Global Mobile Money Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD4767

December 2024

98

About the Report

Global Mobile Money Market Overview

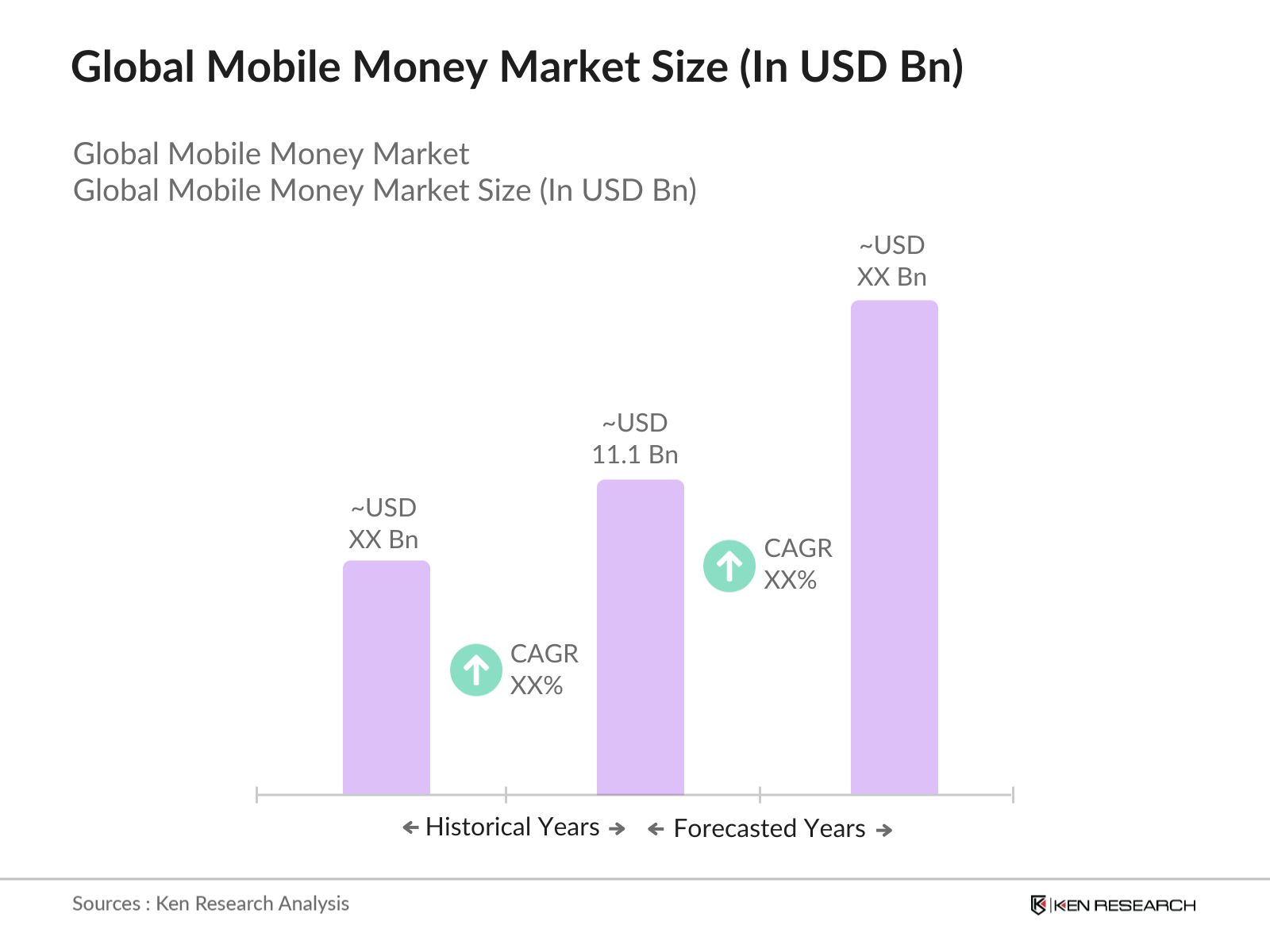

- The global mobile money market is valued at USD 11.1 billion, based on a five-year historical analysis. The market is driven by the growing adoption of mobile devices, increasing internet penetration, and financial inclusion efforts. The expansion of e-commerce, digital wallets, and peer-to-peer transfer platforms also play a significant role in driving this market's growth. With urbanization and technological advancements, mobile money platforms have increasingly become accessible, contributing to the growth trajectory of this market.

