North America Bio Pesticides Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1738

December 2024

86

About the Report

North America Bio Pesticides Market Overview

- The North America bio pesticides market was valued at USD 2.12 billion in 2023, driven by increased demand for sustainable agricultural practices and stringent regulations limiting the use of synthetic chemicals. This growth is primarily fueled by the increasing awareness among consumers and farmers about the benefits of bio pesticides, which are derived from natural materials and are environmentally friendly.

- The North American bio pesticides market is highly competitive, with several key players driving innovation and market expansion. Some of the major players include BASF SE, Bayer CropScience AG, Valent BioSciences LLC, Marrone Bio Innovations, Inc., and Certis USA LLC. These companies are investing heavily in research and development to introduce new and more effective bio pesticide products to meet the growing demand.

- BASF launchedExponus insecticide in India in April 2022. Powered by the new active ingredientBroflanilide, Exponus offers a new mode of action for controlling key insect pests like caterpillars and thrips in oilseeds, pulses and vegetable crops. With its unique mode of action, Exponus is among the first compounds introduced under the new IRAC group 30, representing a totally new class of insecticides.

- In 2023, California was the leading state, and within California, the city of Salinas stands out as a dominant force in the market. Salinas is often referred to as the "Salad Bowl of the World" due to its extensive production of leafy greens and other vegetables. The citys dominance in the bio pesticides market is driven by its large-scale organic farming industry, which heavily relies on bio pesticides to manage pest control in an environmentally friendly manner.

