Myanmar Agriculture Machinery Market Outlook to 2025

Driven by Growth in Machinery Supply and Governments Focus on Agriculture Mechanization in the Country

Region:Asia

Author(s):Fanindra Tibrewal

Product Code:KR1059

April 2021

95

About the Report

The report titled “Myanmar Agriculture Machinery Market Outlook to 2025: Driven by Growth in Machinery Supply and Government's Focus on Agriculture Mechanization in the Country” provides a comprehensive analysis on the performance of the agriculture machinery market in Myanmar. The report covers various aspects including sales value, volume, trends & developments, issues & challenges faced by the industry, competition landscape, financing players, and others. It also covers the country overview, regulatory framework, agricultural overview of Myanmar, land under cultivation, changes in the cropping patterns, farm holding structure & scale of mechanization. The report concludes with the projections for the future of industry including forecasted sales value and volume; future projections by product type and regional demand by the year ending 2025, COVID-19 impact, and analyst recommendations highlighting the major opportunities and cautions in the industry.

Myanmar Agriculture Machinery Market Overview and Size

Myanmar Agriculture Machinery Market Overview and Size

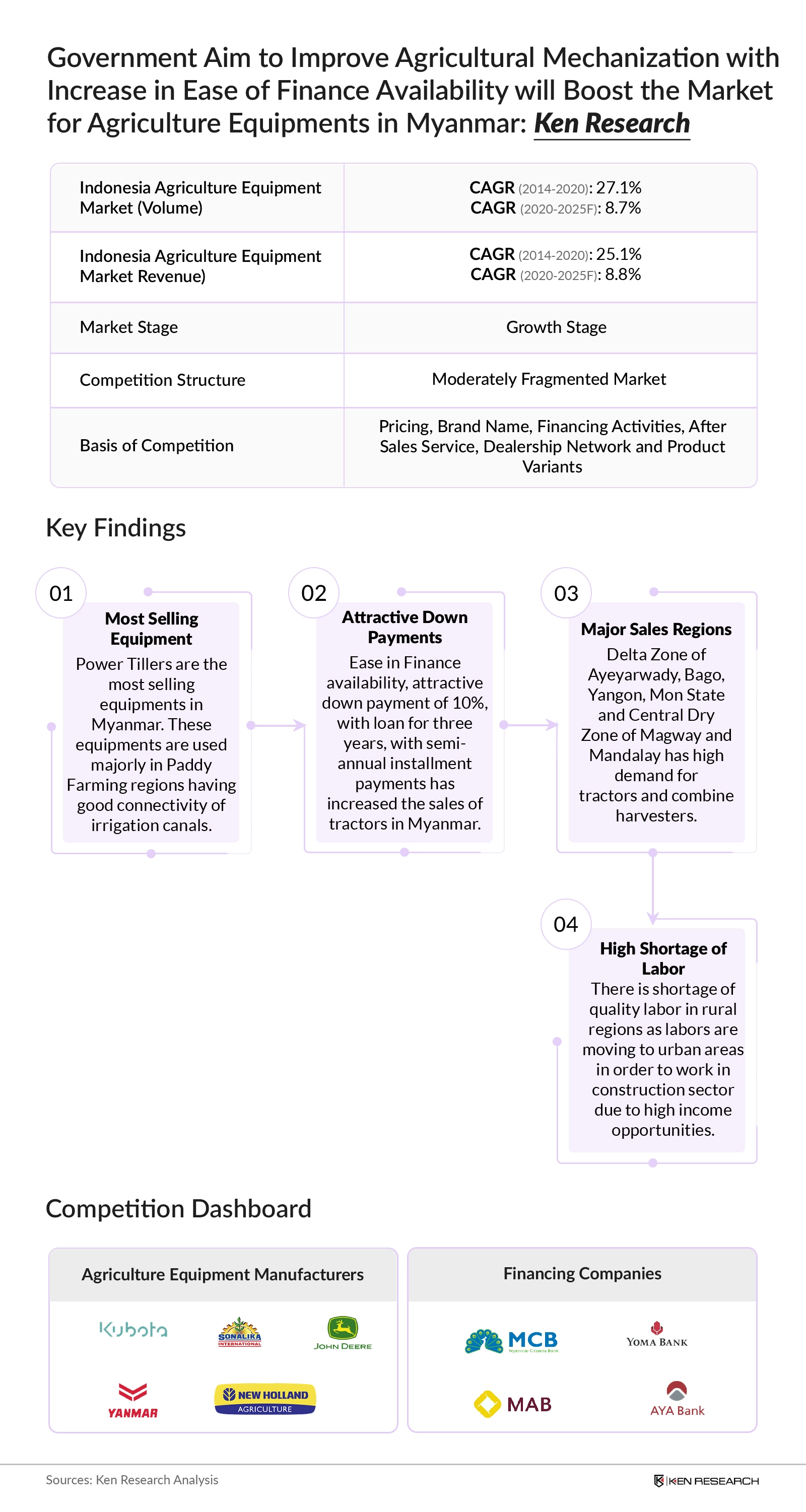

The revenues from the overall agriculture machinery market increased at CAGR of ~25%during the review period 2014-2020. The equipment market in Myanmar is completely import dependent with major trade partners being China, India, Thailand and other countries. Tractors, Combine Harvesters and Implements are the most demanded machineries in the country. Tractor is the most deployed equipment in the country followed by combine harvesters and implements. The contribution of the tractor market to the overall market stood at more than ~83% in terms of volume and ~67% in terms of revenue during the review period.

Myanmar Tractor Market Size and Segmentation

Four Wheeler and Two Wheeler Tractors are available for sale in the country. Major regions where demand for tractors is concentrated in Myanmar are Ayeyarwady, Yangon, Kayah, Mandalay and Magway. The demand for two wheeler tractors declined during the review period are farmers preferred using low HP four wheeler tractors instead of two wheeler tractors. Tractors are appropriate for narrow areas, high efficiency soil processing, commercial farming & cooperatives. Kubota, Sonalika, New Holland and John Deere are the companies dominating the demand for tractors in Myanmar.

