Morocco Auto Accessories Market Outlook to 2030

Region:Africa

Author(s):Shubham Kashyap

Product Code:KROD9632

October 2024

83

About the Report

Morocco Auto Accessories Market Overview

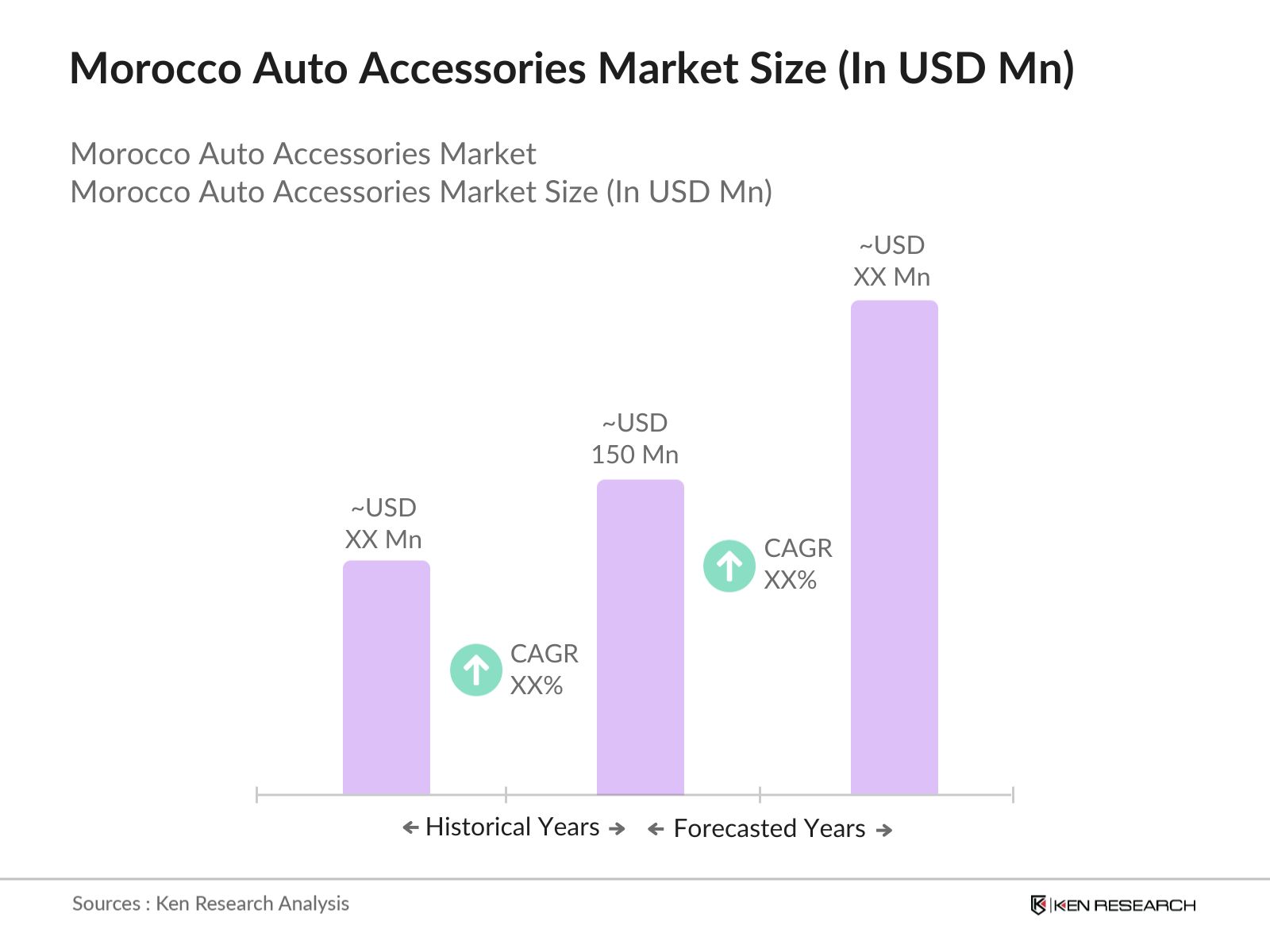

- The Morocco auto accessories market is valued at USD 150 Mn and is anticipated to experience growth, driven by the rising demand for vehicle customization, an expanding automotive industry, and an increasing number of car owners. The market is currently witnessing a surge in the adoption of accessories such as car infotainment systems, seat covers, and floor mats, as consumers seek to personalize and enhance their driving experience. Additionally, advancements in automotive technology, such as the integration of smart devices, are further boosting market expansion.