North America Bio Pesticides Market Segmentation

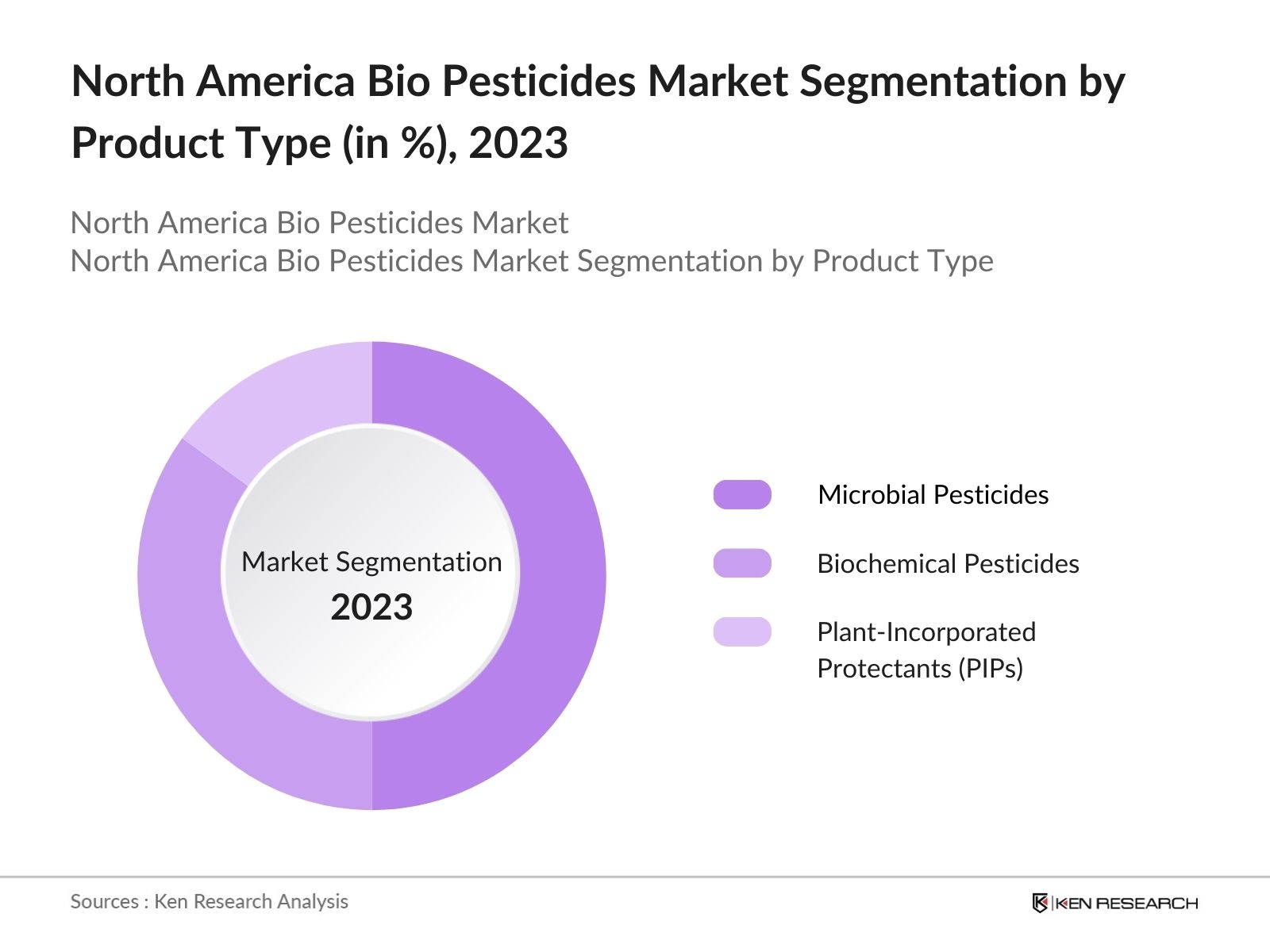

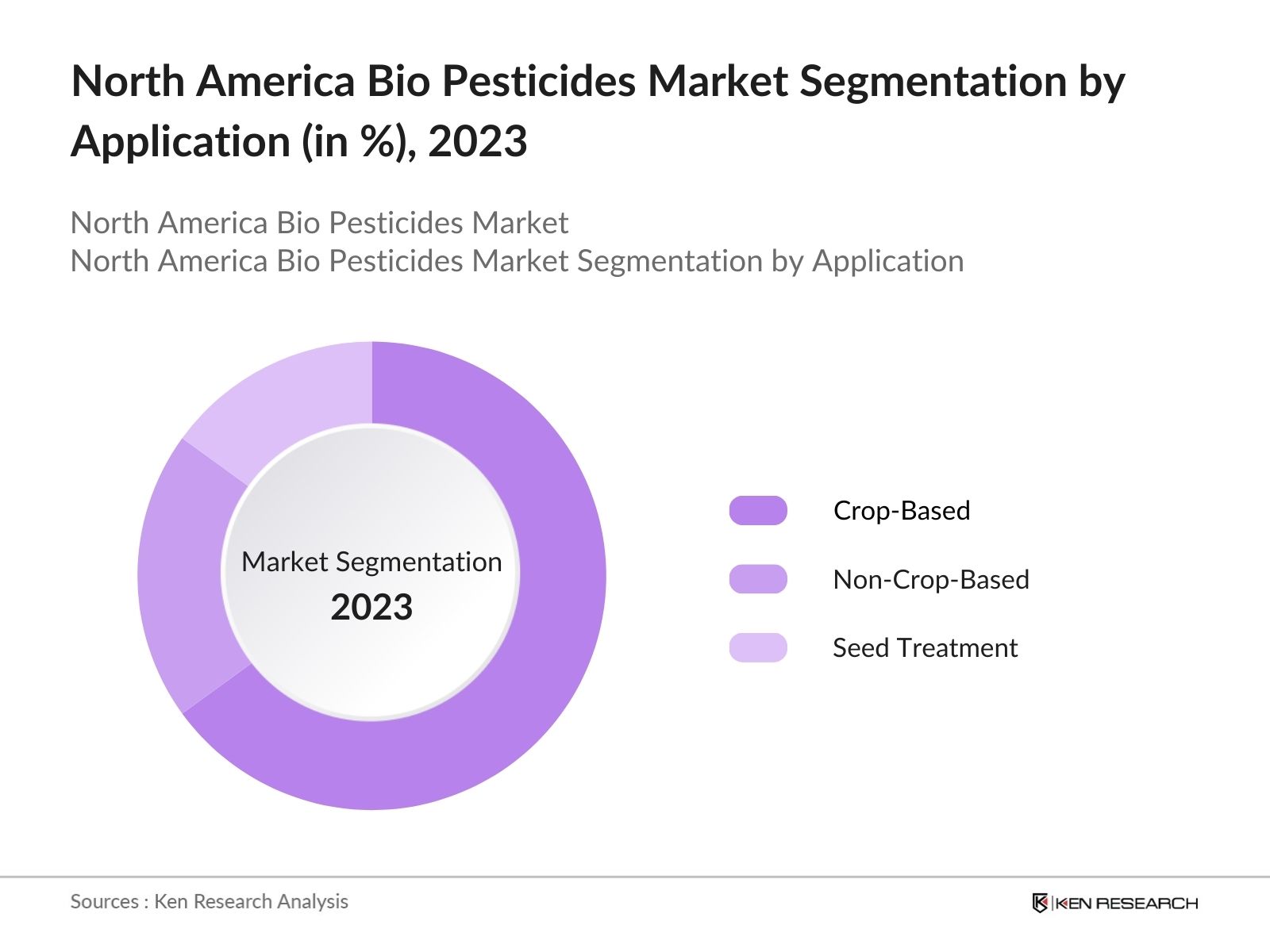

The North America Bio Pesticides Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into microbial pesticides, biochemical pesticides, and plant-incorporated protectants (PIPs). In 2023, microbial pesticides were dominating the market. The dominance of this segment can be attributed to the effectiveness of microbial pesticides in controlling a wide range of pests, coupled with their relatively lower cost compared to other bio pesticide types. The growing preference for microbial solutions in organic farming is expected to further drive this segments growth in the coming years.

By Region: The market is segmented by region into the United States and Canada. In 2023, the United States dominated the market largely due to its attributed to the countrys extensive agricultural industry, which is one of the largest in the world. The United States' strong regulatory framework, which supports sustainable farming practices, has also significantly contributed to the adoption of bio pesticides. Additionally, the high consumer demand for organic and sustainably produced food has driven the growth of the bio pesticides market in the U.S.

By Application: The market is also segmented by application into crop-based, non-crop-based, and seed treatment. In 2023, the crop-based segment was dominating the market, driven by the extensive use of bio pesticides in the cultivation of fruits and vegetables, cereals, and grains, which are highly susceptible to pest attacks. The rising demand for organic produce, especially in the U.S. and Canada, has led to increased adoption of bio pesticides in crop production, making this segment the largest in the market.

North America Bio Pesticides Market Competitive Landscape

