North America Aerogel Market Outlook to 2030

Region:North America

Author(s):Shambhavi Awasthi

Product Code:KROD1394

October 2024

89

About the Report

North America Aerogel Market overview

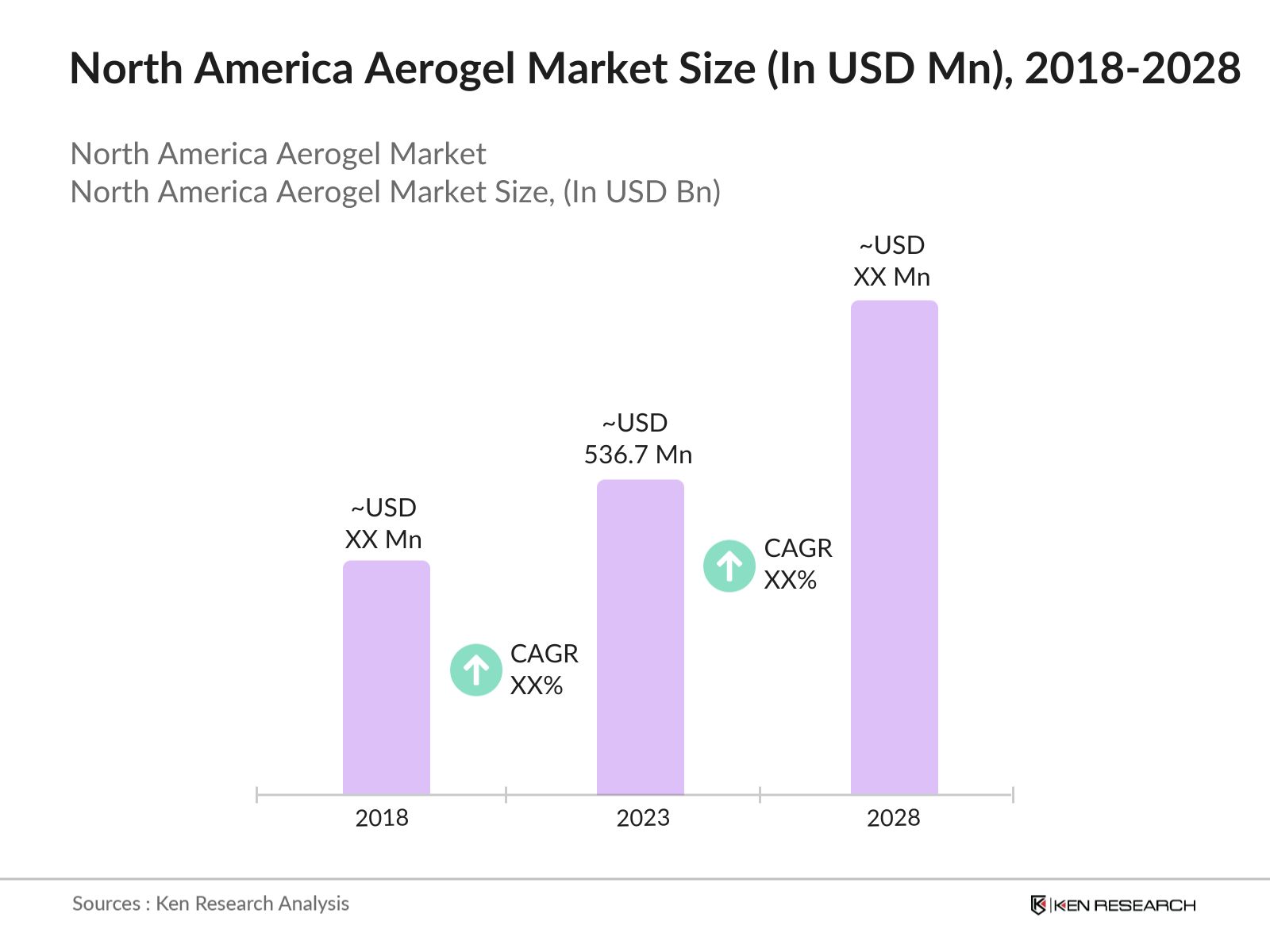

- The North America aerogel market reached a size of USD 536.7 million in 2023, driven primarily by the rising demand for high-performance insulation materials in the construction and oil & gas industries. The market is witnessing increased adoption due to aerogels exceptional thermal insulation properties, making it a preferred choice for various applications. Additionally, advancements in aerogel production technologies support the market's growth, which have reduced manufacturing costs and made these materials more accessible across industries.

