North America 5G Chipset Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD2927

October 2024

94

About the Report

North America 5G Chipset Market Overview

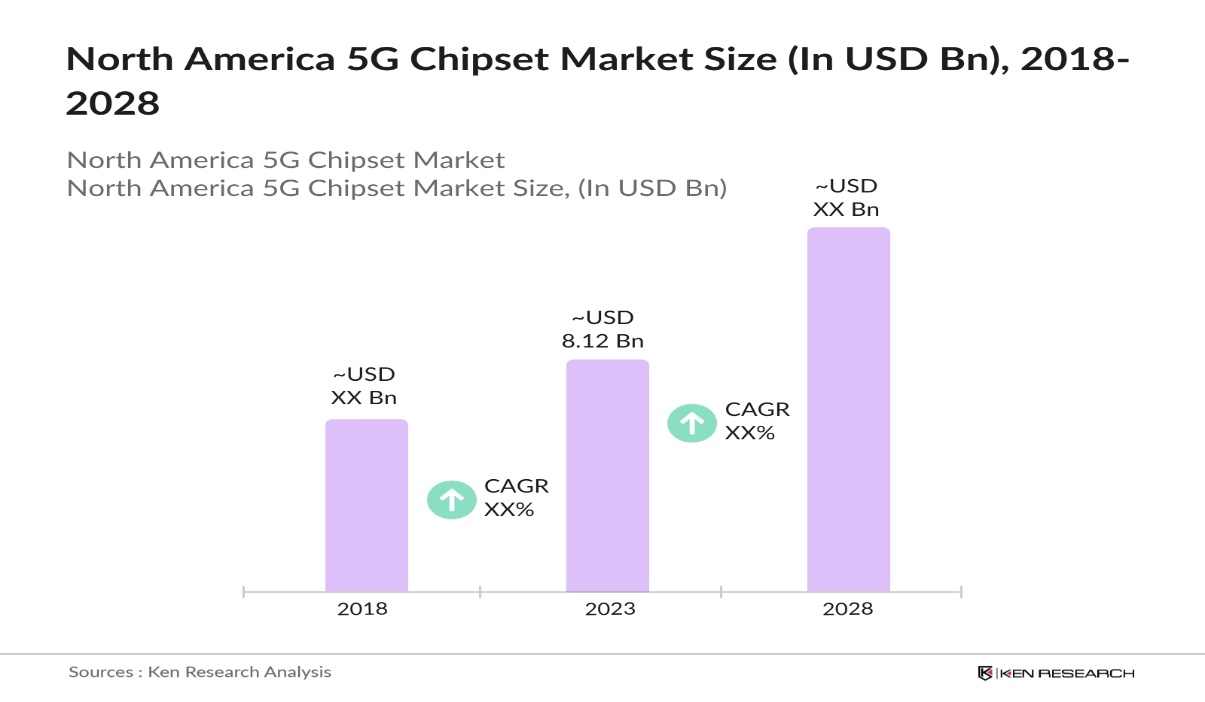

- The North America 5G chipset market reached a size of USD 8.12 billion in 2023, driven primarily by the growing adoption of 5G technology across various industries, including automotive, healthcare, and consumer electronics. The increasing demand for high-speed internet connectivity and the proliferation of IoT devices are significant drivers. Key factors such as advancements in AI and machine learning, which require high data speeds and low latency, further bolster market growth.

- Leading players in the North American 5G chipset market include Qualcomm Technologies Inc., Intel Corporation, Broadcom Inc., MediaTek Inc., and Samsung Electronics Co., Ltd. These companies dominate the market through continuous innovation and extensive R&D investments to develop advanced chipset technologies that cater to various industry needs. Their strong distribution networks and strategic partnerships with telecom operators and device manufacturers help maintain their market position.

- The CHIPS and Science Act (2022), aimed at promoting investment in semiconductor manufacturing in the U.S., which includes 5G chipset production. This initiative seeks to alleviate supply chain challenges and boost the development and production of advanced 5G wireless chips, crucial for the expansion of 5G networks across the country. The act supports efforts to reintroduce skilled manufacturing employment opportunities in the U.S., enhancing the local semiconductor industry.

