North America Artificial Intelligence in Healthcare Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD4506

November 2024

89

About the Report

North America Artificial Intelligence in Healthcare Market Overview

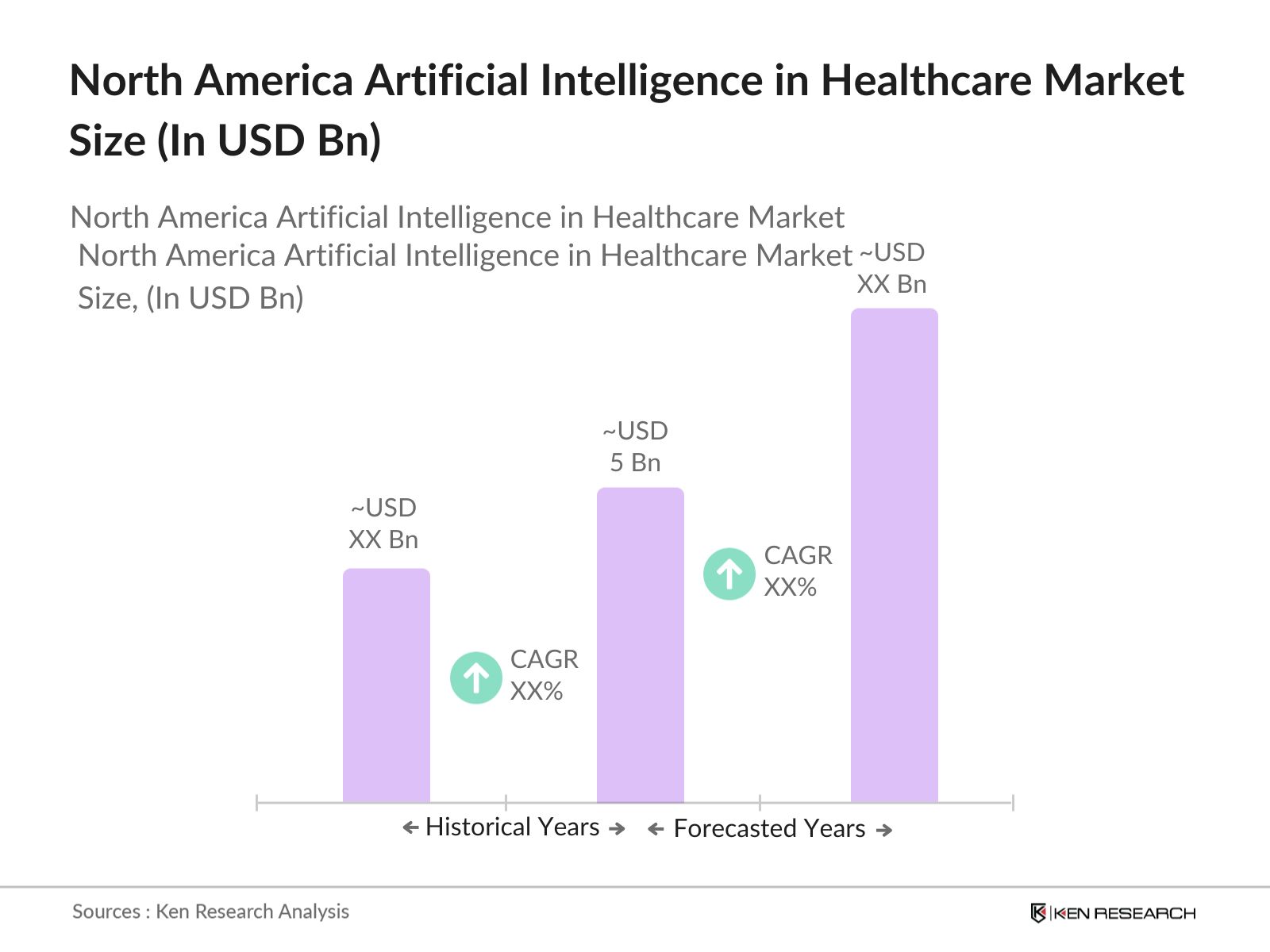

- The North America Artificial Intelligence in Healthcare Market is valued at USD 5 billion, driven primarily by the adoption of AI technologies in predictive analytics, patient data management, and clinical decision-making. Key advancements in cloud infrastructure, coupled with investments in AI-enabled drug discovery and diagnostics, are fueling the markets growth. Increased interest from public and private healthcare institutions is also contributing significantly to the adoption rate, with growth further supported by data governance standards in place.

