North America Antimicrobial Packaging Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3365

October 2024

83

About the Report

North America Antimicrobial Packaging Market Overview

The North America Antimicrobial Packaging market is valued at USD 4 billion, driven by increasing concerns over food safety, coupled with the growing demand for packaging solutions that enhance the shelf life of products. The market is shaped by the rising consumer awareness about health and hygiene, particularly in the food and beverage sector, where antimicrobial packaging plays a crucial role. Additionally, advancements in technology, such as the development of antimicrobial coatings and films, are further driving the market's growth.

The United States and Canada are the dominant markets in the region, primarily due to their robust food and beverage industries and stringent regulatory standards. The growing demand for longer-lasting packaging solutions in urban centers like New York, Los Angeles, and Toronto is pushing manufacturers to adopt antimicrobial packaging. The significant presence of leading packaging firms in these cities further contributes to the regions dominance.

The FDA and EPA play critical roles in regulating antimicrobial packaging materials in North America. As of 2024, these agencies have implemented stringent guidelines to ensure that antimicrobial packaging is safe for food contact and effective in preventing contamination. The FDA regulates antimicrobial agents used in food packaging under the Federal Food, Drug, and Cosmetic Act (FFDCA), while the EPA oversees the use of antimicrobial pesticides in packaging. These regulations are essential in maintaining high standards for consumer safety and driving innovation in antimicrobial packaging technologies.

