North America Automotive Sensors Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1734

December 2024

85

About the Report

North America Automotive Sensors Market Overview

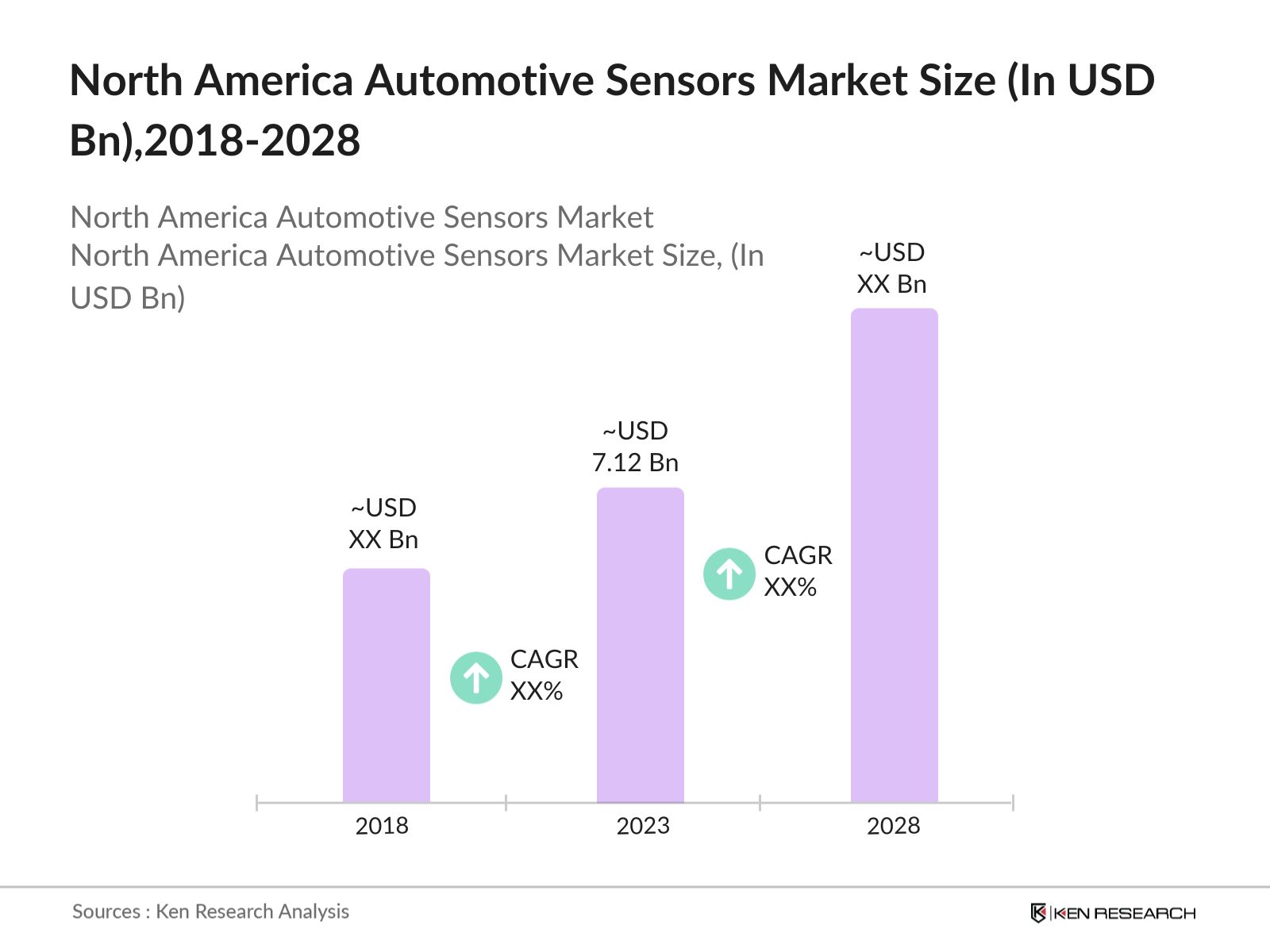

- The North America Automotive Sensors Market was valued at USD 7.12 billion in 2023. The market's growth is primarily driven by the rising demand for advanced driver-assistance systems (ADAS), stringent government regulations for vehicle safety, and the increasing adoption of electric vehicles (EVs).