- Key cities dominating the North American 5G chipset market include New York, San Francisco, and Dallas. New York is dominating the market due to the advanced technological infrastructure, innovation and also because it is home to numerous technology firms that drive demand for 5G chipsets

North America 5G Chipset Market Segmentation

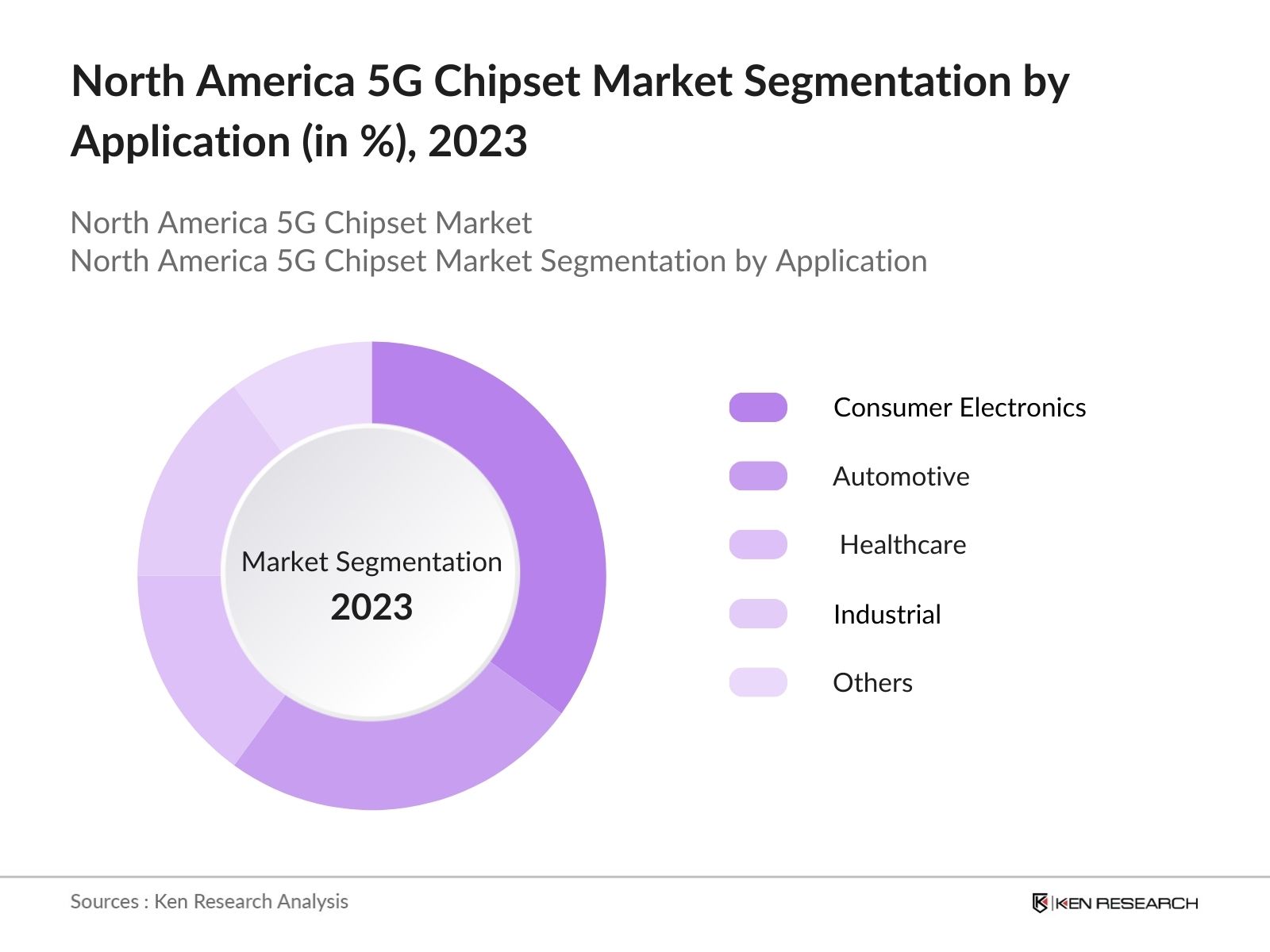

By Application: The North America 5G chipset market is segmented by application into automotive, consumer electronics, healthcare, industrial, and others. In 2023, consumer electronics dominated the market share within this segmentation. The proliferation of 5G-enabled smartphones, tablets, and wearable devices has significantly driven this segment. The need for higher data speeds and low latency for augmented reality (AR), virtual reality (VR), and gaming applications also supports the growth of the consumer electronics segment.

