North America Aircraft Hangar Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4598

November 2024

94

About the Report

North America Aircraft Hangar Market Overview

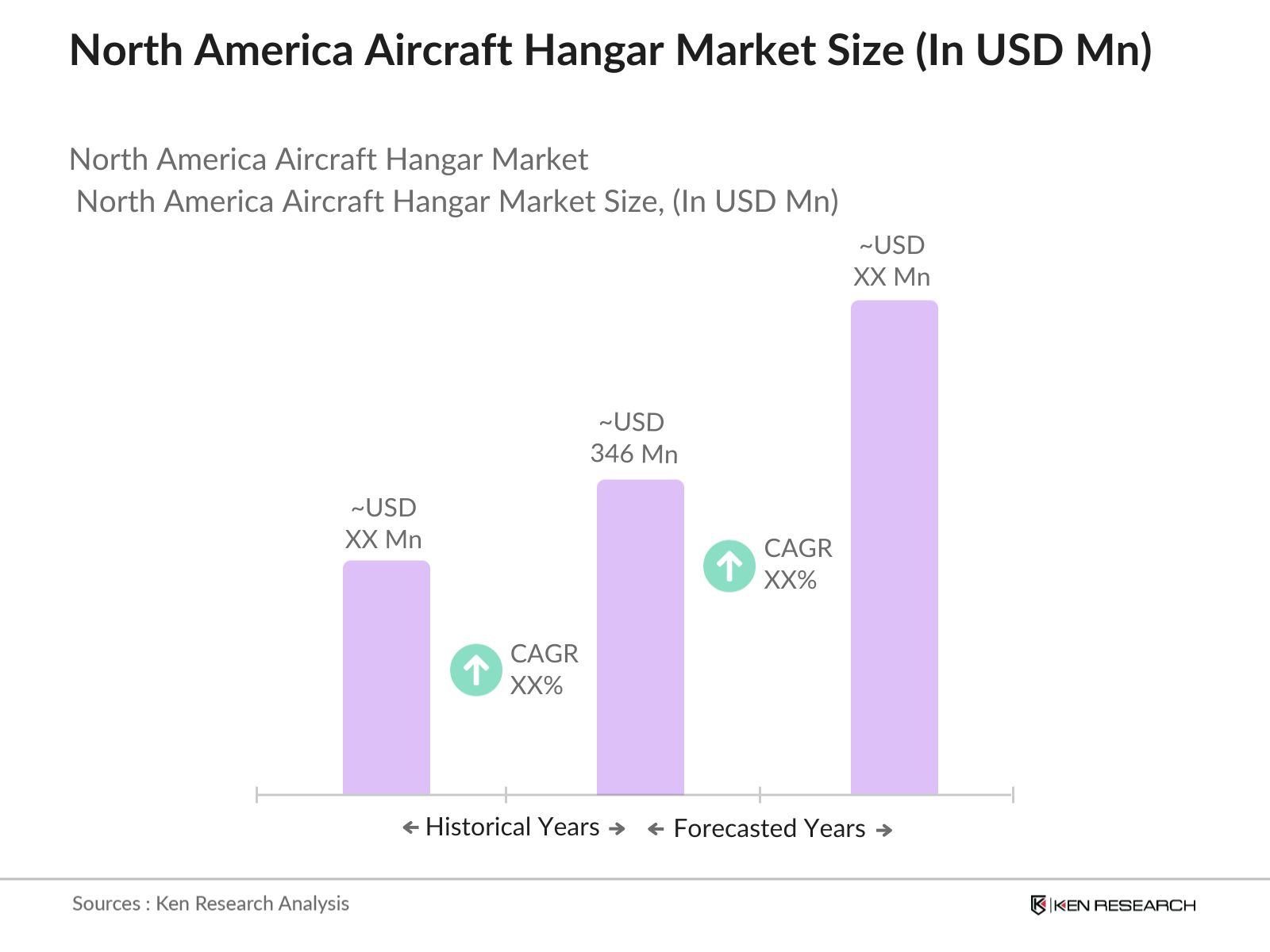

- The North America Aircraft Hangar Market, valued at USD 346 million, is driven by the continuous expansion of aviation infrastructure and the increasing volume of air traffic, both commercial and private. The rising demand for aircraft maintenance, repair, and overhaul (MRO) facilities across the region is a key factor fueling the growth of this market. This surge is primarily due to increased investments from both private sector aviation companies and government defense budgets, which require high-tech, secure, and well-constructed hangars for maintenance purposes. The proliferation of new aircraft models also demands larger, more modern hangar spaces to accommodate the advanced technology requirements.

