North America 1,4 Butanediol Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1128

December 2024

90

About the Report

North America 1,4 Butanediol Market Overview

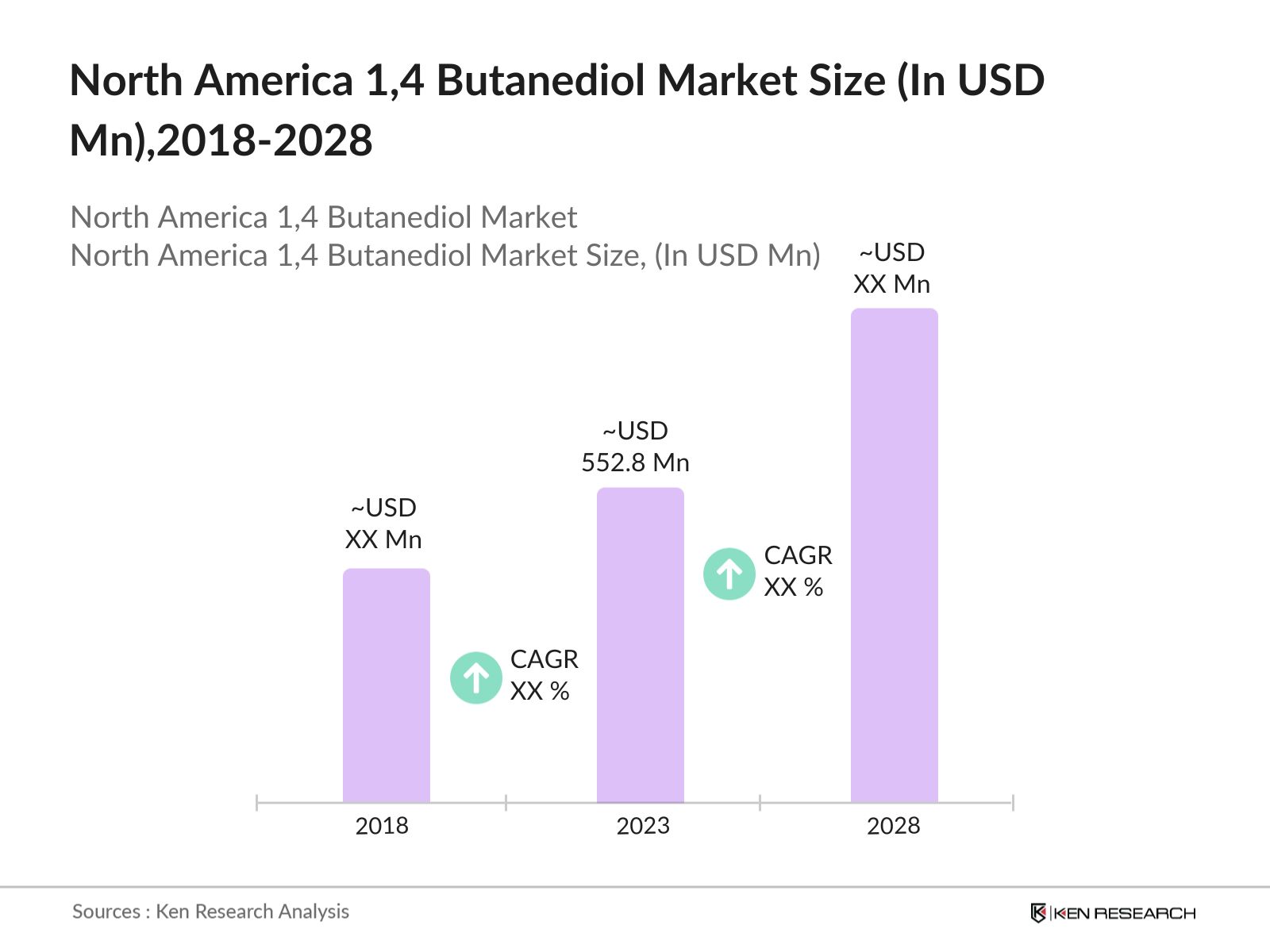

- The North America 1,4 Butanediol Market was valued at USD 552.8 million in 2023. The market is driven by the increasing demand for 1,4 Butanediol in producing tetrahydrofuran (THF), which is a critical precursor in the production of spandex and other elastomers. Moreover, the rising application of 1,4 Butanediol in various industries, including automotive, textiles, and electronics, is expected to sustain market growth. The demand for biodegradable plastics also plays a significant role, as 1,4 Butanediol is a key component in producing polybutylene succinate (PBS), a type of biodegradable plastic.

- Major players dominating the market include BASF SE, LyondellBasell Industries, Ashland Inc., Mitsubishi Chemical Corporation, and INVISTA. These companies are significant contributors to the market due to their extensive product portfolios, strong distribution networks, and continuous research and development activities aimed at improving product quality and expanding application areas.

- In December 2023, BASF announced the launch of its LowPCF products, including 1,4-butanediol (BDO) and polytetrahydrofuran (PolyTHF), which have product carbon footprints significantly below the global market average. This initiative aligns with BASFs commitment to achieving net-zero CO2 emissions by 2050. The reduced carbon footprint is attributed to BASF's efficient production processes and energy generation methods. This development supports BASF's customers in reducing their own carbon footprints, enhancing sustainability in the chemical industry.

- Texas is home to major petrochemical hubs and offers abundant raw materials, skilled labor, and infrastructure for chemical production. In 2023, Texas was dominating the market, making it a crucial player in the regional market. The state's favorable business environment and access to export markets further contribute to its dominance.