- Urban areas like Casablanca, Rabat, and Marrakech are key drivers of demand due to their growing populations and higher disposable income levels. The increasing availability of auto accessories through online platforms, coupled with discounts and easy product comparisons, has made it more convenient for consumers to purchase auto accessories. The shift towards electric vehicles (EVs) in Morocco is also expected to generate demand for new types of accessories tailored to EV owners.

- Morocco’s government imposes a range of import duties and trade regulations on auto accessories to protect local manufacturers and encourage domestic production. In 2024, import duties on automotive parts and accessories range from 2% to 30%, depending on the product category. These regulations are part of Morocco’s broader trade policies aimed at reducing the trade deficit and boosting local industry.

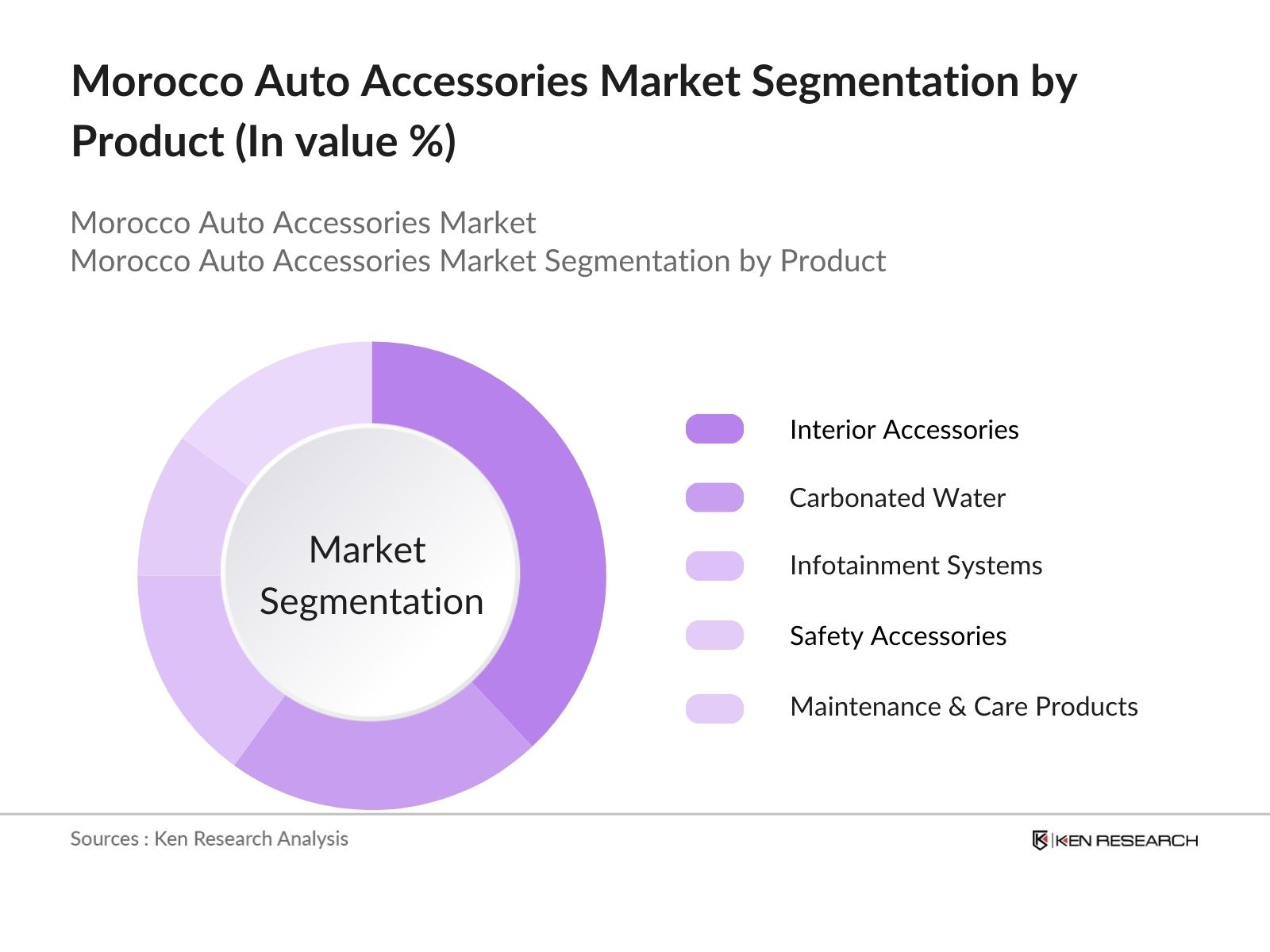

Morocco Auto Accessories Market Segmentation

- By Product Type: The market is segmented by product type into Interior, Carbonated, Safety, Maintenance & Care Product and Infotainment accessories. Interior accessories, including seat covers, floor mats, and steering wheel covers, dominate the market due to their popularity in enhancing comfort and aesthetics. Exterior accessories, such as car wraps and body kits, are also gaining traction, particularly among younger drivers looking for customization options. Infotainment accessories, including GPS navigation systems and advanced audio systems, are becoming increasingly popular as consumers seek enhanced in-car entertainment experiences.

