North America 3D CAD Software Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD7834

December 2024

89

About the Report

North America 3D CAD Software Market Overview

- The North America 3D CAD software market was valued at USD 10.51 billion, driven by increasing demand across various industries such as architecture, engineering, and construction (AEC), automotive, and manufacturing. Factors contributing to this growth include the adoption of cloud-based CAD solutions, which offer enhanced collaboration, scalability, and cost-effectiveness for businesses of all sizes.

- In North America, the United States dominates the 3D CAD software market due to its advanced technological infrastructure and the presence of major software providers such as Autodesk, Siemens, and PTC . Additionally, the growing demand for digital solutions in industries like healthcare and automotive further boosts the market's position in the region. Canada also contributes significantly, with its expanding architecture and engineering sectors.

- The U.S. government has committed over $10 billion in 2023 for initiatives that support digital manufacturing, including grants for companies adopting advanced 3D CAD software. By 2024, this funding is expected to assist over 5,000 manufacturing companies in upgrading their design technologies, thereby fostering innovation and competitiveness in the global market.

North America 3D CAD Software Market Segmentation

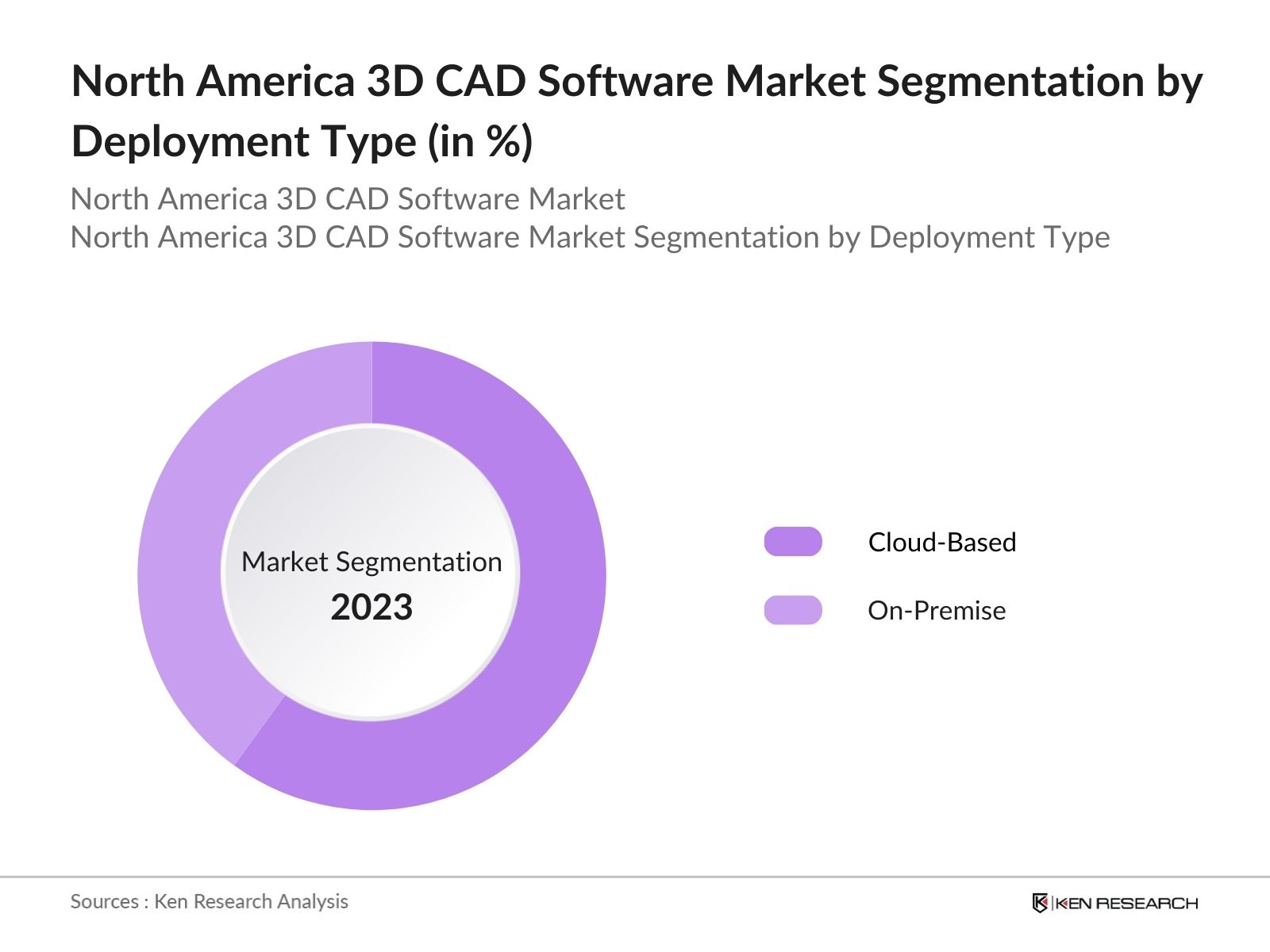

By Deployment Type: The market is segmented by deployment type into Cloud-Based and On-Premise solutions. Cloud-based CAD solutions have gained a dominant market share due to their ability to provide remote access, enhanced collaboration, and lower upfront costs. The increasing shift towards Industry 4.0 and digital transformation has driven the adoption of cloud-based CAD, as companies across industries seek to optimize product development through collaborative design tools.

