North America Alloy Wheels Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD8675

December 2024

99

About the Report

North America Alloy Wheels Market Overview

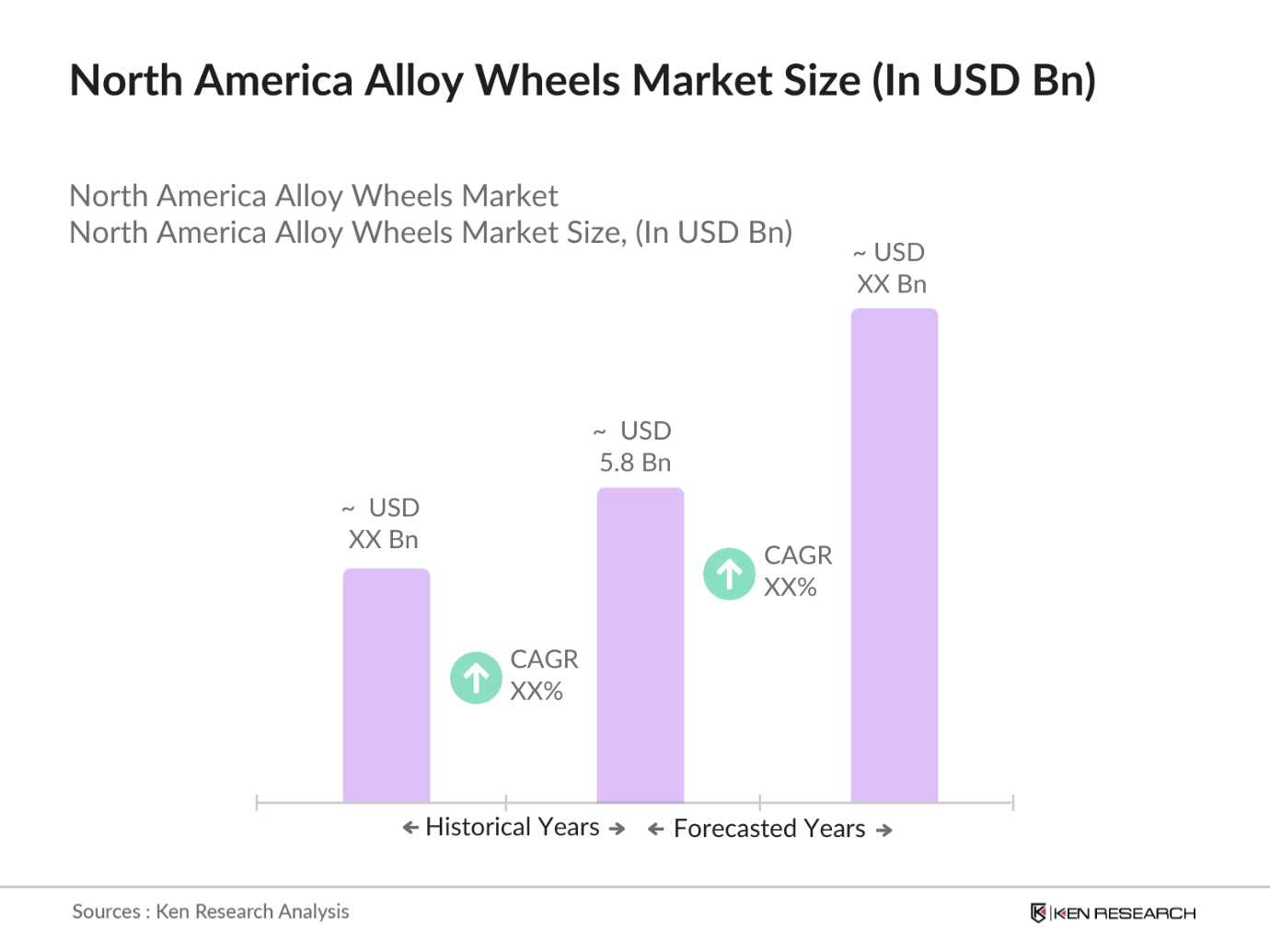

- The North America Alloy Wheels Market is valued at USD 5.8 billion based on a five-year historical analysis, driven by increasing demand from the automotive industry, where alloy wheels are increasingly preferred due to their lighter weight and aesthetic appeal. The trend toward vehicle customization and the demand for high-performance wheels, especially in luxury and sports cars, are strong market drivers. This growth trajectory is further reinforced by advancements in alloy wheel technology, which enhance fuel efficiency and vehicle performance.

