Middle East and Africa Sandwich Panel Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9155

October 2024

82

About the Report

Middle East and Africa Sandwich Panel Market Overview

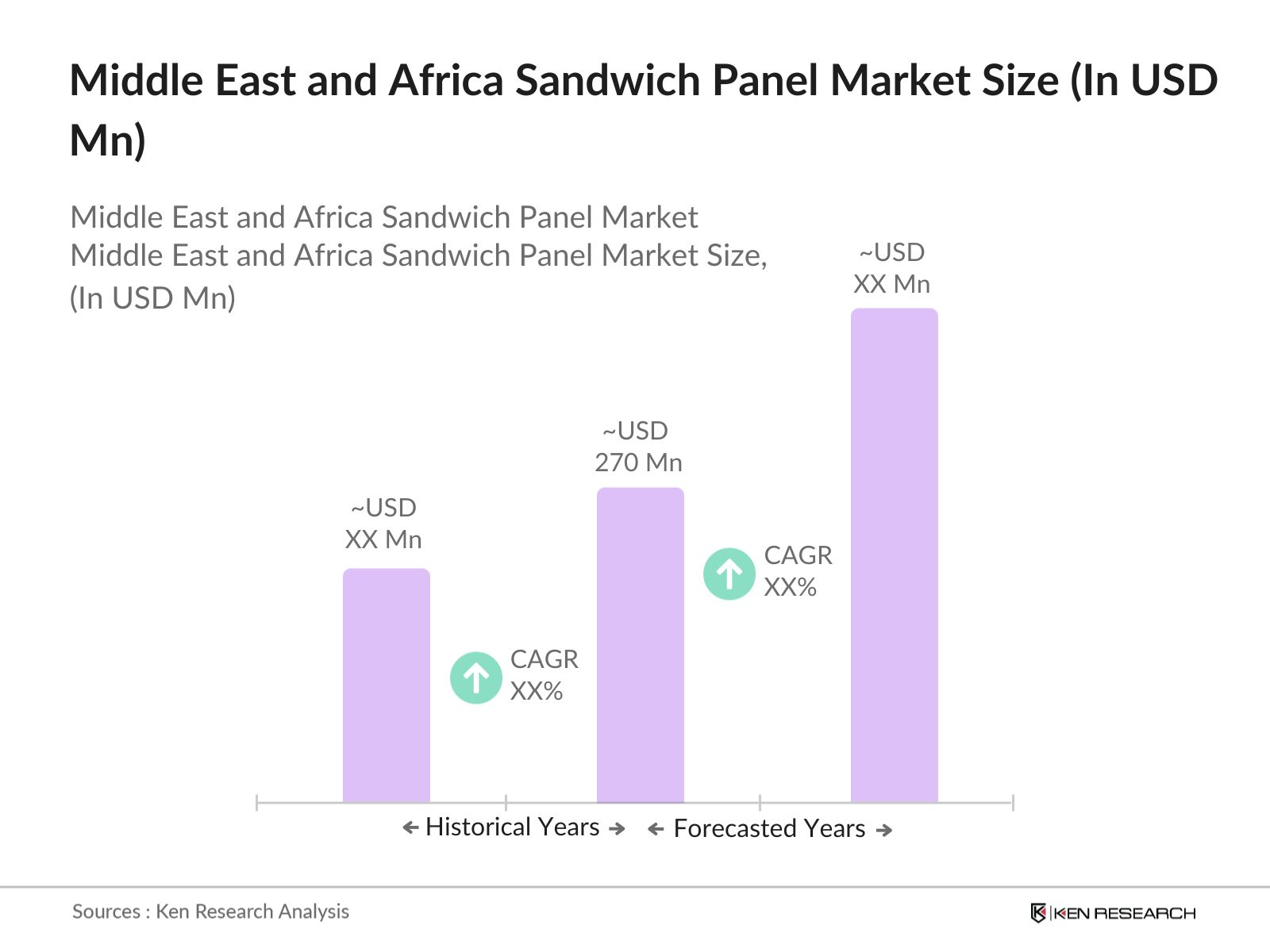

- The Middle East and Africa sandwich panel market is valued at USD 270 million, with demand driven by the rapid expansion of the construction sector, particularly in the GCC region. The growing emphasis on energy efficiency and sustainability in building projects has led to increased use of sandwich panels due to their thermal insulation properties. Furthermore, the surge in cold storage facilities and logistics in Africa has further fueled demand for sandwich panels, which are used extensively in temperature-controlled environments like warehouses and food processing units.

- Dominant countries in this market include Saudi Arabia and the UAE, where government-backed infrastructure projects and Vision 2030 initiatives are increasing construction activities. Additionally, countries like South Africa and Egypt are leading due to their expanding industrial and agricultural sectors. The GCC dominance is attributed to its wealth of infrastructure projects, driven by high government spending on economic diversification, while African nations like Nigeria and Kenya see growth in logistics and warehousing sectors.

- Government regulations in the Middle East and Africa increasingly mandate compliance with building codes focused on energy efficiency. U-value and R-value certifications, which measure thermal conductivity and resistance, are becoming more stringent across the region. The UAE and Saudi Arabia have introduced new building codes that require sandwich panels to meet specific energy efficiency standards, reducing building energy consumption by as much as 30%. These regulations are helping to drive demand for advanced sandwich panel solutions.

