Middle East and Africa Smartwatch Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD5506

November 2024

97

About the Report

Middle East and Africa Smartwatch Market Overview

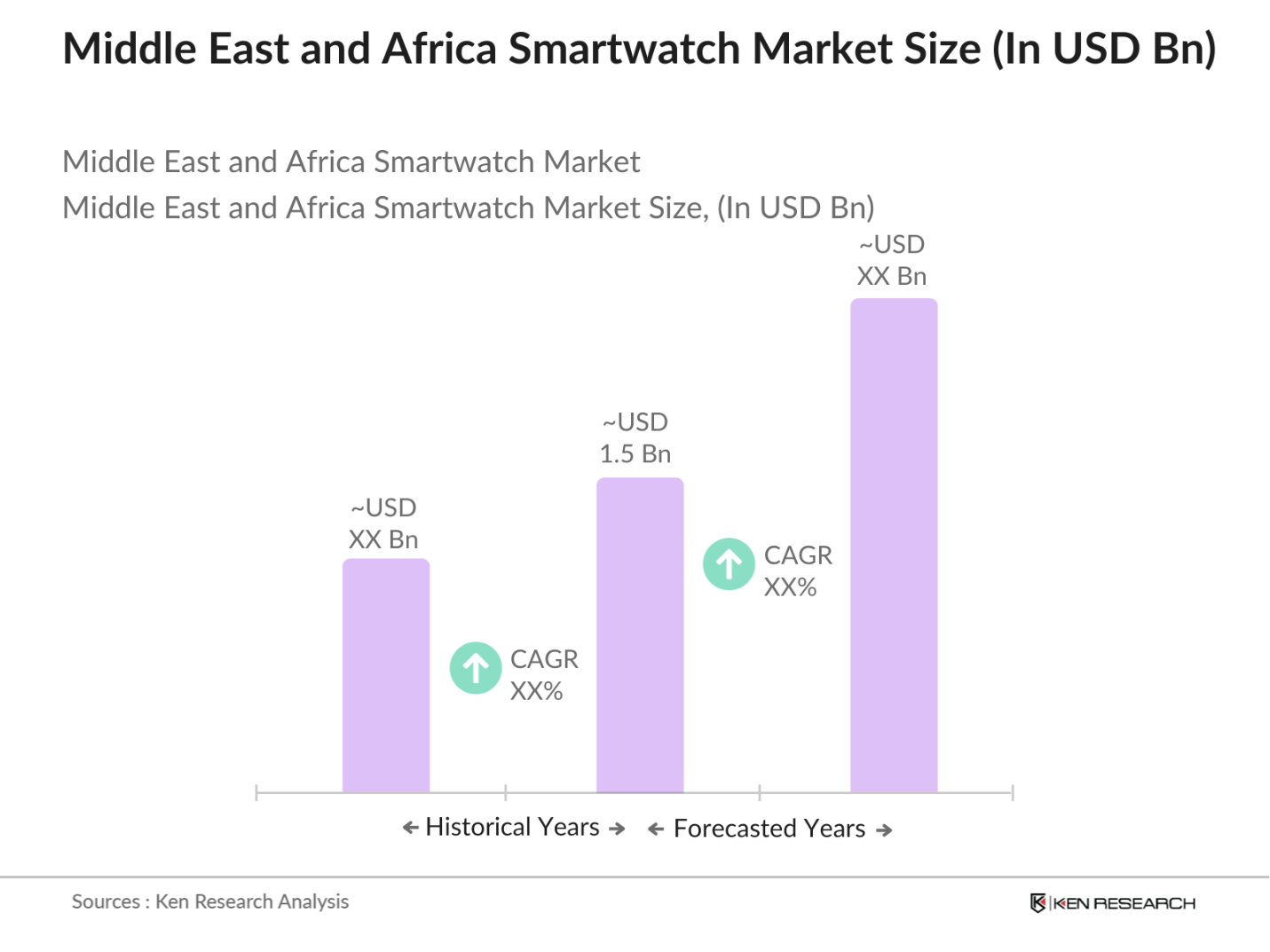

- The Middle East and Africa Smartwatch Market is valued at USD 1.5 billion, based on a five-year historical analysis. The market's growth is driven by a combination of factors, such as the rising demand for health monitoring devices, increased disposable income, and the growing popularity of wearable technologies. Consumer preference for smart devices that offer a blend of fitness tracking, communication, and personal assistance features continues to fuel the smartwatch market in this region. Moreover, the integration of advanced biometric sensors and the shift towards healthier lifestyles have accelerated market growth.