- Major players in the North American automotive sensors market include Robert Bosch GmbH, Continental AG, DENSO Corporation, Analog Devices, Inc., and Infineon Technologies AG. These companies are at the forefront of innovation and development, significantly influencing market trends and the adoption of new sensor technologies.

- In March 2024, Continental AG announced the launch of its next-generation LiDAR sensor for autonomous vehicles. This development is expected to push the boundaries of autonomous driving, providing vehicles with enhanced spatial awareness and safety features. This launch has positioned Continental AG as a leader in automotive sensor technology, particularly in the emerging field of autonomous vehicles.

- The Detroit, often referred to as the "Motor City," holds a central role in the U.S. automotive industry. In 2023, Detroit was dominating the market, making it the most significant contributor to the regions dominance. The citys strong automotive heritage, combined with the presence of major automakers like General Motors, Ford, and Stellantis, has cemented its position as a key player in the market.

North America Automotive Sensors Market Segmentation

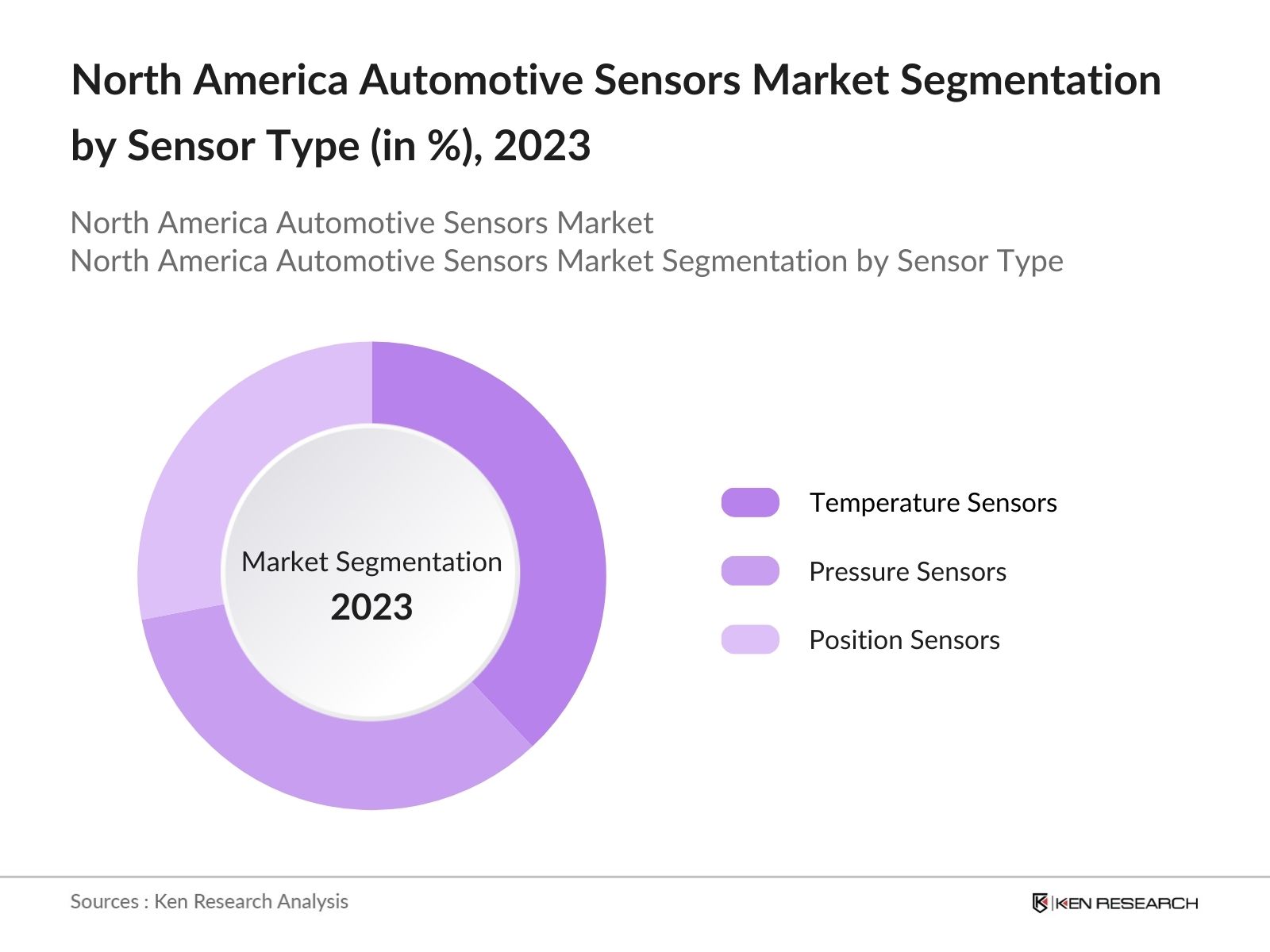

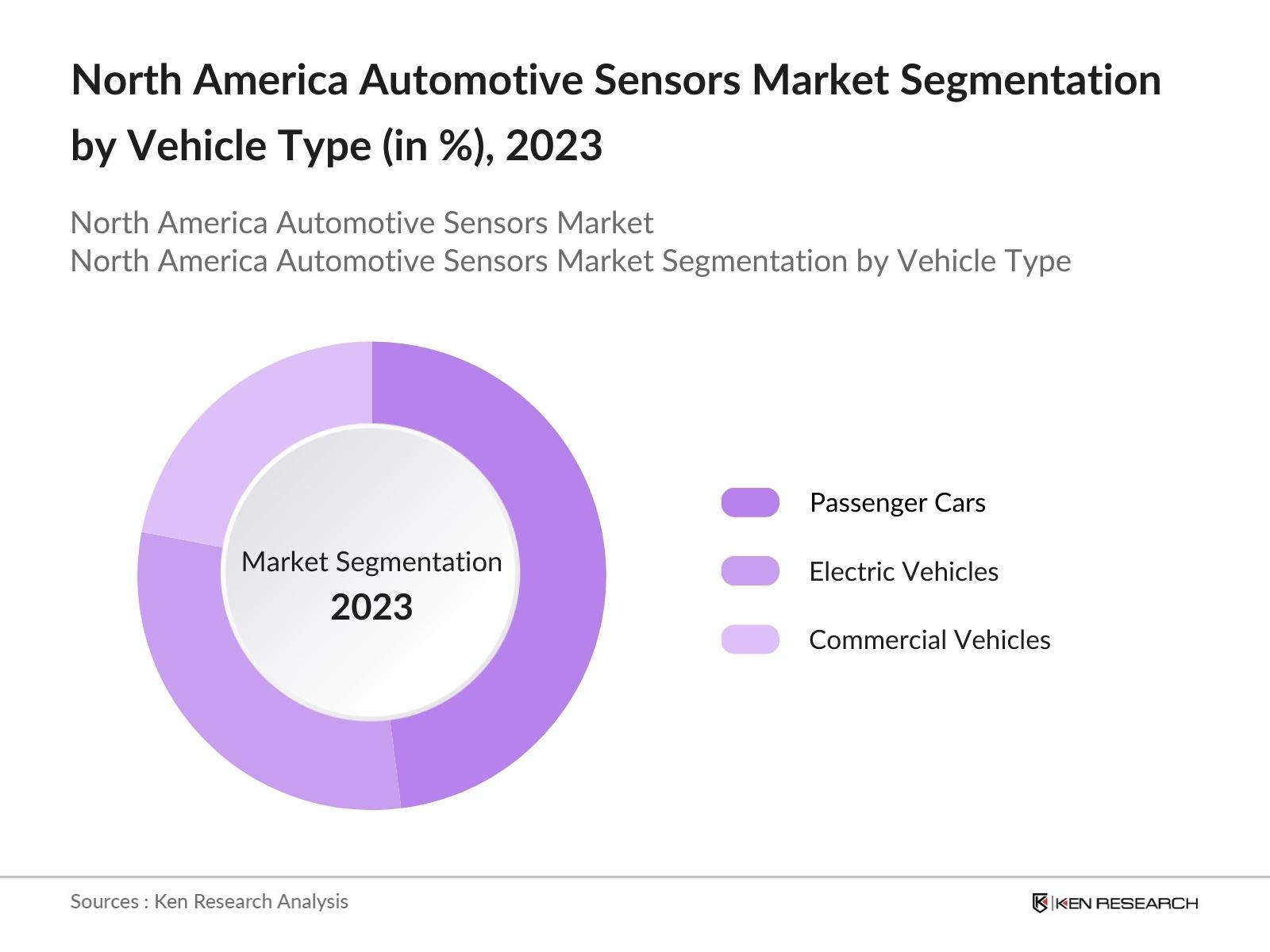

The North America Automotive Sensors Market is segmented into different factors like by product type, by application and region.

By Sensor Type: The market is segmented by sensor type into temperature sensors, pressure sensors, and position sensors. In 2023, temperature sensors were dominating the market due to their critical role in monitoring and maintaining optimal operating conditions in vehicles, particularly in electric and hybrid vehicles. Temperature sensors are essential for managing engine temperature, battery performance in electric vehicles (EVs), and ensuring the efficient operation of heating, ventilation, and air conditioning (HVAC) systems.

