North America CAR T-Cell Therapy Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD2920

November 2024

88

About the Report

North America CAR T-Cell Therapy Market Overview

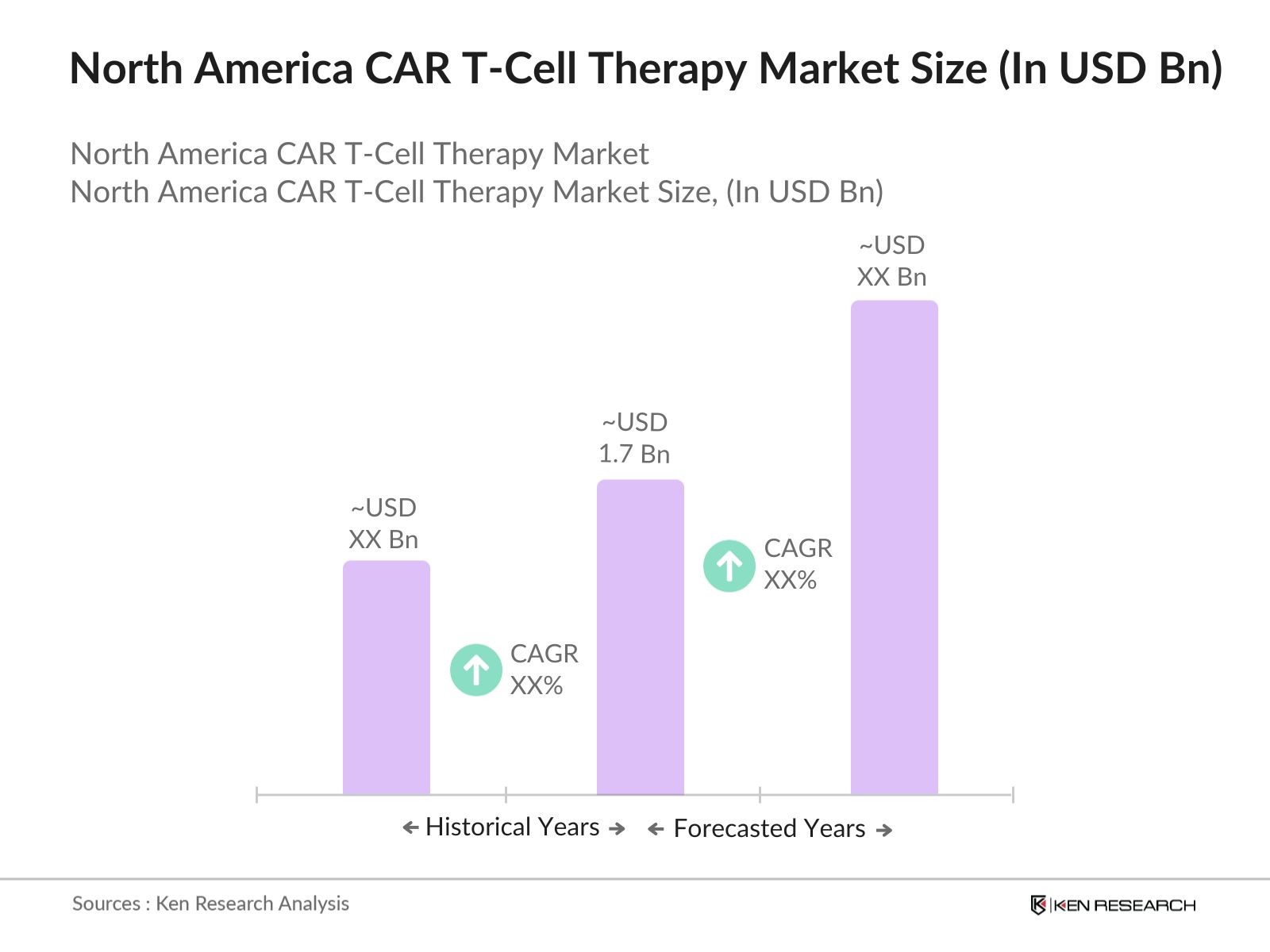

The North America CAR T-Cell Therapy market reached a valuation of USD 1.7 billion based on the historical data of past five years. The market is primarily driven by advancements in immunotherapy and a rising prevalence of hematological cancers such as leukemia and lymphoma, which are primary targets for CAR T-Cell therapies. An increasing number of regulatory approvals for therapies in the region further stimulates market growth.

