Middle East Vertical Farming Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9395

November 2024

88

About the Report

Middle East Vertical Farming Market Overview

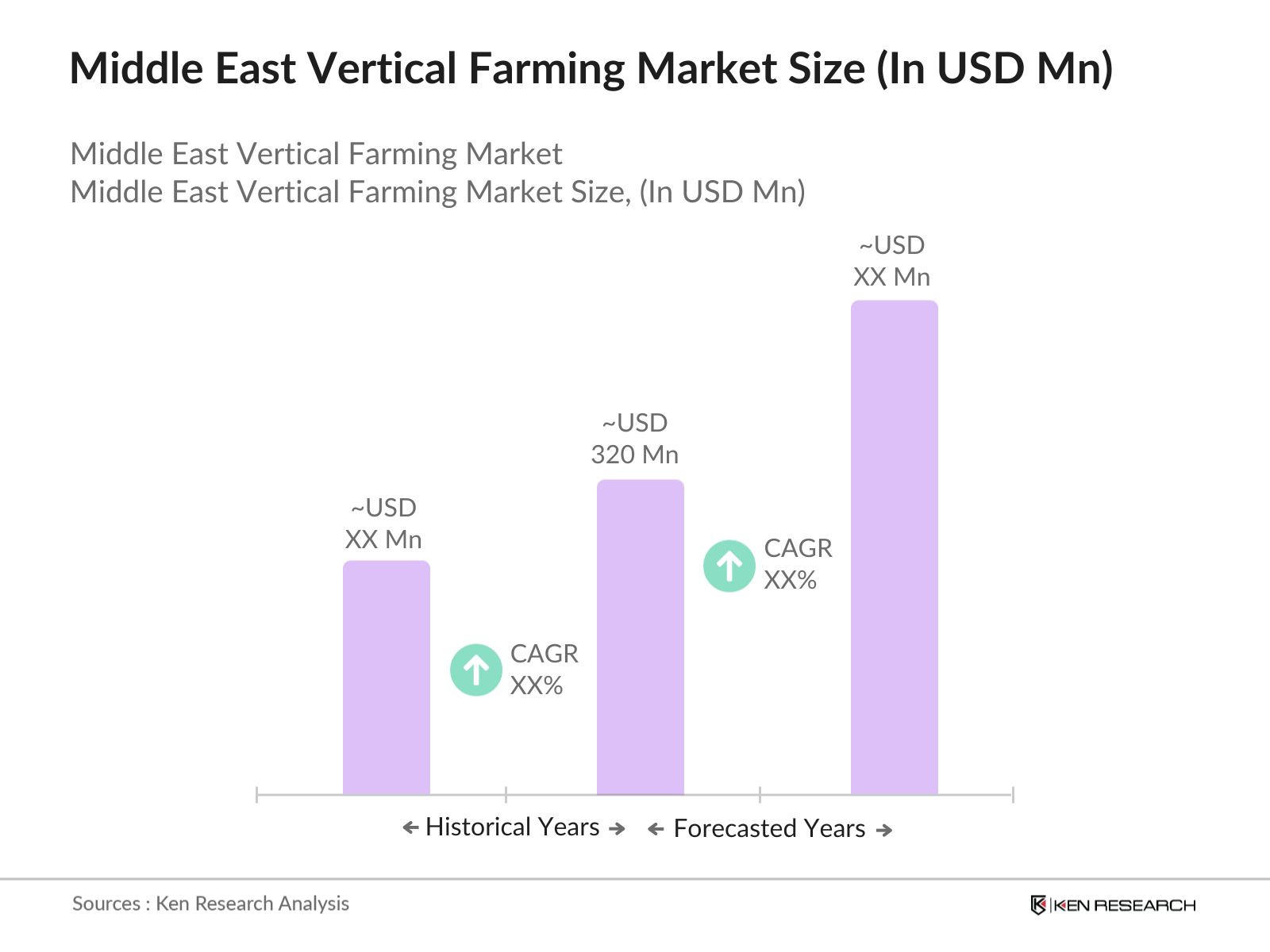

- The Middle East vertical farming market is valued at USD 320 million, driven by an increasing need for sustainable agricultural practices amidst urbanization and water scarcity. The region's reliance on food imports and limited arable land has propelled the demand for vertical farming. These systems optimize space, reduce water consumption by up to 95%, and allow year-round crop production, addressing food security concerns. Additionally, government initiatives and investments in Agri-Tech solutions are also contributing to the expansion of this market, especially in urban centers.

