North America Algorithmic Trading Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD11026

November 2024

97

About the Report

North America Algorithmic Trading Market Overview

- The North America Algorithmic Trading Market is valued at USD 939 billion. This valuation is driven by the demand for precision trading solutions enabled by algorithms, the vast data accessibility across financial markets, and the advancements in real-time analytics. The integration of AI in algorithmic trading has particularly enhanced performance and risk management, meeting the needs of institutional investors.

- Key financial centers such as New York, Chicago, and San Francisco lead the market due to their established stock exchanges, regulatory frameworks, and concentration of institutional trading firms. The market dominance in these cities is supported by high-frequency trading demand and proximity to key technology infrastructure, including low-latency networks essential for algorithmic execution.

- In December 2022, the SEC proposed significant reforms aimed at improving market structure, enhancing transparency, and ensuring fair trading practices. These include rules on best execution, order competition, and increased disclosure requirements. SEC reforms promote competitive neutrality across trading venues, ensuring equal opportunities and addressing concerns of market fragmentation. These regulatory guidelines support a stable trading environment.

North America Algorithmic Trading Market Segmentation

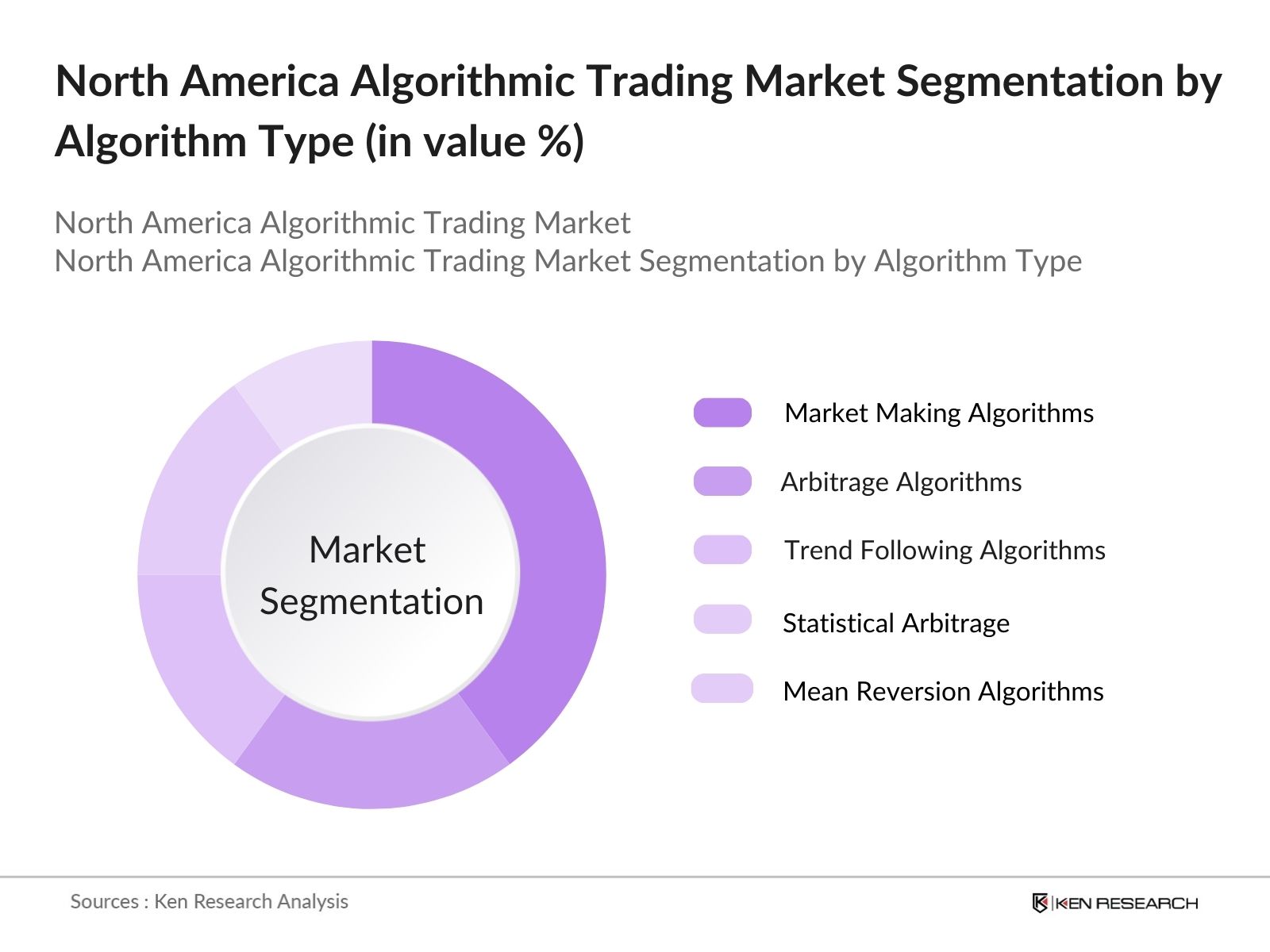

By Algorithm Type: The market is segmented by algorithm type into Market Making Algorithms, Arbitrage Algorithms, Trend Following Algorithms, Statistical Arbitrage, and Mean Reversion Algorithms. The Market Making Algorithms hold a dominant position in North America, driven by their capacity to provide liquidity and optimize trading costs. Institutional firms favor these algorithms for their efficiency in large-volume trades, which are frequent on exchanges in New York and Chicago. The ability to quickly adjust to market demands further strengthens this segment.

