North America Autonomous Underwater Vehicle Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD9603

October 2024

81

About the Report

North America Autonomous Underwater Vehicle Market Overview

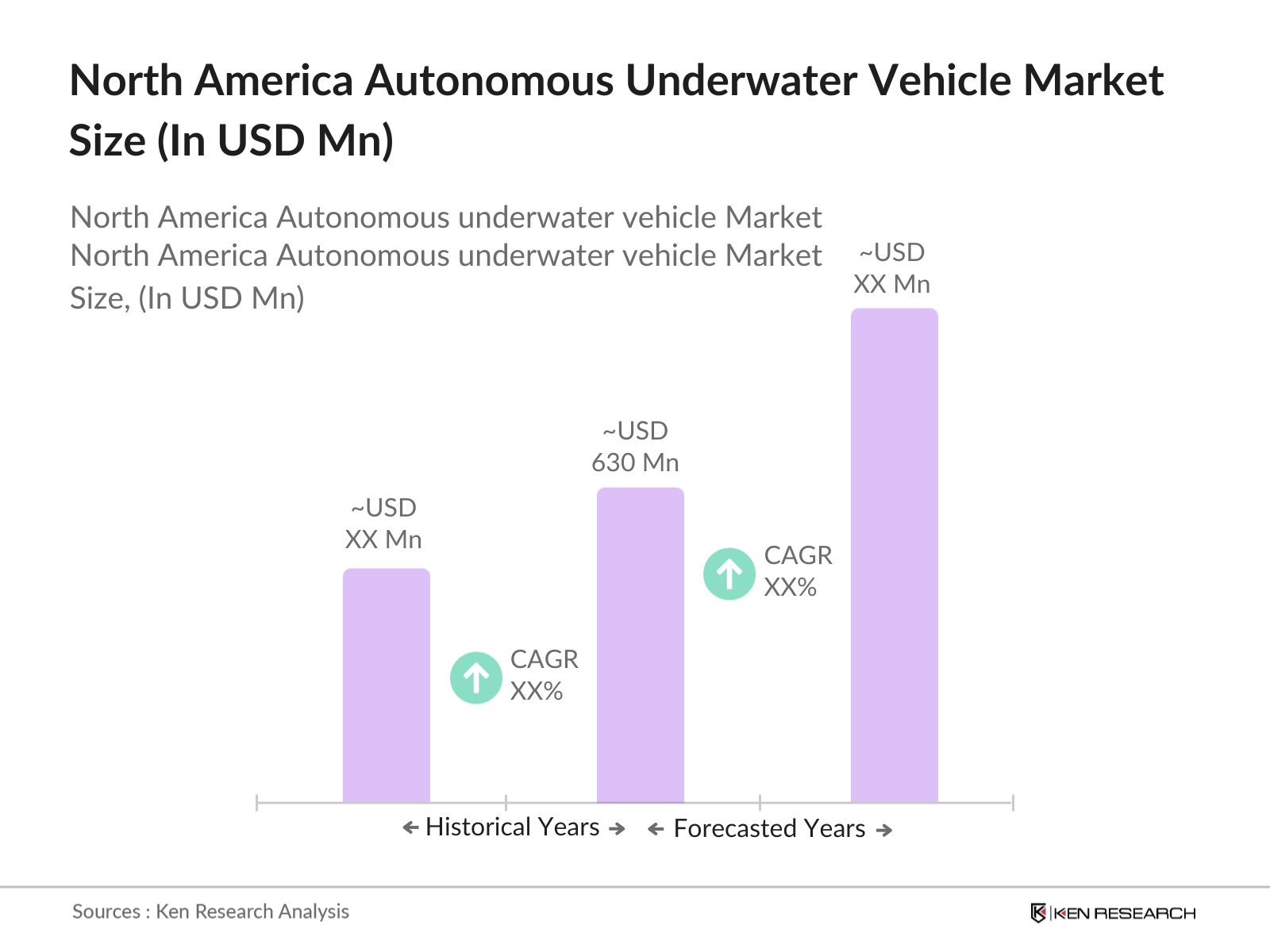

- The North America Autonomous Underwater Vehicle (AUV) market is valued at USD 630 million, based on a five-year historical analysis. This market is primarily driven by the expanding need for unmanned underwater operations in sectors such as defense, oil and gas exploration, and marine research. Increased government spending on maritime defense and technological advancements in underwater communication systems have contributed to this growth. Moreover, the adoption of AUVs for environmental monitoring and oceanographic studies has further propelled market expansion.