Middle East and Africa Sandwich Panel Market Segmentation

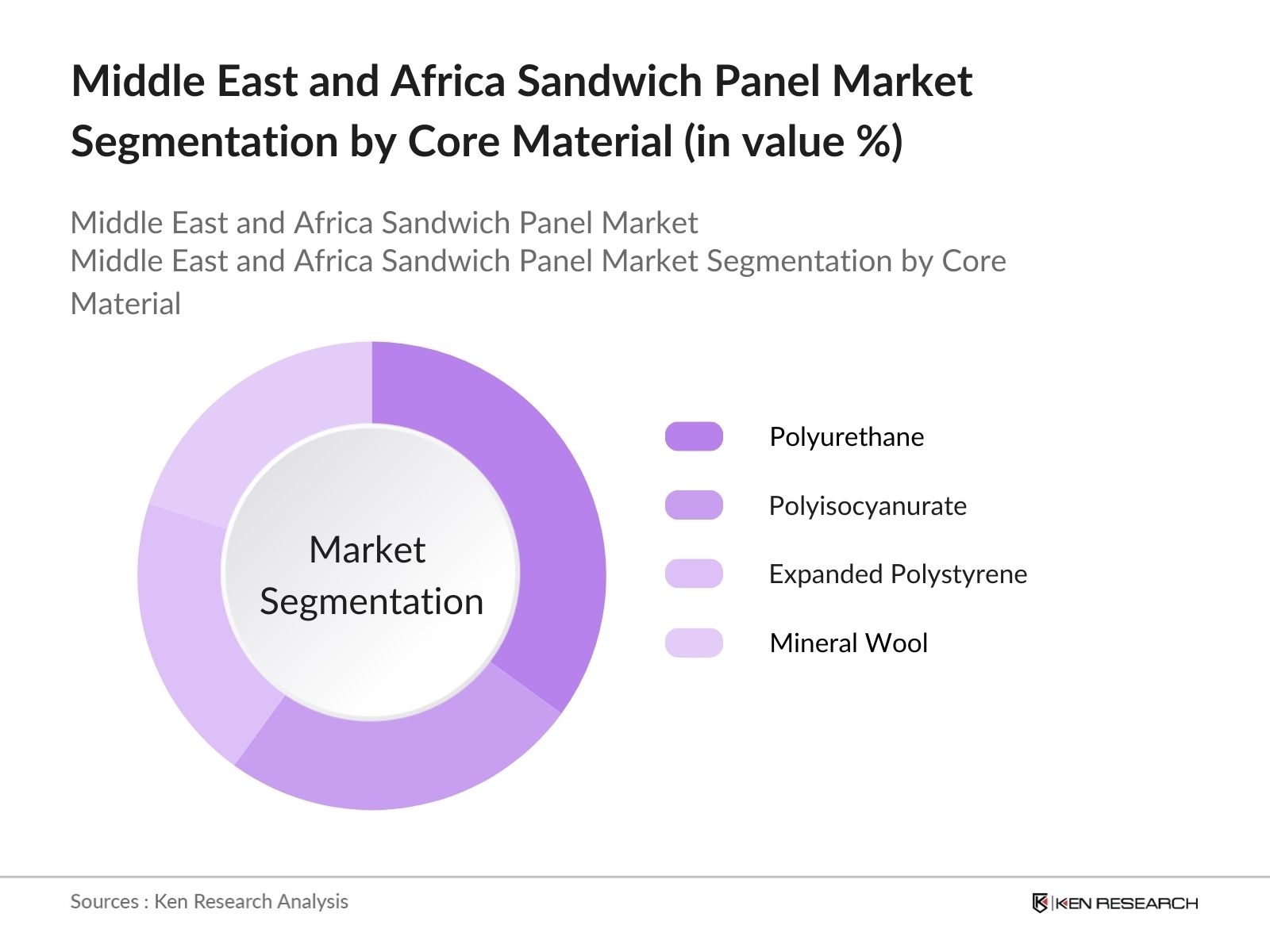

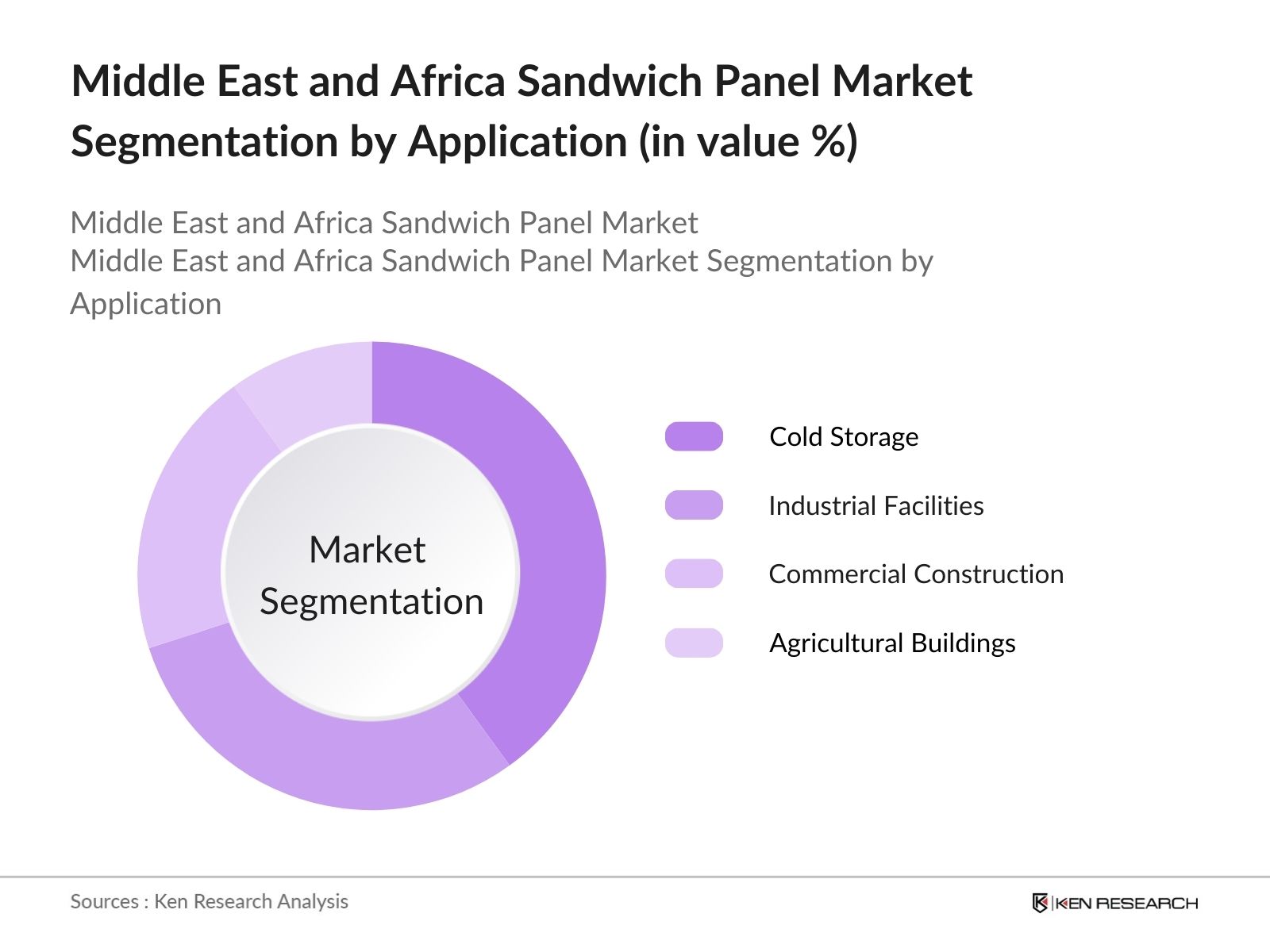

The Middle East and Africa sandwich panel market can be segmented by core material and by application.

- By Core Material: The Middle East and Africa sandwich panel market is segmented by core material into polyurethane (PU), polyisocyanurate (PIR), expanded polystyrene (EPS), and mineral wool. Recently, polyurethane (PU) has held a dominant market share due to its superior thermal insulation properties and widespread usage in cold storage and food logistics sectors. Its lightweight, cost-efficiency, and insulation capabilities make it an ideal choice for prefabricated buildings, driving its popularity in GCC and Southern Africa.

- By Application: The market is segmented by application into commercial construction, industrial facilities, cold storage, and agricultural buildings. The cold storage segment dominates the market due to the rising demand for refrigerated warehouses, especially