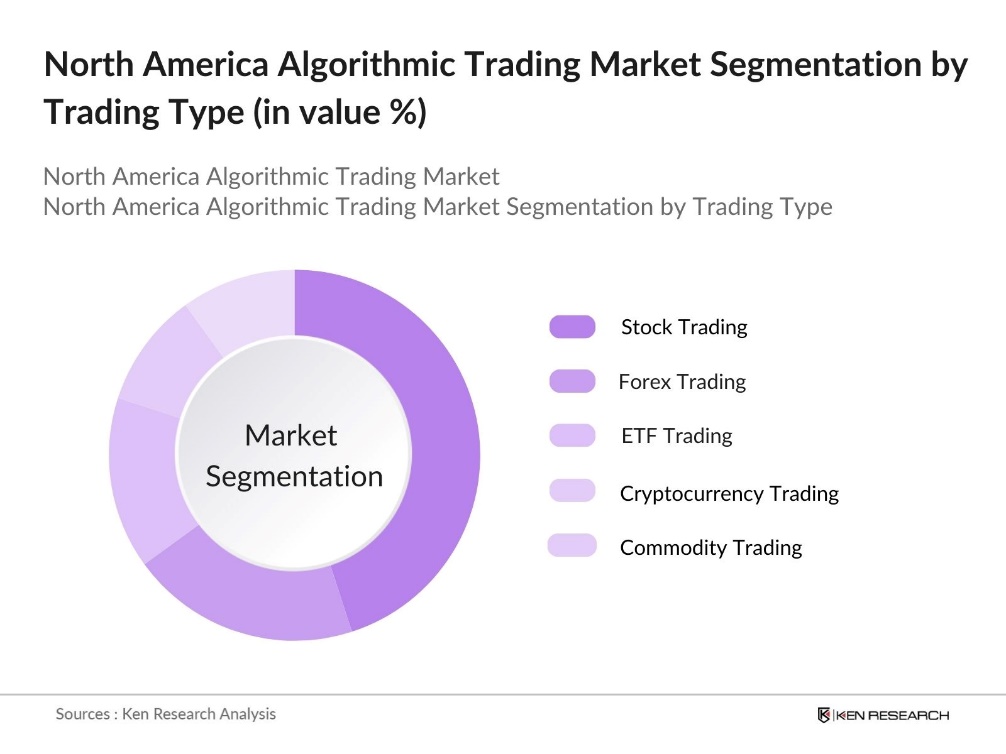

By Trading Type: The market is segmented by trading type into Stock Trading, Forex Trading, ETF Trading, Cryptocurrency Trading, and Commodity Trading. The Stock Trading dominates this segment as it offers high liquidity, attracting algorithmic trading firms that prioritize high-frequency, high-volume trades. The stock markets in New York and Chicago are hubs for this segment, providing robust infrastructure and regulatory support for seamless algorithmic execution in equity markets.

North America Algorithmic Trading Market Competitive Landscape

The North America Algorithmic Trading Market is dominated by major players who leverage advanced technology and robust financial analytics. Firms like Citadel LLC, Virtu Financial, and Jane Street have significant market influence due to their extensive networks and technological investment.

North America Algorithmic Trading Industry Analysis

Growth Drivers

- Institutional Adoption of AI-Based Trading (Institutional Adoption): The adoption of AI-driven algorithms by North American institutional investors has notably increased, with the financial sector. This adoption aims to automate and improve trading decisions, responding to an increase in market data volumes and the demand for precision in high-stakes trading environments. In 2022, around 45% of institutional trades utilized AI-enhanced algorithms, leveraging the ability to analyze large datasets at high speeds. The Federal Reserve has acknowledged AIs role in trading, focusing on its impact on market efficiency and volatility.