- Key cities such as Dubai and Riyadh dominate the vertical farming market, primarily due to their ambitious sustainability goals and smart city initiatives. Dubais government has supported innovation in vertical farming to reduce food imports, while Saudi Arabia's Vision 2030 program encourages agricultural investments to diversify the economy. These regions benefit from well-established infrastructure, favorable regulations, and access to investment, positioning them as leaders in the vertical farming sector.

- The governments of Saudi Arabia and the UAE are actively implementing policies to support vertical farming as part of their broader agricultural strategies. Saudi Arabia's Vision 2030 includes policies aimed at reducing food imports and increasing local food production through sustainable methods. Similarly, the UAEs National Food Security Strategy promotes vertical farming as a solution to enhance domestic agricultural output, with favorable regulations to ease the import of necessary equipment and technologies. These policies have accelerated the growth of vertical farming in the region.

Middle East Vertical Farming Market Segmentation

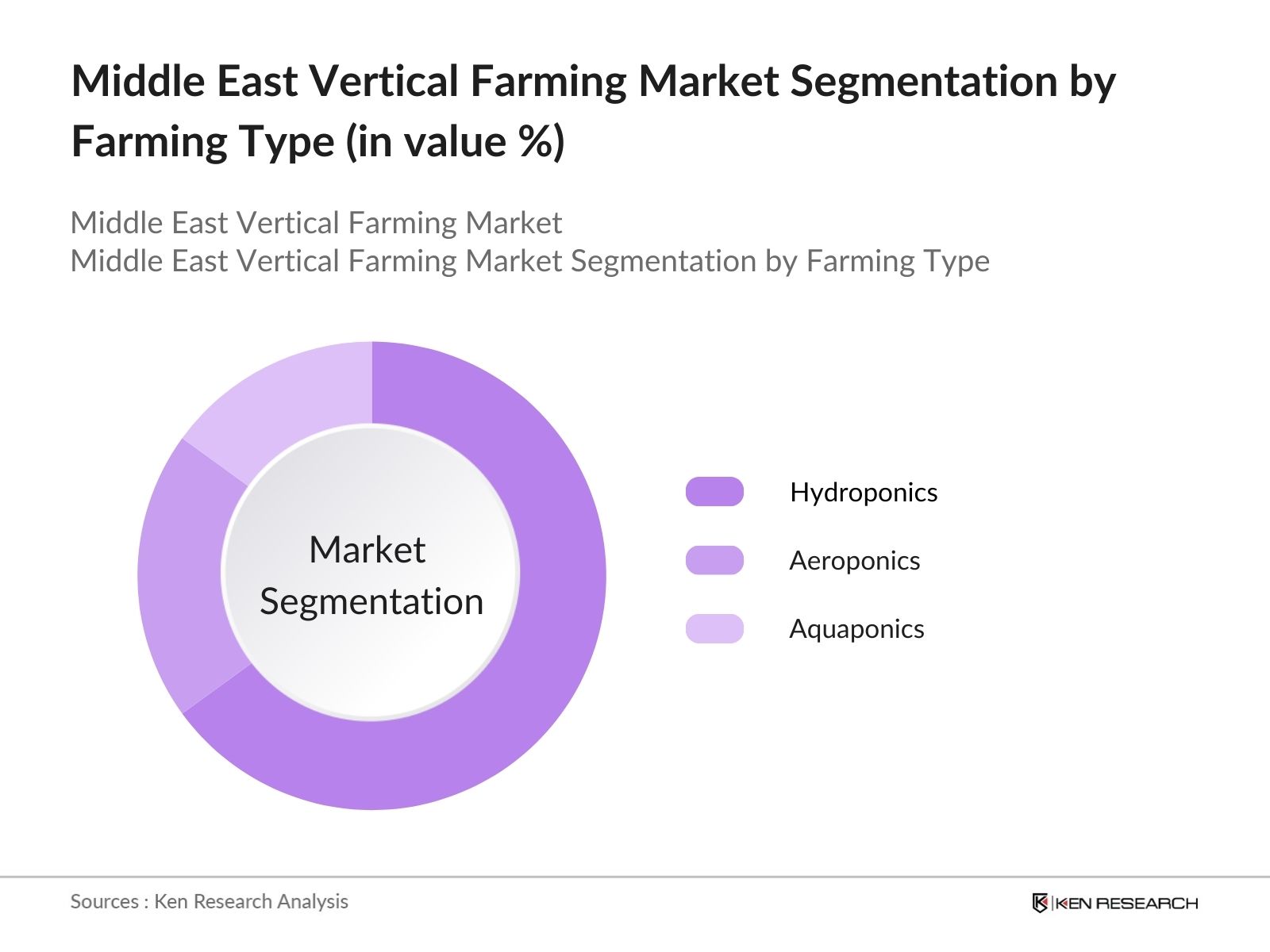

- By Farming Type: The market is segmented by farming type into hydroponics, aeroponics, and aquaponics. Recently, hydroponics has been the dominant sub-segment, as it requires less water than traditional farming methodsan essential factor for Middle Eastern countries where water scarcity is a critical issue. This segment has benefited from innovations in nutrient delivery systems and is widely adopted by urban farms across the region.