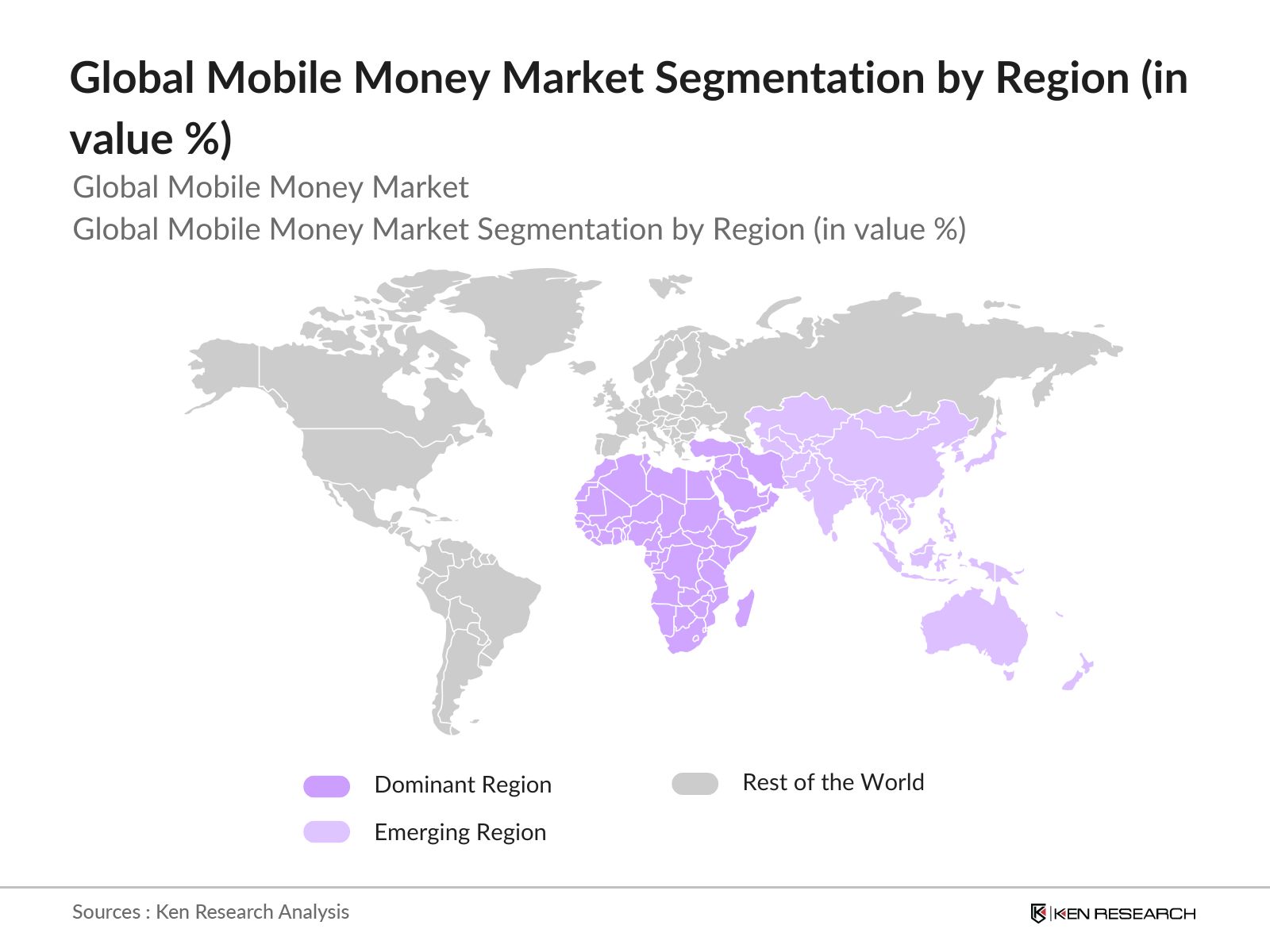

- In the global mobile money market, regions such as Sub-Saharan Africa, Southeast Asia, and Latin America dominate due to a combination of factors. In countries like Kenya, mobile money adoption is deeply ingrained due to limited access to traditional banking services, making platforms like M-Pesa pivotal. Similarly, Southeast Asia, with its high smartphone penetration and growing middle-class population, has seen countries like the Philippines and Indonesia emerge as leaders in the mobile money space.

- Compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) regulations is crucial for mobile money operators. According to the Financial Action Task Force (FATF), approximately $1.5 trillion in illicit funds move globally, and mobile money providers are required to comply with AML/CFT guidelines to mitigate such risks. In 2023, Ghana implemented strict AML compliance requirements for its mobile money services, which has led to a decline in illegal financial activities in the countrys mobile money market.

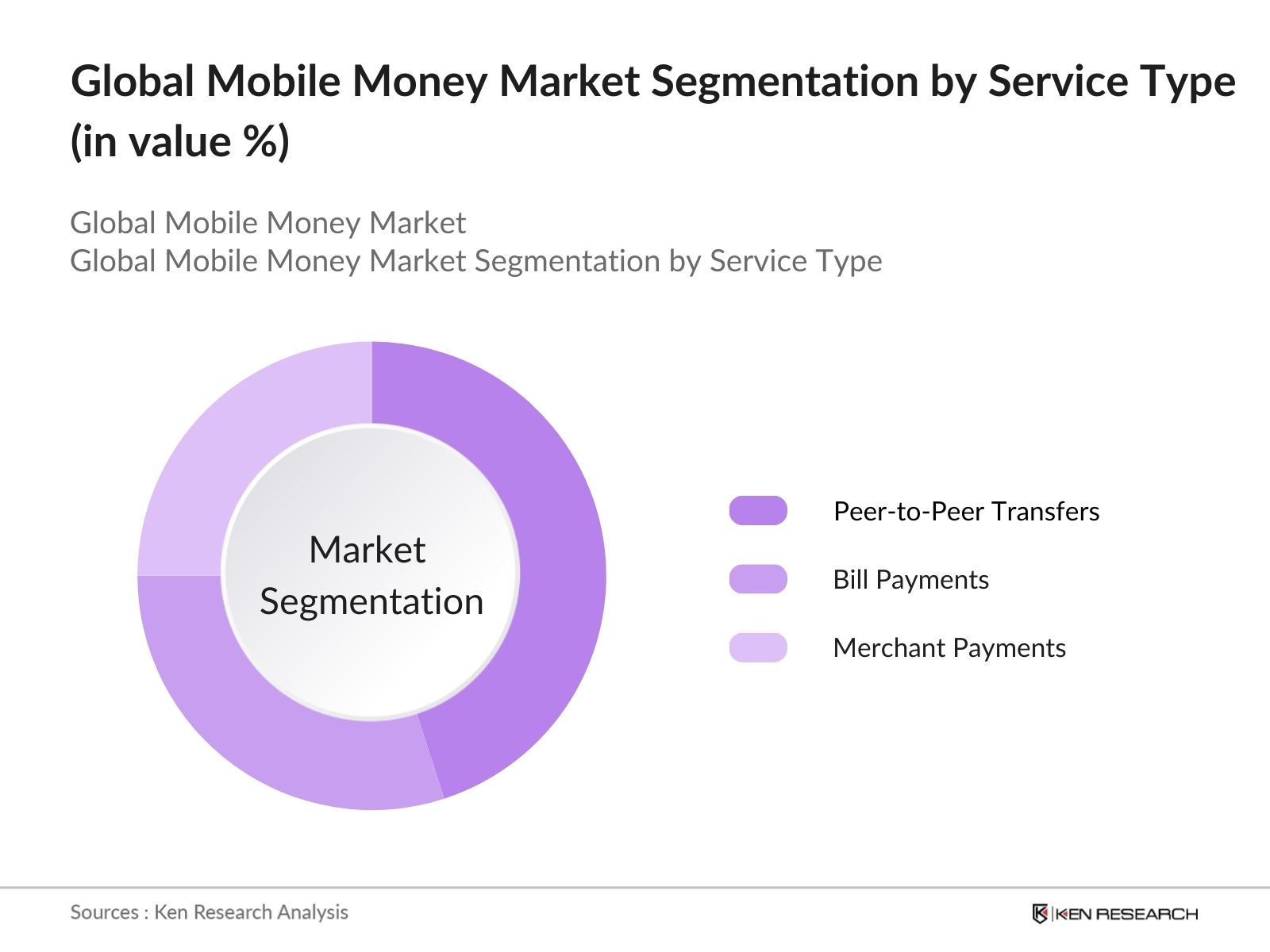

Global Mobile Money Market Segmentation

- By Service Type: The global mobile money market is segmented by service type into peer-to-peer transfers, bill payments, and merchant payments. Peer-to-peer transfers have dominated the market in 2023 due to their widespread usage in regions where formal banking systems are underdeveloped. In rural areas of Africa and Asia, people rely on mobile money services to send remittances, which has made peer-to-peer transfers the largest segment under service type. The ease of use and quick transaction capabilities have further strengthened this segment's market share.

- By Technology: The market is segmented by technology into USSD, NFC, mobile wallets, and QR code payments. USSD (Unstructured Supplementary Service Data) technology dominates the mobile money market, especially in regions with limited internet access. This technology enables users to conduct transactions without an internet connection, which is why it has the highest market share in developing countries. The use of USSD has been critical in enabling mobile banking in rural areas, where internet penetration remains low.

- By Region: The global mobile money market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Sub-Saharan Africa dominates the market due to the high dependence on mobile banking services, especially in countries like Kenya, Tanzania, and Ghana. Mobile money has become a reliable financial tool in these regions, where traditional banking infrastructure is limited, making Africa the top region for mobile money transactions in 2023.

Global Mobile Money Market Competitive Landscape

The global mobile money market is dominated by a few major players, including Vodafone Group, Ant Group, and MTN Group. This consolidation reflects the critical role these companies play in shaping the market, with their expansive networks, strong user base, and innovative service offerings. Collaboration between telecommunications companies and financial institutions is a key strategy employed by these market leaders.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD Bn) |