- The United States and Canada dominate the AUV market in North America, with the U.S. holding the lead due to its robust naval defense spending and extensive offshore oil exploration activities. The strong presence of leading defense contractors and research institutions, combined with favorable government policies, positions the U.S. as a market leader. Canada follows due to its investments in environmental monitoring and research, particularly in Arctic waters.

- India's Intellectual Property Rights (IPR) policies have been strengthened in recent years, with a focus on curbing content piracy. The government has launched the "Digital IP Protection Campaign" in 2024, which aims to reduce online piracy of copyrighted content, including anime. This initiative seeks to protect the rights of content creators and enhance the profitability of legal anime streaming services.

North America Autonomous Underwater Vehicle Market Segmentation

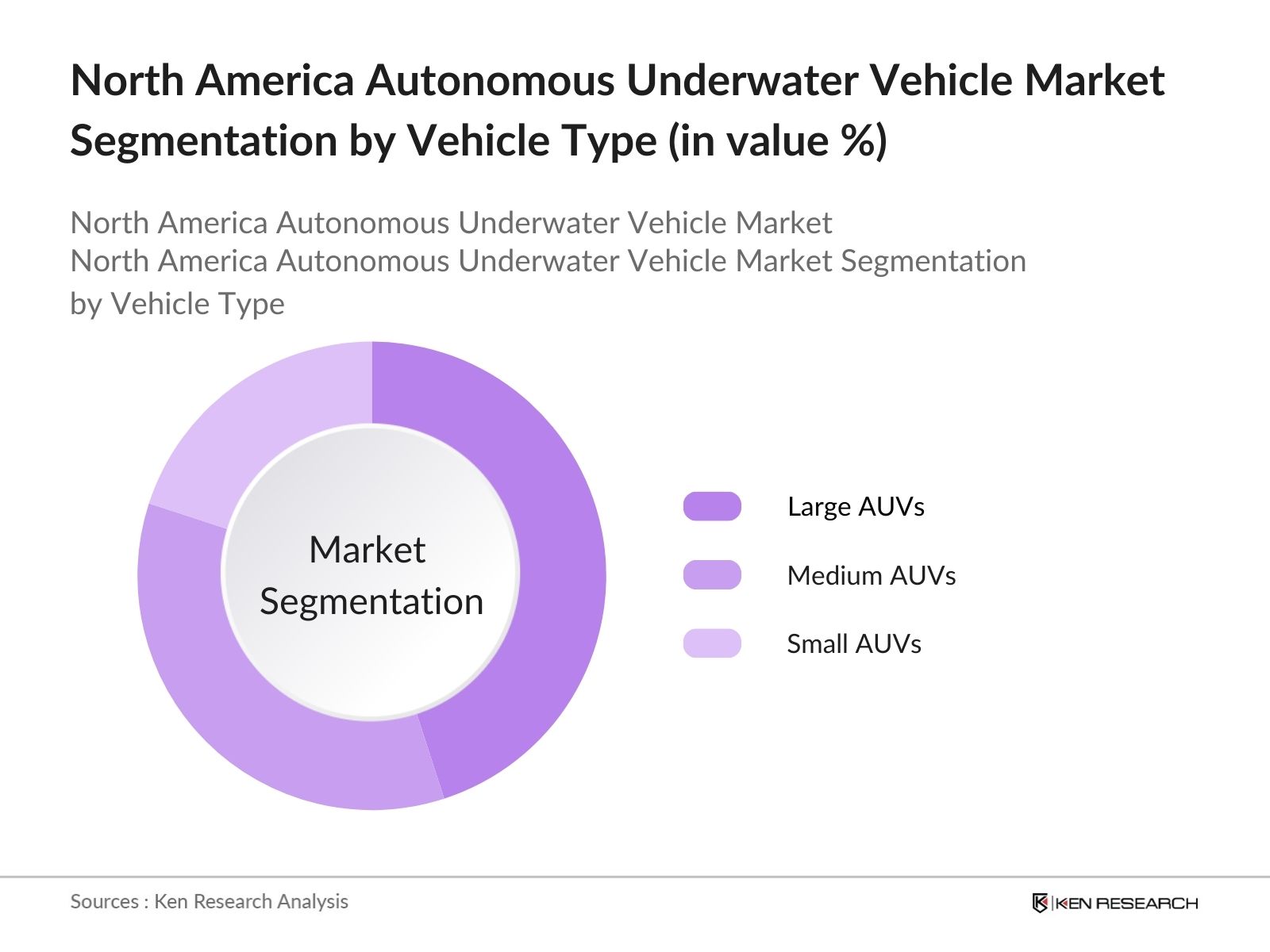

By Vehicle Type: The market is segmented by vehicle type into large AUVs, medium AUVs, and small AUVs. Large AUVs hold the dominant market share due to their capability to perform long-duration, deep-sea missions that are crucial for military and offshore oil exploration operations. Their advanced sensor integration, longer battery life, and extensive communication systems make them ideal for high-stakes missions. Large AUVs are used extensively by defense and energy sectors, where operational reliability and deep-sea capabilities are essential.