- The United States and Canada lead the North American AI healthcare market, primarily due to advanced healthcare systems and substantial R&D funding. The U.S., in particular, benefits from a well-developed technology sector and significant government funding for healthcare innovations. Canadas dominance is bolstered by its focus on healthcare reforms and AI-driven public health programs, positioning it as a leading AI healthcare player.

- The FDA enforces strict regulations on AI-enabled medical devices, mandating rigorous validation to ensure patient safety. In 2024, 950 AI/ML-enabled medical devices were under FDA review, as indicated by the FDA's recent reports. The regulatory pathway for these devices requires consistent validation, impacting the time-to-market for innovative AI technologies. These regulations underscore the FDAs commitment to upholding safety in AI-driven healthcare applications.

North America Artificial Intelligence in Healthcare Market Segmentation

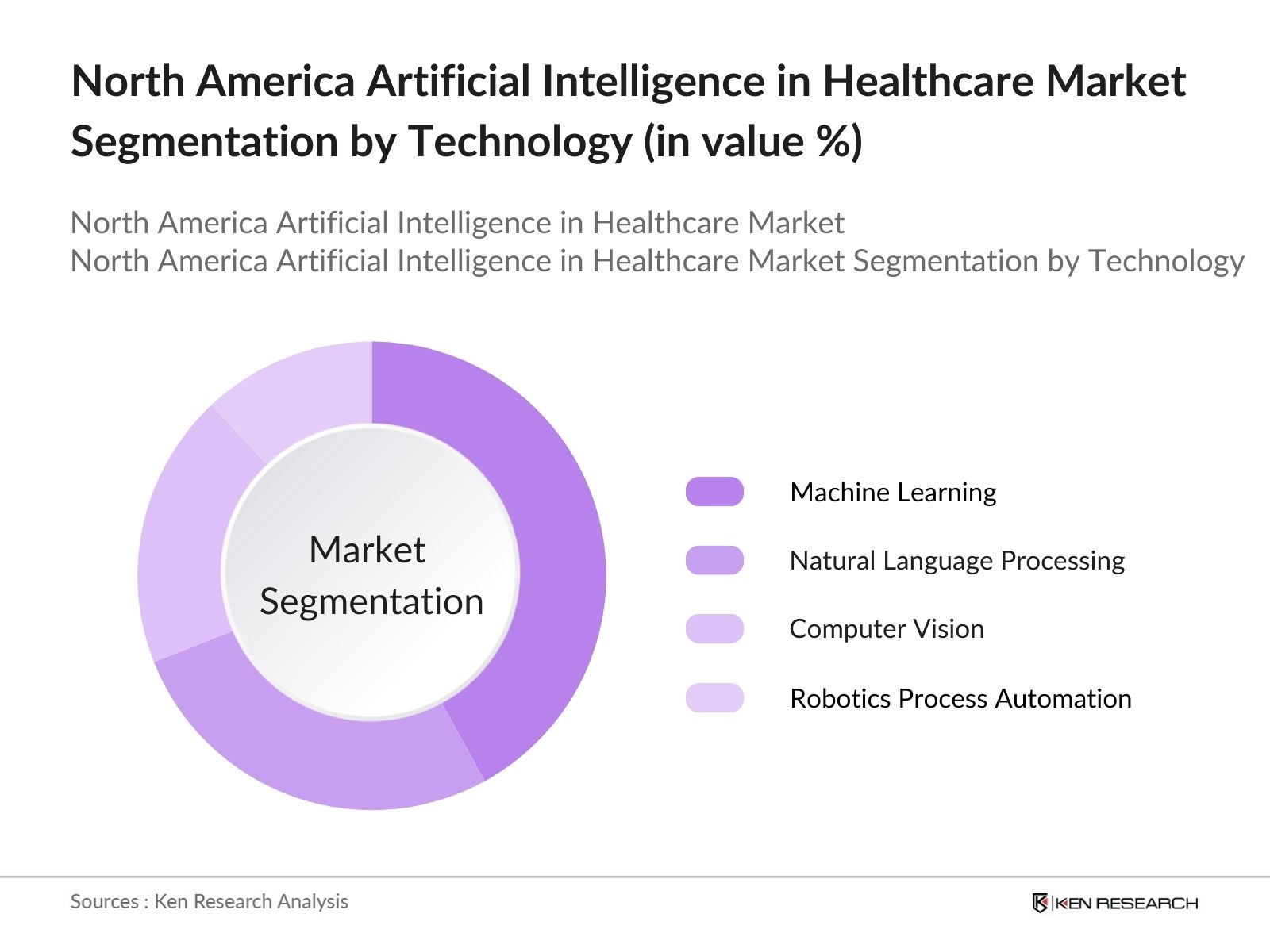

By Technology: The North America AI in Healthcare market is segmented by technology into Machine Learning, Natural Language Processing, Computer Vision, and Robotic Process Automation. Machine Learning (ML) holds the dominant market share due to its extensive applications in diagnostic imaging, personalized medicine, and predictive analytics. The vast datasets generated in the healthcare sector benefit significantly from ML algorithms, which enhance accuracy and efficiency in disease detection and treatment recommendations. ML's critical role in clinical workflows and real-time patient monitoring underpins its market dominance.

