North America BIM (Building Information Modeling) Market Outlook to 2030

Global Carmines Market Outlook to 2028

Region:North America

Author(s):Shreya Garg

Product Code:KROD6051

December 2024

86

About the Report

North America BIM Market Overview

- The North American Building Information Modeling (BIM) market is valued at USD 2.9 billion, based on a five-year historical analysis. This market is driven by the increasing adoption of BIM technology in both private and public construction projects. Governments have made strides in mandating BIM for large infrastructure projects, resulting in higher demand from construction companies, architects, and engineers. Additionally, the push for sustainable building practices and the integration of energy-efficient technologies further drives the markets expansion.

- The United States leads the North American BIM market, primarily due to the country's large-scale infrastructure projects and robust construction sector. Major cities like New York, Los Angeles, and Chicago dominate the BIM landscape, driven by stringent regulations and a high demand for modern construction methods. Canada is another key player, with strong government initiatives promoting the use of BIM for infrastructure development and sustainability goals.

- Strict energy efficiency regulations are driving the adoption of BIM in North America. In 2023, the U.S. Department of Energy updated its building energy codes, requiring new commercial buildings to meet energy performance standards, which can be optimized through BIM. The updated codes aim to reduce energy consumption in commercial buildings by 10% by 2025. Similarly, Canadas National Energy Code of Canada for Buildings (NECB) has imposed stricter energy efficiency requirements, promoting the use of BIM in designing compliant buildings.

