North America Cannabis Beverages Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6070

December 2024

99

About the Report

North America Cannabis Beverages Market Overview

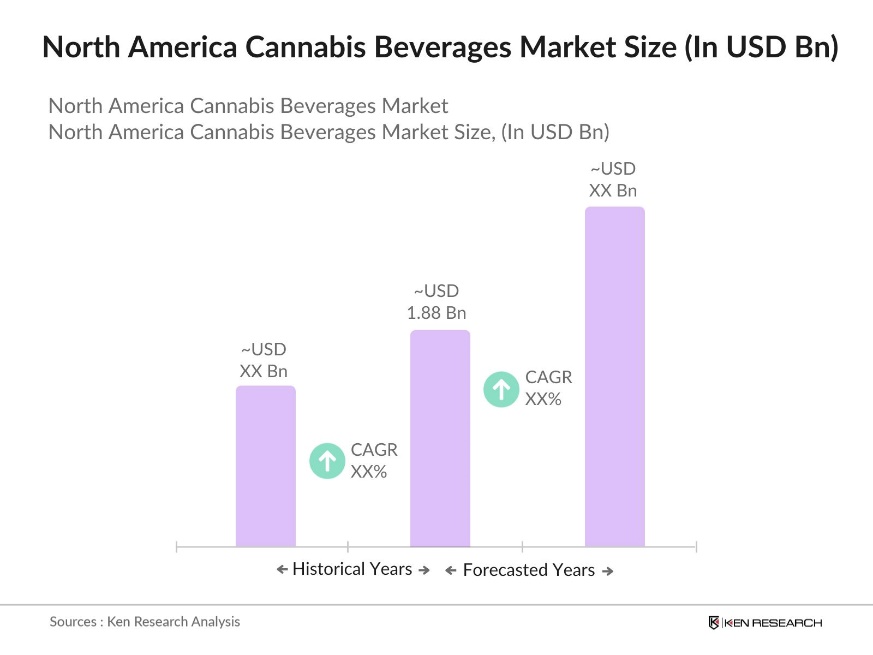

- The North America Cannabis Beverages Market is valued at USD 1.88 billion, according to a detailed analysis of the industrys historical performance. This market has been driven by several factors, including the widespread legalization of cannabis products across the U.S. and Canada, as well as growing consumer preference for beverages infused with cannabis as an alternative to traditional forms of consumption.

- Key cities and countries dominating the North American cannabis beverages market include major metropolitan areas in the United States, particularly California, Colorado, and Washington, where the legal cannabis industry is well-established. Additionally, Canadian cities such as Toronto and Vancouver are major players due to Canadas nationwide legalization of cannabis and a more streamlined regulatory environment.

- Cannabis beverage manufacturers in North America must adhere to regulations from both the FDA in the U.S. and Health Canada. The FDA's prohibition on interstate THC beverage sales complicates distribution. In Canada, Health Canada conducted 662 inspections under the Cannabis Act during 2023-24, resulting in 21 non-compliant reports issued to license holders. These strict regulatory frameworks add significant compliance challenges for cannabis beverage producers.

