North America Aseptic Packaging Market Outlook to 2030

Region:North America

Author(s):Sanjana

Product Code:KROD2353

October 2024

99

About the Report

North America Aseptic Packaging Market Overview

- North America Aseptic Packaging Market was valued at USD 11 billion in 2023, driven by increasing demand for shelf-stable food and beverages, and advanced packaging technologies. Growth is further fueled by the need for sustainable packaging solutions, with aseptic packaging minimizing food wastage and reducing the need for preservatives.

- Major players include Tetra Pak, Amcor, SIG Combibloc, and Sealed Air. These companies have a large market share due to their technological advancements and large-scale production capabilities. Tetra Pak, for instance, holds a dominant position due to its strong global presence and investments in sustainable aseptic packaging solutions. Amcor has also significantly expanded its aseptic product lines, driven by increasing demand in the food and beverage sector.

- In 2024, Tetra Pak has launched an innovative Industrial Protein Mixer designed to enhance efficiency in protein mixing processes. This new solution aims to eliminate foaming issues and reduce operational costs, making it a significant advancement for food and beverage manufacturers. The mixer is part of Tetra Pak's commitment to sustainability and improving production processes, reflecting the company's focus on addressing consumer trends and enhancing food system transition.

- Cities such as Los Angeles, New York, and Chicago dominate the aseptic packaging market due to their large population base, high demand for packaged food and beverages, and the presence of major food and pharmaceutical companies. These urban centers are also hubs for innovation in packaging technologies, driven by consumer preferences for healthier, longer-lasting products and sustainability trends.