in countries like Egypt and South Africa. This trend is driven by the rapid growth of the food processing industry, where temperature-controlled environments are critical for maintaining product quality and extending shelf life.

Middle East and Africa Sandwich Panel Market Competitive Landscape

The Middle East and Africa sandwich panel market is highly competitive, with a mix of global and regional players. Key manufacturers have consolidated their market positions through mergers and acquisitions, enhancing production capacities and expanding their product portfolios. Global players such as Kingspan and ArcelorMittal dominate due to their extensive distribution networks and technological innovations, while local companies like Emirates Industrial Panel (EIP) cater to region-specific demands, particularly in the GCC.

|

Company Name |

Year Established |

Headquarters |

Manufacturing Capacity |

Fire Safety Certifications |

R&D Investment |

Energy Efficiency |

Market Presence |

Strategic Partnerships |

|

Kingspan Group |

1965 |

Ireland |

||||||

|

Al Shahin Metal Industries |

1978 |

Saudi Arabia |

||||||

|

ArcelorMittal Construction |

2006 |

Luxembourg |

||||||

|

Emirates Industrial Panel |

2004 |

UAE |

||||||

|

Jindal Mectec |

1973 |

India |

Middle East and Africa Sandwich Panel Industry Analysis

Growth Drivers

- Expansion of Construction Sector: The Middle East and Africa region is witnessing significant growth in its construction sector, driven by urbanization and major infrastructure projects. Saudi Arabia alone has committed over $1 trillion to various megaprojects under Vision 2030, with a focus on housing and commercial real estate. This surge is fueling demand for sandwich panels, widely used in walls, roofs, and floors of new buildings for their insulation properties. Additionally, Egypt has initiated projects like the New Administrative Capital and Suez Canal Corridor, enhancing construction activity in the region. These projects are solidifying demand for construction materials like sandwich panels.