- Within North America, the United States holds a dominant position in the alloy wheels market, attributed to the presence of major automotive manufacturing facilities and a large consumer base with a high disposable income. This economic environment supports demand for premium vehicle components, including alloy wheels. Additionally, California, Texas, and Florida stand out due to high vehicle registration rates and the popularity of car customization cultures, further solidifying the U.S. as a market leader.

- Government regulations, particularly emissions standards, play a crucial role in shaping the alloy wheels market. The U.S. government has set ambitious targets to reduce greenhouse gas emissions from vehicles, necessitating innovations in manufacturing and design. The EPA's recent updates on emission standards require manufacturers to adopt lightweight materials to meet fuel efficiency targets, influencing the adoption of alloy wheels as a preferred option. Compliance with these regulations can drive investment in new technologies and materials.

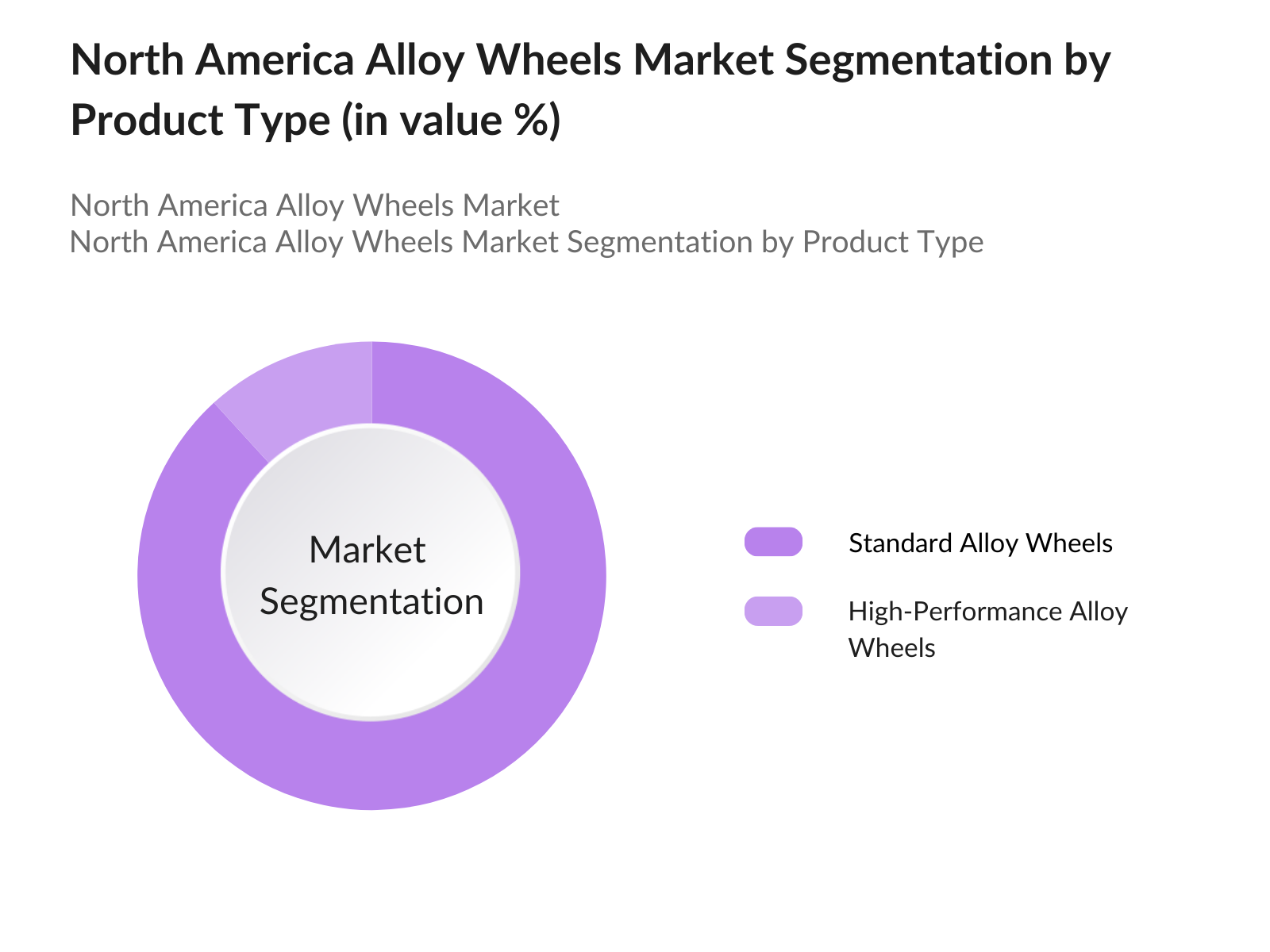

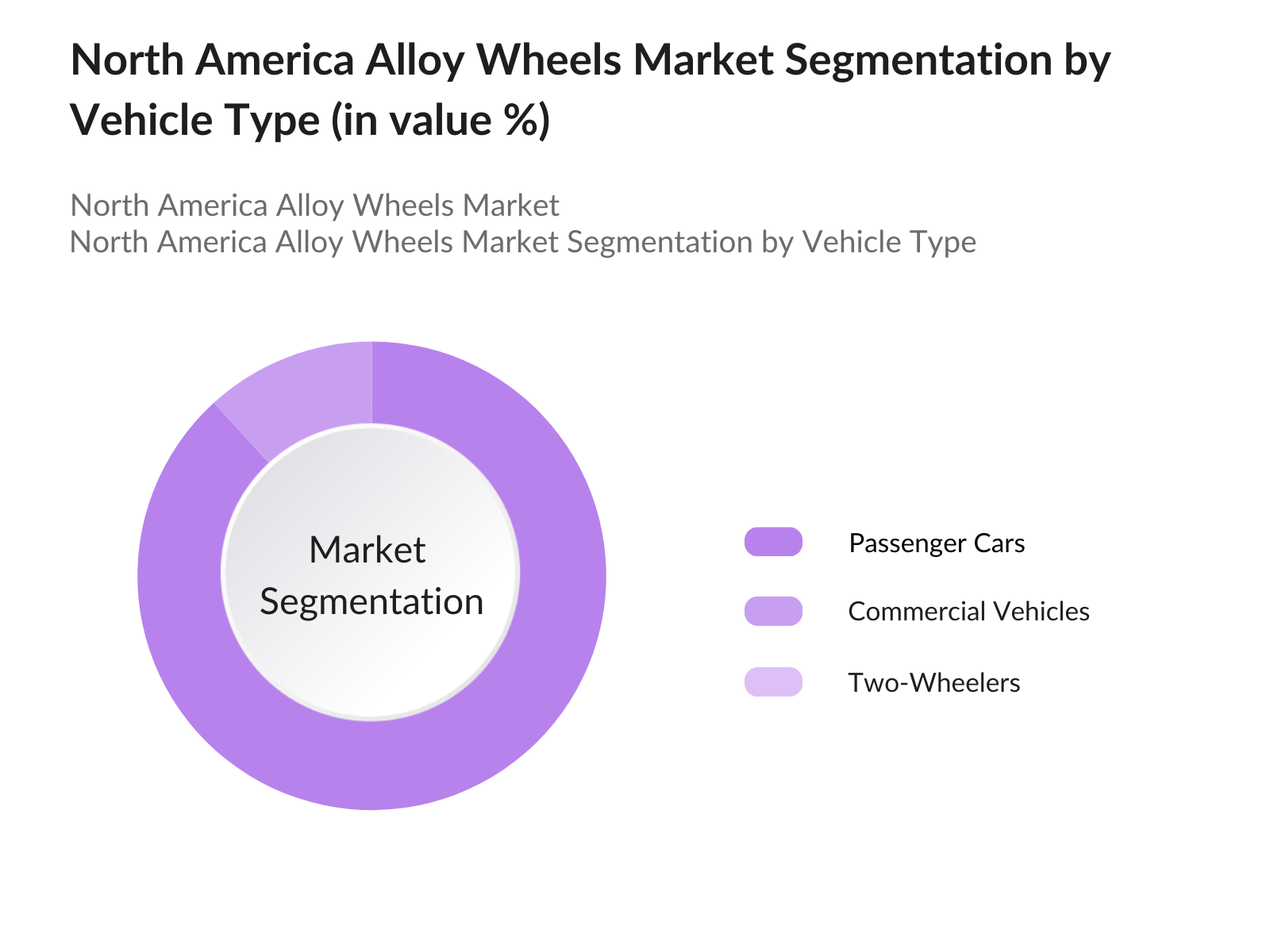

North America Alloy Wheels Market Segmentation

By Product Type: The North America Alloy Wheels Market is segmented by product type into standard alloy wheels and high-performance alloy wheels. High-performance alloy wheels dominate due to their increasing adoption in sports and luxury vehicles, as they provide a balance of strength, weight reduction, and thermal conductivity. This segments demand is fueled by automotive enthusiasts who seek improved handling and braking performance in vehicles.