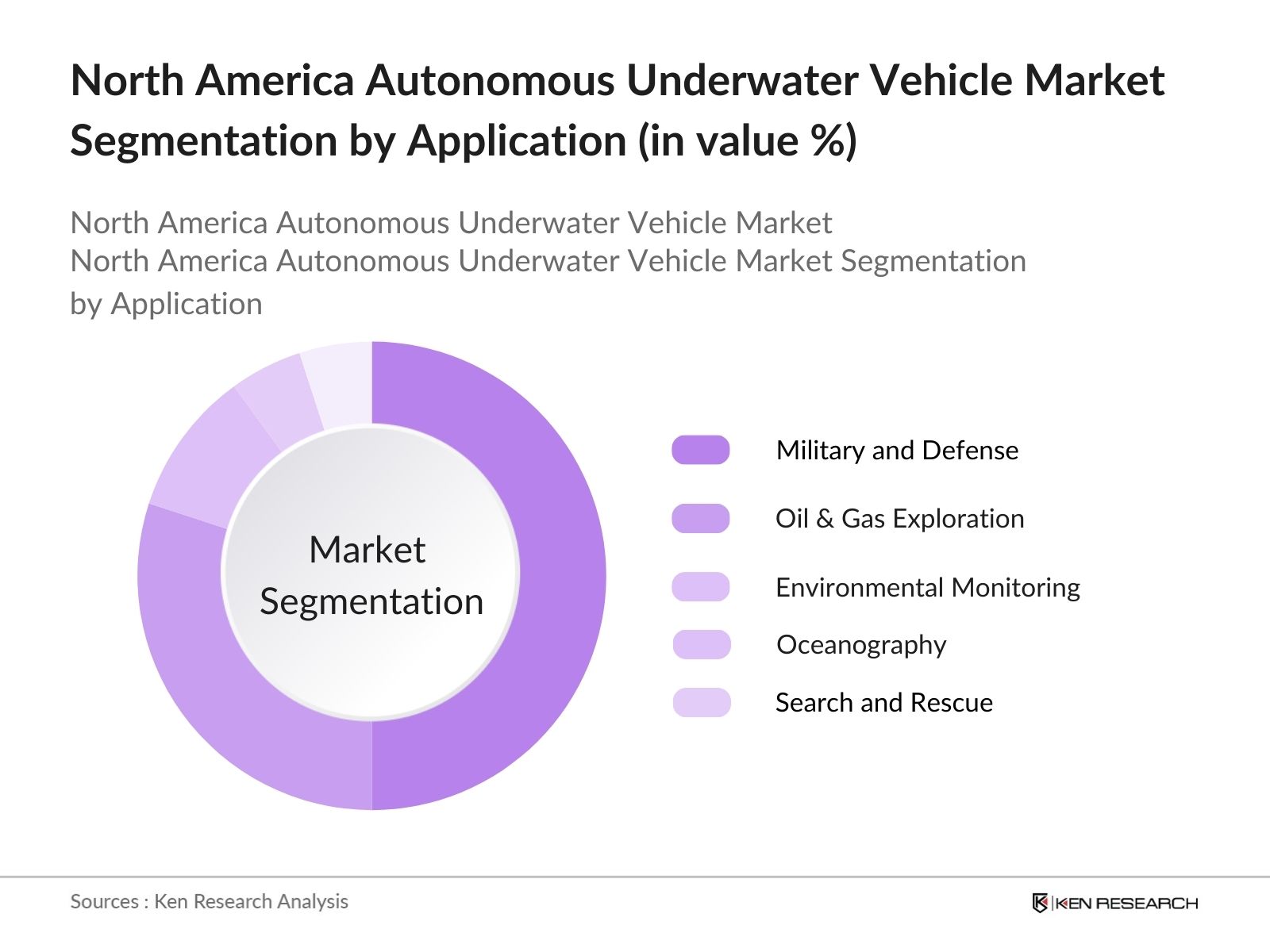

By Application: The market in North America is segmented by application into military and defense, oil & gas exploration, environmental monitoring, oceanography, and search and rescue. The military and defense segment dominates the market due to the increasing use of AUVs for surveillance, mine detection, and underwater combat operations. The demand for unmanned underwater systems in naval operations continues to grow, driven by the need for reducing human risk in hazardous missions and enhancing real-time data collection capabilities.

North America Autonomous Underwater Vehicle Market Competitive Landscape

The North America Autonomous Underwater Vehicle market is dominated by key players, with a few large corporations controlling portions of the market. These companies lead in terms of R&D investment, technological innovation, and strategic partnerships with defense and energy sectors. The defense sector is heavily consolidated with companies like General Dynamics and Boeing, leveraging their historical ties to the U.S. Navy.

| Company Name | Establishment Year | Headquarters | Revenue (USD bn) | R&D Investment (%) | Key Contracts | No. of Employees | Primary Application | Strategic Partnerships |

|---|---|---|---|---|---|---|---|---|

| General Dynamics | 1952 | Reston, Virginia, USA | - | - | - | - | - | - |

| Boeing | 1916 | Chicago, Illinois, USA | - | - | - | - | - | - |

| L3Harris Technologies | 2019 | Melbourne, Florida, USA | - | - | - | - | - | - |

| Teledyne Marine | 1960 | Thousand Oaks, CA, USA | - | - | - | - | - | - |

| Saab AB | 1937 | Stockholm, Sweden | - | - | - | - | - | - |

