North America 3D Printing Metal Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1896

October 2024

87

About the Report

North America 3D Printing Metal Market Overview

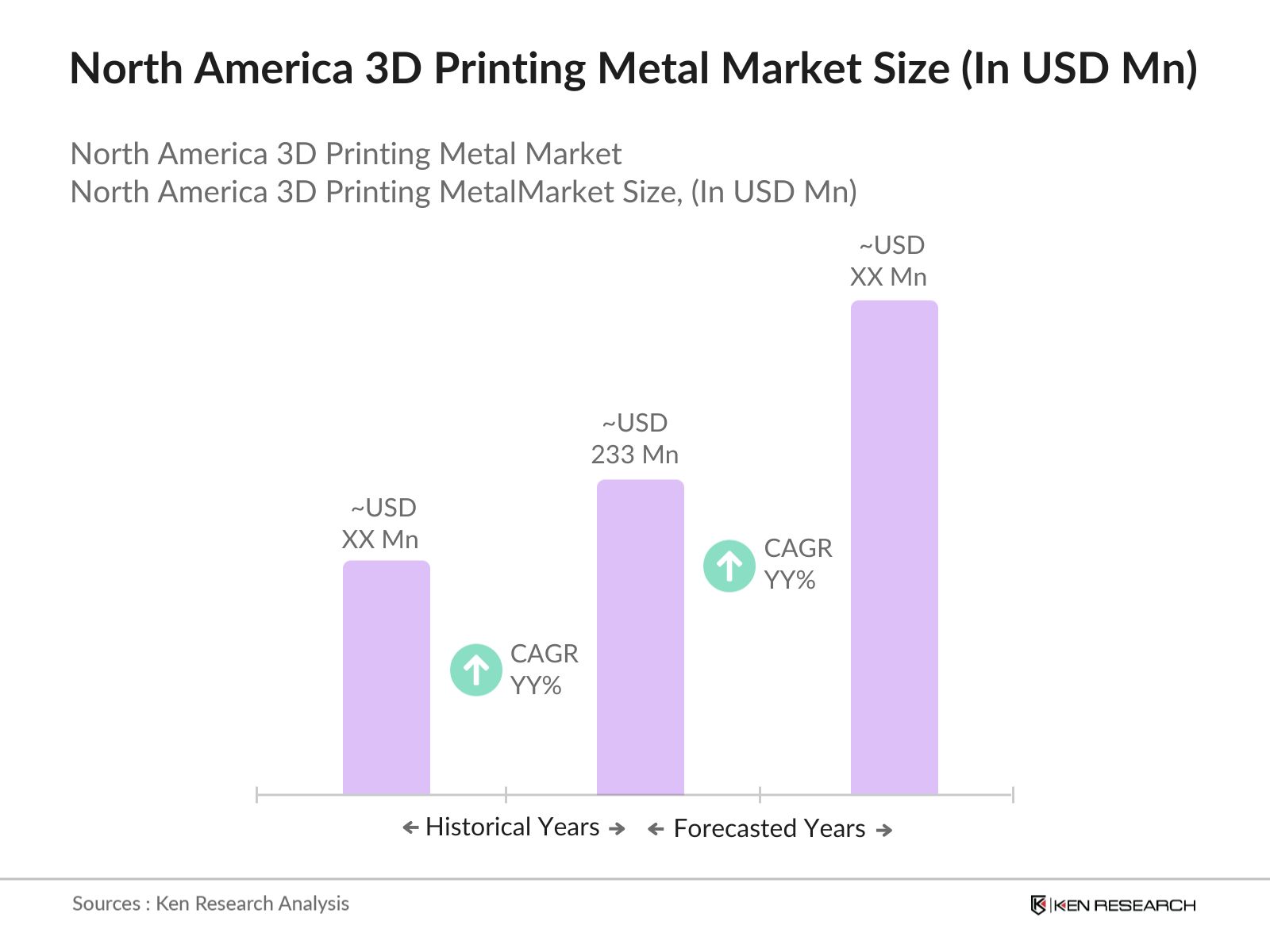

- The North America 3D printing metal market is valued at USD 223 million, based on a five-year historical analysis. This growth is largely driven by the increasing adoption of metal additive manufacturing across industries such as aerospace, automotive, and healthcare. The ability to create complex metal parts at reduced costs, compared to traditional methods, has been a growth driver.

