North America Artificial Intelligence in Health Care Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD9574

October 2024

85

About the Report

North America Artificial Intelligence in Health Care Market Overview

The North America Artificial Intelligence (AI) in Health Care market is valued at USD 8.8 billion, driven by significant technological advancements in AI-based diagnostic and treatment solutions. Over recent years, increasing adoption of AI technologies, such as machine learning and natural language processing, has allowed health care institutions to optimize their workflow and deliver better patient outcomes. These developments have been crucial in improving patient diagnostics, predictive analytics, and automating administrative tasks, ultimately leading to an efficient healthcare system. The surge in investments from government and private sectors has been instrumental in pushing the growth of AI in healthcare.

The United States, specifically cities such as Boston and San Francisco, are leading the market for AI in health care, primarily due to their strong presence of AI tech companies, advanced research institutions, and robust healthcare infrastructure. These cities are home to numerous startups and established AI firms that collaborate with healthcare providers, ensuring rapid technological integration. Canada, particularly Toronto, is also emerging as a key player due to substantial government support and a flourishing AI research community.

The FDA and Health Canada are actively developing regulatory frameworks to address the safe use of AI in healthcare. As of 2024, the FDA had cleared over 500 AI and machine learning-based devices for clinical use, a 40% increase since 2020. These agencies continue to refine guidelines to ensure that AI systems meet safety and efficacy standards before being deployed in clinical settings. These regulations ensure that AI applications are rigorously tested, mitigating potential risks.

