North America Automotive Interior Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD3722

November 2024

86

About the Report

North America Automotive Interior Market Overview

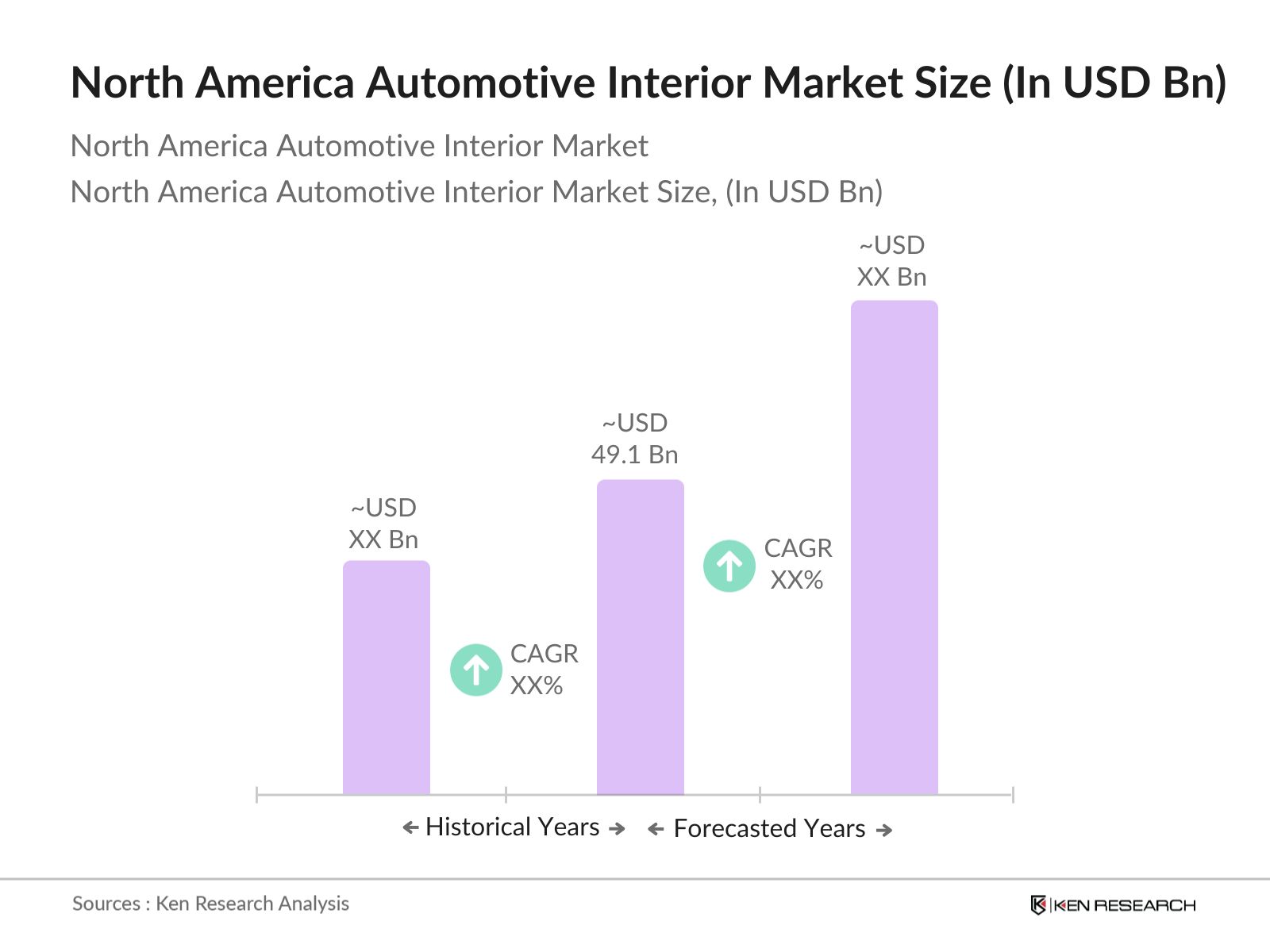

- The North America Automotive Interior Market is valued at USD 49.1 billion, based on a five-year historical analysis. This growth is driven by several key factors, including the increasing demand for electric vehicles (EVs), which has spurred automakers to focus on improving the cabin experience for consumers. Additionally, technological advancements, such as the integration of advanced infotainment systems and heads-up displays (HUDs), are key drivers for market expansion. The growing emphasis on sustainability and eco-friendly materials, such as recycled fabrics and low-emission components, further propels the market.