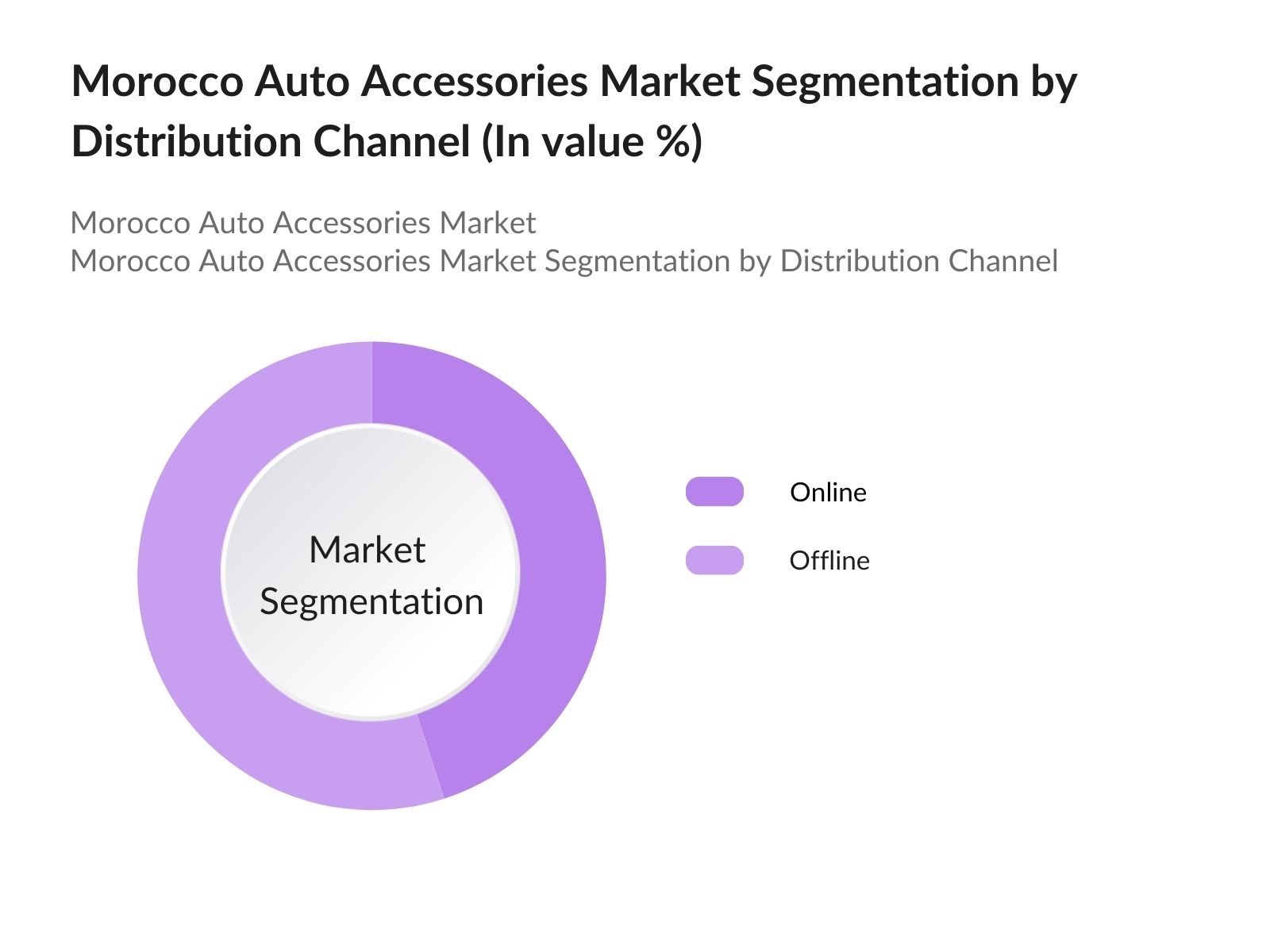

- By Distribution Channel: The market is segmented by distribution channel into Online and Offline channels. Online sales of auto accessories are growing rapidly due to the convenience of shopping from home, access to a wider variety of products, and the ability to compare prices across different platforms. Offline channels, including specialty stores and automotive service centers, continue to hold a share of the market, particularly in rural areas where online penetration is lower.

Morocco Auto Accessories Market Competitive Landscape

The auto accessories market in Morocco is highly competitive, with both international and local players vying for market share. Major companies such as Bosch, Valeo, and Michelin are introducing new products with advanced features like enhanced durability, smart connectivity, and improved aesthetic appeal to cater to diverse consumer needs. Local brands are also gaining traction by offering affordable, high-quality products tailored to the preferences of Moroccan consumers.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD) |

Product Portfolio |

Market Presence |

R&D Investment |

Key Markets |

Technological Innovation |

|

Bosch |

1886 |

Germany |

|

|

|

|

|

|

|

Valeo |

1923 |

France |

|

|

|

|

|

|

|

Michelin |

1889 |

France |

|

|

|

|

|

|

|

Denso Corporation |

1949 |

Japan |

|

|

|

|

|

|

|

AutoZone |

1979 |

USA |

|

|

|

|

|

|

Morocco Auto Accessories Industry Analysis

Growth Drivers

- Increasing Vehicle Ownership: In 2024, Morocco's vehicle ownership has seen a notable increase, with over 4.4 million registered vehicles compared to 4.12 million in 2020. The country's automotive industry is supported by government investments, as well as the growing middle class. The World Bank reports Morocco's annual GDP growth at 3.4%, with increased household income fueling vehicle purchases. Government initiatives such as tax breaks and incentives on vehicle purchases have also contributed to this trend, leading to higher demand for auto accessories as vehicle ownership rises. This growth is reflected in the expanding automotive aftermarket, driven by greater vehicle customization preferences.

