North America Ammunition Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD6737

December 2024

100

About the Report

North America Ammunition Market Overview

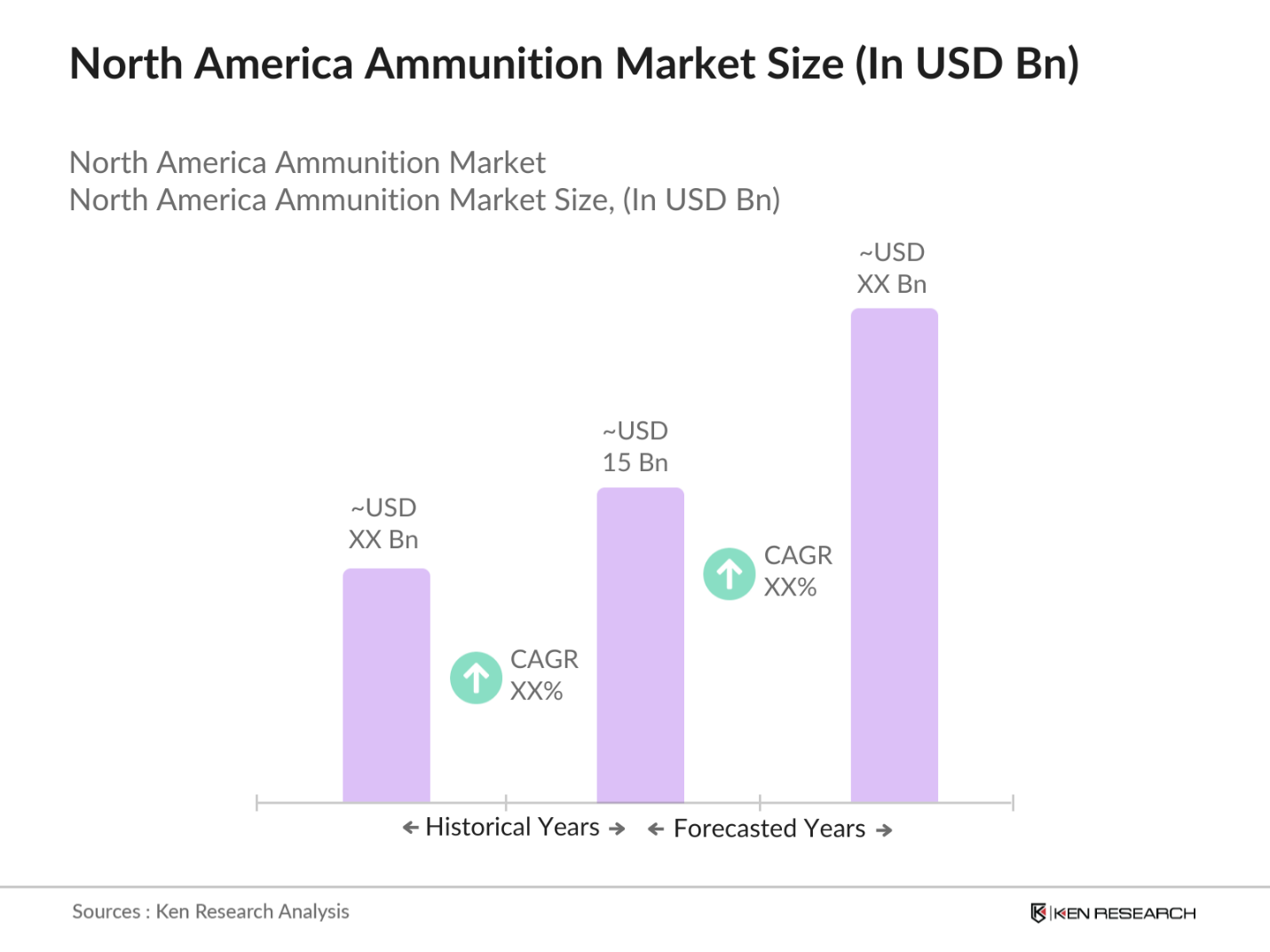

- The North American ammunition market is valued at USD 15 billion, based on a five-year historical analysis. This valuation is driven by increased defense spending, advancements in ammunition technology, and a rise in civilian firearm ownership.

- The United States leads the market due to its substantial military budget and a significant number of civilian firearm owners. Canada and Mexico also contribute, with Canada focusing on defense modernization and Mexico addressing security challenges.

