North America Automated Guided Vehicles Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4603

December 2024

85

About the Report

North America Automated Guided Vehicles (AGVs) Market Overview

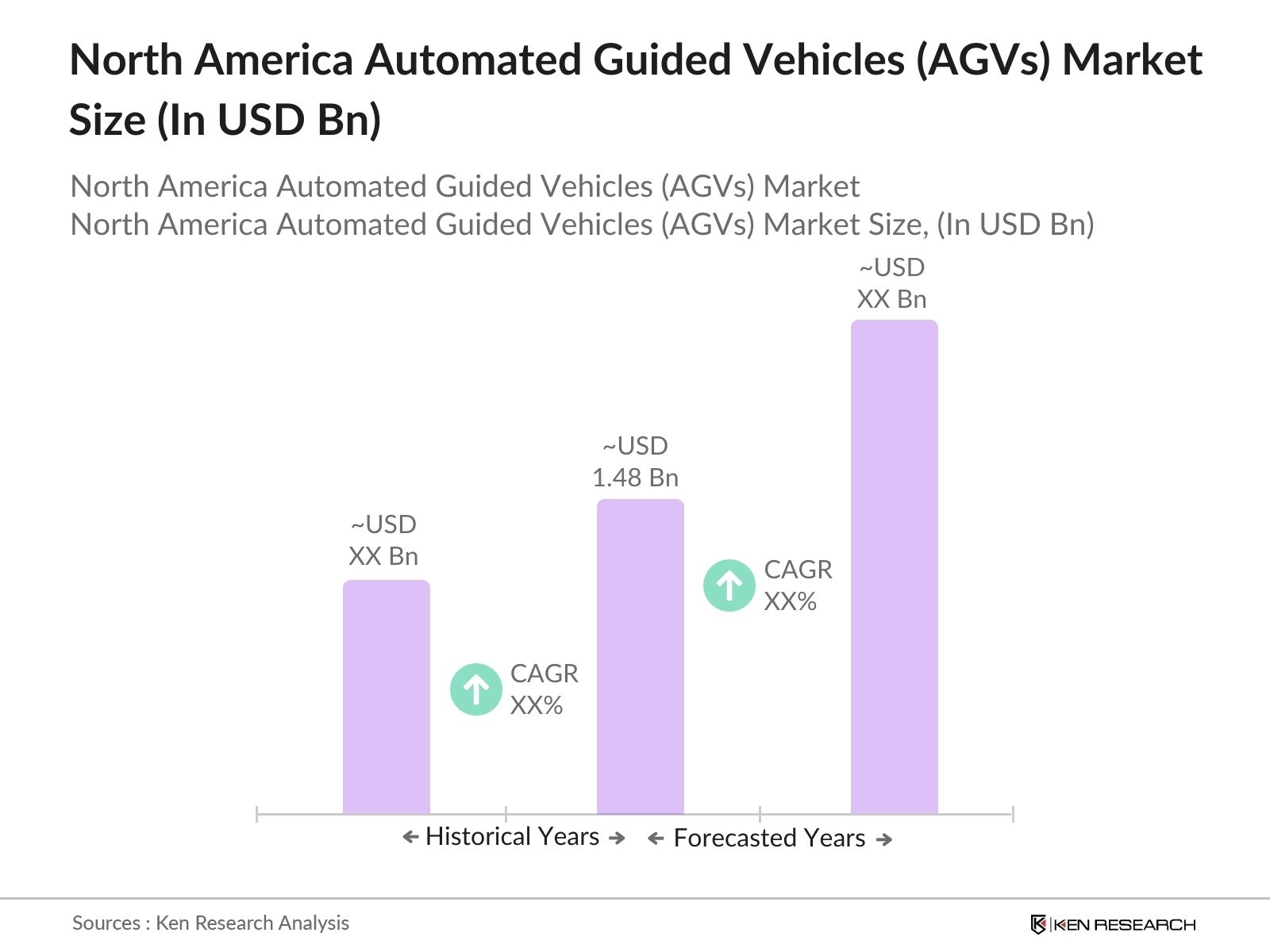

- The North America Automated Guided Vehicles (AGVs) market is valued at USD 1.48 billion based on a five-year historical analysis. This market is driven primarily by the increasing demand for automation across industries, including warehousing, manufacturing, and logistics. As companies face labor shortages and operational inefficiencies, AGVs provide a solution to improve productivity and reduce reliance on human labor. Additionally, the adoption of AI and machine learning technologies has enhanced AGV capabilities, pushing the market to grow steadily.