North America Artificial Intelligence in Health Care Market Segmentation

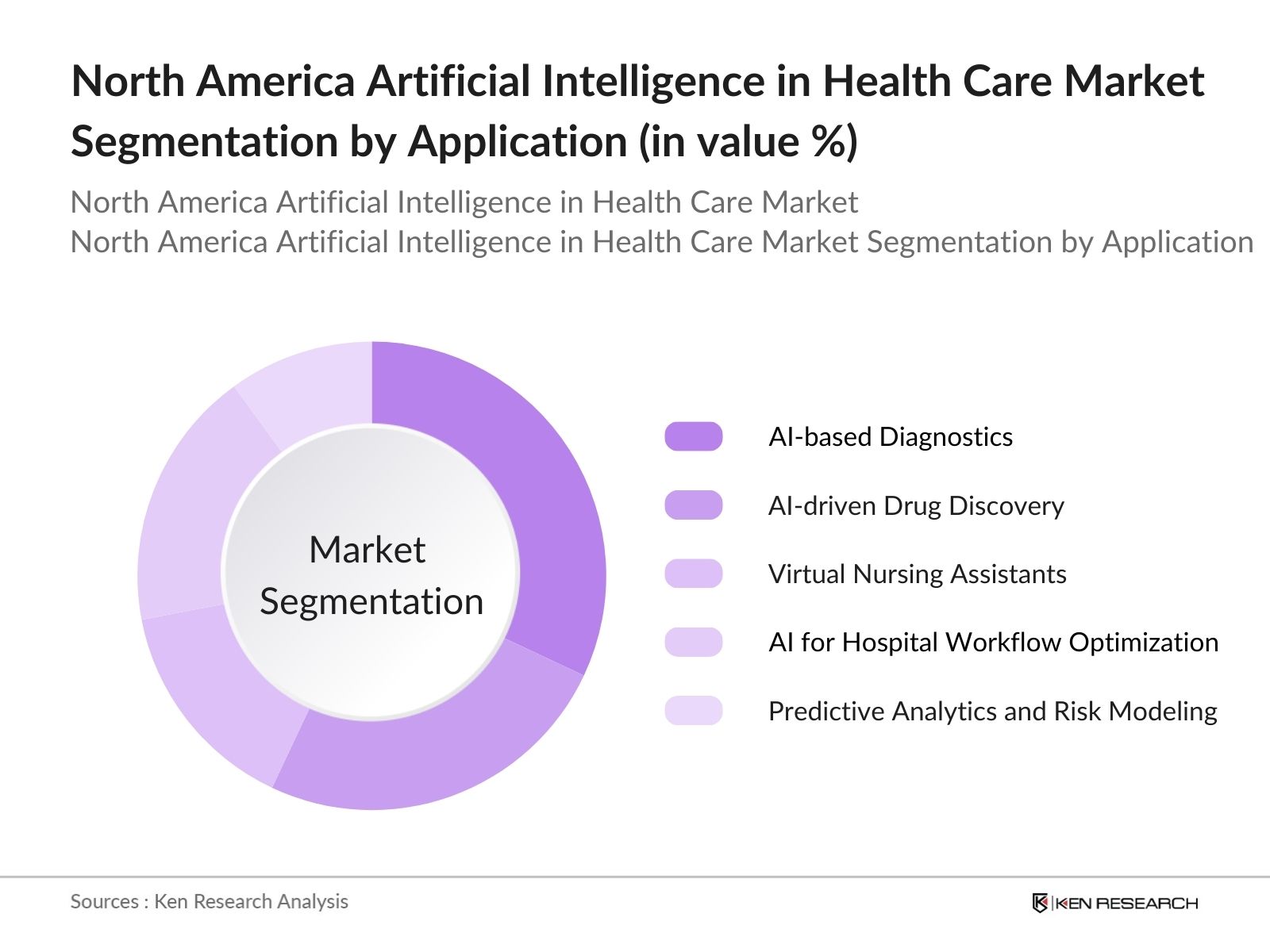

By Application: The market is segmented by application into AI-based diagnostics, AI-driven drug discovery, virtual nursing assistants, AI for hospital workflow optimization, and predictive analytics and risk modeling. AI-based diagnostics hold a dominant market share, mainly because of the rising need for accurate and early detection of diseases such as cancer and cardiovascular disorders. These AI-driven diagnostic tools have reduced the margin of error in identifying medical conditions, making them highly valuable in clinical settings, particularly in radiology and pathology.