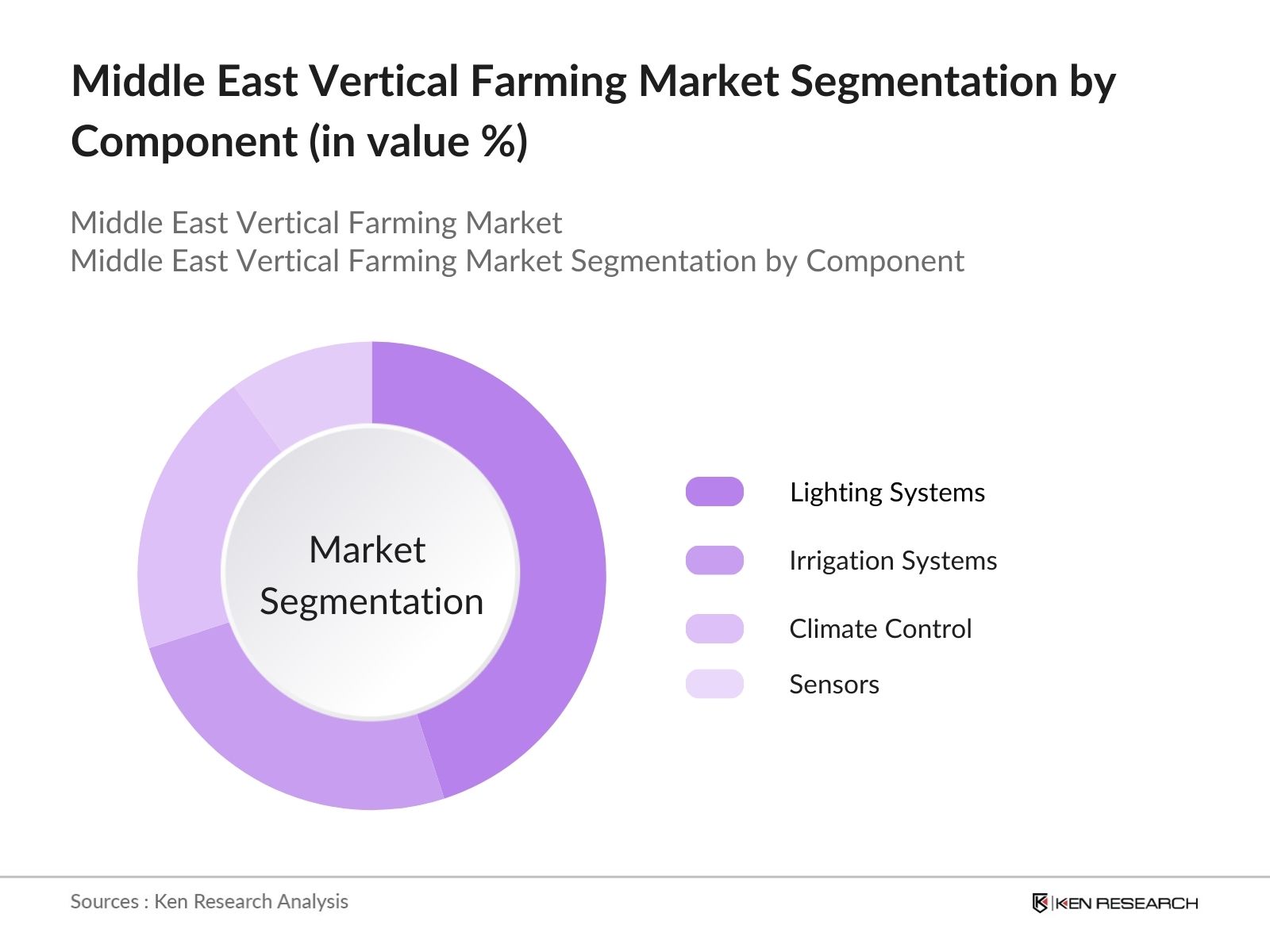

- By Component: The market is segmented by component into climate control systems, sensors, irrigation systems, and lighting systems. Among these, lighting systems hold a dominant market share as they are critical for plant growth in controlled environments, especially in urban settings with limited access to natural light. The adoption of LED grow lights, which are energy-efficient and optimize plant growth, has been widespread in commercial vertical farms, driving the demand in this segment.

Middle East Vertical Farming Market Competitive Landscape

The Middle East vertical farming market is dominated by key players with strong technological capabilities and access to capital. The market features a combination of regional and global companies. The competitive landscape is shaped by continuous investments in innovative farming technologies, strategic partnerships, and government-backed projects aimed at sustainable food production.

|

Company |

Year Established |

Headquarters |

No. of Farms |

Technology Adoption |

Revenue (USD mn) |

Farm Size (sqm) |

Annual Yield (kg) |

Investment Projects |

Energy Efficiency |

|

AeroFarms |

2004 |

USA |

|||||||

|

Badia Farms |

2016 |

UAE |

|||||||

|

Emirates Bio Farm |

2010 |

UAE |

|||||||

|

Smart Acres |

2019 |

UAE |

|||||||

|

Oasis Biotech |

2018 |

UAE |

Middle East Vertical Farming Industry Analysis

Market Growth Drivers

- Increasing Urbanization (Urban Population Growth, Smart City Initiatives): The Middle East is experiencing rapid urbanization, with urban populations growing at an average annual rate of 2.5 million, as reported by the World Bank. Cities like Dubai and Riyadh are focusing on smart city initiatives that integrate sustainable food production methods, such as vertical farming. By 2024, these urbanization trends are expected to drive demand for locally grown produce, reducing dependency on imported food and bolstering food security. The increase in urban population also puts pressure on traditional agriculture, further driving the need for innovative solutions like vertical farming.