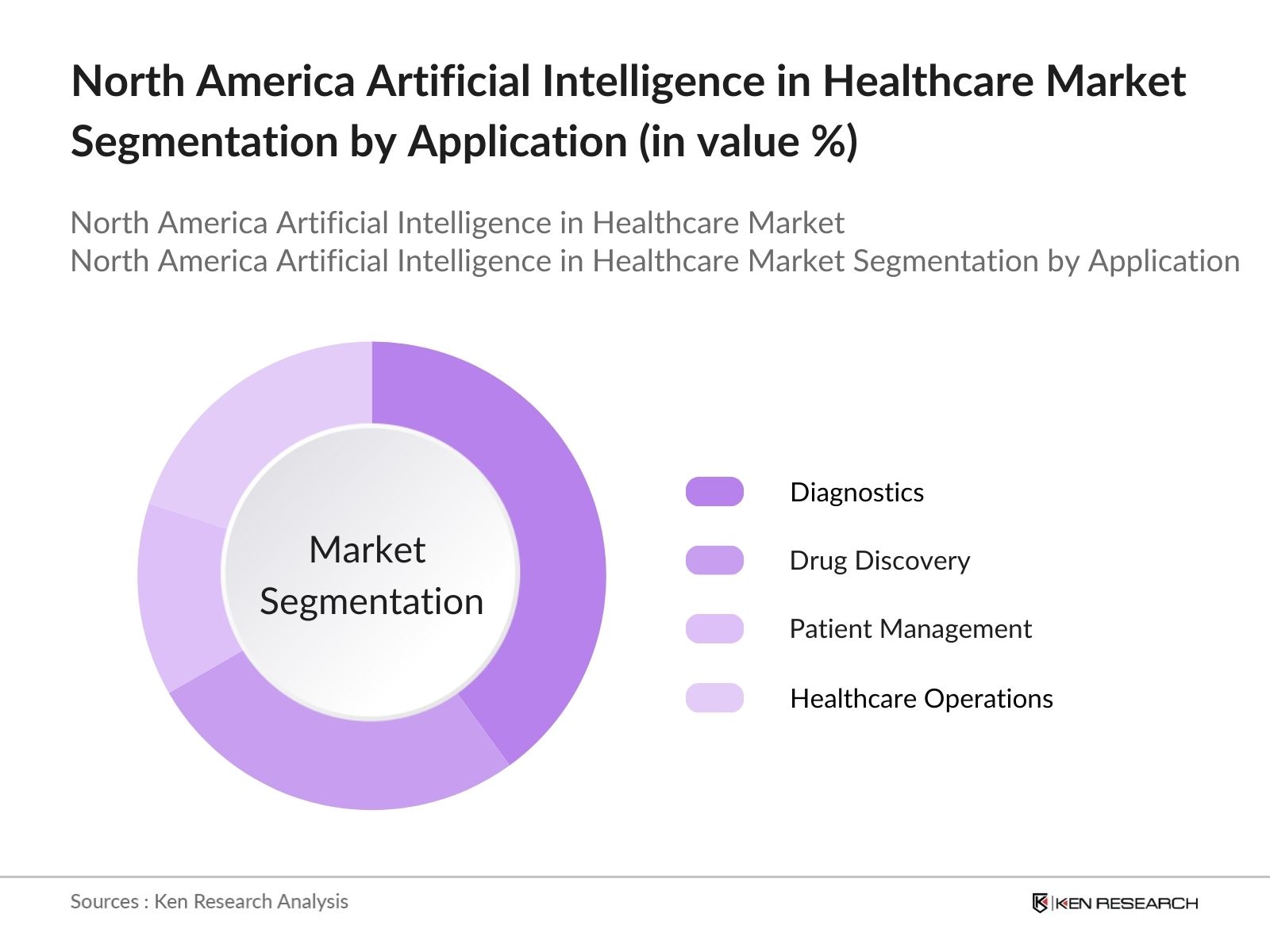

By Application: The AI healthcare market is also segmented by application, including Diagnostics, Drug Discovery, Patient Management, and Healthcare Operations. Diagnostics leads this segment, propelled by the need for precise and timely disease detection. AI-based diagnostic tools have been increasingly adopted across hospitals and clinics due to their high accuracy and ability to process large volumes of medical images. This segments prominence is driven by the growing demand for non-invasive diagnostic methods and AIs role in early-stage disease identification.

North America Artificial Intelligence in Healthcare Market Competitive Landscape

North America Artificial Intelligence in Healthcare Market Competitive Landscape

The North America Artificial Intelligence in Healthcare market is highly competitive, with key players strategically focused on R&D investments, partnerships, and expanding their product portfolios. Companies like IBM Watson Health and Microsoft Azure for Healthcare have established a strong foothold in AI healthcare applications, with an emphasis on robust technological integration and large-scale data handling. Global giants such as GE Healthcare and Amazon Web Services are also shaping the market, leveraging cloud solutions and computational power to enhance healthcare services.

North America Artificial Intelligence in Healthcare Market Analysis

Growth Drivers

- Growing Investments in AI-enabled Drug Discovery: In North America, AI-driven drug discovery investments have surged, with pharmaceutical companies allocating an average of $5 billion annually towards AI integration in drug development processes from 2022 to 2024. These investments enable rapid data processing for molecule analysis and reduce preclinical drug development times by nearly 50%, as reported by the National Institutes of Health (NIH). This AI adoption has contributed to identifying over 120 potential drug candidates in 2023 alone, supporting a shift toward data-intensive, precision-based drug discovery.