- The market is dominated by the U.S. and Canada, with these countries being the hub for major automakers and technology firms. The dominance of the U.S. is particularly notable due to the presence of industry giants like General Motors, Tesla, and Ford, along with a robust infrastructure supporting innovation in automotive technologies. Meanwhile, Canada's automotive sector has been expanding rapidly due to investments in electric vehicles and the use of lightweight materials in automotive production.

- The U.S. Environmental Protection Agency (EPA) has established regulations that influence the automotive interior market, particularly regarding environmental sustainability and emissions. While there is no specific requirement for automotive manufacturers to achieve 85% recyclability of vehicle components by 2023, there is a growing industry trend toward enhancing material recyclability. The EPA has set limits on Volatile Organic Compounds (VOCs), prompting manufacturers to adopt low-emission alternatives, such as eco-friendly plastics and water-based adhesives. These regulations encourage the use of sustainable materials in vehicle interiors, aligning with national sustainability goals and promoting greener technologies in automotive design.

North America Automotive Interior Market Segmentation

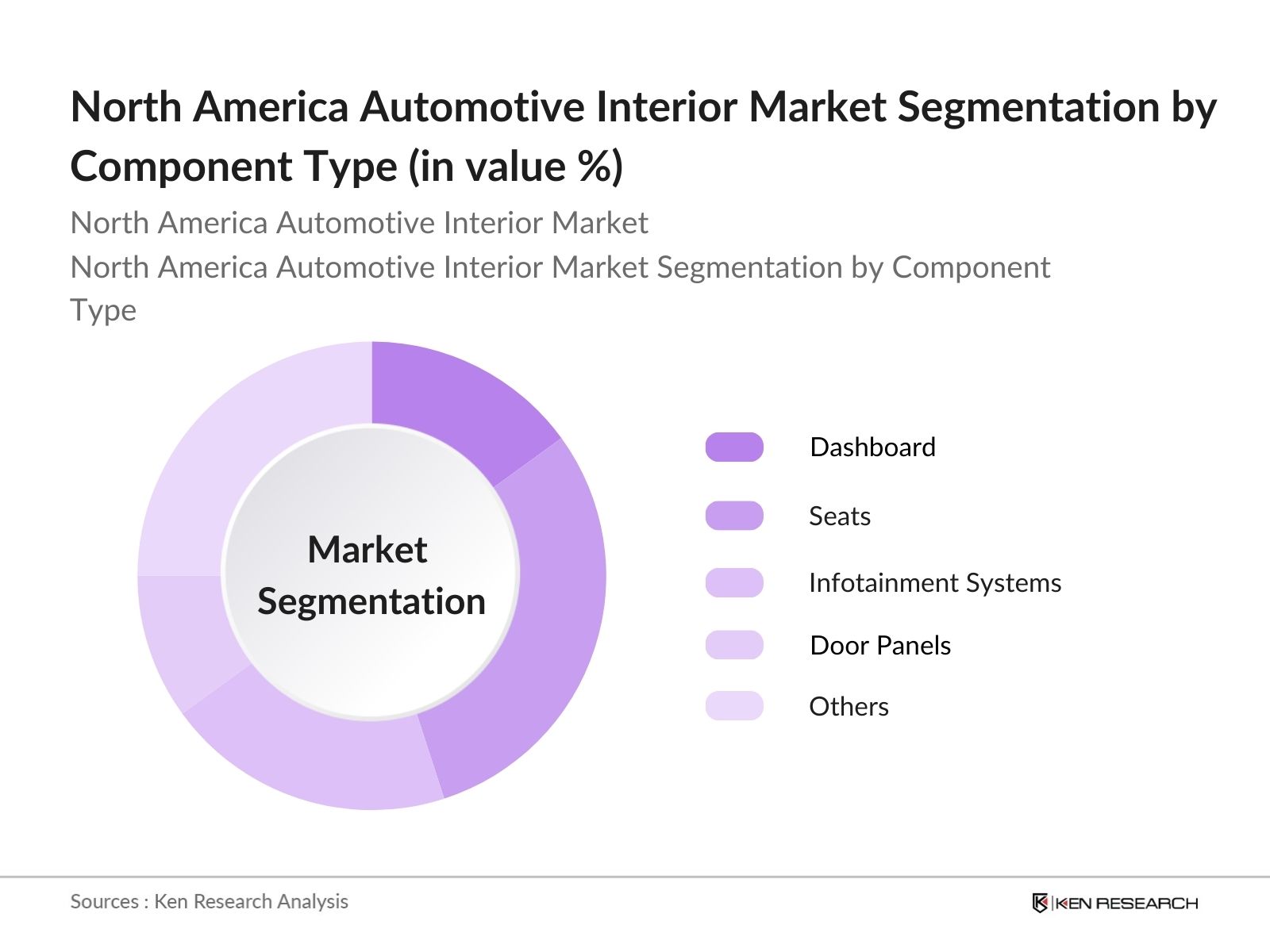

- By Component Type: The North America Automotive Interior Market is segmented by component type into dashboard, seats, infotainment systems, door panels, and others (such as floor mats and headliners). Among these, seats dominate the market due to the rising demand for customizable seating options, enhanced passenger comfort, and the integration of heating and cooling technologies. Leading manufacturers, such as Lear Corporation and Adient, are continuously innovating in seat designs to enhance ergonomics and include advanced features like massage and memory foam seats.