By Region: The market is segmented by region into the United States and Canada. In 2023, the United States was dominating the market, driven by several factors, including the presence of major automotive manufacturers, a robust technological ecosystem, and significant investments in autonomous driving and electric vehicle (EV) technologies. The U.S. automotive industry has been at the forefront of adopting advanced sensor technologies, particularly in the development of ADAS and autonomous vehicles.

By Vehicle Type: The market is further segmented by vehicle type into Passenger Cars, Commercial Vehicles, and Electric Vehicles (EVs). In 2023, Passenger Cars dominated the market due to its attributed to the high production volumes and the increasing integration of advanced driver-assistance systems (ADAS) and other sensor-driven technologies in passenger vehicles. With consumers demanding more safety and convenience features, automakers are incorporating more sensors into passenger cars, driving the growth of this segment.

North America Automotive Sensors Market Competitive Landscape

North America Automotive Sensors Market Major Players

|

Company Name |

Year of Establishment |

Headquarters |

|---|---|---|

|

Robert Bosch GmbH |

1886 |

Stuttgart, Germany |

|

Continental AG |

1871 |

Hanover, Germany |

|

DENSO Corporation |

1949 |

Kariya, Japan |

|

Analog Devices, Inc. |

1965 |

Norwood, USA |

|

Infineon Technologies AG |

1999 |

Neubiberg, Germany |