- Key players in the North American aerogel market include Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, Svenska Aerogel AB, and BASF SE. These companies dominate the market due to their extensive product portfolios, strong distribution networks, and continuous investments in R&D. Aspen Aerogels, for example, leads the market with its robust product offerings in the construction and energy sectors, while Cabot Corporation focuses on high-performance aerogels for the automotive industry.

- In 2023, Aspen Aerogels announced the expansion of its manufacturing facility in East Providence, Rhode Island, increasing its production capacity by 30%. This development is significant as it aims to meet the growing demand for aerogels in the construction and automotive industries. Additionally, Cabot Corporation introduced a new line of aerogels designed specifically for electric vehicle batteries, which is expected to drive further growth in the market.

- Dominant cities in the North America Aerogel market are Houston, Los Angeles, and New York. Houston leads due to its large oil & gas industry, which heavily relies on aerogels for insulation in pipelines and refineries. Los Angeles and New York are major markets due to their ongoing investments in sustainable construction and green buildings, where aerogels are increasingly used for their superior thermal insulation properties.

North America Aerogel Market Segmentation

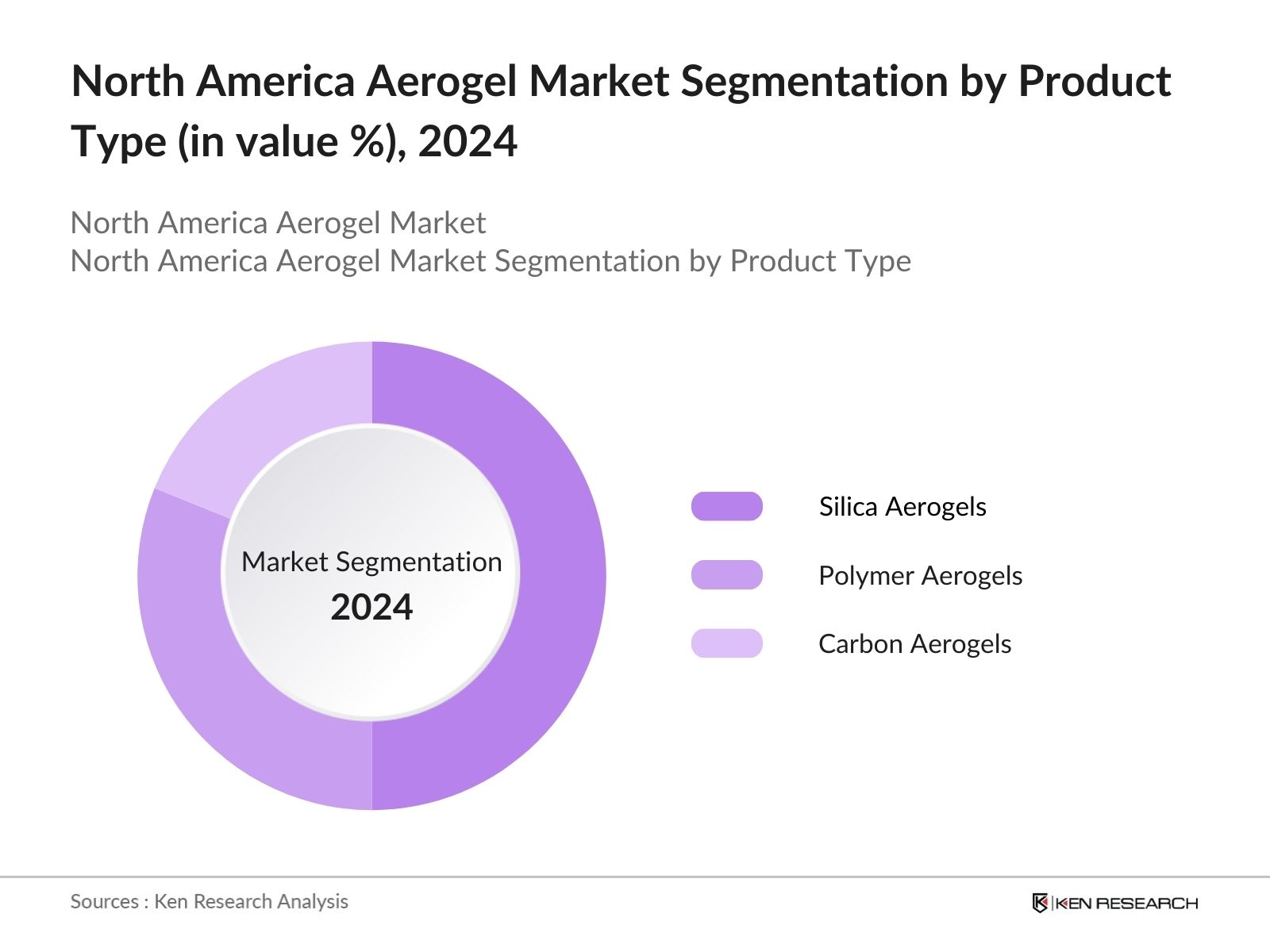

By Product Type: The North America Aerogel market is segmented by product type into silica aerogels, polymer aerogels, and carbon aerogels. In 2023, silica aerogels held a dominant market share due to their extensive use in construction and oil & gas applications. Silica aerogels are favored for their high thermal insulation properties, lightweight nature, and ease of application in both residential and industrial settings. The widespread availability and cost-effectiveness of silica aerogels have further contributed to their dominance in the market.

