North America Armorthane Polyurea Coatings Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD5530

December 2024

93

About the Report

North America Armorthane Polyurea Coatings Market Overview

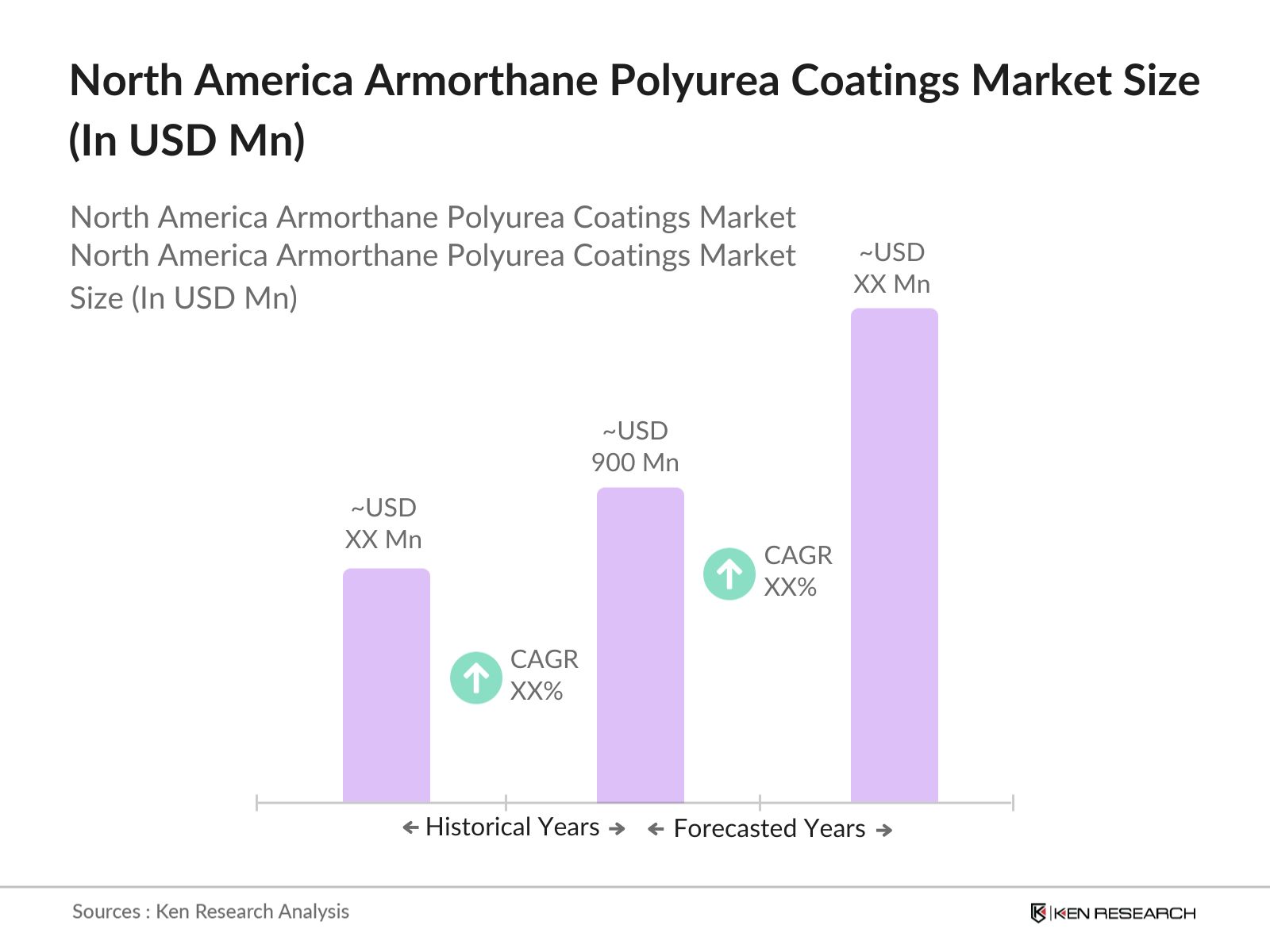

- The North America Armorthane Polyurea Coatings market is valued at USD 900 million, primarily driven by its extensive use across industries such as construction, automotive, and marine. The market's growth stems from the increasing demand for high performance, durable, and environmentally compliant coatings. Innovations in polyurea technology, offering rapid curing and resistance to extreme conditions, further bolster demand. Key sectors like pipeline protection and industrial flooring capitalize on the materials versatility, making the market resilient and poised for sustained growth.

- Major demand centers for Armorthane polyurea coatings in North America include the United States, Canada, and Mexico. The United States dominates due to its largescale infrastructure projects, robust automotive manufacturing, and oil and gas industry requirements. Canada follows, with its thriving marine and industrial sectors, while Mexico benefits from its growing construction activities and investments in transportation infrastructure, enhancing its market share. These regions also leverage strong R&D capabilities and regulatory support for environmental compliance.

- The U.S. Environmental Protection Agency (EPA) enforces stringent regulations to limit volatile organic compound (VOC) emissions from coatings, aiming to reduce air pollution and protect public health. Polyurea coatings, known for their low VOC content, align with these standards, making them a preferred choice in industries seeking compliance. For instance, the EPA's National Volatile Organic Compound Emission Standards for Architectural Coatings set specific VOC limits that polyurea formulations can meet or exceed.

