North America Automotive Air Filters Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD4451

December 2024

94

About the Report

North America Automotive Air Filters Market Overview

- The North America automotive air filters market is valued at USD 6 billion, driven by increasing demand for air filtration systems amidst rising vehicle sales and environmental regulations targeting emissions control. Stringent governmental policies aimed at reducing airborne pollutants from vehicles and the surge in automotive production fuel this market's expansion. Advanced automotive technology adoption, particularly in the United States and Canada, underpins the markets growth trajectory, supported by strong economic conditions and consumer demand for efficient air filtration.

- In the North America automotive air filters market, the United States dominates due to its large vehicle manufacturing base and established automotive sector. The countrys high consumer preference for passenger vehicles with enhanced air filtration features further strengthens its position. Additionally, Canada contributes significantly owing to the growing demand for premium vehicles equipped with advanced filtration systems, driven by the rising awareness regarding air quality and health concerns associated with pollutants.

- The Environmental Protection Agencys Tier 3 emissions standards mandate a reduction of sulfur content in gasoline to 10 parts per million, which indirectly increases demand for effective air filters in gasoline vehicles. Automotive companies must comply with these regulations to reduce pollutants, bolstering the need for filters that can handle stringent environmental requirements.

North America Automotive Air Filters Market Segmentation

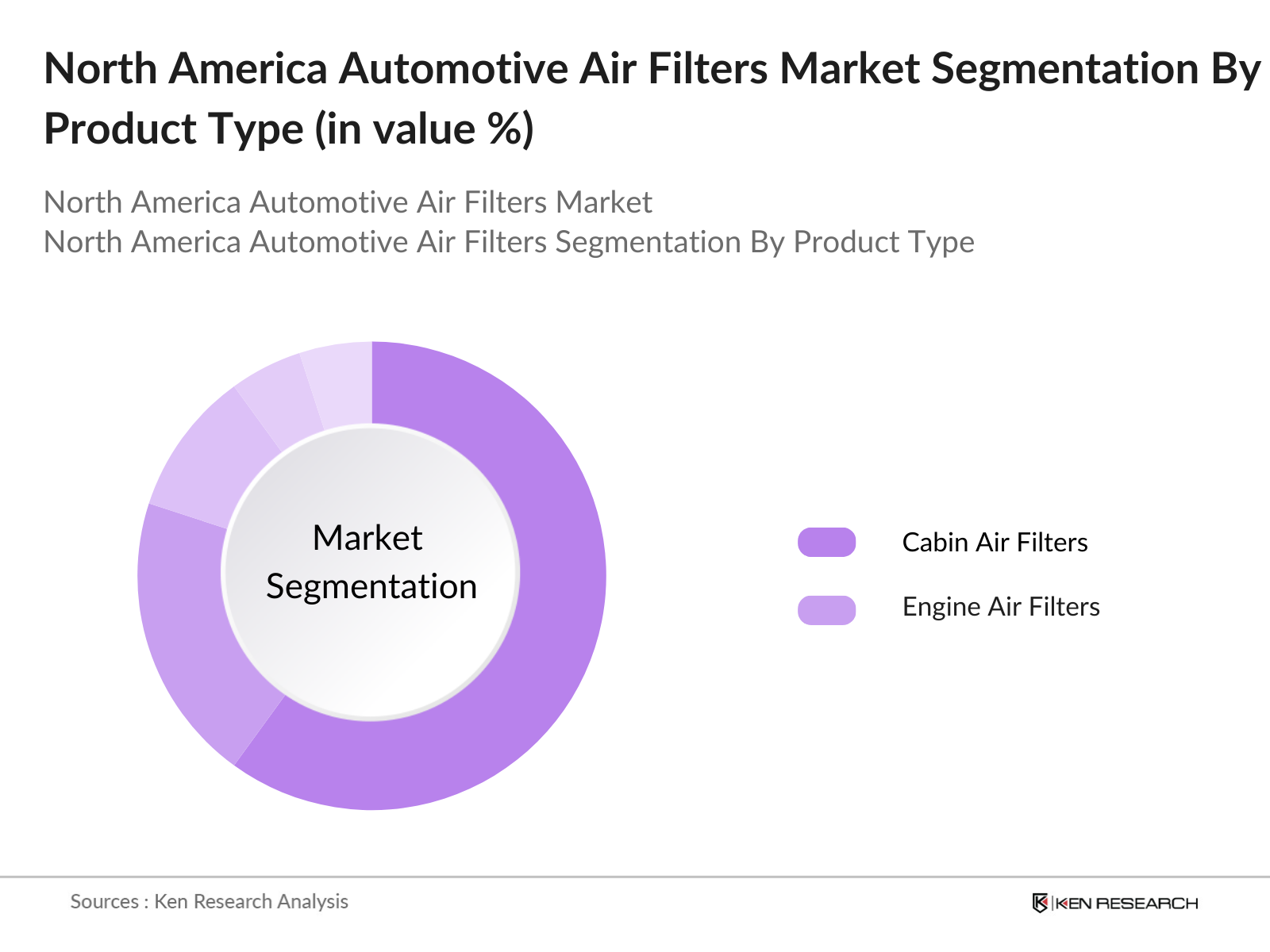

By Product Type: The North America automotive air filters market is segmented by product type into Cabin Air Filters and Engine Air Filters. Cabin air filters hold a significant market share under product type, driven by consumer awareness regarding indoor air quality and health. These filters help eliminate pollutants like pollen, dust, and other airborne contaminants within the vehicle cabin, enhancing passenger comfort. The demand for cabin air filters is particularly high in urban regions where pollution levels are elevated, further driving the need for effective air filtration systems.

