North America Assistive Technology Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD7725

December 2024

88

About the Report

North America Assistive Technology Market Overview

- The North America Assistive Technology Market is valued at USD 8.7 billion, driven by the rising elderly population and increasing demand for devices that aid individuals with disabilities. This growth is further fueled by advancements in healthcare technology and favourable government regulations. Assistive devices such as mobility aids, hearing aids, and vision assistance tools have seen widespread adoption, with growing awareness of disability rights and insurance coverage across the region bolstering the market.

- In North America, the United States dominates the assistive technology market due to its robust healthcare infrastructure, R&D investment, and strong regulatory support for assistive technologies. The availability of advanced assistive devices and high healthcare expenditure contribute to the leadership of U.S. cities such as New York, Los Angeles, and Chicago. Additionally, Canada's emphasis on disability inclusion and growing investments in healthcare technology make it a prominent player in the market.

- The Americans with Disabilities Act (ADA) has been a crucial regulation in ensuring accessibility for individuals with disabilities. As of 2023, ADA-compliant devices and services have expanded subatntially, with businesses and public institutions required to provide accessible technology solutions. The ADA mandates that public entities must accommodate individuals with disabilities, driving demand for assistive technologies like screen readers, hearing aids, and mobility devices. This legislation has been instrumental in ensuring market growth by enforcing compliance.

