North America Aircraft Turn Coordinator Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5944

December 2024

89

About the Report

North America Aircraft Turn Coordinator Market Overview

- The North America Aircraft Turn Coordinator Market, valued at USD 0.70 billion, is driven by continuous advancements in avionics technology and increasing demand for reliable safety instruments across all aircraft categories. The integration of next-generation navigation systems in both commercial and general aviation sectors further fuels the demand for precision flight instruments, including turn coordinators. The rise of unmanned aerial vehicles (UAVs) also contributes to the market's growth, particularly in the United States.

- The United States remains the dominant market for aircraft turn coordinators due to its vast aircraft fleet and strong presence of major aerospace manufacturers and aviation operators. Leading cities such as Seattle, home to Boeing, and Los Angeles, with its significant military and commercial aviation activities, lead in the adoption of advanced avionics systems. Furthermore, the Canadian aerospace sector, centered in cities like Montreal, contributes to the regional market dominance with its robust production capacity and technology innovations.

- The Federal Aviation Administration (FAA) has introduced mandates requiring that all general aviation and commercial aircraft be equipped with upgraded avionics systems by 2025, including turn coordinators that meet stringent safety standards. In 2022 alone, over 10,000 aircraft were required to retrofit new safety systems in the U.S., with a focus on improving flight safety and compliance. These mandates have accelerated the adoption of advanced avionics technologies across the North American aviation industry .

North America Aircraft Turn Coordinator Market Segmentation

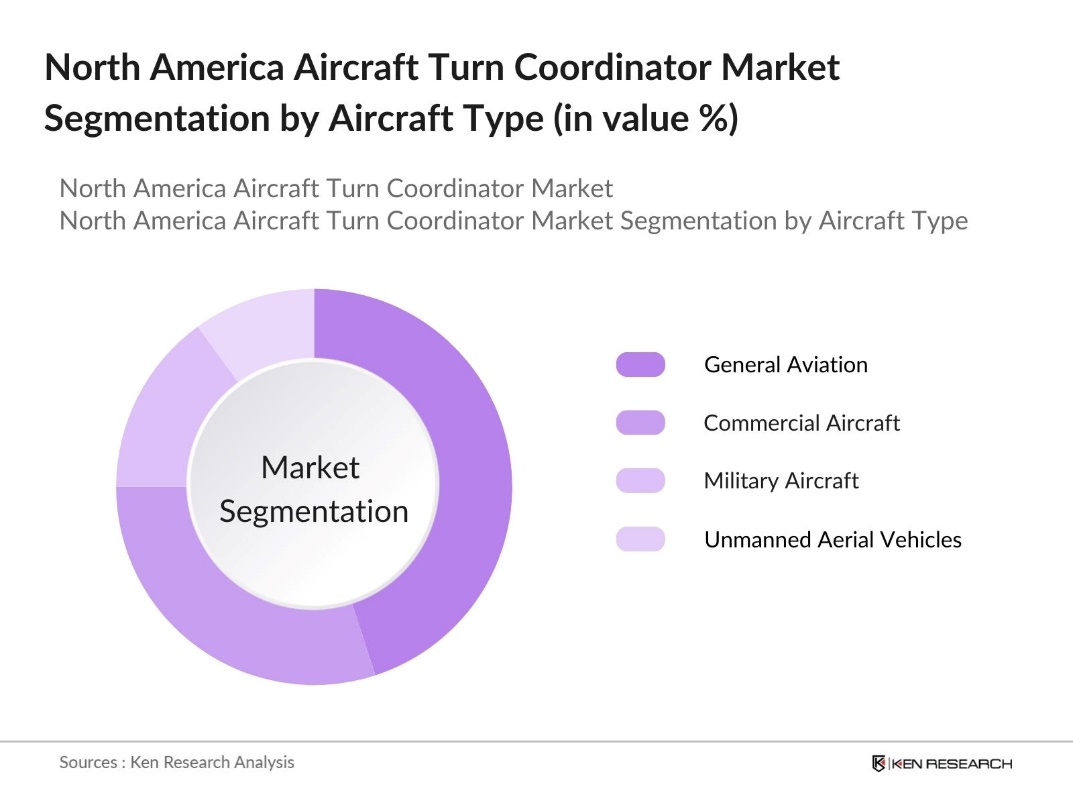

By Aircraft Type: The North America Aircraft Turn Coordinator Market is segmented by aircraft type into General Aviation, Commercial Aircraft, Military Aircraft, and Unmanned Aerial Vehicles (UAVs). General aviation aircraft have a dominant market share under this segmentation due to the large fleet size in North America, particularly in the United States. General aviation, which encompasses private planes, charter services, and recreational aircraft, accounts for a significant demand for turn coordinators because of the mandatory installation of avionics safety systems in smaller aircraft.