North America BIM Market Segmentation

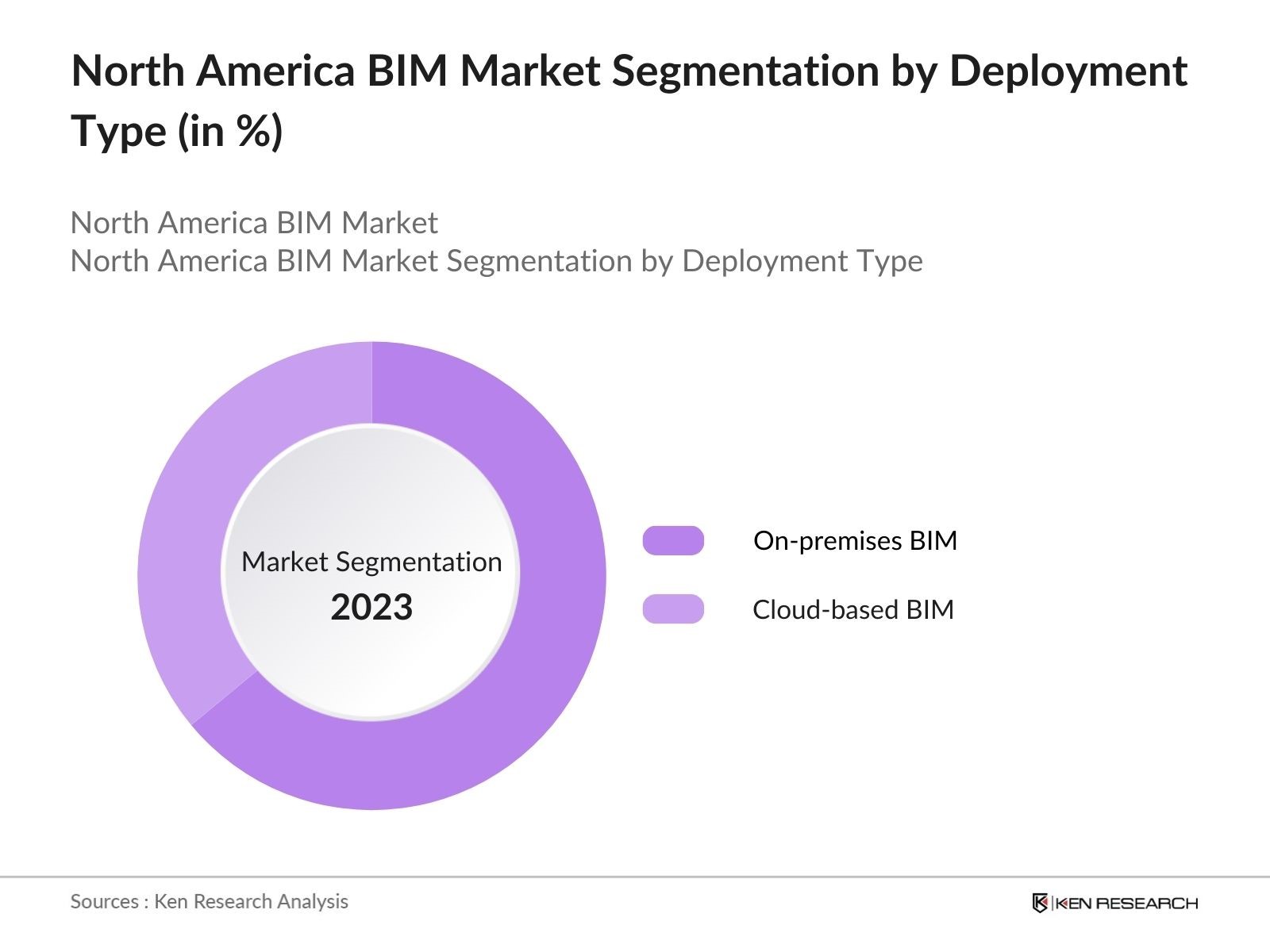

By Deployment Type: The market is segmented by deployment type into on-premises BIM solutions and cloud-based BIM solutions. On-premises solutions hold a dominant market share due to concerns over data security and the need for localized control of BIM data. Large construction companies prefer on-premises deployments because they provide higher levels of data customization and control, which are crucial for complex projects like airports, commercial skyscrapers, and government buildings. On the other hand, cloud-based solutions are gaining traction, especially among small and medium-sized enterprises, due to their cost-effectiveness and ease of collaboration.

By End-User: In terms of end-users, the North American BIM market is segmented into architects, contractors, engineers, and facility managers. Among these, contractors hold the largest market share. This is mainly because they are the ones who directly oversee project management, labor allocation, and material procurement, which benefit greatly from the predictive capabilities and cost-efficiency offered by BIM. Contractors use BIM to enhance efficiency in workflows and minimize project delays, which makes this segment crucial for large-scale and complex constructions like hospitals, stadiums, and public infrastructure.

North America BIM Competitive Landscape

The North American BIM market is dominated by a few major players, including both global companies and emerging startups. These companies have made strategic investments in technology, resulting in more sophisticated BIM tools. The market shows consolidation, with top firms like Autodesk, Bentley Systems, and Trimble leading in innovation and market share. These firms have established a stronghold through strategic partnerships with construction firms, software integrations, and government mandates for BIM adoption in public projects.

|

Company Name |

Established Year |

Headquarters |

Key BIM Tools |

Number of Employees |

Notable Projects |

Revenue (USD Bn) |

Key Regions of Operation |

|

Autodesk, Inc. |

1982 |

San Rafael, CA |

|||||

|

Bentley Systems, Inc. |

1984 |

Exton, PA |

|||||

|

Trimble Inc. |

1978 |

Westminster, CO |

|||||

|

Nemetschek SE |

1963 |

Munich, Germany |

|||||

|

Dassault Systmes |

1981 |

Vlizy-Villacoublay |

North America BIM Industry Analysis

Growth Drivers

- Increasing Government Mandates for BIM Adoption: In North America, several governments have mandated the use of Building Information Modeling (BIM) in public sector projects, particularly in infrastructure and large-scale construction projects. The U.S. General Services Administration (GSA) requires BIM for major federal buildings. Additionally, Canadas national government is increasingly incorporating BIM into public works. According to the U.S. Department of Transportation, BIM has been mandated in several large-scale public projects since 2020, driving its usage throughout the industry. Government incentives further promote BIM adoption in large infrastructure projects to improve efficiency and reduce delays.

- Rising Demand for Energy-efficient Buildings: The demand for energy-efficient buildings is accelerating due to rising energy costs and government regulations. According to the U.S. Energy Information Administration (EIA), energy consumption in commercial buildings accounted for 20.2 quadrillion British thermal units (BTUs) in 2023, leading to stricter building energy codes across the region. BIM facilitates the design and construction of energy-efficient buildings by optimizing energy use, improving HVAC systems, and reducing waste. Canada also targets a 40% reduction in greenhouse gas emissions by 2030, and BIM is crucial in achieving these sustainability goals.

- Enhanced Collaboration and Project Management Capabilities: BIM enables enhanced collaboration among architects, engineers, and construction professionals, improving project management and reducing delays. In 2023, over 70% of large infrastructure projects in North America implemented collaborative BIM platforms, according to a report by the U.S. Department of Commerce. The shared data environment and 3D modeling allow teams to resolve issues early, saving time and costs. Furthermore, integrated BIM solutions improve documentation accuracy and streamline communication across different project stages.