North America Assistive Technology Market Segmentation

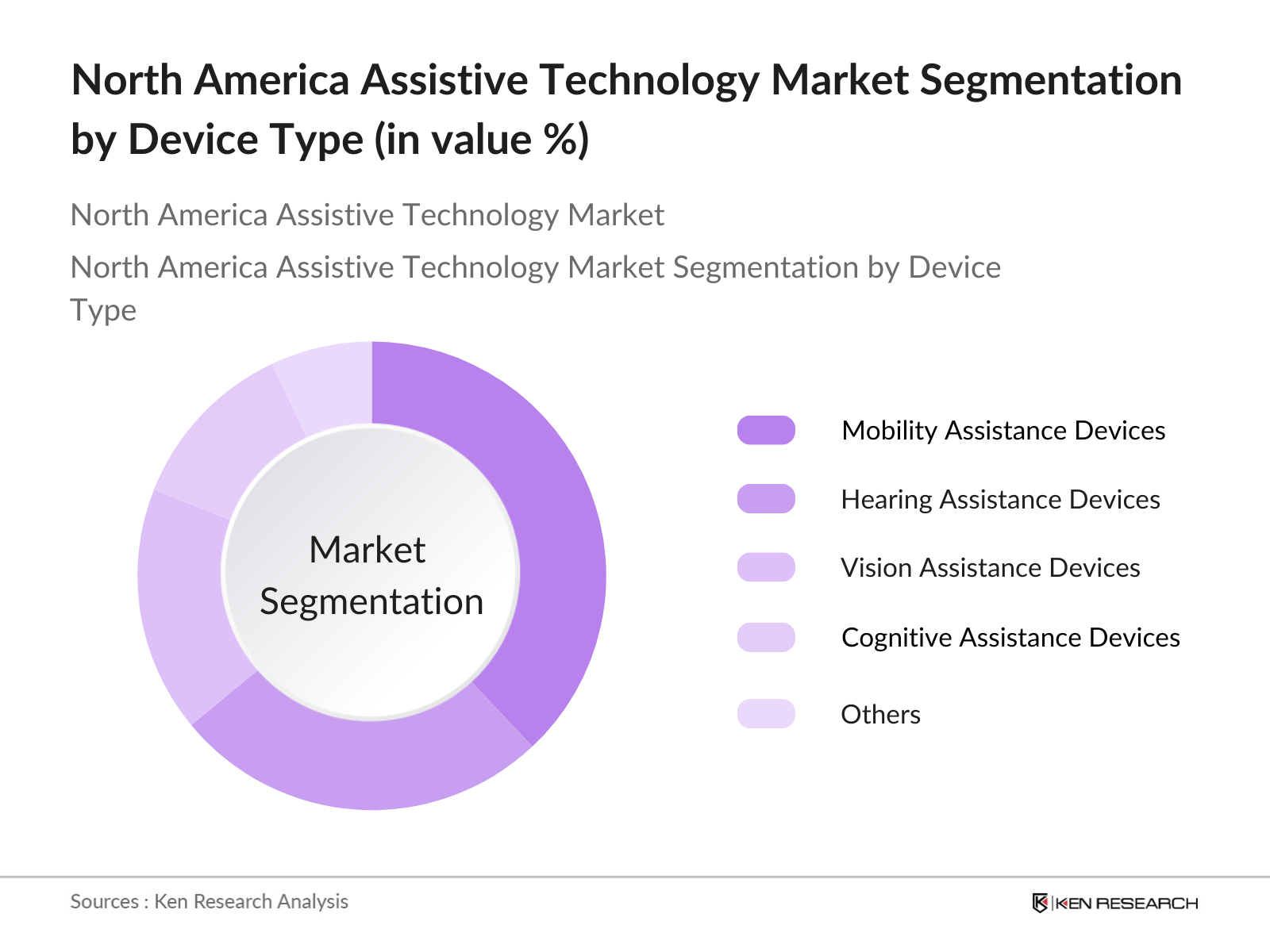

- By Device Type: The North America Assistive Technology Market is segmented by device type into mobility assistance devices, hearing assistance devices, vision assistance devices, cognitive assistance devices, and others. Recently, mobility assistance devices, including wheelchairs and walkers, have held a dominant market share. The dominance is attributed to the growing aging population and the increasing incidence of mobility impairments due to age-related conditions. Moreover, technological advancements in powered wheelchairs and exoskeletons have also propelled growth in this segment.