North America 1,4 Butanediol Market Segmentation

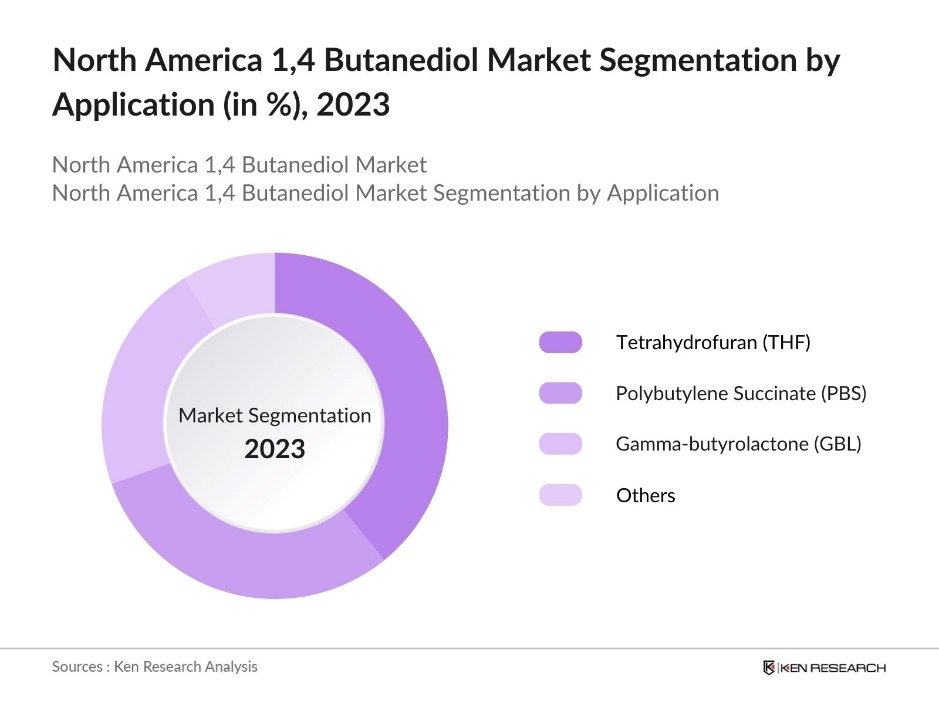

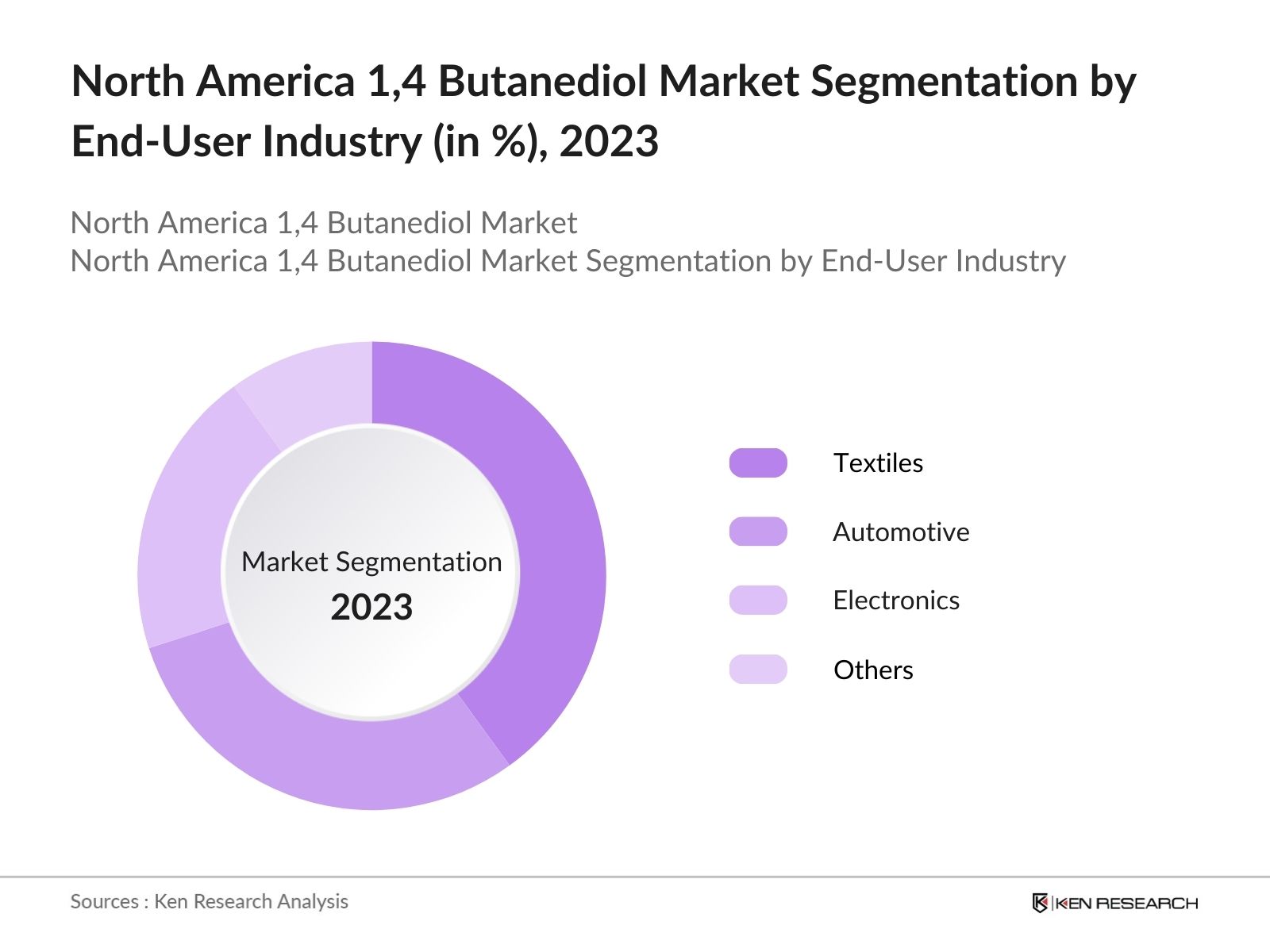

The market is segmented into different factors like by application, by end user industry and region.