The North American CAR T-Cell therapy market is dominated by several key players including Kite Pharma (Gilead Sciences), Novartis, Juno Therapeutics (Bristol-Myers Squibb), Legend Biotech, and Autolus Therapeutics. These companies are pioneers in the field, with Kite Pharma and Novartis leading the commercial approval of CAR T-cell therapies like Yescarta and Kymriah, respectively, making them critical players in the development of next-generation therapies.

In May 2023, Gilead Sciences announced the expansion of its CAR T-cell therapy production facility in California to meet growing demand. The expansion is set to increase its production capacity by 25%, targeting more patients in North America. This development is seen as a strategic move to solidify Kite Pharmas position as a market leader, particularly as the demand for CAR T-cell therapies rises across the region.

California is emerging as the dominant state in the North American CAR T-cell therapy industry, driven by its concentration of biotechnology companies and world-class research institutions. In 2023, the state accounted for more than one-third of the total CAR T-cell therapy treatments in the U.S., largely due to the presence of major players like Gilead Sciences and the proximity to research hubs such as Stanford University.

North America CAR T-Cell Therapy Market Segmentation

The North America CAR T-cell therapy market is segmented into various factors product type, therapeutic application and region etc.

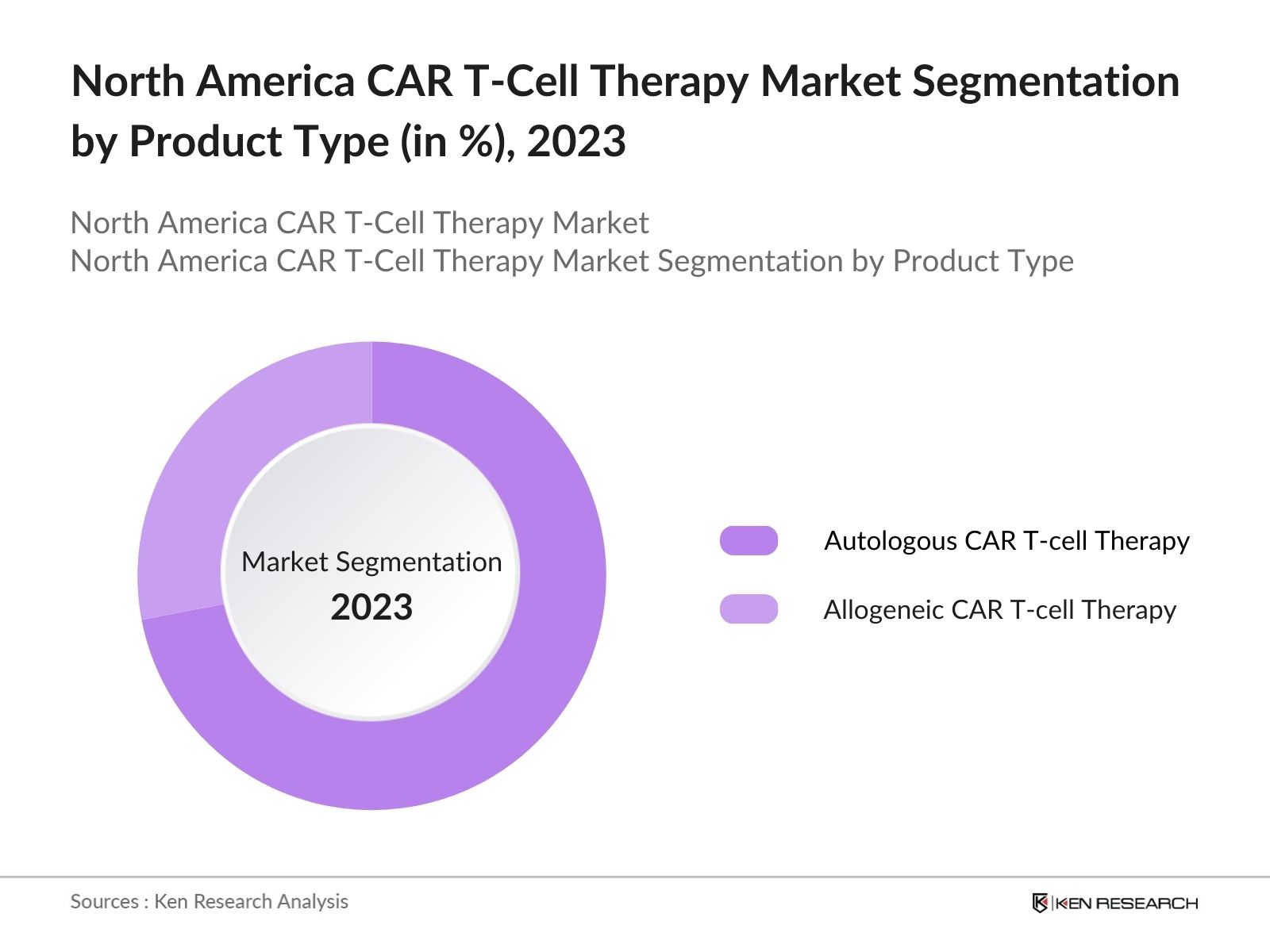

By Product Type: The market is segmented by product type into Autologous CAR T-cell Therapy and Allogeneic CAR T-cell Therapy. Autologous CAR T-cell Therapy held a dominant market share in 2023 due to its effectiveness in personalized treatment. The therapy uses the patient's own cells, reducing the risk of immune rejection and increasing therapeutic efficacy.