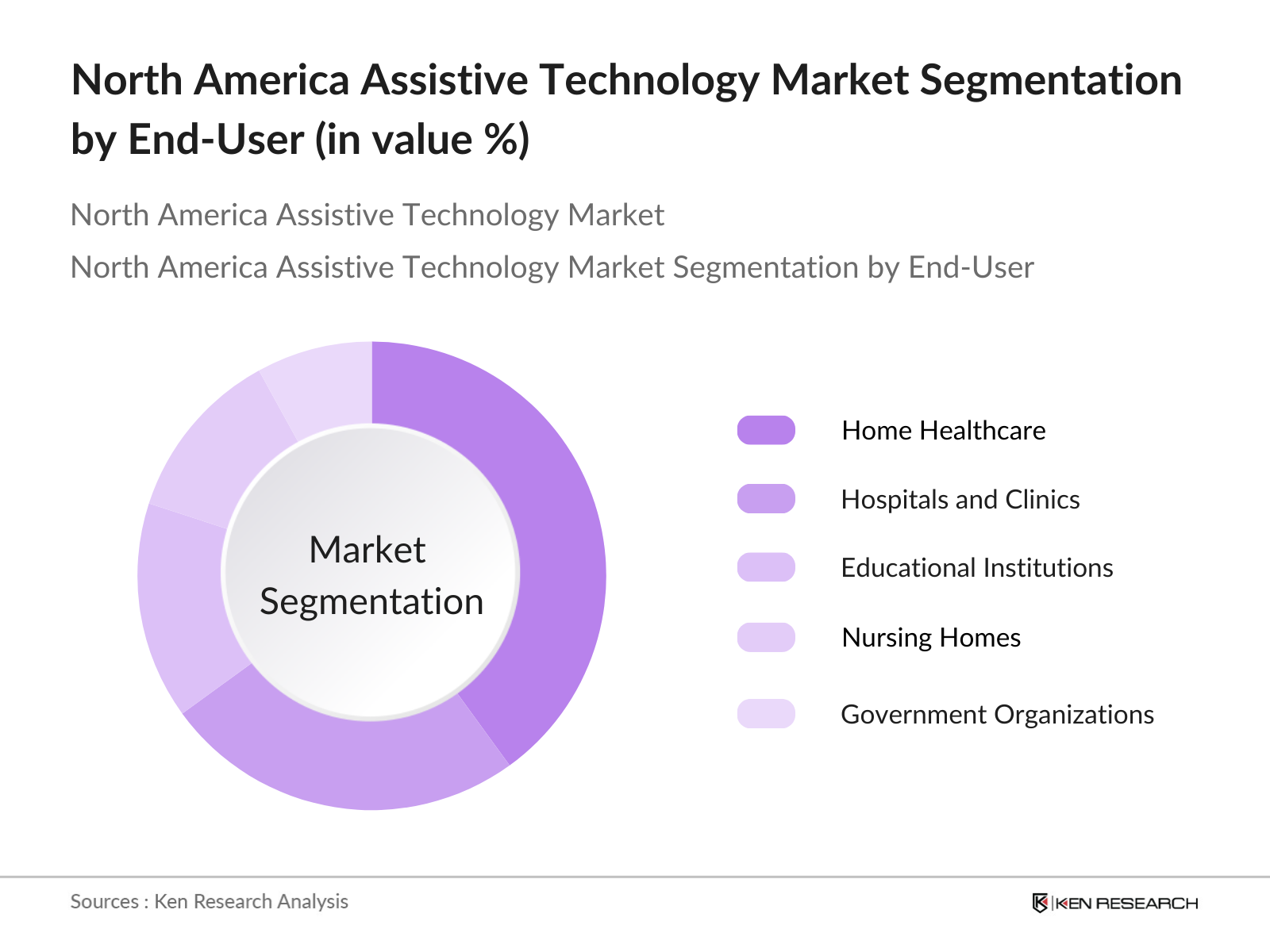

- By End-User: The market is further segmented by end-users into hospitals and clinics, home healthcare, educational institutions, nursing homes, and government organizations. The home healthcare segment is the largest end-user, driven by the increasing preference for home-based care among elderly patients and those with chronic conditions. Home healthcare services allow patients to use assistive technologies in the comfort of their homes, reducing hospital visits and improving overall quality of life. The rise of telehealth and remote monitoring technologies has also boosted the adoption of assistive devices in this segment.

North America Assistive Technology Market Competitive Landscape

The North America Assistive Technology Market is dominated by a few key players, including large multinational corporations and local companies offering niche solutions. These players focus on continuous innovation, strategic collaborations, and expanding their product portfolios to maintain their competitive edge. The consolidation of the market reflects the influence of major players, who leverage their established brands, distribution networks, and R&D capabilities to capture market share.

North America Assistive Technology Market Analysis

North America Assistive Technology Market Growth Drivers

- Aging Population Growth: The aging population in North America is a major growth driver for the assistive technology market. According to the U.S. Census Bureau, by 2024, the number of Americans aged 65 and older is projected to surpass 58 million, representing a notable portion of the population. This demographic is more prone to age-related disabilities, such as mobility impairments, hearing loss, and vision problems, driving the demand for assistive technologies. The rising elderly population places increasing pressure on healthcare systems, which in turn promotes investment in advanced assistive devices to ensure the quality of life for seniors.

- Rising Disability Cases: An increase in the number of people with disabilities is a key driver for assistive technology. According to the Centers for Disease Control and Prevention (CDC), as of 2022, around 61 million adults in the U.S. live with a disability. This number is expected to increase with the growing population and higher rates of chronic diseases. Disabilities related to mobility, cognition, and sensory functions are prevalent and require assistive devices for day-to-day living. The need for products such as hearing aids, wheelchairs, and communication aids continues to expand as disability cases rise, creating demand for innovation and accessibility in this market.

- Increased Insurance Coverage for Assistive Devices: Insurance coverage for assistive devices has expanded in recent years, boosting the markets growth. According to the National Association of Insurance Commissioners (NAIC), many private insurance companies now offer coverage for a range of assistive technologies, including mobility devices, hearing aids, and communication aids. In 2023, insurance coverage for such devices increased by 15%, helping reduce out-of-pocket expenses for individuals requiring these technologies. This expansion of coverage is expected to further increase access to assistive devices, addressing both the medical and non-medical needs of users across North America.

North America Assistive Technology Market Challenges

- High Costs of Assistive Technology: The high cost of assistive technology remains a major barrier to widespread adoption. Devices such as advanced prosthetics, powered wheelchairs, and communication aids often come with hefty price tags. According to the Rehabilitation Engineering and Assistive Technology Society of North America (RESNA), the average cost of a powered wheelchair in 2023 was between $10,000 and $15,000, making it inaccessible for many without substantial financial aid. This high cost, combined with limited insurance coverage in some regions, continues to restrict market growth despite technological advancements.

- Limited Access to Assistive Services in Rural Areas: Rural areas in North America face challenges in accessing assistive technology services. The U.S. Department of Agriculture (USDA) reports that nearly 19% of the U.S. population lives in rural regions, where healthcare and assistive services are limited. Rural residents often experience long travel distances to access specialized care and technology, exacerbating the disparity in healthcare service distribution. Additionally, rural areas frequently lack the necessary infrastructure to support high-tech assistive devices, which limits adoption and usage rates. Bridging this access gap remains a key challenge in the market.

