Middle East and Africa Steel Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD5155

November 2024

85

About the Report

Middle East and Africa Steel Market Overview

- The MEA Steel Market is currently valued at USD 13 billion, driven by the continuous growth of the construction and infrastructure sectors across the Middle East and Africa. Major development projects, such as Saudi Arabia's Vision 2030 initiative and the expansion of urban centers in Africa, have significantly bolstered the demand for steel. The automotive and energy industries are also key contributors, utilizing steel in vehicle production, pipelines, and energy transmission projects. The steel demand remains robust due to rising urbanization and the region's focus on sustainable construction materials.

- Dominant countries in the MEA steel market include Saudi Arabia, the UAE, and Egypt. Saudi Arabia's dominance stems from its ambitious infrastructure projects, including Neom and smart city developments, which require vast amounts of steel for construction. The UAE leads in industrial projects, particularly in oil and gas, which utilize specialized steel grades. Egypt is experiencing rapid industrialization and urbanization, leading to a growing demand for steel in housing, energy, and transportation infrastructure.

- Government policies in the MEA region, such as import tariffs and local sourcing regulations, are shaping the steel market. Saudi Arabia, for instance, imposes tariffs on steel imports to protect domestic manufacturers, which strengthens local production capabilities. Meanwhile, the UAE's policies encourage the use of locally sourced steel in infrastructure projects. These policies aim to support the growth of the regional steel industry by reducing dependence on imports and fostering local production.