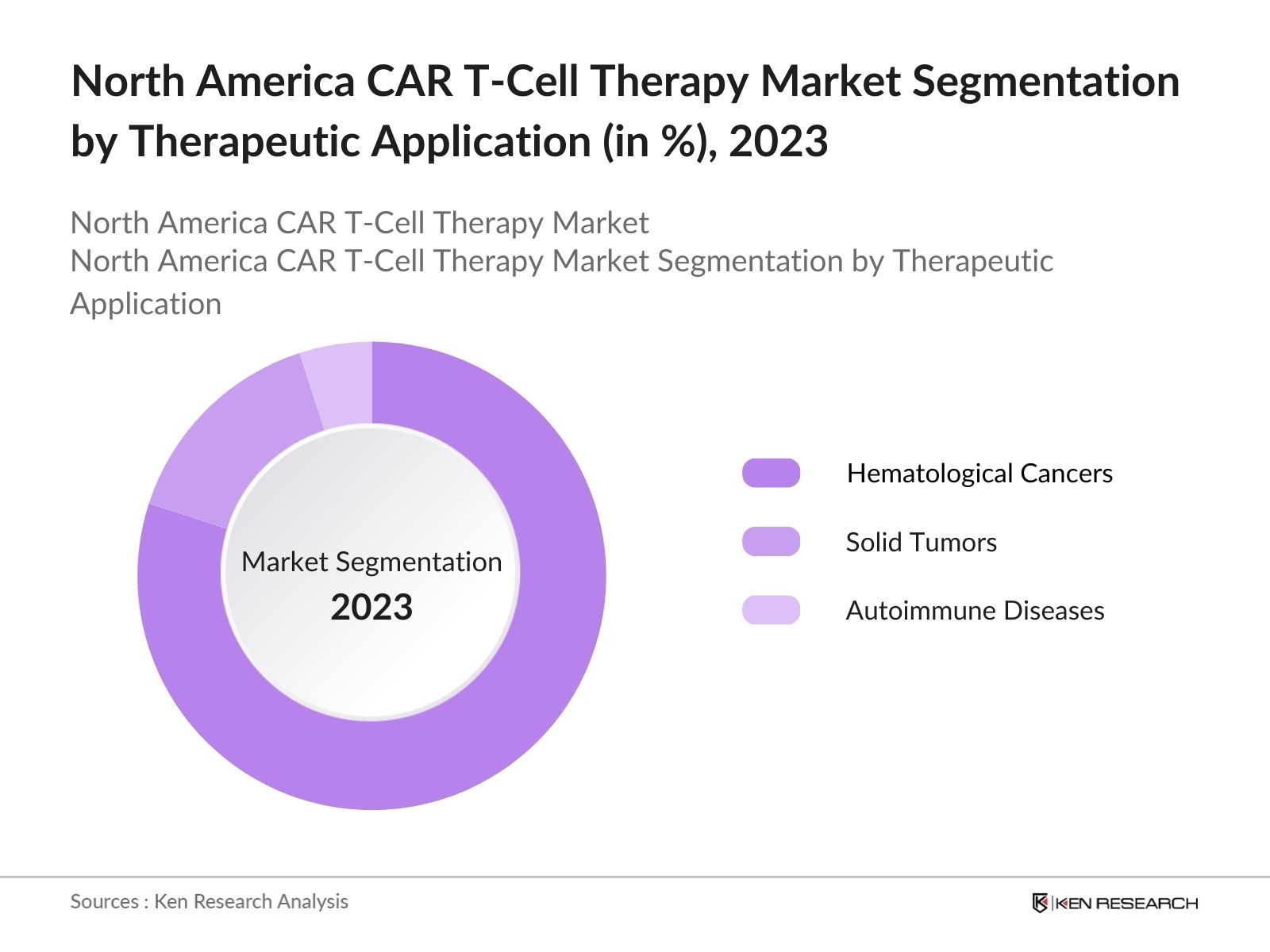

By Therapeutic Application: The market is segmented into Hematological Cancers, Solid Tumors, and Autoimmune Diseases. Hematological Cancers accounted dominated the market share, driven by the success of CAR T-cell therapies in treating conditions like B-cell lymphomas and multiple myeloma. The dominance of this segment is attributed to the high efficacy rates observed in hematological malignancies, which have seen a complete remission rate in relapsed or refractory patients.

By Therapeutic Application: The market is segmented into Hematological Cancers, Solid Tumors, and Autoimmune Diseases. Hematological Cancers accounted dominated the market share, driven by the success of CAR T-cell therapies in treating conditions like B-cell lymphomas and multiple myeloma. The dominance of this segment is attributed to the high efficacy rates observed in hematological malignancies, which have seen a complete remission rate in relapsed or refractory patients.

By Region: The market is segmented regionally into USA and Canada. The USA dominates the North America CAR T-Cell Therapy market, accounting for a dominant part of the market. This is due to the presence of major biotechnology companies, advanced research facilities, and a robust regulatory framework that supports the rapid approval and commercialization of CAR T-cell therapies.

North America CAR T-Cell Therapy Market Competitive Landscape

|

Player Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Kite Pharma (Gilead) |

2009 |

Santa Monica, CA |

|

Novartis |

1996 |

Basel, Switzerland |

|

Juno Therapeutics (BMS) |

2013 |

Seattle, WA |

|

Legend Biotech |

2014 |

Somerset, NJ |

|

Autolus Therapeutics |

2014 |

London, UK |