- Growth in Cold Storage and Logistics (Use of Sandwich Panels in Temperature-Controlled Facilities): The cold storage and logistics industry in the Middle East and Africa is expanding rapidly, driven by the need to enhance food security and manage pharmaceutical supplies. South Africa is investing in expanding its cold storage capacity, as the country imported over $1.5 billion worth of medical and pharmaceutical products in 2022. Similarly, the UAE is seeing rapid growth in its logistics sector due to its strategic position in global trade. Sandwich panels play a crucial role in this sector, providing essential thermal insulation for cold storage facilities. IMF Link.

- Rising Focus on Energy Efficiency (Thermal and Acoustic Insulation Properties): With increasing awareness of energy efficiency, many governments in the region are encouraging the use of energy-efficient construction materials, including sandwich panels. These panels significantly reduce the energy consumption of buildings due to their superior thermal insulation. For instance, in the UAE, buildings account for nearly 60% of total energy consumption, prompting government regulations promoting energy-efficient materials. Egypt has also introduced policies that emphasize energy-efficient construction to reduce the nations energy demand, which stood at over 200,000 GWh in 2023.

Market Challenges

- Volatility in Raw Material Prices (Steel, Aluminum, Insulating Core Materials): Raw materials like steel and aluminum, essential for sandwich panels, have seen price volatility. For instance, steel prices in the Middle East fluctuated between $600 and $700 per metric ton in 2023 due to supply chain disruptions and global demand. This price volatility affects the cost structure of sandwich panel manufacturers. Additionally, the prices of insulating materials such as polyurethane and polyisocyanurate, used in sandwich panel cores, have also been affected by supply chain constraints.

- Competition from Low-Cost Alternatives (Metal Sheets, Insulated Plasterboards): The sandwich panel market faces competition from cheaper alternatives like metal sheets and insulated plasterboards. These alternatives are widely used in less complex projects, particularly in rural areas where cost reduction is a priority. In countries like Kenya and Nigeria, where construction budgets for residential and small-scale commercial projects remain constrained, builders prefer low-cost alternatives. This reduces the market penetration of sandwich panels, particularly for cost-sensitive projects.

Middle East and Africa Sandwich Panel Market Future Outlook

Over the next five years, the Middle East and Africa sandwich panel market is expected to witness robust growth, driven by an increasing focus on energy efficiency and sustainability in construction projects. The growing demand for cold storage infrastructure, especially in the African food and logistics sectors, will be a significant growth driver. Additionally, advancements in core material technology, such as the development of more fire-resistant and eco-friendly sandwich panels, will further stimulate market growth.

Future Market Opportunities

- Adoption of Sustainable Building Materials: Governments across the region are promoting the use of sustainable materials to reduce carbon footprints, providing an opportunity for sandwich panel manufacturers to capitalize on green building initiatives. For instance, the UAE Green Building Regulations and Saudi Arabias Vision 2030 initiatives are pushing for sustainable and energy-efficient building materials. This shift towards sustainability is boosting demand for sandwich panels, which offer excellent insulation and are recyclable. In 2023, Saudi Arabia launched a $30 billion initiative to improve building efficiency, reflecting growing demand for sustainable construction materials. IMF Link.

- Growing Demand from Emerging Markets (Growth in African Infrastructure Projects): Africa's growing infrastructure needs present a significant opportunity for sandwich panel manufacturers. Countries like Nigeria, Ethiopia, and Kenya are undertaking large-scale infrastructure projects, from residential buildings to industrial complexes, as part of national development strategies. For example, Nigeria is planning to spend $29.7 billion on infrastructure development by 2025, which will increase demand for building materials, including sandwich panels. The African Continental Free Trade Area (AfCFTA) is also stimulating construction across borders, further expanding market opportunities.