- In terms of regional dominance, the United States and Canada lead the North American AGVs market. This is largely due to the advanced industrial landscape, high labor costs, and the strong presence of e-commerce giants, which have been driving demand for automated systems in warehouses and distribution centers. The concentration of AGV manufacturers in these countries also boosts technological advancements and rapid adoption rates across various sectors, including automotive and retail logistics.

- The Canadian government has also played a proactive role in fostering automation through its Strategic Innovation Fund. In 2024, the fund allocated $300 million specifically for research and development in robotics, including AGVs, to enhance the competitiveness of Canadian manufacturers. The program has successfully stimulated AGV adoption in industries like aerospace and pharmaceuticals, positioning Canada as a leader in advanced automation technologies.

North America Automated Guided Vehicles (AGVs) Market Segmentation

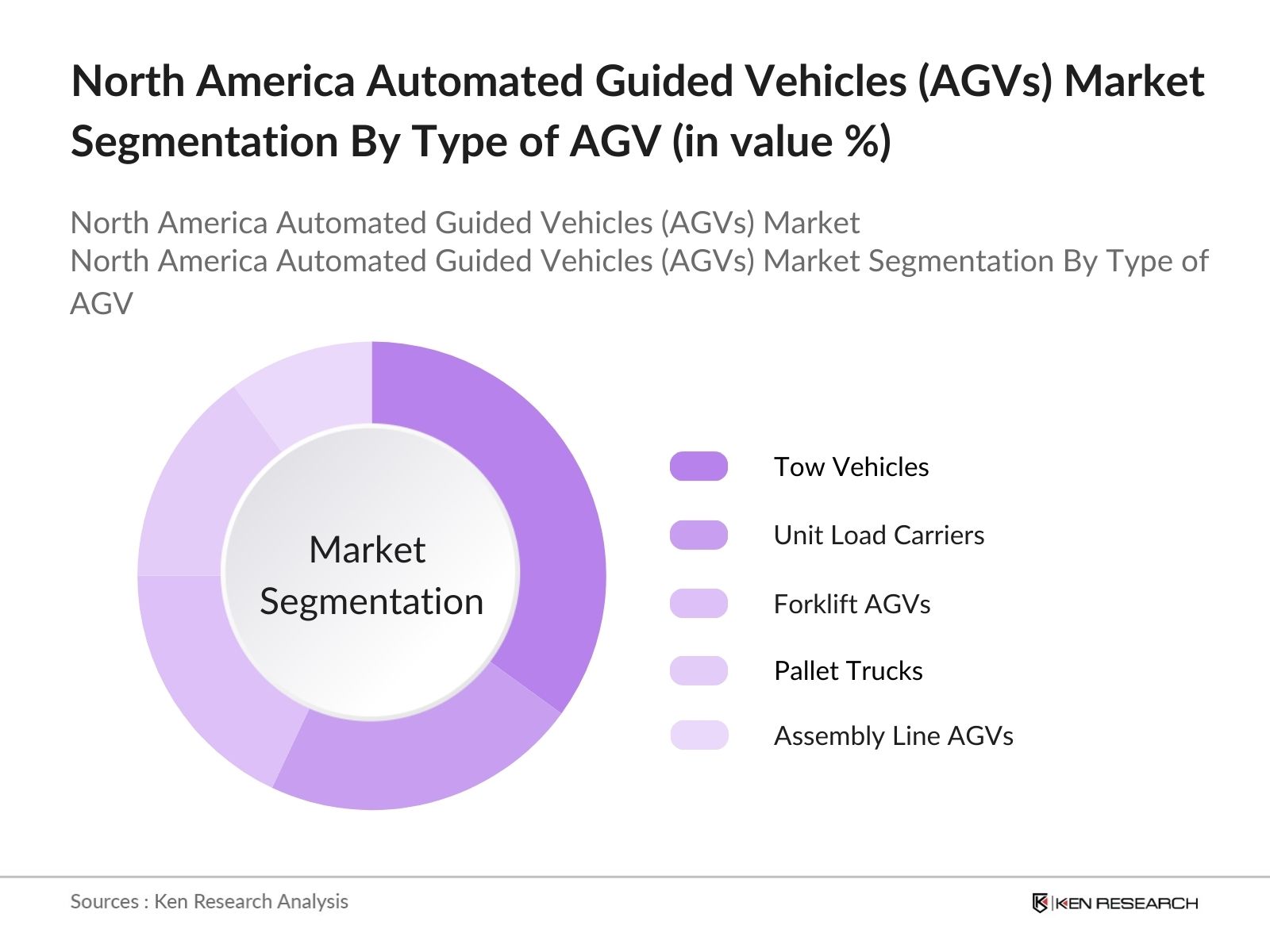

By Type of AGV: The North America AGVs market is segmented by type into tow vehicles, unit load carriers, forklift AGVs, pallet trucks, and assembly line AGVs. Recently, tow vehicles hold the dominant market share under this segmentation. This is due to their extensive use in both warehouses and manufacturing facilities, where they efficiently transport heavy loads over long distances. Their versatility in handling various types of goods and materials has made them a preferred option for large-scale industries.

