North America Buy Now Pay Later (BNPL) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4816

November 2024

84

About the Report

North America BNPL Market Overview

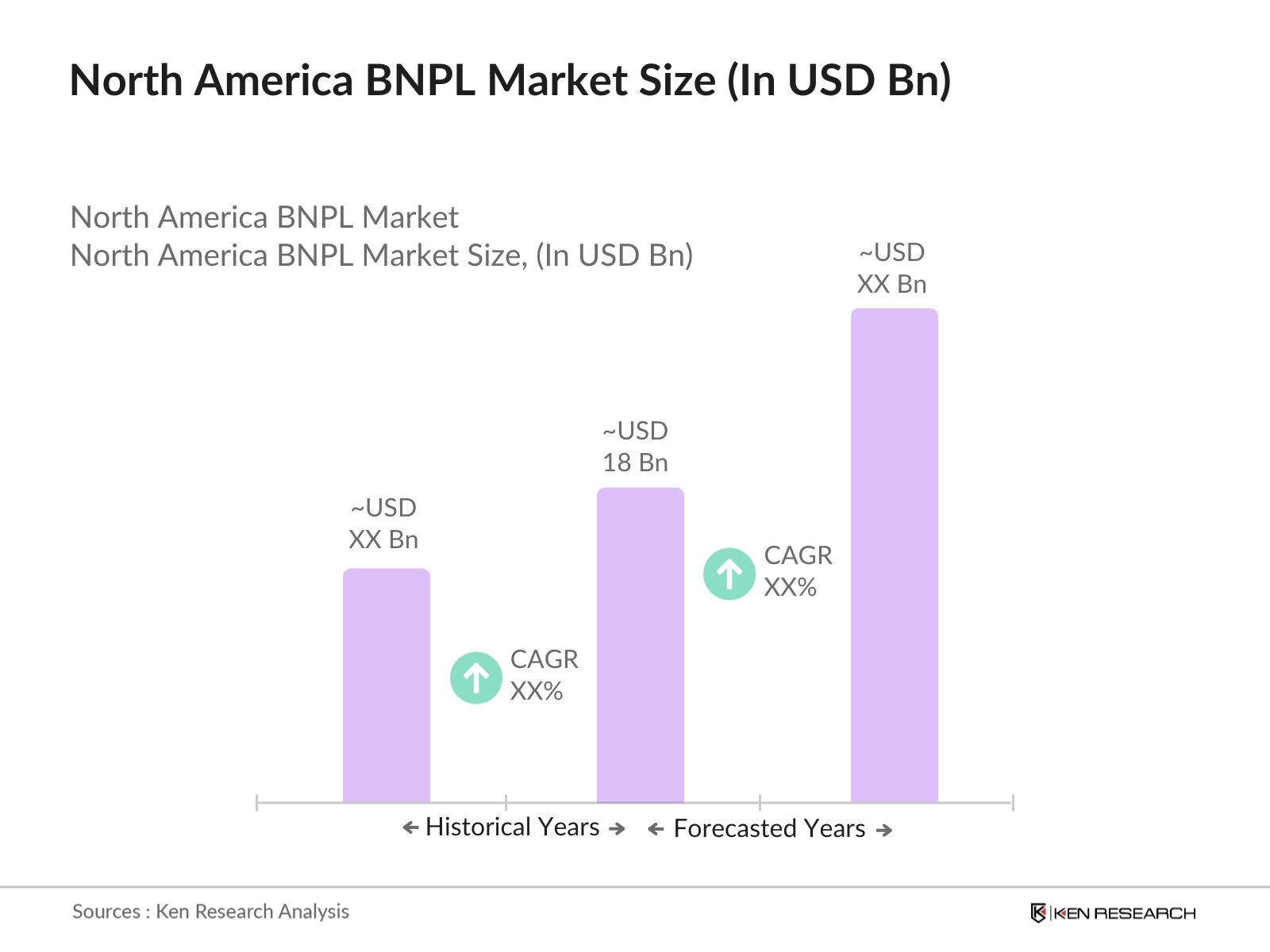

- The North America Buy Now Pay Later (BNPL) market is valued at USD 18 billion, based on a comprehensive analysis of market dynamics and trends. The market's growth is fueled by the increasing adoption of digital payment methods, particularly driven by younger consumers seeking flexible payment options. The rapid rise of e-commerce in North America has contributed to the demand for BNPL services, especially as consumers prioritize convenience and control over their spending. Leading financial institutions and retailers have increasingly integrated BNPL solutions to meet growing customer demand for alternative credit options, boosting market growth.