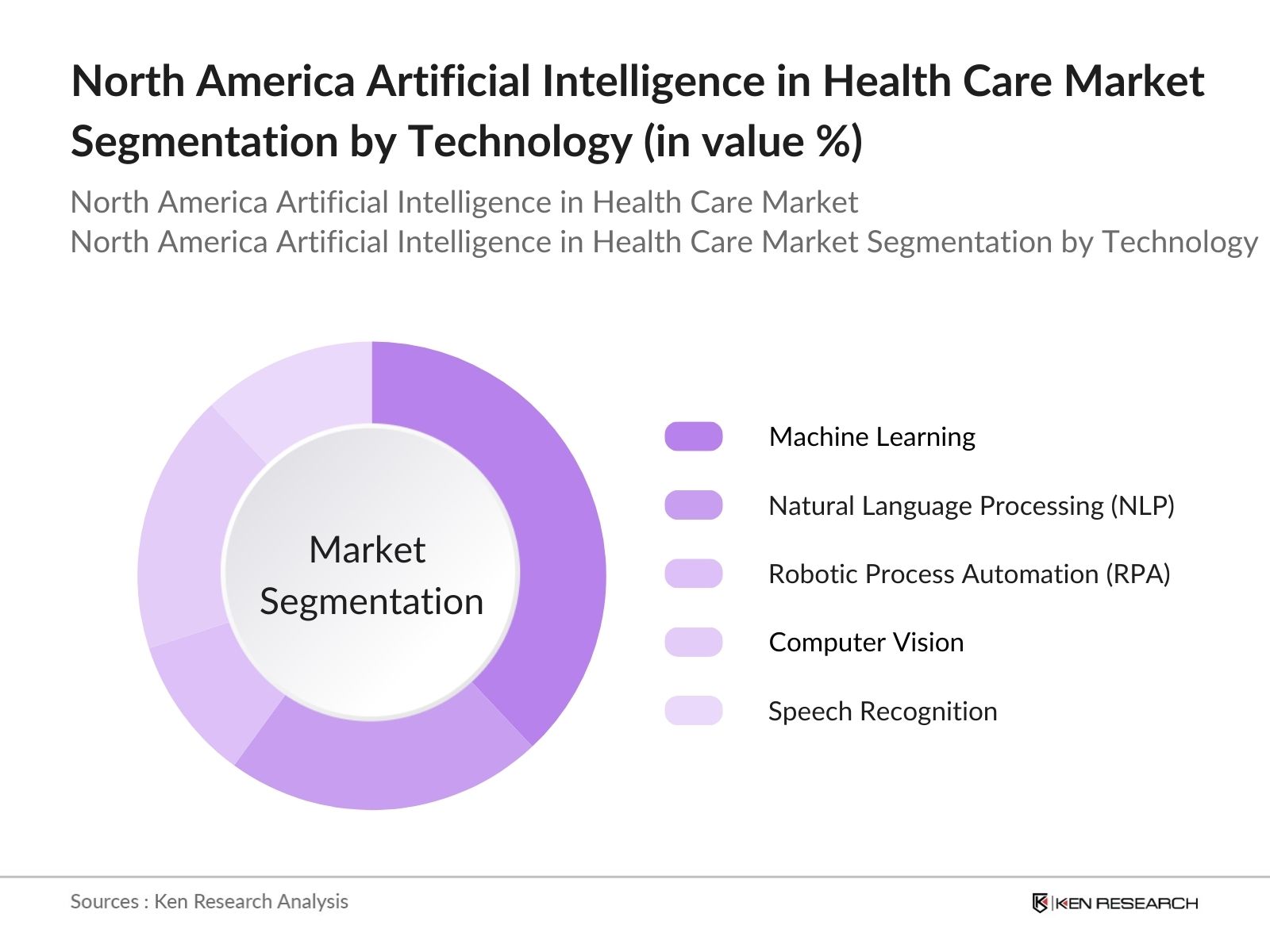

By Technology: This market is segmented by technology into machine learning, natural language processing, robotic process automation, computer vision, and speech recognition. Machine learning (ML) dominates the technology landscape, holding a significant share of the market. The prominence of ML is attributed to its widespread use in predictive analytics and diagnostic tools. Hospitals and research institutions are increasingly using ML algorithms to analyze patient data and derive actionable insights, thereby improving the quality of care and driving revenue growth for health care providers.

North America Artificial Intelligence in Health Care Market Competitive Landscape

The North America AI health care market is dominated by a few key players who lead the industry due to their advanced technologies, high R&D expenditure, and strategic partnerships with healthcare institutions. These companies are heavily focused on creating AI-based solutions for diagnostics, drug discovery, and operational optimization. Furthermore, AI-based health start-ups are growing rapidly, contributing to a highly competitive market landscape.

|

Company Name |

Establishment Year |

Headquarters |

R&D Budget (USD) |

AI Healthcare Solutions |

AI Patents |

Collaborations |

Strategic Acquisitions |

Product Launches (AI) |

|

IBM Watson Health |

1911 |

USA |

||||||

|

Microsoft Azure AI Health |

1975 |

USA |

||||||

|

GE Healthcare |

1892 |

USA |

||||||

|

Siemens Healthineers |

1847 |

Germany |

||||||

|

Tempus Labs |

2015 |

USA |

North America Artificial Intelligence in Health Care Industry Analysis

Growth Drivers

Increasing Adoption of AI-based Diagnostics Solutions: The increasing adoption of AI-powered diagnostic tools, including image recognition and machine learning algorithms, is transforming the healthcare landscape. For example, AI-based imaging tools can identify conditions such as cancer with high accuracy. A report by the U.S. Food and Drug Administration (FDA) shows that as of 2023, more than 350 AI-based medical devices are authorized for use in clinical settings, including 222 in radiology alone. This adoption addresses the rising need for faster and more precise diagnostics. Furthermore, AI is increasingly deployed to analyze large datasets, speeding up diagnosis and improving patient outcomes.

Growing Demand for Personalized Medicine: AI applications in genomics and precision treatments have driven the growth of personalized medicine in North America. AI-powered algorithms help identify genetic mutations, leading to targeted therapies that are more effective for specific patients. According to the National Human Genome Research Institute, over 100 million Americans had their DNA sequenced by 2022, and AI platforms are extensively used to interpret this data. AI-driven precision medicine is particularly impactful in treating cancers, where AI tailors treatment plans by analyzing genetic profiles, thus increasing the effectiveness of interventions.

Rising Healthcare Costs and Need for Operational Efficiency: The application of AI in hospital management has become crucial as healthcare costs in North America continue to rise. The Centers for Medicare & Medicaid Services (CMS) estimated that the U.S. national healthcare expenditure was $4.6 trillion in 2022. AIs ability to optimize resource allocation, forecast demand, and reduce operational inefficiencies is paramount. Hospitals that implemented AI-driven predictive analytics reported a 15% reduction in patient readmission rates and significant savings in administrative costs, underscoring AI's role in streamlining healthcare operations.

Market Challenges

Regulatory and Compliance Issues

Regulatory and compliance issues remain a significant challenge in AI adoption within healthcare. The U.S. FDA has approved numerous AI-based devices but also requires stringent validation to ensure patient safety. As of 2024, the FDA has cleared over 500 AI and machine learning-enabled medical devices, but navigating these regulations can delay time-to-market for AI health technologies. Similarly, in Canada, Health Canada enforces rigorous guidelines for AI adoption in healthcare, further complicating the regulatory environment for manufacturers.

