North America Bakery Products Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD5897

December 2024

90

About the Report

North America Bakery Products Market Overview

- The North America bakery products market is valued at USD 94 billion, driven primarily by growing consumer demand for convenience foods and the increasing adoption of healthier alternatives like gluten-free and organic products. The market has shown steady growth, backed by urbanization and lifestyle changes that push consumers towards ready-to-eat bakery items. With a shift towards premium and artisanal offerings, consumers have also developed a preference for locally sourced, fresh ingredients, further bolstering the markets growth.

- The market is dominated by the United States and Canada, largely due to their well-developed food and beverage industries and high consumer spending on bakery goods. These regions benefit from established supply chains, robust retail infrastructures, and a high demand for premium bakery products like croissants, bagels, and artisanal bread. The increasing inclination towards healthier lifestyle choices in urban areas also supports their dominance, with cities like New York, Los Angeles, and Toronto leading consumption trends.

- Food safety and labeling regulations play a crucial role in shaping the bakery products market in North America. In 2023, the U.S. Food and Drug Administration (FDA) updated its food labeling guidelines, mandating clearer nutritional information and allergen declarations for bakery products. This regulation impacts the entire supply chain, from production to packaging, requiring companies to comply with stringent labeling standards. The FDA's focus on consumer transparency has pushed bakeries to invest in product reformulations and more accurate labeling practices to meet regulatory demands.