Scope of the Report

|

By Core Material |

|

|||

|

By Skin Material |

Steel Aluminum Stainless Steel |

|||

|

By Application |

Commercial Construction Industrial Facilities Cold Storage Agricultural Buildings |

|||

|

By End-User Industry |

Construction Food & Beverage Logistics & Warehousing Manufacturing Healthcare |

|||

|

By Region |

North East West South |

Products

Key Target Audience

Sandwich Panel Manufacturers

Construction and Infrastructure Companies

Food and Beverage Processing Companies

Logistics and Warehousing Companies

Cold Storage Facility Providers

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Dubai Municipality, Saudi Standards, Metrology, and Quality Organization - SASO)

Energy Efficiency Consultants

Companies

Players Mention in the Report:

-

Kingspan Group

Al Shahin Metal Industries

ArcelorMittal Construction

Emirates Industrial Panel (EIP)

Assan Panel

Isopan

Metecno

Jindal Mectec

Dana Steel

Tata Steel Europe

Nucor Building Systems

Rautaruukki Corporation

Multicolor Steels India Pvt. Ltd.

Safal Group

NCI Building Systems

Table of Contents

1. Middle East and Africa Sandwich Panel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East and Africa Sandwich Panel Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East and Africa Sandwich Panel Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Construction Sector

3.1.2. Growth in Cold Storage and Logistics (Use of Sandwich Panels in Temperature-Controlled Facilities)

3.1.3. Rising Focus on Energy Efficiency (Thermal and Acoustic Insulation Properties)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (Steel, Aluminum, Insulating Core Materials)

3.2.2. Competition from Low-Cost Alternatives (Metal Sheets, Insulated Plasterboards)

3.2.3. Regulatory Barriers (Fire Safety Standards and Certifications)

3.3. Opportunities

3.3.1. Adoption of Sustainable Building Materials

3.3.2. Growing Demand from Emerging Markets (Growth in African Infrastructure Projects)

3.3.3. Technological Advancements in Core Insulation Materials (Polyurethane, PIR, Rockwool)

3.4. Trends

3.4.1. Modular Construction and Prefabrication (Increased Use of Sandwich Panels in Prefabricated Buildings)

3.4.2. Lightweight and High-Strength Sandwich Panels (Innovation in Lightweight Materials)

3.4.3. Integration of Smart Technologies (Sensor-Embedded Panels for Structural Monitoring)

3.5. Government Regulations

3.5.1. Building Codes and Energy Efficiency Standards (U-value, R-value Certifications)

3.5.2. Fire Resistance and Safety Compliance (FM Approval, BS Standards)

3.5.3. Policies Promoting Green Buildings

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Industry Rivalry, Supplier Bargaining Power, Buyer Bargaining Power, Threat of Substitutes, Threat of New Entrants)