Data Privacy and Security Concerns: Patient data privacy remains a top concern in AI healthcare applications. The U.S. Department of Health and Human Services (HHS) enforces the Health Insurance Portability and Accountability Act (HIPAA), which mandates strict rules for handling patient data. In 2023, healthcare organizations accounted for nearly 20% of all data breaches reported in North America, with AI-related cybersecurity vulnerabilities being a key issue. Ensuring AI tools comply with data protection laws, like HIPAA in the U.S. and the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada, is essential for widespread adoption.

North America Artificial Intelligence in Health Care Market Future Outlook

Over the next five years, the North America Artificial Intelligence in Health Care market is expected to continue its upward trajectory, driven by ongoing technological innovations, government initiatives promoting AI adoption, and rising demand for efficient health care solutions. With AI revolutionizing areas such as diagnostics, predictive analytics, and personalized medicine, hospitals and health systems will increasingly integrate AI to optimize patient outcomes and reduce operational costs. Additionally, AI's role in drug discovery and telemedicine will further expand the markets growth potential.

Future Market Opportunities

Integration of AI in Telemedicine: AI integration in telemedicine is expanding rapidly, enabling virtual health consultations and remote diagnostics. In 2023, approximately 40% of primary care visits in the U.S. were conducted via telehealth, aided by AI tools that help physicians analyze patient data remotely. AI-driven chatbots and diagnostic tools assist in triaging patients, which reduces the burden on healthcare systems. This trend is particularly beneficial in rural and underserved areas where access to healthcare professionals is limited, further enhancing the scalability of telemedicine.

AI-driven Drug Discovery: AI is playing a crucial role in pharmaceutical research by accelerating drug discovery processes. By 2023, over 150 drugs were developed using AI algorithms, significantly reducing the time and cost of drug development. Pharmaceutical companies in North America reported a 20% reduction in the time needed to identify viable drug candidates using AI platforms. These AI-driven innovations help address the pressing need for new treatments in areas such as oncology and rare diseases, as they enable faster clinical trials and drug approval processes.

Scope of the Report

|

Segment |

Sub-segments |

|

Application |

AI-based Diagnostics |

|

AI-driven Drug Discovery |

|

|

Virtual Nursing Assistants |

|

|

AI for Hospital Workflow Optimization |

|

|

Predictive Analytics and Risk Modeling |

|

|

Technology |

Machine Learning |

|

Natural Language Processing |

|

|

Robotic Process Automation |

|

|

Computer Vision |

|

|

Speech Recognition |

|

|

End-User |

Hospitals and Clinics |

|

Research Institutions |

|

|

Diagnostic Laboratories |

|

|

Pharmaceutical Companies |

|

|

Patients/Consumers |

|

|

Deployment Mode |

Cloud-based |

|

On-premise |

|

|

Region |

United States |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

Hospitals and Healthcare Providers

AI and Health Care Technology Companies

Pharmaceutical Companies

Government and Regulatory Bodies (FDA, Health Canada)

Research Institutions and Laboratories

Banks and Financial Institutes

Medical Device Manufacturers

Investors and Venture Capital Firms

Health Insurance Companies

Table of Contents

1. North America Artificial Intelligence in Health Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Artificial Intelligence in Health Care Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Artificial Intelligence in Health Care Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of AI-based Diagnostics Solutions (AI-powered diagnostic tools, image recognition, etc.)

3.1.2. Growing Demand for Personalized Medicine (AI applications in genomics and precision treatments)

3.1.3. Rising Healthcare Costs and Need for Operational Efficiency (AI for predictive analytics in hospital management)

3.1.4. Government and Private Investments in AI (investment metrics and venture capital activities in AI health startups)

3.2. Market Challenges

3.2.1. Regulatory and Compliance Issues (FDA and Health Canada AI regulations)

3.2.2. Data Privacy and Security Concerns (patient data protection laws and AI ethics)

3.2.3. High Cost of AI Integration in Healthcare Systems (ROI on AI healthcare systems implementation)

3.2.4. Limited Access to Quality Healthcare Data (AI training data availability and quality issues)

3.3. Opportunities

3.3.1. Integration of AI in Telemedicine (virtual health consultations and remote diagnostics with AI)

3.3.2. AI-driven Drug Discovery (applications in pharmaceutical research)

3.3.3. Collaborations Between AI Providers and Healthcare Institutions (partnerships and alliances)

3.4. Trends

3.4.1. Expansion of AI in Robotic Surgery (AI-enhanced robotic-assisted procedures)

3.4.2. Predictive Analytics for Patient Outcomes (AI-based prognosis tools in care management)

3.4.3. AI in Mental Health Treatment (AI-based cognitive behavioral therapy and treatment tools)

3.4.4. Blockchain and AI Integration in Health Records (decentralized and secure AI data sharing)

3.5. Government Regulations

3.5.1. AI Regulation Policies by the FDA and Health Canada

3.5.2. Data Protection Acts and HIPAA Compliance for AI Solutions

3.5.3. National AI in Healthcare Initiatives

3.5.4. Public-Private Partnerships for AI Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Artificial Intelligence in Health Care Market Segmentation