North America Bakery Products Market Segmentation

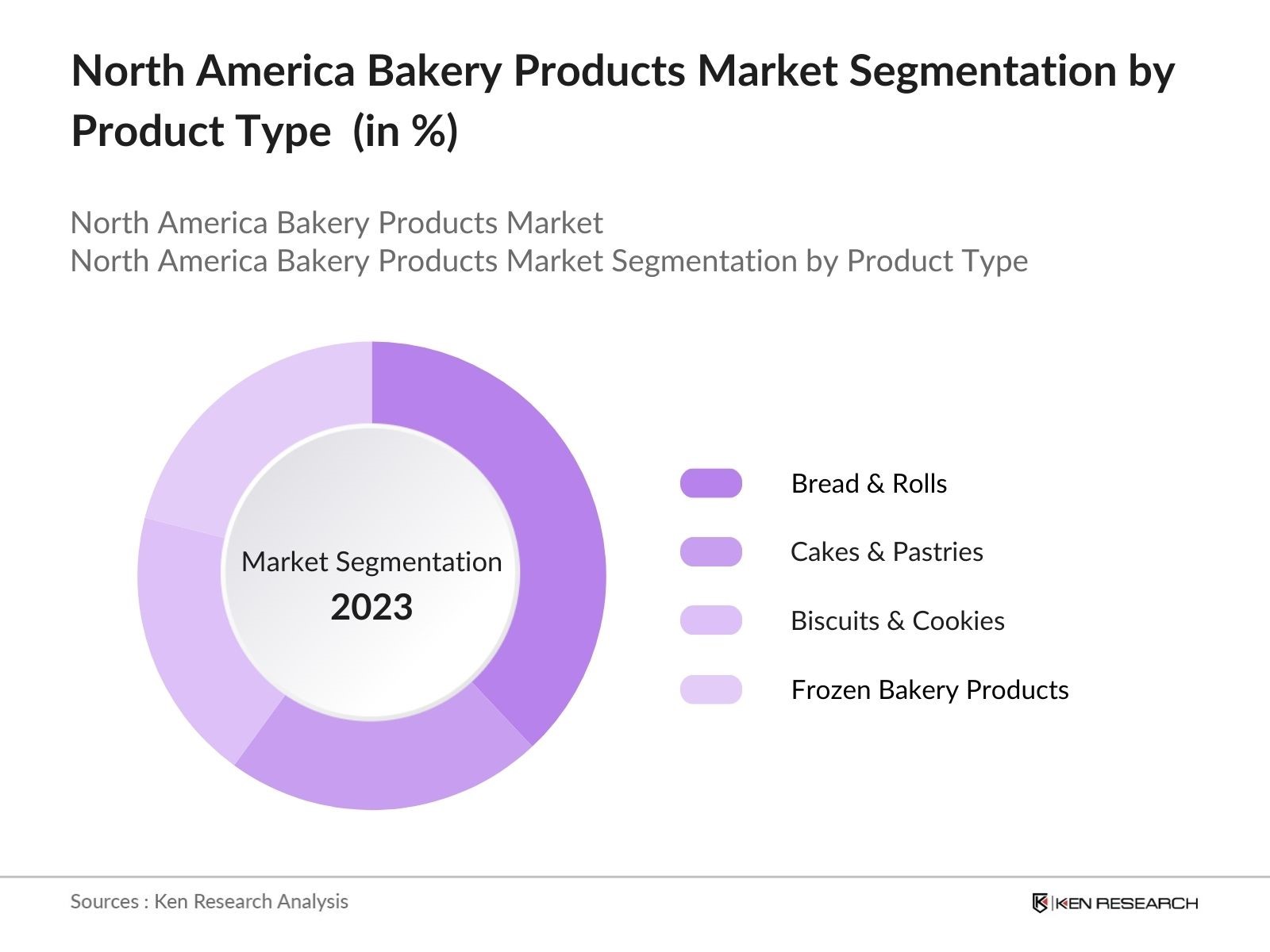

By Product Type: The market is segmented by product type into bread & rolls, cakes & pastries, biscuits & cookies, and frozen bakery products. Bread & rolls hold a dominant market share due to their staple nature in the North American diet. Their widespread consumption, particularly in the form of sandwiches, and the constant introduction of new varieties like whole grain and multigrain products, drive this segment. Additionally, their relatively longer shelf life compared to other baked goods makes them a preferred choice among consumers.

