North America Agricultural Tractors Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6819

December 2024

92

About the Report

North America Agricultural Tractors Market Overview

- The North America Agricultural Tractors market is valued at USD 15.5 billion, with the market dynamics strongly influenced by high mechanization rates across the region. With agriculture becoming increasingly reliant on technology, the demand for tractors has risen due to the need for efficient crop production.

- The United States and Canada dominate the North America Agricultural Tractors market. The United States stands out due to its substantial farmlands and established agribusiness sector, supporting high levels of mechanization. Canadas dominance is driven by extensive farming in regions like Alberta and Ontario, where technologically advanced tractors are critical for grain and cereal crop production.

- Safety standards and certifications are enforced to ensure the safe operation of agricultural tractors. In North America, tractors must comply with OSHA and ANSI standards, which establish safety requirements for roll-over protection and machinery operation. For instance, a study highlighted that agricultural injuries might be underreported by as much as 70%.

North America Agricultural Tractors Market Segmentation

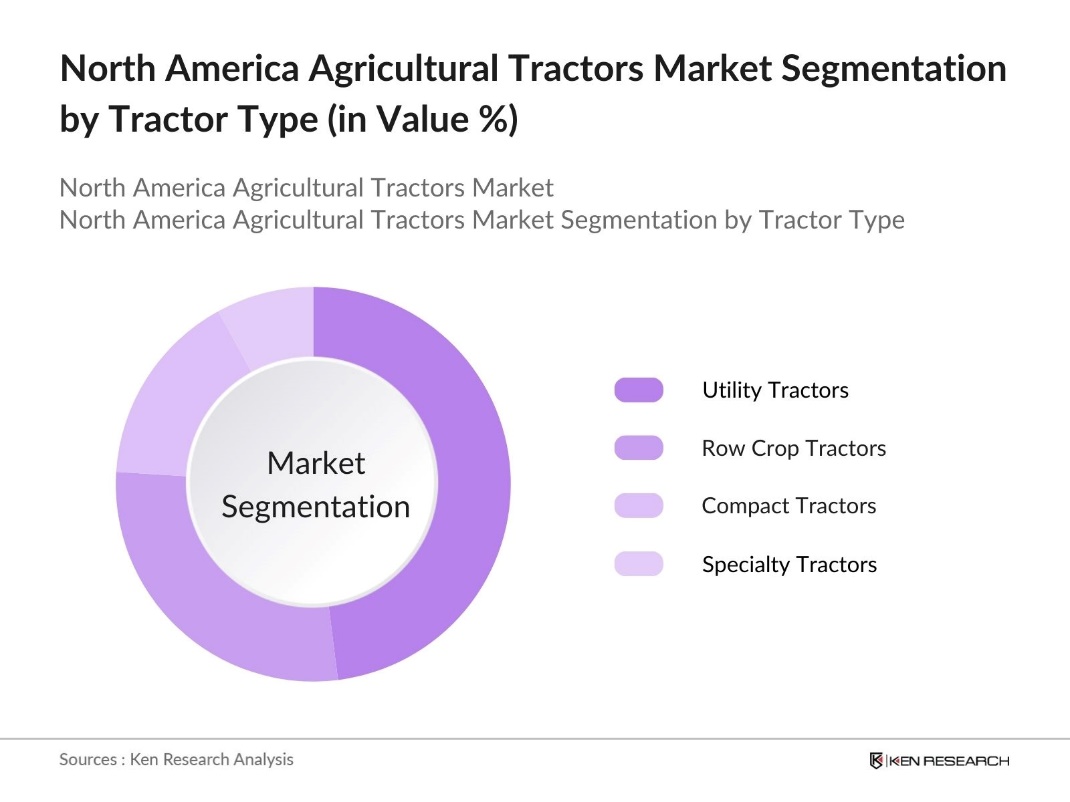

By Tractor Type: The market is segmented by tractor type into utility tractors, row crop tractors, compact tractors, and specialty tractors. Utility tractors hold a dominant position, driven by their versatility across multiple farming tasks such as plowing, harrowing, and hauling. This multifunctional capability makes utility tractors the preferred choice among farmers seeking cost-effective solutions for varied tasks, which has solidified their position within the tractor type segment.