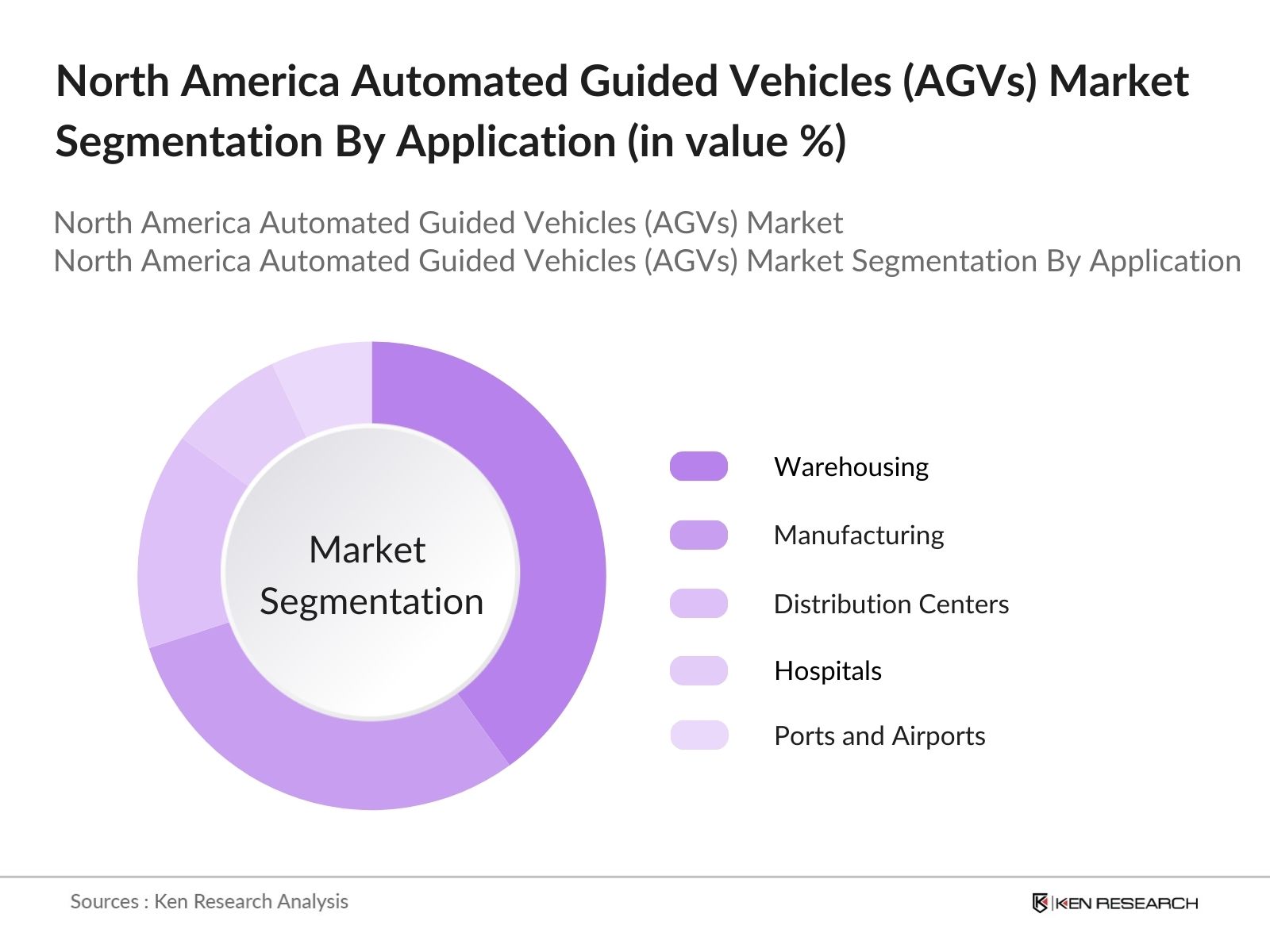

By Application: The market is further segmented by application into manufacturing, warehousing, distribution centers, hospitals, and ports. Warehousing is the leading sub-segment, driven by the rapid expansion of e-commerce and the need for efficient inventory management. Warehouses are increasingly adopting AGVs to streamline operations, reduce labor costs, and improve the accuracy of order fulfillment, especially for companies dealing with high-volume consumer goods.

North America Automated Guided Vehicles (AGVs) Market Competitive Landscape

The North America AGVs market is characterized by the presence of both regional and global players. The competition is driven by technological advancements, partnerships with third-party logistics providers, and the development of AI-powered AGVs. Key players in the market continue to focus on product innovation and strategic collaborations to maintain their market position.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Technology Leadership |

Product Portfolio |

Strategic Partnerships |

R&D Expenditure |

Market Share (%) |

|

Daifuku Co., Ltd. |

1937 |

Osaka, Japan |

- | - | - | - | - | - | - |

|

Toyota Industries Corp. |

1926 |

Kariya, Japan |

- | - | - | - | - | - | - |

|

JBT Corporation |

1884 |

Chicago, USA |

- | - | - | - | - | - | - |

|

Swisslog (KUKA Group) |

1900 |

Buchs, Switzerland |

- | - | - | - | - | - | - |

|

Seegrid Corporation |

2003 |

Pittsburgh, USA |

- | - | - | - | - | - | - |

North America Automated Guided Vehicles (AGVs) Market Analysis

Growth Drivers

- Increased Demand for Automation in Key Industries: The need for automation in manufacturing, automotive, and logistics has driven the adoption of AGVs in North America. As of 2024, the U.S. manufacturing sector increasingly relies on AGVs to improve operational efficiency and reduce production downtime. In the automotive sector alone, manufacturers produced over 8.8 million vehicles, with AGVs playing a pivotal role in streamlining assembly lines and enhancing precision in high-volume production environments. The logistics industry is also seeing AGVs mitigate bottlenecks, especially in high-demand e-commerce-driven warehouses.

- Labor Shortages in the Warehousing and Logistics Sector: Labor shortages across North America are a critical driver of AGV adoption. By 2024, the U.S. faced a deficit of 500,000 logistics workers, as noted by the Bureau of Labor Statistics. This shortage in a sector responsible for handling over 15 billion packages annually has propelled companies to turn to AGVs for more efficient material handling and storage solutions. AGVs have effectively reduced reliance on manual labor, maintaining order fulfillment rates and minimizing disruptions in an e-commerce-driven economy.