- Robert Bosch GmbHs: By 2026, Robert Bosch GmbH announced the expansion of its semiconductor production facility in Dresden, Germany, with a 3 billion(approximately$3.3 billion) investment. This expansion is set to double the production capacity for automotive sensors, particularly those used in EVs and ADAS. The increased production is expected to address the ongoing supply chain challenges and meet the growing demand in North America.

- Infineon Technologies AG: InNovember 2022, the company launched theXENSIV TLE4971 series, which provides accurate magnetic current sensing for automotive applications. This series is designed to mitigate the negative effects of magnetic cores, enhancing performance in various automotive systems.

North America Automotive Sensors Market Analysis

North America Automotive Sensors Market Growth Drivers

- Rising Adoption of Electric Vehicles (EVs): In 2024, North America is expected to witness the registration of approximately 2.5 million electric vehicles, a substantial increase from the previous year. This surge is largely due to government incentives and stricter emission regulations. The transition to electric vehicles is driving demand for advanced automotive sensors, particularly for battery management and thermal monitoring systems.

- Technological Innovations in Sensor Technology: In 2024, significant advancements in sensor miniaturization and enhanced sensitivity were reported, particularly in the development of MEMS (Micro-Electro-Mechanical Systems) sensors. These innovations are enabling the integration of more sensors into smaller and more complex vehicle systems. For instance, the latest MEMS gyroscopes introduced in 2024 are now being deployed in advanced navigation systems, enabling more precise vehicle control and safety.