- Key countries and cities leading the smartwatch market in the Middle East and Africa include the United Arab Emirates, Saudi Arabia, South Africa, and Egypt. These regions dominate the market due to their high smartphone penetration, rapid urbanization, and increasing consumer awareness of wearable technology. For instance, the UAE's tech-savvy population and high purchasing power have positioned it as a prominent leader. In addition, government initiatives promoting technological advancements contribute to the region's dominance in the market.

- Data privacy regulations are becoming increasingly critical in the wearable technology market, particularly as governments in the Middle East and Africa seek to protect consumer data. In 2022, several countries, including South Africa, implemented data protection laws, emphasizing user consent and data security. As the number of wearable device users rises, adherence to these regulations becomes vital for manufacturers. A robust regulatory framework helps ensure consumer trust in wearable technologies, encouraging broader adoption and market growth as companies align their practices with legal requirements

Middle East and Africa Smartwatch Market Segmentation

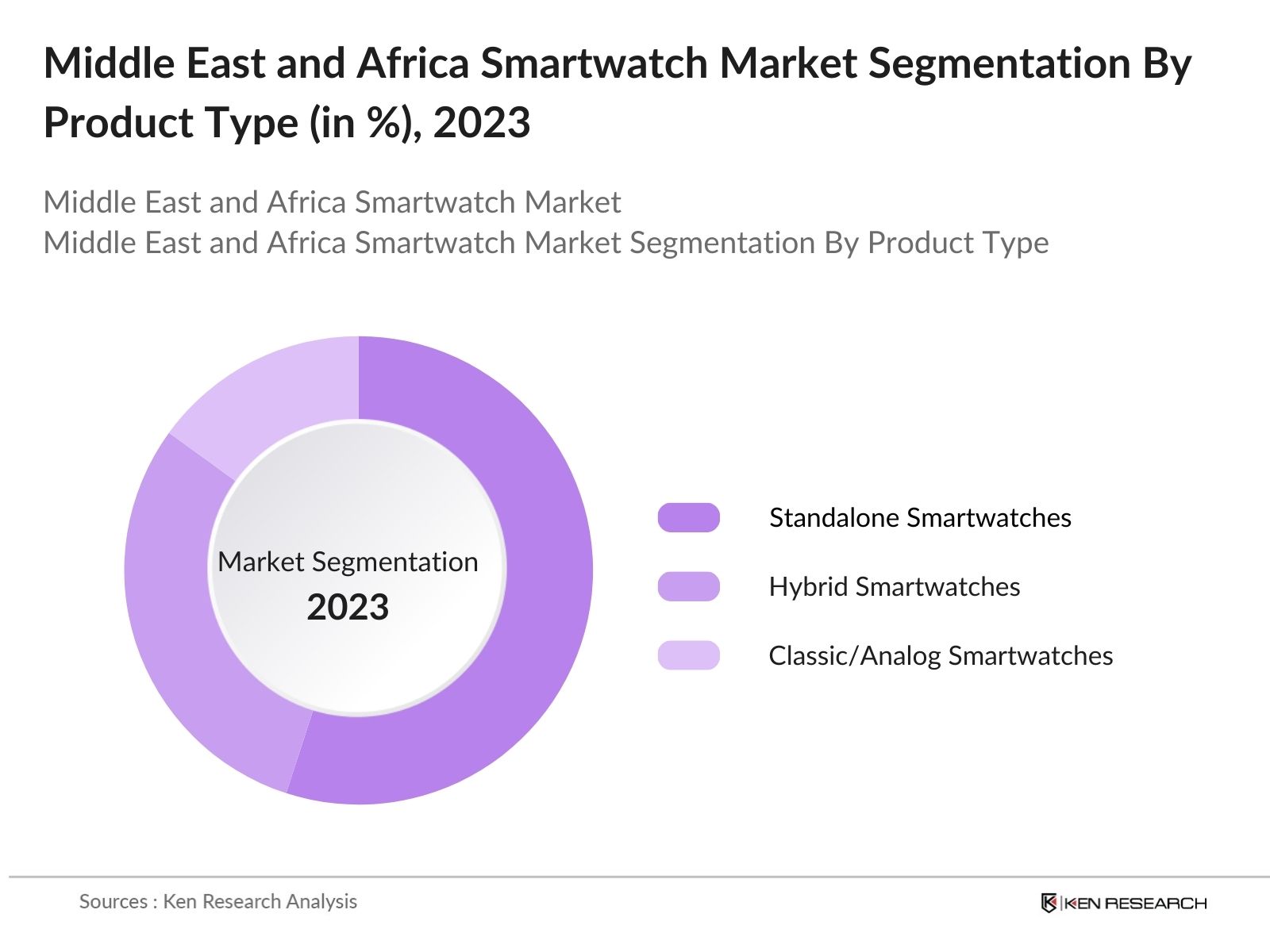

By Product Type: The Middle East and Africa Smartwatch Market is segmented by product type into standalone smartwatches, hybrid smartwatches, and classic/analog smartwatches. Standalone smartwatches dominate the market, as they offer more functionalities such as SIM card compatibility, cellular connectivity, and GPS, allowing users to make calls, send messages, and access the internet without relying on smartphones. This independence from smartphones makes standalone smartwatches particularly attractive to tech-savvy consumers who seek enhanced connectivity on the go.