- The BNPL market in North America is dominated by cities like New York, Los Angeles, and Toronto. These urban centers are home to a large and digitally savvy population, with strong demand for flexible payment solutions. The dominance of these cities can be attributed to their robust retail ecosystems, thriving e-commerce markets, and a high concentration of tech-savvy consumers. Additionally, financial hubs such as New York are essential due to their proximity to global fintech companies and investment activity, further bolstering the BNPL ecosystem.

- Fintech oversight bodies in North America play a pivotal role in regulating BNPL services. In the U.S., the Office of the Comptroller of the Currency (OCC) and the CFPB have taken an active role in monitoring BNPL providers to ensure compliance with financial regulations. In Canada, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) oversees BNPL transactions to prevent money laundering and financial fraud. The increasing involvement of these bodies highlights the growing importance of regulatory compliance in the BNPL market.

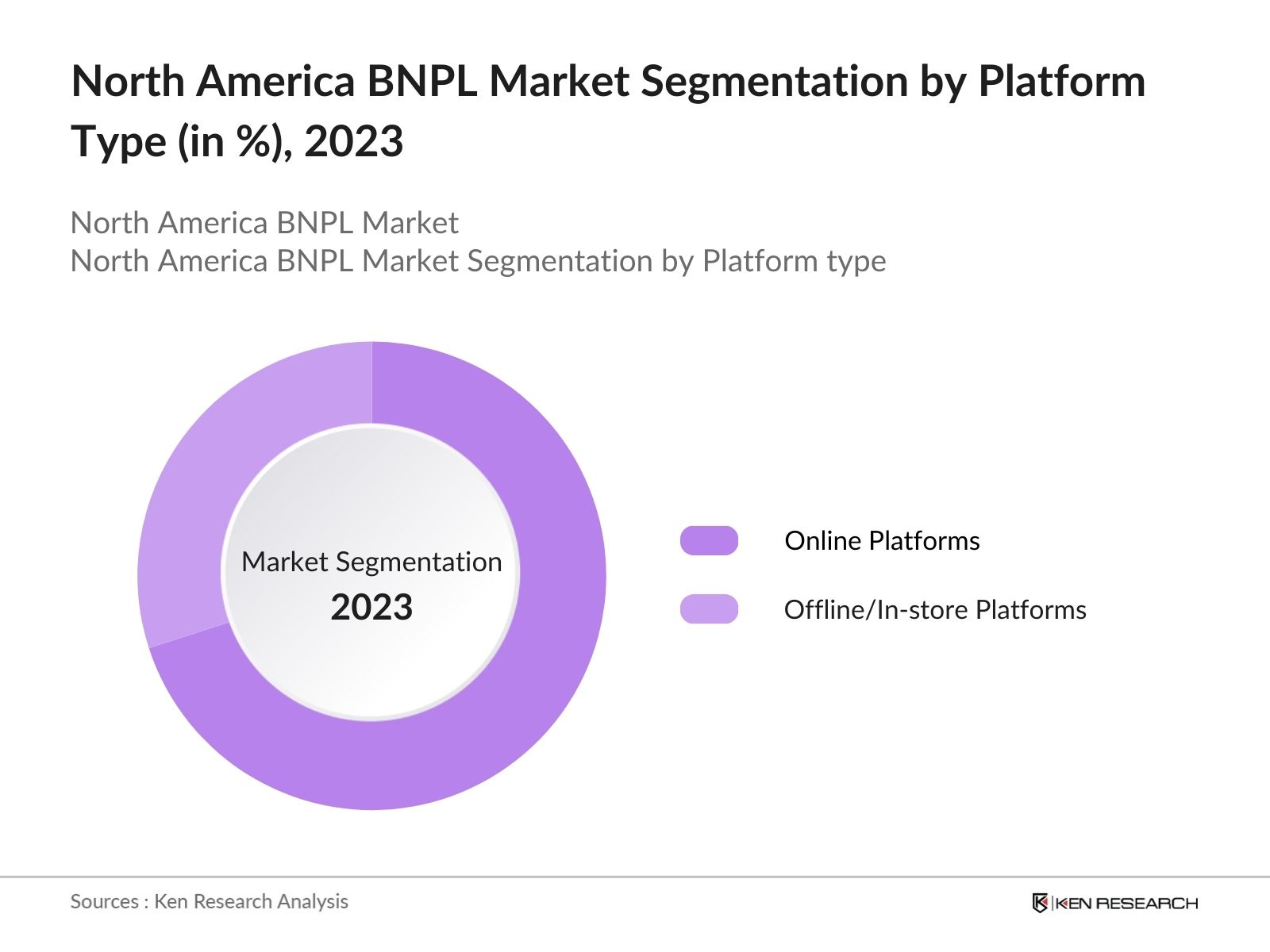

North America BNPL Market Segmentation

By Platform Type: The market is segmented by platform type into online platforms and offline/in-store platforms. Recently, online platforms have captured a dominant market share within this segment, due to the rapid growth of e-commerce and the increasing consumer preference for online shopping. The ease of integrating BNPL solutions into existing e-commerce payment gateways has accelerated the growth of online platforms. Retailers and fintech companies have collaborated to create seamless payment experiences, driving the popularity of online BNPL options over offline counterparts. Additionally, the convenience of deferred payments through digital platforms aligns with consumer trends favoring online shopping.