By Vehicle Type: The market is segmented by vehicle type into passenger cars, commercial vehicles, and two-wheelers. Alloy wheels in the passenger car segment command a larger market share due to the significant sales volume of passenger vehicles in North America. As alloy wheels enhance both the performance and appearance of cars, their popularity among car owners, particularly for customization, further drives this segments dominance.

North America Alloy Wheels Market Competitive Landscape

The North America Alloy Wheels Market is dominated by a few key players that shape the industrys competitive landscape. This consolidation reflects the impact of these players technological advancements, product variety, and distribution networks.

North America Alloy Wheels Market Analysis

Growth Drivers

- Increasing Vehicle Production: The North American automotive industry is witnessing significant growth, with over 17 million light vehicles produced annually. This growth is driven by consumer demand for vehicles, pushing manufacturers to increase output. According to the National Automobile Dealers Association (NADA), light vehicle sales are projected to remain robust, contributing to the rising demand for alloy wheels. With increased vehicle production comes the heightened need for lightweight and high-performance alloy wheels, leading to a competitive market environment.

- Consumer Preference for Lightweight Materials: As consumers become more environmentally conscious, there is a shift towards lightweight automotive components to enhance fuel efficiency. Lightweight alloy wheels play a crucial role in reducing vehicle weight, thereby improving fuel economy. Data from the U.S. Department of Transportation indicates that reducing vehicle weight by 10% can enhance fuel efficiency by up to 7%. This trend is significantly influencing the alloy wheels market, as manufacturers focus on producing lightweight, durable products to meet consumer demands.

- Rising Fuel Efficiency Standards: Regulatory bodies in North America are enforcing stringent fuel efficiency standards. The Corporate Average Fuel Economy (CAFE) standards mandate that automakers improve the average fuel economy of their fleets. The U.S. Environmental Protection Agency (EPA) estimates that the 2025 target is 54.5 miles per gallon (mpg), which is driving automakers to adopt lightweight materials like alloy wheels to meet these requirements. This regulatory push is a significant driver for the alloy wheels market, as manufacturers innovate to comply with these standards.

Market Challenges

- Fluctuating Raw Material Prices: The alloy wheels market faces challenges due to the volatility of raw material prices, particularly aluminum and magnesium. Prices for aluminum have fluctuated significantly, affecting production costs. For instance, the London Metal Exchange reported that aluminum prices surged by 20% in 2023 due to supply chain disruptions. This fluctuation poses a challenge for manufacturers to maintain competitive pricing while managing operational costs.

- Competition from Steel Wheels: Despite the advantages of alloy wheels, the market faces stiff competition from steel wheels, which are generally less expensive. Steel wheels are commonly used in lower-end vehicles, and many consumers prioritize cost over performance and aesthetics. Market research shows that approximately 30% of vehicles in North America still utilize steel wheels, challenging the growth of the alloy wheels segment. Manufacturers need to differentiate their products through innovative designs and marketing strategies to capture market share.

North America Alloy Wheels Market Future Outlook

The North America Alloy Wheels Market is expected to experience sustained growth over the next five years, fueled by continuous innovation in alloy materials and increased demand for vehicle customization. Enhanced production techniques and lightweight materials will likely boost the adoption of alloy wheels across different vehicle types, including electric vehicles, as automakers seek improved efficiency and aesthetics. Additionally, the expanding aftermarket sector and the steady replacement demand will contribute significantly to market expansion.

Opportunities

- Expansion of Electric Vehicle Market: The rise of electric vehicles (EVs) presents a significant opportunity for the alloy wheels market. With an estimated 10 million EVs projected to be on U.S. roads by 2025, there is a growing demand for lightweight components that enhance efficiency. Alloy wheels are essential in EV manufacturing due to their lightweight properties, contributing to improved battery performance and range. Manufacturers can leverage this trend by developing specialized alloy wheels tailored for the EV market, positioning themselves advantageously in a rapidly evolving segment.

- Technological Innovations in Alloy Production: Advancements in alloy manufacturing technologies present opportunities for market growth. Innovations such as 3D printing and advanced casting techniques enable manufacturers to produce high-performance, lightweight wheels with intricate designs. As the technology matures, production costs are expected to decrease, enhancing competitiveness. Furthermore, the integration of smart manufacturing practices can improve efficiency and reduce waste, aligning with sustainability trends that are increasingly important to consumers.