- Government Support (Subsidies, Regulatory Support): Governments across the Middle East, particularly in the UAE and Saudi Arabia, are heavily supporting the vertical farming sector. The UAE government allocated over $1.5 billion towards agricultural technology initiatives, including vertical farming projects under its National Food Security Strategy. Saudi Arabia is also providing regulatory support by easing import restrictions on vertical farming technologies and offering tax incentives for sustainable agricultural practices. Such government interventions are making it easier for businesses to adopt vertical farming, accelerating its growth across the region.

- Technological Advancements (Automation, AI Integration, Controlled Environment Agriculture): Technological advancements, particularly in automation and AI, are revolutionizing vertical farming in the Middle East. Controlled Environment Agriculture (CEA) technologies, such as climate control and LED lighting, allow vertical farms to optimize growth conditions year-round. In 2024, investments in AgriTech across the Middle East exceeded $500 million, with a portion directed towards AI-integrated farming systems that reduce labor costs and increase yield efficiency. This has made vertical farming more scalable and attractive for large-scale operations in resource-scarce regions.

Market Challenges

- High Initial Setup Costs (Cost Structure, Financing Limitations): Vertical farming requires upfront investments in infrastructure, technology, and energy. In the Middle East, the cost of establishing a vertical farm range between $10 million to $20 million for a mid-sized operation. Although the UAE and Saudi Arabia have launched financial programs to support AgriTech initiatives, accessing sufficient capital remains a challenge, especially for smaller entrepreneurs. Banks in the region are hesitant to finance these projects due to perceived risks, limiting expansion in the market.