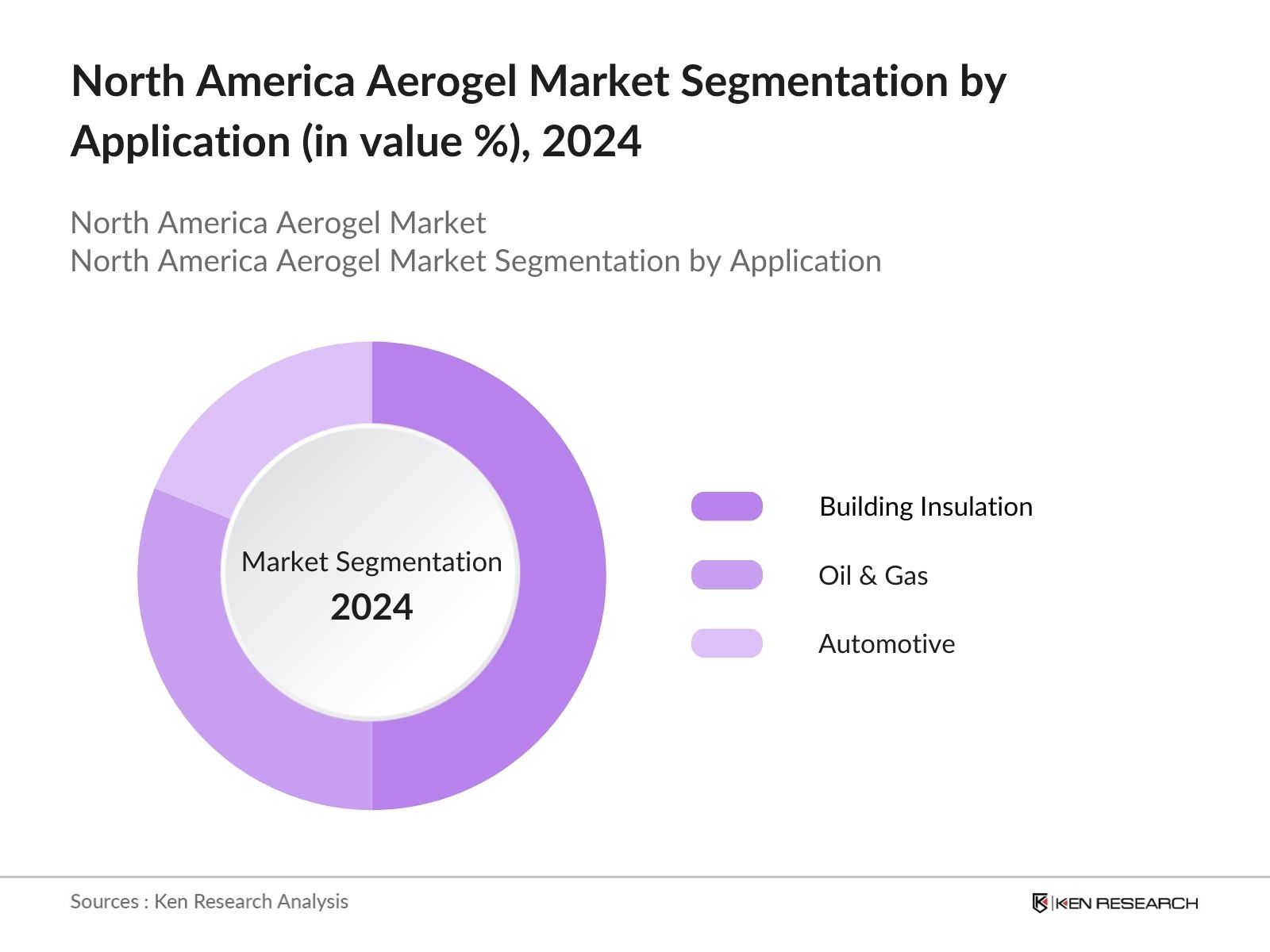

By Application The North America Aerogel market is segmented by application into building insulation, oil & gas, automotive, and others. In 2023, the building insulation segment dominated the market due to the increasing demand for energy-efficient buildings. Aerogels are preferred in this segment for their ability to provide superior insulation with minimal thickness, making them ideal for retrofitting older buildings and new construction projects aiming to achieve green building certifications. The rise in sustainable construction practices further drives this segment's dominance.

By Application The North America Aerogel market is segmented by application into building insulation, oil & gas, automotive, and others. In 2023, the building insulation segment dominated the market due to the increasing demand for energy-efficient buildings. Aerogels are preferred in this segment for their ability to provide superior insulation with minimal thickness, making them ideal for retrofitting older buildings and new construction projects aiming to achieve green building certifications. The rise in sustainable construction practices further drives this segment's dominance.

By Region: The North American Aerogel market is segmented into the United States, Canada. In 2023, the United States dominated the North American Aerogel market, driven by its extensive adoption in the oil & gas industry, robust construction activities, and significant investments in research and development for advanced insulation materials. The country's focus on energy efficiency, coupled with government incentives for sustainable building practices, further bolstered its leadership in the market.

North America Aerogel Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Aspen Aerogels, Inc. |

