North America Aerospace Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11272

December 2024

82

About the Report

North America Aerospace Market Overview

- The North America aerospace market is a significant segment of the global aerospace industry, driven by technological advancements and increasing demand for air travel. The market was valued at USD 168 billion, reflecting a robust growth trajectory. This expansion is primarily fueled by the resurgence of commercial aviation post-pandemic, increased defense spending, and innovations in aerospace technologies.

- The United States stands as the dominant player in the North American aerospace market, attributed to its extensive infrastructure, substantial defense budget, and presence of leading aerospace manufacturers. Canada also contributes significantly, with a strong focus on aerospace parts manufacturing and maintenance, repair, and overhaul (MRO) services. These countries' dominance is bolstered by well-established supply chains, skilled labor forces, and supportive government policies.

- Environmental regulations are increasingly impacting the aerospace market in North America. The FAA and the Environmental Protection Agency (EPA) are implementing stricter emission norms to reduce aviations environmental footprint. In 2023, the EPA introduced guidelines that target a 25% reduction in nitrogen oxide emissions from commercial aircraft engines by 2027. These regulations are pushing aerospace manufacturers to invest in more fuel-efficient technologies and sustainable aviation fuels, encouraging innovation within the sector.

North America Aerospace Market Segmentation

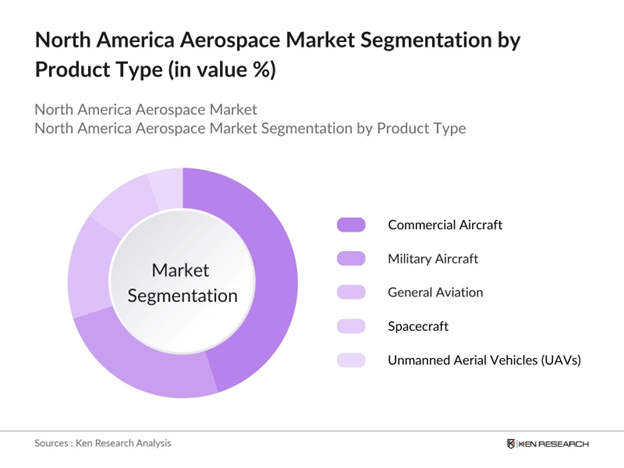

By Product Type: The North America aerospace market is segmented by product type into commercial aircraft, military aircraft, general aviation, spacecraft, and unmanned aerial vehicles (UAVs). Among these, commercial aircraft hold a dominant market share, driven by the resurgence of passenger air travel and fleet expansions by major airlines. The increasing demand for fuel-efficient and technologically advanced aircraft further propels this segment's growth.