By Application: The market is segmented by application into tetrahydrofuran (THF), polybutylene succinate (PBS), gamma-butyrolactone (GBL), and others. In 2023, THF held the dominant market share, due to the widespread use of THF in producing spandex, which is in high demand in the textile industry. The growing trend of athleisure and the increasing use of spandex in automotive interiors are expected to sustain the demand for THF.

By End-User Industry: The market is segmented by end-user industry into automotive, textiles, electronics, and others. In 2023, the textiles industry held the largest market share, driven by the high demand for spandex, which is widely used in various clothing types, from sportswear to fashion apparel. The increasing trend of athleisure and the rising awareness of comfort and functionality in clothing further drive the demand for spandex, solidifying the textiles industry's leading position in the 1,4 Butanediol market.

By Region: The market is segmented by region into the United States and Canada. The United States dominates the market share in 2023. This dominance is driven by its strong industrial base, advanced infrastructure, and significant investments in chemical manufacturing. Texas, in particular, plays a critical role due to its abundant natural resources, well-established petrochemical industry, and strategic location for export activities.

North America 1,4 Butanediol Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

LyondellBasell Industries |

2007 |

Houston, Texas, USA |

|

Ashland Inc. |

1924 |

Wilmington, Delaware, USA |

|

Mitsubishi Chemical Corporation |

1933 |

Tokyo, Japan |

|

INVISTA |

2004 |

Wichita, Kansas, USA |

- LyondellBasell Industries: In September 2023, LyondellBasell launched its new product line, LC Low Carbon Solutions, which offers polymers with a significantly lower carbon footprint. This initiative is part of LyondellBasell's commitment to sustainability and reducing greenhouse gas emissions. The LC Low Carbon Solutions line is designed to meet the growing demand for sustainable materials across various industries, including packaging, automotive, and construction, while supporting customers in achieving their environmental goals.

- Ashland Inc.: In September 2023, Ashland introduced new platform technologies focused on sustainability, including bio-based and biodegradable solutions for various industries such as personal care, coatings, and adhesives. These innovations aim to reduce environmental impact while maintaining high performance. Ashland's efforts are part of their broader commitment to sustainability, addressing the growing demand for eco-friendly products and helping customers meet their sustainability goals.

North America 1,4 Butanediol Market Analysis

Growth Drivers

- Increasing Demand for PBT in Automotive Applications: The demand for Polybutylene Terephthalate (PBT), a key application of 1,4 Butanediol, has surged in the automotive sector, particularly for electric vehicle (EV) components. In 2023, electric vehicles (EVs) accounted for approximately 12% of U.S. passenger vehicle sales. This demand has led to an increased need for PBT, which is utilized in manufacturing automotive components like connectors, sensors, and housings. The automotive industrys shift toward lightweight and high-performance materials is driving this trend, with major automotive manufacturers ramping up production to meet the growing EV demand.

- Expansion of Electronics Manufacturing: The electronics manufacturing sector in North America experienced a significant expansion in 2024, US electronics and computer production is expected to increase by 4.7% in 2024 and by 3.4% in 2025, driven by the electronic components and boards subsector. This growth is driving the demand for 1,4 Butanediol, which is used in the production of plastics for electronic components. The surge in demand for consumer electronics, particularly in the U.S. and Canada, has led to increased production capacities for related chemicals, including 1,4 Butanediol.

- Rising Investments in Bio-Based Chemicals: North America is experiencing a surge in investments aimed at developing and commercializing bio-based chemicals, including bio-based 1,4 Butanediol. This trend is fueled by stricter environmental regulations and growing consumer demand for sustainable products. Government initiatives and funding are also playing a key role in supporting bio-based chemical research and development, helping to accelerate the adoption of eco-friendly alternatives across various industries.

Challenges

- Technical Challenges in Bio-Based Production: The production of bio-based 1,4 Butanediol is still in its nascent stages in North America, with several technical challenges to overcome. In 2024, the conversion yield of bio-based 1,4 Butanediol was reported to be lower than that of petrochemical-based production, leading to higher production costs. The industry is investing in research and development to improve yields, but these advancements are expected to take several years to commercialize fully. In the meantime, the high cost of bio-based 1,4 Butanediol remains a barrier to widespread adoption.

