated towards building state-of-the-art eSports arenas and encouraging global gaming companies to establish regional headquarters in the kingdom. The UAE has also set up regulations and created infrastructure to host international eSports tournaments. In 2023, the Middle East and Africa had over 100 million active eSports players, positioning the region as a significant player in global competitive gaming, which further boosts the gaming market.

Market Challenges

- Regulatory Constraints and Data Privacy Laws: Regulatory challenges related to online gaming and data privacy remain a significant issue in the region. Countries like Egypt and Saudi Arabia impose strict restrictions on online gambling, which limits the variety of games that can be offered. In addition, data protection regulations, such as South Africas POPI Act, require companies to implement stringent data protection measures, increasing operational costs for gaming companies. These regulatory hurdles slow down market expansion, particularly in countries where data protection laws are still evolving and vary significantly from one jurisdiction to another.

- Limited Access to Payment Gateways: Despite mobile payment solutions gaining traction, limited access to secure and widespread payment gateways hinders in-game transactions in several African countries. In 2024, only 50% of the population in sub-Saharan Africa had access to formal banking services. This gap in financial inclusion restricts the ability of many gamers to make in-game purchases, such as for premium content or microtransactions. Although mobile money is gaining popularity, especially in East African nations like Kenya, a lack of comprehensive digital payment infrastructure across the region remains a challenge for the gaming industry.

Middle East and Africa Gaming Market Future Outlook

Over the next five years, the Middle East and Africa Gaming Market is expected to experience robust growth. This growth will be fueled by increasing investments in game development studios, the expansion of the eSports ecosystem, and the growing prominence of mobile gaming. Governments across the region are likely to continue supporting the gaming industry by creating favorable regulations and investing in gaming infrastructure, particularly in high-potential countries such as Saudi Arabia and South Africa. The widespread adoption of 5G technology will further enhance the gaming experience, driving engagement and market expansion.

Market Opportunities

- Growth in Cloud Gaming: Cloud gaming presents a significant opportunity for the gaming industry in the Middle East and Africa. With the expansion of 5G networks in countries like the UAE and South Africa, cloud gaming platforms are expected to gain traction as they eliminate the need for high-end gaming hardware. In 2023, South Africa became one of the first countries in Africa to roll out commercial 5G services, enabling faster and more reliable cloud-based gaming experiences. As internet speeds improve and latency issues are resolved, cloud gaming is set to become a key growth area in the region.

- Monetization through In-App Purchases: The growing adoption of mobile gaming platforms in the Middle East and Africa presents significant monetization opportunities through in-app purchases. As of 2023, there were over 250 million mobile gamers in the region, many of whom engage in microtransactions to enhance their gaming experiences. Games such as "PUBG Mobile" and "Call of Duty Mobile" have capitalized on this trend, generating significant revenue through in-game purchases. With the rise of freemium models, developers have the potential to tap into this revenue stream by offering customizable content, skins, and downloadable expansions.

Scope of the Report

|

By Game Type |

Online Games Offline Games Mobile Games Console Games PC Games |

|

By Platform |

iOS Android Windows PlayStation Xbox |

|

By Genre |

Action/Adventure Sports Shooter Puzzle RPG |

|

By End-User |

Casual Gamers Hardcore Gamers Professional Gamers (eSports) |

|

By Region |

GCC Countries North Africa Sub-Saharan Africa South Africa |

Products

Key Target Audience

Game Developers and Publishers

eSports Organizations

Mobile Game Developers

Gaming Hardware Manufacturers

Government and Regulatory Bodies (Saudi Arabia General Authority for Audio-Visual Media)

Telecommunication Companies

Investments and Venture Capitalist Firms

Online Payment Solution Providers

Companies

Players Mentioned in the Report:

Tencent Holdings Ltd.

Sony Corporation

Microsoft Corporation

Ubisoft Entertainment SA

Activision Blizzard, Inc.

Take-Two Interactive Software, Inc.

Epic Games, Inc.

Netease, Inc.

Sega Corporation

Nintendo Co., Ltd.