2001 |

Northborough, Massachusetts |

|

Cabot Corporation |

1882 |

Boston, Massachusetts |

|

Aerogel Technologies |

2005 |

Boston, Massachusetts |

|

Svenska Aerogel AB |

2008 |

Gvle, Sweden |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- Cabot Corporation: Cabot Corporation, in 2023, launched a new product line of aerogels specifically designed for thermal management in electric vehicles. This product targets the rapidly growing EV market and offers superior insulation properties, enhancing battery safety and performance. Moreover, Cabot Corporation announced a strategic partnership with a leading EV manufacturer to integrate these aerogels into their next-generation vehicle models, highlighting the companys innovative approach to market demands.

- Aerogel Technologies, LLC: Aerogel Technologies expanded its aerogel product line in 2024 to include ultra-lightweight aerogels for aerospace applications. This new product range offers enhanced thermal insulation and structural stability, making it ideal for use in aircraft and spacecraft. The company also collaborated with NASA to supply aerogels for upcoming space missions, further solidifying its position as a key player in the aerogel market.

North America Aerogel Market Competitive Landscape

North America Growth Drivers

- Increased Demand for Energy-Efficient Solutions: The growing emphasis on energy conservation across various industries is a significant driver for the aerogel market in the North America. Aerogels are known for their superior thermal insulation properties, making them an ideal material for applications in construction, oil & gas, and automotive industries. According to the U.S. Energy Information Administration, the industrial sector is projected to account for 35% of total U.S. energy consumption by 2024.