- Rising Demand for Predictive Analytics in Patient Management: Predictive analytics in patient management has gained significant traction, as 70% of U.S. healthcare providers adopted predictive AI tools to anticipate patient health risks by 2024. For example, AI-driven analytics assist in tracking high-risk conditions, reducing patient readmission rates by 15%, according to the Centers for Medicare & Medicaid Services. This technologys usage is expected to rise with the growing need for proactive and personalized healthcare solutions in North America, making it a vital tool for effective patient management.

- Enhanced Data Infrastructure: By 2024, more than 80% of healthcare institutions in North America have shifted to cloud-based EHR systems, facilitating enhanced data sharing and security for AI applications. The integration of cloud storage in healthcare has been shown to improve data retrieval times by up to 40%, as reported by the U.S. Department of Health. Additionally, AI applications embedded in cloud infrastructure contribute to significant reductions in data storage costs, with cloud-based EHR costing nearly 30% less than traditional systems, increasing the appeal for cloud-integrated healthcare solutions.

Challenges

- Data Privacy Concerns: Data privacy remains a key challenge in AI-enabled healthcare, with over 2 million reported cases of data breaches in the U.S. healthcare sector in 2023 alone. The Health Insurance Portability and Accountability Act (HIPAA) demands stringent patient data security, yet healthcare providers report a 25% rise in cyber threats since 2022. The increased data usage from AI models further emphasizes the need for robust data protection mechanisms, as data breaches can lead to financial penalties and damage patient trust.