North America Aseptic Packaging Market Segmentation

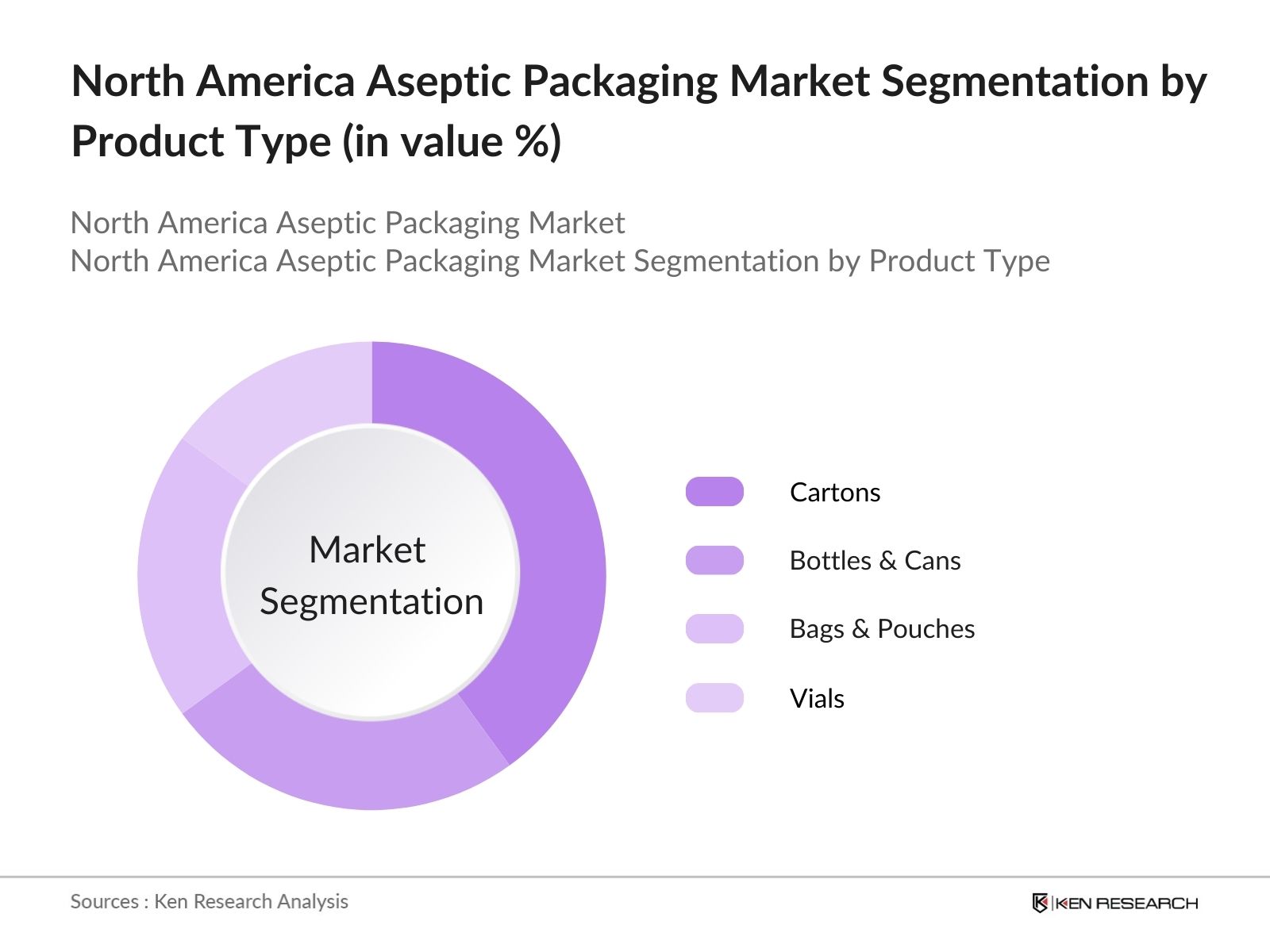

By Product Type: North America Aseptic Packaging Market is segmented by product type into cartons, bottles and cans, bags and pouches, and vials. In 2023, cartons had the dominant market share in this segment, primarily due to their widespread use in the dairy and beverage industries. Cartons are preferred for their light weight, ability to preserve the freshness of liquid products without refrigeration, and recyclable nature, making them a popular choice for manufacturers focusing on sustainability.