North America Antimicrobial Packaging Market Segmentation

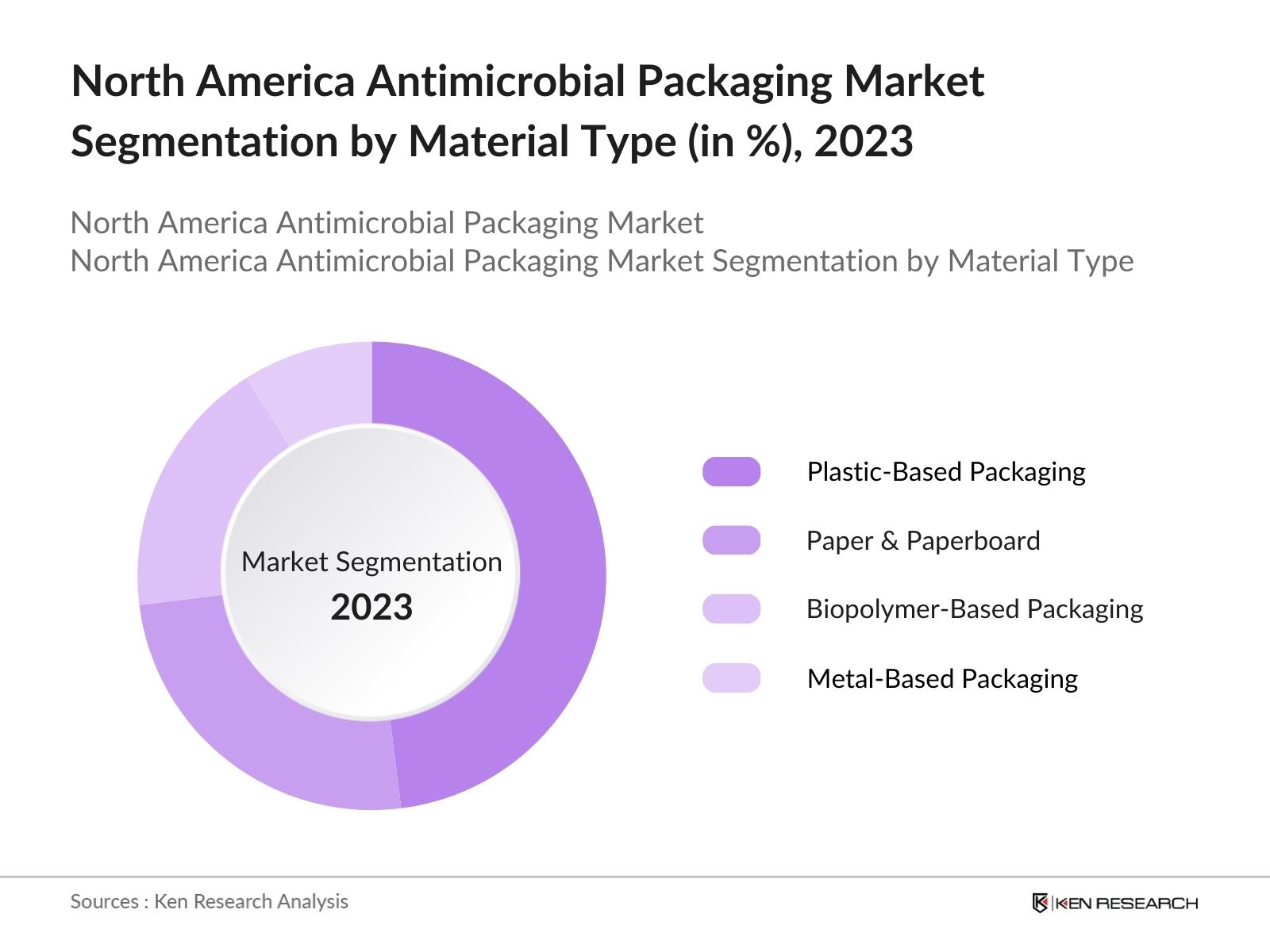

By Material Type: The market is segmented by material type into plastic-based packaging, paper & paperboard, biopolymer-based packaging, and metal-based packaging. Plastic-based packaging holds a dominant market share due to its wide application across the food, healthcare, and personal care industries. Its adaptability, durability, and cost-efficiency make it a preferred material for antimicrobial packaging. Additionally, plastic packagings ability to integrate antimicrobial agents, such as silver ions and organic acids, offers superior protection against bacterial growth, driving its market leadership.