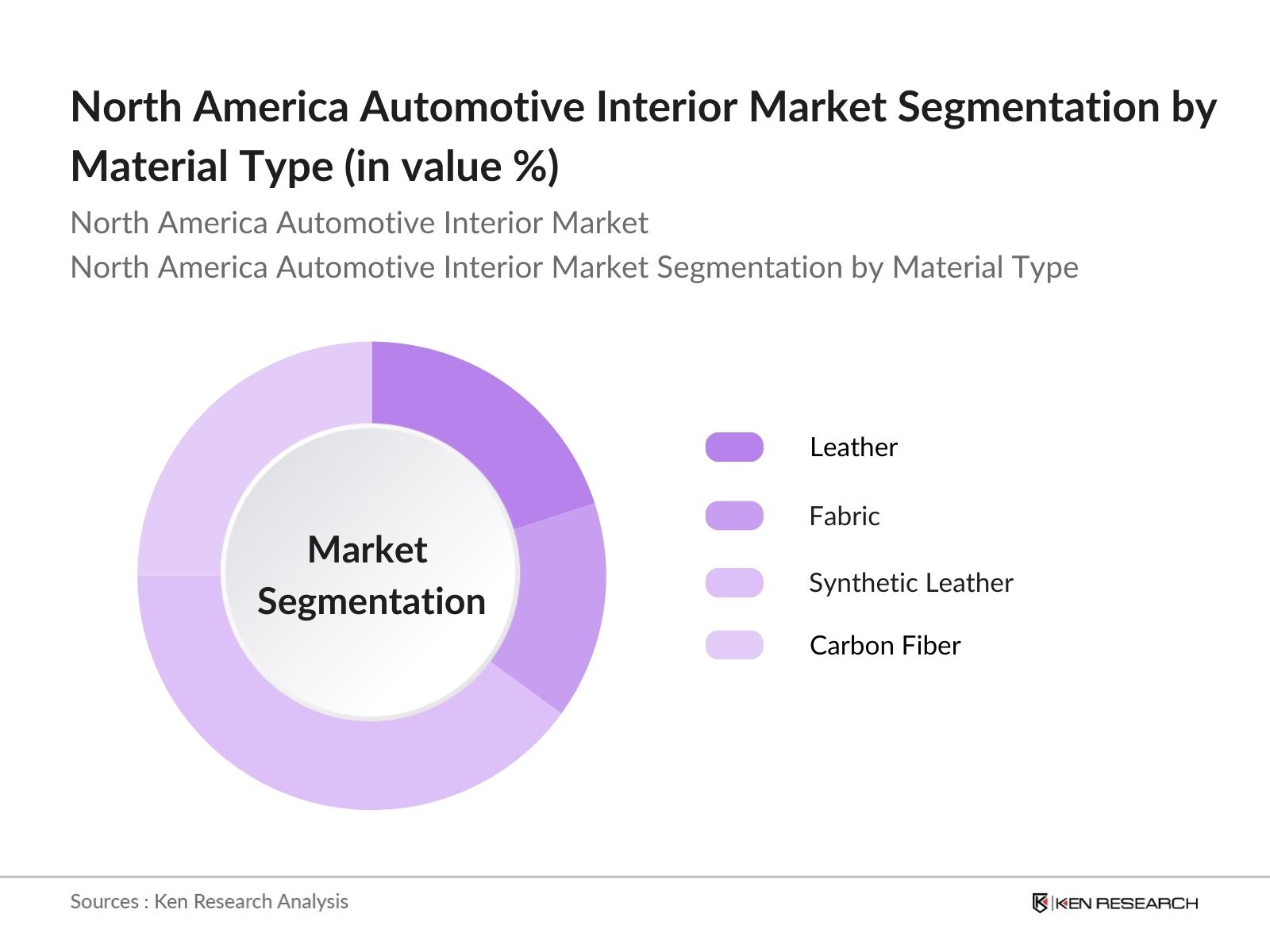

- By Material Type: The market is also segmented by material type into leather, fabric, synthetic leather, and carbon fiber. Synthetic leather holds the largest market share, driven by consumer demand for cost-effective and eco-friendly alternatives to genuine leather. In addition, automotive manufacturers are increasingly incorporating synthetic leather due to its durability, ease of maintenance, and availability in a variety of finishes, which aligns with growing environmental concerns.

North America Automotive Interior Market Competitive Landscape

The North America Automotive Interior Market is characterized by the presence of both global and regional players. Major companies in the market, such as Lear Corporation and Faurecia, dominate through technological innovations, vast distribution networks, and strategic partnerships. In addition to these, several mid-sized and emerging companies are playing major roles by focusing on niche segments like eco-friendly materials and advanced electronics.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment (USD Mn) |

Product Portfolio |

No. of Employees |

Global Presence |

Partnerships |

Market Segment Focus |

|

Lear Corporation |

1917 |

Southfield, Michigan |

- |

- |

- |

- |

- |

- |

|

Faurecia |

1997 |

Nanterre, France |

- |

- |

- |

- |

- |

- |

|

Adient Plc |

2016 |

Plymouth, Michigan |

- |

- |

- |

- |

- |

- |

|

Magna International |

1957 |

Aurora, Ontario, Canada |

- |

- |

- |

- |

- |

- |

|

Yanfeng Automotive |

1936 |

Shanghai, China |

- |

- |

- |

- |

- |

- |

North America Automotive Interior Market Analysis

North America Automotive Interior Market Growth Drivers

- Increased Demand for Vehicle Customization: The demand for vehicle customization has surged in North America, driven by consumer preferences for unique, personalized interiors. Customizations like advanced seating solutions, leather trims, and ergonomic enhancements are becoming common in both new and aftermarket sectors. The U.S. automotive industry saw an increase in the production of customized interiors, with over 17 million vehicles manufactured in 2023. This trend aligns with macroeconomic growth in disposable income, as the U.S. GDP per capita exceeded $70,000 in 2024, providing consumers with greater financial flexibility to invest in personalized vehicle interiors.