- Increased Investment in Autonomous Vehicle Technology: Investment in autonomous vehicle technology is growing as companies and governments see the potential of self-driving cars to improve road safety and transform transportation. These vehicles use sensors like LiDAR, radar, and cameras for navigation and real-time decisions. The push to develop autonomous vehicles drives demand for sensors that offer high accuracy and reliability.

North America Automotive Sensors Market Challenges

- Technical Integration Issues: As vehicles become more technologically advanced, integrating various sensors into a cohesive system poses significant challenges. In 2024, the number of new vehicle models faced delays in their launch due to technical issues related to sensor integration, particularly in EVs and autonomous vehicles. These issues include sensor calibration, software compatibility, and system reliability, which can lead to operational inefficiencies and increased production costs.

- Environmental Concerns Related to Sensor Production: The production of certain automotive sensors, particularly those that use rare earth elements, has raised environmental concerns in 2024. The extraction and processing of these elements, which are critical for sensors like permanent magnets used in electric motors, have significant environmental impacts, including habitat destruction and pollution. As environmental regulations tighten, particularly in North America, sensor manufacturers are under pressure to adopt more sustainable practices.

North America Automotive Sensors Market Government Initiatives

- U.S. Federal Tax Incentives for EVs: In 2024, the U.S. government extended federal tax credits for electric vehicles, with eligible buyers receiving up to $7,500 in tax rebates. This initiative is expected to accelerate the adoption of EVs, driving demand for sensors required in electric powertrains and battery management systems. There are income limits for individuals to claim the credit, ranging from $150,000 to $300,000 based on tax filing status.

- Canadas Zero-Emission Vehicle (ZEV) Mandate: Canadas federal government introduced a mandate in 2024 requiring that 20% of new light-duty vehicles sold in Canada must be ZEVs by 2026. This policy is anticipated to drive significant growth in the automotive sensors market, as ZEVs typically require more sensors than traditional vehicles. The regulation will bring significant health benefits to the country by reducing air pollutant emissions from road vehicles, which currently account for 1,200 premature deaths and 210,000 asthma symptom days annually, primarily affecting vulnerable populations living close to high-traffic areas.

North America Automotive Sensors Market Future Outlook

The North America Automotive Sensors Market is projected to grow exponentially by 2028, driven by the continued adoption of EVs and autonomous vehicles. The market will likely witness increased demand for sensors such as LiDAR, radar, and ultrasonic sensors, essential for advanced safety systems and autonomous driving capabilities.

Market Trends

- Expansion of Autonomous Vehicles: By 2028, North America is expected to have a greater number of autonomous vehicles on the roads, with a significant portion equipped with advanced sensors such as LiDAR, radar, and ultrasonic sensors. The autonomous vehicle markets growth will be driven by advancements in sensor technology, including improvements in accuracy, reliability, and cost-effectiveness.

- Advancements in Sensor Miniaturization: Over the next five years, significant advancements in sensor miniaturization are expected, enabling the integration of more sensors into vehicles without increasing space or weight. These miniaturized sensors will be critical for the development of more compact and efficient EVs and autonomous vehicles. By 2028, it is anticipated that the no. of new vehicles in North America will be equipped with next-generation miniaturized sensors, enhancing vehicle performance and safety.

Scope of the Report

|

By Sensor Type |

Temperature Sensors Pressure Sensors Position Sensors |

|

By Vehicle Type: |

Passenger Cars Commercial Vehicles Electric Vehicles (EVs) |

|

By Region |

United States Canada |

|

By Application |

Powertrain Safety & Control Exhaust Chassis Others |

|

By Technology |

MEMS Non-MEMS |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Dealerships

Automotive Testing Laboratories

Technology Firms

Software Companies

Insurance Companies

Government Regulatory Bodies (U.S. National Highway Traffic Safety Administration (NHTSA), Federal Motor Carrier Safety Administration)

Investors and VC Firms

Banks and Financial Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Robert Bosch GmbH

Continental AG

DENSO Corporation

Analog Devices, Inc.

Infineon Technologies AG

Sensata Technologies

Texas Instruments Inc.