North America Cannabis Beverages Market Segmentation

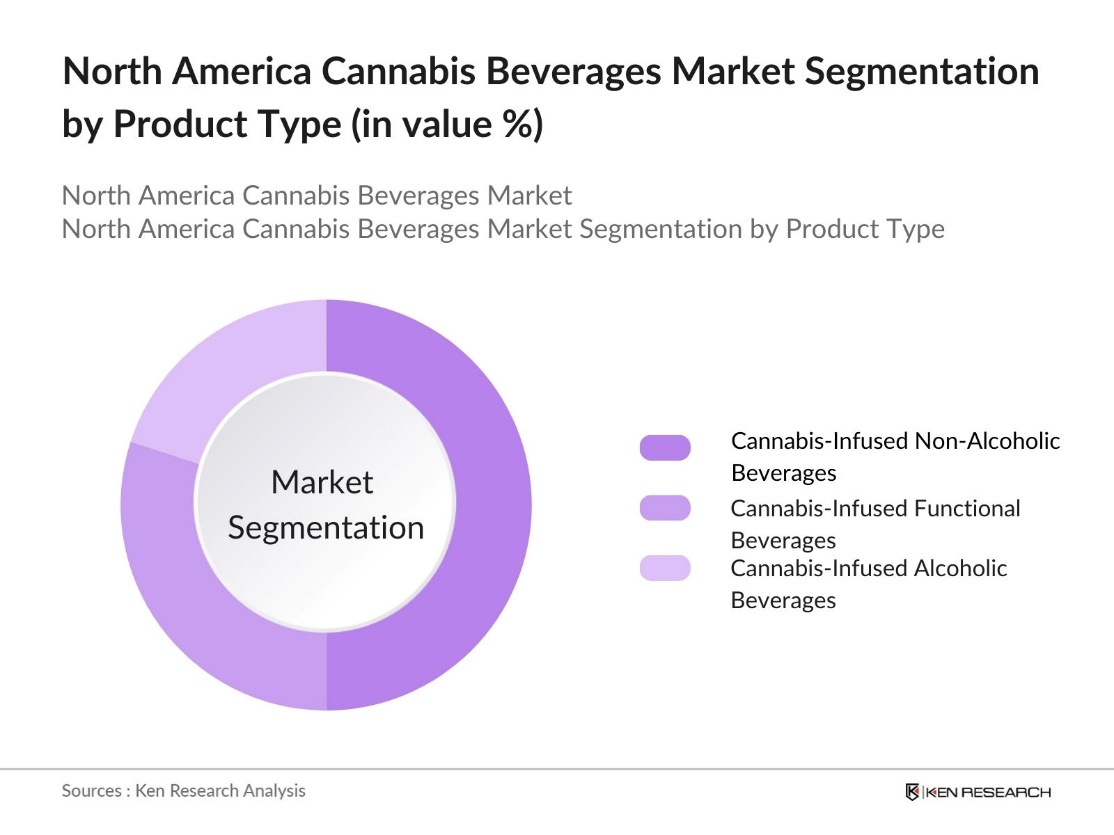

By Product Type: The North America cannabis beverages market is segmented by product type into cannabis-infused alcoholic beverages, cannabis-infused non-alcoholic beverages, and cannabis-infused functional beverages. Recently, cannabis-infused non-alcoholic beverages have a dominant market share under the segmentation by product type. This is primarily due to the increasing demand for wellness-oriented beverages that offer the benefits of cannabis without the intoxicating effects of alcohol. Consumers are drawn to the health benefits of CBD, such as relaxation and stress relief, without the high associated with THC. In contrast, alcoholic cannabis beverages are facing regulatory hurdles that limit their market penetration.