- Limited Access to High-Quality Datasets: Access to high-quality datasets is limited, impacting the effectiveness of AI applications in healthcare. Approximately 45% of AI-driven healthcare applications face data quality issues, as per the U.S. Department of Health and Human Services. High-quality, standardized data for model training remains scarce, resulting in less accurate diagnostics and treatment outcomes. In 2023, over $1 billion was allocated by federal agencies to improve healthcare data accessibility, but challenges persist in obtaining data for smaller, specialized health conditions.

North America Artificial Intelligence in Healthcare Market Future Outlook

North America Artificial Intelligence in Healthcare market is expected to experience robust growth, driven by advancements in machine learning algorithms, expansion of cloud-based healthcare solutions, and the growing need for personalized medicine. AI-driven innovations in drug discovery, diagnostics, and patient management are anticipated to shape future trends, with significant investments from both public and private sectors. The focus on improving healthcare delivery and patient outcomes through AI integration positions this market for long-term growth.

Market Opportunities

- Expansion in Remote Patient Monitoring: The expansion of AI in remote patient monitoring offers significant growth potential, with nearly 35% of North American healthcare providers incorporating AI-based remote monitoring by 2024. The adoption of AI-driven wearable devices reduced hospital readmissions by 20%, as reported by the Centers for Disease Control and Prevention. Remote patient monitoring enables real-time health tracking for patients, especially in rural areas, highlighting the potential for AI in enhancing accessible healthcare services.

- Growth in AI Applications in Personalized Medicine: Personalized medicine stands as a promising opportunity, with AI models processing patient data to tailor specific treatment plans. By 2024, about 60% of healthcare institutions in North America utilize AI for personalized healthcare strategies, particularly in oncology and cardiology. According to the National Institutes of Health, AI has enabled tailored treatment options for over 500,000 patients in the past year, reflecting its potential to transform treatment precision and patient outcomes in North America.

Scope of the Report

|

Segment |

Sub-Segments |

|

Technology |

Machine Learning Natural Language Processing Computer Vision Robotics Process Automation |

|

Application |

Diagnostics Drug Discovery Patient Management Healthcare Operations |

|

Component |

Software Solutions Hardware Services |

|

Deployment Model |

Cloud-Based On-Premise Hybrid |

|

End User |

Hospitals and Clinics Pharmaceuticals and Biotechnology Companies Academic and Research Institutes Government Agencies |

Products

Key Target Audience

AI Solution Providers

Healthcare Providers (Hospitals, Clinics)

Pharmaceutical and Biotechnology Companies

Medical Device Manufacturers

Academic and Research Institutes

Cloud Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, HIPAA Compliant Authorities)

Companies

Players Mentioned in the Report

IBM Watson Health

Microsoft Azure for Healthcare

GE Healthcare

Amazon Web Services (AWS)

Philips Healthcare

NVIDIA Corporation

Google Health

Siemens Healthineers

Oracle Health

Intel Corporation

Table of Contents

1. North America Artificial Intelligence in Healthcare Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics and Landscape

1.4 Market Segmentation Overview

2. North America Artificial Intelligence in Healthcare Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Artificial Intelligence in Healthcare Market Analysis

