Middle East Dairy Alternatives Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9972

December 2024

85

About the Report

Middle East Dairy Alternatives Market Overview

- The Middle East Dairy Alternatives market is valued at USD 330 million, based on a five-year historical analysis. The market's growth is driven by increasing awareness regarding health benefits, especially among lactose-intolerant consumers, and a rising vegan population. Additionally, environmental concerns about traditional dairy farming are prompting consumers to shift towards plant-based alternatives, further fueling market growth. The expansion of major retail channels, including supermarkets and online platforms, is also contributing to the market's upward trajectory.

- Dominant countries in this market include the United Arab Emirates (UAE) and Saudi Arabia. These countries dominate the market due to high disposable incomes, a significant expatriate population, and a growing trend towards plant-based and health-conscious food consumption. The UAEs status as a global food hub and the growing presence of plant-based food companies, especially in Dubai and Abu Dhabi, further solidifies its leadership position. Saudi Arabia benefits from its growing urban population and increased awareness of dietary alternatives, aligning with global health trends.

- Governments in the Middle East have implemented stringent food labeling standards for dairy alternatives to ensure consumer safety. By 2024, countries like Saudi Arabia and the UAE mandated that plant-based dairy products display clear labeling regarding nutritional content, allergens, and ingredients. These regulations ensure product transparency and help consumers make informed purchasing decisions.