- Expansion of the Electric Vehicle (EV) Market: The rapid growth of the electric vehicle market in North America is driving the demand for aerogels, particularly in battery insulation applications. According to the U.S. Department of Energy, in 2024, electric car sales in the United States are projected to rise by 20% compared to the previous year, translating to almost half a million more sales, relative to 2023, representing a significant increase from previous years. Aerogels offer exceptional thermal management capabilities, which are crucial for maintaining battery safety and performance in EVs.

- Government Support for Sustainable Building Practices: Government support for sustainable building practices, such as the EPAs Energy Star program, is boosting the North American aerogel market. In 2023, over 8,800 commercial buildings earned ENERGY STAR certification, highlighting a shift towards energy efficiency. Aerogels, known for their superior insulation properties, are increasingly used in certified buildings, which consume 35% less energy, driving demand for aerogel products in the region.

North America Aerogel Market Challenges

- High Production Costs: Despite the benefits of aerogels, one of the major challenges facing the North American aerogel market is the high production cost associated with these materials. The manufacturing process for aerogels is complex and energy-intensive, resulting in higher costs compared to traditional insulation materials. According to a 2023 report by the U.S. Department of Energy, the cost of aerogel insulation is approximately three times higher than that of conventional insulation materials like fibreglass, posing a challenge for its adoption in large-scale projects.

- Limited Awareness and Adoption in Some Sectors: While aerogels are gaining popularity in industries like construction and oil & gas, there remains limited awareness and adoption in other sectors. In the automotive industry, although aerogels offer significant benefits for thermal management, many manufacturers are still reliant on traditional materials. This limited awareness and adoption in certain sectors pose a challenge to the overall growth of the aerogel market.

North America Aerogel Market Government Initiatives

- U.S. Department of Energys Advanced Manufacturing Office (AMO) Initiative: In 2023, the U.S. Department of Energys Advanced Manufacturing Office (AMO) launched an initiative aimed at reducing the cost and improving the efficiency of aerogel production. The initiative includes funding for research and development of new manufacturing techniques that can lower energy consumption and reduce the overall production cost of aerogels.

- Federal Tax Incentives for Energy-Efficient Buildings: The U.S. government has implemented federal tax incentives to encourage the construction of energy-efficient buildings. Under Section 179D of the Internal Revenue Code, the IRA expanded the Energy Efficient Commercial Building Tax Deduction, allowing businesses to deduct up to $5.00 per square foot for energy-efficient improvements made to commercial properties starting in 2023.

North America Aerogel Market Future Outlook

The North America Aerogel market is poised for significant growth, driven by increasing demand for energy-efficient solutions, advancements in manufacturing technologies, and expanding applications in green building and renewable energy sectors. By 2028, aerogels are expected to become a mainstream insulation material across various industries, supported by government initiatives and a strong focus on sustainability.

Future Trends

- Growth in Green Building Certifications: The North American Aerogel market is expected to see substantial growth in the adoption of aerogels for green building certifications over the next five years. By 2028, the number of LEED-certified buildings incorporating aerogels is projected to increase, driven by stricter energy efficiency regulations and growing awareness of sustainable construction practices.

- Expansion of Aerogel Applications in Renewable Energy: Aerogels are anticipated to play a critical role in the renewable energy sector, particularly in the insulation of solar panels and wind turbines. By 2028, the market for aerogels in renewable energy applications supported by government initiatives promoting clean energy adoption. The U.S. Department of Energy projects that the installed capacity of solar and wind energy will increase through 2025, creating a significant demand for advanced insulation materials like aerogels to enhance energy efficiency and durability.

Scope of the Report

|

By Application |

Building Insulation Oil & Gas Automotive Others |

|

By Product Type |

Silica Aerogels Polymer Aerogels Carbon Aerogels |

|

By Technology |

Supercritical Drying Ambient Pressure Drying |

|

By Form |

Blanket Particle Panel Monolith |

|

By Region |

United States Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Construction Companies

Oil & Gas Companies

Automotive Manufacturers

Aerospace and Defence Contractors

Electric Vehicle Manufacturers

Insulation Material Suppliers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Aspen Aerogels, Inc.