- Rising Trend for Customization: The rise in vehicle customization is becoming a key growth driver in Morocco's auto accessories market. Majority of Moroccan car owners, particularly younger demographics, have shown a preference for personalizing their vehicles. The trend is supported by the country's automotive culture and availability of affordable accessories from international suppliers. Increased social media influence and car modification events have further popularized customization. With Morocco’s GDP per capita exceeding USD 3,370 in 2023, the disposable income available for such non-essential purchases has spurred further demand for this market segment.

- Technological Integration in Vehicles: With majority of newly sold vehicles in Morocco in 2024 featuring advanced technologies, the integration of technological innovations is driving the growth of the auto accessories market. Increasing consumer demand for tech-enabled auto accessories like parking sensors, dash cams, and in-car infotainment systems has grown due to heightened safety concerns and enhanced driving experiences. The Moroccan government’s focus on promoting smart transportation solutions aligns with this trend, driving demand for tech-integrated auto accessories. As Morocco’s digital economy grows, supported by a projected internet penetration rate of 93% by 2023, tech-focused accessory demand will continue rising.

Market Challenges

- High Price Sensitivity: The Moroccan auto accessories market is highly price-sensitive, with consumers gravitating toward affordable solutions due to limited disposable incomes. Morocco’s economic conditions, including inflationary pressures, have further strained purchasing power, making price a critical factor for many consumers. This sensitivity challenges suppliers, particularly international brands that offer premium-priced products. Local manufacturers and sellers tend to dominate the lower-price segment by providing more cost-effective alternatives, making it difficult for global brands to compete effectively in the mass market.

- Proliferation of Counterfeit Products: The market faces challenges from the proliferation of counterfeit auto accessories, which pose risks to product quality and safety standards. These counterfeit products, often entering through weakly enforced borders, offer lower-priced alternatives that can undercut legitimate businesses. Despite the government’s efforts to strengthen customs regulations, counterfeit goods remain prevalent, creating hurdles for authentic manufacturers and suppliers to maintain a competitive edge. These issues contribute to a complex market environment, where the presence of non-compliant products erodes consumer trust.