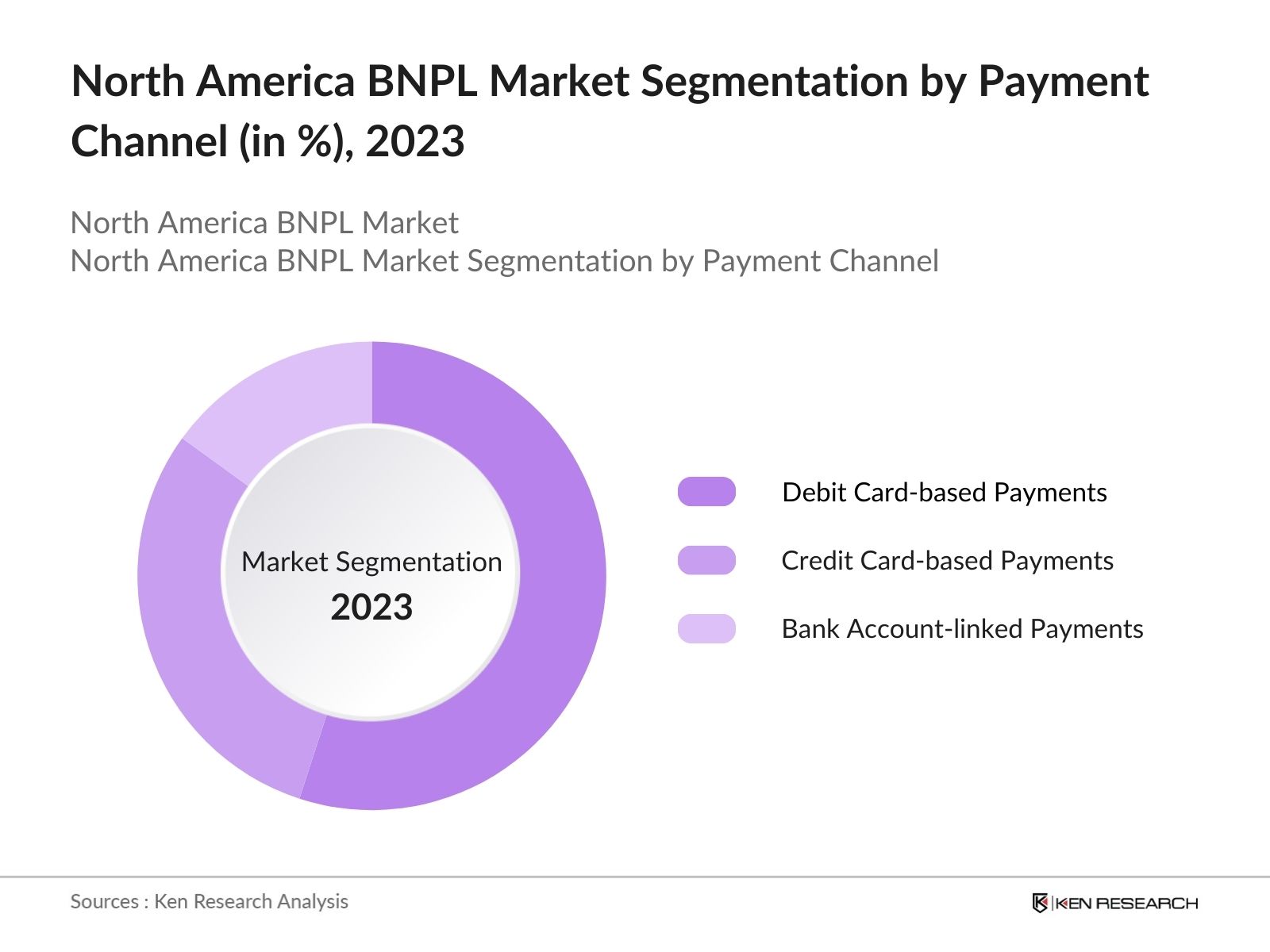

By Payment Channel: The market is also segmented by payment channel into debit card-based payments, credit card-based payments, and bank account-linked payments. Debit card-based payments dominate the BNPL market due to consumer concerns about accumulating credit card debt and the preference for immediate fund availability. Many consumers view debit cards as a more responsible and transparent payment option, reducing the risk of interest and late fees. Debit-based BNPL services provide a smoother transaction experience for consumers, especially for those who are averse to taking on additional credit.

By Payment Channel: The market is also segmented by payment channel into debit card-based payments, credit card-based payments, and bank account-linked payments. Debit card-based payments dominate the BNPL market due to consumer concerns about accumulating credit card debt and the preference for immediate fund availability. Many consumers view debit cards as a more responsible and transparent payment option, reducing the risk of interest and late fees. Debit-based BNPL services provide a smoother transaction experience for consumers, especially for those who are averse to taking on additional credit.

North America BNPL Competitive Landscape

North America BNPL Competitive Landscape

The North American BNPL market is dominated by several key players, including both local fintech companies and international firms. The landscape is competitive, with companies focusing on expanding their merchant networks and offering enhanced payment flexibility. Major players like Klarna, Affirm, and Afterpay have solidified their market positions through extensive partnerships with leading retailers. These firms have capitalized on the growing demand for alternative payment solutions, leveraging strong brand recognition and innovative mobile-first payment platforms to gain a foothold in the market. Additionally, strategic mergers and acquisitions have helped major players consolidate their market shares and expand their user bases.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Merchant Network |