North America Autonomous Underwater Vehicle Industry Analysis

Growth Drivers

- Rise in Digital Streaming Platforms (OTT penetration): India's OTT sector has seen growth due to increased internet access, with over 830 million internet users in 2024, as reported by TRAI (Telecom Regulatory Authority of India). Anime content is rapidly expanding on these platforms, particularly with services like Netflix and Crunchyroll, which have introduced Japanese anime to a growing audience. The rapid digitalization of the Indian entertainment landscape allows the anime market to tap into a large, tech-savvy youth demographic that consumes digital content regularly.

- Increasing Youth Population (Demographic trends): India's population under 35 years old constitutes over 65% of the total population, according to government census data (2024). This large, youthful population is a key driver for anime consumption, which appeals to this age group due to its visual storytelling and diverse genres. India is one of the youngest countries globally, with an average age of 29 in 2024, fostering a demand for youth-targeted content like anime across digital platforms.

- Local Content Creation and Licensing (Content production ecosystem): India’s animation and content production ecosystem has expanded with initiatives such as "Make in India," promoting local content development. In 2024, the Indian government reported over 1,000 animation and VFX studios, some venturing into anime-inspired content for local and global audiences. Localized anime content has gained traction, as Japanese studios increasingly license their works to Indian OTT platforms, boosting regional engagement.