Morocco Auto Accessories Market Future Outlook

The Morocco auto accessories market is expected to experience robust growth over the next five years, driven by increasing vehicle ownership, growing interest in customization, and the expansion of e-commerce. Additionally, the rise of electric vehicles (EVs) and the adoption of smart auto accessories will contribute to the market's long-term growth.

Future Market Opportunities

- Adoption of Smart Accessories: With the increasing adoption of advanced technologies in vehicles, the demand for smart auto accessories is rising. In 2024, more than half of newly sold vehicles in Morocco come equipped with in-built smart technology, including infotainment systems, GPS trackers, and safety monitoring devices. This shift towards technology integration presents a opportunity for the auto accessories market to expand, especially in offering aftermarket smart products. Morocco’s automotive industry is supported by government initiatives to modernize the vehicle fleet, encouraging consumers to adopt smart, tech-driven accessories.

- Electric Vehicle Accessories Market Growth: With Morocco’s electric vehicle (EV) market expected to expand, the demand for EV-compatible accessories is on the rise. In 2023, the Moroccan government introduced incentives for EV purchases, resulting in a 15% increase in EV registrations. This has opened opportunities for businesses to cater to the specific needs of EV users, including specialized charging cables, portable chargers, and battery maintenance accessories. With plans to increase EV infrastructure nationwide, including the installation of 2,500 charging stations by 2026, the EV accessory segment presents a lucrative opportunity for the auto accessories market.

Scope of the Report

|

By Product Type |

Interior Carbonated Safety Accessories Maintenance & Care Product Infotainment accessories |

|

By Distribution Channel |

Online Offline |

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles |

|

By Price Range |

Premium Accessories Budget Accessories |

|

By End-User |

Individual Consumers Fleet Operators Ride-Hailing Services |

Products

Key Target Audience

- Automotive Manufacturers

- Automotive Dealerships

- Fleet Operators

- Vehicle Customization Shops

- E-commerce Platforms (Amazon, Alibaba)

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry, Trade, and Green and Digital Economy)

- Electric Vehicle Charging Infrastructure Providers

- Banks and Financial Institutions

Companies

Players Mentioned in the Report

- Bosch

- Valeo

- Michelin

- Denso Corporation

- AutoZone

- Pioneer Corporation

- Garmin Ltd.

- Magneti Marelli

- HELLA GmbH & Co. KGaA

- Delphi Technologies

- Yokohama Rubber Company

- ACDelco

- Continental AG

- Amazon (Auto Accessories Division)

- Alibaba (Auto Accessories Division)

Table of Contents

1. Morocco Auto Accessories Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Morocco Auto Accessories Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Morocco Auto Accessories Market Analysis

3.1 Growth Drivers (Vehicle Customization, Rising Automotive Sales, Technological Advancements, Aftermarket Expansion)

3.1.1 Increasing Vehicle Ownership

3.1.2 Rising Trend for Customization

3.1.3 Technological Integration in Vehicles

3.1.4 Expanding Aftermarket Services

3.2 Market Challenges (Price Sensitivity, Counterfeit Products, High Competition)

3.2.1 High Price Sensitivity

3.2.2 Proliferation of Counterfeit Products

3.2.3 High Competition Among Global and Local Players

3.3 Opportunities (Growth in E-commerce, Smart Auto Accessories, Rising EV Adoption)

3.3.1 Growth in Online Retail for Auto Accessories

3.3.2 Adoption of Smart Accessories

3.3.3 Electric Vehicle Accessories Market Growth

3.4 Trends (Infotainment Systems, Sustainable Auto Accessories, Rise of EV-compatible Accessories)

3.4.1 Increased Demand for Infotainment Systems

3.4.2 Growing Focus on Sustainable and Eco-friendly Accessories

3.4.3 Rise of EV-compatible Accessories

3.5 Government Regulations (Import Duties, EV Incentives, Safety Standards)

3.5.1 Import Duties and Trade Regulations

3.5.2 Incentives for EV Adoption

3.5.3 Safety Standards for Auto Accessories

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Distributors, E-commerce, Service Centers)

