North America Biomass Power Market Outlook to 2030

Region:Global

Author(s):Shubham Kashyap

Product Code:KROD2178

November 2024

92

About the Report

North America Biomass Power Market Overview

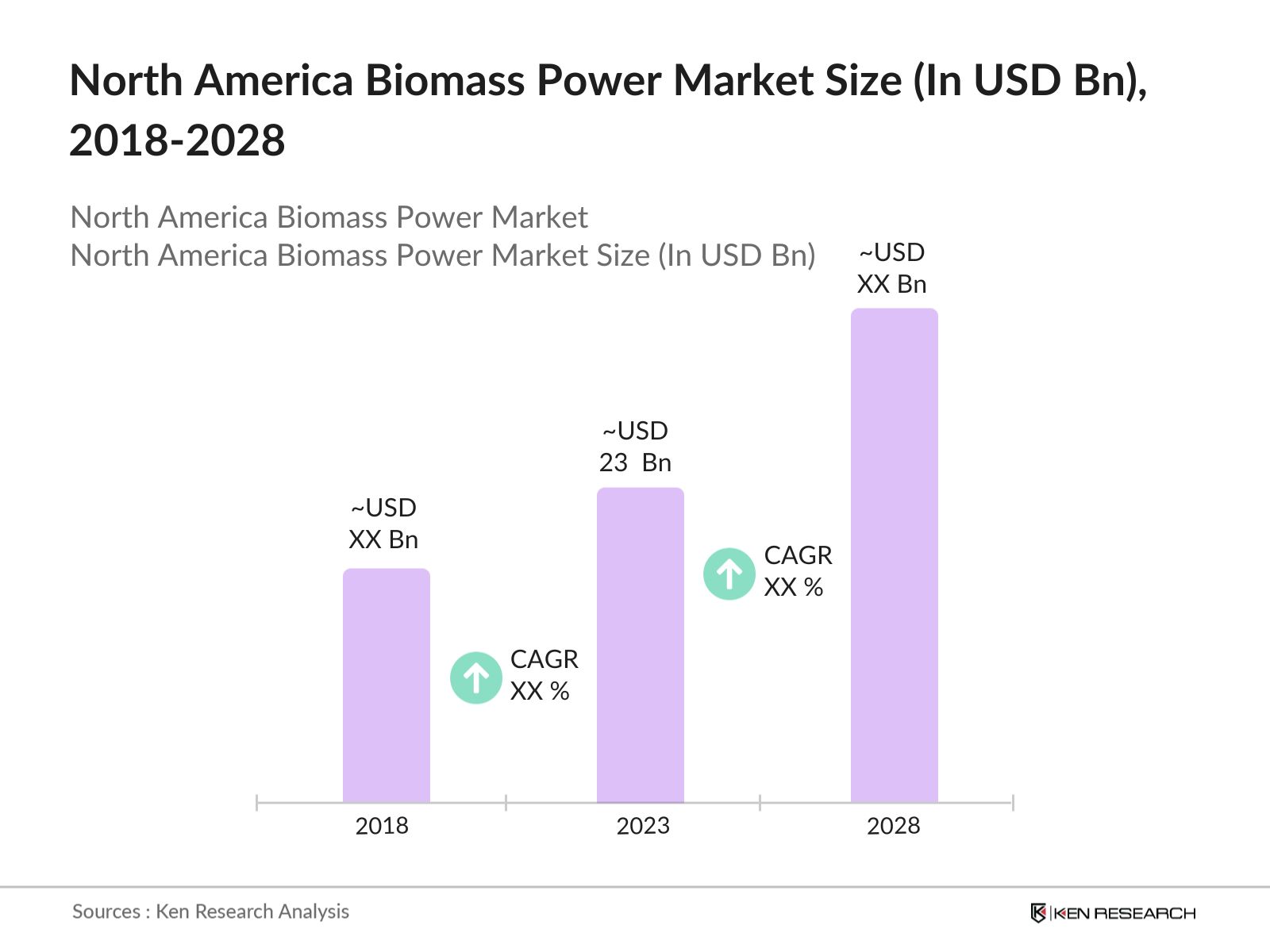

- In 2023, the North America Biomass Power Market was valued at USD 23 billion, driven by increasing demand for renewable energy sources and favorable government initiatives. The market is witnessing rapid growth due to the use of organic materials such as agricultural residue, wood, and animal waste to generate electricity.