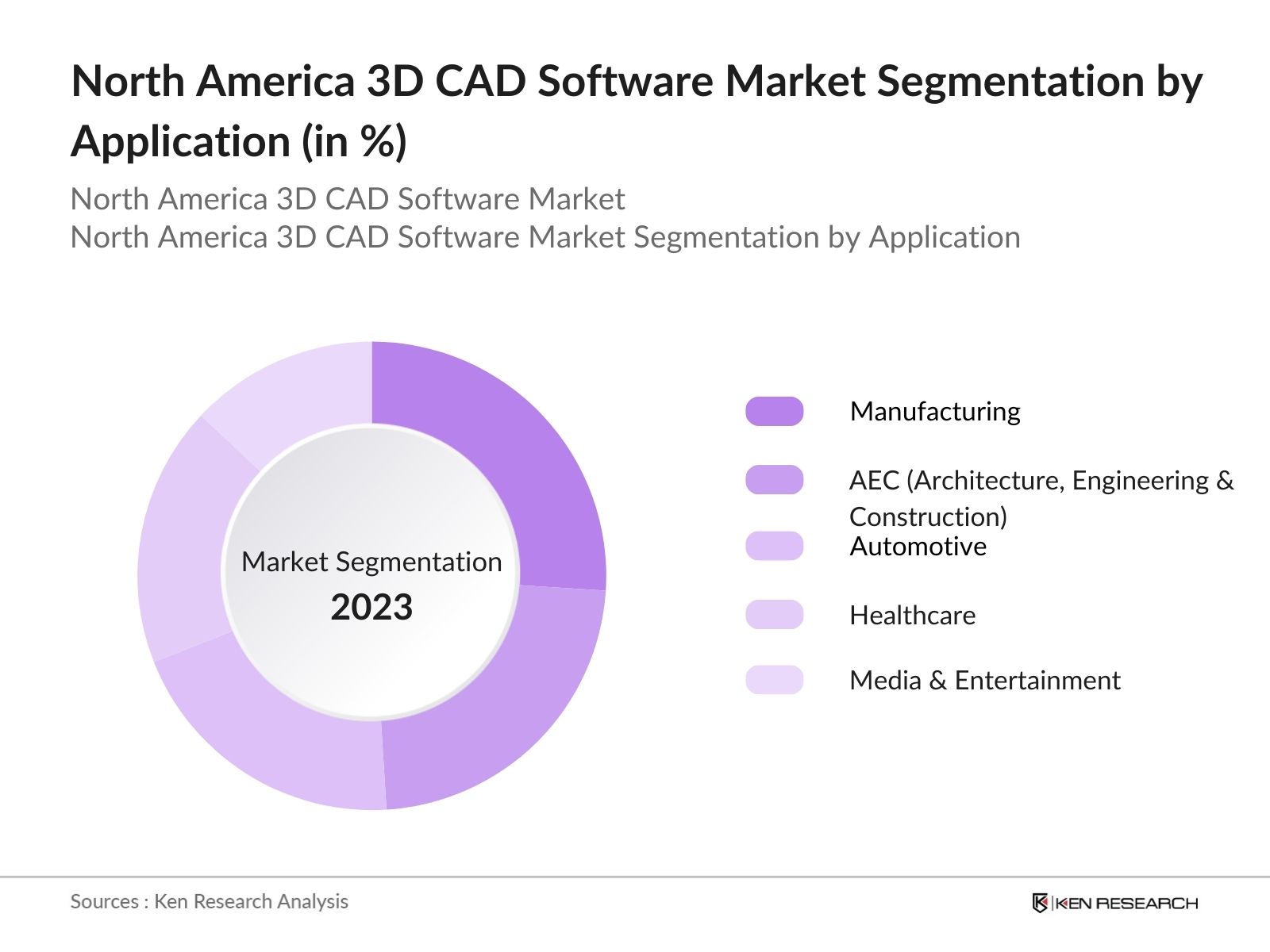

By Application: The market is further segmented by application into Manufacturing, Automotive, Healthcare, AEC (Architecture, Engineering, and Construction), and Media & Entertainment. The manufacturing segment dominates due to the extensive use of 3D CAD software in product design and simulation, helping companies reduce production errors and costs. The rise in additive manufacturing and 3D printing technologies has further cemented this segment's position, as CAD is essential for creating precise 3D printable models.