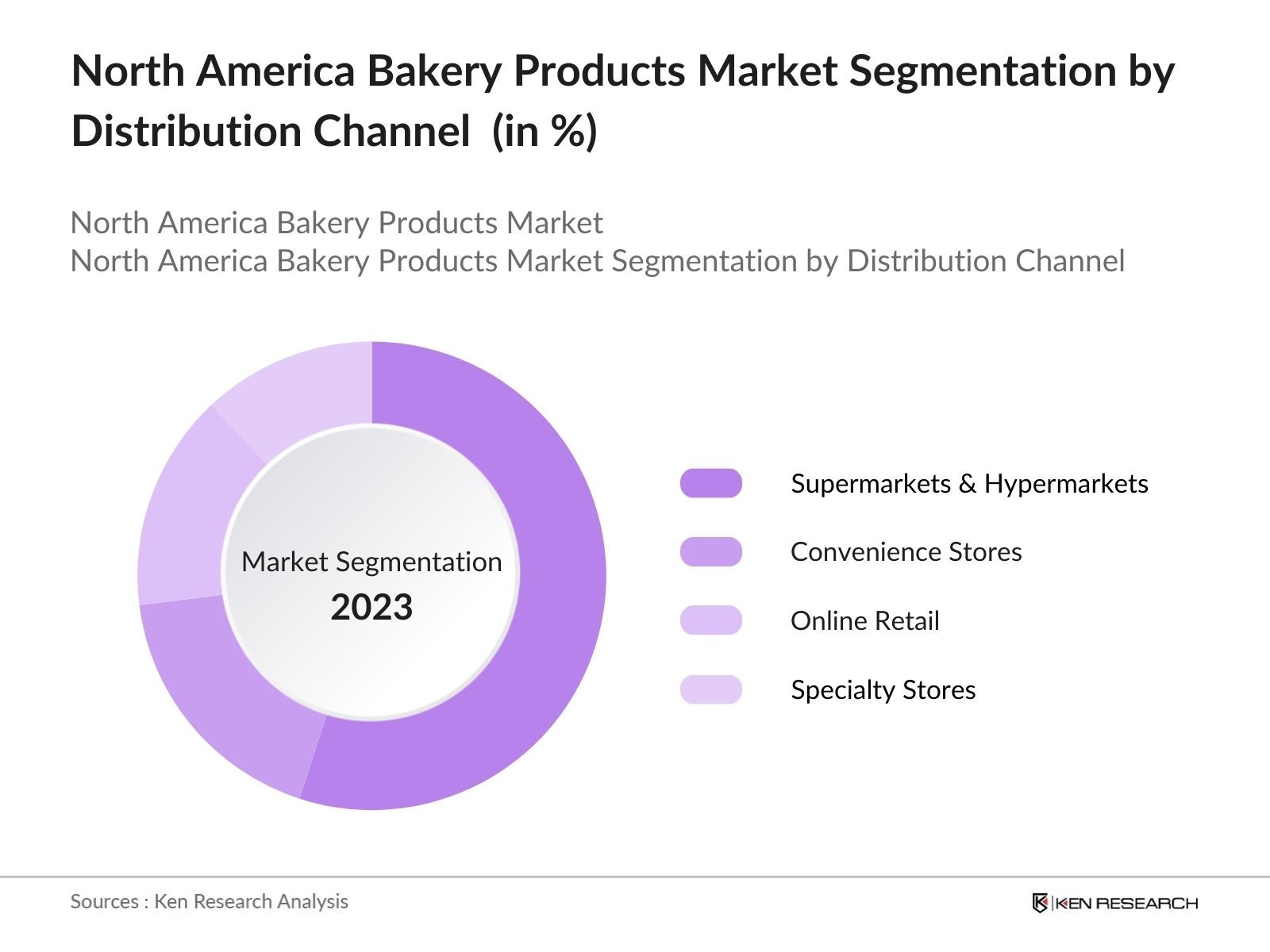

By Distribution Channel: The market is segmented by distribution channels into supermarkets & hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets & hypermarkets lead the market due to their large product variety, ease of access, and promotional offers. These retail outlets provide consumers with a broad selection of bakery products, ranging from freshly baked goods to packaged items, all under one roof. Their significant foot traffic and extensive reach into urban and suburban markets further solidify their position as the dominant distribution channel.

North America Bakery Products Market Competitive Landscape

The North American bakery products market is highly competitive, with a mix of global giants and local players. The major companies in this market continually innovate by introducing healthier alternatives and expanding their product portfolios to cater to evolving consumer preferences. Additionally, many key players are focused on sustainability initiatives, such as eco-friendly packaging and reducing carbon footprints across their supply chains.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (2023) |

Geographic Reach |

R&D Investments |

Sustainability Initiatives |

Partnerships |

|

Grupo Bimbo |

1945 |

Mexico City, Mexico |

||||||

|

Mondelez International |

1923 |

Chicago, USA |

||||||

|

General Mills |

1866 |

Minneapolis, USA |

||||||

|

Flowers Foods |

1919 |

Thomasville, USA |

||||||

|

Aryzta AG |

2008 |

Zurich, Switzerland |

North America Bakery Products Industry Analysis

Growth Drivers

- Growing Popularity of Health-conscious Bakery Products: The demand for health-conscious bakery products has grown, driven by increased consumer awareness of nutrition and health. According to data from the World Bank, the U.S. saw a notable rise in obesity, affecting over 42.4% of adults by 2022. This has led to an increased demand for low-calorie, low-sugar, and gluten-free bakery items. Companies in the bakery sector have responded by introducing healthier alternatives, particularly targeting consumers who seek nutritional transparency and lower fat content in their foods. This trend is reshaping the North American bakery products market.

- Rise in Urbanization and Changing Lifestyles: Urbanization is a key driver in the expansion of the bakery products market in North America. The urban population in Canada reached 81.3% in 2022, according to World Bank figures, contributing to an evolving demand for convenient, ready-to-eat bakery products. Changing consumer lifestyles, characterized by reduced home cooking time and the preference for on-the-go food, have further pushed the consumption of bakery goods. This shift is being embraced by bakeries, which are innovating their product lines to meet the needs of busy, urban consumers.

- Expansion of E-commerce in the Food & Beverage Sector: E-commerce has become a crucial distribution channel for bakery products in North America, with online grocery sales hitting $128 billion in the U.S. by 2023, according to World Bank reports. This surge in online shopping is driven by consumer preferences for convenience and home delivery options. Bakery companies are now leveraging e-commerce platforms to expand their reach, particularly in remote areas and urban centers. The growing digital transformation in food retail is expected to continue supporting the growth of the bakery products market in the near future.