- Increased Efficiency in E-commerce Fulfillment: In 2023, North Americas e-commerce sector generated over $1.1 trillion in sales, increasing the pressure on logistics providers to deliver faster and more accurately. AGVs have become indispensable in large-scale distribution centers, streamlining operations by automating repetitive tasks such as sorting, picking, and palletizing. The rise of AGVs has enabled warehouses to handle growing volumes of online orders without compromising on delivery speed or accuracy, helping companies like Amazon and Walmart meet customer demand for faster deliveries.

Market Challenges

- High Capital Costs of AGV Deployment: AGVs require significant upfront investment, which is a major challenge for companies, especially small and medium-sized enterprises (SMEs). A single AGV system costs high, making it difficult for businesses with limited capital budgets to justify their purchase. Despite the potential for long-term cost savings, many firms are unable to allocate the resources necessary for large-scale automation projects, leading to slower adoption of AGVs across the industry.

- Integration with Legacy Systems: Many companies still operate legacy systems that are incompatible with modern AGV technologies. In 2023, over 35% of North American manufacturing firms reported integration challenges when attempting to implement AGVs alongside older inventory and enterprise resource planning (ERP) systems. The cost of upgrading these legacy systems to support AGVs can be prohibitive, and delays in resolving compatibility issues often result in significant downtime, offsetting the productivity gains that AGVs offer.

North America Automated Guided Vehicles (AGVs) Market Future Outlook

Over the next five years, the North America Automated Guided Vehicles (AGVs) market is expected to witness significant growth driven by increasing demand for automation in industries such as warehousing, manufacturing, and logistics. The integration of AI and IoT technologies will further enhance AGVs capabilities, making them more adaptable and efficient in real-time decision-making processes. As labor shortages continue to affect several industries, AGVs will be critical in ensuring operational efficiency and reducing costs.