3.1 Growth Drivers

3.1.1 Integration of AI with Clinical Workflows

3.1.2 Growing Investments in AI-enabled Drug Discovery

3.1.3 Rising Demand for Predictive Analytics in Patient Management

3.1.4 Enhanced Data Infrastructure (Cloud Integration, EHR Systems)

3.2 Market Challenges

3.2.1 Data Privacy Concerns

3.2.2 Limited Access to High-Quality Datasets

3.2.3 Regulatory Compliance Complexities

3.2.4 High Initial Costs for AI Infrastructure

3.3 Opportunities

3.3.1 Expansion in Remote Patient Monitoring

3.3.2 Growth in AI Applications in Personalized Medicine

3.3.3 AI in Genomic Data Analysis

3.3.4 Collaboration between Technology and Healthcare Sectors

3.4 Trends

3.4.1 AI-Driven Diagnostics Tools

3.4.2 Rise in AI-based Virtual Health Assistants

3.4.3 AI for Patient Triage and Screening

3.4.4 Edge AI in Wearable Devices

3.5 Regulatory Overview

3.5.1 HIPAA Compliance and AI

3.5.2 FDA Regulations on AI in Medical Devices

3.5.3 Data Governance Policies

3.5.4 Incentives for AI in Healthcare Innovations

3.6 Competitive Landscape

3.7 SWOT Analysis

3.8 Porters Five Forces Analysis

4. North America Artificial Intelligence in Healthcare Market Segmentation

4.1 By Technology (In Value %)

4.1.1 Machine Learning

4.1.2 Natural Language Processing

4.1.3 Computer Vision

4.1.4 Robotics Process Automation

4.2 By Application (In Value %)

4.2.1 Diagnostics

4.2.2 Drug Discovery

4.2.3 Patient Management

4.2.4 Healthcare Operations

4.3 By Component (In Value %)

4.3.1 Software Solutions

4.3.2 Hardware

4.3.3 Services

4.4 By Deployment Model (In Value %)

4.4.1 Cloud-Based

4.4.2 On-Premise

4.4.3 Hybrid

4.5 By End User (In Value %)

4.5.1 Hospitals and Clinics

4.5.2 Pharmaceuticals and Biotechnology Companies

4.5.3 Academic and Research Institutes

4.5.4 Government Agencies

5. North America Artificial Intelligence in Healthcare Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IBM Watson Health

5.1.2 NVIDIA Corporation

5.1.3 Microsoft Azure for Healthcare

5.1.4 GE Healthcare

5.1.5 Google Health

5.1.6 Philips Healthcare

5.1.7 Siemens Healthineers

5.1.8 Amazon Web Services (AWS) Healthcare

5.1.9 Intel Corporation

5.1.10 Oracle Health

5.2 Cross Comparison Parameters (Product Portfolio, Innovations in AI, Client Base, Regional Presence, AI Patent Filings, AI Integration Level, Revenue from Healthcare Segment, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

6. North America Artificial Intelligence in Healthcare Market Regulatory Framework

6.1 FDA Compliance for AI in Healthcare

6.2 GDPR and CCPA Implications on Healthcare Data

6.3 HIPAA Standards and AI

6.4 Certification Processes for AI-enabled Medical Devices

7. North America Artificial Intelligence in Healthcare Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Artificial Intelligence in Healthcare Market Analysts Recommendations

8.1 Total Addressable Market (TAM) Analysis

8.2 Serviceable Available Market (SAM) Analysis

8.3 Strategic Customer Analysis

8.4 Marketing Initiatives and Best Practices

8.5 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process initiates with a comprehensive analysis of the North America Artificial Intelligence in Healthcare market ecosystem. This includes defining critical market variables and identifying primary drivers, challenges, and stakeholders to build a foundational understanding of market dynamics.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess AI penetration in healthcare, examining growth rates, technology adoption, and regional variations. Market segmentation by technology and application is conducted, considering both the healthcare and technology industries perspectives to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through industry expert interviews conducted via structured surveys. These consultations with professionals from AI, healthcare, and policy fields help refine data points and provide real-world insights into emerging trends.

Step 4: Research Synthesis and Final Output

The final step involves aggregating data from primary and secondary sources to provide a comprehensive view of the market. All insights are synthesized into a report, with validations to ensure data accuracy, and practical recommendations for stakeholders are included.

Frequently Asked Questions

01. How big is the North America Artificial Intelligence in Healthcare Market?

The North America Artificial Intelligence in Healthcare market is valued at USD 5 billion, largely driven by technological advancements and increased healthcare digitization efforts across the region.

02. What are the primary challenges in the North America Artificial Intelligence in Healthcare Market?

Key challenges in North America Artificial Intelligence in Healthcare market include data privacy concerns, high costs of AI technology implementation, and regulatory compliance complexities, which slow down the markets expansion in healthcare.

03. Who are the major players in the North America Artificial Intelligence in Healthcare Market?

Prominent companies in North America Artificial Intelligence in Healthcare market include IBM Watson Health, Microsoft Azure for Healthcare, GE Healthcare, Amazon Web Services, and Philips Healthcare. Their leadership stems from their technological innovations, strategic partnerships, and large-scale infrastructure.

04. What factors are driving growth in the North America Artificial Intelligence in Healthcare Market?

Growth in North America Artificial Intelligence in Healthcare market is driven by the rising demand for predictive analytics, patient data management, and advancements in AI capabilities that enhance clinical decision-making and diagnostic accuracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.