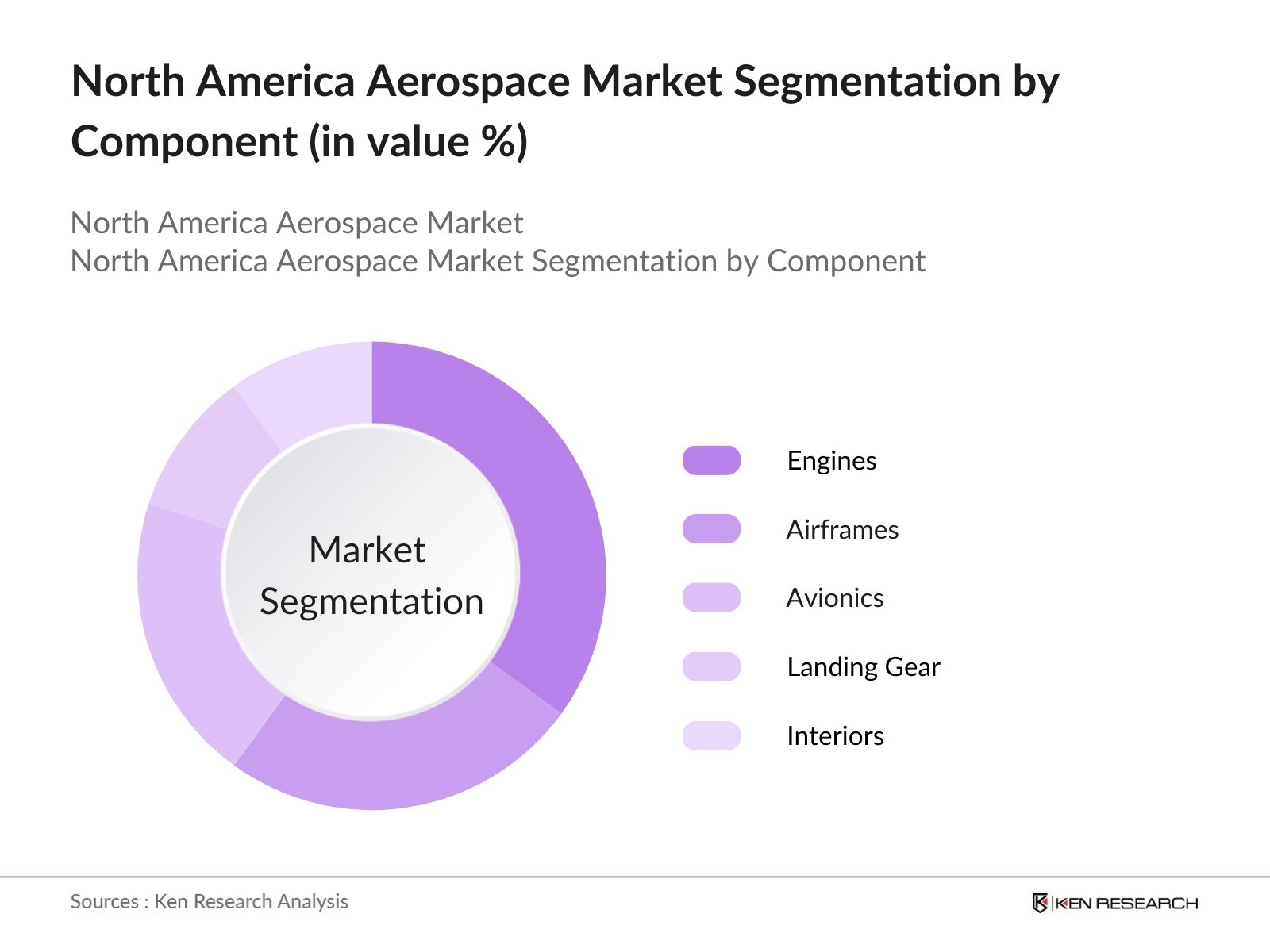

By Component: Segmentation by component includes airframes, engines, avionics, landing gear, and interiors. Engines represent the largest share within this category, owing to the high cost and critical importance of propulsion systems in aircraft performance. Continuous advancements in engine technology aimed at improving fuel efficiency and reducing emissions contribute to the prominence of this segment.

North America Aerospace Market Competitive Landscape

The North America aerospace market is characterized by the presence of several key players who drive innovation and maintain competitive advantages through extensive research and development, strategic partnerships, and diversified product portfolios.

North America Aerospace Market Analysis

Growth Drivers

- Technological Advancements (e.g., AI, 3D Printing): The North American aerospace sector is experiencing significant growth due to technological advancements such as artificial intelligence (AI) and additive manufacturing (3D printing). AI is enhancing predictive maintenance, optimizing flight operations, and improving supply chain management. Additive manufacturing is reducing production times and material waste, leading to cost savings and increased efficiency. For instance, the Federal Aviation Administration (FAA) has been integrating AI to improve air traffic management systems, aiming to handle the projected increase in air traffic efficiently.

- Increasing Air Travel Demand: The demand for air travel in North America has been on the rise, contributing to the expansion of the aerospace market. According to the International Air Transport Association (IATA), North American airlines carried over 1.2 billion passengers in 2023, reflecting a steady recovery from the pandemic-induced downturn. This surge in passenger numbers has led to increased orders for new aircraft and a higher demand for maintenance services, thereby driving growth in the aerospace sector.

- Defense Budget Allocations: The United States has consistently allocated substantial budgets to defense, positively impacting the aerospace industry. In the fiscal year 2024, the U.S. Department of Defense budget was approximately $849.8 billion, with significant portions directed towards aerospace projects, including the development of advanced aircraft and space systems. This consistent investment supports the growth and innovation within the aerospace sector.

Challenges

- Supply Chain Disruptions: The aerospace industry in North America faces significant challenges due to supply chain disruptions. The COVID-19 pandemic exposed vulnerabilities, leading to delays in aircraft production and delivery. For example, Boeing experienced production setbacks for its 737 MAX aircraft due to supply chain issues, impacting delivery schedules. These disruptions have highlighted the need for more resilient and diversified supply chains within the aerospace sector.

- Regulatory Compliance: Compliance with stringent regulations poses a challenge for aerospace companies. The FAA enforces rigorous safety and environmental standards, requiring continuous updates and certifications. For instance, the implementation of the Next Generation Air Transportation System (NextGen) requires aircraft to be equipped with advanced avionics, necessitating significant investments from airlines and manufacturers to meet compliance standards.

North America Aerospace Market Future Outlook

Over the next five years, the North America aerospace market is expected to experience significant growth, driven by continuous technological advancements, increasing defense budgets, and a resurgence in commercial air travel. The integration of sustainable practices and the development of next-generation aircraft are anticipated to further propel the market forward.

Market Opportunities

- Emergence of Urban Air Mobility: Urban Air Mobility (UAM) presents a significant growth opportunity for the aerospace market. Companies like Joby Aviation and Archer Aviation are developing electric vertical takeoff and landing (eVTOL) aircraft aimed at revolutionizing urban transportation. The FAA is actively working on regulatory frameworks to accommodate these new technologies, indicating a supportive environment for UAM development.