North America Armorthane Polyurea Coatings Market Segmentation

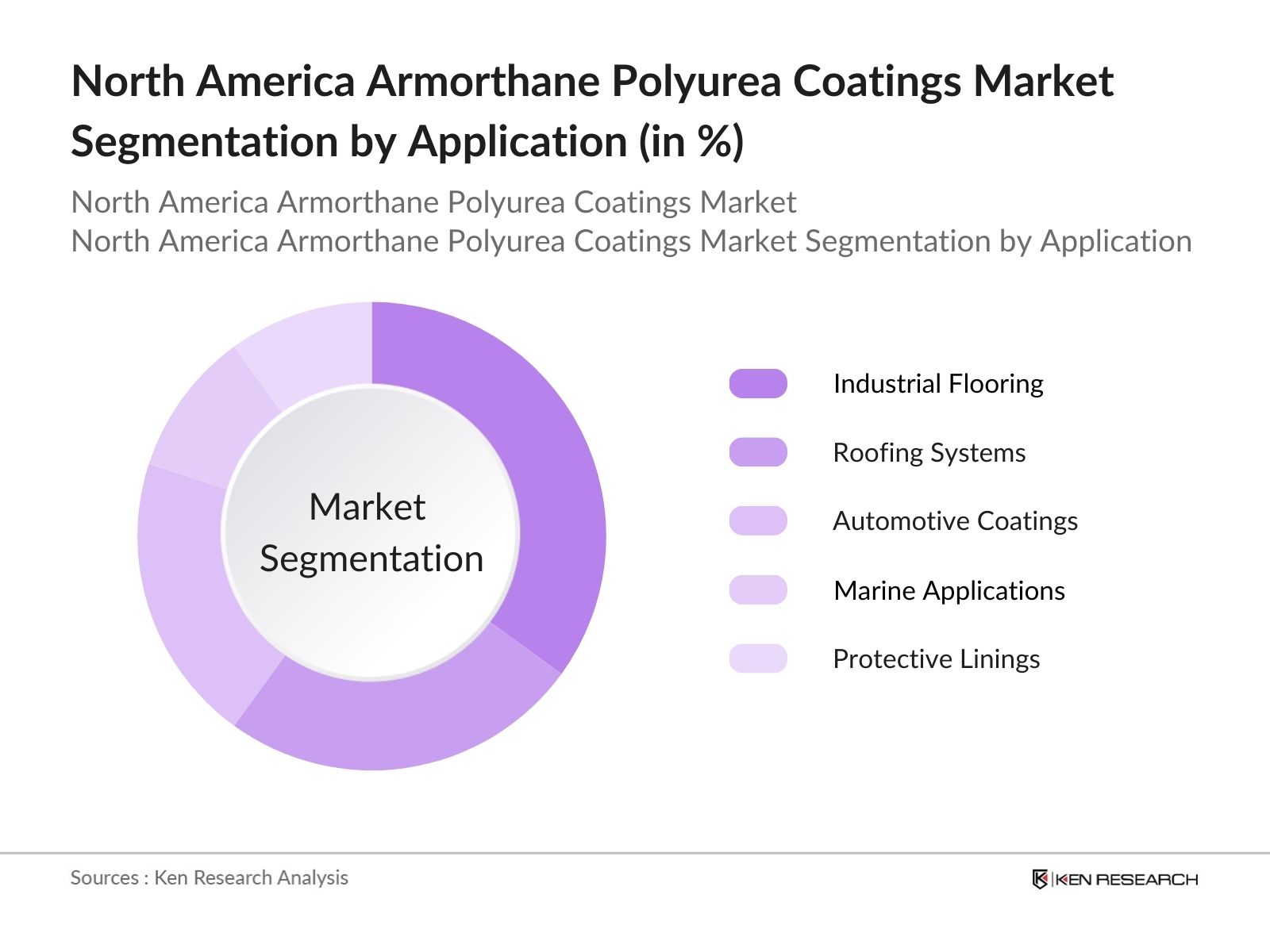

- By Application: The market is segmented by application into industrial flooring, roofing systems, automotive coatings, marine applications, and protective linings. Among these, industrial flooring leads with a market share of 35% in 2023. This dominance is due to polyureas superior durability, chemical resistance, and ability to withstand heavy industrial use. Factories, warehouses, and manufacturing plants prefer polyurea coatings for their rapid application and longterm costeffectiveness. Additionally, the seamless and waterproof characteristics of polyurea make it an ideal choice for industries requiring stringent hygiene and safety standards.