Middle East Dairy Alternatives Market Segmentation

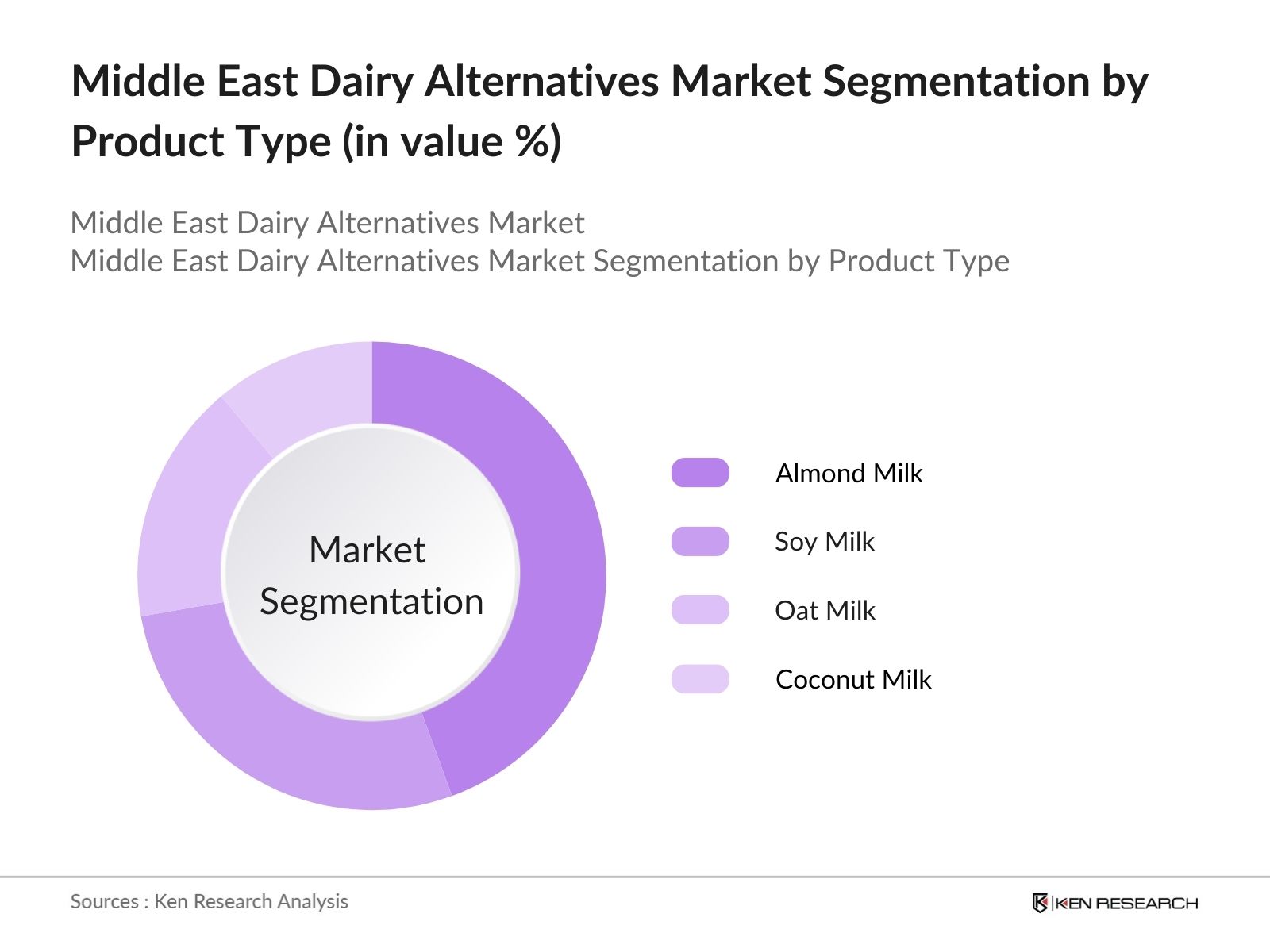

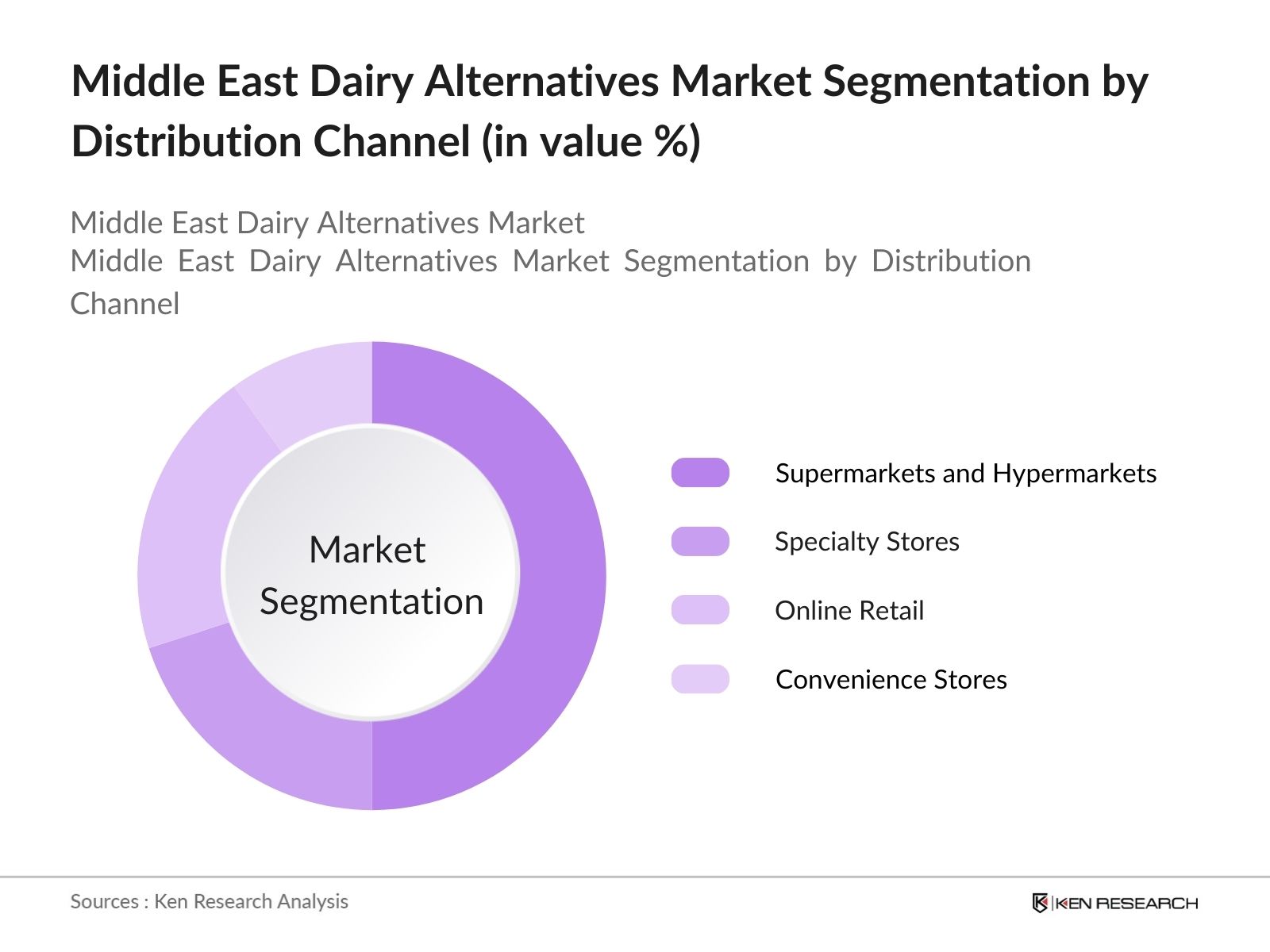

The Middle East Dairy Alternatives market is segmented by product type and by distribution channels.

- By Product Type: The Middle East Dairy Alternatives market is segmented by product type into almond milk, soy milk, oat milk, coconut milk, and other plant-based beverages. Almond milk dominates this segment due to its nutritional benefits, including being low in calories and cholesterol-free, which aligns well with the region's growing health-conscious consumer base. Almond milk has gained popularity in part due to its compatibility with vegan diets and its easy availability in supermarkets and online platforms. The large-scale marketing campaigns of brands like Alpro and Blue Diamond Growers further enhance almond milk's dominant position.

- By Distribution Channel: The distribution channels for dairy alternatives in the Middle East include supermarkets and hypermarkets, specialty stores, online retail, and convenience stores. Supermarkets and hypermarkets lead this segment due to their wide reach and established presence in urban areas, offering a variety of dairy alternatives to a broad customer base. Consumers prefer these stores due to the availability of premium and organic products, alongside frequent promotions and discounts. Major retail chains such as Carrefour and Spinneys play a critical role in the growth of this segment.

Middle East Dairy Alternatives Market Competitive Landscape

The Middle East Dairy Alternatives market is dominated by a few key players, including both regional and international brands. The market is characterized by consolidation, with major companies focusing on expanding their product portfolios and increasing their market presence through collaborations, mergers, and acquisitions. The presence of established dairy brands and newer, plant-based alternatives fosters healthy competition, pushing companies to invest in product innovation and sustainability practices. Key players have also leveraged the growing trend of e-commerce and online shopping to reach a broader customer base.

|