- The United States is the dominant market in North America due to its robust aerospace and defense sector, which heavily utilizes 3D-printed metal components for aircraft and space vehicles. Additionally, cities such as Detroit, known for their automotive production, have embraced 3D printing metal technologies for manufacturing lightweight car components.

- The U.S. Department of Energys AMO has invested heavily in 3D printing metal technologies to improve energy efficiency in manufacturing. In 2024, the AMO allocated $250 million for research and development in additive manufacturing, including metal 3D printing, to reduce material waste and energy consumption. These investments are aimed at promoting sustainable manufacturing practices and reducing the carbon footprint of the manufacturing sector.

North America 3D Printing Metal Market Segmentation

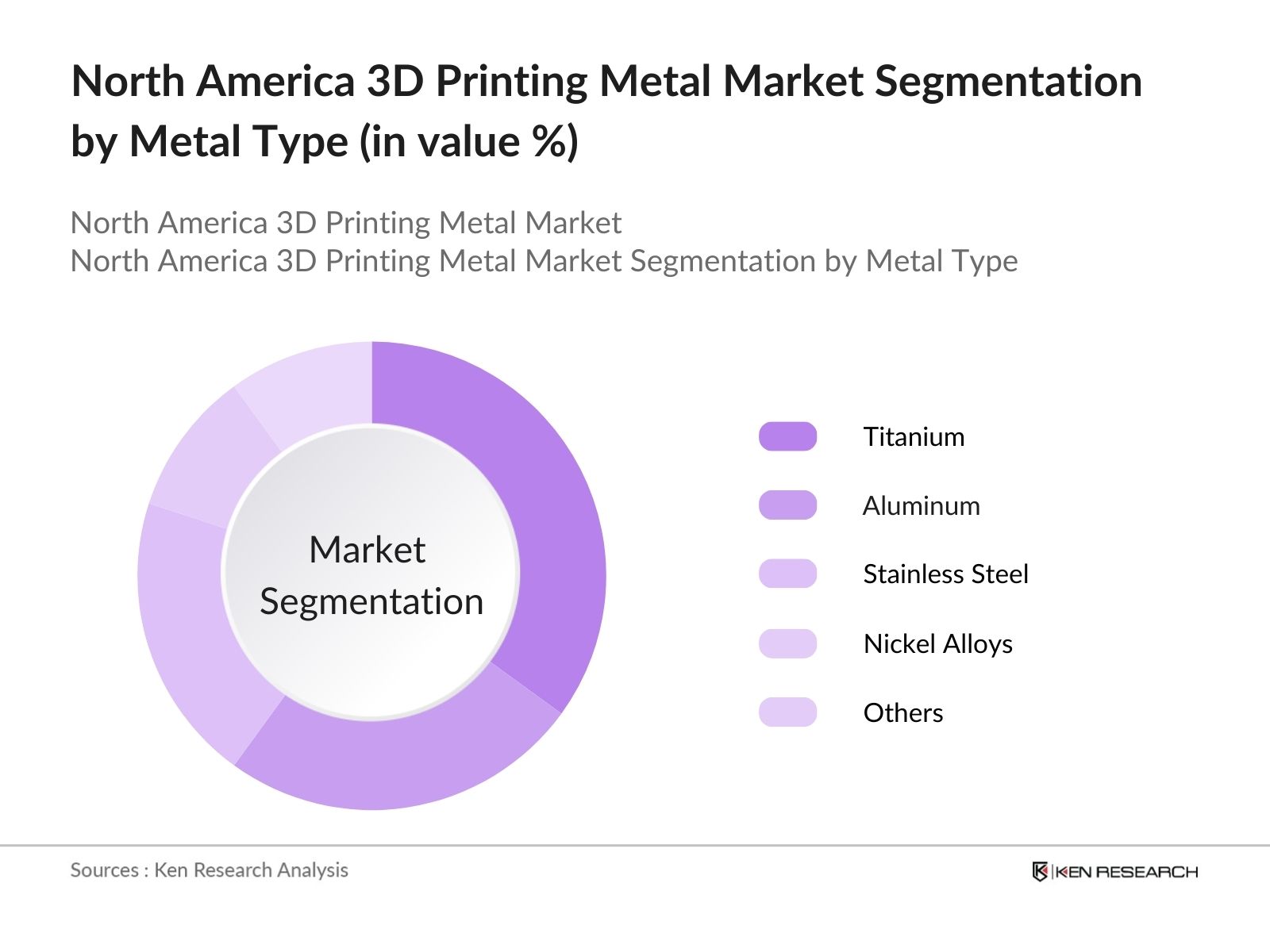

By Metal Type: The market is segmented by metal type into titanium, aluminum, stainless steel, nickel alloys, and others. Titanium holds a dominant share in this segment due to its high strength-to-weight ratio and corrosion resistance, making it ideal for aerospace and medical applications. Titanium is widely used in creating lightweight, strong components, which are essential in aircraft manufacturing and the production of high-quality prosthetics in the healthcare sector.