Myanmar Combine Harvesters Market Size and Segmentation

Combine Harvesters were introduced in Myanmar in 2012 and is currently positioned to be in early growth stage. The demand for combine harvesters is concentrated in Central Region with Yangon, Ayeyarwady and Bago considered as major demand locations for the machinery. Kubota and Yanmar have dominated the market for combine harvesters in the country.

Myanmar Implements Market Size and Segmentation

The demand for implement in Myanmar is dependent on sale of four wheeler tractors. Majority of farmers prefers purchasing implements along with four wheeler tractors. Rotary Tiller and Disc Harrow collectively captured more than 70% of implements market in the country.

Comparative Landscape of Myanmar Agriculture Machinery Market

Competition in the Myanmar Tractor Market is observed to be fragmented in nature with presence of 30-40 players in the industry. Top 3 players namely Kubota, Dongfeng and Sonalika captured ~50% market share. On the other hand, competition in Myanmar Combine Harvester Market is observed to be highly concentrated in nature owing to presence of 7-8 players in the industry. More than 75% of the market is captured by the top two players in the market. Companies with large product assortment, wide regional presence, efficient customer care network and fair pricing are indentified as clear leaders in the industry.

Impact of COVID-19

Due to COVID-19 Outbreak, OEMs were unable to deliver new orders. Due to this, dealers faced low availability of machines, spares and attachments. Major Product Categories witnessed decline in sales between 4-12% on the basis of volume and value. Myanmar’s agriculture machinery market being completely import driven faced high difficulties in fulfilling customer order leading to shortage in supply.

Myanmar Agriculture Equipment Market Future Outlook and Projections

Government’s increased focus on agriculture mechanization in the country is expected to increase the demand for agriculture machinery in the country, registering a CAGR of 8.8% during the forecast period. Modernization would drive the growth, as farmers are expected to increase the adoption of combine harvesters and tractors, thereby making their operations more efficient and reducing dependency on labor. In addition to this, government initiative for improving agriculture finance, AMDs effort for improving mechanization, training and development will facilitate growth in future.

Key Topics Covered in the Report:-

- Executive Summary

- Country Overview

- Agriculture Overview in Myanmar

- How do Farmers operate in Myanmar?