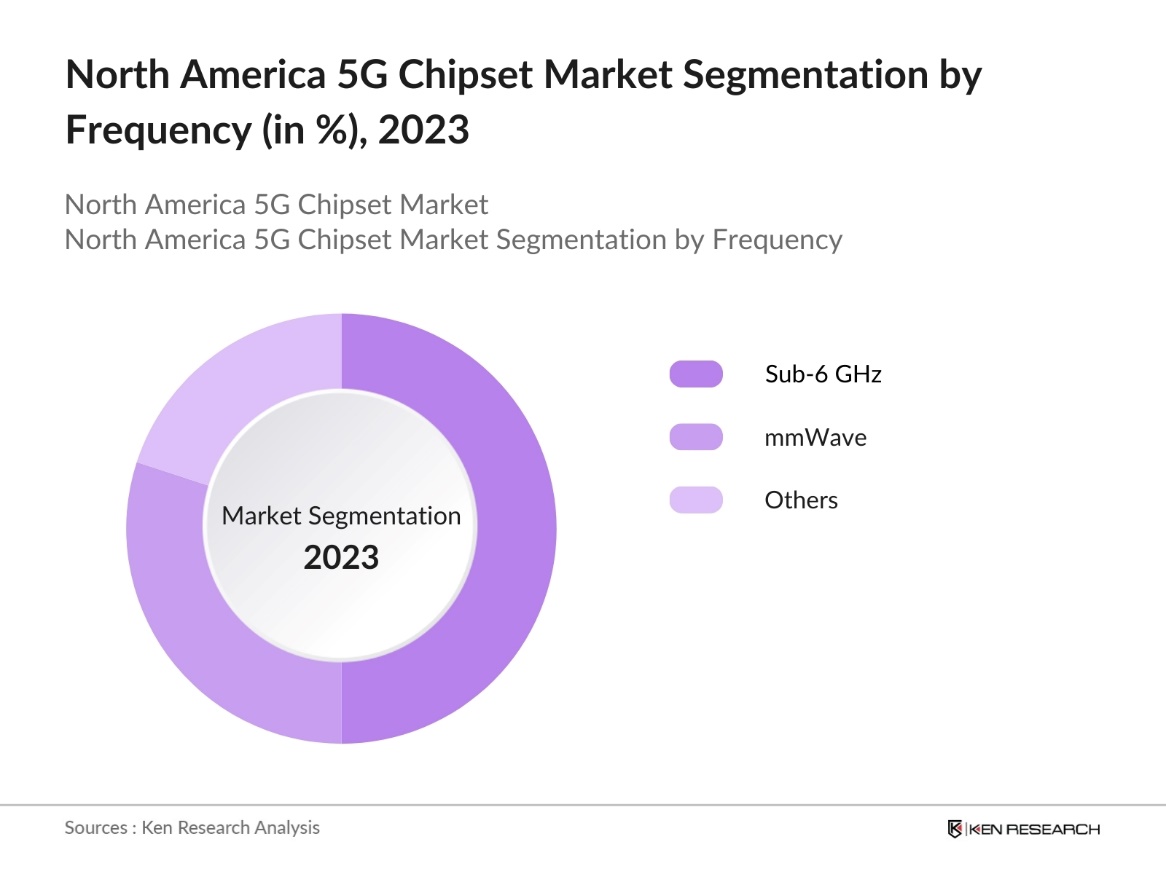

By Frequency Type: The market is segmented by frequency type into Sub-6 GHz, mmWave, and others. In 2023, Sub-6 GHz dominated the market due to its broad coverage and capacity to provide seamless connectivity over long distances, which is crucial for urban and suburban deployments. Sub-6 GHz frequencies offer a balance between speed and range, making them ideal for initial 5G rollouts, particularly in areas with existing LTE infrastructure.

By Region: The North America 5G Chipset Market is segmented by region into the USA and Canada. In 2023, the USA held a dominant market share under this segmentation. This dominance is attributed to the USA's extensive 5G infrastructure development, significant investments by telecom operators, and a strong consumer base for advanced technologies. The presence of major technology hubs and innovation centers, alongside supportive government initiatives such as the CHIPS and Science Act, further reinforces the USA's leadership in the 5G chipset market compared to Canada.

North America 5G Chipset Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Qualcomm Technologies Inc. |

1985 |

San Diego, California |

|

Intel Corporation |

1968 |

Santa Clara, California |

|

Broadcom Inc. |

1991 |

San Jose, California |

|

MediaTek Inc. |

1997 |

Hsinchu, Taiwan |

|

Samsung Electronics Co., Ltd. |

1969 |

Suwon, South Korea |

- Intel Corporation: Intel has introduced a series of new products targeting the deployment of 5G network infrastructure, along with enhancements to its processors designed for scalable data centers. The new offerings include the Atom P5900 processors, the Ethernet 700 Series Network Adapter, and the Diamond Mesa ASIC, specifically developed to accelerate 5G network performance and efficiency. These innovations aim to support the growing demand for high-performance 5G infrastructure and enhance Intel's presence in the 5G market.