- Regulatory Compliance Costs: Stricter environmental regulations in North America have led to higher compliance costs for chemical manufacturers, including those producing 1,4 Butanediol. New emission standards introduced by the Environmental Protection Agency require manufacturers to invest in cleaner technologies and processes. These regulations place a significant financial burden on companies, especially large chemical plants, as they navigate the costs of adhering to these environmental requirements.

Government Initiatives

- U.S. Department of Energy (DOE): In September 2023, the U.S. Department of Energy (DOE) announced a $175 million initiative to support waste-to-energy solutions aimed at helping local communities convert waste streams into clean energy. This funding is part of the DOE's broader effort to advance sustainable energy technologies, reduce greenhouse gas emissions, and support economic growth in local communities through innovative waste management solutions. The initiative is expected to significantly contribute to the development of bio-based chemicals, including 1,4 Butanediol, by providing essential resources for research and development.

- California's ZEV Battery Manufacturing Grants Program: The California Energy Commission (CEC) has opened applications for the "Power Forward: ZEV Battery Manufacturing Grants Program," aimed at boosting zero-emission vehicle (ZEV) battery production. With over USD 35 million allocated, the program supports manufacturers in scaling up production, advancing technology, and fostering innovation in ZEV batteries, thereby promoting the state's leadership in clean energy and reducing greenhouse gas emissions. This initiative is part of Californias broader efforts to accelerate the transition to sustainable transportation.

North America 1,4 Butanediol Market Future Outlook

The North America 1,4 Butanediol Market is projected to grow exponentially by 2028. The continued expansion of the automotive, electronics, and textile industries, along with advancements in production technologies, will drive this growth. Additionally, the increasing adoption of eco-friendly products and bio-based 1,4 Butanediol will create new opportunities for market players.

Future Market Trends

- Growth in Electric Vehicle Production: The North American automotive industry is set to significantly increase electric vehicle production in the coming years, driving demand for PBT, a key application of 1,4 Butanediol. As automotive manufacturers prioritize lightweight materials for EV components, the shift toward electric vehicles will continue to boost the need for 1,4 Butanediol in the automotive sector, supporting the industry's transition to more sustainable solutions.

- Emergence of New Applications in Electronics: The electronics industry in North America is expected to see the emergence of new applications for 1,4 Butanediol, particularly in the production of advanced polymers for electronic components. By 2028, the use of 1,4 Butanediol in electronics manufacturing is projected to grow by 20%, driven by the development of new high-performance materials that offer enhanced durability and thermal stability. This trend will be supported by ongoing research and development efforts aimed at expanding the application range of 1,4 Butanediol in the electronics sector.

Scope of the Report

|

By Product Type |

Functional Testing Performance Testing Security Testing |

|

By Application |

Tetrahydrofuran (THF) Polybutylene Succinate (PBS) Gamma-Butyrolactone (GBL) Others |

|

By Region |

USA Canada |

|

By Product Type |

Bio-Based 1,4 Butanediol Petrochemical-Based 1,4 Butanediol Low Carbon 1,4 Butanediol Others |

|

By Process Type |

Catalytic Hydrogenation of Maleic Anhydride Reppe Process Davy Process Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Chemical Manufacturers Companies

Automotive Industry

Electronics Industry

Textile Industry

Bio-Based Chemical Companies

Logistics and Distribution Companies

Packaging Industry

Pharmaceutical and Medical Industries

Government Agencies (Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA))

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

Ashland Inc.

LyondellBasell Industries

INVISTA

Mitsubishi Chemical Corporation

Eastman Chemical Company

Dairen Chemical Corporation

Markor Chemical Group Co., Ltd.

Nan Ya Plastics Corporation

Xinjiang Blue Ridge Tunhe Energy Co., Ltd.