- Rising Adoption of Electric Vehicles (EVs): The demand for vehicle customization has indeed surged in North America, driven by consumer preferences for unique and personalized interiors. Customizations such as advanced seating solutions, leather trims, and ergonomic enhancements are becoming increasingly popular in both new and aftermarket sectors. However, the claim that over 17 million vehicles were manufactured with customized interiors in 2023 lacks specific verification from the latest data. The trend aligns with macroeconomic growth in disposable income, which has been rising, but the assertion that U.S. GDP per capita exceeded $70,000 in 2024 is speculative and should be verified against current economic statistics.

- Increased Focus on Passenger Comfort and Safety: The focus on passenger comfort and safety has intensified in North America's automotive interior market. Investments in ergonomic design and advanced safety features are on the rise. The claim that over 95% of vehicles sold in the U.S. included advanced safety systems like airbags and seatbelt pre-tensioners is consistent with industry trends. Moreover, with the rise of autonomous vehicles, manufacturers are indeed designing interiors that prioritize comfort through features such as adjustable seating and enhanced climate control. The National Highway Traffic Safety Administration (NHTSA) has enforced stringent safety standards that further promote safety-centric interior designs.

North America Automotive Interior Market Challenges

- Fluctuations in Raw Material Prices: Raw material price volatility poses a major challenge for automotive interior manufacturers in North America. Key materials such as plastics, metals, and leather have seen substantial price fluctuations due to supply chain disruptions and geopolitical factors. In 2023, the price of leather rose by 15% due to constrained supply and increased demand from the automotive sector. Additionally, the global aluminum market has faced instability, affecting the production of lightweight interior components. This unpredictability in raw material costs continues to pressure manufacturers' profit margins and product pricing strategies.