No. of Transactions |

Mobile App Rating |

Countries Operated In |

|

Klarna |

2005 |

Stockholm, Sweden |

||||||

|

Affirm |

2012 |

San Francisco, USA |

||||||

|

Afterpay |

2014 |

Melbourne, Australia |

||||||

|

PayPal (Pay in 4) |

1998 |

San Jose, USA |

||||||

|

Sezzle |

2016 |

Minneapolis, USA |

North America BNPL Industry Analysis

Growth Drivers

- Increasing Consumer Shift Towards Digital Payment Solutions: The surge in digital payments across North America has been driven by the adoption of cashless payment systems. In 2024, it is estimated that over 70% of consumers in the U.S. use digital wallets, reflecting a strong preference for these solutions over traditional payment methods. According to the Federal Reserve, the number of digital transactions in the U.S. has doubled from 2022 to 2024. This shift toward digital payments aligns with the growing demand for Buy Now Pay Later (BNPL) solutions, as more consumers seek faster and more efficient payment methods, contributing to the market's growth.

- Rising E-commerce Penetration: E-commerce continues to play a critical role in North America's BNPL market. By 2024, the U.S. Census Bureau reports that e-commerce sales reached $1.7 trillion. With the rise in online retail, BNPL options have become a preferred payment method for over 30% of digital shoppers, particularly for high-value purchases. Canada also witnessed robust growth, with over 65% of consumers relying on online shopping in 2024, further boosting BNPL adoption rates. This penetration is further enhanced by widespread internet access and digital infrastructure development across the region.