- Lack of Skilled Workforce (Training, Expertise, Talent Gap): The vertical farming sector in the Middle East faces a talent gap, with a shortage of skilled professionals trained in AgriTech and sustainable farming practices. According to a report by the World Bank, the region's agricultural workforce is poorly equipped to handle the technical demands of vertical farming, with less than 5% of agricultural employees trained in advanced technologies. This creates challenges for scaling operations, as businesses struggle to find local expertise, often relying on expensive international consultants to manage farms.

Middle East Vertical Farming Market Future Outlook

Over the next few years, the Middle East vertical farming market is expected to experience growth driven by the increasing focus on food security, advancements in farming technology, and government initiatives aimed at reducing dependence on food imports. With urban populations growing and arable land decreasing, vertical farming presents a sustainable solution that can help meet the regions agricultural needs. Additionally, further innovations in energy-efficient technologies, such as LED grow lights and AI-controlled irrigation systems, are expected to reduce operational costs and enhance productivity in vertical farms.

Future Market Opportunities

- Expansion of Organic and Sustainable Food (Sustainability Trends, Organic Certification): The Middle East is witnessing a growing demand for organic and sustainably produced food, driven by increased consumer awareness of environmental and health issues. In 2024, organic food consumption grew by 15% in major cities like Dubai and Riyadh, as per government agricultural reports. Vertical farms, which can meet organic certification requirements, are well-positioned to capitalize on this trend. Moreover, the region's governments are promoting sustainable agricultural practices through incentives, further encouraging the expansion of organic vertical farming.

- Growing Investments in AgriTech (Venture Capital, Private Equity): Investment in AgriTech across the Middle East is on the rise, with over $700 million in venture capital funding directed towards vertical farming and related technologies by 2024. Major investors are increasingly interested in sustainable food production, particularly in the UAE and Saudi Arabia, where government-backed AgriTech funds are attracting global private equity players. This surge in investment is creating opportunities for vertical farming companies to expand operations, innovate, and improve profitability.

Scope of the Report

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Environment and Climate Change, Agricultural Affairs Authorities)

Food Processing Companies

Urban Development Agencies

Real Estate Developers

AgriTech Startups

Agricultural Equipment Manufacturers

Banks and Financial Institutes

LED and Irrigation System Suppliers

Companies

Major Players

AeroFarms

Badia Farms

Emirates Bio Farm

Smart Acres

Oasis Biotech

Plenty Unlimited Inc.

Bowery Farming

Crop One Holdings

InFarm

BrightFarms

Freight Farms

Green Sense Farms

Spread Co. Ltd.

Sky Greens

Emirates Hydroponics Farms

Table of Contents

1. Middle East Vertical Farming Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Middle East Vertical Farming Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Middle East Vertical Farming Market Analysis

3.1 Growth Drivers

3.1.1 Scarcity of Arable Land (Water Usage, Arable Land Decline, Resource Efficiency)

3.1.2 Increasing Urbanization (Urban Population Growth, Smart City Initiatives)

3.1.3 Government Support (Subsidies, Regulatory Support)

3.1.4 Technological Advancements (Automation, AI Integration, Controlled Environment Agriculture)

3.2 Market Challenges

3.2.1 High Initial Setup Costs (Cost Structure, Financing Limitations)

3.2.2 Lack of Skilled Workforce (Training, Expertise, Talent Gap)

3.2.3 Energy Consumption Issues (Energy Efficiency, Renewable Energy Use)

3.3 Opportunities

3.3.1 Expansion of Organic and Sustainable Food (Sustainability Trends, Organic Certification)

3.3.2 Growing Investments in AgriTech (Venture Capital, Private Equity)

3.3.3 Collaboration with Retail and Distribution Channels (Partnerships, Local Sourcing)

3.4 Trends

3.4.1 Rise in Vertical Farming Technologies (Hydroponics, Aeroponics, Aquaponics)

3.4.2 Adoption of AI and IoT in Agriculture (Automation, Smart Monitoring Systems)

3.4.3 Integration of Renewable Energy in Farms (Solar Panels, Wind Power)

3.5 Government Regulation

3.5.1 National Agricultural Policies (Local Agriculture Policies, Import-Export Regulations)

3.5.2 Incentives for Sustainable Farming (Subsidies, Carbon Footprint Regulations)

3.5.3 Land Use Regulations (Urban Farming Zoning, Licensing Requirements)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Middle East Vertical Farming Market Segmentation

