Middle East Metal Casting Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD549

December 2024

100

About the Report

Middle East Metal Casting Market Overview

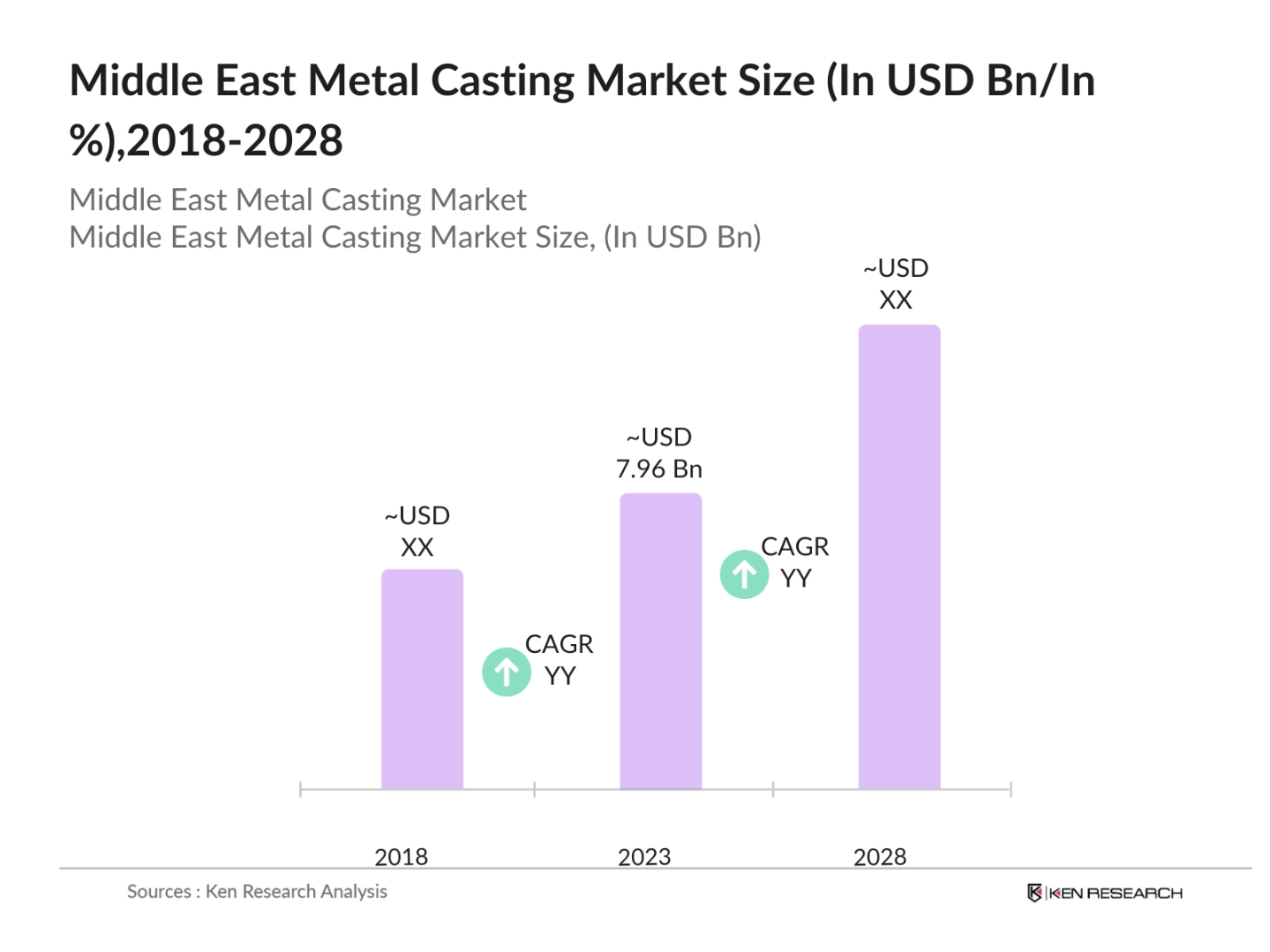

- The Middle East metal casting market reached a valuation of USD 7.96 billion in 2023, propelled by the significant demand in automotive, construction, and oil & gas industries. The market is expanding due to the region's industrialization, infrastructure development, and the adoption of lightweight materials in automotive manufacturing.

- The market is characterized by key players such as Emirates Global Aluminium (EGA), Saudi Arabian Amiantit Company, and Oman Aluminium Rolling Company. These companies are noted for their extensive production capacities, strong regional presence, and strategic investments in new technologies. Their dominance is reinforced by robust distribution networks and a focus on meeting both regional and global demand.