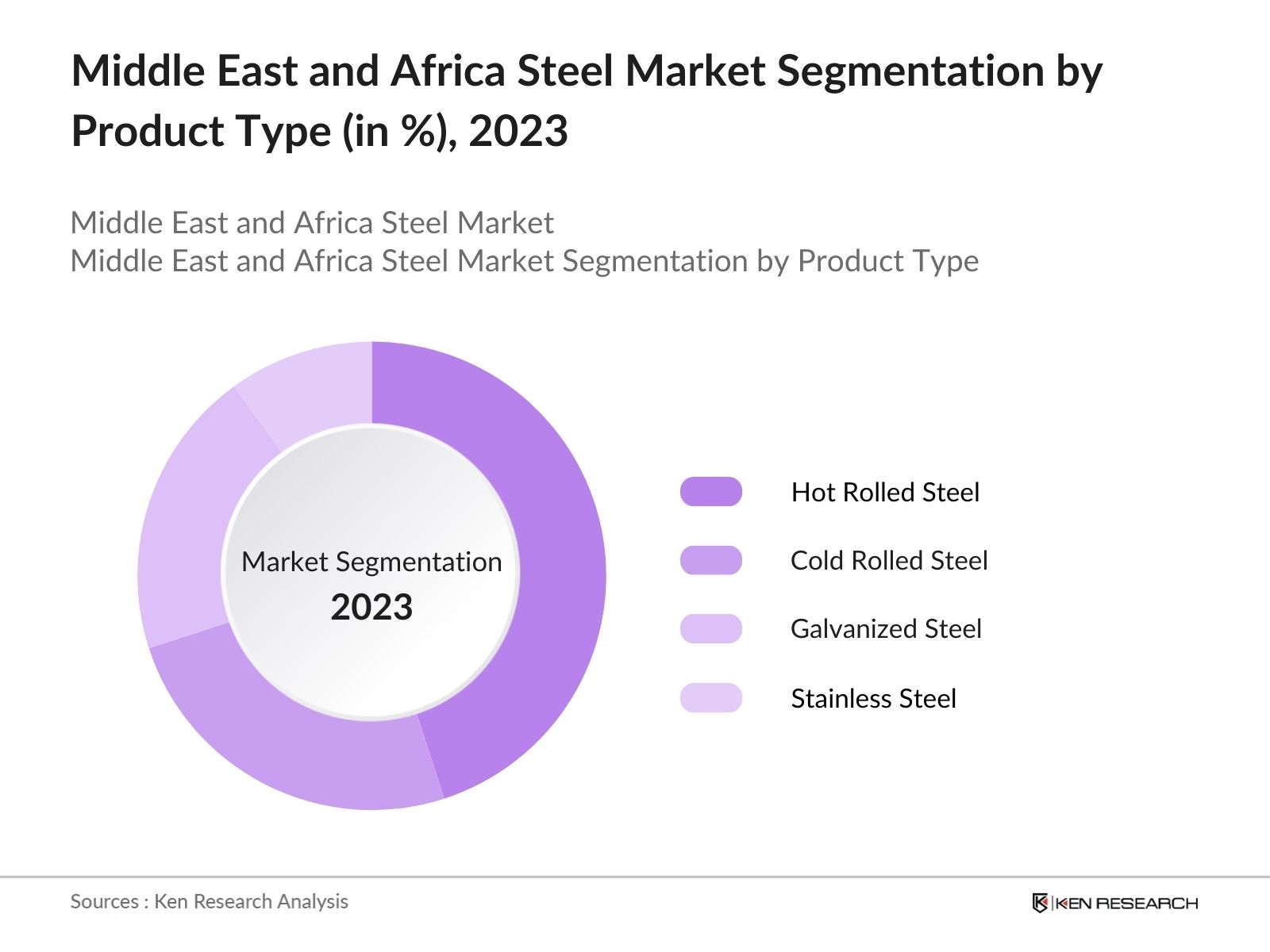

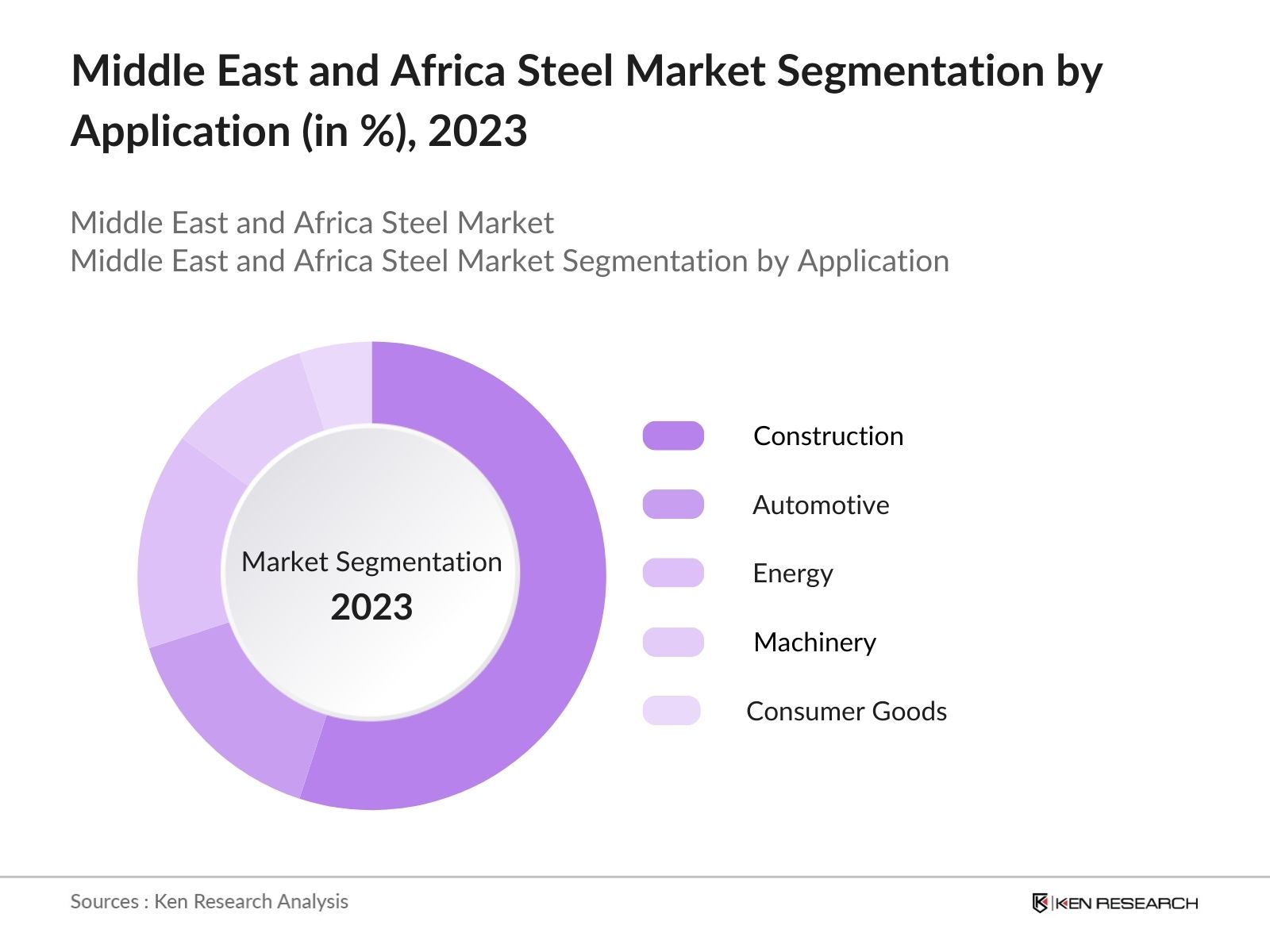

Middle East and Africa Steel Market Segmentation

- By Product Type: The Market is segmented by product type into Hot Rolled Steel, Cold Rolled Steel, Galvanized Steel, and Stainless Steel. Among these, Hot Rolled Steel holds a dominant market share in 2023. This segment is driven by its extensive use in construction and infrastructure projects due to its versatility and strength, making it ideal for building large structures and transportation networks. Additionally, it is widely utilized in manufacturing heavy machinery and automotive components, further enhancing its demand in the region.

- By Application: The market is also segmented by application into Construction, Automotive, Energy, Machinery, and Consumer Goods. The Construction segment dominates the market in 2023, owing to the region's focus on large-scale urban development and infrastructure modernization. Countries like Saudi Arabia and the UAE are investing heavily in high-rise buildings, transportation networks, and smart cities, driving the demand for steel in this segment. The energy sector, which includes oil and gas, is another key area for steel usage, particularly in pipelines and industrial structures.

Middle East and Africa Steel Market Competitive Landscape

The MEA steel market is highly consolidated, with a few key players dominating the market. Major players in the industry include both regional manufacturers and international giants who have established strong production capacities and supply chains across the Middle East and Africa. These companies are engaged in expanding their production capabilities and adopting new technologies to enhance steel production efficiency. Additionally, the focus on environmental sustainability has led these firms to invest in eco-friendly production processes and the development of green steel technologies.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

Product Portfolio |

Revenue |

Market Presence |

Technological Innovation |

Sustainability Initiatives |

|

Emirates Steel |

1998 |

Abu Dhabi, UAE |

||||||

|

SABIC Hadeed |

1979 |

Riyadh, Saudi Arabia |

||||||

|

ArcelorMittal |

2006 |

Luxembourg |

||||||

|

Ezz Steel |

1994 |

Cairo, Egypt |

||||||

|

Qatar Steel |

1974 |

Doha, Qatar |