Market Challenges

- High Piracy Levels (Content piracy impact): Despite the growing legal availability of anime in India, piracy remains a challenge, with a reported 65% of the digital population accessing pirated content in 2024, according to government anti-piracy data. This widespread piracy undermines the profits of official streaming platforms and content creators, impacting the ability of legal anime platforms to monetize their services effectively.

- Lack of Local Anime Production Studios (Production infrastructure gaps): Although India’s animation industry is expanding, there remains a shortage of studios specializing in anime production. Government reports indicate that only a small fraction of the 1,000+ Indian animation studios focus on anime, largely due to a lack of expertise in this niche genre. This gap in local anime production forces Indian platforms to rely heavily on imported content from Japan, limiting homegrown anime creation.

North America Autonomous Underwater Vehicle Market Future Outlook

The North America Autonomous Underwater Vehicle market is poised for substantial growth over the next five years, driven by increasing investments in underwater robotics, military modernization programs, and the growing demand for oil and gas exploration in deeper waters. Technological advancements in sensor integration, artificial intelligence (AI), and machine learning are expected to enhance the capabilities of AUVs, leading to wider adoption across both defense and commercial sectors. Moreover, initiatives for environmental conservation and the exploration of uncharted deep-sea areas will further boost market demand.

Future Market Opportunities

- Localization of Japanese Content (Content translation & dubbing): The localization of Japanese anime through dubbing and subtitling into Indian languages has been a pivotal growth opportunity. In 2024, the Indian government-supported “Digital India” initiative facilitated the dubbing of 200+ anime series in Hindi and other regional languages, broadening the appeal of anime across diverse linguistic demographics. This enhances accessibility for non-English speaking audiences, driving greater consumption in regional markets.

- Expansion of Anime Merchandise Sales (Merchandising market): Anime merchandise has emerged as a lucrative segment, with sales of licensed products reaching $500 million in 2024, driven by an expanding fanbase. Merchandise, including action figures, clothing, and accessories, has become increasingly popular, particularly in major cities like Mumbai and Delhi. This growth provides substantial opportunities for both local and international anime brands to capitalize on fan loyalty through dedicated retail channels and online platforms.

Scope of the Report

|

By Vehicle Type |

Large AUVs Medium AUVs Small AUVs

|

|

By Technology |

Collision Avoidance Sonar Technology Underwater Positioning System |

|

By Application |

Military and Defense Oil & Gas Exploration Environmental Monitoring Oceanography Search and Rescue |

|

By Propulsion Type |

Electric Mechanical Hybrid |

|

By Region |

North East West South |

Products

Key Target Audience

- Defense Contractors

- Oil & Gas Exploration Companies

- Environmental Research Organizations

- Naval and Maritime Defense Agencies (U.S. Navy, Canadian Navy)

- Marine Engineering Firms

- Government and Regulatory Bodies (Environmental Protection Agency, National Oceanic and Atmospheric Administration)

- Banks and Financial Institutes

- Investments and Venture Capitalist Firms

- Technology Solution Providers

Companies

North America Autonomous Underwater Vehicle Market Major Players

- General Dynamics

- Boeing

- Lockheed Martin

- L3Harris Technologies

- Teledyne Marine

- Saab AB

- Fugro

- Ocean Infinity

- Bluefin Robotics

- iXblue

- Hydroid Inc.

- Atlas Elektronik GmbH

- ECA Group

- International Submarine Engineering Ltd.

- Kongsberg Gruppen

Table of Contents

North America Autonomous Underwater Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Autonomous Underwater Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Autonomous Underwater Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Increased Defense Spending (Military Applications)

3.1.2. Advancements in Underwater Communication Technology

3.1.3. Rise in Offshore Oil & Gas Exploration (Commercial Applications)

3.1.4. Growing Environmental Monitoring and Surveying Initiatives (Environmental Protection and Surveying Applications)

3.2. Market Challenges

3.2.1. High Capital Costs (Initial Investment Costs)

3.2.2. Limited Operational Range and Battery Life

3.2.3. Regulatory Barriers in Underwater Exploration

3.3. Opportunities

3.3.1. Growing Demand for Seabed Mapping and Data Collection (Marine Science)

3.3.2. Expanding Application in Underwater Mining

3.3.3. Collaboration with Academic and Research Institutions for R&D

3.4. Trends

3.4.1. Integration of AI and Machine Learning in AUVs

3.4.2. Miniaturization and Modularity of AUVs

3.4.3. Adoption of Hybrid AUV-ROV Systems

3.5. Government Regulation

3.5.1. Environmental Regulations for Marine Operations

3.5.2. Naval Standards for AUV Deployment

3.5.3. International Maritime Organization (IMO) Guidelines for Underwater Operations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