- Sustainable Aviation Initiatives: There is a growing emphasis on sustainable aviation, with initiatives aimed at reducing carbon emissions. The FAA has set goals to achieve net-zero greenhouse gas emissions from the U.S. aviation sector by 2050. This has led to increased research and development in sustainable aviation fuels (SAFs) and more efficient aircraft designs, presenting opportunities for innovation and growth in the aerospace market.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

- Commercial Aircraft |

|

Component |

- Airframes |

|

End-User |

- Commercial Airlines |

|

Technology |

- Conventional |

|

Country |

- United States |

Products

Key Target Audience

Aerospace Manufacturers

Defense Contractors

Commercial Airlines

Maintenance, Repair, and Overhaul (MRO) Service Providers

Aerospace Component Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Aviation Administration)

Research and Development Institutions

Companies

Players Mentioned in the Report

The Boeing Company

Lockheed Martin Corporation

Northrop Grumman Corporation

Raytheon Technologies Corporation

Bombardier Inc.

General Dynamics Corporation

Textron Inc.

Honeywell International Inc.

L3Harris Technologies, Inc.

Spirit AeroSystems Holdings, Inc.

Table of Contents

1. North America Aerospace Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Aerospace Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Aerospace Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements (e.g., AI, 3D Printing)

3.1.2. Increasing Air Travel Demand

3.1.3. Defense Budget Allocations

3.1.4. Expansion of MRO Services

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Compliance

3.2.3. Skilled Labor Shortage

3.3. Opportunities

3.3.1. Emergence of Urban Air Mobility

3.3.2. Sustainable Aviation Initiatives

3.3.3. Growth in Unmanned Aerial Systems (UAS)

3.4. Trends

3.4.1. Adoption of Electric Propulsion

3.4.2. Integration of IoT in Aircraft Systems

3.4.3. Increased Investment in Space Exploration

3.5. Government Regulations

3.5.1. FAA Safety Standards

3.5.2. Environmental Emission Norms

3.5.3. Export Control Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. North America Aerospace Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Commercial Aircraft

4.1.2. Military Aircraft

4.1.3. General Aviation

4.1.4. Spacecraft

4.1.5. Unmanned Aerial Vehicles (UAVs)

4.2. By Component (In Value %)

4.2.1. Airframes

4.2.2. Engines

4.2.3. Avionics

4.2.4. Landing Gear

4.2.5. Interiors

4.3. By End-User (In Value %)

4.3.1. Commercial Airlines

4.3.2. Defense Organizations

4.3.3. Private Operators

4.3.4. Space Agencies

4.4. By Technology (In Value %)

4.4.1. Conventional

4.4.2. More Electric Aircraft (MEA)

4.4.3. Hybrid-Electric

4.4.4. Fully Electric

4.5. By Country (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Aerospace Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. The Boeing Company

5.1.2. Lockheed Martin Corporation

5.1.3. Northrop Grumman Corporation

5.1.4. Raytheon Technologies Corporation

5.1.5. General Dynamics Corporation

5.1.6. Bombardier Inc.

5.1.7. Textron Inc.

5.1.8. Honeywell International Inc.

5.1.9. L3Harris Technologies, Inc.

5.1.10. Spirit AeroSystems Holdings, Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, R&D Investment, Product Portfolio, Geographic Presence, Strategic Initiatives, Employee Strength, Market Capitalization)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. North America Aerospace Market Regulatory Framework

6.1. Aviation Safety Regulations

6.2. Environmental Compliance Standards

6.3. Export Control and Trade Compliance

6.4. Certification Processes

6.5. Labor and Employment Laws

7. North America Aerospace Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Aerospace Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Component (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Country (In Value %)

9. North America Aerospace Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Aerospace Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Aerospace Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aerospace manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Aerospace market.

Frequently Asked Questions

01. How big is the North America Aerospace Market?

The North America aerospace market was valued at USD 168 billion, driven by technological advancements and increasing demand for air travel.

02. What are the challenges in the North America Aerospace Market

Challenges in the North America aerospace market include supply chain disruptions, high regulatory compliance costs, and a shortage of skilled labor. The recent disruptions, particularly in sourcing components and raw materials, have added cost pressures, while stringent regulations require significant compliance investments.

03. Who are the major players in the North America Aerospace Market?

Key players in the North America aerospace market include Boeing, Lockheed Martin, Northrop Grumman, Raytheon Technologies, and Bombardier. These companies lead due to their extensive R&D capabilities, diverse product portfolios, and strong foothold in both commercial and defense sectors.

04. What drives the growth of the North America Aerospace Market?

North America aerospace markets growth is propelled by an increase in commercial air travel, expansion of MRO services, and rising defense budgets. Additionally, advancements in sustainable and fuel-efficient aircraft technology are contributing to the market's positive outlook.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.