- Samsung Electronics Co., Ltd.: Samsung Electronics, a pioneer in semiconductor technology, has announced the development of standardized 5G non-terrestrial network (NTN) modem technology, enabling direct communication between smartphones and satellites, particularly in remote areas. This innovation is set to be integrated into Samsung's Exynos modem solutions, accelerating the rollout of 5G satellite communications.

North America 5G Chipset Market Analysis

Growth Drivers

- Surge in Smart Device Connectivity: The increasing adoption of smart devices, including smartphones, tablets, and IoT devices, is a significant growth driver for the 5G chipset market in North America. According to the Federal Communications Commission (FCC), 400 million smart devices will be connected to 5G networks in the U.S. by the end of 2024. This connectivity surge is driven by consumer demand for faster data speeds and seamless connectivity, necessitating advanced 5G chipsets capable of supporting high data throughput and low latency, crucial for applications like augmented reality and real-time data analytics.

- Increasing Demand in Automotive Sector: The automotive industry in North America is increasingly integrating 5G technology to enhance vehicle connectivity, autonomous driving capabilities, and in-car entertainment systems. This growing trend has led to a rise in demand for specialized 5G chipsets designed to meet the unique requirements of the automotive sector, including high-speed data transmission and reliable connectivity, essential for vehicle-to-everything (V2X) communication.

- Rising demand for High-Speed Internet and Large Network Coverage: Rising demand for high-speed internet and large network coverage for several applications, such as distance learning, autonomous driving, multiuser gaming, videoconferencing, live streaming, telemedicine, and augmented reality, is expected to propel the growth of the 5G chipset market.

Challenges

- High Cost of 5G Chipset Production: One of the primary challenges facing the North American 5G chipset market is the high cost associated with the production of advanced chipsets. The cost of raw materials, coupled with the complexity of designing and manufacturing 5G chipsets, has resulted in elevated production costs.

- Supply Chain Disruptions: The global semiconductor shortage that began in 2021 continues to impact the 5G chipset market in North America. Although there has been some recovery, ongoing geopolitical tensions and supply chain disruptions have created uncertainty. This delay has resulted in increased costs and affected the ability of manufacturers to meet growing demand, particularly for sectors relying on rapid 5G deployment.

Government Initiative

- CHIPS and Science Act Funding: The CHIPS and Science Act, enacted in 2022, allocates $280 billion to bolster semiconductor manufacturing in the U.S., which includes funding for 5G chipset production. This initiative aims to strengthen the U.S. semiconductor industrys global competitiveness and reduce reliance on foreign supply chains, thereby boosting the domestic 5G chipset market.

- 5G Fund for Rural America: The Federal Communications Commission (FCC) has established the 5G Fund for Rural America, which aims to allocate up to$9 billionto expand 5G mobile broadband service in rural areas. This initiative is part of ongoing efforts to bridge the digital divide but does not specifically mention a new $2 billion fund for 5G deployment in 2023.

North America 5G chipset market future outlook

Market Trends

The North America 5G Chipset Market is projected to grow exponentially in coming years. This growth will be driven by Surge in Smart Device Connectivity, Increasing Demand in Automotive Sector and rising popularity of E-Bike sharing programs and increasing health and wellness awareness.

- Expansion of 5G Use Cases in Industrial IoT: Over the next five years, the adoption of 5G chipsets in industrial IoT applications is expected to surge. The integration of 5G technology in manufacturing and supply chain management will enhance automation, real-time monitoring, and data analytics capabilities. North America will be equipped with 5G chipsets, driven by the need for reliable, low-latency communication in critical operations.

- Growth in 5G Satellite Communications: The market is poised to witness significant growth in 5G satellite communications, particularly in remote and underserved areas. By 2028 North Americas 5G traffic will be supported by satellite networks, enabling ubiquitous coverage and connectivity. The demand for 5G chipsets capable of supporting satellite communication is expected to rise, driven by advancements in non-terrestrial network technologies and increased investment in satellite infrastructure.

Scope of the Report

|

By Application Type |

Automotive consumer electronics healthcare industrial |

|

By Frequency Type |

Sub-6 GHz mmWave |

|

By Region |

USA Canada |

Products

Key Target Audience

Telecommunications Companies

Network Equipment Manufacturers

Mobile Device Manufacturers

Automotive Manufacturers

Industrial IoT Companies

Cloud Service Providers

Healthcare Device Manufacturers

Enterprise and Data Center Operators

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Qualcomm Technologies Inc.

Intel Corporation

Broadcom Inc.

MediaTek Inc.