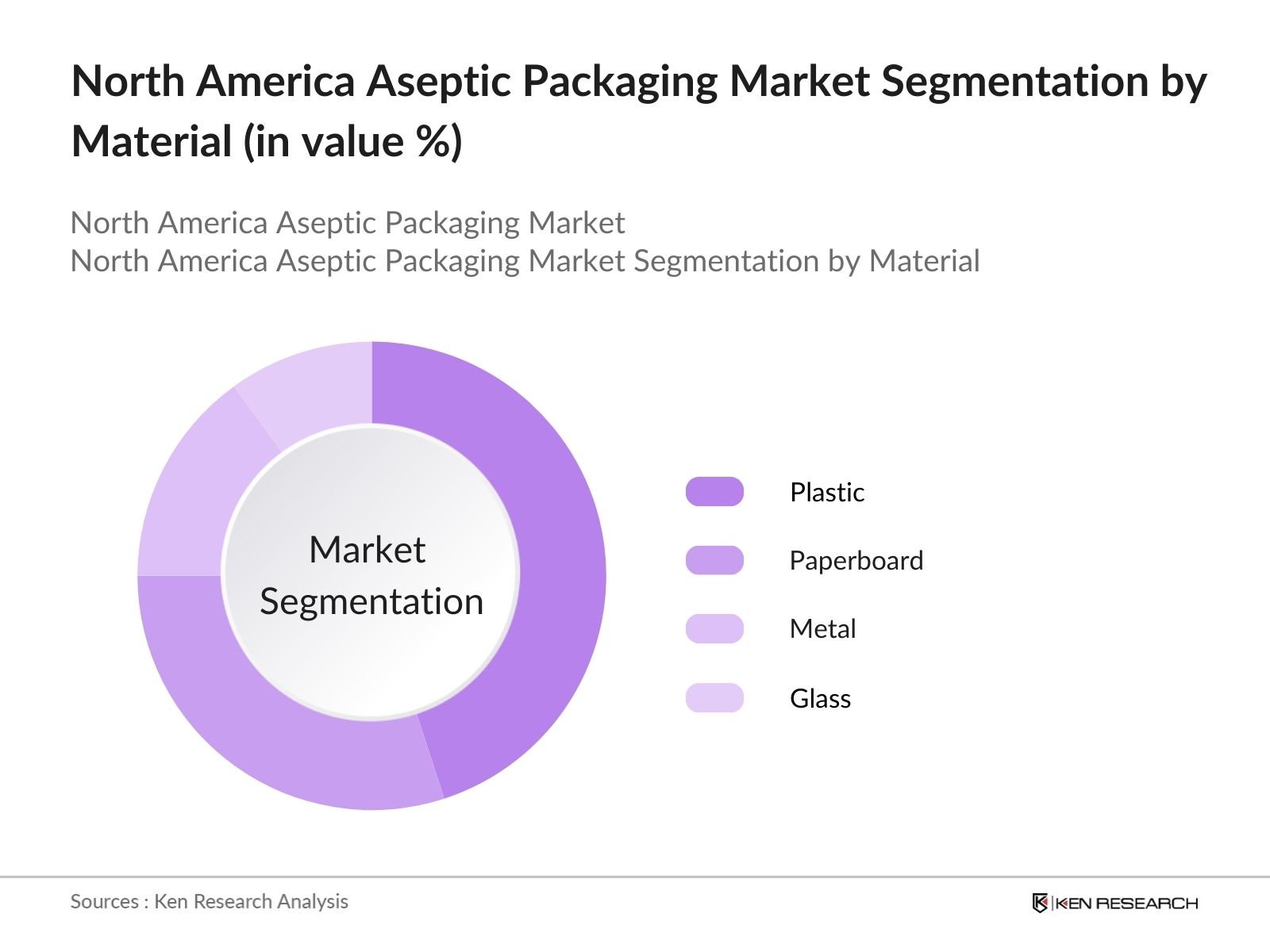

By Material: The aseptic packaging market is also segmented by material into plastic, paperboard, metal, and glass. In 2023, plastic aseptic packaging held the largest share due to its durability, cost-effectiveness, and flexibility in creating custom shapes for various products. However, increasing consumer awareness of environmental issues is driving companies to adopt paperboard solutions, as they are seen as a more sustainable and eco-friendlier alternative.

By Region: The North America aseptic packaging market is segmented regionally into the U.S. and Canada. In 2023, the U.S. held the dominant market share due to its large consumer base and well-established food and beverage industry. Canada's growing demand for packaged food, along with Mexicos expanding pharmaceutical sector, also contributed significantly to the markets growth in the region.

North America Aseptic Packaging Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Tetra Pak |

1951 |

Switzerland |

|

Amcor |

1860 |

Australia |

|

SIG Combibloc |

1853 |

Switzerland |

|

Sealed Air |

1960 |

U.S. |

|

DS Smith |

1940 |

U.K. |

- Amcors Sustainability Push: In 2024, Amcor has announced a significant expansion of its dairy packaging capacity at its facility in Afna, Egypt. This investment aims to enhance production capabilities and meet the growing demand for dairy products in the region. The expansion will include advanced technology and sustainable practices, reinforcing Amcor's commitment to innovation and environmental responsibility in packaging solutions for the dairy industry.

- SIG Combiblocs Innovation: In 2023, SIG Combibloc opened a state-of-the-art aseptic carton packaging production facility in Queretaro, Mexico. This $78 million investment aims to enhance SIG's production capabilities for the North American market, with an initial capacity of 500 million carton packs per year, expected to increase to 1.2 billion in 2024. The facility is designed to respond quickly to customer demand and reduce delivery lead times.

North America Aseptic Packaging Industry Analysis

Growth Drivers:

- Increased Demand for Shelf-Stable Food Products: In the context of food waste, the U.S. discards nearly 60 million tons of food annually, which highlights a significant opportunity for shelf-stable food products that can help reduce waste by extending the usability of food items. The aseptic packaging technique helps preserve these foods without refrigeration, making it an attractive option for food manufacturers and distributors.

- Expansion of the Pharmaceutical Sector: The pharmaceutical industry's continued growth is another key driver for aseptic packaging. Innovations in packaging technologies, such as the use of recyclable materials and automation in aseptic processes, are expected to enhance market growth. These advancements not only improve efficiency but also cater to consumer preferences for hygiene and convenience.

- Rise in Regulatory Standards for Food Safety: The Codex Alimentarius, a collection of internationally recognized standards, guidelines, and codes of practice, is increasingly being adopted in North America. Compliance with these standards ensures product safety and reduces the risk of contamination, making aseptic packaging indispensable in the North American food and beverage industry.