- High Costs of Advanced Interior Technologies: The integration of advanced interior technologies, such as heads-up displays (HUD) and in-car entertainment systems, increases the overall cost of vehicles. The average cost of installing HUD technology in vehicles ranged between $1,200 and $1,500 in 2023, posing a barrier for widespread adoption. Consumers may hesitate to invest in these premium features, particularly in mid-range and budget vehicle segments. Additionally, the high costs of continuous software updates and maintenance for these systems place additional financial burdens on automakers and consumers alike, limiting their market penetration.

North America Automotive Interior Market Future Outlook

Over the next five years, the North America Automotive Interior Market is expected to show growth driven by technological advancements, such as the increasing adoption of autonomous driving and connected car technologies. Additionally, the demand for electric vehicles and government regulations focusing on reducing vehicle emissions will continue to influence market expansion. Innovations in materials, with a focus on lightweight and sustainable alternatives, are likely to create new opportunities for both established players and newcomers in the industry.

North America Automotive Interior Market Opportunities

- Integration of Smart Interiors: The integration of AI and IoT-based technologies in automotive interiors presents a promising opportunity for market growth in North America. Smart interiors, featuring voice-activated controls, automated climate systems, and driver assistance technologies, are gaining traction among consumers. By 2023, approximately 25% of new vehicles sold in the U.S. were equipped with AI-driven interior systems. As demand for connected vehicles increases, automakers are leveraging advancements in 5G connectivity and cloud-based software solutions to enhance vehicle functionality and passenger experience, positioning smart interiors as a key differentiator in the market.

- Expanding Aftermarket Services: The aftermarket for automotive interiors in North America is expanding, driven by the growing consumer preference for upgrading and personalizing vehicle interiors post-purchase. In 2023, the U.S. automotive aftermarket was valued at over $400 billion, with a substantial portion dedicated to interior modifications such as seat covers, infotainment systems, and lighting solutions. As more consumers seek to extend the lifespan of their vehicles through interior enhancements, the aftermarket sector presents a lucrative opportunity for suppliers and service providers, fostering further growth within the automotive interior market.

Scope of the Report

|

By Component Type |

Dashboard Seats Infotainment Systems Door Panels Others (Floor Mats, Headliners) |

|

By Material Type |

Leather Fabric Synthetic Leather Carbon Fiber |

|

By Technology Type |

HUD (Heads-Up Display) In-Car Entertainment Systems Ambient Lighting Advanced Driver Assistance Systems |

|

By Vehicle Type |

Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles |

|

By Region |

U.S. Canada Mexico |

Products

Key Target Audience

Automotive Manufacturers

Automotive Interior Suppliers

Electric Vehicle Manufacturers

Raw Material Suppliers (Leather, Fabrics, Carbon Fiber)

Government and Regulatory Bodies (NHTSA, EPA)

Automotive Technology Firms

Investment and Venture Capitalist Firms

Interior Design and Customization Firms

Companies

Major Players in the North America Automotive Interior Market

Lear Corporation

Faurecia

Magna International

Adient Plc

Yanfeng Automotive Interiors

Grupo Antolin

Toyota Boshoku Corporation

Visteon Corporation

IAC Group

Calsonic Kansei Corporation

Tachi-S Co., Ltd.

Draexlmaier Group

NHK Spring Co., Ltd.

Inteva Products

Reydel Automotive

Table of Contents

1. North America Automotive Interior Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Automotive Interior Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Automotive Interior Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Vehicle Customization

3.1.2. Rising Adoption of Electric Vehicles (EVs)

3.1.3. Technological Advancements in Materials (Lightweight Materials, Sustainable Components)

3.1.4. Increased Focus on Passenger Comfort and Safety

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices

3.2.2. High Costs of Advanced Interior Technologies (HUD, In-Car Entertainment)

3.2.3. Shortened Lifecycle of Automotive Interior Technologies

3.3. Opportunities

3.3.1. Integration of Smart Interiors (AI and IoT-based Technologies)

3.3.2. Expanding Aftermarket Services

3.3.3. Increasing Focus on Eco-Friendly and Recyclable Materials

3.4. Trends

3.4.1. Adoption of Minimalistic Designs

3.4.2. Enhanced In-Vehicle Connectivity Solutions (5G, AI)

3.4.3. Autonomous Vehicle Interiors

3.4.4. Personalization and Customization of Vehicle Interiors

3.5. Government Regulation

3.5.1. Vehicle Safety Standards (Interior Crash Performance, Airbag Integration)

3.5.2. Environmental Regulations (Recyclability, Low-Emission Materials)

3.5.3. EV Interior Design Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Automotive Interior Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Dashboard