- In the United States, the Firearms and Ammunition Excise Tax (FAET) is levied on the sale of firearms and ammunition by manufacturers, producers, and importers. The tax rates are 10% of the sale price for pistols and revolvers, and 11% for other firearms and ammunition. In fiscal year 2023, FAET collections amounted to approximately $761.6 million, reflecting the robust demand for firearms and ammunition. These funds are allocated to wildlife restoration and conservation programs under the Pittman-Robertson Wildlife Restoration Act, highlighting the tax's role in supporting environmental initiatives.

North America Ammunition Market Segmentation

By Caliber: The market is segmented by caliber into small, medium, large, rockets and missiles, and others. Small caliber ammunition holds a dominant market share due to its widespread use in both military and civilian applications. Its versatility in handguns, rifles, and light machine guns makes it essential for personal defense, law enforcement, and military operations. The high demand for small arms in civilian markets, coupled with military procurement, reinforces the prominence of this segment.

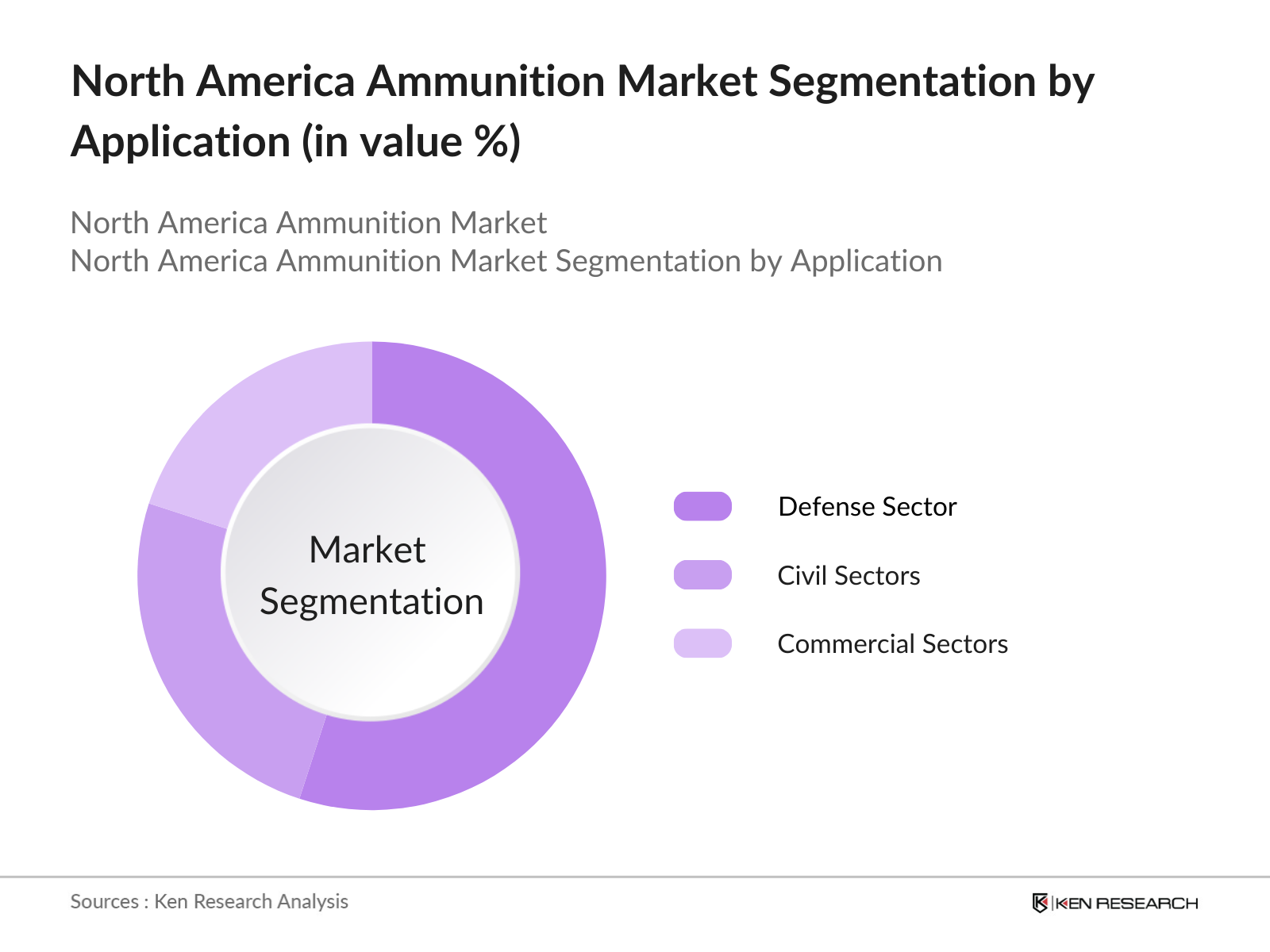

By Application: The market is also segmented by application into defense and civil and commercial sectors. The defense segment dominates the market, driven by ongoing military modernization programs and the need to maintain readiness against emerging threats. Government investments in advanced weaponry and ammunition to equip armed forces contribute significantly to this segment's leading position.

North America Ammunition Market Competitive Landscape

The North American ammunition market is characterized by the presence of several key players, each contributing to the market's dynamics through innovation, strategic partnerships, and extensive distribution networks.

North America Ammunition Industry Analysis

Growth Drivers

- Increased Defense Expenditure: Global military spending reached an unprecedented $2,443 billion in 2023, marking the highest level ever recorded. This surge is attributed to heightened security concerns and ongoing conflicts worldwide. The United States led with $916 billion, followed by China at $296 billion, and Russia at $109 billion. Notably, European NATO members collectively increased their defense budgets, reflecting a shift in threat perceptions. This substantial rise in defense expenditure underscores the escalating demand for advanced weaponry and ammunition.

- Rising Civilian Firearm Ownership: As of 2017, civilians globally owned approximately 857 million firearms, accounting for 85% of the total 1 billion firearms in circulation. The United States had the highest civilian gun ownership rate, with 120.5 firearms per 100 people, totaling about 393 million firearms. This widespread ownership drives consistent demand for ammunition, influencing market dynamics.