Table of Contents

1. Middle East and Africa Gaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East and Africa Gaming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East and Africa Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Internet Infrastructure

3.1.2. Increased Smartphone Penetration

3.1.3. Favorable Government Regulations on Online Gaming

3.1.4. Rising Popularity of eSports

3.2. Market Challenges

3.2.1. Regulatory Barriers (Data Privacy, Anti-Gambling Laws)

3.2.2. Limited Payment Gateway Penetration

3.2.3. Cultural Restrictions in Specific Regions

3.2.4. High Costs of Game Development and Maintenance

3.3. Opportunities

3.3.1. Growth in Cloud Gaming

3.3.2. Monetization through In-App Purchases

3.3.3. Increasing Investment in AR/VR Gaming

3.3.4. International Collaboration with Gaming Developers

3.4. Trends

3.4.1. Shift Towards Mobile Gaming

3.4.2. Adoption of AI and Blockchain in Gaming

3.4.3. Rise of Streaming Platforms for Gaming (eSports & Content Creators)

3.5. Government Regulation

3.5.1. Classification of Gaming Categories (Regulated vs. Unregulated)

3.5.2. Anti-Gambling Policies and Their Impact on Growth

3.5.3. Taxation Policies in the Gaming Sector

3.5.4. Initiatives to Support Local Game Developers

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market Share, Competitive Strategies)

4. Middle East and Africa Gaming Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Online Games

4.1.2. Offline Games

4.1.3. Mobile Games

4.1.4. Console Games

4.1.5. PC Games

4.2. By Platform (In Value %)

4.2.1. iOS

4.2.2. Android

4.2.3. Windows

4.2.4. PlayStation

4.2.5. Xbox

4.3. By Genre (In Value %)

4.3.1. Action/Adventure

4.3.2. Sports

4.3.3. Shooter

4.3.4. Puzzle

4.3.5. Role-Playing Games (RPG)

4.4. By End-User (In Value %)

4.4.1. Casual Gamers

4.4.2. Hardcore Gamers

4.4.3. Professional Gamers (eSports)

4.5. By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. South Africa

5. Middle East and Africa Gaming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tencent Holdings Ltd.

5.1.2. Sony Corporation

5.1.3. Microsoft Corporation

5.1.4. Ubisoft Entertainment SA

5.1.5. Activision Blizzard, Inc.

5.1.6. Take-Two Interactive Software, Inc.

5.1.7. Electronic Arts Inc.

5.1.8. Epic Games, Inc.

5.1.9. Sega Corporation

5.1.10. Nintendo Co., Ltd.

5.1.11. Bandai Namco Entertainment Inc.

5.1.12. NetEase, Inc.

5.1.13. Zynga Inc.

5.1.14. Riot Games, Inc.

5.1.15. CD Projekt S.A.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Market Focus, Market Share, Strategic Partnerships, Acquisition History, Game Titles, Platform Dominance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Middle East and Africa Gaming Market Regulatory Framework

6.1. Legal Framework for Game Development and Distribution

6.2. Regional Certification Requirements for Games

6.3. Age-Based Content Restrictions

6.4. Taxation and Incentives for Game Developers

7. Middle East and Africa Gaming Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East and Africa Gaming Future Market Segmentation

8.1. By Game Type (In Value %)

8.2. By Platform (In Value %)

8.3. By Genre (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Middle East and Africa Gaming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves the identification of all major stakeholders within the Middle East and Africa Gaming Market. This was achieved through comprehensive secondary research and proprietary data collection, focusing on elements such as game development ecosystems, consumer behavior, and mobile penetration.

Step 2: Market Analysis and Construction

The second phase entailed analyzing historical data, particularly the market size and revenue generation across different game types and platforms. Data from local sources and international databases helped refine our projections, offering a granular view of the competitive landscape and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market assumptions through consultations with key industry stakeholders, including gaming executives, game developers, and local industry experts. These consultations provided qualitative insights into the operational and financial trends shaping the gaming market in the region.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesized data from multiple sources and combined it with expert interviews to ensure the accuracy and reliability of the analysis. The final report delivers a comprehensive view of the Middle East and Africa Gaming Market, encompassing current trends, competitive dynamics, and future growth prospects.

Frequently Asked Questions

01. How big is the Middle East and Africa Gaming Market?

The Middle East and Africa Gaming Market is valued at USD 600 million, driven by a growing interest in mobile and online gaming, alongside increased governmental investment in gaming infrastructure.

02. What are the challenges in the Middle East and Africa Gaming Market?

Key challenges include regulatory barriers, such as anti-gambling laws, and the limited availability of reliable payment gateways. Additionally, cultural restrictions in certain Middle Eastern countries create obstacles for specific gaming segments.

03. Who are the major players in the Middle East and Africa Gaming Market?

Major players include Tencent Holdings Ltd., Sony Corporation, Microsoft Corporation, and Ubisoft Entertainment SA. These companies dominate the market through strategic partnerships, exclusive game titles, and investments in game development.

04. What are the growth drivers of the Middle East and Africa Gaming Market?

The market is propelled by increased smartphone penetration, the rising popularity of eSports, and significant governmental investments in gaming infrastructure, particularly in the UAE and Saudi Arabia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.