Scope of the Report

|

By Product Type |

Cast Alloy Wheels |

|

Forged Alloy Wheels |

|

|

Chrome Alloy Wheels |

|

|

By Vehicle Type |

Passenger Cars |

|

Commercial Vehicles |

|

|

Two-Wheelers |

|

|

By Application |

OEMs |

|

Aftermarket |

|

|

By Region |

North East |

|

Midwest |

|

|

South |

|

|

West |

|

|

By Finish Type |

Painted |

|

Polished |

|

|

Machined |

Products

Key Target Audience

Automotive Manufacturers

Aftermarket Automotive Parts Distributors

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Transportation, National Highway Traffic Safety Administration)

Custom Automotive Workshops

Automotive Enthusiast Groups

Tire and Wheel Retailers

Vehicle Dealerships

Companies

Players mentioned in the report

Superior Industries

Alcoa Wheels

Enkei Wheels

American Racing

OZ Racing

BBS USA

Motegi Racing

SSR Wheels

Fuel Off-Road Wheels

Vision Wheels

Raceline Wheels

Konig Wheels

HRE Performance Wheels

Vossen Wheels

Forgiato Wheels

Table of Contents

01. North America Alloy Wheels Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. North America Alloy Wheels Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. North America Alloy Wheels Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Production

3.1.2. Consumer Preference for Lightweight Materials

3.1.3. Rising Fuel Efficiency Standards

3.1.4. Aesthetic and Performance Enhancements

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Competition from Steel Wheels

3.2.3. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Expansion of Electric Vehicle Market

3.3.2. Technological Innovations in Alloy Production

3.3.3. Growth in Aftermarket Sales

3.4. Trends

3.4.1. Increasing Adoption of Lightweight Alloys

3.4.2. Customization Trends in Automotive Wheels

3.4.3. Focus on Sustainability and Recyclability

3.5. Government Regulations

3.5.1. Emission Standards and Fuel Economy Regulations

3.5.2. Safety Standards for Automotive Components

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. North America Alloy Wheels Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cast Alloy Wheels

4.1.2. Forged Alloy Wheels

4.1.3. Chrome Alloy Wheels

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Two-Wheelers

4.3. By Application (In Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.4. By Region (In Value %)

4.4.1. North East

4.4.2. Midwest

4.4.3. South

4.4.4. West

4.5. By Finish Type (In Value %)

4.5.1. Painted

4.5.2. Polished

4.5.3. Machined

05. North America Alloy Wheels Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Alcoa Corporation

5.1.2. AFS Trinity

5.1.3. Enkei Corporation

5.1.4. Superior Industries International

5.1.5. OZ Racing

5.1.6. Momo Srl

5.1.7. Borbet GmbH

5.1.8. TSW Alloy Wheels

5.1.9. American Racing

5.1.10. HRE Wheels

5.1.11. Wheel Pros

5.1.12. Forgeline Wheels

5.1.13. Rotiform Wheels

5.1.14. Vision Wheel

5.1.15. Motegi Racing

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Offerings, Market Reach, R&D Investment, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. North America Alloy Wheels Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. North America Alloy Wheels Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. North America Alloy Wheels Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By Region (In Value %)

8.5. By Finish Type (In Value %)

09. North America Alloy Wheels Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involves creating an ecosystem map of all major stakeholders in the North America Alloy Wheels Market. We gather information from secondary and proprietary databases to define the variables that affect market trends and dynamics, such as consumer preferences, production costs, and technological advancements.

Step 2: Market Analysis and Construction

Historical data on market trends, penetration, and revenue from the alloy wheels sector are analyzed. Key metrics, such as demand across vehicle types and regional variations, are examined to provide a robust revenue estimate for the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are refined through consultations with industry experts using computer-assisted telephone interviews (CATIs). These insights help verify key trends and provide operational and financial perspectives from within the sector.

Step 4: Research Synthesis and Final Output

Direct interactions with alloy wheel manufacturers enable an in-depth understanding of product segments, customer preferences, and sales trends. This final phase synthesizes the data into a comprehensive and validated analysis of the North America Alloy Wheels Market.

Frequently Asked Questions

01. How big is the North America Alloy Wheels Market?

The North America Alloy Wheels Market is valued at USD 5.8 billion, driven by growth in the automotive sector and increased customization demand among vehicle owners.

02. What are the challenges in the North America Alloy Wheels Market?

Challenges include high competition among manufacturers, fluctuating raw material costs, and regulatory compliance issues, impacting profitability and growth potential.

03. Who are the major players in the North America Alloy Wheels Market?

Major players include Superior Industries, Alcoa Wheels, Enkei Wheels, American Racing, and OZ Racing, known for their diverse offerings and strong brand recognition in the market.

04. What are the growth drivers of the North America Alloy Wheels Market?

The market is driven by technological advancements in alloy production, demand for fuel efficiency, and a strong consumer base inclined toward vehicle customization.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.