North America Assistive Technology Market Future Outlook

Over the next five years, the North America Assistive Technology Market is expected to witness substantial growth, driven by increasing demand for personalized assistive solutions, technological advancements, and expanded healthcare access. Government initiatives promoting disability rights and the growing awareness of assistive technology among both consumers and healthcare providers are also likely to boost market growth. Additionally, innovations such as AI-based assistive devices, IoT integration, and 3D-printed assistive technologies are set to revolutionize the market, making devices more affordable and customizable.

North America Assistive Technology Market Opportunities

- Growing Demand for Wearable Assistive Technology: The demand for wearable assistive technology is increasing rapidly, with devices like smartwatches, exoskeletons, and smart glasses gaining popularity. In 2023, wearable technology accounted for 18% of the global assistive tech market, driven by innovations in mobility and sensory enhancement. These devices enable users to monitor their health, improve mobility, and enhance sensory experiences, appealing particularly to younger disabled individuals and active elderly populations. The integration of advanced sensors and real-time monitoring capabilities is a key driver of this growing demand.

- Expansion into Untapped Markets: North Americas assistive technology market holds vast potential for expansion into underserved and untapped regions. In 2022, Canada and rural parts of the U.S. reported lower adoption rates of assistive technologies compared to urban centers. With increased government initiatives and funding allocations to these areas, there are opportunities to expand market reach. Companies investing in these regions can tap into a growing customer base that requires assistive solutions, particularly in rural healthcare and home-based care sectors.

Scope of the Report

Device Type | Mobility Assistance Devices Hearing Assistance Devices Vision Assistance Devices Cognitive Assistance Devices Others |

End-User | Hospitals and Clinics Home Healthcare Educational Institutions Nursing Homes Government Organizations |

Technology | Wearable Assistive Devices Standalone Assistive Devices Integrated Assistive Solutions AI-Based Assistive Technologies IoT-Enabled Assistive Devices |

Disability Type | Hearing Disabilities Visual Impairments Mobility Impairments Cognitive Disabilities Speech Impairments |

Region | United States Canada Mexico |

Products

Key Target Audience

Assistive Technology Device Manufacturers

Hospitals and Healthcare Providers

Home Healthcare Providers

Government and Regulatory Bodies (U.S. Food and Drug Administration, Centers for Medicare & Medicaid Services)

Insurance Companies

Banks and Financial Insitutions

Venture Capital Firms

Disability Advocacy Organizations

Rehabilitation Centers

Companies

Players Mentioned in the Report

Invacare Corporation

Medline Industries, Inc.

Sunrise Medical (US) LLC

Sonova Holding AG

Drive DeVilbiss Healthcare

Starkey Hearing Technologies

Permobil AB

ReSound

Widex A/S

Cochlear Limited

Table of Contents

1. North America Assistive Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Assistive Technology Devices Overview (Hearing Aids, Mobility Devices, Vision Aids, Cognitive Devices, Others)

2. North America Assistive Technology Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Assistive Technology Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population Growth

3.1.2. Rising Disability Cases

3.1.3. Technological Advancements in Assistive Devices

3.1.4. Government Support Programs and Funding

3.1.5. Increased Insurance Coverage for Assistive Devices

3.2. Market Challenges

3.2.1. High Costs of Assistive Technology

3.2.2. Limited Access to Assistive Services in Rural Areas

3.2.3. Low Adoption Rates Due to Stigma and Awareness

3.3. Opportunities

3.3.1. Growing Demand for Wearable Assistive Technology

3.3.2. Expansion into Untapped Markets

3.3.3. Integration with AI and IoT in Assistive Devices

3.3.4. Expansion of Home-Based Healthcare Solutions

3.4. Trends

3.4.1. Digitalization and Remote Access Assistive Devices

3.4.2. 3D-Printed Assistive Devices

3.4.3. Rise in Smart Assistive Devices for Independence

3.4.4. Shift Toward Customizable Assistive Solutions

3.5. Government Regulation

3.5.1. Americans with Disabilities Act (ADA) Compliance

3.5.2. Medicare & Medicaid Assistive Device Coverage

3.5.3. Federal and State-Level Reimbursement Policies

3.5.4. Disability Rights Legislation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (End-Users, Service Providers, Device Manufacturers, NGOs, Government Bodies)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape and Market Ecosystem