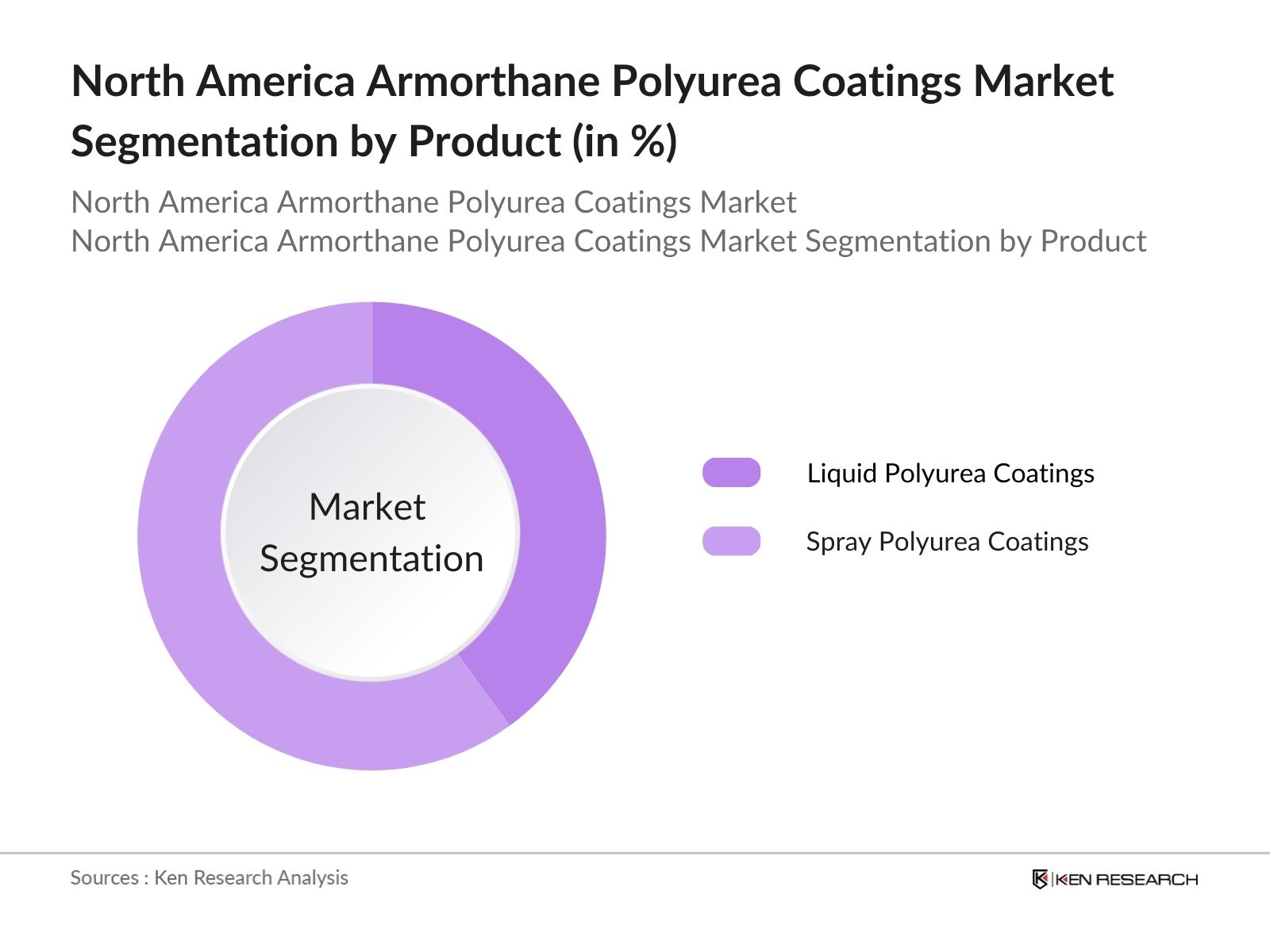

- By Product Type: The market is further segmented by product type into liquid polyurea coatings and spray polyurea coatings. Spray polyurea coatings dominate with a 60% market share in 2023. This dominance arises from their ease of application, adaptability to various surfaces, and quick curing time, making them suitable for largescale applications such as automotive refinishing and industrial flooring. Spray coatings also provide uniform coverage and excellent adhesion, ensuring longlasting protection against environmental factors, abrasion, and chemical exposure.

North America Armorthane Polyurea Coatings Market Competitive Landscape

The North America Armorthane Polyurea Coatings market is dominated by key players such as BASF SE, Huntsman Corporation, RPM International Inc., SherwinWilliams Company, and PPG Industries, Inc. These companies leverage their strong product portfolios, robust R&D capabilities, and extensive distribution networks to maintain market leadership. The competitive landscape reflects a high degree of consolidation, with companies actively pursuing strategic collaborations, product innovations, and geographic expansion to strengthen their positions.

North America Armorthane Polyurea Coatings Market Analysis

Growth Drivers

- Increasing Demand in Construction Sector: The North American construction industry has been experiencing robust growth, with the U.S. Census Bureau reporting that total construction spending reached over 100 billion in 2023. This surge is driven by both residential and non-residential projects, necessitating advanced protective coatings like polyurea to enhance durability and longevity of structures. Armorthane's polyurea coatings are increasingly utilized for waterproofing, corrosion resistance, and abrasion protection in various construction applications, aligning with the sector's expansion.

- Advancements in Coating Technology: Technological innovations have significantly improved the performance of polyurea coatings. Developments such as faster curing times, enhanced adhesion properties, and increased resistance to chemicals and UV radiation have expanded their applicability across industries. The introduction of spray-applied polyurea systems allows for rapid application and minimal downtime, which is crucial in industrial maintenance and repair operations.