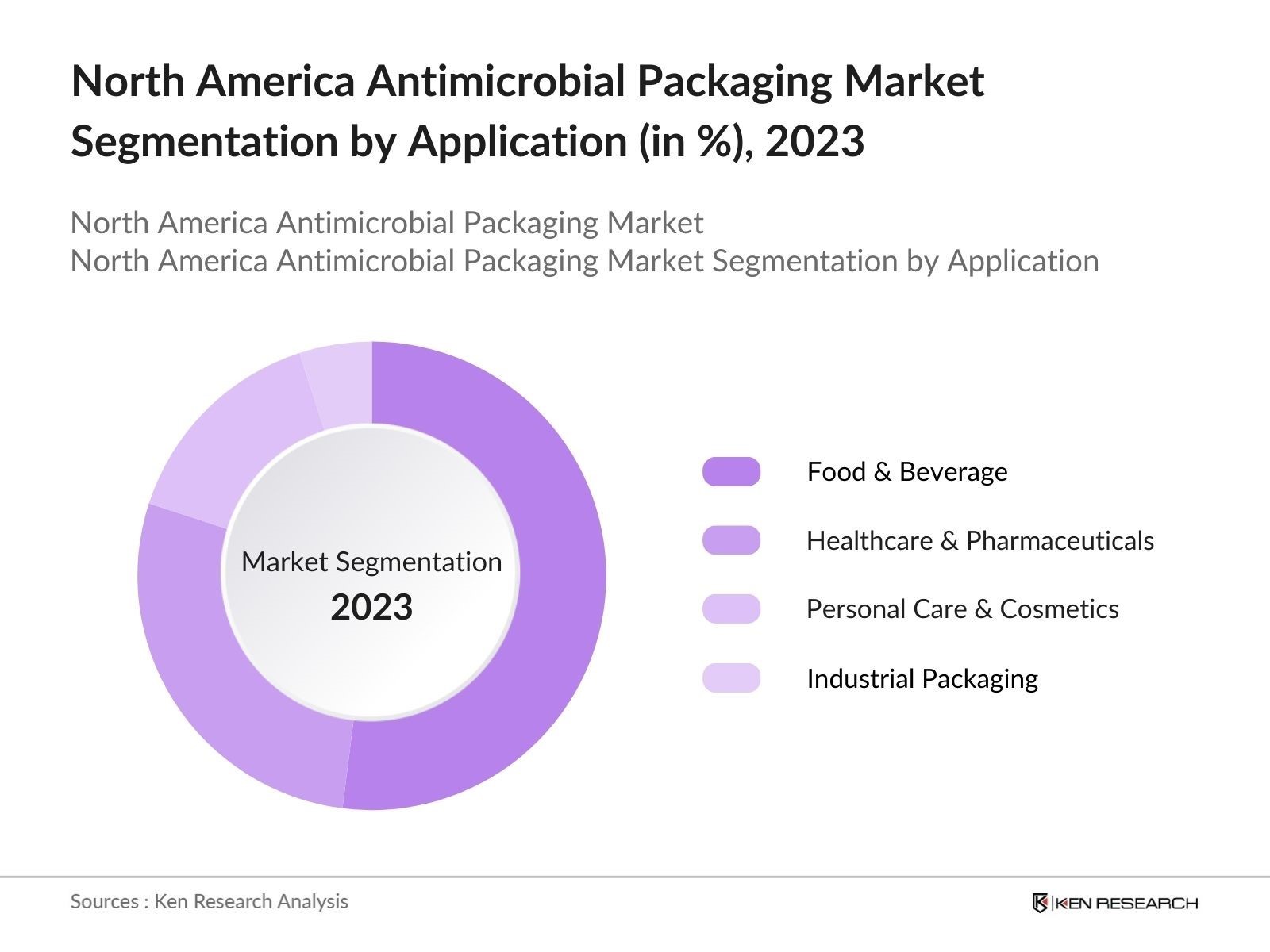

By Application: The market is further segmented by application into food & beverage, healthcare & pharmaceuticals, personal care & cosmetics, and industrial packaging. The food & beverage segment dominates the market due to the growing consumer demand for safe and long-lasting food products. Increasing concerns about foodborne illnesses and the need to extend the shelf life of packaged products have led to a higher adoption of antimicrobial packaging in this segment. The healthcare industry is also rapidly growing due to the need for sterile and infection-resistant packaging solutions.

North America Antimicrobial Packaging Market Competitive Landscape

The North America Antimicrobial Packaging market is characterized by a mix of global and regional players, with key companies engaging in product innovation and strategic partnerships to maintain a competitive edge. Leading players such as Amcor Plc and Sealed Air Corporation dominate the market due to their strong R&D capabilities and widespread distribution networks. Smaller players are also gaining traction by focusing on niche applications and offering sustainable antimicrobial packaging solutions.

|

Company Name |

Established |

Headquarters |

Market Penetration |

Product Portfolio |

R&D Investments |

Sustainability Initiatives |

Global Presence |

Production Capacity |

|

Amcor Plc |

1860 |

Zurich, Switzerland |

||||||

|

Sealed Air Corporation |

1960 |

North Carolina, USA |

||||||

|

DuPont de Nemours, Inc. |

1802 |

Delaware, USA |

||||||

|

Mondi Group |

1967 |

London, UK |

||||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

North America Antimicrobial Packaging Industry Analysis

Growth Drivers

Growth in Packaged Food Industry: The packaged food industry in North America continues to experience substantial growth, driven by convenience, urbanization, and shifting consumer preferences. In 2022, the U.S. packaged food market was valued at over $500 billion, contributing to the rise in demand for antimicrobial packaging. The continued expansion of this industry, with millions of households depending on processed and ready-to-eat meals, emphasizes the need for safe and hygienic packaging solutions to extend shelf life and reduce spoilage risks. Regulatory requirements further push this growth, ensuring food safety standards are maintained.

Advancements in Antimicrobial Technologies: Recent innovations in antimicrobial technologies, including biopolymer-based and silver-based antimicrobials, are reshaping the packaging landscape. By 2023, antimicrobial polymers accounted for a significant portion of the new packaging materials used in food and pharmaceuticals in North America. These technologies are particularly effective in combatting harmful bacteria such as E. coli and Salmonella. Biopolymer innovations like chitosan films and silver-ion technology have gained traction due to their biodegradability and efficacy. North American regulatory agencies such as the FDA have approved numerous antimicrobial packaging solutions, ensuring market growth.

Regulatory Mandates on Packaging Standards: In North America, regulatory bodies like the FDA and EPA impose strict guidelines on packaging materials, especially those containing antimicrobial agents. The Food Safety Modernization Act (FSMA), passed in 2011, continues to impact the packaging industry in 2024 by requiring manufacturers to adhere to rigorous food safety standards, particularly concerning pathogen prevention. These regulations have led to widespread adoption of antimicrobial packaging, as companies aim to comply with federal mandates and avoid penalties. Additionally, evolving environmental standards necessitate the use of sustainable materials, further pushing the development of antimicrobial packaging.

Market Challenges

High Initial Costs of Antimicrobial Packaging: Despite the benefits, antimicrobial packaging incurs high initial costs due to the use of advanced materials like silver nanoparticles and biopolymers. In 2023, the average cost to produce antimicrobial packaging was 15-20% higher than conventional packaging, posing a barrier to widespread adoption, particularly for small and mid-sized companies. The manufacturing process often involves expensive raw materials and specialized equipment, further elevating the costs. This price gap, combined with consumer price sensitivity, limits the growth potential for antimicrobial packaging in cost-competitive markets like food and beverages.