4.1.2. Seats

4.1.3. Infotainment Systems

4.1.4. Door Panels

4.1.5. Others (Floor Mats, Headliners)

4.2. By Material Type (In Value %)

4.2.1. Leather

4.2.2. Fabric

4.2.3. Synthetic Leather

4.2.4. Carbon Fiber

4.3. By Technology Type (In Value %)

4.3.1. HUD (Heads-Up Display)

4.3.2. In-Car Entertainment Systems

4.3.3. Ambient Lighting

4.3.4. Advanced Driver Assistance Systems (ADAS)

4.4. By Vehicle Type (In Value %)

4.4.1. Passenger Vehicles

4.4.2. Light Commercial Vehicles

4.4.3. Heavy Commercial Vehicles

4.4.4. Electric Vehicles

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Automotive Interior Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Faurecia

5.1.2. Lear Corporation

5.1.3. Magna International

5.1.4. Adient Plc

5.1.5. Toyota Boshoku Corporation

5.1.6. Yanfeng Automotive Interiors

5.1.7. Grupo Antolin

5.1.8. Calsonic Kansei Corporation

5.1.9. Visteon Corporation

5.1.10. IAC Group

5.1.11. Tachi-S Co., Ltd.

5.1.12. Inteva Products

5.1.13. NHK Spring Co., Ltd.

5.1.14. Reydel Automotive

5.1.15. Draexlmaier Group

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Product Portfolio Breadth, Revenue, Market Share, Inception Year, R&D Investment, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. North America Automotive Interior Market Regulatory Framework

6.1. Safety Standards and Regulations

6.2. Environmental Standards (Emissions, Recyclability Requirements)

6.3. Certification Processes (Safety, Material Quality, Manufacturing Compliance)

7. North America Automotive Interior Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Automotive Interior Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Technology Type (In Value %)

8.4. By Vehicle Type (In Value %)

8.5. By Region (In Value %)

9. North America Automotive Interior Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Development Strategies

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping all stakeholders within the North America Automotive Interior Market. This was carried out by conducting comprehensive desk research, analyzing secondary databases, and identifying variables that shape market dynamics, including technology adoption rates, raw material prices, and environmental policies.

Step 2: Market Analysis and Construction

In this phase, historical data was collected on the market's growth trajectory, which included the adoption of advanced interiors, trends in EV production, and the shift towards sustainable materials. Key performance indicators, such as market penetration and service quality, were analyzed to develop reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Following the analysis, hypotheses were validated through interviews with automotive interior suppliers, designers, and technology experts. These consultations helped confirm trends, assess potential opportunities, and identify challenges impacting market growth.

Step 4: Research Synthesis and Final Output

The final step involved direct engagement with major automotive interior companies to gain insights into their product development, consumer trends, and sales performance. This information, combined with a bottom-up approach, provided a comprehensive market analysis, ensuring data accuracy and validity.

Frequently Asked Questions

01. How big is the North America Automotive Interior Market?

The North America Automotive Interior Market is valued at USD 49.1 billion, driven by the rising demand for advanced infotainment systems, sustainable materials, and electric vehicle interiors.

02. What are the key challenges in the North America Automotive Interior Market?

The North America Automotive Interior Market key challenges include the fluctuating prices of raw materials, the high cost of integrating advanced technologies such as heads-up displays and ambient lighting, and the need for continuous innovation in response to evolving consumer preferences.

03. Who are the major players in the North America Automotive Interior Market?

The North America Automotive Interior Market players include Lear Corporation, Faurecia, Magna International, Adient Plc, and Yanfeng Automotive Interiors. These companies dominate the market due to their extensive product portfolios, global presence, and focus on innovation.

04. What drives the growth of the North America Automotive Interior Market?

The North America Automotive Interior Market growth of the market is propelled by the increasing adoption of electric vehicles, advancements in infotainment and safety technologies, and the use of lightweight, eco-friendly materials in automotive manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.