- Consumer Demand for Flexible Payment Options: The rising demand for flexible payment options is a major growth driver for the BNPL market in North America. A report by the U.S. Department of Commerce shows that nearly 40 million consumers opted for BNPL services in 2023 alone. The increasing preference for installment payments, particularly among millennials and Gen Z, reflects a shift away from traditional credit models. In 2024, it is expected that over 25% of e-commerce payments in the U.S. will be conducted through BNPL services. This demand is fueled by the economic uncertainty surrounding inflation, pushing consumers to seek payment flexibility.

Market Challenges

- Concerns over Consumer Debt: BNPLs rapid growth has led to concerns over consumer debt accumulation. According to the Federal Reserve, U.S. consumer debt levels reached $17 trillion in 2024. With BNPL being one of the fastest-growing credit segments, default rates have surged, with an estimated 10% of users falling behind on payments in 2023. Late fees associated with BNPL also compound these challenges. In Canada, similar concerns have arisen, with 8% of BNPL users missing payments, leading to increased scrutiny from financial regulators.

- Limited Merchant Acceptance in Key Sectors: Despite BNPL's popularity, merchant acceptance remains limited in key sectors, particularly in healthcare and education. In 2024, only about 20% of healthcare providers in North America accepted BNPL as a payment option. The reluctance of merchants in these sectors stems from concerns over regulatory challenges and consumer creditworthiness. This lack of acceptance hampers the market's growth potential, as BNPL services remain concentrated in retail and e-commerce. Expanding merchant partnerships in these underserved sectors will be crucial for further adoption.

North America BNPL Future Outlook

Over the next five years, the North American Buy Now Pay Later market is expected to see growth, driven by the continued rise of e-commerce and the growing preference for flexible payment options. BNPL services will likely become further embedded within the consumer retail experience as both merchants and financial service providers prioritize the integration of BNPL solutions. Advancements in financial technology, increased collaboration between fintech companies and traditional banks, and regulatory clarity are expected to fuel further market expansion. The growing number of partnerships with large-scale retailers and the integration of AI-driven credit risk assessment tools will also play a crucial role in shaping the future of the BNPL market in North America.

Future Market Opportunities

- Integration with Digital Wallets: The integration of BNPL services with digital wallets like Apple Pay and Google Pay presents a opportunity for market expansion. In 2024, Apple Pay processed over 5 billion transactions in North America, a number that continues to grow. By partnering with digital wallets, BNPL providers can offer seamless payment experiences, allowing consumers to split payments while leveraging the security and convenience of mobile payment platforms. This integration can enhance the appeal of BNPL services to tech-savvy consumers.

- Collaborations with Financial Institutions: Collaborating with traditional financial institutions offers BNPL providers access to a broader customer base and enhanced credibility. In 2024, major U.S. banks, including JPMorgan Chase and Wells Fargo, began offering BNPL products, allowing consumers to access credit with more flexibility. By partnering with established banks, BNPL providers can mitigate concerns over creditworthiness and compliance. In Canada, similar collaborations have been seen between fintech companies and national banks, expanding the reach of BNPL services.

Scope of the Report

|

Platform Type |

Online Platforms |

|

End-user |

Consumers |

|

Business Model |

Direct-to-Consumer (D2C) Model |

|

Payment Channel |

Debit Card-based Payments |

|

Region |

United States |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Consumer Financial Protection Bureau, Canadian Financial Consumer Agency)

E-commerce Platforms

Large Retail Chains

Banks and Financial Institutes

Payment Processing Companies

Fintech Service Providers

Digital Wallet Providers

Financial Institutions and Banks

Companies

Major Players

Klarna

Affirm

Afterpay

PayPal (Pay in 4)

Sezzle

Zip (QuadPay)

Splitit

Uplift

Perpay

Openpay

Bread

Scalapay

Latitude Pay

Four

Zilch

Table of Contents

North America Buy Now Pay Later Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Buy Now Pay Later Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Buy Now Pay Later Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Shift Towards Digital Payment Solutions