Valeo S.A.

Delphi Technologies

Autoliv Inc.

Aptiv PLC

ZF Friedrichshafen AG

TE Connectivity

Hella GmbH & Co. KGaA

NXP Semiconductors

Table of Contents

1. North America Automotive Sensors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Automotive Sensors Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Automotive Sensors Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of Electric Vehicles (EVs)

3.1.2. Increased Investment in Autonomous Vehicle Technology

3.1.3. Stringent Vehicle Safety Regulations

3.1.4. Technological Innovations in Sensor Technology

3.2. Restraints

3.2.1. High Costs of Advanced Sensor Technologies

3.2.2. Supply Chain Disruptions

3.2.3. Technical Integration Issues

3.2.4. Environmental Concerns Related to Sensor Production

3.3. Opportunities

3.3.1. Expansion of Autonomous Vehicle Market

3.3.2. Increasing Focus on Electric Vehicles

3.3.3. Development of Smart Infrastructure

3.3.4. Growth in Aftermarket Sensor Applications

3.4. Trends

3.4.1. Miniaturization of Sensors

3.4.2. Integration with Connected Vehicle Technologies

3.4.3. Increased Use of Artificial Intelligence in Sensors

3.4.4. Rising Demand for Sustainable Sensor Solutions

3.5. Government Regulation

3.5.1. U.S. Federal Tax Incentives for EVs

3.5.2. Canadas Zero-Emission Vehicle (ZEV) Mandate

3.5.3. Investment in Smart Infrastructure

3.5.4. Regulatory Support for Autonomous Vehicles

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Automotive Sensors Market Segmentation, 2023

4.1. By Sensor Type (in Value %)

4.1.1. Temperature Sensors

4.1.2. Pressure Sensors

4.1.3. Position Sensors

4.2. By Vehicle Type (in Value %)

4.2.1. Passenger Cars

4.2.2. Electric Vehicles

4.2.3. Commercial Vehicles

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

4.4. By Application (in Value %)

4.4.1. Powertrain

4.4.2. Safety & Control

4.4.3. Exhaust

4.4.4. Chassis

4.4.5. Others

4.5. By Technology (in Value %)

4.5.1. MEMS

4.5.2. Non-MEMS

5. North America Automotive Sensors Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Robert Bosch GmbH

5.1.2. Continental AG

5.1.3. DENSO Corporation

5.1.4. Analog Devices, Inc.

5.1.5. Infineon Technologies AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Automotive Sensors Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Automotive Sensors Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Automotive Sensors Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Automotive Sensors Market Future Market Segmentation, 2028

9.1. By Sensor Type (in Value %)

9.2. By Vehicle Type (in Value %)

9.3. By Region (in Value %)

9.4. By Application (in Value %)

9.5. By Technology (in Value %)

10. North America Automotive Sensors Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Automotive Sensors Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Automotive Sensors Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple automotive sensors manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from automotive sensors manufacturing companies.

Frequently Asked Questions

01 How big is the North America Automotive Sensors Market?

The North America Automotive Sensors Market was valued at USD 7.12 billion in 2023. It is driven by the increasing adoption of advanced driver-assistance systems (ADAS), growing investments in electric and autonomous vehicles, and stringent vehicle safety regulations.

02 What are the challenges in the North America Automotive Sensors Market?

Challenges in the North America Automotive Sensors Market include high costs of advanced sensor technologies, supply chain disruptions, technical integration issues, and environmental concerns related to sensor production. These factors can impact market growth and adoption rates.

03 Who are the major players in the North America Automotive Sensors Market?

Key players in the North America Automotive Sensors Market include Robert Bosch GmbH, Continental AG, DENSO Corporation, Analog Devices, Inc., and Infineon Technologies AG. These companies lead the market due to their strong technological capabilities, extensive product portfolios, and significant investments in R&D.

04 What are the growth drivers of the North America Automotive Sensors Market?

Growth drivers for the North America Automotive Sensors Market include the rising adoption of electric vehicles (EVs), increased investment in autonomous vehicle technology, stringent vehicle safety regulations, and technological innovations in sensor technology. These factors are driving demand for advanced and reliable automotive sensors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.