Consumer Perception and Awareness: A major challenge for the North America antimicrobial packaging market is the lack of consumer awareness and perception regarding the benefits of antimicrobial packaging. As of 2022, surveys indicate that only 35% of consumers in the U.S. are familiar with antimicrobial packaging and its benefits. This lack of awareness hinders widespread market adoption, particularly when antimicrobial packaging is compared to conventional packaging solutions. Consumer education campaigns and clear labeling on packaging materials are necessary to overcome this hurdle and build trust in antimicrobial products.

North America Antimicrobial Packaging Future Outlook

Over the next few years, the North America Antimicrobial Packaging market is expected to experience steady growth, driven by rising consumer demand for safe and sustainable packaging solutions. Key growth drivers include advancements in antimicrobial technologies, increasing urbanization, and the expansion of e-commerce, which requires longer-lasting packaging to maintain product integrity during shipping. The healthcare and pharmaceutical sectors will also play a crucial role in propelling the market forward as the demand for sterile packaging solutions continues to rise.

Future Market Opportunities

Expansion in Healthcare and Pharmaceutical Packaging: The healthcare and pharmaceutical sectors in North America present significant growth opportunities for antimicrobial packaging. In 2023, the U.S. pharmaceutical packaging market was valued at over $100 billion, driven by the increasing demand for safe, sterile packaging solutions that prevent contamination. Antimicrobial packaging is crucial in ensuring the safety and efficacy of drugs, vaccines, and medical devices. With the continued growth of the pharmaceutical industry and the increasing focus on infection prevention in hospitals and clinics, the demand for antimicrobial packaging is expected to rise.

Collaborations Between Material Producers and Packaging Firms: Collaborations between material producers and packaging firms are becoming increasingly common in the North American antimicrobial packaging market. By 2023, several key partnerships were formed between biopolymer manufacturers and packaging companies to develop innovative antimicrobial solutions. For instance, biopolymer-based packaging, developed through these collaborations, has shown promising results in increasing the shelf life of perishable products. These collaborations are expected to drive further innovations and accelerate the adoption of antimicrobial packaging across multiple industries, including food, pharmaceuticals, and healthcare.

Scope of the Report

North America Antimicrobial Packaging Market Segmentation

|

Segment |

Sub-segment |

|---|---|

|

Material Type |

Plastic-Based Packaging |

|

Application |

Food & Beverage |

|

Antimicrobial Agents |

Organic Acid-Based |

|

Packaging Format |

Bags & Pouches |

|

Region |

United States |

Products

Key Target Audience

Food and Beverage Manufacturers

Packaging Material Suppliers

Healthcare and Pharmaceutical Companies

Personal Care and Cosmetics Brands

Industrial Packaging Firms

Government and Regulatory Bodies (FDA, EPA)

Investors and Venture Capitalist Firms

Retail and E-Commerce Companies

Companies

Players in North America Antimicrobial Packaging Market

Amcor Plc

Sealed Air Corporation

DuPont de Nemours, Inc.

Mondi Group

BASF SE

Berry Global Inc.

Sonoco Products Company

PolyOne Corporation

Coveris Holdings S.A.

Microban International Ltd.

Table of Contents

1. North America Antimicrobial Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Industry Statistics

1.4. Market Segmentation Overview

2. North America Antimicrobial Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Rate

2.3. Key Market Developments and Milestones

3. North America Antimicrobial Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Food Safety

3.1.2. Growth in Packaged Food Industry

3.1.3. Advancements in Antimicrobial Technologies (e.g., biopolymer innovations, silver-based antimicrobials)

3.1.4. Regulatory Mandates on Packaging Standards

3.2. Market Challenges

3.2.1. High Initial Costs of Antimicrobial Packaging

3.2.2. Consumer Perception and Awareness

3.2.3. Complex Manufacturing Processes

3.3. Opportunities

3.3.1. Expansion in Healthcare and Pharmaceutical Packaging

3.3.2. Rising E-Commerce and Cold Chain Logistics Demand

3.3.3. Collaborations Between Material Producers and Packaging Firms

3.4. Trends

3.4.1. Sustainable and Biodegradable Antimicrobial Packaging

3.4.2. Smart Packaging Integration (e.g., antimicrobial + sensors)

3.4.3. Adoption of Non-Toxic Antimicrobials

3.5. Government Regulation

3.5.1. FDA and EPA Guidelines on Antimicrobial Packaging

3.5.2. North America Food Safety Modernization Act (FSMA) Impact

3.5.3. Environmental Standards on Packaging Waste

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Material Suppliers, Packaging Manufacturers, Regulatory Bodies)