3.1.2. Rising E-commerce Penetration (E-commerce Transactions, Digital Adoption)

3.1.3. Consumer Demand for Flexible Payment Options

3.1.4. Impact of Financial Inclusion Initiatives

3.2. Market Challenges

3.2.1. Regulatory Uncertainty (Consumer Protection Laws, Compliance)

3.2.2. Rising Concerns over Consumer Debt (Default Rates, Late Fees)

3.2.3. Limited Merchant Acceptance in Key Sectors

3.3. Opportunities

3.3.1. Expansion into Niche Retail Markets (Luxury Goods, Travel)

3.3.2. Integration with Digital Wallets (Apple Pay, Google Pay)

3.3.3. Collaborations with Financial Institutions (Banks, Credit Providers)

3.4. Trends

3.4.1. Mobile-first Payment Solutions

3.4.2. Growth of Embedded Finance and APIs

3.4.3. Adoption of AI and Big Data in Credit Scoring

3.5. Government Regulations

3.5.1. BNPL Regulatory Framework in the U.S.

3.5.2. Canada BNPL Consumer Protection Rules

3.5.3. Role of Fintech Oversight Bodies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

North America Buy Now Pay Later Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Online Platforms

4.1.2. Offline/In-store Platforms

4.2. By End-user (In Value %)

4.2.1. Consumers (Individual, Family)

4.2.2. Merchants (SMEs, Large Retailers)

4.3. By Business Model (In Value %)

4.3.1. Direct-to-Consumer (D2C) Model

4.3.2. Merchant-integrated Model

4.4. By Payment Channel (In Value %)

4.4.1. Debit Card-based Payments

4.4.2. Credit Card-based Payments

4.4.3. Bank Account-linked Payments

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

North America Buy Now Pay Later Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Afterpay

5.1.2. Klarna

5.1.3. Affirm

5.1.4. Sezzle

5.1.5. PayPal (Pay in 4)

5.1.6. Zip (QuadPay)

5.1.7. Splitit

5.1.8. Uplift

5.1.9. Perpay

5.1.10. Openpay

5.1.11. Bread

5.1.12. Scalapay

5.1.13. Latitude Pay

5.1.14. Four

5.1.15. Zilch

5.2. Cross Comparison Parameters (Transaction Volume, User Base, Merchant Network, Fees, Customer Satisfaction Rating, Payment Flexibility, Revenue Model, Mobile App Availability)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Buy Now Pay Later Market Regulatory Framework

6.1. Licensing and Registration Requirements

6.2. Consumer Rights and Disclosure Obligations

6.3. Financial Reporting Standards

North America Buy Now Pay Later Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Buy Now Pay Later Future Market Segmentation

8.1. By Platform Type (In Value %)

8.2. By End-user (In Value %)

8.3. By Business Model (In Value %)

8.4. By Payment Channel (In Value %)

8.5. By Region (In Value %)

North America Buy Now Pay Later Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of key stakeholders in the North America BNPL market. Extensive desk research utilizing proprietary databases and secondary sources provides critical insights into market drivers, trends, and challenges. The objective is to identify essential variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the North America BNPL market. This includes assessing the ratio of marketplace adoption, service provider penetration, and revenue generation. An evaluation of service quality statistics is conducted to ensure reliable data for estimating market revenue and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, industry experts are engaged through interviews and surveys. This consultation provides insights into financial and operational trends from BNPL market leaders, which enhances the credibility and accuracy of the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from BNPL service providers and consumer surveys. This ensures a comprehensive and accurate analysis of market segments, consumer preferences, and service performance, resulting in a validated and detailed market report.

Frequently Asked Questions

01. How big is the North America Buy Now Pay Later market?

The North America Buy Now Pay Later market is valued at USD 18 billion, driven by the increasing demand for flexible payment options and rising e-commerce adoption across the region.

02. What are the challenges in the North America BNPL Market?

Challenges in the North America Buy Now Pay Later market include regulatory uncertainty surrounding BNPL services and rising concerns over consumer debt accumulation, particularly among younger consumers.

03. Who are the major players in the North America BNPL market?

Key players in the North America Buy Now Pay Later market include Klarna, Affirm, Afterpay, Sezzle, and PayPal (Pay in 4), who dominate the market due to their extensive partnerships with large retailers and innovative mobile payment solutions.

04. What are the growth drivers of the North America BNPL market?

Growth in the North America Buy Now Pay Later market is driven by increasing consumer preference for flexible payment solutions, the rise of e-commerce, and technological advancements in mobile payment platforms.

05. What is the competitive landscape of the North America BNPL market?

The North America Buy Now Pay Later market is competitive, with leading companies like Klarna, Affirm, and Afterpay leveraging strong merchant networks and consumer adoption to maintain a competitive edge.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.