4.1. By Application (In Value %)

4.1.1. AI-based Diagnostics

4.1.2. AI-driven Drug Discovery

4.1.3. Virtual Nursing Assistants

4.1.4. AI for Hospital Workflow Optimization

4.1.5. Predictive Analytics and Risk Modeling

4.2. By Technology (In Value %)

4.2.1. Machine Learning (Supervised, Unsupervised, Reinforcement Learning)

4.2.2. Natural Language Processing (NLP)

4.2.3. Robotic Process Automation (RPA)

4.2.4. Computer Vision

4.2.5. Speech Recognition

4.3. By End-User (In Value %)

4.3.1. Hospitals and Clinics

4.3.2. Research Institutions

4.3.3. Diagnostic Laboratories

4.3.4. Pharmaceutical Companies

4.3.5. Patients/Consumers

4.4. By Deployment Mode (In Value %)

4.4.1. Cloud-based

4.4.2. On-premise

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Artificial Intelligence in Health Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Watson Health

5.1.2. Microsoft Azure AI Health

5.1.3. GE Healthcare

5.1.4. Siemens Healthineers

5.1.5. NVIDIA Corporation

5.1.6. Google Health

5.1.7. Philips Healthcare

5.1.8. Medtronic

5.1.9. Butterfly Network

5.1.10. Cerner Corporation

5.1.11. Tempus Labs

5.1.12. Zebra Medical Vision

5.1.13. PathAI

5.1.14. CloudMedX

5.1.15. Viz.ai

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, AI R&D Investments, AI Patent Portfolio, Strategic Partnerships, Clinical Trial Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Artificial Intelligence in Health Care Market Regulatory Framework

6.1. Regulatory Approvals for AI-based Healthcare Solutions

6.2. Compliance with Healthcare Data Standards

6.3. Certification Processes for AI-driven Devices

6.4. Policies for AI-enabled Clinical Trials

7. North America Artificial Intelligence in Health Care Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Artificial Intelligence in Health Care Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Technology (In Value %)

8.3. By End-User (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Region (In Value %)

9. North America Artificial Intelligence in Health Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the entire ecosystem of the North America AI Health Care market, identifying all major stakeholders, from technology developers to health care providers. This includes a thorough investigation of market trends, technology adoption, and consumer preferences through reliable proprietary and secondary databases.

Step 2: Market Analysis and Construction

This phase involves evaluating historical market data and identifying trends related to AI adoption in health care. Market penetration rates, usage statistics of AI in clinical settings, and revenue generation from AI solutions are assessed to provide a comprehensive view of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are tested through interviews with AI developers, health care providers, and industry experts. These insights are gathered to refine the initial hypotheses and ensure that the market projections are grounded in real-world data.

Step 4: Research Synthesis and Final Output

The final stage consolidates all gathered data into actionable insights. These insights are validated by industry experts and health care institutions, ensuring a thorough analysis of the AI health care market.

Frequently Asked Questions

01. How big is the North America AI Health Care market?

The North America AI Health Care market is valued at USD 8.8 billion, driven by advancements in AI-based diagnostics, predictive analytics, and hospital workflow optimization.

02. What are the major challenges in the AI health care market?

The major challenges in the North America AI Health Care market include regulatory hurdles, data privacy concerns, and the high cost of integrating AI solutions into existing health care infrastructures.

03. Who are the key players in the North America AI health care market?

Key players in the North America AI Health Care market include IBM Watson Health, Microsoft Azure AI Health, GE Healthcare, Google Health, and Philips Healthcare, among others.

04. What drives the growth of AI in health care?

Growth in the North America AI Health Care market is driven by increasing demand for personalized medicine, improved diagnostic capabilities, and the ability of AI to optimize hospital operations, leading to cost savings and better patient outcomes.

05. How is AI used in drug discovery?

AI is used to speed up the drug discovery process by analyzing vast datasets, identifying potential drug candidates, and optimizing clinical trials, making it a valuable tool for pharmaceutical companies in the North America AI Health Care market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.