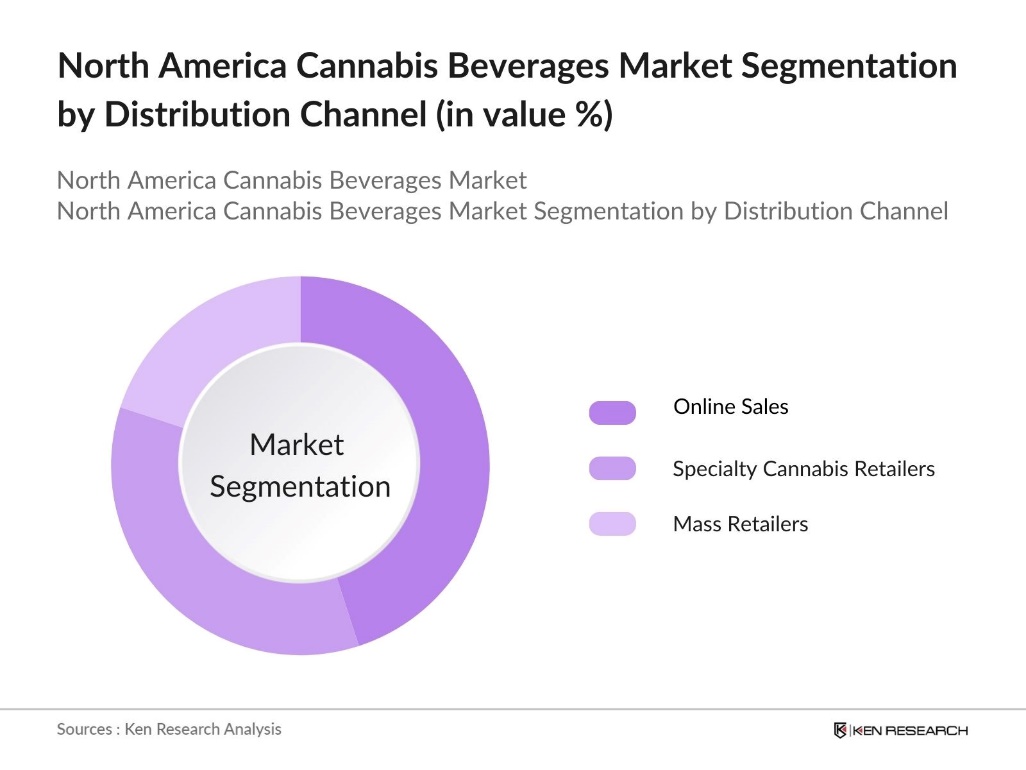

By Distribution Channel: The North America cannabis beverages market is segmented by distribution channels into online sales, specialty cannabis retailers, and mass retailers. Online sales dominate this segment due to the convenience they offer and the ability to access a wide range of products. During the COVID-19 pandemic, online platforms saw a surge in sales, which has continued as a preferred purchasing method for many consumers. Specialty cannabis retailers, however, remain crucial due to their knowledgeable staff and the in-store experience they provide for consumers seeking expert advice on product selection.

North America Cannabis Beverages Market Competitive Landscape

The market is dominated by a few major players, including both cannabis-focused companies and traditional beverage giants entering the cannabis sector. Companies like Canopy Growth Corporation and Tilray Inc. lead the market due to their diversified portfolios and strategic partnerships with established beverage companies. These companies are leveraging both cannabis expertise and existing distribution networks to expand their market share.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD) |

No. of Employees |

Product Portfolio |

Market Presence |

R&D Investments |

Distribution Network |

|

Canopy Growth Corporation |

2013 |

Ontario, Canada |

||||||

|

Tilray Inc. |

2014 |

New York, USA |

||||||

|

Hexo Corp. |

2013 |

Quebec, Canada |

||||||

|

Alkaline88 |

2012 |

Arizona, USA |

||||||

|

Molson Coors Beverage Co. |

1786 |

Colorado, USA |

North America Cannabis Beverages Industry Analysis

Growth Drivers

- Legalization of Cannabis in Multiple States (Legal Parameters): The legalization of cannabis across numerous states in the U.S. has paved the way for the growing cannabis beverages market. By 2024, 38 states, including California and New York, have legalized cannabis for medicinal or recreational use, enabling widespread consumption. This regulatory shift fosters growth opportunities for cannabis-infused beverages, particularly in states with well-established retail channels.

- Health and Wellness Trends Driving Non-Alcoholic Cannabis Beverages (Consumer Behavior): The rising focus on health and wellness in North America is driving the demand for non-alcoholic cannabis beverages as an alternative to alcohol. For instance, ready-to-drink THC beverages are becoming popular due to their low-calorie content, often containing 25 calories or less per serving. This aligns with a growing trend where younger consumers, particularly Gen Z and millennials, are choosing to drink less alcohol and are more open to alternatives like cannabis drinks.

- Expansion of Retail Channels (Retail Infrastructure): The expansion of retail channels, including cannabis dispensaries and mainstream retailers, is significantly enhancing the availability of cannabis beverages across North America. The increasing number of dispensaries and partnerships with major retail chains are making these products more accessible to consumers. Collaborations between convenience stores and cannabis companies are further driving market growth by integrating cannabis beverages into everyday shopping experiences.