Market Opportunities

- Integration of AI for Route Optimization and Predictive Maintenance: The integration of artificial intelligence (AI) into AGVs presents a major opportunity for optimizing performance and reducing operational costs. AI algorithms now allow AGVs to autonomously optimize routes based on real-time traffic and warehouse data, leading to a 15% increase in productivity in logistics operations, as noted by the U.S. Department of Transportation in 2024. Predictive maintenance enabled by machine learning can also significantly reduce downtime, with NIST reporting that early fault detection can extend AGV lifespan by 25%. This integration of AI offers a substantial return on investment for AGV adopters.

- Adoption of Hybrid AGVs: Hybrid AGVs, which combine multiple navigation technologies such as laser, magnetic, and optical guidance, are gaining traction in North America. In 2024, these AGVs accounted for 45% of new deployments, according to a report by the National Robotics Initiative. These systems offer greater flexibility and adaptability in complex environments, allowing them to navigate around obstacles and adjust to changing layouts in real-time. Adoption of these systems is expanding in sectors like pharmaceuticals and automotive, where precision and adaptability are critical to operational success.

Scope of the Report

|

By Type of AGV |

Tow Vehicles Unit Load Carriers Forklift AGVs Pallet Trucks Assembly Line AGVs |

|

By Application |

Manufacturing Warehousing Distribution Centers Hospitals Ports and Airports |

|

By Navigation Technology |

Laser Guided Magnetic Tape Vision Guidance GPS-Guided |

|

By Component |

Hardware (Sensors, Controllers) Software (Fleet Management) Services (Installation) |

|

By End-User Industry |

Automotive Food & Beverage Pharmaceuticals Retail Electronics |

Products

Key Target Audience

AGVs Manufacturers

Warehouse and Distribution Centers

Automotive Industry

Food and Beverage Companies

Pharmaceutical Companies

Logistics and 3PL Providers

Government and Regulatory Bodies (e.g., OSHA, U.S. Department of Labor)

Investors and Venture Capital Firms

Companies

Players Mentioned in the Report

Daifuku Co., Ltd.

Toyota Industries Corporation

JBT Corporation

Swisslog (KUKA Group)

Seegrid Corporation

Crown Equipment Corporation

Murata Machinery, Ltd.

Dematic (KION Group)

Bastian Solutions, LLC

Kollmorgen

Table of Contents

1. North America Automated Guided Vehicles (AGVs) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Automated Guided Vehicles (AGVs) Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Automated Guided Vehicles (AGVs) Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Automation in Manufacturing

3.1.2. Labor Shortages in Warehousing and Logistics

3.1.3. Technological Advancements in AGVs (AI, Machine Learning, Robotics Integration)

3.1.4. Expansion of E-commerce and Just-In-Time Manufacturing

3.2. Market Challenges

3.2.1. High Capital Investment and Deployment Costs

3.2.2. Integration Issues with Legacy Systems

3.2.3. Cybersecurity Threats in AGVs Systems

3.2.4. Limited Awareness and Skilled Workforce

3.3. Opportunities

3.3.1. Integration of AI for Route Optimization and Predictive Maintenance

3.3.2. Adoption of Hybrid AGVs (Laser, Magnetic, and Optical Navigation Systems)

3.3.3. Expansion into Smaller Warehouses and SMEs

3.3.4. Partnerships between AGVs Manufacturers and 3PL Providers

3.4. Trends

3.4.1. Growing Popularity of Fleet Management Systems

3.4.2. Collaboration Between AGVs and Autonomous Mobile Robots (AMRs)

3.4.3. Integration with IoT and 5G Networks for Real-time Data

3.4.4. Adoption of Sustainable AGV Models (Electric AGVs)

3.5. Regulatory Environment

3.5.1. U.S. Safety Standards for Autonomous Systems (ANSI, ISO)

3.5.2. Data Protection and Cybersecurity Regulations

3.5.3. Trade Regulations Impacting Imports of AGVs Components

3.5.4. Government Funding Initiatives for Automation in Logistics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. North America Automated Guided Vehicles (AGVs) Market Segmentation