3.9. Competitive Landscape and Market Positioning

4. Middle East and Africa Sandwich Panel Market Segmentation

4.1. By Core Material (In Value %)

4.1.1. Polyurethane (PU)

4.1.2. Polyisocyanurate (PIR)

4.1.3. Mineral Wool (Rockwool)

4.1.4. Expanded Polystyrene (EPS)

4.2. By Skin Material (In Value %)

4.2.1. Steel

4.2.2. Aluminum

4.2.3. Stainless Steel

4.3. By Application (In Value %)

4.3.1. Commercial Construction (Office Buildings, Retail)

4.3.2. Industrial Facilities (Factories, Warehouses)

4.3.3. Cold Storage (Refrigerated Warehouses, Food Logistics)

4.3.4. Agricultural Buildings (Barns, Storage Facilities)

4.4. By End-User Industry (In Value %)

4.4.1. Construction

4.4.2. Food & Beverage Industry

4.4.3. Logistics & Warehousing

4.4.4. Manufacturing

4.4.5. Healthcare (Hospitals, Laboratories)

4.5. By Region (In Value %)

4.5.1North

4.5.2. West

4.5.3. East

4.5.4. South

5. Middle East and Africa Sandwich Panel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kingspan Group

5.1.2. Al Shahin Metal Industries

5.1.3. ArcelorMittal Construction

5.1.4. Isopan

5.1.5. Assan Panel

5.1.6. Metecno

5.1.7. Rautaruukki Corporation

5.1.8. NCI Building Systems

5.1.9. Jindal Mectec

5.1.10. Tata Steel Europe

5.1.11. Multicolor Steels India Pvt. Ltd.

5.1.12. Nucor Building Systems

5.1.13. Emirates Industrial Panel (EIP)

5.1.14. Dana Steel

5.1.15. Safal Group

5.2. Cross Comparison Parameters

5.2.1. Manufacturing Capacity

5.2.2. Product Range

5.2.3. Core Material Innovation

5.2.4. Regional Market Penetration

5.2.5. Fire Safety Certifications

5.2.6. Cost Competitiveness

5.2.7. Energy Efficiency (U-Values)

5.2.8. Strategic Partnerships (Joint Ventures, Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East and Africa Sandwich Panel Market Regulatory Framework

6.1. Building Codes and Material Specifications

6.2. Energy Efficiency and Environmental Compliance

6.3. Fire Safety and Resistance Standards

7. Middle East and Africa Sandwich Panel Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East and Africa Sandwich Panel Future Market Segmentation

8.1. By Core Material (In Value %)

8.2. By Skin Material (In Value %)

8.3. By Application (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Middle East and Africa Sandwich Panel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying major variables that influence the Middle East and Africa sandwich panel market. This involves detailed ecosystem mapping of key stakeholders such as manufacturers, end-users, and regulatory bodies. The information is collected through desk research using both secondary sources and proprietary databases.

Step 2: Market Analysis and Construction

In this step, historical data is compiled to assess market trends, including penetration rates and key developments in the sandwich panel market. Industry penetration, technology adoption rates, and revenue generation ratios are evaluated to develop a solid understanding of market growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

The research team conducts expert consultations with key stakeholders in the industry through interviews and CATI (computer-assisted telephone interviews). These insights are critical for validating market hypotheses and refining the collected data to ensure its accuracy.

Step 4: Research Synthesis and Final Output

Finally, the collected data is synthesized into a comprehensive market report, which includes data validation from bottom-up approaches with industry players to provide accurate projections of future market trends and insights into emerging opportunities in the sandwich panel market.

Frequently Asked Questions

1 How big is the Middle East and Africa Sandwich Panel Market?

The Middle East and Africa sandwich panel market was valued at USD 270 million, driven by increased demand in construction, cold storage, and logistics sectors across the region.

2 What are the key challenges in the Middle East and Africa Sandwich Panel Market?

Challenges in Middle East and Africa sandwich panel market include volatile raw material prices, compliance with fire safety regulations, and competition from cheaper alternatives like traditional building materials.

3 Who are the major players in the Middle East and Africa Sandwich Panel Market?

Key players in the Middle East and Africa sandwich panel market include Kingspan Group, Al Shahin Metal Industries, ArcelorMittal Construction, Emirates Industrial Panel, and Assan Panel, all of which have established significant market presence through innovation and strategic partnerships.

4 What is driving the growth of the Middle East and Africa Sandwich Panel Market?

Middle East and Africa sandwich panel market Growth is driven by the expansion of infrastructure projects, especially in the GCC region, and the increasing need for energy-efficient and temperature-controlled buildings, particularly in the logistics and food industries.

5 What are the future trends in the Middle East and Africa Sandwich Panel Market?

The Middle East and Africa sandwich panel market is expected to witness innovations in core materials, an increasing focus on sustainability, and growth in cold storage and prefabricated buildings in emerging African markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.