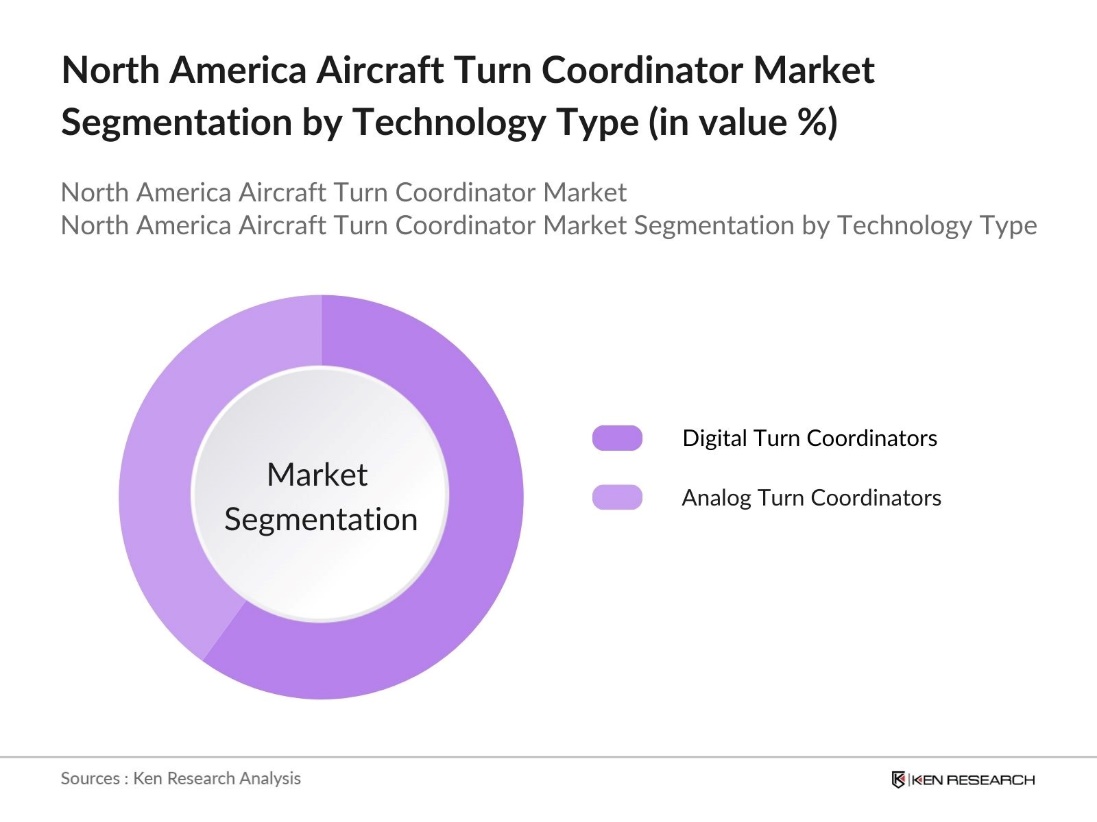

By Technology: The North America Aircraft Turn Coordinator Market is also segmented by technology into Analog Turn Coordinators and Digital Turn Coordinators. Digital turn coordinators dominate the market share due to the increasing trend of cockpit digitalization and enhanced reliability compared to analog systems. Aircraft operators, especially in the commercial and military segments, are investing heavily in digital avionics suites to improve operational efficiency and comply with regulatory requirements.

North America Aircraft Turn Coordinator Market Competitive Landscape

The North America Aircraft Turn Coordinator Market is characterized by a competitive landscape where several key players hold significant positions. The market is largely dominated by major avionics manufacturers such as Honeywell and Garmin. These companies have a strong foothold due to their robust product portfolios, long-standing client relationships, and continuous innovation in avionics technologies.

|

Company Name |

Establishment Year |

Headquarters |

Key Product Line |

R&D Investment (USD Mn) |

Employees |

Market Revenue (USD Mn) |

Technology Patents |

Geographic Reach |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

||||||

|

Garmin Ltd. |

1989 |

Olathe, USA |

||||||

|

Collins Aerospace |

2018 (merged) |

Charlotte, USA |

||||||

|

L3Harris Technologies |

1890 |

Melbourne, USA |

||||||

|

Dynon Avionics |

2000 |

Woodinville, USA |

North America Aircraft Turn Coordinator Industry Analysis

Growth Drivers

- Increasing Adoption of General Aviation Aircraft: The North America Aircraft Turn Coordinator market is driven by a significant rise in the adoption of general aviation aircraft. The FAA forecasts that the active GA fleet will increase by approximately 3.5% between 2023 and 2043. This fleet expansion is directly correlated with the demand for avionics systems like turn coordinators, which are crucial for ensuring the safe operation of these aircraft.