Active Users (Mn) |

Key Markets |

Key Service Offered |

Technology Used |

|

Vodafone Group |

1982 |

Newbury, UK |

- |

- |

- |

- |

- |

- |

|

MTN Group |

1994 |

Johannesburg, SA |

- |

- |

- |

- |

- |

- |

|

Ant Group |

2014 |

Hangzhou, China |

- |

- |

- |

- |

- |

- |

|

PayPal Holdings |

1998 |

San Jose, USA |

- |

- |

- |

- |

- |

- |

|

Western Union |

1851 |

Denver, USA |

- |

- |

- |

- |

- |

- |

Global Mobile Money Market Analysis

Global Mobile Money Market Growth Drivers

- Increasing Smartphone Penetration: Smartphone penetration has surged globally, with over 6.8 billion mobile phone users by 2024, according to GSMA's Mobile Economy Report. This wide adoption of smartphones is driving mobile money services as more people gain access to mobile networks, particularly in developing regions. In sub-Saharan Africa, for instance, mobile connectivity has grown by 10% annually over the past five years, facilitating the expansion of mobile money ecosystems. The World Bank reports that over 50% of the world's unbanked population now owns a mobile phone, which significantly accelerates mobile-based financial services and digital transactions.

- Rising Financial Inclusion Efforts: Governments globally are focusing on financial inclusion, with mobile money platforms playing a critical role in these efforts. The World Bank estimates that 1.4 billion adults remain unbanked, but financial inclusion initiatives in emerging economies, such as India's "Jan Dhan Yojana," have brought over 400 million people into the banking system via mobile money solutions. In Kenya, 85% of adults now use mobile money due to regulatory backing and policies promoting digital financial inclusion. Government-led initiatives are progressively bridging the gap between the unbanked and formal financial systems.

- Expansion of E-commerce and Digital Payments: The global shift towards e-commerce, now valued at over $5.5 trillion, has bolstered the mobile money market by increasing the demand for digital payment systems. As online retail platforms expand in regions like Southeast Asia and Africa, mobile money solutions are being integrated as primary payment methods. A report from the International Finance Corporation (IFC) reveals that 70% of e-commerce transactions in Africa are now processed via mobile money. This growth is further catalyzed by increasing smartphone ownership and internet accessibility, particularly in developing economies.