- Rising Industrial Applications: The industrial sector's expansion has led to a higher demand for protective coatings. Industries such as oil and gas, manufacturing, and mining require robust solutions to protect equipment and infrastructure from harsh environmental conditions. Polyurea coatings offer excellent resistance to chemicals, abrasion, and impact, making them ideal for applications like tank linings, pipeline coatings, and containment areas. The U.S. Energy Information Administration reported that in 2023, the U.S. produced around 12 million barrels of crude oil per day, underscoring the scale of industrial activity requiring such protective measures.

Challenges

- High Initial Costs: Polyurea coatings, while offering superior performance and durability, face adoption challenges due to their high initial costs. These coatings require specialized raw materials such as isocyanates and polyamines, which are typically more expensive than those used in traditional coatings like epoxy or polyurethane. Furthermore, the manufacturing process often demands advanced production facilities, contributing to the higher material costs.

- Technical Application Constraints: The application of polyurea coatings is a technically demanding process, requiring specialized skills and advanced equipment. Polyurea reacts almost instantaneously upon mixing, curing within seconds to minutes, which leaves minimal margin for error. This rapid setting time necessitates precise preparation, including surface cleaning and priming, to ensure proper adhesion and performance. Applying the coating also requires high-pressure, dual-component spray machines capable of handling its fast-curing properties.

North America Armorthane Polyurea Coatings Market Future Outlook

The North America Armorthane Polyurea Coatings market is set for steady growth, supported by expanding applications in construction, automotive, and industrial sectors. The market is also likely to benefit from technological advancements in coating formulations and application techniques, enhancing efficiency and sustainability. Increasing investments in green infrastructure projects and the growing adoption of smart coatings with IoTenabled monitoring capabilities will further drive demand. Additionally, the focus on extending product lifespans in industrial applications will create new opportunities for market expansion.

Future Market Opportunities

- Integration of Smart Coatings: The integration of Internet of Things (IoT) technology into polyurea coatings represents a significant leap forward in industrial coating solutions. IoT-enabled polyurea coatings can incorporate sensors or microchips to monitor real-time surface conditions such as temperature, humidity, wear, and potential damage. This data is transmitted to centralized systems, enabling predictive maintenance and reducing the risk of unexpected failures.

- Expansion in Emerging Sectors: The marine and transportation sectors offer significant growth opportunities for polyurea coatings due to their unique durability and resistance to harsh environmental conditions. In the marine industry, vessels and offshore platforms are exposed to constant abrasion, saltwater corrosion, and extreme weather conditions. Polyurea coatings, with their exceptional resistance to water, UV radiation, and impact, provide an ideal solution for protecting hulls, decks, and underwater structures.

Scope of the Report

|

By Product Type |

Liquid Polyurea Coatings |

|

By Application |

Industrial Flooring |

|

By Technology |

OnePart Polyurea |

|

By EndUser |

Construction |

|

By Region |

United States |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Canadian Standards Association)

Construction Firms

Automotive Manufacturers

Marine Industry Operators

Pipeline and Infrastructure Developers

Coating and Paint Distributors

Companies

Players Mentioned in the Report

BASF SE

Huntsman Corporation

RPM International Inc.

SherwinWilliams Company

PPG Industries, Inc.

Sika AG

Axalta Coating Systems

Henkel AG & Co. KGaA

The Dow Chemical Company

Covestro AG

Eastman Chemical Company

Akzo Nobel N.V.

Momentive Performance Materials Inc.