4. North America Assistive Technology Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Mobility Assistance Devices (Wheelchairs, Walkers, Canes)

4.1.2. Hearing Assistance Devices (Hearing Aids, Cochlear Implants)

4.1.3. Vision Assistance Devices (Braille Readers, Screen Readers, Magnifiers)

4.1.4. Cognitive Assistance Devices (Memory Aids, Reminder Systems)

4.1.5. Others (Assistive Software, Prosthetics)

4.2. By End-User (In Value %)

4.2.1. Hospitals and Clinics

4.2.2. Home Healthcare

4.2.3. Educational Institutions

4.2.4. Nursing Homes

4.2.5. Government Organizations

4.3. By Technology (In Value %)

4.3.1. Wearable Assistive Devices

4.3.2. Standalone Assistive Devices

4.3.3. Integrated Assistive Solutions

4.3.4. AI-Based Assistive Technologies

4.3.5. IoT-Enabled Assistive Devices

4.4. By Disability Type (In Value %)

4.4.1. Hearing Disabilities

4.4.2. Visual Impairments

4.4.3. Mobility Impairments

4.4.4. Cognitive Disabilities

4.4.5. Speech Impairments

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Assistive Technology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Invacare Corporation

5.1.2. Medline Industries, Inc.

5.1.3. Sunrise Medical (US) LLC

5.1.4. Permobil AB

5.1.5. Sonova Holding AG

5.1.6. GN Store Nord A/S

5.1.7. Starkey Hearing Technologies

5.1.8. Drive DeVilbiss Healthcare

5.1.9. ReSound

5.1.10. Cochlear Limited

5.1.11. Widex A/S

5.1.12. William Demant Holding A/S

5.1.13. Freedom Scientific

5.1.14. Tobii Dynavox

5.1.15. HumanWare

5.2 Cross Comparison Parameters (Revenue, Market Share, R&D Expenditure, Technological Leadership, Product Launches, Regional Penetration, Manufacturing Capacity, Innovation Score)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. North America Assistive Technology Market Regulatory Framework

6.1. Assistive Technology Standards (ISO, ANSI)

6.2. Reimbursement Policies and Coverage Rules

6.3. FDA Regulations for Assistive Devices

6.4. Compliance and Certification Processes

7. North America Assistive Technology Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Assistive Technology Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Disability Type (In Value %)

8.5. By Region (In Value %)

9. North America Assistive Technology Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the assistive technology ecosystem, identifying stakeholders such as device manufacturers, healthcare providers, and end-users. Extensive desk research is conducted, utilizing secondary databases and proprietary sources to gather industry data. The key variables influencing the market are disability rates, technological adoption, and healthcare expenditure.

Step 2: Market Analysis and Construction

Historical data is collected to assess the penetration of assistive technology in North America, focusing on the adoption rate of devices in key segments such as mobility and hearing aids. This data is cross-verified with healthcare spending statistics and revenue figures from device manufacturers to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading assistive technology companies are consulted via interviews to validate market hypotheses. These experts provide insights into operational challenges, technological advancements, and sales performance, which help refine the market analysis.

Step 4: Research Synthesis and Final Output

In the final step, the data gathered from desk research, expert consultations, and proprietary sources is synthesized to produce the final market report. This ensures a well-rounded and validated view of the North America Assistive Technology Market, highlighting growth opportunities and market trends.

Frequently Asked Questions

01. How big is the North America Assistive Technology Market?

The North America Assistive Technology Market is valued at USD 8.7 billion, driven by increasing demand for assistive devices, the aging population, and technological advancements in the sector.

02. What are the challenges in the North America Assistive Technology Market?

Key challenges in the North America Assistive Technology Market include high costs of advanced assistive devices, limited access to assistive technologies in rural areas, and low awareness levels among potential users regarding available assistive solutions.

03. Who are the major players in the North America Assistive Technology Market?

Major players in the North America Assistive Technology Market include Invacare Corporation, Medline Industries, Sunrise Medical, Sonova Holding AG, and Drive DeVilbiss Healthcare, all of whom hold market shares due to their extensive product offerings and strong distribution networks.

04. What are the growth drivers of the North America Assistive Technology Market?

The North America Assistive Technology Market is driven by an aging population, rising incidences of disabilities, advancements in assistive technology, and supportive government policies, especially around healthcare access and disability rights.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.