Challenges:

- Complex Supply Chain Issues: The complex supply chain involved in aseptic packaging is another significant challenge. Several North American food manufacturers reported delays in obtaining aseptic packaging materials due to global supply chain disruptions. With reliance on imports for specific raw materials such as aluminum foils and specialized plastic films, these delays caused production backlogs and increased operational costs. Resolving these challenges is critical for the markets sustainable growth.

- Environmental Concerns: Despite being more sustainable than traditional packaging, aseptic packaging still faces scrutiny regarding its environmental impact. Recycling aseptic packaging is complicated due to the multi-layered materials (plastic, paper, and aluminum) used in the process. Few aseptic cartons were recycled in North America falling short of environmental targets. The difficulty of separating materials in recycling facilities remains a challenge, prompting industry players to find more eco-friendly solution.

North America Aseptic Packaging Market Government Initiatives

- USDA Agriculture Innovation Agenda: The Agriculture Innovation Agenda (AIA) was initiated by the U.S. Department of Agriculture (USDA) in early 2021. It was officially announced during the 2021 Agricultural Outlook Forum, which took place on February 18-19, 2021. The AIA is a comprehensive effort aimed at increasing U.S. agricultural production by 40% while simultaneously reducing the environmental footprint of agriculture by half by the year 2050. It is likely to drive demand for sustainable solutions like aseptic packaging in North America's agricultural and food sectors.

- Canadas Zero Plastic Waste Strategy: This initiative is part of a broader Canada-wide Strategy on Zero Plastic Waste, which was approved in 2018. It aims to achieve significant reductions in plastic waste by 2030. This includes commitments to recycle and reuse at least 55% of plastic packaging and to recover 100% of all plastics by 2040. This policy directly impacts the aseptic packaging industry, requiring manufacturers to develop more recyclable aseptic packages and materials to comply with these new regulations.

North America Aseptic Packaging Future Market Outlook

North America aseptic packaging market is expected to experience robust growth over the next five years, driven by increasing demand for sustainable and eco-friendly packaging solutions. As regulatory bodies impose stricter standards for food safety and environmental sustainability, the market is set to benefit from innovations in biodegradable materials and advanced manufacturing technologies.

Future Trends

- Development of Fully Recyclable Aseptic Packaging: The focus will shift toward fully recyclable aseptic packaging materials. Companies are expected to invest heavily in creating multi-layered packaging that can be efficiently separated and recycled, responding to both consumer demand and government regulations. This trend will see the introduction of new packaging solutions that combine sustainability with product longevity.

- Growth in Pharmaceutical Packaging: As the North American pharmaceutical sector continues to grow, demand for aseptic packaging will increase, particularly for biologics and injectable drugs. Aseptic packaging will play a critical role in maintaining product sterility and meeting FDA guidelines. The development of specialized packaging for biologics and personalized medicines will be a key area of innovation in the market.

Scope of the Report

|

North America Aseptic Packaging Market Segmentation |

|

|

By Product Type |

Cartons Bottles and Cans Bags and Pouches Vials |

|

By Material |

Plastic Paperboard Metal Glass |

|

By Region |

USA |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Food and Beverage Manufacturers

Pharmaceutical Companies

Contract Packaging Manufacturers

Sustainable Packaging Innovators

Packaging Machinery Manufacturers

Logistics and Distribution Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Tetra Pak

Amcor

SIG Combibloc

Sealed Air

DS Smith

UFlex

Elopak

WestRock

Greatview Aseptic Packaging

Ecolean

Mondi Group

Smurfit Kappa

Wihuri Group

Liqui-Box

Sonoco Products Company

Table of Contents

1. North America Aseptic Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Aseptic Packaging Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

2.4 Market Size Forecast

3. North America Aseptic Packaging Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Demand for Shelf-Stable Food and Beverages