- Supply Side of Myanmar Agriculture Machinery Market

- Myanmar Tractors and Combine Harvesters Market, 2014-2025

- Snapshot on Rental Agriculture Equipment Business in Myanmar

- Snapshot on Second Hand Machinery Market in Myanmar

- Financing for Agriculture Machinery in Myanmar

- Comparative Landscape in Myanmar Agriculture Machinery Market

- Impact of COVID-19 on Myanmar Agriculture Machinery Market

- Myanmar Future Outlook & Projections, 2020-2025

- Analyst Recommendations

Products

Key Target Audience

Agriculture Equipment Manufacturing Companies

Industry Associations

Regulatory Bodies

Financing Companies

Agriculture Equipment Distributors & Authorized Dealerships

Time Period Captured in the Report:-

Historical Period – 2014-2020

Forecast Period – 2020-2025

Companies

Key Segments Covered:

Total Myanmar Agriculture Machinery Market: By Product Type

Tractors

Combine Harvesters

Implements

Myanmar Tractor Market

By Product Type

Two Wheeler Tractor

Four Wheeler Tractor

By Power

Less than 40HP

From 40HP to 70HP

Above 70HP

By State

North

Central

South

Myanmar Combine Harvester Market

By State

North

Central

South

Companies Covered

Kubota Myanmar Co., Ltd.

Sonalika

Yanmar Myanmar Co., Ltd.

New Holland

John Deere

Mahindra

Chinese Players (Dongfeng, Iseki, Shifeng, Yto, Wuzheng Group and Others)

Table of Contents

1. Executive Summary

1.1 Executive Summary- How is Agriculture Machinery Market Positioned in Myanmar?

2. Country Overview

2.1 Country Overview of Myanmar including (Gross Domestic Product, Major Industries, Country Demographics, Trade Scenario and Geographical Location)

3. Agriculture Overview / Scenario in Myanmar

3.1 Agriculture Overview of Myanmar including Agriculture GDP, Production of Top Crops, 2014-2019

3.2 Agricultural Indicators in Myanmar including Total Land Area, Arable Land, Number of Farmers , Average Farm Size and Others)

3.3 Production and Harvested Area of Major Crops grown in Myanmar including Paddy, Sugarcane and Maize in Thousand Tons, 2014-2018

3.4 Export & Import of Food Crops in Myanmar – By Value, 2014-2019

3.5 Digital Tools deployed in Myanmar Agriculture Sector

3.6 How would Agritech Solve Farmer’s Issues?

4. Crop land Planting Trends in Myanmar, 2015 and 2019

4.1 Major Crops grown in Myanmar by Zone

4.2 10 year Production Trend for Top 3 Crops in Myanmar: Paddy, Sugarcane and Maize

4.3 Production, Sown and Harvested Area of Paddy, Area Under Irrigation and Weir 2014-2019

4.4 Paddy Environment in Myanmar

5. How Farmers Operate in Myanmar?

5.1 Characteristics of Farmers

5.2 Farm Labour Wages Trends

5.3 Agricultural Machinery Purchase Decision Making Parameters of Farmers

6. Supply Side Analysis: Myanmar Agriculture Machinery Market

6.1 Ecosystem: Myanmar Agriculture Machinery Market

6.2 Operating Model: Myanmar Agriculture Machinery Market

6.3 Agriculture Machinery – Import Value and Volume – By Major Countries, 2015-2019

6.4 Agriculture Machinery – Export Value and Volume – By Major Countries, 2015-2019

6.5 Growth Drivers, Trends and Developments

6.6 Growth Restraints, Issues & Challenges

6.7 Regulatory Landscape in Myanmar Agriculture Machinery Market

6.8 Agriculture Development Strategy

6.9 Import and Export Regulations in Myanmar Agriculture Machinery Market

7. Myanmar Agriculture Machinery Market Size, 2014-2020P

7.1 Myanmar Agriculture Machinery Market Size on the basis of Revenue and Sales Volume, 2014-2020P

7.2 Myanmar Agriculture Machinery Market Segmentation By Product Type (Tractors, Combine Harvesters & Implements), 2014, 2019, 2020P