- Advancements in Ammunition Technology: The defense sector is experiencing significant growth amidst global conflicts like Russia's war in Ukraine. Military expenditures have increased by 34% over the past five years, leading to new orders for US defense contractors. This growth coincides with the AI revolution, suggesting a need for affordable, numerous, and advanced weapon systems. Lessons from Ukraine emphasize the necessity for adaptable and resilient communication systems that can withstand electronic warfare. The high cost-capability disparity in current warfare calls for innovative and cost-effective solutions.

Market Challenges

- Stringent Regulatory Frameworks: The firearms and ammunition industry operates under complex regulatory frameworks that vary by country. In the United States, the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) enforces regulations on the manufacture, distribution, and sale of firearms and ammunition. Compliance with these regulations requires significant resources and can impact market operations.

- Environmental Concerns: The use of lead in ammunition has raised environmental concerns due to its toxic effects on wildlife and ecosystems. Studies have shown that lead poisoning from spent ammunition poses significant risks to birds and other wildlife. In response, some regions have implemented regulations to reduce or ban the use of lead-based ammunition, prompting manufacturers to develop alternative materials.

North America Ammunition Market Future Outlook

Over the next five years, the North American ammunition market is expected to show significant growth driven by continuous government support, advancements in ammunition technology, and increasing consumer demand for firearms. The integration of smart technologies and the development of non-lethal ammunition are anticipated to open new avenues for market expansion. Additionally, the focus on environmental sustainability is likely to influence manufacturing processes and product offerings.

Future Market Opportunities

- Emerging Markets in Latin America: Latin American countries are experiencing growth in their defense and law enforcement sectors. For example, Brazil's military spending increased by 3.1% to $22.9 billion in 2023. This expansion creates opportunities for ammunition manufacturers to enter and establish a presence in these emerging markets, catering to the increasing demand for firearms and ammunition.

- Integration of Smart Technologies: Advancements in technology have led to the development of smart ammunition equipped with features like precision guidance and enhanced targeting capabilities. The U.S. military has been investing in such technologies to improve combat effectiveness. The integration of smart technologies into ammunition offers manufacturers the opportunity to provide value-added products that meet the evolving needs of modern armed forces.