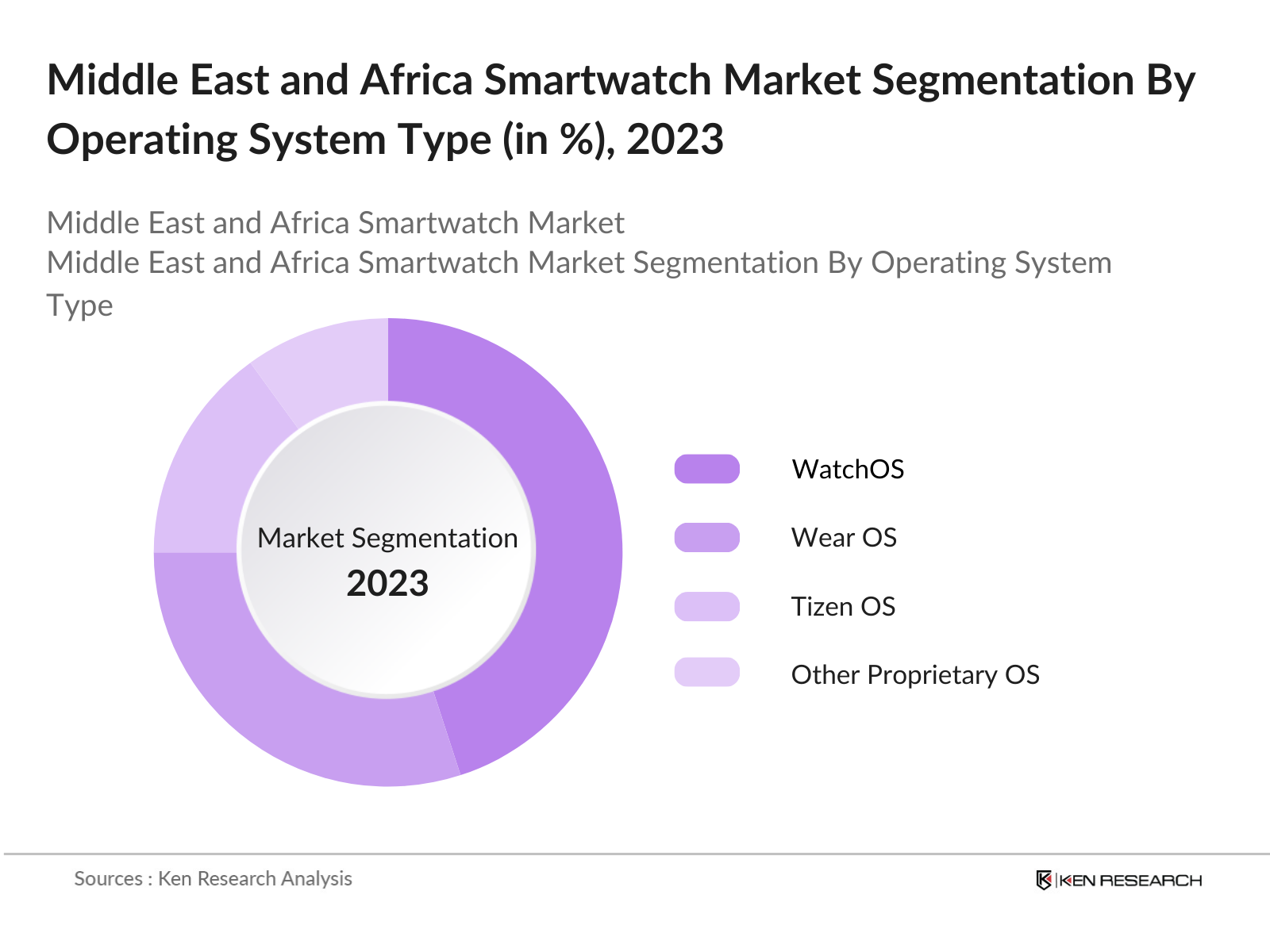

By Operating System: The smartwatch market is further segmented by operating systems into WatchOS, Wear OS, Tizen OS, and other proprietary operating systems. WatchOS holds a dominant market share, attributed to Apples leadership in the premium smartwatch category. Apples strong brand recognition, seamless integration with iPhones, and the wide range of health and fitness apps available on WatchOS ensure that it remains the operating system of choice for a significant portion of consumers in the Middle East and Africa.

Middle East and Africa Smartwatch Market Competitive Landscape

The Middle East and Africa Smartwatch Market is highly competitive, with both global giants and regional players vying for market share. Companies like Apple, Samsung, and Huawei lead the market due to their robust product portfolios, cutting-edge technology, and well-established distribution networks. In contrast, emerging local brands are also gaining traction by offering affordable alternatives with localized features.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

Product Portfolio |

Market Share (%) |

R&D Investment (USD Mn) |

No. of Employees |

Presence in MEA |

Strategic Partnerships |

|

Apple Inc. |

1976 |

Cupertino, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Huawei Technologies |

1987 |

Shenzhen, China |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Garmin Ltd. |

1989 |

Olathe, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Fitbit (Alphabet Inc.) |

2007 |

San Francisco, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Middle East and Africa Smartwatch Industry Analysis

Growth Drivers

- Increasing Penetration of Smartphones: The smartphone penetration rate in the Middle East and Africa has significantly increased, reaching approximately 60% in 2023, according to the International Telecommunication Union (ITU). This rise enhances the potential for smartwatch adoption as these devices often serve as extensions of smartphones, allowing users to receive notifications, control apps, and monitor health metrics seamlessly. The smartphone market in the region is projected to grow further, with over 80 million smartphones sold annually, providing a strong foundation for the wearable technology sector. The growth in smartphone users is expected to fuel the demand for compatible smartwatches.