North America Bio Pesticides Market Major Players

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Bayer CropScience AG |

2002 |

Leverkusen, Germany |

|

Valent BioSciences LLC |

2001 |

Libertyville, USA |

|

Marrone Bio Innovations |

2006 |

Davis, USA |

|

Certis USA LLC |

2001 |

Columbia, USA |

- Valent BioSciences LLC: In 2022, Valent BioSciences recently launched a new biostimulant operating unit, which became fully operational. This unit focuses on selling biostimulant products, including arbuscular mycorrhizal fungi (AMF) technologies, directly to the U.S. market. The biostimulants are marketed under the Symvado and Proliant brands, with the goal of enhancing crop performance and supporting sustainability efforts aligned with Sumitomo Chemical Co., Ltd.'s mission for carbon neutrality by 2050.

- Certis USA LLC: In June 2022, Certis partnered withNovozymesto develop new technologies for effective fungal disease control, enhancing their offerings for row crop growers. This collaboration aims to leverage both companies' expertise to deliver innovative solutions to the agricultural sector.

North America Bio Pesticides Market Analysis

North America Bio Pesticides Market Growth Drivers

- Increasing Adoption of Organic Farming: 2021, the total certified organic land in the U.S. was approximately 4.89 million acres, and while there has been growth in organic farming. This rise in organic farming practices has significantly boosted the demand for bio pesticides, as synthetic chemical usage is strictly prohibited in organic agriculture. The organic food market is driving the need for sustainable crop protection solutions. The expanding acreage under organic cultivation necessitates the adoption of bio pesticides to meet pest management requirements while adhering to organic farming standards.