- Key players in the North America biomass power market include Drax Group, Enviva Partners LP, Georgia Biomass LLC, Covanta Energy, and Engie North America. These companies are investing in modern technologies to enhance efficiency and output, focusing on sustainable biomass power generation.

- The major markets for biomass power in North America include the United States, Canada, and Mexico. The U.S. leads the market with extensive use of agricultural and forest residues for biomass power generation. Canada is also experiencing growth, driven by an abundance of biomass feedstock and supportive policies promoting renewable energy. In Mexico, biomass power is gaining traction with rising investments in clean energy projects.

- In 2023, Drax Group plans to increase its biomass pellet production capacity from 4.5 million tons to 8 million tons by 2027. This expansion aims to support a long-term future for sustainable biomass and enhance Drax's supply chain security through a diversified approach. In addition to increasing production capacity, Drax is also focusing on developing Bioenergy with Carbon Capture and Storage (BECCS) projects in the U.S.

North America Biomass Power Market Segmentation

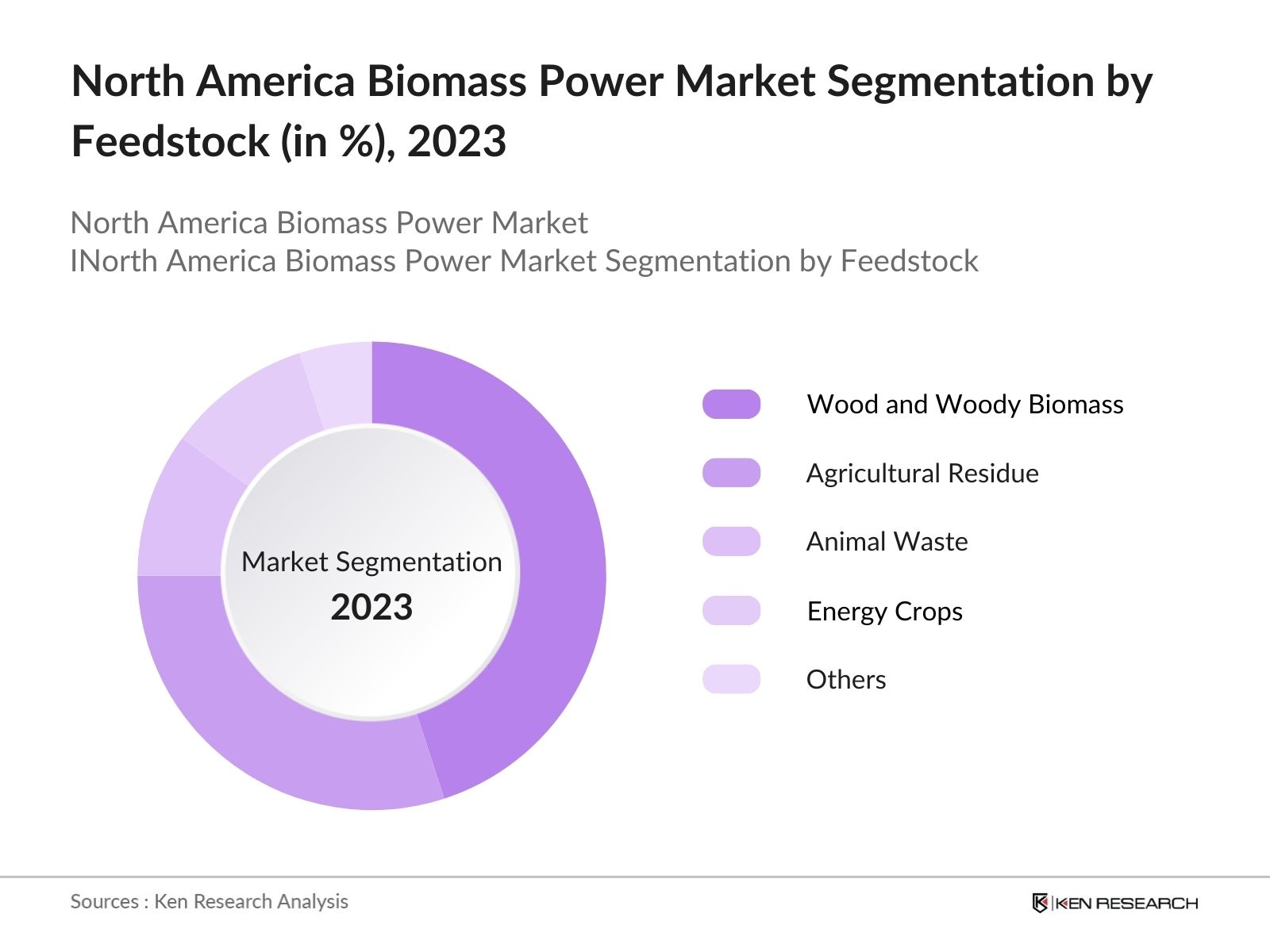

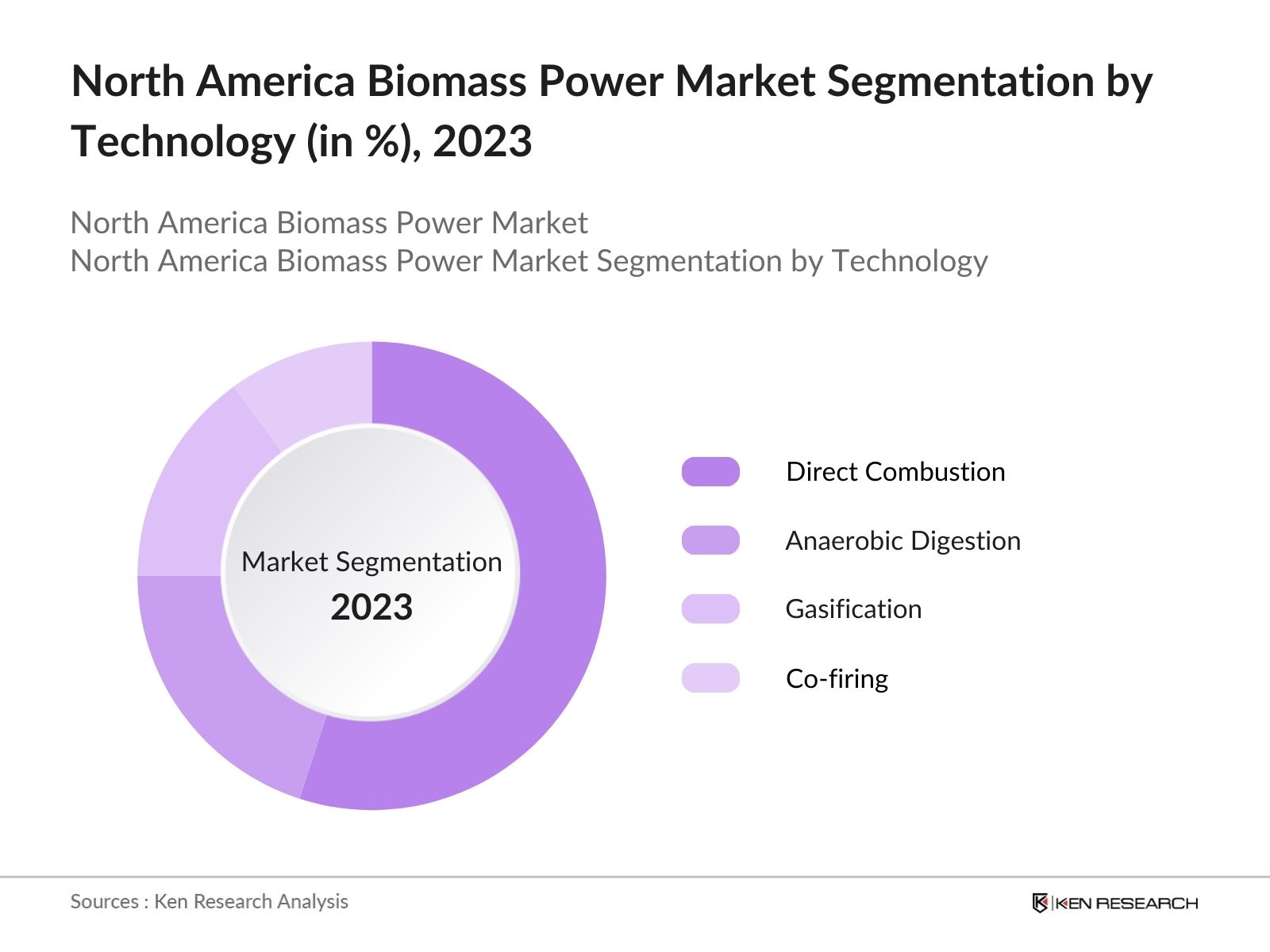

The North America Biomass Power Market is segmented based on feedstock type, technology, and region:

- By Feedstock Type: The market is segmented into Agricultural Residue, Wood and Woody Biomass, Animal Waste, Energy Crops, and Others. In 2023, Wood and Woody Biomass held the largest market share, driven by its widespread availability and lower cost. Agricultural residues, including crop waste, are also prominent due to the growing focus on sustainable energy sources.