- Rising Disposable Income Levels: According to the World Bank, the average disposable income in the Middle East is estimated at $7,500 per capita in 2023, while Africas average is around $3,200. The increase in income levels enables consumers to allocate more funds towards discretionary spending, including smartwatches. Countries like the UAE and Saudi Arabia are witnessing notable growth in disposable income, with significant increases of $1,000 and $500, respectively, over the past year. This financial flexibility supports the purchasing power for consumers looking to invest in wearable technology for health, fitness, and connectivity.

- Health and Fitness Awareness: The rising health consciousness in the Middle East and Africa is evidenced by a 25% increase in fitness app downloads and a corresponding growth in fitness center memberships, which have surged to 7 million across the region in 2023. The World Health Organization (WHO) emphasizes the importance of regular physical activity, leading many to seek tools that aid in monitoring health metrics. Smartwatches with health tracking capabilities are becoming essential, as they provide users with immediate access to heart rate, sleep patterns, and activity levels, encouraging a healthier lifestyle among the growing fitness-focused population.

Market Challenges

- High Cost of Smartwatches: Despite growing demand, the high cost of smartwatches remains a significant barrier to widespread adoption. Premium smartwatches can range from $300 to over $1,000, limiting accessibility for a considerable portion of the population in the Middle East and Africa. For instance, while consumers in urban areas may spend up to $800 on a smartwatch, those in rural regions may find even entry-level models, averaging around $150, to be financially unfeasible. The disparity in income levels contributes to the challenge of making smartwatches a mainstream product across various economic strata.