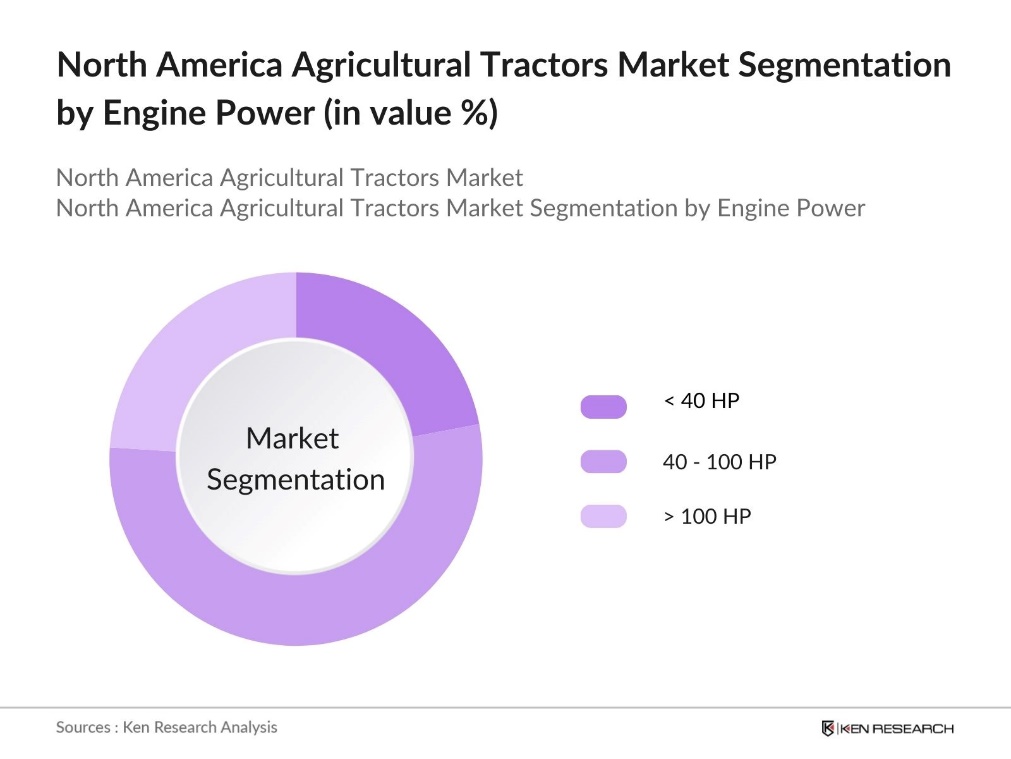

By Engine Power: The market is segmented by engine power, covering tractors with engine capacities of < 40 HP, 40-100 HP, and > 100 HP. Tractors in the 40-100 HP category lead in terms of market share due to their suitability for medium to large-scale farms, where they handle various tasks with efficiency. This segments balance between power and operational cost effectiveness makes it ideal for most farming operations across North America.

North America Agricultural Tractors Market Competitive Landscape

The North America Agricultural Tractors market is characterized by a few dominant players with strong brand loyalty, extensive distribution networks, and significant investments in R&D for tractor technology and smart farming integration. These companies cater to varying farm sizes and types, offering a broad range of tractors that address both traditional and precision agriculture needs.

North America Agricultural Tractors Industry Analysis

Growth Drivers

- Demand for Precision Agriculture: The demand for precision agriculture is a major growth driver in the North America Agricultural Tractors Market. A study by the Association of Equipment Manufacturers (AEM) indicated a 4% increase in crop production associated with these technologies, with potential for additional gains through broader adoption. The USDA highlights that precision farming adoption rates have accelerated due to reduced input costs and increased crop productivity. Precision agriculture equipment continues to grow in use due to its efficiency in conserving water, fertilizers, and pesticides, aligning with sustainable farming practices.

- Shift Towards Sustainable Farming Practices: Sustainable farming is increasingly important to North American farmers, driving the adoption of eco-friendly tractors that minimize environmental impact. by 2024, the adoption rate of electric farm equipment in the U.S. is expected to be around7%for compact track loaders and other electric vehicles. This shift aligns with policy support for environmentally friendly farming practices, such as Californias incentives for adopting electric and hybrid agricultural machinery.