- Government Support for Sustainable Agriculture: In May 2024, the USDA awarded $300 million to 66 U.S. organizations under the new Regional Agricultural Promotion Program (RAPP). This initiative aims to expand U.S. agricultural exports to high-potential markets in Africa, Latin America, and Southeast Asia. The funding supports a variety of projects, including trade education seminars, market research, and trade missions, which are crucial for building demand for bio-based agricultural products, including bio pesticides. This diversification of export markets is expected to boost the U.S. bio pesticides market by opening new international opportunities.

- Technological Advancements in Bio Pesticide Development: In 2024, significant advancements in biotechnology have led to the development of more effective and targeted bio pesticides. Companies have invested collectively in R&D to create bio pesticides that are more efficient, have longer shelf lives, and can target specific pests without affecting non-target organisms. These advancements are driving the adoption of bio pesticides as they offer superior efficacy compared to traditional pesticides, thus supporting market growth. The continuous innovation in this field is expected to attract more farmers to switch to bio-based solutions.

North America Bio Pesticides Market Challenges

- High Production Costs and Economic Viability: The production of bio pesticides involves sophisticated biological processes, which are generally more costly compared to the production of synthetic chemicals. The high production costs can make bio pesticides less economically viable, especially for small-scale farmers. This financial barrier limits broader market penetration, particularly in regions where agricultural budgets are constrained.

- Limited Shelf Life and Storage Challenges: Bio pesticides typically have a shorter shelf life and require specific storage conditions to maintain their effectiveness. These requirements can lead to higher logistical costs and complexities, particularly in areas with extreme weather conditions. The need for careful handling and storage adds an additional layer of challenge, potentially limiting the accessibility and adoption of bio pesticides.

North America Bio Pesticides Market Government Initiatives

- Sustainable Agricultural Value Chains Initiative (SAVCI): In 2024, the Canadian government proposed the Sustainable Agricultural Value Chains Initiative (SAVCI) with an initial funding of $550 million over five years. This initiative aims to support rural and remote communities by promoting sustainable agricultural practices, including the adoption of bio pesticides. SAVCI is designed to help farmers transition to more environmentally friendly practices while enhancing productivity and profitability. The initiative also emphasizes the importance of collaboration with local and Indigenous communities to ensure regionally appropriate solutions for sustainable agriculture.

- Strengthening Scientific Advisory and Regulatory Oversight: In 2024, the U.S. Environmental Protection Agency (EPA) strengthened its regulatory oversight of pesticides, including bio pesticides, by appointing new members to the FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act) Scientific Advisory Panel. This panel plays a crucial role in providing independent scientific advice to the EPA on complex pesticide regulatory issues. The enhanced focus on scientific expertise and transparent decision-making is expected to improve the regulatory process for bio pesticides, ensuring they meet rigorous safety and efficacy standards while facilitating market growth.

North America Bio Pesticides Market Future Outlook

The North America bio pesticides market is expected to continue its growth by 2028. This growth will be driven by ongoing advancements in biotechnologies, increased adoption of integrated pest management (IPM) practices, and supportive government policies. The shift towards organic farming and sustainable agriculture will further bolster the demand for bio pesticides, ensuring a positive outlook for the market.

Market Trends

- Expansion of Bio Pesticides in Row Crops: Traditionally, bio pesticides have been more commonly used in specialty crops like fruits and vegetables. However, by 2028, it is expected that the use of bio pesticides in row crops such as corn, soybeans, and wheat will increase significantly. This expansion is driven by the development of new bio pesticide formulations specifically designed for large-scale crops. The increasing resistance of pests to chemical pesticides in these crops will also contribute to the growing adoption of bio pesticides in this segment.

- Development of New Bio Pesticide Formulations for Climate Change Adaptation: As climate change continues to impact agricultural practices, there will be a growing need for bio pesticide formulations that can withstand extreme weather conditions. By 2028, it is expected that a significant portion of R&D investments in the bio pesticides market will be directed towards developing products that are effective under varying climatic conditions. These innovations will be crucial for ensuring crop protection in regions prone to extreme temperatures, droughts, and floods.