- In May 2023, EGA signed a long-term agreement with Alcoa to procure up to 15.6 million metric tons of smelter-grade alumina over eight years, starting in 2024. This agreement is significant as it aligns with EGA's sustainability goals and secures a substantial portion of its alumina needs from a long-term supplier.

- The Northern region of the Middle East, encompassing countries like Saudi Arabia and the UAE, dominates the metal casting market. This dominance is attributed to the advanced industrial infrastructure, significant investments in manufacturing facilities, and the presence of key market players in this region. The ongoing industrialization and government-led initiatives in these countries continue to fuel market growth.

Middle East Metal Casting Market Segmentation

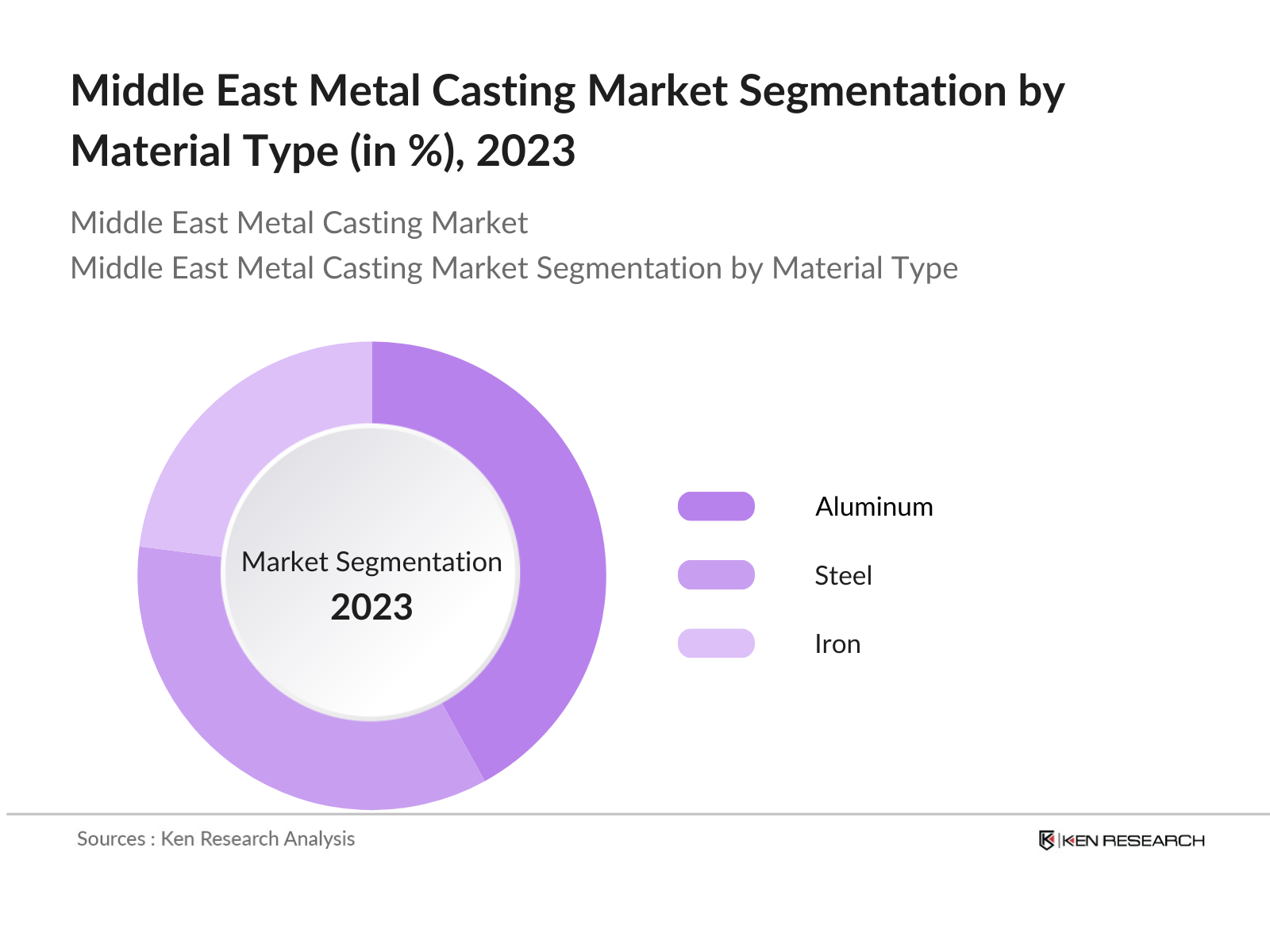

The Middle East metal casting market can be segmented by various factors like Material Type, End-User Industry, and Region.

- By Material Type: The Middle East metal casting market is segmented by Material Type into Aluminum, Steel, and Iron. In 2023, Aluminum dominated the segment due to its lightweight properties and high demand in the automotive and construction industries. The growing trend towards energy-efficient and lightweight vehicles has led to an increased preference for aluminum castings.