4.1 By Farming Type (In Value %)

4.1.1 Hydroponics

4.1.2 Aeroponics

4.1.3 Aquaponics

4.1.4 Other Vertical Farming Systems

4.2 By Component (In Value %)

4.2.1 Climate Control

4.2.2 Sensors

4.2.3 Irrigation System

4.2.4 Lighting Systems

4.3 By Crop Type (In Value %)

4.3.1 Leafy Greens

4.3.2 Fruits & Vegetables

4.3.3 Herbs & Microgreens

4.3.4 Flowers

4.4 By Application (In Value %)

4.4.1 Residential

4.4.2 Commercial

4.4.3 Industrial

4.5 By Region (In Value %)

4.5.1 South

4.5.2 North

4.5.3 East

4.5.4. West

5. Middle East Vertical Farming Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AeroFarms

5.1.2 Bowery Farming

5.1.3 Plenty Unlimited Inc.

5.1.4 InFarm

5.1.5 Crop One Holdings

5.1.6 Emirates Bio Farm

5.1.7 Badia Farms

5.1.8 Oasis Biotech

5.1.9 Smart Acres

5.1.10 Kalera

5.1.11 BrightFarms

5.1.12 Freight Farms

5.1.13 Green Sense Farms

5.1.14 Spread Co. Ltd.

5.1.15 Sky Greens

5.2 Cross Comparison Parameters (Farm Capacity, Headquarters, No. of Facilities, Inception Year, Technology Adoption, Yield per Square Meter, Revenue, Workforce Size)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East Vertical Farming Market Regulatory Framework

6.1 Environmental Regulations (Greenhouse Emissions, Water Usage Standards)

6.2 Compliance Requirements (Food Safety, Certification)

6.3 Certification Processes (ISO Certifications, Organic Certification Standards)

7. Middle East Vertical Farming Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Middle East Vertical Farming Future Market Segmentation

8.1 By Farming Type (In Value %)

8.2 By Component (In Value %)

8.3 By Crop Type (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Middle East Vertical Farming Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the ecosystem of vertical farming stakeholders in the Middle East, including technology providers, farm operators, and regulatory bodies. This desk research combined proprietary databases and secondary sources to identify the most impactful variables driving the market.

Step 2: Market Analysis and Construction

In this phase, historical market data for vertical farming was collected and analyzed. Key metrics, such as the number of operational vertical farms and yield efficiency, were evaluated to form a comprehensive view of the market's structure and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through interviews to validate key hypotheses. Experts from vertical farm operators and agricultural technology firms provided insights into operational challenges, financial performance, and technological trends shaping the market.

Step 4: Research Synthesis and Final Output

The final research synthesis involved cross-verification of all data points with multiple sources, ensuring that the vertical farming market analysis was accurate and comprehensive. The resulting report integrates insights from both top-down and bottom-up approaches to present a holistic view of the market.

Frequently Asked Questions

01. How big is the Middle East Vertical Farming Market?

The Middle East vertical farming market is valued at USD 320 million, driven by advancements in farming technology and growing demand for sustainable agriculture solutions in the region.

02. What are the challenges in the Middle East Vertical Farming Market?

Challenges in Middle East vertical farming market include high energy costs, a lack of skilled workforce, and high initial setup costs, particularly for large-scale commercial farms. Water scarcity and operational complexities are additional barriers.

03. Who are the major players in the Middle East Vertical Farming Market?

Key players in the m Middle East vertical farming market include AeroFarms, Badia Farms, Emirates Bio Farm, Smart Acres, and Oasis Biotech. These companies lead in technological innovation and have established strong regional operations.

04. What are the growth drivers of the Middle East Vertical Farming Market?

The Middle East vertical farming market is driven by increasing urbanization, limited arable land, water scarcity, and government support for sustainable agricultural practices. Technological advancements in farming methods also contribute .

05. What trends are shaping the Middle East Vertical Farming Market?

Trends Middle East vertical farming market in include the adoption of hydroponics and aeroponics, integration of AI and IoT systems for precision farming, and the use of renewable energy sources like solar panels to power vertical farms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.