Market Challenges

- Regulatory and Compliance Hurdles (Legal Parameters): Cannabis beverages encounter substantial regulatory challenges due to differing legal frameworks across states and countries in North America. While many U.S. states have legalized cannabis, federal restrictions still prevent interstate commerce, resulting in a fragmented market. Additionally, cannabis remains a Schedule I substance under U.S. federal law, complicating operations for companies across multiple states. In Canada, stringent labeling and marketing regulations further limit the promotion and penetration of cannabis beverages.

- High Taxation in Some States (Taxation Policy): High taxation in certain U.S. states creates significant cost barriers for cannabis beverage manufacturers and consumers. These tax policies, often higher than those applied to other products, raise the retail prices of cannabis beverages, making them less affordable. The elevated taxes also affect profit margins, challenging producers to balance costs while remaining competitive in the market. This has slowed down broader adoption in highly taxed regions.

North America Cannabis Beverages Market Future Outlook

The North America cannabis beverages market is poised for significant growth in the coming years, driven by the continued expansion of cannabis legalization across states in the U.S. and further advancements in cannabis-infused product innovation. The industry will likely see a rise in consumer demand for low-sugar, wellness-oriented products, with a particular focus on functional beverages that offer specific health benefits such as improved sleep, relaxation, and enhanced focus.

Market Opportunities

- Increasing Popularity of Cannabis-Infused Functional Beverages (Product Innovation): The rising demand for functional beverages is opening new opportunities for cannabis-infused drinks. Consumers are increasingly seeking beverages that offer health benefits, such as relaxation and stress relief, making cannabis beverages an appealing alternative to traditional soft drinks and alcohol. Infused with CBD and THC, these beverages are becoming a popular choice for those looking for a balance between wellness and enjoyment.

- Growth of Online Retailing Channels (Digitalization): The expansion of e-commerce platforms in North America is driving growth in cannabis beverage sales. Online retailing offers consumers convenience and access to a wider range of products, especially in regions with fewer physical dispensaries. Companies are enhancing their digital presence to tap into this growing online demand, providing consumers with easy ordering and delivery options.

Scope of the Report

|

Product Type |

Cannabis-Infused Alcoholic Beverages Cannabis-Infused Non-Alcoholic Beverages Cannabis-Infused Functional Beverages |

|

Distribution Channel |

Online Sales Specialty Cannabis Retailers Mass Retailers |

|

Consumer Demographics |

Millennials Gen Z Baby Boomers |

|

Source |

THC-Infused Beverages CBD-Infused Beverages Hybrid-Infused Beverages |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Cannabis Beverage Manufacturers

Health and Wellness Product Companies

Packaging Companies

Government and Regulatory Bodies (FDA, Health Canada)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Canopy Growth Corporation

Tilray Inc.

Hexo Corp.

Alkaline88

Molson Coors Beverage Company

Constellation Brands

Anheuser-Busch InBev

Keef Brands

Aphria Inc.

New Age Beverages Corporation

Table of Contents

1. North America Cannabis Beverages Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. North America Cannabis Beverages Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Cannabis Beverages Market Analysis