- Advancements in Avionics Systems: The ongoing advancements in avionics systems, focused on safety and regulatory compliance, are driving growth in the turn coordinator market. As part of the FAA's extensive NextGen modernization program, which has seen over $14 billion invested through fiscal year 2022, upgrades to air traffic control and avionics systems highlight the importance of components like turn coordinators in enhancing flight safety across general aviation and commercial sectors.

- Growing Commercial Aviation Sector: The growing commercial aviation sector in North America is driving demand for aircraft turn coordinators. With a significant increase in commercial flights and a continuously expanding fleet of aircraft, avionics systems like turn coordinators play a crucial role in ensuring safety and compliance with aviation regulations. The increasing number of regional and large commercial aircraft further strengthens the need for reliable avionics, which are essential for maintaining operational efficiency.

Market Challenges

- High Cost of Aircraft Avionics Components: The high cost of avionics components poses a significant challenge for the aircraft turn coordinator market. Upgrading and maintaining these systems can be financially burdensome, especially for smaller operators in the general aviation sector. This financial strain limits the widespread adoption of advanced avionics like turn coordinators, slowing overall market growth and affecting both commercial and defense aviation sectors.

- Stringent Certification Processes (FAA and EASA Standards): Stringent certification processes from regulatory bodies like the FAA and EASA slow down the adoption of new avionics technologies, including turn coordinators. These rigorous standards ensure safety but can lead to long delays in market entry, restricting the rapid implementation of advanced systems. The extended certification timeline limits the pace of innovation and market expansion in the aviation industry.

North America Aircraft Turn Coordinator Market Future Outlook

Over the next few years, the North America Aircraft Turn Coordinator Market is expected to see continued growth due to rising investments in advanced avionics, increasing demand for unmanned aerial systems, and the push for the modernization of existing aircraft fleets. The market will benefit from new aircraft production as well as retrofit programs for aging aircraft, particularly in the general aviation sector.

Market Opportunities

- Emerging Demand from UAV and Drone Manufacturers: The expanding UAV and drone market in North America is creating increased demand for avionics systems, including turn coordinators. These systems are essential for ensuring navigation and safety in larger commercial drones, which are becoming more prevalent in sectors like agriculture, logistics, and defense. As drones play an increasingly critical role across various industries, the need for reliable avionics components presents a notable growth opportunity for the turn coordinator market.

- Technological Collaborations in Avionics Development: Collaborations between avionics manufacturers and aircraft Original Equipment Manufacturers (OEMs) are driving innovation in the turn coordinator market. These partnerships are focused on developing more efficient and reliable avionics systems, improving safety, and reducing component weight. By fostering technological advancements, these collaborations offer significant opportunities for expanding the turn coordinator market as new, integrated systems meet the evolving needs of modern aviation.

Scope of the Report

|

By Aircraft Type |

General Aviation Commercial Aircraft Military Aircraft UAVs and Drones |

|

By Technology |

Analog Turn Coordinators Digital Turn Coordinators |

|

By Sales Channel |

OEM Aftermarket |

|

By End-User |

Civil Aviation Military Aviation UAV Operators |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Aircraft Restoration Companies

Aircraft Leasing Companies

Business Jet Manufacturers

Government and Regulatory Bodies (Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA))

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Honeywell International Inc.

Garmin Ltd.

Collins Aerospace (Raytheon Technologies)

Dynon Avionics

BendixKing (Honeywell)

Aerosonic Corporation

Mid-Continent Instruments and Avionics

SigmaTek

L3Harris Technologies, Inc.

Aspen Avionics

Table of Contents

1. North America Aircraft Turn Coordinator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Incorporating Aircraft Fleet Expansion, Navigation System Advancements)

1.4. Market Segmentation Overview

2. North America Aircraft Turn Coordinator Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Technological Integrations, Fleet Upgrades)

3. North America Aircraft Turn Coordinator Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of General Aviation Aircraft

3.1.2. Advancements in Avionics Systems (Emphasis on Safety and Compliance Standards)

3.1.3. Growing Commercial Aviation Sector

3.1.4. Regulatory Requirements for Aircraft Safety

3.2. Market Challenges

3.2.1. High Cost of Aircraft Avionics Components

3.2.2. Stringent Certification Processes (FAA and EASA Standards)

3.2.3. Limited Availability of Skilled Technicians

3.3. Opportunities

3.3.1. Emerging Demand from UAV and Drone Manufacturers

3.3.2. Technological Collaborations in Avionics Development

3.3.3. Expansion into Electric and Hybrid Aircraft Segments

3.4. Trends

3.4.1. Shift Towards Digital Cockpit Systems

3.4.2. Integration with Autonomous Navigation Systems

3.4.3. Increased Focus on Lightweight Components for Fuel Efficiency

3.5. Government Regulation

3.5.1. FAA Mandates on Avionics Safety Standards

3.5.2. EASA Compliance for Turn Coordinator Systems

3.5.3. Trade and Import Regulations Impacting Component Availability

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Focusing on Supplier Power and New Entrants in Avionics Manufacturing)