- Government Subsidies for Mechanization: Government subsidies are essential in promoting mechanization across North American agriculture, significantly impacting tractor adoption. U.S. initiatives like the Farm Bill and Canadas Agricultural Clean Technology Program offer grants that ease the financial burden for farmers adopting advanced, eco-friendly tractors. These programs facilitate the shift to modernized, high-tech machinery, supporting enhanced productivity and efficiency in farming operations by making advanced technology more accessible.

Market Challenges

- High Cost of Advanced Tractors: The high cost of advanced tractors presents a significant challenge for small and mid-sized farms. Technologically equipped tractors with GPS, AI, and precision farming tools are often financially prohibitive for smaller operations, where economies of scale are less impactful. Although alternative financing or leasing options are available, affordability remains a substantial barrier, particularly for smaller farms, limiting widespread adoption of advanced agricultural machinery.

- Regulatory Compliance and Emission Standards: Strict regulatory compliance on emission standards creates additional challenges for the agricultural tractor market. Requirements like the U.S. EPAs Tier 4 standards mandate emissions reductions, prompting costly modifications in tractor design and technology. Similarly, Canadian regulations enforce emission standards that affect tractor production and operational costs. While these standards promote environmental sustainability, they introduce financial and logistical burdens for both manufacturers and farmers.

North America Agricultural Tractors Market Future Outlook

The North America Agricultural Tractors market is set to experience continued growth, fueled by advancements in agricultural mechanization, increased adoption of smart farming practices, and ongoing innovations in tractor technology. These factors are expected to drive the demand for tractors that enhance productivity, reduce labor dependence, and support sustainable farming practices.

Market Opportunities

- Electrification of Tractors: The electrification of tractors offers a promising opportunity to lower operational costs and emissions, supporting sustainable farming objectives. Both Canada and the U.S. are encouraging electric tractor adoption through environmental policies and subsidies to reduce high initial costs. Electric tractors are gaining traction across North American farms, aligning with eco-friendly goals and signaling potential growth for cleaner, more efficient farming practices.

- Expansion in Precision Agriculture Tools: The expansion of precision agriculture tools is transforming the tractor market, encouraging the use of GPS and IoT-integrated equipment. Precision tools enable enhanced productivity and data-driven approaches on farms, allowing for resource optimization and improved yields. This growth creates opportunities for manufacturers to equip tractors with sensors, drones, and real-time monitoring capabilities, aligning technology with sustainable farming practices.

Scope of the Report

|

By Tractor Type |

Utility Tractors Row Crop Tractors Compact Tractors |

|

By Engine Power |

< 40 HP 40 - 100 HP > 100 HP |

|

By Drive Type |

2-Wheel Drive 4-Wheel Drive |

|

By Application |

Crop Farming Livestock Farming Horticulture |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Agricultural Machinery Manufacturers

Agricultural Insurance Companies

Soil and Crop Health Monitoring Firm

Agricultural Transport and Logistics Companies

Agricultural Equipment Financing Firms

Government and Regulatory Bodies (USDA, Canadian Ministry of Agriculture)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Deere & Company

CNH Industrial N.V.

AGCO Corporation

Kubota Corporation

Mahindra & Mahindra Ltd.

CLAAS Group

Yanmar Holdings Co. Ltd.

Fendt (AGCO Brand)

New Holland Agriculture

Versatile (Buhler Industries)