Market Challenges

- High Initial Implementation Costs: The initial cost of implementing BIM software and training personnel continues to pose challenges, especially for smaller firms. Data from the U.S. Small Business Administration reveals that the average upfront cost for BIM software, including training, ranges between USD 50,000 to USD 100,000 per project, making it a significant investment for businesses. Additionally, the integration of hardware, such as high-end computing systems and scanners, adds to the financial burden. These costs can slow down the adoption of BIM among mid-sized and small construction firms.

- Interoperability Issues in Software Integration: Interoperability between different BIM software platforms continues to challenge seamless integration across various project phases. A study by the National Institute of Standards and Technology (NIST) revealed that interoperability issues in North America led to an estimated USD 15.8 billion in construction project losses in 2023, primarily due to delays and data mismanagement. These issues arise from incompatibility between different software solutions, causing project teams to rely on manual data transfers, which increases the risk of errors and inefficiencies.

North America BIM Market Future Outlook

Over the next five years, the North America BIM market is expected to exhibit robust growth, driven by government initiatives, technological advancements, and increasing industry adoption. The rising demand for sustainable construction and energy-efficient buildings is expected to amplify the adoption of BIM. Furthermore, the integration of technologies like IoT, artificial intelligence, and augmented reality with BIM platforms will offer more dynamic project management and predictive analytics, which will be key drivers of market growth.

Future Market Opportunities

- Growth in Cloud-based BIM Solutions: The increasing demand for cloud-based BIM solutions offers significant growth potential. As of 2023, more than 50% of construction firms in North America have adopted cloud-based BIM platforms to improve project scalability and real-time collaboration, according to data from the U.S. National Institute of Building Sciences. These solutions reduce the need for costly on-premises IT infrastructure while offering higher flexibility in project management. This trend is expected to drive further adoption of BIM, particularly among medium-sized firms seeking to reduce overhead costs.

- Rising Demand in Smart Cities Development: Smart city development across North America is driving the demand for BIM technology, particularly in urban infrastructure projects. In 2023, the U.S. government allocated USD 500 million toward smart city initiatives, with a focus on integrating advanced technologies such as BIM to streamline urban planning and infrastructure development. Similarly, Canada invested CAD 2 billion in smart city projects, further fueling the adoption of BIM. These projects aim to enhance public services, reduce energy consumption, and improve overall urban efficiency, positioning BIM as a key tool in smart city development.

Scope of the Report

|

By Deployment Type |

On-premises BIM Solutions Cloud-based BIM Solutions |

|

By Component |

Software Services |

|

By End-User |

Architects Contractors Engineers Facility Managers |

|

By Application |

Commercial Buildings Industrial Residential Public Infrastructure |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Transportation, Public Services and Procurement Canada)

BIM Software Providers

General Contractors

Architectural and Engineering Firms

Real Estate Developers

Construction Project Managers

Smart City Development Agencies

Banks and Financial Institutions

Companies

Major Players

Autodesk, Inc.

Bentley Systems, Incorporated

Trimble Inc.

Nemetschek SE

Dassault Systmes

Hexagon AB

RIB Software SE

AVEVA Group plc

Asite Solutions Limited

Vectorworks, Inc.

Oracle Corporation

Procore Technologies

Graphisoft SE

InEight, Inc.

Arcadis N.V.

Table of Contents

1. North America BIM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, revenue growth, market maturity stage)

1.4. Market Segmentation Overview

2. North America BIM Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (revenue growth by key countries)

2.3. Key Market Developments and Milestones (government initiatives, industry standards)

3. North America BIM Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Government Mandates for BIM Adoption

3.1.2. Growth in Construction Sector (Green buildings, large-scale infrastructure projects)

3.1.3. Rising Demand for Energy-efficient Buildings

3.1.4. Enhanced Collaboration and Project Management Capabilities

3.2. Market Challenges

3.2.1. High Initial Implementation Costs

3.2.2. Lack of Skilled Workforce (BIM experts, technology adoption rates)

3.2.3. Interoperability Issues in Software Integration

3.3. Opportunities

3.3.1. Growth in Cloud-based BIM Solutions

3.3.2. Integration of BIM with IoT and AI (digital twin technology, predictive analytics)

3.3.3. Rising Demand in Smart Cities Development

3.4. Trends

3.4.1. Increased Use of 5D BIM for Cost Management

3.4.2. Integration of Augmented Reality (AR) and Virtual Reality (VR) in BIM

3.4.3. Shift Towards Modular and Prefabrication Construction Techniques

3.5. Government Regulation

3.5.1. BIM Mandates in Public Infrastructure Projects

3.5.2. Building Energy Regulations and Compliance

3.5.3. National BIM Standard Development (NBS)

3.5.4. Green Building Certifications (LEED, BREEAM)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Software Providers (Revit, ArchiCAD)