- By Technology: The market is segmented into Direct Combustion, Anaerobic Digestion, Gasification, and Co-firing. Direct Combustion dominated the market in 2023, with its established infrastructure and reliability in large-scale power generation. Anaerobic digestion is gaining popularity due to its ability to process organic waste while generating biogas.

- By Region: The market is segmented into the United States, Canada, and Mexico. The United States accounted for the largest market share in 2023, backed by favorable policies and a robust biomass supply chain. Canada is experiencing rapid growth due to its vast forest resources and government support for renewable energy projects. Mexico is emerging as a promising market with increasing investments in biomass power generation.

North America Biomass Power Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Drax Group |

1935 |

Selby, UK |

|

Enviva Partners LP |

2010 |

Bethesda, USA |

|

Georgia Biomass LLC |

2007 |

Waycross, USA |

|

Covanta Energy |

1986 |

Morristown, USA |

|

Engie North America |

2000 |

Houston, USA |

- Enviva Partners LP: In August 2020, Enviva Partners, LP, completed the acquisition of Georgia Biomass LLC's wood pellet production plant in Waycross, Georgia. The facility has a production capacity of approximately 800,000 metric tons per year, all of which is exported through the Port of Savannah to Enviva's customers under long-term contracts Enviva Partners LP.

- Covanta Energy: Covanta announced its acquisition of Circon Holdings, a full-service provider of environmental services with a strong presence in wastewater treatment and waste management. This acquisition is notable as it is Covanta's largest in two decades as Circon brings over 600 employees and a customer base across more than 20 waste facilities in the Midwest, Southeast, and Gulf Coast regions.

North America Biomass Power Market Analysis

Growth Drivers:

- Rising Demand for Renewable Energy: The increasing focus on reducing carbon emissions and transitioning to renewable energy sources has driven the demand for biomass power in North America. Renewables, including large hydropower, represented about 25% of electricity generated in the U.S. in the first half of 2023. Additionally, In 2023, the U.S. consumed 94 quadrillion British thermal units of energy, with fossil fuels comprising nearly 83% and no fossil fuels, including renewables and nuclear energy, accounting for the remaining 17%.

- Abundance of Biomass Feedstock: North America, particularly the United States and Canada, is rich in biomass feedstock, such as agricultural residues, forest residues, and animal waste. According to the U.S. Department of Agriculture (USDA), Biomass sourced from forestlands accounts for 142 million dry tons of the total annual consumption of 190 million dry tons in the United States, as agricultural production and forest management practices improve. The abundance and availability of feedstock ensure a steady supply for biomass power plants, lowering fuel costs and enhancing the sector's growth potential.