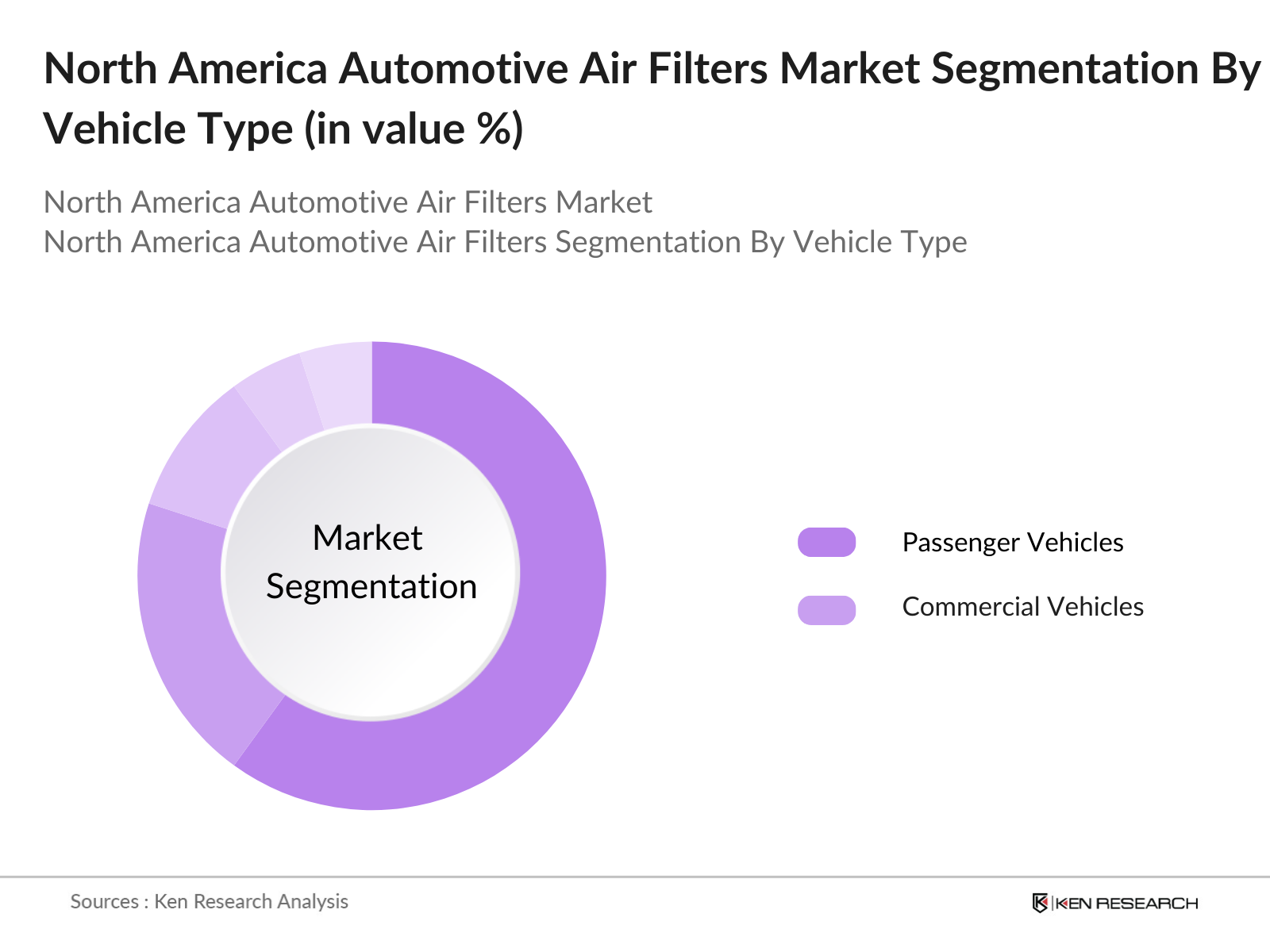

By Vehicle Type: The North America automotive air filters market is further segmented by vehicle type into Passenger Vehicles and Commercial Vehicles. Passenger vehicles hold a dominant share within this segment due to the increasing use of private vehicles and rising consumer demand for comfort and clean air. The higher volume of passenger vehicles on the road and greater emphasis on air quality in enclosed spaces contribute to this segment's leading position in the market. Demand for luxury cars, which often come with premium air filtration systems, also fuels growth.

North America Automotive Air Filters Market Competitive Landscape

The North America automotive air filters market is dominated by a few major players who significantly influence market trends and product innovation. Key players include Fram Group, Denso Corporation, Robert Bosch GmbH, and others who provide a wide array of air filtration products suited to various automotive applications. These companies have a strong distribution network and advanced R&D capabilities, making them prominent in the competitive landscape.

North America Automotive Air Filters Market

Growth Drivers

- Increasing Vehicle Production: North America has experienced a surge in vehicle manufacturing, with approximately 10 million vehicles produced annually in the United States. This increase supports the demand for automotive air filters as necessary components, especially in states like Michigan and Texas, which have seen consistent production growth due to expanded manufacturing capabilities. The automotive sector's resilience in these regions directly impacts the need for high-performance air filtration systems.

- Rising Environmental Regulations: The Environmental Protection Agency (EPA) has enforced stricter emission standards in 2024, compelling automakers to incorporate advanced filtration systems to meet new pollutant reduction mandates. Regulations under the Clean Air Act continue to target vehicle emissions, requiring advanced air filters that can capture smaller pollutants more efficiently, a key factor for automakers in compliance.

- Technological Advancements in Filtration: Innovations such as high-efficiency particulate air (HEPA) filters and nanofiber materials have boosted air filter performance, capturing pollutants at microscopic levels. In 2024, HEPA filter advancements have reduced particle contamination by 99.97%, a key selling point among automakers focusing on vehicle longevity and consumer health benefits. This technological edge has heightened consumer preference for vehicles with advanced filtration features, aligning with trends in personal health awareness.

Challenges