Global Mobile Money Market Challenges

- Regulatory Barriers: Regulatory frameworks for mobile money services vary globally, often presenting challenges for expansion. Countries like India and Nigeria have strict licensing requirements for mobile money operators, which can delay market entry and inhibit growth. In Nigeria, for example, only 20% of mobile network operators are licensed to offer mobile money services due to compliance hurdles with the Central Bank's regulations. The World Bank notes that over-regulation in the financial sector can slow the pace of innovation and adoption in mobile money services, particularly in emerging markets.

- Fraud and Cybersecurity Concerns: Mobile money services are increasingly targeted by cybercriminals, with fraud cases amounting to approximately $1.5 billion in losses annually, as reported by GSMA. The rise of mobile transactions has amplified concerns over data privacy, with countries such as India reporting over 7 million fraudulent transactions in 2023. Regulatory bodies are tightening cybersecurity requirements, with the European Union's General Data Protection Regulation (GDPR) setting stringent rules for data handling in mobile transactions. However, the lack of a global regulatory standard poses risks for cross-border transactions and data sharing.

Global Mobile Money Market Future Outlook

Over the next five years, the global mobile money market is expected to exhibit strong growth, driven by expanding mobile connectivity, increasing financial inclusion initiatives, and the growing need for digital financial services in emerging markets. The proliferation of smartphones and internet access in rural areas, coupled with rising government support for mobile payments, will continue to push the market forward. Additionally, advancements in blockchain and AI for mobile payments are expected to introduce innovative solutions, improving security and user experience.

Global Mobile Money Market Opportunities

- Growth in Rural Mobile Adoption: The rural population in developing countries is increasingly adopting mobile phones, driving growth in mobile money services. As of 2024, rural mobile penetration in Africa has reached 60%, up from 35% in 2015, according to the GSMA. This rapid growth in rural areas presents opportunities for mobile money operators to reach underserved populations, offering them access to digital financial services. The World Bank highlights that access to mobile financial services can lift rural communities out of poverty by facilitating remittances, savings, and payments.

- Partnerships Between Telecoms and Banks: Telecom companies and banks are increasingly collaborating to offer integrated mobile money solutions. For instance, in 2023, Vodacom partnered with Standard Bank to provide seamless mobile money services across South Africa. Such partnerships allow for the pooling of resources and expertise, facilitating greater financial inclusion. In Bangladesh, mobile financial services transactions have grown by over 200 million annually due to partnerships between telecom operators and local banks. This collaborative ecosystem is essential for driving innovation and ensuring wide-scale adoption of mobile money services.

Scope of the Report

|

By Service Type |

Peer-to-Peer Transfers Bill Payments Mobile Banking Merchant Payments |

|

By Technology |

USSD NFC Mobile Wallets QR Code Payments |

|

By Transaction Type |

Domestic Transfers International Remittances |

|

By Payment Mode |

Mobile Applications SMS-Based Payments USSD-Based Payments |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Mobile Network Operators

Payment Processing Companies

Financial Technology (FinTech) Firms

Retail and E-commerce Companies

Government and Regulatory Bodies (e.g., Central Banks)

Venture Capital and Private Equity Firms

Remittance Service Providers

Blockchain Technology Providers

Companies

Global Mobile Money Market Major Players

Vodafone Group

MTN Group

Ant Group

PayPal Holdings

Western Union

Airtel Africa

Google Pay

Apple Pay

Telenor Group

WeChat Pay

Stripe

WorldRemit

TransferWise (Wise)

EcoCash

Orange S.A.