- By End-User Industry: The market is segmented by End-User Industry into Automotive, Construction, and Oil & Gas. In 2023, the automotive industry dominated due to the increasing production of vehicles in the region, particularly in Saudi Arabia and the UAE. The industry's shift towards electric vehicles and the use of lightweight components have further fueled the demand for metal casting products.

- By Region: The Middle East and Africa metal casting market is segmented by Region into Israel, United Arab Emirates, Jordan, Morocco, South Africa, and Rest of MEA. In 2023, the United Arab Emirates dominated the market due to its advanced manufacturing capabilities, strategic investments in industrial development, and favorable government policies promoting local production.

Middle East Metal Casting Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Emirates Global Aluminium (EGA) |

1979 |

Dubai, UAE |

|

Saudi Arabian Amiantit Company |

1968 |

Dammam, Saudi Arabia |

|

Oman Aluminium Rolling Company |

2011 |

Sohar, Oman |

|

Qatar Aluminium Manufacturing Co |

2018 |

Doha, Qatar |

|

Egypt Aluminum Company |

1972 |

Nag Hammadi, Egypt |

- In 2024, Saudi Arabian Amiantit Company secured a contract worth $46.3 million for supplying metal pipes and castings for a major water infrastructure project in Saudi Arabia. This contract aligns with the Kingdoms Vision 2030 plan to improve its water supply infrastructure, and it significantly boosts the companys order book, reinforcing its leadership in the regional market.

- Emirates Global Aluminium (EGA) introduced its Green Finance Framework in 2024 to support decarbonization projects and initiatives that contribute to the transition to a low-carbon economy. It aims to facilitate access to diversified funding sources for loans and bonds, potentially reducing borrowing costs while enhancing transparency.

Middle East Metal Casting Industry Analysis

Middle East Metal Casting Market Growth Drivers

- Government Regulations and Economic Diversification: The Middle East governments, particularly in Saudi Arabia and the UAE, have implemented economic diversification strategies under Vision 2030 and similar initiatives. By 2024, the Saudi government had invested $2 billion in new industrial zones, significantly boosting the local metal-casting market.

- Increased Demand from the Automotive Sector: The Dubai Water and Electricity Authority anticipates that the number of electric vehicles will rise by 2025, creating a higher demand for lightweight metal castings that enhance vehicle efficiency and performance. This trend is expected to contribute to the expansion of the metal casting market, particularly in the automotive sector, which accounted for 27.4% of the market share in 2022.

- Technological Advancements in Casting Processes: The Middle East metal casting market is benefiting from advancements in casting technologies, such as the adoption of 3D printing techniques, which are expected to enhance production efficiency and reduce waste. In 2024, it is estimated that around 20% of metal castings will be produced using advanced manufacturing technologies.

Middle East Metal Casting Market Challenges

- Environmental Regulations and Compliance Costs: Stringent environmental regulations in the Middle East are increasing the operational costs for metal casting companies. Saudi Arabia, in 2023, introduced new emission standards that required facilities to invest in advanced waste management systems. These regulations led to an industry-wide expenditure of $300 million, adding financial pressure on companies to comply with environmental standards.

- Competition from Global Markets: The Middle East metal casting industry faces stiff competition from international markets, particularly from low-cost producers in Asia. In 2024, there was a 20% increase in imports of metal castings from countries like China and India, undercutting local manufacturers.

Middle East Metal Casting Market Government Initiatives

- UAEs Operation 300bn (Launched in 2021): Operation 300bn is the UAEs ambitious plan to boost its industrial sector over ten years. By 2024, the initiative had drawn over $1 billion in investments into the metal casting industry, focusing on upgrading production facilities and enhancing export capabilities. This strategy is part of the UAEs broader goal to increase the industrial sectors contribution to GDP.

- Omans Industrial Strategy 2040 (Launched in 2019): Omans Industrial Strategy 2040 has set the foundation for significant growth in the manufacturing sector, including metal casting. The government has invested $500 million in the development of industrial zones, particularly in the Sohar region, aimed at increasing production capacity and fostering innovation in metal casting. This initiative positions Oman as a competitive player in the regional market.

Middle East Metal Casting Market Future Outlook

The Middle East metal casting market is expected to experience significant growth by 2028, with a steady CAGR driven by ongoing industrialization, infrastructure development, and the adoption of advanced manufacturing technologies. The market will benefit from increased investments in local manufacturing and government-led initiatives aimed at diversifying economies and reducing reliance on imports.