Table of Contents

1. North America Agricultural Tractors Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Development Framework

1.4 Key Agricultural Regions

2. North America Agricultural Tractors Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Market Development Milestones

2.3 Regional Analysis of Market Size

3. North America Agricultural Tractors Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Precision Agriculture

3.1.2 Government Subsidies for Mechanization

3.1.3 Shift Towards Sustainable Farming Practices

3.2 Market Challenges

3.2.1 High Cost of Advanced Tractors

3.2.2 Regulatory Compliance and Emission Standards

3.2.3 Maintenance and Skill Requirements

3.3 Opportunities

3.3.1 Electrification of Tractors

3.3.2 Expansion in Precision Agriculture Tools

3.3.3 Growth in Autonomous Tractors Segment

3.4 Trends

3.4.1 Integration with IoT and AI Technologies

3.4.2 Adoption of Lightweight Tractors for Smaller Farms

3.4.3 Increasing Investment in R&D for Tractor Innovation

3.5 Regulatory Environment

3.5.1 Emission Standards for Agricultural Machinery

3.5.2 Safety Standards and Certifications

3.5.3 Government Support Programs

3.6 Competitive Landscape Analysis

3.7 Market Ecosystem

3.8 Porters Five Forces Analysis

4. North America Agricultural Tractors Market Segmentation

4.1 By Tractor Type (In Value %)

4.1.1 Utility Tractors

4.1.2 Row Crop Tractors

4.1.3 Compact Tractors

4.2 By Engine Power (In Value %)

4.2.1 < 40 HP

4.2.2 40 - 100 HP

4.2.3 > 100 HP

4.3 By Drive Type (In Value %)

4.3.1 2-Wheel Drive

4.3.2 4-Wheel Drive

4.4 By Application (In Value %)

4.4.1 Crop Farming

4.4.2 Livestock Farming

4.4.3 Horticulture

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Agricultural Tractors Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Deere & Company

5.1.2 CNH Industrial N.V.

5.1.3 AGCO Corporation

5.1.4 Kubota Corporation

5.1.5 Mahindra & Mahindra Ltd.

5.1.6 CLAAS Group

5.1.7 Yanmar Holdings Co. Ltd.

5.1.8 Fendt (AGCO Brand)

5.1.9 New Holland Agriculture

5.1.10 Versatile (Buhler Industries)

5.1.11 Massey Ferguson

5.1.12 Kioti Tractor (Daedong Industrial)

5.1.13 Valtra Inc.

5.1.14 LS Tractor

5.1.15 Solis (ITL)

5.2 Cross Comparison Parameters (Annual Sales Volume, Market Share, Tractor Portfolio, Innovation Capability, Distribution Network, Brand Perception, After-Sales Service, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Funding and Investment Insights

5.7 Venture Capital and Private Equity Involvement

5.8 Technological Innovation and Patents

6. North America Agricultural Tractors Market Regulatory Framework

6.1 Emission Regulations

6.2 Safety and Compliance Standards

6.3 Certification Requirements

6.4 Government Subsidies and Support Programs

7. Future Market Segmentation

7.1 By Tractor Type (In Value %)

7.2 By Engine Power (In Value %)

7.3 By Drive Type (In Value %)

7.4 By Application (In Value %)

7.5 By Region (In Value %)

8. Market Analyst Recommendations

8.1 Target Addressable Market (TAM) Analysis

8.2 Precision Agriculture Integration Strategy

8.3 Regional Expansion Opportunities

8.4 White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping out the entire ecosystem surrounding the North America Agricultural Tractors market. Primary and secondary sources are utilized to gather relevant industry information, focusing on identifying critical variables that affect the market landscape.

Step 2: Market Analysis and Construction

In this step, historical data related to the North America Agricultural Tractors market is compiled, including market penetration levels and revenue distribution across segments. These datasets serve as the foundation for assessing market structure and service quality metrics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are formed and then validated through consultations with industry experts, conducted via computer-assisted telephone interviews (CATIs). These discussions provide practical insights that enhance the accuracy and reliability of the research.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings from manufacturer interactions, proprietary databases, and bottom-up approaches to produce a validated, comprehensive analysis of the North America Agricultural Tractors market.

Frequently Asked Questions

01 How big is the North America Agricultural Tractors Market?

The North America Agricultural Tractors Market is valued at USD 15.5 billion, driven by technological integration and the expansion of precision farming practices.

02 What are the key challenges in the North America Agricultural Tractors Market?

Key challenges in North America Agricultural Tractors Market include high tractor acquisition costs, emission regulations, and the need for skilled operators to manage advanced equipment.

03 Who are the major players in the North America Agricultural Tractors Market?

Leading companies in North America Agricultural Tractors Market include Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, and Mahindra & Mahindra Ltd.

04 What factors are driving growth in the North America Agricultural Tractors Market?

The North America Agricultural Tractors Market growth is fueled by increased farm mechanization, government incentives, and the adoption of precision agriculture technologies across large-scale farms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.