- In the North American market, cities like Los Angeles, New York, Dallas, and Miami, as well as regions like California and Texas, dominate the market due to the concentration of major airports, aerospace manufacturing hubs, and military bases. These locations house key players and aviation clusters that contribute to the regional markets dominance. Moreover, the substantial presence of defense contractors and private aviation companies in these areas ensures a constant demand for new and upgraded hangar facilities.

- The FAA governs the construction and operation of aircraft hangars in the U.S., setting stringent guidelines that all builders must follow. In 2024, these regulations include specific requirements for fire safety, structural integrity, and operational efficiency. The FAA also enforces guidelines on the proximity of hangars to runways and taxiways to ensure smooth air traffic operations. Builders must ensure compliance with these rules, which adds complexity and costs to the construction process. Adhering to FAA regulations is essential for obtaining the necessary permits to build and operate hangars.

North America Aircraft Hangar Market Segmentation

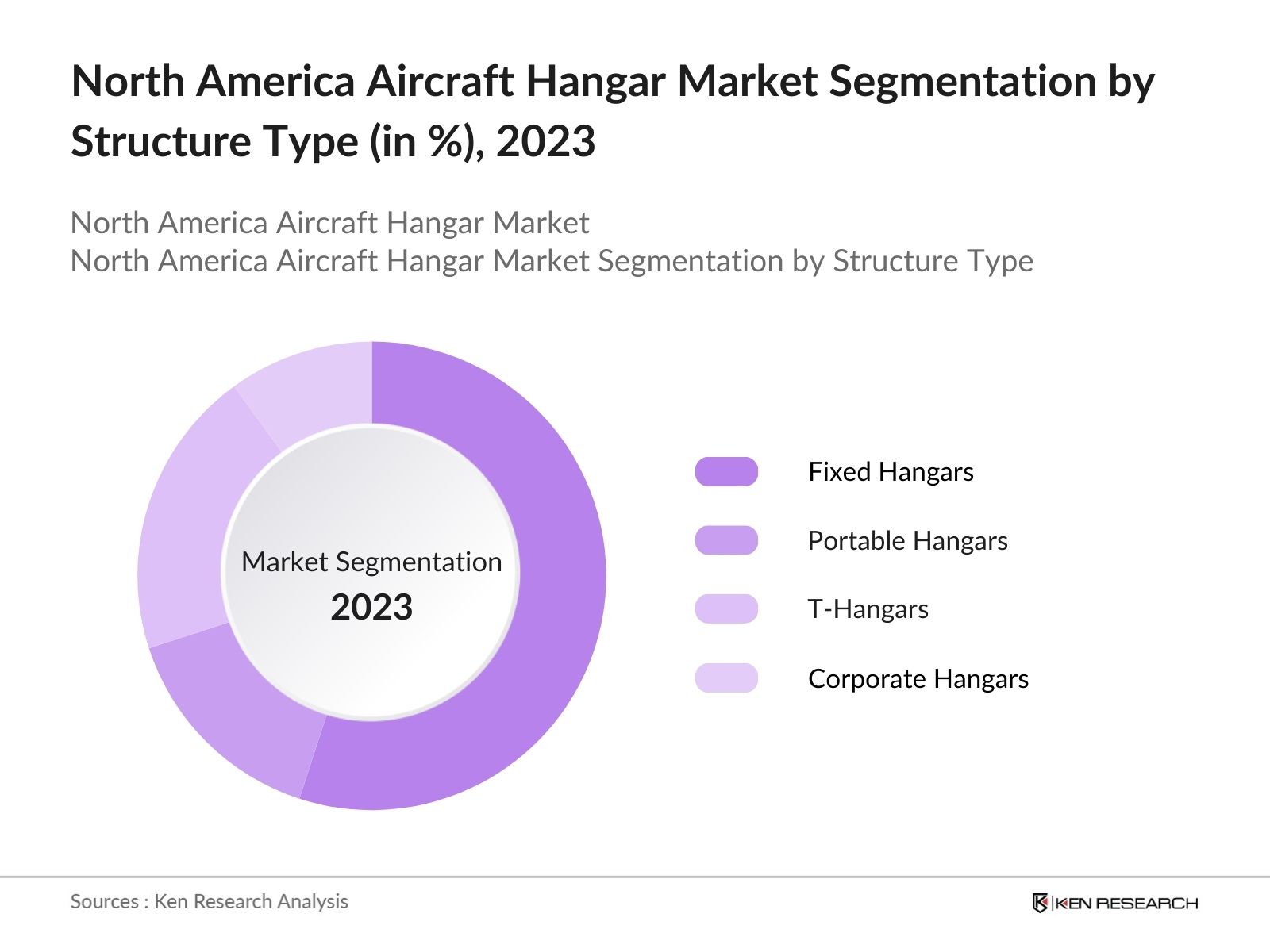

By Structure Type: The Market is segmented by structure type into Fixed Hangars, Portable Hangars, T-Hangars, and Corporate Hangars. Fixed Hangars currently dominate the market, largely due to their long-term utility and ability to support both commercial and military operations. Fixed hangars are often preferred for large airports and military bases, where the need for durable, permanent structures is paramount. Their ability to house wide-body aircraft, advanced storage, and maintenance systems make them indispensable in regions with high air traffic, such as the United States.