Company |

Established Year |

Headquarters |

Revenue (USD) |

Product Portfolio |

Employees |

|

Alpro |

1980 |

Belgium |

|||

|

Oatly |

1994 |

Sweden |

|||

|

Danone SA |

1919 |

France |

|||

|

Blue Diamond Growers |

1910 |

United States |

|||

|

Vitasoy International |

1940 |

Hong Kong |

Middle East Dairy Alternatives Industry Analysis

Growth Drivers

- Increasing Lactose Intolerance Cases (Health Trends): Lactose intolerance in the Middle East is becoming increasingly prevalent, affecting over 70% of the population in countries such as Saudi Arabia and Jordan, according to the WHO. This shift in health dynamics has been a key driver of demand for dairy alternatives. Governments have begun emphasizing dietary adjustments, supporting the development of lactose-free products. For example, Saudi Arabia's Ministry of Health has pushed educational campaigns highlighting lactose intolerance's impact on health, driving more people to seek dairy alternatives.

- Growing Vegan and Flexitarian Population (Demographic Shift): The Middle East has seen an increase in veganism and flexitarian diets, with about 5 million people in the Gulf Cooperation Council (GCC) countries now adopting plant-based diets. The UAE and Saudi Arabia are leading the shift, with governmental health initiatives pushing for reduced animal product consumption. These dietary shifts reflect changing health awareness and environmental concerns in the region. This demographic change has significantly expanded the demand for dairy alternatives like almond and soy milk.

- Increasing Awareness About Environmental Sustainability (Consumer Behavior): Growing environmental consciousness is driving demand for plant-based dairy alternatives, as dairy farming is seen as environmentally taxing. In 2024, around 40% of consumers in Saudi Arabia and the UAE cited environmental reasons for reducing their dairy consumption, according to regional consumer surveys. Government efforts like the UAEs National Food Security Strategy are also promoting sustainability, encouraging companies to offer eco-friendly alternatives, which aligns with consumer demand for environmentally sustainable products.