North America 3D CAD Software Market Competitive Landscape

The market is dominated by a few key players who have established a strong presence through strategic initiatives such as mergers, acquisitions, and product development. Companies like Autodesk, Siemens, and Dassault Systmes lead the market due to their comprehensive portfolios, offering both cloud-based and on-premise CAD solutions.

|

Company Name |

Establishment Year |

Headquarters |

Deployment Type |

Revenue (USD) |

R&D Investments (USD) |

No. of Employees |

Strategic Partners |

Global Presence |

Product Portfolio |

|

Autodesk Inc. |

1982 |

U.S. |

|||||||

|

Siemens AG |

1847 |

Germany |

|||||||

|

Dassault Systmes |

1981 |

France |

|||||||

|

PTC Inc. |

1985 |

U.S. |

|||||||

|

Bentley Systems Inc. |

1984 |

U.S. |

North America 3D CAD Software Market Analysis

Market Growth Drivers

- Increased Adoption of 3D Printing in Manufacturing: The integration of 3D CAD software with 3D printing technologies is driving market growth in North America. By 2024, it is estimated that over 50,000 manufacturing firms across the U.S. and Canada will rely on 3D printing in their production processes, necessitating advanced 3D CAD software to design and optimize models for production.

- Growing Demand for Automation in Design and Product Development: In North America, more than 80,000 enterprises in sectors like automotive, aerospace, and construction are projected to utilize automated design solutions by the end of 2024, enhancing the demand for 3D CAD software. Automation in product development helps reduce design time and errors, contributing to faster time-to-market for new products.

- Government Initiatives to Boost Innovation in Engineering and Design: The U.S. government allocated over $200 billion in 2023 for innovation grants and funding across technology sectors, with a significant portion directed toward advancing engineering design tools like 3D CAD software. By 2024, it is estimated that at least 1,500 startups focusing on industrial design and innovation will benefit from these initiatives, leading to greater investments in 3D CAD tools as part of this technological push.

Market Challenges

- Complexity in Software Integration with Existing Systems: Over 50,000 enterprises in North America using older enterprise resource planning (ERP) systems are expected to encounter integration issues when attempting to incorporate advanced 3D CAD software in 2024.

- Data Security Concerns in Cloud-Based CAD Solutions: As cloud-based 3D CAD software continues to grow, concerns over data security and intellectual property protection are significant. In 2024, it is anticipated that around 70% of enterprises in the U.S. will be using cloud-based CAD systems, raising concerns about data breaches.

North America 3D CAD Software Market Future Outlook

Over the next five years, the North America 3D CAD software industry is expected to experience growth, driven by advancements in AI-based design automation, the rise of Industry 4.0, and the growing adoption of cloud-based CAD platforms.

Future Market Opportunities

- Integration of Augmented Reality (AR) with CAD Software: In the next five years, the North American market is expected to see widespread adoption of augmented reality (AR) within CAD software. By 2029, over 10,000 companies are projected to incorporate AR-based design reviews, allowing engineers and designers to visualize 3D models in real-world settings, enhancing design precision and collaboration across industries like construction and automotive.

- Increased Use of Generative Design for Sustainable Products: By 2029, more than 8,000 companies in North America are expected to adopt generative design tools within CAD software to create environmentally sustainable products. These tools will enable designers to optimize material use, resulting in cost savings of up to $5 billion annually across industries such as aerospace, where lightweight materials are crucial.

Scope of the Report

|

By Deployment Type |

Cloud-based On-premise |

|

By Application |

AEC Manufacturing Automotive Healthcare Media & Entertainment |

|

By End-User Size |

Large Enterprises SMEs |

|

By Region |

United States Canada Mexico Rest of North America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Commerce)

3D Printing Companies

Automotive Manufacturers

Healthcare Providers (Hospitals and Medical Device Manufacturers)

Aerospace and Defense Companies

Architecture and Engineering Firms

Cloud Service Providers

Companies

Players Mentioned in the Report:

Autodesk Inc.

Siemens AG

Dassault Systmes

PTC Inc.

Bentley Systems Inc.

Bricsys NV

Oracle Corporation

Schott Systeme GmbH

ZWSOFT Co. Ltd.