Samsung Electronics Co., Ltd.

Huawei Technologies Co., Ltd.

Nokia Corporation

Ericsson AB

Infineon Technologies AG

Skyworks Solutions, Inc.

Table of Contents

1. North America 5G Chipset Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

2. North America 5G Chipset Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America 5G Chipset Market Dynamics

3.1. Growth Drivers

3.1.1. Surge in Smart Device Connectivity

3.1.2. Increasing Demand in Automotive Sector

3.1.3. Rising demand for High-Speed Internet and Large Network Coverage

3.2. Market Challenges

3.2.1. High Cost of 5G Chipset Production

3.2.2. Supply Chain Disruptions

3.2.3. Regulatory Hurdles

3.3. Government Initiatives

3.3.1. CHIPS and Science Act Funding

3.3.2. 5G Fund for Rural America

3.3.3. Canada’s Spectrum Strategy 2024

3.4. Recent Trends

3.4.1. Increased Adoption of mmWave Technology

3.4.2. Rise in Multi-Mode 5G Chipsets

3.4.3. Integration of AI Capabilities

4. North America 5G Chipset Market Segmentation, 2023

4.1. By Application (Value %)

4.1.1. Consumer Electronics

4.1.2. Automotive

4.1.3. Healthcare

4.1.4. Industrial

4.2. By Frequency Type (Value %)

4.2.1. Sub-6 GHz

4.2.2. mmWave

4.2.3. Others

4.3. By Region (Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. North America 5G Chipset Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Qualcomm Technologies Inc.

5.4.2. Intel Corporation

5.4.3. Broadcom Inc.

5.4.4. MediaTek Inc.

5.4.5. Samsung Electronics Co., Ltd.

6. North America 5G Chipset Market Regulatory and Legal Framework

6.1. Regulatory Standards and Compliance

6.2. Spectrum Allocation Policies

6.3. Environmental and Safety Regulations

7. North America 5G Chipset Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

8. Future Market Segmentation, 2028

8.1. By Application (Value %)

8.2. By Frequency Type (Value %)

8.3. By Region (Value %)

9. Analyst Recommendations and Strategic Insights

9.1. Total Addressable Market (TAM) Analysis

9.2. Key Strategic Initiatives for Market Penetration

9.3. Recommendations for Future Investments

10. Appendix

10.1. List of Abbreviations

10.2. Sources and References

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involved mapping out the North America 5G chipset market, identifying major stakeholders such as chipset manufacturers, telecom service providers, OEMs (Original Equipment Manufacturers), and consumers. Through extensive desk research using proprietary and public data sources, we identified critical variables such as technological advancements, 5G adoption trends, raw material costs, and distribution channel preferences.

Step 2: Market Analysis and Construction

Historical data from the North America 5G chipset market was analyzed to assess revenue generation, market penetration, and the influence of chipset performance trends on sales performance. This phase involved evaluating both consumer electronics sales (smartphones, IoT devices) and telecommunications infrastructure (base stations, routers), as well as the impact of online distribution channels for 5G chipsets.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the growth of 5G chipset technologies and the influence of e-commerce were validated through expert interviews. These interviews were conducted with industry professionals from key 5G chipset manufacturers and telecom operators to gather insights on consumer preferences and market strategies.

Step 4: Research Synthesis and Final Output

Finally, all gathered data was synthesized and cross-verified through interactions with 5G chipset manufacturers, providing a robust and comprehensive market analysis. This multi-step approach ensures the accuracy and reliability of the final output, which reflects the current trends and challenges in the North America 5G chipset market.

Frequently Asked Questions

1.How big is the North America 5G Chipset Market?

The North America 5G Chipset Market was valued at USD 8.12 billion in 2023, driven by the growing demand for high-speed internet connectivity, increased adoption of smart devices, and the expansion of 5G infrastructure across the region.

2. What are the challenges in the North America 5G Chipset Market?

Challenges in the North America 5G Chipset Market include high production costs, supply chain disruptions due to semiconductor shortages, and regulatory hurdles related to spectrum allocation and deployment standards.

3.Who are the major players in the North America 5G Chipset Market?

Key players in the North America 5G Chipset Market include Qualcomm Technologies Inc., Intel Corporation, Broadcom Inc., MediaTek Inc., and Samsung Electronics Co., Ltd., who lead due to their innovative technologies and strong industry partnerships.

4.What are the growth drivers of the North America 5G Chipset Market?

Growth drivers of the North America 5G Chipset Market include the increasing adoption of smart devices, expansion of 5G network infrastructure, and rising demand for 5G technology in the automotive sector for enhanced vehicle connectivity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.