Market Challenges

- High Cost of Dairy Alternative Products (Price Sensitivity): Dairy alternative products remain significantly more expensive than traditional dairy products in the Middle East. For example, the cost of almond milk in Saudi Arabia averages 40 SAR per liter, nearly double the cost of regular cows milk. The high cost is a deterrent for lower-income consumers, even as demand grows. This price gap poses a challenge for widespread market adoption.

- Limited Availability of Raw Materials (Supply Chain Constraints): The Middle East faces a shortage of raw materials like almonds and oats, which are crucial for the production of dairy alternatives. In 2024, countries like Saudi Arabia and the UAE imported more than 90% of their almond and soy requirements. This reliance on imports creates supply chain vulnerabilities, driving up costs and limiting availability.

Middle East Dairy Alternatives Market Future Outlook

Over the next five years, the Middle East Dairy Alternatives market is expected to witness robust growth, driven by increasing consumer awareness of health benefits associated with plant-based diets, advancements in alternative milk products, and growing e-commerce penetration. Additionally, the expanding urban population and rising disposable incomes in the region will contribute to market expansion. Companies are likely to focus on innovation in product offerings, such as flavored and fortified dairy alternatives, and further investment in sustainability and eco-friendly production methods to cater to the growing demand for healthier and environmentally conscious products.

Market Opportunities

- Product Innovation in Flavors and Fortification (Product Innovation): Innovation in dairy alternatives is creating new market opportunities. In 2024, major brands like Alpro and Koita have introduced fortified plant-based milks, rich in calcium and vitamin D, tailored to Middle Eastern consumers. These innovations not only cater to health-conscious consumers but also enhance product appeal by offering enriched nutritional benefits. This focus on innovation presents a lucrative avenue for growth in the market.

- Increasing Demand for Organic Dairy Alternatives (Organic Movement): The demand for organic dairy alternatives is rising, particularly in the UAE and Qatar, where consumer preferences are shifting toward organic food products. By 2024, the organic food market in the UAE had reached $1 billion, driven by increased demand for organic plant-based milks. Governments have introduced certification processes for organic products, further encouraging this trend.

Scope of the Report

|

Almond Milk Soy Milk Oat Milk Coconut Milk |

|

|

By Distribution Channel |

Supermarkets and Hypermarkets Specialty Stores Online Retail Convenience Stores |

|

By Application |

Beverages Food Snacks Nutritional Supplements |

|

By Source |

Plant-Based Nut-Based Cereal-Based |

|

By Region |

North East West South |

Products

Key Target Audience

Dairy Alternative Manufacturers

Retailers and Distributors

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Ministry of Agriculture)

Food & Beverage Companies

Environmental Sustainability Organizations

E-commerce Platforms

Health and Wellness Brands

Companies

Players Mention in the Report:

Alpro

Oatly

Danone SA

Blue Diamond Growers

Vitasoy International

Califia Farms

Ripple Foods

SunOpta Inc.

Daiya Foods Inc.

Provamel

The Bridge

Earth's Own Food Company

Valsoia S.p.A.

Elmhurst Milked Direct LLC

Kite Hill

Table of Contents

1. Middle East Dairy Alternatives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East Dairy Alternatives Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East Dairy Alternatives Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Lactose Intolerance Cases (Health Trends)