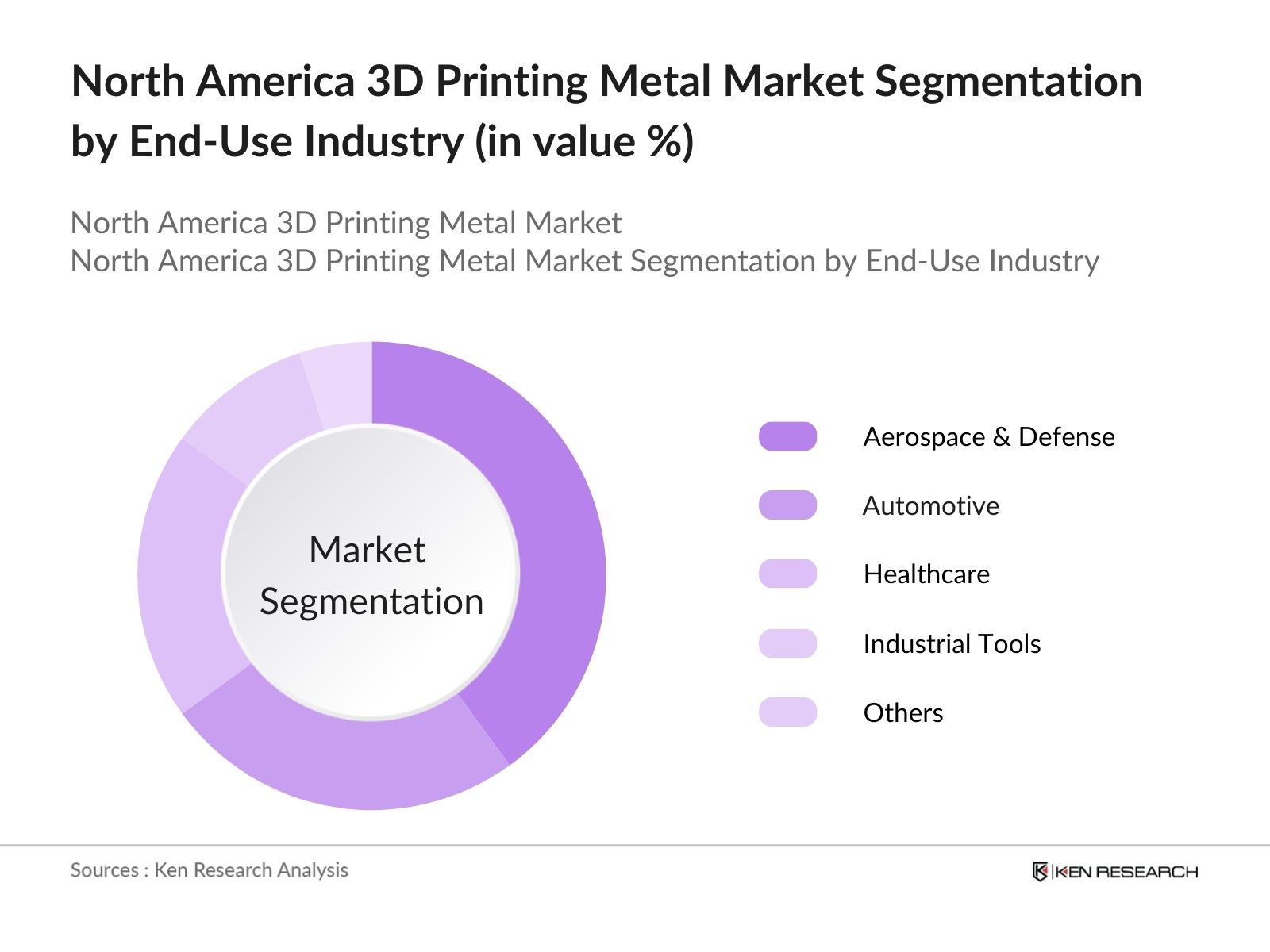

By End-Use Industry: The market is also segmented by end-use industry into aerospace & defense, automotive, healthcare, industrial tools, and others. Aerospace & defense is the dominant segment, accounting for a large share of the market. The demand for lightweight yet strong metal components in the aviation industry and space exploration drives the growth of this segment. The use of metal 3D printing has enabled the creation of intricate parts that are not feasible with traditional manufacturing methods, leading to significant cost and time savings.

North America 3D Printing Metal Market Competitive Landscape

The market is characterized by the presence of several key players that dominate due to their advanced manufacturing capabilities, strong R&D investments, and extensive partnerships across industries. Leading companies such as 3D Systems Corporation and Stratasys Ltd. are constantly innovating to maintain their position in the market.

|

Company |

Establishment Year |

Headquarters |

Innovation Capabilities |

Metal Portfolio |

R&D Investments |

Partnerships |

Employees |

Revenue |

Market Reach |

|

3D Systems Corporation |

1986 |

Rock Hill, SC |

|||||||

|

Stratasys Ltd. |

1989 |

Eden Prairie, MN |

|||||||

|

General Electric Additive |

1892 |

Boston, MA |

|||||||

|

EOS GmbH |

1989 |

Krailling, Germany |

|||||||

|

Renishaw plc |

1973 |

Gloucestershire, UK |

North America 3D Printing Metal Market Opportunities

Market Growth Drivers

- Rising Demand in the Aerospace Industry: The aerospace sector in North America is a major driver for 3D printing metals. As of 2024, the U.S. aerospace industry has invested over $120 billion in R&D to enhance manufacturing efficiency and reduce material waste. 3D printing with metals is a key technology in this effort, enabling the production of lightweight, durable components. The Federal Aviation Administration (FAA) is also working to approve more 3D printed metal parts for use in commercial aviation, further expanding the demand for this technology in the aerospace sector.

- Automotive Sector's Shift Towards Electrification: The transition to electric vehicles (EVs) in North America is fueling demand for 3D printed metal components, especially in battery manufacturing and lightweight structural parts. In 2024, the U.S. government grants for EV production, encouraging automakers to adopt advanced manufacturing technologies like metal 3D printing to improve energy efficiency and reduce production costs. Companies like Tesla and General Motors are already integrating 3D printing metals into their production lines to develop more efficient and durable components for EVs.

- Expansion in Medical Device Manufacturing: North America's medical device manufacturing industry, is increasingly adopting 3D printing metals to produce custom implants and prosthetics. The U.S. Food and Drug Administration (FDA) has approved several 3D printed metal implants for clinical use, driving growth in this sector. The precision and customization offered by 3D printing metals are particularly useful in orthopedics and dental applications, where patient-specific devices are crucial.

Market Challenges

- Material Limitations and Quality Control: Despite advances in technology, not all metals are suitable for 3D printing, and maintaining consistent material quality remains a challenge. For example, certain high-strength alloys used in aerospace and defense applications require precise temperature and pressure control during the printing process. Post-processing steps, such as heat treatment and surface finishing, are also time-consuming and add to the overall production costs.

