North America Beauty And Personal Care Products Market Overview

- The North America Beauty and Personal Care Products Market is valued at USD 130 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for innovative and high-quality products, a rising focus on personal grooming and self-care, and the widespread adoption of digital channels for product discovery and purchase. The market has seen a significant shift towards natural, organic, and cruelty-free products, reflecting changing consumer preferences and heightened awareness of health, wellness, and sustainability .

- The United States and Canada dominate the North American beauty and personal care market due to their large consumer base, high disposable income, and robust retail infrastructure. Major urban centers such as New York, Los Angeles, and Toronto serve as key hubs for beauty trends, product launches, and influencer-driven marketing, further solidifying their positions as market leaders. The presence of numerous established brands, a growing number of indie and emerging companies, and the influence of social media contribute to the market's vibrancy and innovation .

- In 2023, the U.S. government enacted regulations under the Modernization of Cosmetics Regulation Act (MoCRA), requiring all cosmetic products to be labeled with a comprehensive ingredient list and mandating enhanced safety substantiation. This regulation aims to improve consumer safety and transparency, ensuring that consumers are well-informed about the products they use. The initiative reflects a broader trend toward stricter safety standards and regulatory oversight in the beauty and personal care industry, promoting the use of safe and effective ingredients .

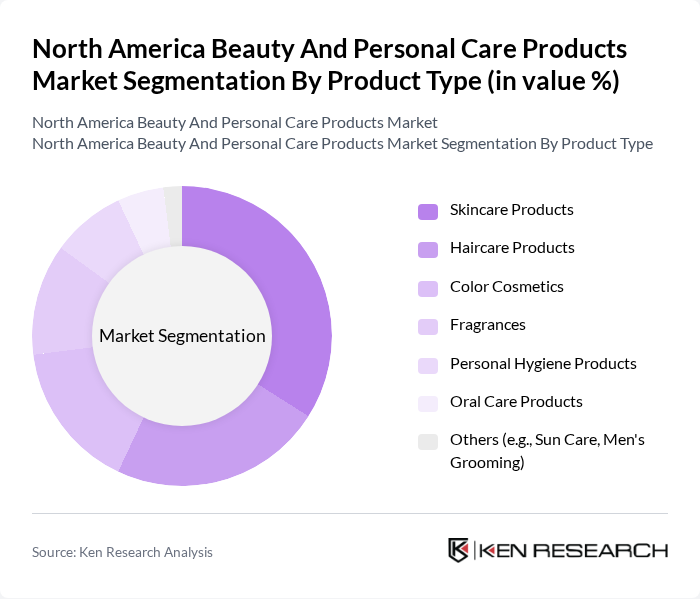

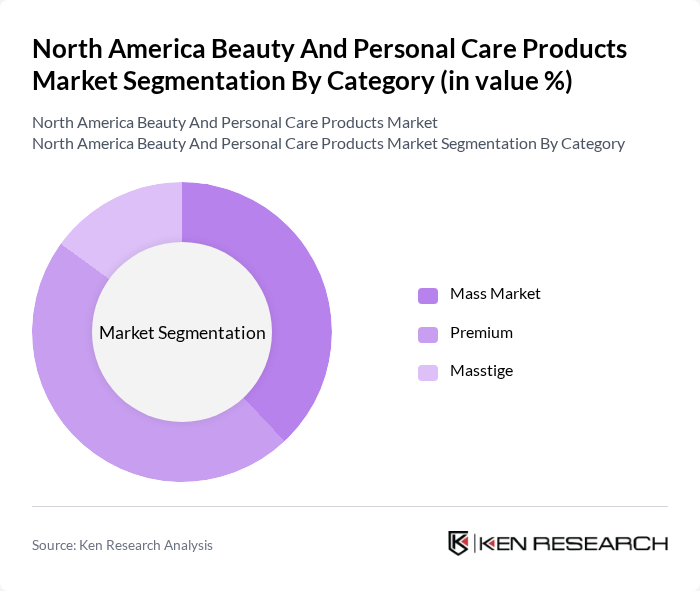

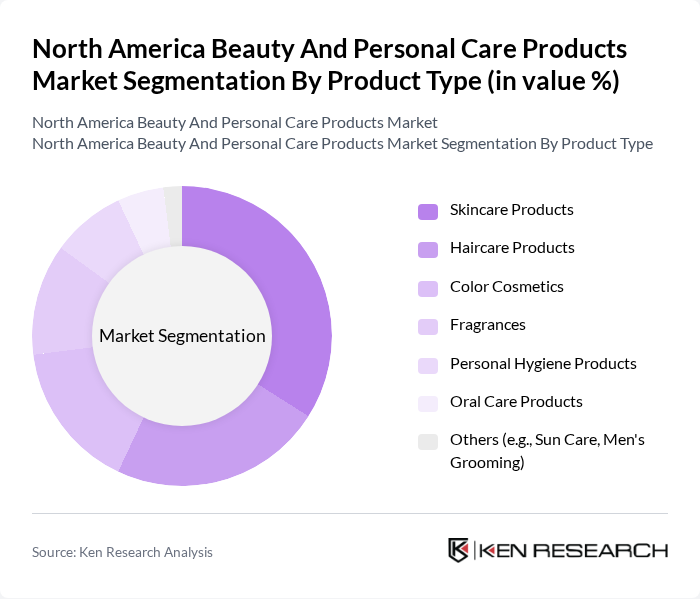

North America Beauty And Personal Care Products Market Segmentation

By Product Type:The product type segmentation includes skincare products, haircare products, color cosmetics, fragrances, personal hygiene products, oral care products, and others (such as sun care and men's grooming). Among these, skincare products are the most dominant segment, driven by increasing consumer awareness about skin health, the growing popularity of anti-aging and moisturizing products, and rising concerns over environmental stressors. Haircare products also hold a significant share, fueled by trends in hair styling, scalp health, and treatment-focused innovations .

By Category:The category segmentation includes mass market, premium, and masstige products. The premium category is currently leading the market, driven by consumers' willingness to invest in high-quality and luxury beauty products, particularly among millennials and Gen Z who prioritize brand reputation, product efficacy, and ethical standards. The mass market segment remains strong due to its affordability and accessibility, catering to a broad consumer base, while the masstige segment is gaining traction as consumers seek a blend of quality and value .

North America Beauty And Personal Care Products Market Competitive Landscape

The North America Beauty And Personal Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., The Estée Lauder Companies Inc., Coty Inc., Revlon Inc., Johnson & Johnson Consumer Inc., L'Oréal USA Inc., Mary Kay Inc., Avon Products Inc., Unilever United States, Inc., Shiseido Americas Corporation, Amway Corp., Neutrogena Corporation, Colgate-Palmolive Company, Kimberly-Clark Corporation, Beautycounter, Edgewell Personal Care Company, E.l.f. Beauty, Inc., Jack Henry, Jaxon Lane, and Sephora USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