3.1.2. Growing Vegan and Flexitarian Population (Demographic Shift)

3.1.3. Increasing Awareness About Environmental Sustainability (Consumer Behavior)

3.1.4. Expansion of Supermarket and Retail Chains (Distribution Expansion)

3.2. Market Challenges

3.2.1. High Cost of Dairy Alternative Products (Price Sensitivity)

3.2.2. Limited Availability of Raw Materials (Supply Chain Constraints)

3.2.3. Consumer Taste Preferences (Consumer Adoption)

3.2.4. Import Restrictions and Trade Barriers (Regulatory Hurdles)

3.3. Opportunities

3.3.1. Product Innovation in Flavors and Fortification (Product Innovation)

3.3.2. Increasing Demand for Organic Dairy Alternatives (Organic Movement)

3.3.3. Growing E-commerce Penetration in the Region (Distribution Channel Expansion)

3.4. Trends

3.4.1. Rising Interest in Oat and Almond-Based Dairy Alternatives (Consumer Preferences)

3.4.2. Expansion of Clean Label Products (Health-Conscious Consumers)

3.4.3. Adoption of Plant-Based Proteins in Dairy Alternatives (Product Innovation)

3.5. Government Regulations

3.5.1. Food Labeling Standards for Dairy Alternatives (Compliance)

3.5.2. Tariffs and Trade Policies (Trade Barriers)

3.5.3. National Policies Supporting Sustainable Agriculture (Sustainability Initiatives)

3.5.4. Certification and Approval Procedures (Quality Control)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Middle East Dairy Alternatives Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Almond Milk

4.1.2. Soy Milk

4.1.3. Oat Milk

4.1.4. Coconut Milk

4.1.5. Other Plant-Based Beverages

4.2. By Application (In Value %)

4.2.1. Beverages

4.2.2. Food

4.2.3. Snacks

4.2.4. Nutritional Supplements

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Retail

4.3.4. Convenience Stores

4.4. By Source (In Value %)

4.4.1. Plant-Based

4.4.2. Nut-Based

4.4.3. Cereal-Based

4.5. By Region (In Value %)

4.5.1. GCC Countries

4.5.2. North Africa

4.5.3. Levant

4.5.4. Turkey

4.5.5. Other Middle East Regions

5. Middle East Dairy Alternatives Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Alpro

5.1.2. Oatly

5.1.3. Danone SA

5.1.4. Vitasoy International

5.1.5. Blue Diamond Growers

5.1.6. SunOpta Inc.

5.1.7. Califia Farms

5.1.8. Ripple Foods

5.1.9. Earths Own Food Company

5.1.10. Valsoia S.p.A.

5.1.11. The Bridge

5.1.12. Daiya Foods Inc.

5.1.13. Elmhurst Milked Direct LLC

5.1.14. Kite Hill

5.1.15. Provamel

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. No. of Employees

5.2.4. Product Portfolio

5.2.5. Headquarters

5.2.6. Key Partnerships

5.2.7. Manufacturing Capacity

5.2.8. Distribution Network

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East Dairy Alternatives Market Regulatory Framework

6.1. Food Safety and Standards Authority Regulations

6.2. Import Tariffs on Dairy Alternatives

6.3. Sustainability Certifications and Labels

6.4. Advertising and Labeling Requirements

7. Middle East Dairy Alternatives Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East Dairy Alternatives Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Middle East Dairy Alternatives Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), Serviceable Obtainable Market (SOM)

9.2. Consumer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Middle East Dairy Alternatives Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Middle East Dairy Alternatives Market. This includes assessing market penetration, the ratio of product offerings to service providers, and the resultant revenue generation. Furthermore, an evaluation of product quality and consumer satisfaction statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple dairy alternative producers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Middle East Dairy Alternatives Market.

Frequently Asked Questions

01. How big is the Middle East Dairy Alternatives Market?

The Middle East Dairy Alternatives market was valued at USD 330 million, driven by increasing consumer demand for plant-based diets, health-conscious purchasing, and environmental sustainability trends.

02. What are the challenges in the Middle East Dairy Alternatives Market?

Middle East Dairy Alternatives Market Challenges include supply chain disruptions due to limited raw material availability, high product prices compared to dairy, and consumer taste preferences which may hinder market expansion.

03. Who are the major players in the Middle East Dairy Alternatives Market?

Key players in the Middle East Dairy Alternatives market include Alpro, Oatly, Danone SA, Blue Diamond Growers, and Vitasoy International. These companies dominate due to their wide product portfolios and strong distribution networks across the region.

04. What are the growth drivers of the Middle East Dairy Alternatives Market?

Middle East Dairy Alternatives Market Growth is propelled by increasing health awareness, rising cases of lactose intolerance, a growing vegan population, and heightened environmental concerns regarding traditional dairy farming.

05. Which countries dominate the Middle East Dairy Alternatives Market?

The UAE and Saudi Arabia lead the market due to high disposable incomes, increasing urbanization, and a growing trend towards plant-based diets, driven by health and sustainability concerns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.