- Lack of Industry Standards: The lack of standardized testing and certification procedures for 3D printed metal parts is another obstacle to widespread adoption. While organizations like the American Society for Testing and Materials (ASTM) are working to develop industry standards, many sectors, particularly aerospace and defense, require rigorous certification processes that 3D printed metals have yet to fully meet. This uncertainty around quality and reliability limits the integration of 3D printing metals in highly regulated industries.

North America 3D Printing Metal Market Future Outlook

Over the next five years, the North America 3D printing metal industry is expected to see steady growth driven by technological advancements, increasing adoption in industrial sectors, and expanding applications in medical and aerospace industries. The market will continue to evolve with the development of new metal powders and the refinement of printing technologies.

Future Market Opportunities

- Increased Use of AI in Metal 3D Printing: Over the next five years, the integration of artificial intelligence (AI) with 3D printing metal technologies will accelerate. AI will be used to optimize design processes, enhance quality control, and reduce production times. By 2029, AI-driven metal 3D printing is expected to be a standard practice in industries like aerospace and automotive, enabling faster production cycles and higher precision in metal parts.

- Expansion of 3D Printing Metal Capabilities for Space Exploration: The demand for 3D printed metal components in space exploration is expected to grow over the next five years. Companies like SpaceX and Blue Origin are already using metal 3D printing to produce rocket engines and structural components. By 2029, 3D printing will play a crucial role in manufacturing components for space stations and lunar habitats, reducing reliance on Earth-based supply chains.

Scope of the Report

|

By Form |

Powder, Filament |

|

By Technology |

Powder Bed Fusion, Directed Energy Deposition, Binder Jetting, Metal Extrusion, Others |

|

By Metal Type |

Titanium, Nickel, Stainless Steel, Aluminum, Others |

|

By End-Use Industry |

Aerospace & Defense, Automotive, Medical & Dental, Consumer Goods, Others |

|

By Country |

United States, Canada, Mexico |

Products

Key Target Audience

Aerospace & Defense Companies

Automotive Manufacturers

Medical Device Manufacturers

Industrial Tools Manufacturers

Metal Powder Suppliers

Venture Capital & Investment Firms

Government and Regulatory Bodies (U.S. Federal Aviation Administration, Canadian Medical Device Bureau)

Metal Additive Manufacturing Companies

Companies

Players Mentioned in the Report

3D Systems Corporation

Stratasys Ltd.

EOS GmbH

General Electric Additive

Renishaw plc

Hgans AB

Desktop Metal

Arcam AB

HP Inc.

ExOne Company

Velo3D

Optomec, Inc.

Materialise NV

SLM Solutions Group AG

Markforged Inc.

Table of Contents

1. North America 3D Printing Metal Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America 3D Printing Metal Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America 3D Printing Metal Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Metal Additive Manufacturing

3.1.2. Increasing Adoption in Aerospace & Defense

3.1.3. Rising Demand for Lightweight Components (in automotive, healthcare, etc.)

3.1.4. Government Support & Industrial Collaborations

3.2. Market Challenges

3.2.1. High Cost of Metal Powders

3.2.2. Limited Availability of Raw Materials (Metal Powders)

3.2.3. Technical Barriers in Large-Scale Production

3.2.4. Complex Certification & Regulatory Approvals

3.3. Opportunities

3.3.1. Expansion into Medical Applications

3.3.2. Customization of Metal Parts for Niche Markets

3.3.3. Integration with Traditional Manufacturing Processes

3.3.4. Growing Use in Prototyping & Small Batch Production

3.4. Trends

3.4.1. Increasing Use of Hybrid Manufacturing

3.4.2. Adoption of Multi-Material 3D Printing

3.4.3. Developments in New Metal Alloys (Titanium, Aluminum, etc.)

3.4.4. Expansion of On-Demand Manufacturing

3.5. Government Regulations

3.5.1. Import Tariffs on Raw Materials

3.5.2. Industry Standards for Metal Additive Manufacturing

3.5.3. Certifications for Aerospace and Medical Applications

3.5.4. Environmental Compliance (Carbon Footprint, Recycling)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America 3D Printing Metal Market Segmentation