Graphisoft (Nemetschek Group)

Table of Contents

North America 3D CAD Software Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

North America 3D CAD Software Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

North America 3D CAD Software Market Analysis

Growth Drivers (Adoption in Manufacturing, Automotive, and AEC Sectors)

Increasing Use in Automotive Sector (Design Flexibility and Cost Reduction)

Rise of Cloud Collaboration in AEC Industry

Advancements in Additive Manufacturing and 3D Printing

Growth of Virtual Reality and Augmented Reality in Design

Market Challenges (Cost, Integration, and Training Barriers)

High Initial Costs for On-premise Solutions

Lack of Skilled Workforce in SMEs

Cybersecurity Concerns in Cloud Deployment

Opportunities (Cloud-based 3D CAD Solutions, Customization in Product Design)

Rising Adoption of Cloud-based CAD Software

Customization Demand in Healthcare (Medical Devices and Implants)

Integration with AI and IoT for Smart Manufacturing

Trends (Emergence of AI-based Design and Simulation Tools)

Increased Usage of AI for Automated Design Optimizations

Growth of Parametric Design Techniques in Manufacturing

Government Regulations (Digitalization Policies and Innovation Funds)

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

North America 3D CAD Software Market Segmentation

By Deployment Type (In Value %)

Cloud-Based

On-Premise

By Application (In Value %)

Architecture, Engineering, and Construction (AEC)

Manufacturing

Automotive

Healthcare

Media and Entertainment

By End-User Size (In Value %)

Large Enterprises

SMEs

By Region (In Value %)

United States

Canada

Mexico

Rest of North America

North America 3D CAD Software Market Competitive Analysis

Detailed Profiles of Major Companies

Autodesk Inc.

Siemens AG

Dassault Systmes

Bentley Systems

PTC Inc.

Bricsys NV

Oracle Corporation

Schott Systeme GmbH

ZWSOFT Co. Ltd.

Graphisoft (Nemetschek Group)

Trimble Inc.

Ansys Inc.

Dassault SolidWorks Corp.

CAXA Technology Co., Ltd.

Hexagon AB

Cross Comparison Parameters (Deployment Type, Revenue, Headquarters, Key Clients, R&D Investments)

Market Share Analysis

Strategic Initiatives (Partnerships, Acquisitions, Product Launches)

Investment Analysis (Private Equity, Venture Capital)

Mergers and Acquisitions Overview

Government Grants and Innovation Funds

North America 3D CAD Software Market Regulatory Framework

Compliance Requirements for Software Deployment (GDPR, Cybersecurity)

Certification and Licensing Processes (ISO, HIPAA for Healthcare Sector)

North America 3D CAD Software Future Market Size (In USD Bn)

Market Size Projections

Factors Driving Future Growth

North America 3D CAD Software Future Market Segmentation

By Deployment Type (In Value %)

By Application (In Value %)

By End-User Size (In Value %)

By Region (In Value %)

North America 3D CAD Software Market Analysts Recommendations

TAM/SAM/SOM Analysis (Total, Serviceable, and Obtainable Market)

Competitive Benchmarking

White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved extensive desk research to map key stakeholders in the North America 3D CAD Software Market. The research process focused on identifying critical variables such as deployment types, applications, and regional dynamics influencing the market.

Step 2: Market Analysis and Construction

The research team analyzed historical data to assess the penetration of 3D CAD software across industries such as manufacturing and AEC. Revenue generation trends and market competition were studied to determine growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around market drivers and challenges were validated through expert consultations, including interviews with leading players in the CAD software space. These insights were used to corroborate data from secondary research.

Step 4: Research Synthesis and Final Output

The final phase included direct engagements with 3D CAD software vendors to gather insights on product portfolios, market positioning, and future developments. This provided a comprehensive and accurate analysis of the North American market.

Frequently Asked Questions

01. How big is the North America 3D CAD Software Market?

The North America 3D CAD Software Market is valued at USD 10.51 billion, driven by increasing demand across the manufacturing, automotive, and AEC sectors.

02. What are the challenges in the North America 3D CAD Software Market?

Challenges in the North America 3D CAD Software Market include the high initial costs associated with on-premise solutions, a lack of skilled professionals in small and medium enterprises, and concerns over data security in cloud-based deployments.

03. Who are the major players in the North America 3D CAD Software Market?

Key players in the North America 3D CAD Software Market include Autodesk, Siemens AG, Dassault Systmes, PTC Inc., and Bentley Systems, which lead the market through their innovative software solutions and partnerships.

04. What drives the growth of the North America 3D CAD Software Market?

Growth in the North America 3D CAD Software Market is driven by the increasing adoption of cloud-based CAD solutions, the demand for advanced design tools in manufacturing, and the integration of AI and IoT in product design and simulation.

05. What are the key applications of 3D CAD software in North America?

Key applications include manufacturing, healthcare, automotive, AEC (architecture, engineering, and construction), and media and entertainment, where 3D CAD tools are used to streamline design and reduce production errors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.