3.1.2 Adoption of Sustainable Packaging Solutions

3.1.3 Innovations in Aseptic Packaging Technologies

3.2 Restraints

3.2.1 Complex Supply Chain Issues

3.2.2 Environmental Concerns (Recycling challenges)

3.3 Opportunities

3.3.1 Expanding Pharmaceutical Sector

3.3.2 Demand for Recyclable and Biodegradable Packaging

3.4 Trends

3.4.1 Shift Toward Fully Recyclable Aseptic Packaging

3.4.2 Growth in Pharmaceutical and Biologics Packaging

3.4.3 Integration of Advanced Manufacturing Technologies

3.5 Regulatory Landscape

3.5.1 Food Safety Regulations (Codex Alimentarius, FDA Guidelines)

3.5.2 Environmental Standards (Zero Plastic Waste Strategy in Canada)

4. North America Aseptic Packaging Market Segmentation (5 segments)

4.1 By Product Type (In value %)

4.1.1 Cartons

4.1.2 Bottles and Cans

4.1.3 Bags and Pouches

4.1.4 Vials

4.2 By Material (In value %)

4.2.1 Plastic

4.2.2 Paperboard

4.2.3 Metal

4.2.4 Glass

4.3 By Application (In value %)

4.3.1 Food and Beverages

4.3.2 Pharmaceuticals

4.3.3 Dairy Products

4.3.4 Nutritional Products

4.4 By Region (In value %)

4.4.1 United States

4.4.2 Canada

4.4.3 Mexico

4.5 By End-User Industry (In value %)

4.5.1 FMCG Companies

4.5.2 Pharmaceutical Manufacturers

4.5.3 Dairy Industry

4.5.4 Nutraceutical Companies

5. Competitive Landscape (15 competitors)

5.1 Market Share Analysis (Financial and operational metrics)

5.2 Strategic Initiatives

5.2.1 Product Launches

5.2.2 Mergers and Acquisitions

5.3 Key Competitors (Including financial parameters such as revenue)

5.3.1 Tetra Pak

5.3.2 Amcor

5.3.3 SIG Combibloc

5.3.4 Sealed Air

5.3.5 DS Smith

5.3.6 UFlex

5.3.7 Elopak

5.3.8 WestRock

5.3.9 Greatview Aseptic Packaging

5.3.10 Ecolean

5.3.11 Mondi Group

5.3.12 Smurfit Kappa

5.3.13 Wihuri Group

5.3.14 Liqui-Box

5.3.15 Sonoco Products Company

6. Industry Analysis

6.1 Supply Chain Analysis

6.2 Impact of Supply Chain Disruptions

6.3 Technological Innovations in Aseptic Packaging Processes

6.4 Sustainable Manufacturing Practices

7. Market Regulations

7.1 Food and Safety Compliance Standards

7.2 Environmental Impact Regulations

7.3 Certification Processes for Aseptic Packaging Materials

8. North America Aseptic Packaging Market Future Outlook

8.1 Key Market Projections and Forecast

8.2 Factors Driving Future Market Growth

8.3 Key Emerging Trends

9. North America Aseptic Packaging Market Investment Analysis

9.1 Venture Capital Funding and Investment Trends

9.2 Government Initiatives and Grants

9.3 Private Equity Investments in Aseptic Packaging Technologies

10. Analysts Recommendations for Market Entry and Growth

10.1 TAM/SAM/SOM Analysis

10.2 Key Consumer Cohorts

10.3 Strategic Growth Initiatives for Manufacturers

11. Conclusion

11.1 Key Takeaways

11.2 Market Opportunities & Strategic Imperatives

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on North America Aseptic Packaging Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Aseptic Packaging Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple Aseptic Packaging companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Aseptic Packaging companies.

Frequently Asked Questions

01 How big is North America Aseptic Packaging Market?

North America Aseptic Packaging Market was valued at USD 11 billion in 2023, driven by increasing demand for shelf-stable food and beverages, and advanced packaging technologies.

02 What are the challenges in the North America Aseptic Packaging Market?

Challenges of North America Aseptic Packaging Market include high capital investment for setting up aseptic packaging lines, complex supply chains, and environmental concerns related to the recycling of multi-layered packaging materials, which can complicate sustainability efforts.

03 What are the growth drivers of North America Aseptic Packaging Market?

North America Aseptic Packaging Market is propelled by the growing demand for shelf-stable food products, the expansion of the pharmaceutical sector, and increasing regulatory standards for food safety, which encourage the adoption of aseptic packaging solutions.

04 Who are the major players in the North America Aseptic Packaging Market?

Key players in North America Aseptic Packaging Market include Tetra Pak, Amcor, SIG Combibloc, Sealed Air, and DS Smith. These companies dominate the market due to their technological innovations, large production capacities, and focus on sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.