North America Beauty And Personal Care Products Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Personal Care:The North American beauty and personal care market is experiencing a surge in consumer awareness, with 70% of consumers actively seeking information about product ingredients and benefits. This trend is supported by a report from the Personal Care Products Council, which indicates that the market is projected to reach $100 billion, driven by informed purchasing decisions. As consumers prioritize health and wellness, brands that emphasize transparency and education are likely to thrive.

- Rise in E-commerce Sales:E-commerce sales in the beauty and personal care sector are expected to exceed $30 billion, reflecting a 25% increase from the previous year. According to the U.S. Department of Commerce, online shopping has become a primary channel for consumers, particularly among millennials and Gen Z. This shift is fueled by convenience, a wider product selection, and the ability to compare prices easily, prompting brands to enhance their online presence and digital marketing strategies.

- Demand for Natural and Organic Products:The demand for natural and organic beauty products is projected to grow significantly, with sales expected to reach $15 billion. A survey by the Organic Trade Association indicates that 60% of consumers prefer products with natural ingredients, driven by health concerns and environmental awareness. This trend is prompting brands to reformulate existing products and launch new lines that cater to eco-conscious consumers, thereby expanding their market share.

Market Challenges

- Intense Competition:The North American beauty and personal care market is characterized by intense competition, with over 1,000 brands vying for consumer attention. According to IBISWorld, the market is fragmented, making it challenging for new entrants to establish a foothold. Established brands dominate shelf space and consumer loyalty, necessitating innovative marketing strategies and unique product offerings to differentiate from competitors and capture market share.

- Regulatory Compliance Costs:Compliance with regulatory standards in the beauty and personal care industry can impose significant costs on companies. The FDA mandates rigorous testing and labeling requirements, which can exceed $1 million annually for larger firms. Smaller companies often struggle to meet these standards, leading to potential market entry barriers. As regulations evolve, companies must invest in compliance to avoid penalties and maintain consumer trust, impacting profitability.

North America Beauty And Personal Care Products Market Future Outlook

The North American beauty and personal care market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, brands are increasingly leveraging data analytics to tailor products to individual needs. Additionally, the rise of sustainability initiatives is prompting companies to adopt eco-friendly practices, enhancing brand loyalty. With the continued expansion of e-commerce and digital marketing, businesses that adapt to these trends will likely capture a larger share of the market in the future.

Market Opportunities

- Expansion into Emerging Markets:Companies have a significant opportunity to expand into emerging markets, where demand for beauty products is rising. The U.S. Commercial Service reports that markets in Latin America and Asia are experiencing double-digit growth rates, presenting lucrative avenues for brands to increase their global footprint and revenue streams.

- Growth of Male Grooming Products:The male grooming segment is projected to reach $10 billion, driven by changing societal norms and increased spending on personal care. A report from Statista indicates that 40% of men are now using skincare products regularly, creating opportunities for brands to develop targeted marketing strategies and product lines tailored specifically for male consumers.