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. North America Antimicrobial Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic-Based Packaging

4.1.2. Paper & Paperboard

4.1.3. Biopolymer-Based Packaging

4.1.4. Metal-Based Packaging

4.2. By Application (In Value %)

4.2.1. Food & Beverage

4.2.2. Healthcare & Pharmaceuticals

4.2.3. Personal Care & Cosmetics

4.2.4. Industrial Packaging

4.3. By Antimicrobial Agents (In Value %)

4.3.1. Organic Acid-Based

4.3.2. Silver Ions

4.3.3. Copper-Based

4.3.4. Nisin

4.4. By Packaging Format (In Value %)

4.4.1. Bags & Pouches

4.4.2. Trays

4.4.3. Films & Sheets

4.4.4. Bottles

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Antimicrobial Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Amcor Plc

5.1.2. Sealed Air Corporation

5.1.3. DuPont de Nemours, Inc.

5.1.4. Mondi Group

5.1.5. BASF SE

5.1.6. Dow Inc.

5.1.7. Sonoco Products Company

5.1.8. Coveris Holdings S.A.

5.1.9. Berry Global Inc.

5.1.10. Smurfit Kappa Group

5.1.11. Microban International Ltd.

5.1.12. BioCote Limited

5.1.13. PolyOne Corporation

5.1.14. Agion Technologies

5.1.15. Parx Materials N.V.

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Penetration, Innovation Capabilities, Regional Presence, Production Capacity, Environmental Certifications, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

6. North America Antimicrobial Packaging Market Regulatory Framework

6.1. Food Packaging Regulations

6.2. Compliance Standards for Antimicrobial Agents

6.3. Certification Processes and Environmental Impact

7. North America Antimicrobial Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Antimicrobial Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Antimicrobial Agents (In Value %)

8.4. By Packaging Format (In Value %)

8.5. By Region (In Value %)

9. North America Antimicrobial Packaging Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

9.4. Strategic Positioning Recommendations

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing a comprehensive map of the North America Antimicrobial Packaging Market ecosystem. This stage includes gathering extensive data from proprietary databases and secondary research sources, which help to identify the key factors that drive market dynamics, such as technological advancements and regulatory frameworks.

Step 2: Market Analysis and Construct

This phase involves analyzing historical market data and trends to understand the competitive landscape and the penetration of antimicrobial packaging across various end-use industries. Key metrics like market size, segment growth, and market share are used to provide accurate insights.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through surveys and interviews to validate the market assumptions. These interactions provide real-time insights into the operational challenges and opportunities in the market, ensuring the reliability of the analysis.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the data and insights gathered through various stages to produce a comprehensive and validated report. The findings are aligned with current market trends and future projections to provide actionable insights for industry stakeholders.

Frequently Asked Questions

01. How big is the North America Antimicrobial Packaging Market?

The North America Antimicrobial Packaging market is valued at USD 4 billion, driven by increasing demand for food safety and shelf-life extension in various industries such as food and healthcare.

02. What are the challenges in the North America Antimicrobial Packaging Market?

Challenges in the North America Antimicrobial Packaging market include high costs associated with antimicrobial packaging materials, regulatory hurdles, and consumer reluctance towards adopting non-traditional packaging solutions.

03. Who are the major players in the North America Antimicrobial Packaging Market?

Key players in the North America Antimicrobial Packaging market include Amcor Plc, Sealed Air Corporation, DuPont de Nemours, Inc., Mondi Group, and BASF SE, each leading through extensive R&D investments and product portfolios.

04. What are the growth drivers of the North America Antimicrobial Packaging Market?

Growth drivers in the North America Antimicrobial Packaging market include increasing consumer awareness about food safety, advancements in antimicrobial technologies, and the growing demand for eco-friendly and long-lasting packaging solutions.

05. Which segments dominate the North America Antimicrobial Packaging Market?

The food and beverage segment dominates the application-based segmentation due to its need for longer shelf life and safe packaging solutions, while plastic-based packaging leads the material-based segmentation due to its flexibility and adaptability in the North America Antimicrobial Packaging market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.