Cabot Corporation

Aerogel Technologies, LLC

Svenska Aerogel AB

BASF SE

Dow Chemical Company

Airglass AB

American Aerogel Corporation

JIOS Aerogel

Thermablok Aerogels

Table of Contents

1. North America Aerogel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Aerogel Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Aerogel Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Thermal Insulation Materials

3.1.2. Increasing Adoption in the Oil & Gas Industry

3.1.3. Rising Environmental Concerns and Energy Efficiency Regulations

3.2. Restraints

3.2.1. High Production Costs

3.2.2. Limited Awareness and Adoption in Emerging Applications

3.2.3. Technical Challenges in Large-Scale Production

3.3. Opportunities

3.3.1. Technological Innovations in Aerogel Manufacturing

3.3.2. Expansion in Aerospace and Automotive Sectors

3.3.3. Growth in Building & Construction Industry

3.4. Trends

3.4.1. Increasing Use of Aerogels in Energy Storage Applications

3.4.2. Adoption of Aerogel-Based Apparel and Wearables

3.4.3. Development of Bio-Based Aerogels

3.5. Government Regulation

3.5.1. Energy Efficiency Standards and Initiatives

3.5.2. Environmental Impact Regulations

3.5.3. Incentives for Green Building Materials

3.5.4. Public-Private Partnerships for Sustainable Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. North America Aerogel Market Segmentation, 2023

4.1. By Form (in Value %)

4.1.1. Blanket

4.1.2. Particle

4.1.3. Panel

4.1.4. Monolith

4.2. By Application (in Value %)

4.2.1. Oil & Gas

4.2.2. Construction

4.2.3. Automotive & Aerospace

4.2.4. Performance Coatings

4.2.5. Other Applications (including Electronics, Healthcare, etc.)

4.3. By Raw Material (in Value %)

4.3.1. Silica

4.3.2. Carbon

4.3.3. Polymer

4.3.4. Others

4.4. By Technology (in Value %)

4.4.1. Supercritical Drying

4.4.2. Ambient Pressure Drying

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

5. North America Aerogel Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Aspen Aerogels, Inc.

5.1.2. Cabot Corporation

5.1.3. Aerogel Technologies, LLC

5.1.4. NanoPore Incorporated

5.1.5. Svenska Aerogel AB

5.1.6. Armacell International S.A.

5.1.7. BASF SE

5.1.8. Dow Inc.

5.1.9. Airglass AB

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Aerogel Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Aerogel Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Aerogel Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Aerogel Future Market Segmentation, 2028

9.1. By Form (in Value %)

9.2. By Application (in Value %)

9.3. By Raw Material (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

10. North America Aerogel Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the semiconductor ecosystem in North America, focusing on major players, suppliers, and consumers. This step is carried out through extensive secondary research from proprietary databases, public records, and industry reports. Key variables influencing market dynamics such as equipment demand, technological developments, and government policies are identified.

Step 2: Market Analysis and Construction

Historical data on Semiconductor adoption is gathered to analyze trends, growth rates, and market segmentation. This step also includes studying key product types, end-users, and their contribution to revenue generation, enabling a thorough market construction based on the collected data.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses developed during earlier phases are validated through consultations with industry experts and stakeholders. These insights provide clarity on market demand, technological adoption, and the competitive landscape, ensuring data reliability.

Step 4: Research Synthesis and Final Output

The final synthesis involves consolidating primary and secondary research, resulting in a comprehensive report that captures the dynamics of the North America Aerogel market. Key trends, future projections, and recommendations are included to provide actionable insights

Frequently Asked Questions

01 How big is the North America Aerogel Market?

The North America aerogel market was valued at USD 536.7 million in 2023, driven by increasing demand for high-performance insulation materials across industries such as construction, automotive, and oil & gas.

02 What are the challenges in the North America Aerogel Market?

Challenges in the North America aerogel market include high production costs, limited awareness and adoption in certain sectors, and supply chain disruptions affecting the timely availability of materials.

03 Who are the major players in the North America Aerogel Market?

Key players in the North America aerogel market include Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, and BASF SE. These companies lead the market with advanced product offerings and strong distribution networks.

04 What are the growth drivers of the North America Aerogel Market?

Growth drivers for the North America aerogel market include the increasing demand for energy-efficient solutions, the expansion of the electric vehicle market, and government support for sustainable building practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.