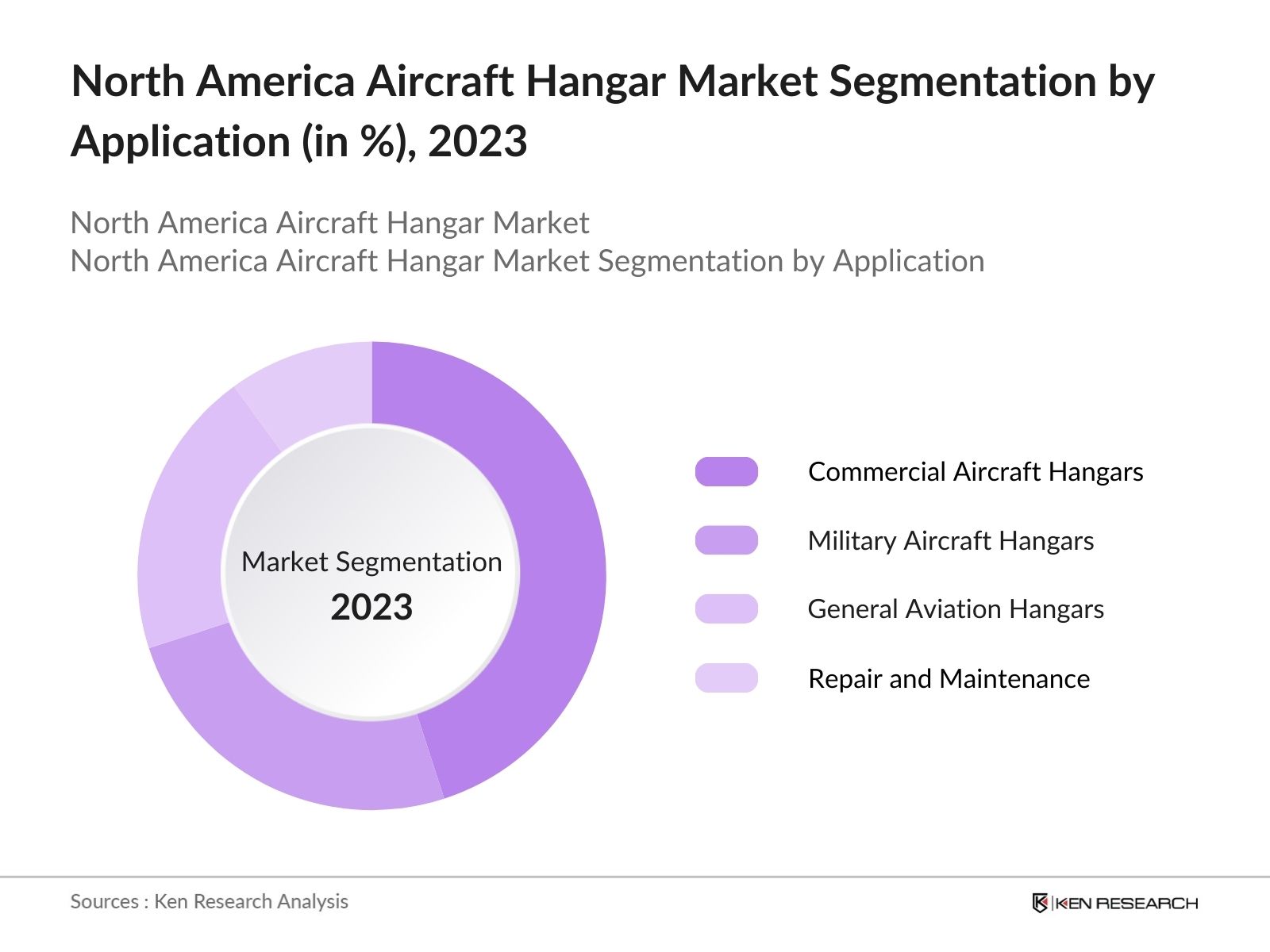

By Application: The market is also segmented by application into Commercial Aircraft Hangars, Military Aircraft Hangars, General Aviation Hangars, and Repair and Maintenance Hangars. Commercial Aircraft Hangars lead the market due to the vast number of commercial airlines operating in North America, including major hubs in cities like Chicago, Atlanta, and Los Angeles. These hangars are critical for housing large commercial fleets and performing essential maintenance operations. The high level of air traffic at major North American airports fuels the demand for such hangars, especially as airlines aim to streamline their operations and reduce turnaround times.

By Application: The market is also segmented by application into Commercial Aircraft Hangars, Military Aircraft Hangars, General Aviation Hangars, and Repair and Maintenance Hangars. Commercial Aircraft Hangars lead the market due to the vast number of commercial airlines operating in North America, including major hubs in cities like Chicago, Atlanta, and Los Angeles. These hangars are critical for housing large commercial fleets and performing essential maintenance operations. The high level of air traffic at major North American airports fuels the demand for such hangars, especially as airlines aim to streamline their operations and reduce turnaround times.

North America Aircraft Hangar Market Competitive Landscape

North America Aircraft Hangar Market Competitive Landscape

The North America Aircraft Hangar Market is dominated by both established aerospace giants and emerging infrastructure firms. Companies are increasingly focusing on innovation, such as modular hangar construction and environmentally sustainable solutions, to gain a competitive edge. The market is consolidated, with a few major players accounting for a portion of the market. These companies benefit from long-term contracts with defense agencies and major airlines, creating a high barrier to entry for new players.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

Key Projects |

Market Presence |

Technological Innovations |

|

Boeing |

1916 |