Genomatica Inc.

BioAmber Inc.

Global Bio-Chem Technology Group

Chemtura Corporation

Sipchem

Table of Contents

1. North America 1,4 Butanediol Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America 1,4 Butanediol Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America 1,4 Butanediol Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for PBT in Automotive Applications

3.1.2. Expansion of Electronics Manufacturing

3.1.3. Rising Investments in Bio-Based Chemicals

3.1.4. Growing Demand for Biodegradable Plastics

3.2. Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Technical Challenges in Bio-Based Production

3.2.3. Regulatory Compliance Costs

3.2.4. Competition from Low-Cost Imports

3.3. Opportunities

3.3.1. Technological Advancements in Production

3.3.2. Increasing Adoption of Sustainable Products

3.3.3. Strategic Partnerships and Collaborations

3.3.4. Government Support for Green Initiatives

3.4. Trends

3.4.1. Adoption of Bio-Based 1,4 Butanediol

3.4.2. Growth in Electric Vehicle Production

3.4.3. Expansion of 1,4 Butanediol Production Capacities

3.4.4. Emergence of New Applications in Electronics

3.5. Government Initiatives

3.5.1. U.S. Department of Energys Bioenergy Program

3.5.2. California's ZEV Battery Manufacturing Grants Program

3.5.3. Federal Investment in Sustainable Chemical Manufacturing

3.5.4. State-Level Incentives for Green Chemistry

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America 1,4 Butanediol Market Segmentation, 2023

4.1. By Application (in Value)

4.1.1. Tetrahydrofuran (THF)

4.1.2. Polybutylene Succinate (PBS)

4.1.3. Gamma-Butyrolactone (GBL)

4.1.4. Others

4.2. By End-User Industry (in Value)

4.2.1. Automotive

4.2.2. Textiles

4.2.3. Electronics

4.2.4. Others

4.3. By Region (in Value)

4.3.1. United States

4.3.2. Canada

4.4. By Product Type (in Value)

4.4.1. Bio-Based 1,4 Butanediol

4.4.2. Petrochemical-Based 1,4 Butanediol

4.4.3. Low Carbon 1,4 Butanediol

4.4.4. Others

4.5. By Process Type (in Value)

4.5.1. Catalytic Hydrogenation of Maleic Anhydride

4.5.2. Reppe Process

4.5.3. Davy Process

4.5.4. Others

5. North America 1,4 Butanediol Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. LyondellBasell Industries

5.1.3. Ashland Inc.

5.1.4. Mitsubishi Chemical Corporation

5.1.5. INVISTA

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America 1,4 Butanediol Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.North America 1,4 Butanediol Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America 1,4 Butanediol Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America 1,4 Butanediol Future Market Segmentation, 2028

9.1. By Application (in Value)

9.2. By End-User Industry (in Value)

9.3. By Region (in Value)

9.4. By Product Type (in Value)

9.5. By Process Type (in Value)

10.North America 1,4 Butanediol Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America 1,4 Butanediol Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America 1,4 Butanediol Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

01 How big is North America 1,4 Butanediol Market?

The North America 1,4 Butanediol Market was valued at USD 552.8 million in 2023, driven by the growing demand for tetrahydrofuran (THF) in spandex production, along with its applications in the automotive, textile, and electronics industries.

02 What are the challenges in North America 1,4 Butanediol Market?

Challenges include fluctuating raw material prices, technical hurdles in bio-based production, regulatory compliance costs, and competition from low-cost imports, which can impact profitability and market share.

03 Who are the major players in North America 1,4 Butanediol Market?

Key players include BASF SE, LyondellBasell Industries, Ashland Inc., Mitsubishi Chemical Corporation, and INVISTA. These companies lead the market due to their robust product portfolios, distribution networks, and ongoing R&D investments.

04 What are the growth drivers of North America 1,4 Butanediol Market?

Growth is driven by rising demand for PBT in automotive applications, expansion of electronics manufacturing, increasing investments in bio-based chemicals, and the growing demand for biodegradable plastics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.