3.1 Growth Drivers

3.1.1 Legalization of Cannabis in Multiple States (Legal Parameters)

3.1.2 Health and Wellness Trends Driving Non-Alcoholic Cannabis Beverages (Consumer Behavior)

3.1.3 Expansion of Retail Channels (Retail Infrastructure)

3.2 Market Challenges

3.2.1 Regulatory and Compliance Hurdles (Legal Parameters)

3.2.2 High Taxation in Some States (Taxation Policy)

3.2.3 Supply Chain Disruptions (Supply Chain Efficiency)

3.3 Opportunities

3.3.1 Increasing Popularity of Cannabis-Infused Functional Beverages (Product Innovation)

3.3.2 Growth of Online Retailing Channels (Digitalization)

3.3.3 Potential Federal Legalization (Legal Landscape)

3.4 Trends

3.4.1 Increasing Demand for Low-Sugar, Organic Beverages (Consumer Preferences)

3.4.2 Collaboration Between Beverage and Cannabis Brands (Partnership Strategies)

3.4.3 Sustainability Initiatives in Packaging (Sustainability)

3.5 Government Regulation

3.5.1 Regulatory Framework for Cannabis Infusion (Legal Framework)

3.5.2 Compliance with FDA and Health Canada (Regulatory Bodies)

3.5.3 State-Level Cannabis Beverage Guidelines (State Regulations)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Cannabis Beverages Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Cannabis-Infused Alcoholic Beverages

4.1.2 Cannabis-Infused Non-Alcoholic Beverages

4.1.3 Cannabis-Infused Functional Beverages

4.2 By Distribution Channel (In Value %)

4.2.1 Online Sales

4.2.2 Specialty Cannabis Retailers

4.2.3 Mass Retailers

4.3 By Consumer Demographics (In Value %)

4.3.1 Millennials

4.3.2 Gen Z

4.3.3 Baby Boomers

4.4 By Source (In Value %)

4.4.1 THC-Infused Beverages

4.4.2 CBD-Infused Beverages

4.4.3 Hybrid-Infused Beverages

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Cannabis Beverages Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Canopy Growth Corporation

5.1.2 Tilray Inc.

5.1.3 Hexo Corp.

5.1.4 Alkaline88

5.1.5 Constellation Brands

5.1.6 Molson Coors Beverage Company

5.1.7 Anheuser-Busch InBev

5.1.8 Keef Brands

5.1.9 Aphria Inc.

5.1.10 New Age Beverages Corporation

5.1.11 Sprig

5.1.12 BevCanna Enterprises

5.1.13 Pabst Labs

5.1.14 Recess

5.1.15 Lagunitas Brewing Company

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, Market Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Cannabis Beverages Market Regulatory Framework

6.1 Licensing Procedures (Licensing Requirements)

6.2 Compliance Requirements (Compliance Standards)

6.3 Certification Processes (FDA, Health Canada Certifications)

7. North America Cannabis Beverages Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Cannabis Beverages Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Demographics (In Value %)

8.4 By Source (In Value %)

8.5 By Region (In Value %)

9. North America Cannabis Beverages Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with the identification of key variables affecting the North America Cannabis Beverages Market. This includes an in-depth analysis of the legal frameworks governing cannabis-infused products and consumer behavior trends. Extensive desk research is used to map out the market ecosystem.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data from cannabis beverages sales, product penetration, and distribution channels. This is followed by an assessment of sales performance and consumer preferences, allowing us to construct an accurate depiction of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with industry experts and stakeholders across various companies using computer-assisted telephone interviews (CATIs) to validate our research hypotheses. This provides insight into operational and financial strategies that companies are adopting.

Step 4: Research Synthesis and Final Output

Finally, the gathered data is synthesized and refined through direct engagements with cannabis beverage manufacturers. This ensures the accuracy of the analysis, as company feedback is used to validate the findings from our market research.

Frequently Asked Questions

01. How big is the North America Cannabis Beverages Market?

The North America Cannabis Beverages Market is valued at USD 1.88 billion, driven by widespread legalization of cannabis and growing consumer demand for wellness-focused beverages.

02. What are the challenges in the North America Cannabis Beverages Market?

Challenges in North America Cannabis Beverages Market include regulatory hurdles across different states, supply chain disruptions, and high taxation on cannabis products, which could limit market growth.

03. Who are the major players in the North America Cannabis Beverages Market?

Major players in the North America Cannabis Beverages Market include Canopy Growth Corporation, Tilray Inc., Hexo Corp., and Molson Coors Beverage Company, who lead due to their diversified product portfolios and strategic partnerships.

04. What are the growth drivers of the North America Cannabis Beverages Market?

The North America Cannabis Beverages Market is driven by increasing consumer interest in non-intoxicating CBD products, health and wellness trends, and expanding retail distribution networks, particularly through online platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.