3.8 Porter’s Five Forces (Bargaining Power of Suppliers, Competitive Rivalry, Threat of New Entrants)

3.9 Competition Ecosystem

4. Morocco Auto Accessories Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Interior Accessories (Seat Covers, Floor Mats, Steering Wheel Covers)

4.1.2 Exterior Accessories (Car Wraps, Alloy Wheels, Body Kits)

4.1.3 Infotainment Systems (GPS, Audio Systems, Smart Connectivity)

4.1.4 Safety Accessories (Car Alarms, Dashcams, Parking Sensors)

4.1.5 Maintenance & Care Accessories (Cleaning Products, Engine Oil Additives)

4.2 By Distribution Channel (In Value %)

4.2.1 Online (E-commerce Platforms, Direct-to-Consumer)

4.2.2 Offline (Auto Dealerships, Specialty Stores, Service Centers)

4.3 By Vehicle Type (In Value %)

4.3.1 Passenger Vehicles

4.3.2 Commercial Vehicles

4.4 By Price Range (In Value %)

4.4.1 Premium Accessories

4.4.2 Budget Accessories

4.5 By End-User (In Value %)

4.5.1 Individual Consumers

4.5.2 Fleet Operators

4.5.3 Ride-Hailing Services

5. Morocco Auto Accessories Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bosch

5.1.2 Valeo

5.1.3 Michelin

5.1.4 Denso Corporation

5.1.5 Continental AG

5.1.6 AutoZone

5.1.7 Amazon (Auto Accessories Division)

5.1.8 Alibaba (Auto Accessories Division)

5.1.9 Pioneer Corporation

5.1.10 Garmin Ltd.

5.1.11 Magneti Marelli

5.1.12 HELLA GmbH & Co. KGaA

5.1.13 Delphi Technologies

5.1.14 Yokohama Rubber Company

5.1.15 ACDelco

5.2 Cross Comparison Parameters (Headquarters, Revenue, Market Share, Product Portfolio, R&D Spending, Employee Base, Geographic Presence, Strategic Initiatives)

5.3 Market Share Analysis (Global Players, Local Players)

5.4 Strategic Initiatives (New Product Launches, Collaborations, Regional Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Incentives

5.9 Private Equity Investments

6. Morocco Auto Accessories Market Regulatory Framework

6.1 Import Duties and Trade Policies

6.2 Compliance and Certification Processes

6.3 Environmental and Safety Standards

7. Morocco Auto Accessories Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Morocco Auto Accessories Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Vehicle Type (In Value %)

8.4 By Price Range (In Value %)

8.5 By End-User (In Value %)

9. Morocco Auto Accessories Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 Go-to-Market Strategy

9.4 Product Innovation Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders in the Morocco auto accessories market. Extensive desk research is performed, drawing from secondary sources and proprietary databases to collect comprehensive industry-level information. This step aims to identify critical variables that influence the market’s dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on Morocco's auto accessories market is compiled and analyzed. The analysis includes assessing market penetration, the ratio of accessories per vehicle sold, and revenue generated by various segments. Key metrics such as customer satisfaction and product quality statistics are also evaluated to ensure accuracy in the market data estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate our hypotheses, consultations with industry experts and practitioners are conducted through computer-assisted telephone interviews (CATIs). Insights from these interviews help refine our data, providing operational and financial insights from experienced market players, ensuring a well-rounded market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, engagement with auto accessories manufacturers provides additional information regarding product segments, customer preferences, and sales performance. This step serves to verify the findings derived from the bottom-up approach, ensuring comprehensive and validated market analysis.

Frequently Asked Questions

01 How big is the Morocco Auto Accessories Market?

The Morocco auto accessories market is valued at USD 150 million, driven by rising vehicle ownership, a growing trend of customization, and advancements in automotive technology.

02 What are the challenges in the Morocco Auto Accessories Market?

Key challenges in the Morocco auto accessories market include price sensitivity among consumers, a proliferation of counterfeit products, and intense competition between global and local brands, which can impact profitability and market share.

03 Who are the major players in the Morocco Auto Accessories Market?

Major players in the Morocco auto accessories market include Bosch, Valeo, Michelin, Denso Corporation, and AutoZone, all of which have established strong market presence with a diverse product portfolio.

04 What are the growth drivers of the Morocco Auto Accessories Market?

The Morocco auto accessories market is driven by increasing vehicle ownership, the rising demand for vehicle personalization, and the adoption of electric vehicles, which has created new demand for specialized accessories.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.