- Real-Time Market Surveillance (Surveillance Needs): Increased investment in real-time market surveillance, has enabled more secure algorithmic trading. Enhanced surveillance systems in major exchanges, such as the New York Stock Exchange, allow instant monitoring of algorithmic activities, deterring fraudulent trading practices and maintaining market integrity. For instance, in 2023, BingX, a global cryptocurrency exchange platform, advanced its trading ecosystem by partnering with ALGOGENE, an algo-trading platform, to enhance customers' trading experience.

- High Frequency Trading (Trading Speed and Frequency): High-Frequency Trading (HFT) facilitates rapid transactions, capitalizing on minor price changes within milliseconds to increase market efficiency. HFT is vital in handling large trade volumes, aligning with demands for swift and precise transactions. Regulatory bodies like the SEC oversee HFT to ensure transparency and mitigate risks, implementing guidelines that aim to stabilize market volatility and maintain liquidity across trading environments.

Market Challenges

- Market Fragmentation (Fragmentation Issues): Market fragmentation in North America presents operational complexities for algorithmic traders, as they navigate multiple trading venues. This dispersed structure impacts latency-sensitive trades and requires seamless algorithm performance across platforms. Fragmentation also introduces regulatory challenges, with agencies like the SEC highlighting inefficiencies and reduced investor confidence. Guidelines have been issued to harmonize operations across exchanges, aiming to streamline trade execution and improve market coherence.

- Regulatory Restrictions (Compliance Constraints): Strict regulatory requirements, including those from the Dodd-Frank Act, shape algorithmic trading by demanding detailed transaction records and risk management measures. These compliance mandates focus on maintaining fair practices and transparency, as overseen by the Federal Reserve and SEC. Both bodies enforce regulations to reduce manipulation risks, setting high compliance standards to ensure robust and transparent market operations.

North America Algorithmic Trading Market Future Outlook

The North America Algorithmic Trading Market is anticipated to experience sustained growth, bolstered by advancements in AI technology, cloud computing integration, and increased regulatory clarity. The expanding demand for automated trading strategies across asset classes highlights the trend toward algorithmic optimization for improved risk-adjusted returns.

Market Opportunities

- Algorithm Innovation (Innovative Algorithms): Algorithmic trading innovation is advancing rapidly, with AI and machine learning developments enhancing trading strategies. These sophisticated algorithms enable more precise trading and advanced risk management, allowing financial entities to respond to market shifts with greater accuracy. This focus on innovation addresses market volatility and adapts trading models to complex data environments, significantly enhancing the reliability and efficiency of algorithmic trading.

- Cross-Border Trading Expansion (Geographical Expansion): Cross-border algorithmic trading is increasingly popular, driven by partnerships between North American and European exchanges. Such collaborations enable algorithmic traders to access diverse markets, optimizing opportunities on a global scale. Regulatory bodies like the SEC advocate for standardized rules across borders to ensure consistency, supporting the seamless integration of international markets and bolstering growth within North America's algorithmic trading ecosystem.

Scope of the Report

|

By Algorithm Type |

Market Making Algorithms |

|

By Trading Type |

Stock Trading |

|

By Deployment Type |

On-Premises Deployment |

|

By Service Type |

Managed Services |

|

By End-User |

Hedge Funds |

Products

Key Target Audience

Algorithmic Trading Firms

Asset Management Firms

Regulatory Technology (RegTech) Firms

Cybersecurity Firms

Government and Regulatory Bodies (SEC, Federal Reserve)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Citadel LLC

Virtu Financial Inc.

Renaissance Technologies LLC

Jump Trading LLC

DRW Holdings LLC

Hudson River Trading LLC

Two Sigma Investments LP

Quantlab Financial LLC

IMC Financial Markets

Flow Traders

Table of Contents

1. North America Algorithmic Trading Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Algorithmic Trading Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Algorithmic Trading Market Analysis

3.1 Growth Drivers

3.1.1 Institutional Adoption of AI-Based Trading (Institutional Adoption)

3.1.2 Expanding Data Availability (Data Expansion)

3.1.3 Real-Time Market Surveillance (Surveillance Needs)

3.1.4 High Frequency Trading (Trading Speed and Frequency)

3.2 Market Challenges

3.2.1 Market Fragmentation (Fragmentation Issues)

3.2.2 Regulatory Restrictions (Compliance Constraints)

3.2.3 Cybersecurity Threats (Cybersecurity Risks)

3.2.4 High Operational Costs (Cost Structures)

3.3 Opportunities

3.3.1 Algorithm Innovation (Innovative Algorithms)

3.3.2 Cross-Border Trading Expansion (Geographical Expansion)

3.3.3 Rising Demand for Customized Solutions (Customization Needs)

3.4 Trends

3.4.1 Quantum Computing in Trading (Quantum Technology)

3.4.2 Integration with Blockchain (Blockchain Integration)

3.4.3 Increasing Use of Cloud Computing (Cloud Infrastructure)

3.4.4 Growth of ESG-Aligned Algorithms (Sustainable Trading)

3.5 Regulatory Framework

3.5.1 Dodd-Frank Act Compliance (Compliance Requirements)

3.5.2 Federal Reserve Regulations (Regulatory Standards)

3.5.3 SEC Market Structure Reforms (Market Structure Regulations)

3.5.4 AI and Algorithmic Governance Policies (AI Governance)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. North America Algorithmic Trading Market Segmentation