- High Raw Material Costs: The cost of raw materials such as synthetic fibers and activated carbon increased by 20% in 2024, a result of supply chain disruptions. This increase has put pressure on filter manufacturers to maintain quality standards while keeping production costs sustainable, creating a challenging pricing scenario for the industry. Material sourcing and cost predictability are key issues affecting manufacturers profitability.

- Supply Chain Disruptions: The automotive supply chain has faced interruptions due to geopolitical tensions and logistical bottlenecks, leading to an average 30% increase in lead times for air filter component deliveries in 2024. These delays impact production timelines for automotive manufacturers, contributing to fluctuations in air filter availability and putting added pressure on industry logistics to meet consumer demand.

North America Automotive Air Filters Future Outlook

The North America automotive air filters market is poised for significant growth over the next five years. This expansion is expected to be driven by the tightening of emission regulations, advancements in filtration technology, and the increasing focus on health-conscious consumer preferences. The growing popularity of electric vehicles, which often require specialized filtration solutions for both cabin and engine components, is likely to open new avenues within the market. Industry players are anticipated to invest in R&D to meet the evolving standards, fostering innovation and sustainable growth.

Market Opportunities

- Expansion in Electric Vehicles: The North American electric vehicle (EV) market saw a surge in sales, reaching 5 million units, which drives demand for specific air filters designed for EV platforms. As EVs gain popularity, air filter manufacturers can innovate to create specialized filters for EV interiors, a growing segment that requires tailored filtration solutions to meet health and maintenance standards.

- Innovations in Filter Materials: With advances in graphene and nanofiber technology, filter materials have achieved higher filtration efficiency, targeting ultra-fine particles and pathogens. In 2024, graphene-based filters are increasingly used, providing 30% better efficiency in particle capture. Manufacturers incorporating these materials gain a competitive edge, addressing the rising demand for premium air quality in vehicles.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Cabin Air Filters |

|

Vehicle Type |

Passenger Cars |

|

Distribution Channel |

OEMs |

|

Material |

Paper-based Filters |

|

Region |

United States |

Products

Key Target Audience

Automotive Manufacturers

Component Suppliers

OEMs and Tier 1 Suppliers

Government Regulatory Bodies (e.g., EPA, Transport Canada)

Automotive Parts Distributors

Aftermarket Service Providers

Investors and Venture Capitalist Firms

Environmental Organizations

Companies

Players mentioned in the report

Fram Group

Denso Corporation

Robert Bosch GmbH

MAHLE GmbH

Sogefi Group

ACDelco

Mann+Hummel

Donaldson Company Inc.