Future Trends

- Adoption of Advanced Manufacturing Technologies: By 2028, the Middle East metal casting market will see widespread adoption of advanced manufacturing technologies, including 3D printing and automation. These innovations will significantly enhance production efficiency, lower costs, and enable manufacturers to produce complex, high-precision components, particularly benefiting the automotive and aerospace industries.

- Expansion of Renewable Energy Projects: The region's focus on renewable energy projects will intensify by 2028, driving increased demand for specialized metal castings. Companies will invest heavily in developing cast components tailored for solar and wind energy applications, supporting the Middle East's efforts to diversify its energy sources and reduce carbon emissions.

Scope of the Report

|

By Material Type |

Aluminum Steel Iron |

|

By End-User Industry |

Automotive Construction Oil & Gas |

|

By Region |

Israel United Arab Emirates Jordan Morocco South Africa Rest of MEA |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Automotive Manufacturers

Construction Companies

Oil & Gas Companies

Renewable Energy Firms

Industrial Equipment Manufacturers

Government & Regulatory Bodies (e.g., Saudi Arabian Standards Organization)

Export and Trade Organizations

Investment and Venture Capitalist Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Emirates Global Aluminium (EGA)

Saudi Arabian Amiantit Company

Oman Aluminium Rolling Company

Qatar Aluminium Manufacturing Company

Egypt Aluminum Company

Dubal Holding LLC

Aluminium Bahrain B.S.C. (Alba)

National Aluminium Products Company SAOG (NAPCO)

United Metals Company (UMC)

Gulf Extrusions Co. LLC

Al Ghurair Iron & Steel LLC

Table of Contents

1. Middle East Metal Casting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East Metal Casting Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East Metal Casting Market Analysis

3.1. Growth Drivers

3.1.1. Economic Diversification Initiatives

3.1.2. Infrastructure Development

3.1.3. Technological Advancements

3.2. Restraints

3.2.1. Volatile Raw Material Costs

3.2.2. Environmental Regulations

3.2.3. Global Competition

3.3. Opportunities

3.3.1. Expansion into Renewable Energy Sector

3.3.2. Regional Collaborations and Joint Ventures

3.3.3. Investments in Advanced Manufacturing Technologies

3.4. Trends

3.4.1. Adoption of Lightweight Materials in Automotive Manufacturing

3.4.2. Integration of Smart Manufacturing Technologies

3.4.3. Increased Focus on Sustainability

3.5. Government Regulation

3.5.1. Saudi Vision 2030

3.5.2. UAE Operation 300bn

3.5.3. Oman Industrial Strategy 2040

3.5.4. Tax Incentives and Tariff Reductions

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Middle East Metal Casting Market Segmentation, 2023

4.1. By Material Type (in Value %)

4.1.1. Aluminum

4.1.2. Steel

4.1.3. Iron

4.2. By End-User Industry (in Value %)

4.2.1. Automotive

4.2.2. Construction

4.2.3. Oil & Gas

4.3. By Region (in Value %)

4.3.1. Israel

4.3.2. United Arab Emirates

4.3.3. Jordan

4.3.4. Morocco

4.3.5. South Africa

4.3.6. Rest of MEA

5. Middle East Metal Casting Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Emirates Global Aluminium (EGA)

5.1.2. Saudi Arabian Amiantit Company

5.1.3. Oman Aluminium Rolling Company

5.1.4. Qatar Aluminium Manufacturing Company

5.1.5. Egypt Aluminum Company

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Middle East Metal Casting Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Middle East Metal Casting Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Middle East Metal Casting Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Middle East Metal Casting Market Future Segmentation, 2028

9.1. By Material Type (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10. Middle East Metal Casting Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on Middle East metal casting market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Middle East metal casting market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple metal casting market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from metal casting market companies.

Frequently Asked Questions

01 How big is the Middle East metal casting market?

The Middle East metal casting market reached a valuation of USD 7.96 billion in 2023, propelled by the significant demand in automotive, construction, and oil & gas industries. The market is expanding due to the region's industrialization, infrastructure development, and the adoption of lightweight materials in automotive manufacturing.

02 What are the challenges in the Middle East metal casting market?

Challenges in the Middle East metal casting market include fluctuating raw material costs, stringent environmental regulations, and increasing competition from international markets. These factors can impact the profitability and competitiveness of regional players in the metal casting industry.

03 Who are the major players in the Middle East metal casting market?

Key players in Middle East metal casting market include Emirates Global Aluminium (EGA), Saudi Arabian Amiantit Company, Oman Aluminium Rolling Company, and Qatar Aluminium Manufacturing Company. These companies dominate due to their extensive production capacities and strong regional presence.

04 What are the growth drivers of the Middle East metal casting market?

The Middle East metal casting market is driven by the expansion of the automotive sector, rising infrastructure projects, and the increased focus on renewable energy projects. These factors are contributing to the growing demand for metal casting products in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.