4.1 By Algorithm Type (in Value %)

4.1.1 Market Making Algorithms

4.1.2 Arbitrage Algorithms

4.1.3 Trend Following Algorithms

4.1.4 Statistical Arbitrage

4.1.5 Mean Reversion Algorithms

4.2 By Trading Type (in Value %)

4.2.1 Stock Trading

4.2.2 Forex Trading

4.2.3 ETF Trading

4.2.4 Cryptocurrency Trading

4.2.5 Commodity Trading

4.3 By Deployment Type (in Value %)

4.3.1 On-Premises Deployment

4.3.2 Cloud-Based Deployment

4.3.3 Hybrid Deployment

4.4 By Service Type (in Value %)

4.4.1 Managed Services

4.4.2 Professional Services

4.4.3 Maintenance and Support

4.5 By End-User (in Value %)

4.5.1 Hedge Funds

4.5.2 Banks and Financial Institutions

4.5.3 Institutional Traders

4.5.4 Individual Traders

4.5.5 Asset Management Firms

5. North America Algorithmic Trading Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Citadel LLC

5.1.2 Virtu Financial Inc.

5.1.3 Renaissance Technologies LLC

5.1.4 Jump Trading LLC

5.1.5 DRW Holdings LLC

5.1.6 Hudson River Trading LLC

5.1.7 Two Sigma Investments LP

5.1.8 Quantlab Financial LLC

5.1.9 IMC Financial Markets

5.1.10 Flow Traders

5.1.11 XTX Markets

5.1.12 Optiver

5.1.13 Tower Research Capital LLC

5.1.14 KCG Holdings Inc.

5.1.15 Jane Street Capital

5.2 Cross Comparison Parameters (Revenue, Headquarters, Algorithm Types, Market Cap, Geographic Reach, Cybersecurity, Innovation Index, Trade Volume)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. North America Algorithmic Trading Market Regulatory Framework

6.1 Compliance Requirements

6.2 Trading Standards

6.3 Algorithm Approval Processes

6.4 Certification Processes

7. North America Algorithmic Trading Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Algorithmic Trading Future Market Segmentation

8.1 By Algorithm Type (in Value %)

8.2 By Trading Type (in Value %)

8.3 By Deployment Type (in Value %)

8.4 By Service Type (in Value %)

8.5 By End-User (in Value %)

9. North America Algorithmic Trading Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with defining the major drivers, including economic indicators, technology adoption rates, and regulatory factors that influence the North American Algorithmic Trading Market. Secondary sources such as government databases and proprietary platforms are used to gather initial data.

Step 2: Market Analysis and Construction

Historical data on algorithmic trading volume, transaction frequency, and market participant data are compiled to assess past performance. A thorough review of each trading type and its performance metrics provides a grounded understanding of market shifts and algorithmic strategies.

Step 3: Hypothesis Validation and Expert Consultation

Our team conducts consultations with industry experts and senior algorithmic trading professionals to validate research findings. Feedback from institutional traders offers insights into operational trends and technology adoption, which is crucial for market forecasting.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing insights from both qualitative and quantitative research phases. Data from algorithmic trading firms and institutional traders is used to refine the analysis, ensuring accurate and validated information for a comprehensive market report.

Frequently Asked Questions

01 How big is the North America Algorithmic Trading Market?

The North America Algorithmic Trading Market is valued at USD 939 billion, with growth driven by the demand for real-time trading solutions, AI integration, and efficient market access.

02 What are the main challenges in the North America Algorithmic Trading Market?

Challenges in North America Algorithmic Trading Market include regulatory hurdles, cybersecurity threats, and high costs associated with maintaining advanced algorithmic infrastructure.

03 Who are the major players in the North America Algorithmic Trading Market?

Key players in North America Algorithmic Trading Market include Citadel LLC, Virtu Financial Inc., Renaissance Technologies LLC, and Hudson River Trading LLC, who dominate due to their technological capabilities and market reach.

04 What are the growth drivers for the North America Algorithmic Trading Market?

Key drivers in North America Algorithmic Trading Market include the integration of AI for enhanced trading strategies, increased data availability, and the development of low-latency networks essential for high-frequency trading.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.