Table of Contents

1. Global Mobile Money Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Mobile Money Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Mobile Money Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Smartphone Penetration (Mobile Connectivity)

3.1.2 Rising Financial Inclusion Efforts (Government Initiatives)

3.1.3 Expansion of E-commerce and Digital Payments (E-commerce Penetration)

3.1.4 Emergence of Mobile-First Economies (Consumer Behavior Shifts)

3.2 Market Challenges

3.2.1 Regulatory Barriers (Licensing and Compliance)

3.2.2 Fraud and Cybersecurity Concerns (Data Privacy)

3.2.3 Lack of Digital Literacy (Financial Education)

3.3 Opportunities

3.3.1 Growth in Rural Mobile Adoption (Rural Penetration)

3.3.2 Partnerships Between Telecoms and Banks (Collaborative Ecosystem)

3.3.3 Introduction of Blockchain for Mobile Payments (Technology Integration)

3.4 Trends

3.4.1 Adoption of Artificial Intelligence in Mobile Transactions (AI Integration)

3.4.2 Rising Use of QR Code-based Payments (Instant Payments)

3.4.3 Increasing Cross-border Mobile Money Transfers (Global Transactions)

3.5 Government Regulation

3.5.1 Mobile Money Regulatory Framework (Financial Regulations)

3.5.2 Know Your Customer (KYC) Norms (Customer Identification)

3.5.3 AML and CFT Compliance (Anti-Money Laundering & Counter-Terrorism Financing)

3.5.4 Role of Central Banks (Monetary Policy Oversight)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Mobile Money Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Peer-to-Peer Transfers

4.1.2 Bill Payments

4.1.3 Mobile Banking

4.1.4 Merchant Payments

4.2 By Technology (In Value %)

4.2.1 USSD

4.2.2 NFC

4.2.3 Mobile Wallets

4.2.4 QR Code Payments

4.3 By Transaction Type (In Value %)

4.3.1 Domestic Transfers

4.3.2 International Remittances

4.4 By Payment Mode (In Value %)

4.4.1 Mobile Applications

4.4.2 SMS-Based Payments

4.4.3 USSD-Based Payments

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Mobile Money Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Vodafone Group

5.1.2 MTN Group

5.1.3 PayPal Holdings

5.1.4 Ant Group

5.1.5 Airtel Africa

5.1.6 Orange S.A.

5.1.7 Western Union

5.1.8 Telenor Group

5.1.9 Google Pay

5.1.10 Apple Pay

5.1.11 M-Pesa

5.1.12 WeChat Pay

5.1.13 WorldRemit

5.1.14 TransferWise (Wise)

5.1.15 Stripe

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Service Type, Revenue, Mobile Adoption Rate, Payment Security Features, Partnerships, Geographic Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Mobile Money Market Regulatory Framework

6.1 Mobile Money Licensing Requirements (Telecom and Banking Regulations)

6.2 Cross-border Payment Regulations (Global Standards)

6.3 Data Protection Laws (Customer Privacy Policies)

6.4 Interoperability Regulations (Seamless Transaction Ecosystem)

7. Global Mobile Money Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Mobile Money Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Transaction Type (In Value %)

8.4 By Payment Mode (In Value %)

8.5 By Region (In Value %)

9. Global Mobile Money Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ecosystem of stakeholders in the global mobile money market. Extensive desk research is conducted using secondary and proprietary databases to gather industry-specific information. This step identifies the critical variables that affect market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the global mobile money market is compiled and analyzed, including transaction volumes, adoption rates, and technological penetration. This analysis forms the basis for revenue forecasts and market insights.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations with industry experts are conducted. Interviews with executives from mobile operators, FinTech firms, and regulatory authorities help refine the data and provide deeper insights into market trends.

Step 4: Research Synthesis and Final Output

The final step integrates data from multiple sources, providing a comprehensive analysis of the mobile money market. This synthesis ensures the accuracy and relevance of the market findings, offering a reliable forecast for business decision-makers.

Frequently Asked Questions

01. How big is the global mobile money market?

The global mobile money market is valued at USD 11.1 billion, driven by rising smartphone penetration, financial inclusion efforts, and the growth of digital payment platforms globally.

02. What are the challenges in the global mobile money market?

The challenges in the global mobile money market include regulatory barriers, cybersecurity concerns, and a lack of digital literacy in certain regions, which hinder the market's growth potential.

03. Who are the major players in the global mobile money market?

Key players in the global mobile money market include Vodafone Group, Ant Group, MTN Group, and PayPal Holdings, which dominate due to their expansive user bases, strong technological infrastructure, and global reach.

04. What are the growth drivers of the global mobile money market?

The global mobile money market is driven by factors such as increasing smartphone penetration, growing e-commerce activities, and government support for digital financial services, particularly in emerging markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.