Market Challenges

- Fluctuations in Raw Material Prices: Volatility in the prices of key raw materials like wheat and sugar poses a significant challenge for the North American bakery products market. In 2023, wheat prices fluctuated between $7.00 and $7.50 per bushel, as reported by the USDA. This instability is driven by factors like unpredictable weather conditions and geopolitical tensions affecting global supply chains. The bakery industry is highly sensitive to these price changes, which directly impact production costs and profit margins. Addressing this challenge requires bakeries to seek cost-effective sourcing and explore alternative ingredients.

- Health Regulations on Sugar and Gluten: Stringent health regulations regarding sugar content and gluten labeling in North America have become more rigorous. By 2022, the U.S. Food and Drug Administration (FDA) imposed stricter guidelines on sugar content in packaged foods, limiting added sugars to 10% of total daily calories. These regulations have pressured the bakery sector to reformulate their products to meet compliance. Gluten labeling laws have also tightened, with mandatory gluten-free certification for certain products in Canada, further complicating production processes for bakery companies operating in multiple regions.

North America Bakery Products Market Future Outlook

Over the next five years, the North America bakery products market is expected to experience steady growth. This growth will be driven by evolving consumer preferences for healthier options, including gluten-free, organic, and vegan bakery products. The increased focus on premium and artisanal offerings, coupled with technological advancements in packaging and manufacturing, will further propel market expansion. Additionally, the growth of e-commerce platforms for the sale of bakery products is anticipated to offer new opportunities for market players.

Future Market Opportunities

- Introduction of Gluten-Free and Organic Products: The North American bakery products market is experiencing increased demand for gluten-free and organic offerings, driven by rising health consciousness and dietary restrictions. By 2023, gluten-free product sales in the U.S. reached $6.6 billion, reflecting a significant market shift. Organic bakery products, often seen as healthier options, are gaining traction, particularly among millennials and Gen Z consumers. This opportunity allows bakeries to tap into a growing segment of health-conscious consumers by introducing innovative product lines with organic and gluten-free ingredients.

- Increasing Demand for Frozen and Ready-to-Eat Products: Frozen bakery products are witnessing a surge in demand; driven by the convenience they offer to time-constrained consumers. According to USDA reports, frozen food sales, including bakery items, grew by 5% in 2022, reflecting consumer preferences for long-lasting, easy-to-prepare foods. Ready-to-eat baked goods like pies, bread, and cakes are becoming household staples, catering to the growing need for quick meal solutions in North America. This demand opens opportunities for bakeries to invest in expanding their frozen product lines and developing innovative packaging solutions.

Scope of the Report

|

Product Type |

Bread & Rolls Cakes & Pastries Biscuits & Cookies Frozen Bakery Products Other Bakery Products |

|

Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Retail Specialty Stores Other Channels |

|

Ingredient Type |

Wheat-Based Gluten-Free Dairy-Free Organic Ingredients |

|

End-User |

Retail Consumers Food Service Industry |

|

Region |

USA Canada Mexico |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, USDA)

Bakery Product Manufacturers

Retail Chains and Supermarkets

Food Service Industry

Ingredient Suppliers

Packaging Solution Providers

E-commerce Platforms

Banks and Financial Institutions

Companies

Major Players

Grupo Bimbo

Mondelez International

General Mills

Flowers Foods

Aryzta AG

Campbell Soup Company

The Kellogg Company

Rich Products Corporation

Weston Foods

Hostess Brands, LLC

Finsbury Food Group

McKee Foods Corporation

Dawn Foods

JAB Holding Company

George Weston Limited

Table of Contents

North America Bakery Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Bakery Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Bakery Products Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Convenience Foods

3.1.2. Growing Popularity of Health-conscious Bakery Products

3.1.3. Rise in Urbanization and Changing Lifestyles

3.1.4. Expansion of E-commerce in the Food & Beverage Sector

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices (Wheat, Sugar)