Chicago, USA |

|||||

|

Airbus |

1970 |

Leiden, NL |

|||||

|

AECOM |

1990 |

Dallas, USA |

|||||

|

REIDsteel |

1919 |

Christchurch, UK |

|||||

|

Sprung Structures |

1887 |

Alberta, Canada |

North America Aircraft Hangar Industry Analysis

Growth Drivers

- Increasing Commercial Air Traffic: North Americas aviation sector continues to grow as commercial air traffic rises sharply. In 2023, the U.S. aviation industry handled 851 million passengers, an increase of over 100 million from 2022, according to the Bureau of Transportation Statistics. This surge in traffic, both in passenger and cargo, is fueling demand for expanded hangar space at major airports, where hangars for commercial airlines are critical to meet maintenance and storage requirements. According to the FAA, the U.S. has more than 19,000 airports, with several undergoing upgrades to accommodate the rising traffic.

- Expansion of Aviation Infrastructure: In 2024, North Americas aviation infrastructure development remains a key factor driving hangar construction. The FAAs Airport Improvement Program (AIP) allocated $3.35 billion in 2023 to enhance airport infrastructure, with much of this investment going toward expanding maintenance facilities and constructing new hangars. Canadas National Trade Corridors Fund has similarly focused on improving its airport infrastructure, committing $3.1 billion for projects in the same year. Such investments are aimed at boosting airport capacity, maintenance facilities, and technical services, thereby driving demand for more hangars.

- Rise in Private Jet Ownership: The rising trend of private jet ownership in North America is boosting demand for hangar space. The U.S. alone registered over 20,000 private jets by the end of 2023. As private jet fleets grow, airport hangar construction is increasing, with many hangars being tailored for smaller private aircraft. Business aviation facilities across major hubs like Teterboro Airport and Van Nuys Airport are seeing increased demand for private jet hangars. This trend is complemented by higher luxury travel demand and greater accessibility to private aviation services.