4.1. By Type of AGV (In Value %)

4.1.1. Tow Vehicles

4.1.2. Unit Load Carriers

4.1.3. Forklift AGVs

4.1.4. Pallet Trucks

4.1.5. Assembly Line AGVs

4.2. By Application (In Value %)

4.2.1. Manufacturing

4.2.2. Warehousing

4.2.3. Distribution Centers

4.2.4. Hospitals and Healthcare

4.2.5. Ports and Airports

4.3. By Navigation Technology (In Value %)

4.3.1. Laser Guided Navigation

4.3.2. Magnetic Tape Guidance

4.3.3. Vision Guidance

4.3.4. GPS-Guided AGVs

4.4. By Component (In Value %)

4.4.1. Hardware (Sensors, Controllers, Motors)

4.4.2. Software (Fleet Management Systems, Maintenance Solutions)

4.4.3. Services (Installation, Maintenance, Retrofit Services)

4.5. By End-User Industry (In Value %)

4.5.1. Automotive

4.5.2. Food & Beverage

4.5.3. Pharmaceuticals

4.5.4. Retail and E-commerce

4.5.5. Electronics and Electricals

5. North America Automated Guided Vehicles (AGVs) Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Daifuku Co., Ltd.

5.1.2. KION Group AG

5.1.3. JBT Corporation

5.1.4. Toyota Industries Corporation

5.1.5. Murata Machinery, Ltd.

5.1.6. Kollmorgen

5.1.7. Seegrid Corporation

5.1.8. E&K Automation GmbH

5.1.9. Swisslog (KUKA Group)

5.1.10. Dematic (KION Group)

5.1.11. Bastian Solutions, LLC

5.1.12. Crown Equipment Corporation

5.1.13. Oceaneering International, Inc.

5.1.14. AGVE Group

5.1.15. Fetch Robotics

5.2 Cross Comparison Parameters (Company Size, Geographic Presence, Revenue, Product Portfolio, Technology Leadership, Innovation Capabilities, Key Partnerships, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Incentives

5.9. R&D Initiatives and Product Innovations

6. North America Automated Guided Vehicles (AGVs) Market Regulatory Framework

6.1. Compliance with Safety Standards (ISO 3691-4)

6.2. Cybersecurity Requirements for Autonomous Systems

6.3. Industry 4.0 and Digital Factory Regulations

6.4. Emissions Regulations for Electric AGVs

7. North America Automated Guided Vehicles (AGVs) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (E-commerce, Green Logistics, Urbanization)

8. North America Automated Guided Vehicles (AGVs) Future Market Segmentation

8.1. By Type of AGV (In Value %)

8.2. By Application (In Value %)

8.3. By Navigation Technology (In Value %)

8.4. By Component (In Value %)

8.5. By End-User Industry (In Value %)

9. North America Automated Guided Vehicles (AGVs) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved constructing a detailed ecosystem map of the North America AGVs market, identifying key stakeholders such as manufacturers, suppliers, and end-users. Desk research was conducted using industry databases and publications to define crucial variables influencing the market.

Step 2: Market Analysis and Construction

This phase included collecting historical market data, analyzing AGV adoption rates across industries, and assessing revenue generation. This analysis provided a foundation for evaluating the competitive landscape and potential growth opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market dynamics were tested through interviews with industry experts, including AGV manufacturers and logistics professionals. Insights from these consultations helped refine the analysis and verify the data collected.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged with manufacturers and logistics companies to confirm our findings. This step ensured the accuracy of the data and allowed for a comprehensive and validated market report on the North America AGVs market.

Frequently Asked Questions

01. How big is the North America Automated Guided Vehicles (AGVs) Market?

The North America AGVs market is valued at USD 1.48 billion, driven by rising demand for automation in industries such as warehousing and manufacturing. Technological advancements in AI and robotics are further fueling market growth.

02. What are the key challenges in the North America AGVs market?

The primary challenges in the North America AGVs market include the high capital costs associated with implementing AGVs, integration difficulties with existing systems, and cybersecurity concerns, especially in highly automated environments.

03. Who are the major players in the North America AGVs Market?

Key players in the North America AGVs market include Daifuku Co., Ltd., Toyota Industries Corporation, JBT Corporation, Swisslog (KUKA Group), and Seegrid Corporation. These companies lead the market due to their robust technological capabilities and extensive industry experience.

04. What are the growth drivers for the North America AGVs market?

Growth drivers in the North America AGVs market include the increasing demand for automation, the rise of e-commerce, labor shortages, and advancements in AI and robotics technologies that enhance AGV performance and versatility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.