Scope of the Report

|

Caliber |

- Small Caliber Ammunition |

|

- Medium Caliber Ammunition |

|

|

- Large Caliber Ammunition |

|

|

- Rockets and Missiles |

|

|

- Others |

|

|

Product Type |

- Rimfire |

|

- Centerfire |

|

|

Application |

- Defense |

|

- Civil and Commercial |

|

|

Guidance Mechanism |

- Guided |

|

- Non-Guided |

|

|

Lethality |

- Lethal |

|

- Less-Lethal |

|

|

Region |

- United States |

|

- Canada |

|

|

- Mexico |

Products

Key Target Audience

Defense Contractors

Law Enforcement Agencies

Firearms Manufacturers

Ammunition Distributors

Shooting Sports Organizations

Homeland Security Departments

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Bureau of Alcohol, Tobacco, Firearms and Explosives)

Companies

Major Players

Northrop Grumman Corporation

General Dynamics Corporation

Olin Corporation

BAE Systems plc

Thales Group

Rheinmetall AG

FN Herstal

Nammo AS

CBC Global Ammunition

Remington Arms Company, LLC

Vista Outdoor Inc.

Poongsan Corporation

Elbit Systems Ltd.

RUAG Ammotec

Nexter Group

Table of Contents

Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

Market Size (In USD Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

Market Analysis

Growth Drivers

Increased Defense Expenditure

Rising Civilian Firearm Ownership

Advancements in Ammunition Technology

Expansion of Law Enforcement Agencies

Market Challenges

Stringent Regulatory Frameworks

Supply Chain Disruptions

Environmental Concerns

Opportunities

Development of Non-Lethal Ammunition

Emerging Markets in Latin America

Integration of Smart Technologies

Trends

Adoption of Lightweight Materials

Customization of Ammunition for Specific Applications

Increased Investment in R&D

Government Regulations

Firearms and Ammunition Excise Tax

Export Control Regulations

Environmental Protection Agency (EPA) Guidelines

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Landscape

Market Segmentation

By Caliber (In Value %)

Small Caliber Ammunition

Medium Caliber Ammunition

Large Caliber Ammunition

Rockets and Missiles

Others

By Product Type (In Value %)

Rimfire

Centerfire

By Application (In Value %)

Defense

Civil and Commercial

By Guidance Mechanism (In Value %)

Guided

Non-Guided

By Lethality (In Value %)

Lethal

Less-Lethal

By Region (In Value %)

United States

Canada

Mexico

Competitive Analysis

Detailed Profiles of Major Companies

Northrop Grumman Corporation

General Dynamics Corporation

Olin Corporation

BAE Systems plc

Thales Group

Rheinmetall AG

FN Herstal

Nammo AS

CBC Global Ammunition

Remington Arms Company, LLC

Vista Outdoor Inc.

Poongsan Corporation

Elbit Systems Ltd.

RUAG Ammotec

Nexter Group

Cross Comparison Parameters

Number of Employees

Headquarters Location

Year of Establishment

Annual Revenue

Product Portfolio

Market Share

Recent Developments

Strategic Initiatives

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

Regulatory Framework

Environmental Standards

Compliance Requirements

Certification Processes

Future Market Size (In USD Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

Future Market Segmentation

By Caliber (In Value %)

By Product Type (In Value %)

By Application (In Value %)

By Guidance Mechanism (In Value %)

By Lethality (In Value %)

By Region (In Value %)

Analysts Recommendations

Total Addressable Market (TAM) Analysis

Serviceable Available Market (SAM) Analysis

Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American Ammunition Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American Ammunition Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple ammunition manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North American Ammunition Market.

Frequently Asked Questions

How big is the North American Ammunition Market?

The North American ammunition market is valued at USD 15 billion, based on a five-year historical analysis.

What are the challenges in the North American Ammunition Market?

Challenges in the North American ammunition market include stringent regulatory frameworks, supply chain disruptions, and environmental concerns related to ammunition manufacturing and usage.

Who are the major players in the North American Ammunition Market?

Key players in the North American ammunition market include Northrop Grumman Corporation, General Dynamics Corporation, Olin Corporation, BAE Systems plc, and Thales Group.

What are the growth drivers of the North American Ammunition Market?

The North American ammunition market is propelled by increased defense expenditure, rising civilian firearm ownership, advancements in ammunition technology, and the expansion of law enforcement agencies.

What opportunities exist in the North American Ammunition Market?

Opportunities in the North American ammunition market include the development of non-lethal ammunition, emerging markets in Latin America, and the integration of smart technologies into ammunition products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.