North America Autonomous Underwater Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Large AUVs

4.1.2. Medium AUVs

4.1.3. Small AUVs

4.2. By Technology (In Value %)

4.2.1. Collision Avoidance

4.2.2. Sonar Technology

4.2.3. Underwater Positioning Systems

4.3. By Application (In Value %)

4.3.1. Military and Defense

4.3.2. Oil & Gas Exploration

4.3.3. Environmental Monitoring

4.3.4. Oceanography

4.3.5. Search and Rescue

4.4. By Propulsion Type (In Value %)

4.4.1. Electric

4.4.2. Mechanical

4.4.3. Hybrid

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. South

North America Autonomous Underwater Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. General Dynamics

5.1.2. Boeing

5.1.3. Lockheed Martin

5.1.4. L3Harris Technologies

5.1.5. Teledyne Marine

5.1.6. Saab AB

5.1.7. Kongsberg Gruppen

5.1.8. Fugro

5.1.9. Bluefin Robotics

5.1.10. Ocean Infinity

5.1.11. International Submarine Engineering Ltd.

5.1.12. Atlas Elektronik GmbH

5.1.13. iXblue

5.1.14. ECA Group

5.1.15. Hydroid Inc.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employees, Product Portfolio, R&D Investment, Market Share, Contracts Secured, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Autonomous Underwater Vehicle Market Regulatory Framework

6.1. Environmental and Maritime Regulations

6.2. Compliance Requirements for Defense Contracts

6.3. Certification Processes for Autonomous Systems

North America Autonomous Underwater Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Autonomous Underwater Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Propulsion Type (In Value %)

8.5. By Region (In Value %)

North America Autonomous Underwater Vehicle Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Market Entry and Expansion Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying key variables influencing the North America AUV market, focusing on defense contracts, oil exploration, and environmental monitoring. Extensive secondary research using proprietary databases is conducted to define market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

This step compiles historical data related to AUV deployments, analyzing defense spending patterns, offshore exploration activities, and research missions in North American waters. An assessment of operational success rates and technological adoption is also conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on AUV adoption trends are validated through expert interviews with industry leaders from defense, oil, and environmental sectors. These insights offer a deeper understanding of operational challenges and R&D investment trends.

Step 4: Research Synthesis and Final Output

Finally, primary data collected from AUV manufacturers is combined with secondary research to synthesize a final report. This process ensures that the market analysis is comprehensive, providing an accurate reflection of the North America AUV market dynamics.

Frequently Asked Questions

01. How big is the North America Autonomous Underwater Vehicle Market?

The North America Autonomous Underwater Vehicle market is valued at USD 630 million, driven by increased defense spending and the growing need for environmental monitoring in offshore regions.

02. What are the challenges in the North America AUV Market?

Challenges in North America Autonomous Underwater Vehicle market include high operational costs, limited battery life, and regulatory barriers in underwater operations. These challenges hinder the wider adoption of AUVs, particularly in commercial sectors.

03. Who are the major players in the North America AUV Market?

Key players in the North America Autonomous Underwater Vehicle market include General Dynamics, Boeing, Lockheed Martin, L3Harris Technologies, and Teledyne Marine. These companies dominate due to their extensive R&D capabilities and strong defense sector ties.

04. What are the growth drivers of the North America AUV Market?

Growth drivers in North America Autonomous Underwater Vehicle market include rising defense budgets, advancements in underwater communication technologies, and the increasing need for oil and gas exploration in deeper waters.

05. What role do government regulations play in the North America AUV Market?

Government regulations play a crucial role in North America Autonomous Underwater Vehicle market, particularly in defense contracts and environmental monitoring mandates. Compliance with international maritime laws also shapes market strategies for AUV manufacturers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.