8. Myanmar Tractors Market, 2014-2025

8.1 Total Myanmar Tractors Market Size by Value and Volume, 2014-2020

8.2 Myanmar Tractors Market Size of 2W and 4W Tractors by Value and Volume, 2014-2020

8.3 Myanmar Tractors Market Segmentation By Power of 4W Tractors and Region, 2014, 2019 and 2020

8.4 Myanmar Tractors Market Future Projections of 2W and 4W Tractors by Value and Volume, 2020-2025

8.5 Myanmar Tractors Market Segmentation By Power of 4W Tractors and Region, 2025

9. Myanmar Combine Harvesters Market, 2014-2025

9.1 Myanmar Combine Harvesters Market Size by Value and Volume, 2014-2020

9.2 Myanmar Combine Harvesters Market Segmentation by Region, 2014, 2019 and 2020

9.3 Myanmar Combine Harvesters Market Future Projections by Value and Volume, 2020-2025

9.4 Myanmar Combine Harvesters Market Segmentation by Region, 2025

10. Myanmar Implements Market, 2014-2025

10.1 Myanmar Implements Market Size by Value, 2014-2020

10.2 Myanmar Implements Market Segmentation By Product Type, 2014, 2019 and 2020

10.3 Myanmar Implements Market Future Projections by Value, 2020-2025

10.4 Myanmar Implements Market Segmentation By Product Type, 2025

11. Snapshot on Rental Business in Myanmar Agriculture Machinery Market

11.1 Myanmar Agriculture Rental Machinery Market Overview including Market Structure Analysis, Product Category, Competition Analysis

and Regional Analysis

11.2 Overview of Organized Players including Yoma Heavy Rental Machinery, Agricultural Mechanization Department (AMD) and Digital

Platform: Tunyat

11.3 Value Chain in Myanmar Agriculture Machinery Rental Market

12. Snapshot on Myanmar Second Hand Agriculture Machinery Market

12.1 Myanmar Second Hand Machinery Market including Age of Machinery, Brands Preferred, Product Categories Preferred and Channels Available

13. Financing for Agriculture Machinery in Myanmar

13.1 Overview of Financing of Agriculture Machinery in Myanmar

13.2 Cross Comparison of Financial Institutions offering Agriculture Machinery on Loan basis – Year of Establishment, Headquarters, Product Type, Brands and Regional Presence

14. Comparative Landscape in Myanmar Agriculture Machinery Market

14.1 Competition Structure in Myanmar 4W Tractor Market

14.2 Competition Structure in Myanmar Combine Harvester Tractor Market

14.3 Cross Comparison of Major Players on the basis of (Establishment Year, Headquarters, Business Model, Regional Presence, Distributors / Dealers/ Partners, Leading Product Category, Warranty and Finance Partners)

14.4 Company Profiles of Kubota, Sonalika, John Deere, Yanmar and New Holland including Overview, Product Category, Dealer Network, Business Strategies, Recent Developments and Future Plans / Outlook

14.5 Snapshot on Chinese Players Supplying Agriculture Machinery in Myanmar

15. Myanmar Agriculture Machinery Product Analysis

15.1 Pricing Analysis of Myanmar Agriculture Machinery Market

15.2 Product Portfolio of Major Players (Kubota, Sonalika, John Deere, New Holland, Mahindra and Escorts) in Myanmar Agriculture Machinery Market

16. Myanmar Agriculture Machinery Market Future Outlook & Projections, 2020-2025

16.1 COVID-19 Impact on Myanmar Agriculture Machinery Market

16.2 Myanmar Agriculture Machinery Market Future Projections, By Value and Volume, 2020-2025

16.3 Myanmar Agriculture Machinery Market Segmentation By Product Type (Tractors, Combine Harvesters and Implements), 2020-2025

17. Analyst Recommendations

17.1 Preferable Serviceable Locations

17.2 Expanding Dealership Network

17.3 Expansion to New Client Segments

17.4 Focus on After Sale Service

17.5 Marketing and Branding Activities

17.6 Strategic Partnerships

18. Industry Speak

18.1 Interview with Pankaj Gupta, Managing Director at Zetor India Private Limited

19. Appendix

DisclaimerWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.