- Government Policies and Incentives: Government initiatives promoting renewable energy adoption, such as tax incentives, renewable portfolio standards, and direct subsidies, have been crucial growth drivers for the biomass power market. In 2023, the U.S. government extended tax credits under the Renewable Electricity Production Tax Credit (PTC) program, offering 1.5 cents per kWh for electricity generated from biomass. Furthermore, Canadas Clean Fuel Standard (CFS) mandates that one-third of power in major cities like Vancouver and Toronto must come from renewable sources, including biomass, by 2025.

Challenges:

- Supply Chain Issues: Although North America is abundant in biomass feedstock, challenges such as logistical constraints and seasonal variations can disrupt the steady supply of raw materials. In 2023, several biomass power plants in the southeastern U.S. reported disruptions in feedstock supply due to transportation bottlenecks and higher costs. The U.S. Department of Agriculture (USDA) warned that rising transportation costs, coupled with regional droughts affecting agricultural output, could hinder the biomass power sectors growth.

- Competition from Other Renewable Sources: While biomass is a critical component of the renewable energy mix, it faces strong competition from solar and wind power. The U.S. Energy Information Administration (EIA) reported that in 2023, solar and wind accounted for majority of all new renewable energy capacity additions in the U.S., overshadowing biomass. Solar and wind benefit from falling technology costs, while biomass continues to grapple with the challenges of high feedstock and operational costs.

Government Initiatives:

- U.S. Renewable Fuel Standard (RFS) Expansion: In 2023, the U.S. government expanded the Renewable Fuel Standard (RFS) program to increase the volume of renewable fuels used in electricity generation. This mandate requires a higher percentage of electricity to come from biomass sources, particularly in states like California and Texas, where large-scale biomass plants are already operational.

- Canada's Clean Energy Fund: Canada's Clean Fuel Standard (CFS) is a key policy aimed at reducing greenhouse gas (GHG) emissions from the transportation sector.The CFS aims to reduce the lifecycle carbon intensity (CI) of transportation fuels used in Canada by 15% below 2016 levels by 2030. It will apply to liquid fossil fuels like gasoline and diesel, as well as solid and gaseous fuels in the future.

North America Biomass Power Market Future Outlook

The North America Biomass Power Market is projected to grow steadily in the forecasted period, driven by increasing investments in renewable energy infrastructure, technological advancements, and government support for clean energy initiatives.

Future Market Trends:

- Advanced Biomass Conversion Technologies: Over the next five years, there will be advancements in biomass conversion technologies, such as gasification and pyrolysis. These technologies are expected to improve the efficiency of biomass power plants by increasing the amount of energy that can be extracted from feedstock

- Increased Role of Bioenergy with Carbon Capture and Storage (BECCS): Bioenergy with Carbon Capture and Storage (BECCS) is expected to become a critical component of the North American biomass power market by 2028. BECCS technologies allow biomass power plants to capture and store carbon dioxide emissions, effectively making them carbon-negative.

Scope of the Report

|

By Region |

United States Canada |

|

By Feedstock Type |

Wood and Woody Biomass Agricultural Residue Animal Waste Energy Crops Others |

|

By Technology |

Direct Combustion Anaerobic Digestion Gasification Co-firing |

|

By Application |

Electricity Generation Combined Heat and Power Heat Generation |

|

By End-User |

Industrial Residential Commercial Agricultural |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Biomass Power Producers

Renewable Energy Companies

Agricultural and Forestry Sector Stakeholders

Utilities and Energy Providers

Equipment Manufacturers

Biomass Feedstock Suppliers

Independent Power Producers (IPPs)

Investments and Venture Capitalist Firms

Banks and Financial Institute

Government and Regulatory Bodies (EPA, Department of Energy)

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Drax Group

Enviva Partners LP

Covanta Energy

Georgia Biomass LLC

Engie North America

Greenleaf Power

Veolia North America

ReEnergy Holdings LLC

Westervelt Renewable Energy

Pinnacle Renewable Energy Inc.