Middle East and Africa Steel Industry Analysis

Growth Drivers

- Infrastructure Development: The Middle East and Africa (MEA) region is witnessing significant infrastructure growth, driven by large-scale construction and transportation projects. The GCC countries, particularly Saudi Arabia, are focusing on projects like NEOM city, which alone requires substantial amounts of steel for building smart cities and transport networks. By 2024, the Saudi government is expected to spend over $500 billion on infrastructure. In Africa, ongoing projects like Egypts new administrative capital also drive steel demand for roads, bridges, and high-rise buildings. Steel remains crucial for these developments.

- Automotive Industry Growth: The MEA automotive industry is expected to grow due to increasing demand for fuel-efficient vehicles, with steel playing a key role in lightweight construction. For example, automotive manufacturers in South Africa are increasingly utilizing advanced high-strength steel (AHSS) to reduce vehicle weight, thereby improving fuel economy. Saudi Arabias Vision 2030 initiative has also sparked interest in developing a domestic automotive sector, which is expected to increase demand for steel by over 20% for vehicle manufacturing.

- Energy Sector Expansion: Energy expansion across the MEA region, including investments in renewable energy sources, is driving demand for steel. In Saudi Arabia, the energy sector is a key component of Vision 2030, with plans to increase renewable energy capacity by adding more than 58.7 GW, much of which requires steel for wind turbines and power plants. Africa is also expanding its energy infrastructure, with countries like South Africa investing heavily in solar and wind power projects. Steel is vital for the construction of these facilities.

Market Challenges

- Fluctuating Raw Material Costs: Raw material price volatility, particularly in iron ore and coking coal, remains a significant challenge for steel producers in the MEA region. In 2023, global iron ore prices fluctuated between $100 and $130 per ton, leading to uncertainty in steel production costs. This unpredictability affects profit margins for steel manufacturers in the region, especially as many raw materials are imported. Countries like Egypt and Morocco, which rely on steel imports, are particularly vulnerable to these cost fluctuations.