Market Challenges

- High Initial Investment Costs for Hangar Construction: The high upfront costs of building aircraft hangars remain a major challenge in North America. Hangar construction costs for large aircraft can range from $2 million to $20 million, depending on location and size. These costs include land acquisition, engineering, and construction, along with required approvals from regulatory bodies. The FAA mandates strict compliance with aviation safety codes, adding to both the cost and time required for construction. This high capital expenditure is often a deterrent for smaller aviation players, slowing hangar construction growth.

- Environmental Impact: Sustainability requirements are becoming a growing challenge for hangar construction in North America, as airports face increasing pressure to meet environmental standards. In 2024, green building codes mandate energy-efficient designs, with airports integrating renewable energy sources like solar panels into hangar designs. The shift towards carbon neutrality is pushing builders to adopt eco-friendly materials and technologies, raising costs. Airport operators are also required to adhere to strict guidelines on waste management and emissions, making hangar construction more expensive and technically challenging.

North America Aircraft Hangar Market Future Outlook

Over the next five years, the North America Aircraft Hangar Market is expected to witness considerable growth, driven by continuous advancements in aviation technology, increased government and defense spending, and the rising need for modernized MRO facilities. The demand for eco-friendly and energy-efficient hangars is also expected to shape the market, as aviation companies look to reduce their carbon footprint. The markets growth will likely be fueled by public-private partnerships aimed at enhancing airport infrastructure, as well as by the expansion of military bases across the U.S. and Canada.

Future Market Opportunities

- Green Building Certification for Hangars: Green building certifications present an opportunity for North American hangar developers to align with sustainability goals. As of 2024, hangars that incorporate energy-efficient designs, such as solar panels, can earn LEED (Leadership in Energy and Environmental Design) certification, which adds long-term value to the property. U.S. airports like Chicago OHare and San Francisco International are investing in green hangar solutions to reduce their carbon footprints. Green certifications are expected to become more valuable as airport operators seek to comply with stringent environmental regulations, boosting hangar construction that meets these standards.

- Partnerships with Defense Contractors for Military Hangars: Military hangar construction is another area of growth opportunity. In 2023, the U.S. government signed contracts with major defense contractors like Lockheed Martin and Boeing for building military hangars to accommodate advanced aircraft, including F-35 fighter jets. Such partnerships not only ensure state-of-the-art hangar construction but also enhance national defense capabilities. The Canadian military is also working with domestic contractors to expand its hangar capacity for new aircraft, driven by a $32 billion defense budget allocation.

Scope of the Report

|

By Structure Type |

Fixed Hangars Portable Hangars T-Hangars Corporate Hangars |

|

By Application |

Commercial Aircraft Military Aircraft General Aviation Repair and Maintenance |

|

By Material Type |

Steel Aluminum Fabric |

|

By Ownership |

Private Public Defense |

|

By Region |

U.S. Canada Mexico |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FAA, Transport Canada)

Airport Infrastructure Developers

Aircraft Manufacturers

Banks and Financial Institutes

Defense Contractors

Airline Operators

Private Jet Owners and Operators

Maintenance, Repair, and Overhaul (MRO) Providers

Companies

Major Players

Boeing

Airbus

AECOM

REIDsteel

Sprung Structures

Legacy Building Solutions

Aluvision

Butler Manufacturing

Morton Buildings

SteelMaster Buildings

Big Top Manufacturing

Worldwide Steel Buildings

Fulfab

Rubb Buildings

ClearSpan Fabric Structures

Table of Contents

1. North America Aircraft Hangar Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Aircraft Hangar Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Aircraft Hangar Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Commercial Air Traffic (Passenger and Cargo)

3.1.2. Expansion of Aviation Infrastructure (Airports and Maintenance Facilities)

3.1.3. Government Defense and Aerospace Investments

3.1.4. Rise in Private Jet Ownership

3.2. Market Challenges

3.2.1. High Initial Investment Costs for Hangar Construction

3.2.2. Regulatory Hurdles (FAA Regulations)

3.2.3. Environmental Impact (Sustainability and Energy Efficiency Requirements)

3.3. Opportunities

3.3.1. Green Building Certification for Hangars

3.3.2. Emergence of Modular and Pre-Fabricated Hangar Solutions

3.3.3. Partnerships with Defense Contractors for Military Hangars

3.4. Trends

3.4.1. Integration of Smart Technologies (IoT Sensors, Automated Hangar Doors)

3.4.2. Sustainable Hangar Designs (Solar Panels, LEED Certification)

3.4.3. Increased Adoption of Large-Span Hangars for Wide-Body Aircraft

3.5. Government Regulation

3.5.1. Federal Aviation Administration (FAA) Guidelines

3.5.2. Green Building Codes for Airport Hangars

3.5.3. Safety Standards (Fireproofing, Structural Integrity)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. North America Aircraft Hangar Market Segmentation