Wacker Chemie AG

H.B. Fuller Company

Table of Contents

North America Armorthane Polyurea Coatings Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Armorthane Polyurea Coatings Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Armorthane Polyurea Coatings Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Construction Sector

3.1.2. Advancements in Coating Technology

3.1.3. Rising Industrial Applications

3.1.4. Environmental Compliance Requirements

3.2. Market Challenges

3.2.1. High Material Costs

3.2.2. Technical Application Constraints

3.2.3. Limited Awareness Among End-Users

3.3. Opportunities

3.3.1. Expansion in Automotive Sector

3.3.2. Growth in Infrastructure Projects

3.3.3. Innovations in Sustainable Coatings

3.4. Trends

3.4.1. Adoption of Smart Coating Technologies

3.4.2. Integration with IoT for Monitoring

3.4.3. Increased Use of Multi-functional Coatings

3.5. Government Regulation

3.5.1. Environmental Protection Standards

3.5.2. Safety Regulations in Manufacturing

3.5.3. Incentives for Sustainable Practices

3.5.4. Public-Private Partnerships for Innovation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

North America Armorthane Polyurea Coatings Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Liquid Polyurea Coatings

4.1.2. Spray Polyurea Coatings

4.2. By Application (In Value %)

4.2.1. Industrial Flooring

4.2.2. Roofing Systems

4.2.3. Automotive Coatings

4.2.4. Marine Applications

4.2.5. Protective Linings

4.3. By Technology (In Value %)

4.3.1. One-Part Polyurea

4.3.2. Two-Part Polyurea

4.4. By End-User (In Value %)

4.4.1. Construction

4.4.2. Automotive

4.4.3. Industrial Manufacturing

4.4.4. Marine

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

4.5.4. Rest of North America

North America Armorthane Polyurea Coatings Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Huntsman Corporation

5.1.2. BASF SE

5.1.3. RPM International Inc.

5.1.4. Sherwin-Williams Company

5.1.5. PPG Industries, Inc.

5.1.6. Sika AG

5.1.7. Axalta Coating Systems

5.1.8. Henkel AG & Co. KGaA

5.1.9. The Dow Chemical Company

5.1.10. Covestro AG

5.1.11. Eastman Chemical Company

5.1.12. Akzo Nobel N.V.

5.1.13. Momentive Performance Materials Inc.

5.1.14. Wacker Chemie AG

5.1.15. H.B. Fuller Company

5.2. Cross Comparison Parameters

- Number of Employees

- Headquarters Location

- Inception Year

- Revenue

- Product Portfolio

- Geographic Presence

- R&D Capabilities

- Market Share

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Armorthane Polyurea Coatings Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

North America Armorthane Polyurea Coatings Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Armorthane Polyurea Coatings Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

North America Armorthane Polyurea Coatings Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all key stakeholders in the North America Armorthane Polyurea Coatings market through comprehensive desk research, supported by proprietary and secondary databases. This process identifies critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase compiles historical and current market data to assess penetration rates, revenue generation, and application segmentation. An evaluation of service quality statistics ensures the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industryspecific hypotheses are validated through structured interviews with market practitioners and technical experts, offering insights into operational trends and financial performance.

Step 4: Research Synthesis and Final Output

Engagement with leading manufacturers and endusers ensures validation of derived data. This step complements statistics from bottomup approaches and refines the overall market analysis.

Frequently Asked Questions

01. How big is the North America Armorthane Polyurea Coatings market?

The North America Armorthane Polyurea Coatings market is valued at USD 900 million, driven by growing demand across industrial, automotive, and construction sectors.

02. What challenges are faced in the North America Armorthane Polyurea Coatings market?

Challenges in the North American armorthane Polyurea Coatings market include high initial costs, technical application constraints, and the need for specialized skills and equipment for proper application.

03. Which application segment dominates the market?

The industrial flooring segment leads the North America Armorthane Polyurea Coatings market share due to its high durability, chemical resistance, and cost effectiveness in heavy use environments.

04. Who are the major players in the North America Armorthane Polyurea Coatings market?

Key players in the North America Armorthane Polyurea Coatings market include BASF SE, Huntsman Corporation, RPM International Inc., Sherwin-Williams Company, and PPG Industries, Inc., which dominate due to their extensive product offerings and innovation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.