- Stringent Environmental Regulations: Environmental regulations are tightening in the MEA region, especially regarding carbon emissions from steel production. The UAE, for instance, has set ambitious targets to reduce carbon emissions by 23.5% by 2030 as part of its Green Growth Strategy, which directly impacts the steel industry. Compliance with these regulations requires investment in cleaner production technologies, which may increase production costs. Steelmakers are also facing pressure to adopt more environmentally sustainable practices, such as using scrap steel in production.

Middle East and Africa Steel Market Future Outlook

Over the next few years, the MEA steel market is expected to experience moderate growth, driven by several key factors. Governments across the region are continuing to prioritize infrastructure development, especially in areas like transportation, real estate, and energy. In particular, Saudi Arabia's Vision 2030 plan is anticipated to spur a new wave of demand for steel products, as the country focuses on diversifying its economy through the development of non-oil industries. Moreover, advancements in technology, such as the use of automation and IoT in steel production, will lead to increased efficiency and higher output in the coming years.

Future Market Opportunities

- Adoption of High-Strength Steel: The adoption of high-strength steel in both the automotive and construction industries is opening up new opportunities for the MEA steel market. High-strength steel offers superior performance in terms of durability and weight reduction, particularly in vehicles where fuel efficiency is critical. The UAE and Saudi Arabia are leading the adoption of advanced high-strength steel (AHSS), with local industries projected to consume over 1 million tons by 2025 for building materials and automotive components.

- Development of Green Steel: Green steel, produced using hydrogen and renewable energy, is an emerging opportunity in the MEA region. With increasing pressure to reduce carbon emissions, the UAE is piloting green steel projects, using direct reduced iron (DRI) technology powered by hydrogen. This shift to green steel aligns with the regions sustainability goals, and experts expect the production of green steel to gain momentum as carbon regulations tighten. Green steel offers a significant long-term growth opportunity for the MEA steel industry.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

By Product Type |

Hot Rolled Steel |

|

Cold Rolled Steel |

|

|

Galvanized Steel |

|

|

Stainless Steel |

|

|

By Application |

Construction |

|

Automotive |

|

|

Energy |

|

|

Machinery |

|

|

Consumer Goods |

|

|

By End-User Industry |

Residential & Commercial Construction |

|

Manufacturing |

|

|

Oil & Gas |

|

|

Defense & Aerospace |

|

|

Transportation |

|

|

By Production Method |

Basic Oxygen Furnace (BOF) |

|

Electric Arc Furnace (EAF) |

|

|

By Region |

Saudi Arabia |

|

UAE |

|

|

Egypt |

|

|

South Africa |

|

|

Rest of MEA |

Products

Key Target Audience

Steel Manufacturers

Construction Companies

Automotive Manufacturers

Energy Companies

Government and Regulatory Bodies (e.g., Saudi Standards, Metrology and Quality Organization)

Infrastructure Development Agencies (e.g., Roads and Transport Authority, UAE)

Investor and Venture Capitalist Firms

Steel Distributors and Traders

Companies

Major Players in the Market

Emirates Steel

SABIC Hadeed

ArcelorMittal

Tata Steel

Ezz Steel

Qatar Steel

Jindal Steel & Power

Al-Ittefaq Steel

Bahrain Steel

Liberty Steel Group

Hyundai Steel

United Iron & Steel Company

Nippon Steel

Essar Steel

Suez Steel Company

Table of Contents

1. MEA Steel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Steel Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Steel Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Steel Demand for Construction and Transportation Projects)

3.1.2. Automotive Industry Growth (Lightweight Steel Demand for Fuel Efficiency)

3.1.3. Energy Sector Expansion (Steel for Power Plants, Wind Turbines)

3.1.4. Increasing Urbanization (High-Rise Buildings and Real Estate Projects)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Costs (Iron Ore, Coking Coal)

3.2.2. Stringent Environmental Regulations (Carbon Emission Control in Steel Production)

3.2.3. Competition from Alternative Materials (Aluminum, Composites)

3.3. Opportunities

3.3.1. Adoption of High-Strength Steel (Automotive and Construction Sectors)

3.3.2. Development of Green Steel (Environmentally Sustainable Production)

3.3.3. Government Initiatives (Local Manufacturing Boost in Saudi Arabia, UAE)

3.4. Trends

3.4.1. Digitization in Steel Production (Industry 4.0, IoT)

3.4.2. Circular Economy Practices (Steel Recycling and Reusability)

3.4.3. Increased Use of Smart Manufacturing Solutions

3.5. Government Regulations

3.5.1. MEA Regional Steel Policy (Import Tariffs, Local Sourcing)

3.5.2. Environmental Standards (CO2 Emission Reduction Targets)

3.5.3. Trade Agreements (Free Trade Zones, Export Quotas)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Steel Manufacturers, Suppliers, End-Users, Regulators)