4.1. By Metal Type (In Value %)

4.1.1. Titanium

4.1.2. Aluminum

4.1.3. Stainless Steel

4.1.4. Nickel Alloys

4.1.5. Others

4.2. By End-Use Industry (In Value %)

4.2.1. Aerospace & Defense

4.2.2. Automotive

4.2.3. Healthcare

4.2.4. Industrial Tools

4.2.5. Others (Consumer Goods, Jewelry, etc.)

4.3. By Technology (In Value %)

4.3.1. Direct Metal Laser Sintering (DMLS)

4.3.2. Selective Laser Melting (SLM)

4.3.3. Electron Beam Melting (EBM)

4.3.4. Binder Jetting

4.3.5. Other Technologies

4.4. By Application (In Value %)

4.4.1. Prototyping

4.4.2. Manufacturing of Components

4.4.3. Customization

4.4.4. Tooling

4.4.5. Repair & Refurbishment

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

5. North America 3D Printing Metal Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3D Systems Corporation

5.1.2. Stratasys Ltd.

5.1.3. EOS GmbH

5.1.4. General Electric Additive

5.1.5. Renishaw plc

5.1.6. SLM Solutions Group AG

5.1.7. Materialise NV

5.1.8. Desktop Metal

5.1.9. ExOne Company

5.1.10. Arcam AB

5.1.11. Hgans AB

5.1.12. Velo3D

5.1.13. HP Inc.

5.1.14. Optomec, Inc.

5.1.15. Markforged Inc.

5.2. Cross Comparison Parameters (Market Share, Innovation Capabilities, Partnerships, Product Portfolio, Revenue, R&D Investments, No. of Employees, Headquarters)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America 3D Printing Metal Market Regulatory Framework

6.1. Industry Standards for Metal Additive Manufacturing

6.2. Compliance with Aerospace and Defense Standards

6.3. Certifications for Medical Applications

6.4. Environmental Regulations

7. North America 3D Printing Metal Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America 3D Printing Metal Future Market Segmentation

8.1. By Metal Type

8.2. By End-Use Industry

8.3. By Technology

8.4. By Application

8.5. By Region

9. North America 3D Printing Metal Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables that impact the North America 3D printing metal market. This includes studying the role of key stakeholders such as manufacturers, suppliers, and end-users. Comprehensive secondary research from proprietary databases and public sources is used to gather this data.

Step 2: Market Analysis and Construction

This step involves collecting and analyzing historical data on market performance, trends, and the adoption of 3D printing technologies in various industries. Market penetration rates and revenue generation statistics are closely monitored to understand market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

After initial analysis, market hypotheses are developed and validated through direct consultations with industry experts. These experts provide insights into operational and technical challenges, market growth opportunities, and regulatory factors.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the collected data and expert insights to create a validated, detailed report. Bottom-up and top-down approaches are used to ensure the accuracy of the analysis, providing a holistic view of the North America 3D printing metal market.

Frequently Asked Questions

01. How big is the North America 3D Printing Metal Market?

The North America 3D printing metal market is valued at USD 223 million, driven by increased industrial applications, particularly in aerospace, automotive, and healthcare industries.

02. What are the challenges in the North America 3D Printing Metal Market?

Challenges include high costs of metal powders, regulatory hurdles in aerospace and medical applications, and technical barriers in large-scale production, limiting market expansion.

03. Who are the major players in the North America 3D Printing Metal Market?

Key players include 3D Systems Corporation, Stratasys Ltd., EOS GmbH, General Electric Additive, and Renishaw plc. These companies dominate due to their strong R&D investments, advanced manufacturing capabilities, and partnerships across industries.

04. What are the growth drivers of the North America 3D Printing Metal Market?

The market is driven by technological advancements, increasing adoption in the aerospace and automotive sectors, and the growing demand for lightweight, durable components. Government support for metal additive manufacturing also plays a significant role.

05. What is the future outlook for the North America 3D Printing Metal Market?

The market is expected to experience steady growth over the next five years, driven by advancements in 3D printing technologies, increasing applications in aerospace and healthcare, and the development of new metal powders.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.