3.9. Competition Ecosystem (Including OEMs and Aftermarket Providers)

4. North America Aircraft Turn Coordinator Market Segmentation

4.1. By Aircraft Type (In Value %)

4.1.1. General Aviation

4.1.2. Commercial Aircraft

4.1.3. Military Aircraft

4.1.4. UAVs and Drones

4.2. By Technology (In Value %)

4.2.1. Analog Turn Coordinators

4.2.2. Digital Turn Coordinators

4.3. By Sales Channel (In Value %)

4.3.1. OEM

4.3.2. Aftermarket

4.4. By End-User (In Value %)

4.4.1. Civil Aviation

4.4.2. Military Aviation

4.4.3. UAV Operators

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Aircraft Turn Coordinator Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (Competitors Analysis)

5.1.1. Honeywell International Inc.

5.1.2. Garmin Ltd.

5.1.3. Collins Aerospace (Raytheon Technologies)

5.1.4. L3Harris Technologies, Inc.

5.1.5. Dynon Avionics

5.1.6. BendixKing

5.1.7. Mid-Continent Instruments and Avionics

5.1.8. Aerosonic Corporation

5.1.9. SigmaTek

5.1.10. Genesys Aerosystems

5.1.11. Aspen Avionics

5.1.12. Sandia Aerospace

5.1.13. TruTrak Flight Systems

5.1.14. Avidyne Corporation

5.1.15. Precise Flight Inc.

5.2 Cross Comparison Parameters (Product Portfolio, Turn Coordinator Types, Production Capacity, Avionics Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Partnerships, and Acquisitions)

5.5. Investment Analysis (R&D Investment in Avionics Systems)

5.6. Venture Capital Funding (For Start-ups in Avionics Innovation)

5.7. Government Grants and Support for Aircraft Component Manufacturers

6. North America Aircraft Turn Coordinator Market Regulatory Framework

6.1. FAA Certification Requirements for Turn Coordinators

6.2. EASA Compliance Guidelines

6.3. Environmental and Sustainability Standards

7. North America Aircraft Turn Coordinator Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Aircraft Turn Coordinator Future Market Segmentation

8.1. By Aircraft Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Aircraft Turn Coordinator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Focusing on Aftermarket Expansion)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping the ecosystem of stakeholders in the North America Aircraft Turn Coordinator Market, utilizing both primary and secondary sources. Extensive desk research was conducted through governmental aviation agencies and proprietary databases to identify the most critical variables, such as avionics demand trends, regulatory requirements, and technological advancements.

Step 2: Market Analysis and Construction

Historical data from the past five years was analyzed, including the penetration of turn coordinators across different aircraft categories. The revenue generation of key market players was also assessed, and sales patterns of turn coordinator systems were analyzed to understand their adoption rates across general aviation, commercial airlines, and UAV manufacturers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through direct interviews with industry experts from major avionics manufacturing companies and airlines. These consultations provided insights into the operational and financial dynamics of the turn coordinator market, including key drivers of growth and potential challenges.

Step 4: Research Synthesis and Final Output

The final stage involved engaging with multiple aircraft manufacturers to gain direct feedback on product preferences, regulatory influences, and emerging trends in turn coordinator systems. The collected data was synthesized and cross-verified to deliver a comprehensive report on the North America Aircraft Turn Coordinator Market.

Frequently Asked Questions

01. How big is the North America Aircraft Turn Coordinator Market?

The North America Aircraft Turn Coordinator Market was valued at USD 0.70 billion. The market is driven by advancements in avionics technology and increasing demand from general and commercial aviation sectors, as well as the UAV market.

02. What are the key challenges in the North America Aircraft Turn Coordinator Market?

The key challenges in the North America Aircraft Turn Coordinator Market include high costs of avionics components, stringent certification requirements from aviation authorities like the FAA, and the shortage of skilled technicians required for system installations and maintenance.

03. Who are the major players in the North America Aircraft Turn Coordinator Market?

Key players in the North America Aircraft Turn Coordinator Market include Honeywell International, Garmin Ltd., Collins Aerospace, Dynon Avionics, and BendixKing, which dominate the market due to their extensive product offerings and strong relationships with aircraft manufacturers and airlines.

04. What are the growth drivers in the North America Aircraft Turn Coordinator Market?

Growth drivers in North America Aircraft Turn Coordinator Market include the increasing production of general and commercial aviation aircraft, rising demand for UAV systems, and advancements in digital avionics that improve aircraft safety and operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.