3.8. Porters Five Forces (Bargaining Power of Buyers, Suppliers, Threats from Substitutes)

3.9. Competition Ecosystem

4. MEA Steel Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hot Rolled Steel

4.1.2. Cold Rolled Steel

4.1.3. Galvanized Steel

4.1.4. Stainless Steel

4.2. By Application (In Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Energy

4.2.4. Machinery

4.2.5. Consumer Goods

4.3. By End-User Industry (In Value %)

4.3.1. Residential and Commercial Construction

4.3.2. Manufacturing

4.3.3. Oil & Gas

4.3.4. Defense and Aerospace

4.3.5. Transportation

4.4. By Production Method (In Value %)

4.4.1. Basic Oxygen Furnace (BOF)

4.4.2. Electric Arc Furnace (EAF)

4.5. By Region (In Value %)

4.5.1. Saudi Arabia

4.5.2. UAE

4.5.3. Egypt

4.5.4. South Africa

4.5.5. Rest of MEA

5. MEA Steel Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Emirates Steel

5.1.2. SABIC Hadeed

5.1.3. ArcelorMittal

5.1.4. Tata Steel

5.1.5. Ezz Steel

5.1.6. Qatar Steel

5.1.7. Suez Steel Company

5.1.8. Jindal Steel & Power

5.1.9. Al-Ittefaq Steel

5.1.10. Bahrain Steel

5.1.11. Essar Steel

5.1.12. Liberty Steel Group

5.1.13. Hyundai Steel

5.1.14. United Iron & Steel Company

5.1.15. Nippon Steel

5.2. Cross Comparison Parameters (Production Capacity, Product Portfolio, Revenue, Market Share, Innovation Capacity, Geographical Footprint, Supply Chain Integration, ESG Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Technological Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capital Expenditure in New Plants and Facilities)

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

6. MEA Steel Market Regulatory Framework

6.1. Environmental Compliance (Pollution Control Regulations)

6.2. Trade Regulations (Export/Import Policies)

6.3. Certification Processes (ISO Certifications, Compliance Standards)

7. MEA Steel Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Steel Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. White Space Opportunities (Underserved Market Segments)

8.3. Supply Chain Optimization Initiatives

8.4. Market Entry Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we map out the ecosystem of the MEA Steel Market by identifying key players, regulatory frameworks, and demand drivers. Extensive desk research was conducted to gather data from reputable industry sources, including government publications and proprietary databases.

Step 2: Market Analysis and Construction

We analyzed historical data and market dynamics by evaluating trends in construction, automotive, and energy sectors. This data was compiled to create a comprehensive understanding of the current market landscape, including key growth drivers and challenges.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, we engaged industry experts through structured interviews. These experts provided insights into the steel production process, demand fluctuations, and technological trends, which were instrumental in confirming our market analysis.

Step 4: Research Synthesis and Final Output

Finally, we synthesized the data gathered from both primary and secondary sources, ensuring that the analysis reflects current market conditions. The final report provides a clear and detailed overview of the MEA steel market.

Frequently Asked Questions

01. How big is the MEA Steel Market?

The MEA Steel Market is valued at USD 13 billion, driven by significant demand from infrastructure and construction projects across the region.

02. What are the challenges in the MEA Steel Market?

Key challenges in the MEA Steel Market include fluctuating raw material costs, environmental regulations aimed at reducing carbon emissions, and competition from alternative materials such as aluminum and composites.

03. Who are the major players in the MEA Steel Market?

The major players in the MEA Steel Market include Emirates Steel, SABIC Hadeed, ArcelorMittal, Ezz Steel, and Qatar Steel. These companies dominate due to their vast production capacities and well-established distribution networks.

04. What are the growth drivers of the MEA Steel Market?

Growth in the MEA Steel Market is driven by infrastructure development, urbanization, and increasing demand from the automotive and energy sectors. Government-led initiatives such as Vision 2030 in Saudi Arabia are also key contributors to market expansion.

05. Which segments dominate the MEA Steel Market?

The construction segment dominates the market, primarily due to the focus on large-scale urban development projects. Additionally, the energy sector remains a significant driver of demand for steel products in the MEA Steel Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.