4.1. By Structure Type (In Value %)

4.1.1. Fixed Hangars

4.1.2. Portable Hangars

4.1.3. T-Hangars

4.1.4. Corporate Hangars

4.2. By Application (In Value %)

4.2.1. Commercial Aircraft Hangars

4.2.2. Military Aircraft Hangars

4.2.3. General Aviation Hangars

4.2.4. Repair and Maintenance Hangars

4.3. By Material Type (In Value %)

4.3.1. Steel

4.3.2. Aluminum

4.3.3. Fabric

4.4. By Ownership (In Value %)

4.4.1. Private

4.4.2. Public

4.4.3. Defense

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Aircraft Hangar Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Boeing

5.1.2. Airbus

5.1.3. AECOM

5.1.4. REIDsteel

5.1.5. Aluvision

5.1.6. Rubb Buildings

5.1.7. Sprung Structures

5.1.8. Legacy Building Solutions

5.1.9. SteelMaster Buildings

5.1.10. Big Top Manufacturing

5.1.11. Fulfab

5.1.12. Worldwide Steel Buildings

5.1.13. Butler Manufacturing

5.1.14. Morton Buildings

5.1.15. ClearSpan Fabric Structures

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Hangar Capacity, Geographical Presence, Key Clients, Technological Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Aircraft Hangar Market Regulatory Framework

6.1. Environmental Standards (Sustainability, LEED Certification)

6.2. Compliance Requirements (FAA, OSHA)

6.3. Certification Processes (ISO 9001, ISO 14001)

7. North America Aircraft Hangar Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Air Traffic Growth, Defense Investments, Technological Advancements)

8. North America Aircraft Hangar Future Market Segmentation

8.1. By Structure Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By Ownership (In Value %)

8.5. By Region (In Value %)

9. North America Aircraft Hangar Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the aircraft hangar markets ecosystem to understand the influence of key stakeholders. Secondary sources such as government databases, industry reports, and proprietary databases are leveraged to identify the critical variables driving the market.

Step 2: Market Analysis and Construction

Historical data analysis of hangar infrastructure investments and air traffic volumes is undertaken to assess growth patterns. Additional metrics, such as the penetration of MRO services and military expansion programs, are evaluated to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Key industry players are consulted via telephone interviews to validate market hypotheses. Feedback from aerospace contractors, defense agencies, and airport authorities helps refine and corroborate market projections.

Step 4: Research Synthesis and Final Output

Insights from aircraft manufacturers, government agencies, and airport operators are integrated to provide a comprehensive and validated assessment of the North America Aircraft Hangar Market. This final output is further refined through a bottom-up approach to ensure accuracy.

Frequently Asked Questions

01. How big is the North America Aircraft Hangar Market?

The North America Aircraft Hangar Market is valued at USD 346 million, driven by increasing investments in aviation infrastructure and the growing demand for MRO facilities.

02. What are the challenges in the North America Aircraft Hangar Market?

Key challenges in the North America Aircraft Hangar Market include high initial construction costs, stringent government regulations, and the need for environmentally sustainable solutions, which increase both the complexity and cost of hangar projects.

03. Who are the major players in the North America Aircraft Hangar Market?

Leading companies in the North America Aircraft Hangar Market include Boeing, Airbus, AECOM, REIDsteel, and Sprung Structures, all of which have extensive market presence and expertise in large-scale aircraft hangar projects.

04. What are the growth drivers of the North America Aircraft Hangar Market?

The North America Aircraft Hangar Market is primarily driven by the expansion of aviation infrastructure, rising demand for MRO services, increased defense spending, and a growing private jet ownership base in North America.

05. What trends are shaping the North America Aircraft Hangar Market?

Key trends in the North America Aircraft Hangar Market include the rise of eco-friendly hangar construction, the integration of smart technologies, and modular construction methods, all aimed at reducing costs and enhancing operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.