- Limited Battery Life: The average battery life of smartwatches currently ranges from 1 to 3 days, which can be a drawback for users expecting longevity from their devices. A report from the Global Energy Agency highlights that consumer dissatisfaction with short battery life often leads to lower adoption rates, particularly in regions where access to charging infrastructure may be limited. In remote areas of Africa, many users face challenges in charging their devices daily, further complicating the usability of smartwatches. This limitation hampers the potential growth of the market in less urbanized locales. Source.

Middle East and Africa Smartwatch Market Future Outlook

Over the next five years, the Middle East and Africa Smartwatch Market is expected to show substantial growth, driven by increasing consumer adoption of wearable technologies, the integration of advanced health-monitoring features, and improvements in battery life and design. Furthermore, governments and healthcare providers are exploring the role of smartwatches in preventative healthcare, particularly for managing chronic conditions such as diabetes and cardiovascular diseases. With the continuous rollout of 5G networks and the rise of the Internet of Things (IoT), smartwatches will become even more indispensable to users daily lives, offering a higher level of connectivity, real-time monitoring, and seamless integration with other devices.

Opportunities

- Technological Advancements: The current technological advancements in biometric sensors and GPS technology have laid a solid foundation for smartwatches to evolve into sophisticated health and fitness monitoring devices. As of 2023, biometric capabilities, such as heart rate monitoring and blood oxygen level tracking, have become standard in over 50% of new smartwatch models released in the region. The integration of GPS functionality also enhances the appeal of smartwatches for fitness enthusiasts and outdoor adventurers, contributing to a projected growth in consumer interest as these technologies become more prevalent and refined. Source.

- Expansion into Untapped Markets: Currently, urban centers dominate smartwatch sales, while rural regions remain largely untapped, representing a significant growth opportunity. With approximately 70% of the African population residing in rural areas, efforts to increase market penetration in these regions could prove fruitful. By leveraging mobile network expansions and improving internet access, companies could introduce affordable smartwatch options tailored to the unique needs of rural consumers, which could help in capturing a substantial segment of the market that is currently underserved.

Scope of the Report

|

By Product Type |

Standalone Smartwatches Hybrid Smartwatches Classic/Analog Smartwatches |

|

By Operating System |

Watch OS Wear OS Tizen OS Other Proprietary OS |

|

By Application |

Fitness Tracking Healthcare Monitoring Personal Assistance Entertainment |

|

By End-User |

Men Women Children |

|

By Distribution Channel |

Online, Offline |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Smartwatch Manufacturing Companies

Telecommunication Industries

Healthcare Provider Companies

Government and Regulatory Bodies (e.g., UAE Telecommunications Regulatory Authority, Saudi Communications and Information Technology Commission)

Investor and Venture Capitalist Firms

Fitness and Wellness Companies

Consumer Electronics Industries

Technology Integrator Companies

Companies

Players Mentioned in the Report

Apple Inc.

Samsung Electronics

Huawei Technologies

Garmin Ltd.

Fitbit (Alphabet Inc.)

Fossil Group

Xiaomi Corporation

Amazfit (Zepp Health)

Suunto Oy

Casio Computer Co., Ltd.

Table of Contents

1. Middle East and Africa Smartwatch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Year-On-Year Growth)

1.4. Market Segmentation Overview

2. Middle East and Africa Smartwatch Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East and Africa Smartwatch Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Penetration of Smartphones