3.2.2. Health Regulations on Sugar and Gluten

3.2.3. Rising Competition from Private Labels

3.3. Opportunities

3.3.1. Introduction of Gluten-Free and Organic Products

3.3.2. Increasing Demand for Frozen and Ready-to-Eat Products

3.3.3. Potential for Innovation in Packaging and Shelf-Life Improvement

3.4. Trends

3.4.1. Growing Demand for Vegan and Plant-Based Bakery Products

3.4.2. Rise in Artisanal and Specialty Bakery Products

3.4.3. Expansion of Bakery Cafes and Boutique Stores

3.5. Government Regulations

3.5.1. Food Safety Standards and Labeling Regulations

3.5.2. Regulations on Nutritional Content (Sugar, Fat)

3.5.3. Import Tariffs on Ingredients (Wheat, Dairy)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

North America Bakery Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bread & Rolls

4.1.2. Cakes & Pastries

4.1.3. Biscuits & Cookies

4.1.4. Frozen Bakery Products

4.1.5. Other Bakery Products

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Other Channels

4.3. By Ingredient Type (In Value %)

4.3.1. Wheat-Based

4.3.2. Gluten-Free

4.3.3. Dairy-Free

4.3.4. Organic Ingredients

4.4. By End-User (In Value %)

4.4.1. Retail Consumers

4.4.2. Food Service Industry

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

North America Bakery Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Grupo Bimbo

5.1.2. Mondelez International

5.1.3. General Mills

5.1.4. Campbell Soup Company

5.1.5. The Kellogg Company

5.1.6. Flowers Foods

5.1.7. Aryzta AG

5.1.8. Hostess Brands, LLC

5.1.9. George Weston Limited

5.1.10. Rich Products Corporation

5.1.11. McKee Foods Corporation

5.1.12. JAB Holding Company

5.1.13. Finsbury Food Group

5.1.14. Weston Foods

5.1.15. Dawn Foods

5.2. Cross Comparison Parameters (Product Portfolio, Geographical Presence, Revenue, Production Capacity, Market Share, Innovation Strategies, Sustainability Initiatives, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Bakery Products Market Regulatory Framework

6.1. Food Safety Regulations

6.2. Nutritional Labeling Requirements

6.3. Compliance with Packaging and Sustainability Standards

North America Bakery Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Bakery Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

North America Bakery Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. White Space Opportunity Analysis

9.4. Product Innovation Strategies

Research Methodology

Step 1: Identification of Key Variables

This phase involves the construction of a detailed ecosystem map of the North America Bakery Products Market. Comprehensive desk research is conducted using proprietary databases and secondary research sources to identify all relevant variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data is analyzed to evaluate the bakery product markets penetration and revenue generation across key segments. This includes an in-depth assessment of consumer preferences, purchasing patterns, and product innovations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts, conducted via structured interviews. These interviews provide firsthand insights into market operations, key challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagements with manufacturers and industry stakeholders to corroborate findings and ensure the accuracy of the market data. The synthesis of research provides a comprehensive, validated analysis of the North America bakery products market.

Frequently Asked Questions

01. How big is the North America Bakery Products Market?

The North America bakery products market is valued at USD 94 billion, driven by increasing consumer demand for convenience foods and the rising popularity of gluten-free and organic products.

02. What are the challenges in the North America Bakery Products Market?

Challenges in the North America bakery products market include fluctuating raw material prices such as wheat and sugar, strict health regulations concerning sugar and gluten, and increasing competition from private label brands.

03. Who are the major players in the North America Bakery Products Market?

Key players in the North America bakery products market include Grupo Bimbo, Mondelez International, General Mills, Flowers Foods, and Aryzta AG. These companies dominate due to their extensive product portfolios, global reach, and sustainability initiatives.

04. What are the growth drivers of the North America Bakery Products Market?

Growth drivers in the North America bakery products market include the increasing consumer demand for healthier products, such as gluten-free and organic options, as well as innovations in packaging that enhance product shelf life.

05. How is the distribution landscape of the North America Bakery Products Market?

Supermarkets and hypermarkets dominate the distribution landscape, providing consumers with a wide variety of bakery products and benefiting from extensive foot traffic in urban and suburban areas in the North America bakery products market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.