Valeo SA

Hengst SE

K&N Engineering

Parker Hannifin Corporation

Cummins Filtration

UFI Filters

Baldwin Filters Inc.

Table of Contents

- North America Automotive Air Filters Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

- North America Automotive Air Filters Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

- North America Automotive Air Filters Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Production

3.1.2. Rising Environmental Regulations

3.1.3. Technological Advancements in Filtration

3.1.4. Growing Consumer Awareness

3.2. Market Challenges

3.2.1. High Raw Material Costs

3.2.2. Supply Chain Disruptions

3.2.3. Intense Competition

3.3. Opportunities

3.3.1. Expansion in Electric Vehicles

3.3.2. Innovations in Filter Materials

3.3.3. Aftermarket Growth

3.4. Trends

3.4.1. Adoption of Smart Filters

3.4.2. Integration with IoT Devices

3.4.3. Sustainable and Eco-friendly Filters

3.5. Government Regulation

3.5.1. Emission Standards Compliance

3.5.2. Incentives for Green Technologies

3.5.3. Safety Regulations

3.5.4. Trade Policies Impacting Imports and Exports

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

- North America Automotive Air Filters Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cabin Air Filters

4.1.2. Engine Air Filters

4.1.3. Transmission Air Filters

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.3. By Distribution Channel (In Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.4. By Material (In Value %)

4.4.1. Paper-based Filters

4.4.2. Synthetic Fiber Filters

4.4.3. Combination Filters

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

4.5.4. Rest of North America

- North America Automotive Air Filters Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Donaldson Company, Inc.

5.1.2. Mann+Hummel Group

5.1.3. Bosch Group

5.1.4. ACDelco

5.1.5. Fram Group

5.1.6. WIX Filters

5.1.7. Hengst SE

5.1.8. Mahle GmbH

5.1.9. K&N Engineering, Inc.

5.1.10. Purflux Inc.

5.1.11. Hengst Automotive Filters

5.1.12. Wurth Group

5.1.13. Cummins Inc.

5.1.14. Baldwin Filters

5.1.15. AAF Flanders

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, R&D Expenditure, Production Capacity, Geographic Presence, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

- North America Automotive Air Filters Market Regulatory Framework

6.1. Emission Standards

6.2. Safety Compliance Requirements

6.3. Certification Processes

6.4. Trade Regulations

- North America Automotive Air Filters Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

- North America Automotive Air Filters Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material (In Value %)

8.5. By Region (In Value %)

- North America Automotive Air Filters Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the automotive air filter ecosystem, identifying key stakeholders such as manufacturers, OEMs, and regulatory bodies. Data collection includes both secondary and proprietary sources, focusing on essential market variables.

Step 2: Market Analysis and Construction

Historical data related to air filter penetration and market dynamics is analyzed. Market trends are assessed to determine the adoption rate across different vehicle types and regions, ensuring accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts. These consultations help refine the analysis by providing practical insights on production costs, demand patterns, and technological innovations.

Step 4: Research Synthesis and Final Output

The final analysis is synthesized to provide a cohesive market report. Engagement with air filter manufacturers allows for further validation, ensuring a reliable and comprehensive understanding of the North America automotive air filters market.

Frequently Asked Questions

-

How big is the North America automotive air filters market?

The North America automotive air filters market is valued at approximately USD 6 billion, driven by growing vehicle demand and stricter emission control regulations. -

What are the major growth drivers of the North America automotive air filters market?

Major drivers include stringent emissions standards, increased vehicle production, and rising consumer awareness regarding air quality in vehicles, spurring demand for air filtration solutions. -

Who are the key players in the North America automotive air filters market?

Key players include Fram Group, Denso Corporation, Robert Bosch GmbH, MAHLE GmbH, and Sogefi Group, each contributing through extensive product offerings and strategic partnerships. -

What challenges exist in the North America automotive air filters market?

Challenges include the rising cost of raw materials and the need for continuous innovation to comply with evolving emission standards. Additionally, fluctuations in vehicle sales affect market demand. -

What is the future outlook for the North America automotive air filters market?

The market is expected to experience steady growth as regulations tighten and consumer preferences shift towards healthier in-vehicle air environments, prompting further technological advancements in filtration solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.