Scope of the Report

|

By Product Type |

Microbial Pesticides Biochemical Pesticides Plant-Incorporated Protectants (PIPs) |

|

By Application |

Crop-Based Non-Crop-Based Seed Treatment |

|

By Region |

United States Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food Processing Companies

Agrochemical Companies

Chemical Companies

Food Firms

Importers and Exporters of Agricultural Companies

Government Agencies (e.g., USDA, EPA)

Banks and Financial Institutions

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

Bayer CropScience AG

Valent BioSciences LLC

Marrone Bio Innovations, Inc.

Certis USA LLC

Syngenta AG

FMC Corporation

Nufarm Limited

Dow AgroSciences LLC

Koppert Biological Systems

BioWorks Inc.

Novozymes A/S

Andermatt Biocontrol AG

Isagro S.p.A.

W. Neudorff GmbH

Table of Contents

1. North America Bio Pesticides Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Bio Pesticides Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Bio Pesticides Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Organic Farming

3.1.2. Government Support for Sustainable Agriculture

3.1.3. Technological Advancements in Bio Pesticide Development

3.1.4. Rising Environmental and Health Concerns

3.2. Challenges

3.2.1. High Production Costs and Economic Viability

3.2.2. Limited Shelf Life and Storage Challenges

3.2.3. Regulatory Barriers and Lengthy Approval Processes

3.2.4. Lack of Awareness and Technical Expertise

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Integration with Organic Farming Practices

3.3.3. Partnerships and Collaborations

3.3.4. Development of Climate-Resilient Bio Pesticides

3.4. Trends

3.4.1. Expansion of Bio Pesticides in Row Crops

3.4.2. Increasing Use of Bio Pesticides in Conventional Farming

3.4.3. Development of New Bio Pesticide Formulations for Climate Change Adaptation

3.4.4. Growing Demand for Sustainable Crop Protection Solutions

3.5. Government Regulation

3.5.1. USDA Initiatives

3.5.2. Canadian Government Programs

3.5.3. EPA Regulatory Framework

3.5.4. International Regulatory Harmonization

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Bio Pesticides Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Microbial Pesticides

4.1.2. Biochemical Pesticides

4.1.3. Plant-Incorporated Protectants (PIPs)

4.2. By Application (in Value %)

4.2.1. Crop-Based

4.2.2. Non-Crop-Based

4.2.3. Seed Treatment

4.3. By Source (in Value %)

4.3.1. Natural Sources

4.3.2. Synthetic Bio Pesticides

4.4. By Formulation (in Value %)

4.4.1. Liquid Formulations

4.4.2. Dry Formulations

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

5. North America Bio Pesticides Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Bayer CropScience AG

5.1.3. Valent BioSciences LLC

5.1.4. Marrone Bio Innovations

5.1.5. Certis USA LLC

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Bio Pesticides Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Bio Pesticides Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Bio Pesticides Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Bio Pesticides Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Source (in Value %)

9.4. By Formulation (in Value %)

9.5. By Region (in Value %)

10. North America Bio Pesticides Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Bio Pesticides Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Bio Pesticides Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

01 How big is the North America Bio Pesticides Market?

The North America bio pesticides market was valued at USD 2.12 billion in 2023, driven by increased demand for sustainable agricultural practices and stringent regulations limiting the use of synthetic chemicals.

02 What are the challenges in the North America Bio Pesticides Market?

Challenges in North America bio pesticides market include high production costs, limited shelf life, regulatory hurdles, and a lack of awareness among farmers about the benefits and usage of bio pesticides.

03 Who are the major players in the North America Bio Pesticides Market?

Key players in North America bio pesticides market include BASF SE, Bayer CropScience AG, Valent BioSciences LLC, Marrone Bio Innovations, Inc., and Certis USA LLC, driving market innovation and expansion.

04 What are the growth drivers of the North America Bio Pesticides Market?

Growth drivers in North America bio pesticides market include the increasing adoption of organic farming, government support for sustainable agriculture, advancements in bio pesticide development, and rising awareness of environmental and health concerns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.