Eagle Valley Clean Energy

New Biomass Energy

Blue Sphere Corporation

Pacific BioEnergy

RWE Renewables

Table of Contents

1. North America Biomass Power Market Overview

Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Biomass Power Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Biomass Power Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Renewable Energy

3.1.2. Abundance of Biomass Feedstock

3.1.3. Government Policies and Incentives

3.2. Challenges

3.2.1. Supply Chain Issues

3.2.2. Competition from Other Renewable Sources

3.3. Opportunities

3.3.1. Expansion of Biomass Energy Infrastructure

3.3.2. Bioenergy with Carbon Capture and Storage (BECCS) Potential

3.4. Trends

3.4.1. Advancements in Biomass Conversion Technologies

3.4.2. Growing Adoption of Small-Scale Biomass Plants

3.5. Government Regulations

3.5.1. U.S. Renewable Fuel Standard (RFS) Expansion

3.5.2. Canadas Clean Fuel Standard (CFS)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. North America Biomass Power Market Segmentation, 2023

4.1. By Feedstock Type (in Value %)

4.1.1. Wood and Woody Biomass

4.1.2. Agricultural Residue

4.1.3. Animal Waste

4.1.4. Energy Crops

4.1.5. Others

4.2. By Technology (in Value %)

4.2.1. Direct Combustion

4.2.2. Anaerobic Digestion

4.2.3. Gasification

4.2.4. Co-firing

4.3. By Application (in Value %)

4.3.1. Electricity Generation

4.3.2. Combined Heat and Power

4.3.3. Heat Generation

4.4. By Region (in Value %)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

4.5. By End-User Industry (in Value %)

4.5.1. Industrial

4.5.2. Residential

4.5.3. Commercial

4.5.4. Agricultural

5. North America Biomass Power Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Drax Group

5.1.2. Enviva Partners LP

5.1.3. Georgia Biomass LLC

5.1.4. Covanta Energy

5.1.5. Engie North America

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Biomass Power Market Share Analysis, 2023

6.1. Market Share Analysis by Feedstock Type

6.2. Market Share Analysis by Technology

6.3. Market Share Analysis by Application

6.4. Market Share Analysis by Region

6.5. Market Share Analysis by End-User Industry

7. North America Biomass Power Market Future Size (in USD Bn), 2023-2028

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Biomass Power Market Future Segmentation, 2028

8.1. By Feedstock Type (in Value %)

8.2. By Technology (in Value %)

8.3. By Application (in Value %)

8.4. By Region (in Value %)

8.5. By End-User Industry (in Value %)

9. North America Biomass Power Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing and Expansion Strategies

9.3. Market Penetration and Growth Opportunities

9.4. White Space Opportunity Analysis

10. North America Biomass Power Market Investment Analysis

10.1. Government Grants and Subsidies

10.2. Venture Capital and Private Equity Investments

10.3. Strategic Partnerships and Mergers

11. North America Biomass Power Market Regulatory Framework

11.1. Compliance Requirements

11.2. Certification Processes

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building

Collating statistics on the North America biomass power market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the North America biomass power market. We will also review service quality statistics to understand revenue generated to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple essential biomass power companies to understand product segments and sales, consumer preferences, and other parameters, which will support us in validating statistics derived through a bottom-to-top approach from biomass power companies.

Frequently Asked Questions

1. How big is the North America Biomass Power Market?

The North America Biomass Power Market was valued at USD 23 billion in 2023, driven by the increasing demand for renewable energy sources and favorable government policies promoting sustainable power generation.

2. What are the challenges in the North America Biomass Power Market?

Challenges in the North America biomass power market include high capital investment costs for setting up biomass power plants, logistical constraints in the feedstock supply chain, and competition from other renewable energy sources such as solar and wind power.

3. Who are the major players in the North America Biomass Power Market?

Key players in the North America biomass power market include Drax Group, Enviva Partners LP, Georgia Biomass LLC, Covanta Energy, and Engie North America. These companies dominate through technological advancements and strategic investments in biomass power projects.

4. What are the growth drivers of the North America Biomass Power Market?

The North America biomass power market is propelled by increasing demand for renewable energy, an abundance of biomass feedstock, and supportive government policies, such as tax incentives and renewable portfolio standards that promote biomass power generation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.