3.1.2. Rising Disposable Income Levels

3.1.3. Health and Fitness Awareness

3.1.4. Adoption of Wearable Technology

3.2. Market Challenges

3.2.1. High Cost of Smartwatches

3.2.2. Limited Battery Life

3.2.3. Low Internet Penetration in Remote Areas

3.3. Opportunities

3.3.1. Technological Advancements (Biometric Sensors, GPS)

3.3.2. Expansion into Untapped Markets (Rural Regions)

3.3.3. Partnerships with Fitness and Healthcare Providers

3.4. Trends

3.4.1. Integration of Smartwatches with Health Monitoring Systems

3.4.2. Growth in E-commerce Sales of Smartwatches

3.4.3. Rise in Wearable Payment Systems

3.5. Government Regulations

3.5.1. Data Privacy Regulations for Wearable Devices

3.5.2. Standardization of Smartwatch Technologies

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

- Strengths, Weaknesses, Opportunities, and Threats

3.7. Stakeholder Ecosystem (Technology Providers, Distributors, Retailers)

3.8. Porters Five Forces Analysis (Threat of New Entrants, Bargaining Power of Suppliers, etc.)

3.9. Competition Ecosystem

4. Middle East and Africa Smartwatch Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Standalone Smartwatches

4.1.2. Hybrid Smartwatches

4.1.3. Classic/Analog Smartwatches

4.2. By Operating System (In Value %)

4.2.1. WatchOS

4.2.2. Wear OS

4.2.3. Tizen OS

4.2.4. Other Proprietary OS

4.3. By Application (In Value %)

4.3.1. Fitness Tracking

4.3.2. Healthcare Monitoring

4.3.3. Personal Assistance

4.3.4. Entertainment

4.4. By End-User (In Value %)

4.4.1. Men

4.4.2. Women

4.4.3. Children

4.5. By Distribution Channel (In Value %)

4.5.1. Online

4.5.2. Offline (Retail, Specialty Stores)

5. Middle East and Africa Smartwatch Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Samsung Electronics

5.1.3. Huawei Technologies

5.1.4. Garmin Ltd.

5.1.5. Fitbit (Alphabet Inc.)

5.1.6. Fossil Group

5.1.7. Xiaomi Corporation

5.1.8. Amazfit (Zepp Health)

5.1.9. Suunto Oy

5.1.10. Casio Computer Co., Ltd.

5.1.11. Withings

5.1.12. Realme

5.1.13. Oppo

5.1.14. Mobvoi

5.1.15. Noise

5.2. Cross Comparison Parameters (Headquarters, Revenue, No. of Employees, Product Portfolio, Market Share, R&D Investment, Partnerships, Competitive Strategy)

5.3. Market Share Analysis (Top Competitors, Regional Players)

5.4. Strategic Initiatives (Partnerships, Product Launches, Geographic Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity)

5.7. Government Grants and Funding Initiatives

6. Middle East and Africa Smartwatch Market Regulatory Framework

6.1. Compliance Standards for Wearable Devices

6.2. Data Security and Privacy Regulations

6.3. Certification Processes for Health Monitoring Devices

7. Middle East and Africa Smartwatch Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East and Africa Smartwatch Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Operating System (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (Middle East, Africa)

9. Middle East and Africa Smartwatch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Key Market Entry Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involved mapping the smartwatch ecosystem in the Middle East and Africa. Comprehensive desk research was conducted, which included data collection from proprietary databases, industry reports, and government publications. Key variables such as consumer trends, market drivers, and competitive dynamics were identified.

Step 2: Market Analysis and Construction

During this phase, historical market data was compiled to assess the market penetration and growth trajectory of smartwatches in the region. The analysis included a detailed breakdown of product types, operating systems, and application segments to estimate revenue shares accurately.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were tested through consultations with key stakeholders from top smartwatch brands and healthcare providers in the region. These interviews provided insights into consumer preferences, regional challenges, and the role of smartwatches in health monitoring.

Step 4: Research Synthesis and Final Output

The final phase included validation of market findings through bottom-up and top-down approaches. The collected data was synthesized into a comprehensive market report, highlighting both quantitative and qualitative trends in the Middle East and Africa Smartwatch Market.

Frequently Asked Questions

1. How big is the Middle East and Africa Smartwatch Market?

The Middle East and Africa Smartwatch Market is valued at USD 1.5 billion in 2023, driven by increased consumer demand for wearable technology, particularly in health monitoring and personal fitness.

2. What are the challenges in the Middle East and Africa Smartwatch Market?

Challenges in the market include high costs associated with premium smartwatches, limited battery life, and lower internet penetration in remote areas, which restricts full utilization of connected features.

3. Who are the major players in the Middle East and Africa Smartwatch Market?

The market is dominated by major players such as Apple Inc., Samsung Electronics, Huawei Technologies, Garmin Ltd., and Fitbit (Alphabet Inc.), all of which have established strong distribution networks and product portfolios.

4. What are the growth drivers of the Middle East and Africa Smartwatch Market?

Key growth drivers include the increasing focus on health and fitness, rising disposable incomes, and the proliferation of smartphones, which have contributed to the growing popularity of wearable devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.