3.7.2. Contractors, Architects, Engineers

3.7.3. BIM Consultants

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers (software vendors, hardware providers)

3.8.2. Threat of New Entrants (emerging software solutions, startups)

3.8.3. Competitive Rivalry (top software providers)

3.9. Competition Ecosystem

4. North America BIM Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-premises BIM Solutions

4.1.2. Cloud-based BIM Solutions

4.2. By Component (In Value %)

4.2.1. Software (3D modeling, clash detection, rendering)

4.2.2. Services (consulting, training, implementation)

4.3. By End-User (In Value %)

4.3.1. Architects

4.3.2. Contractors

4.3.3. Engineers

4.3.4. Facility Managers

4.4. By Application (In Value %)

4.4.1. Commercial Buildings

4.4.2. Industrial

4.4.3. Residential

4.4.4. Public Infrastructure

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America BIM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Autodesk, Inc.

5.1.2. Bentley Systems, Incorporated

5.1.3. Trimble Inc.

5.1.4. Nemetschek SE

5.1.5. Dassault Systmes

5.1.6. Hexagon AB

5.1.7. RIB Software SE

5.1.8. AVEVA Group plc

5.1.9. Asite Solutions Limited

5.1.10. Vectorworks, Inc.

5.1.11. Oracle Corporation

5.1.12. Procore Technologies

5.1.13. Graphisoft SE

5.1.14. InEight, Inc.

5.1.15. Arcadis N.V.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, BIM tool portfolio, key market segments, notable projects, strategic partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (new product launches, technological advancements)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America BIM Market Regulatory Framework

6.1. Industry Standards (ISO 19650, COBie)

6.2. Compliance Requirements (building regulations, safety standards)

6.3. Certification Processes (BIM certification, energy efficiency ratings)

7. North America BIM Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (demand from emerging smart cities, infrastructure renewal projects)

8. North America BIM Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Component (In Value %)

8.3. By End-User (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. North America BIM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (early adopters, technology-savvy firms)

9.3. Marketing Initiatives (market penetration strategies, demand generation)

9.4. White Space Opportunity Analysis (underserved regions, small/medium enterprises adoption)

Research Methodology

Step 1: Identification of Key Variables

This stage involved the mapping of the BIM ecosystem in North America, taking into account software vendors, construction firms, and regulatory bodies. Extensive desk research was conducted using secondary and proprietary databases to define critical variables, including BIM adoption rates, regulatory impacts, and technological advancements.

Step 2: Market Analysis and Construction

Historical market data, including BIM penetration rates across end-users and deployment types, were compiled and analyzed. Data on construction workflows, cost efficiencies, and revenue impacts were collected to build reliable market forecasts. Market segmentation was then evaluated for accuracy.

Step 3: Hypothesis Validation and Expert Consultation

This phase involved interviews with industry experts via computer-assisted telephone interviews (CATIs). Insights were gathered from professionals in construction, architecture, and BIM software development to validate the data and refine market trends, competitive dynamics, and growth factors.

Step 4: Research Synthesis and Final Output

Engagement with construction firms and BIM vendors was conducted to collect first-hand data on project-level BIM adoption, software functionality, and technological advancements. This information was synthesized to ensure the comprehensive accuracy of the report, allowing for a clear outlook on the market.

Frequently Asked Questions

01. How big is the North America BIM Market?

The North America BIM market is valued at USD 2.9 billion, driven by increasing government regulations and the rising demand for efficient project management in construction projects.

02. What are the challenges in the North America BIM Market?

The challenges in the North America BIM market include high initial costs of BIM implementation, lack of skilled professionals, and interoperability issues between different BIM software platforms.

03. Who are the major players in the North America BIM Market?

Key players in the North America BIM market include Autodesk, Bentley Systems, Trimble Inc., Nemetschek SE, and Dassault Systmes. These companies dominate due to their innovative software offerings and strategic partnerships.

04. What are the growth drivers of the North America BIM Market?

The growth of the North America BIM market is driven by government mandates for its use in public projects, increased demand for sustainable buildings, and advancements in digital technologies such as AI and cloud computing.

05. Which segments dominate the North America BIM Market?

The on-premises BIM deployment segment dominates due to data security concerns, and the contractor end-user segment holds the largest share due to the efficiency gains BIM offers in project management North America BIM market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.