- Legend Biotechs License Agreement with Novartis: Legend Biotech recently announced an exclusive, global license agreement with Novartis for certain CAR-T therapies targeting DLL3.The deal grants Novartis the exclusive worldwide rights to develop, manufacture and commercialize these cell therapies, including Legend Biotech's autologous CAR-T cell therapy candidate LB2102

- Novartis Partners with Major Research Institutions: Novartis has been actively developing its T-Charge platform, a next-generation CAR-T technology designed to enhance the efficacy and safety of CAR-T therapies. This platform aims to preserve T cell stemness, which is critical for maintaining the therapeutic potential of CAR-T cells. Early clinical trials using this platform, specifically with therapies YTB323 (targeting CD19) and PHE885 (targeting BCMA).

North America CAR T-Cell Therapy Industry Analysis

Growth Drivers

- Increasing Cancer Incidence: In North America, the number of patients diagnosed with hematological cancers, such as lymphoma and leukemia, is significantly rising. In 2024, new cases of blood cancers are being reported, driving the demand for advanced treatment options like CAR T-cell therapy. This rising patient population has led to a surge in clinical trials, with trials actively investigating CAR T-cell therapies in 2024.

- Advances in CAR T-Cell Therapy Manufacturing: CAR T-cell therapies are benefitting from improvements in manufacturing processes, reducing the time required to produce personalized treatments. In 2024, the average production time for autologous CAR T-cell therapies has decreased from 22 days to 15 days. This advancement is expected to allow an additional 1,500 patients in the U.S. to access treatment by the end of the year. Enhanced manufacturing capabilities, combined with increased investment, are pushing the availability of these therapies beyond their traditional use cases.

- Rising Investment in Immuno-oncology: The biotechnology sector, including immuno-oncology, has seen record-setting investments, with the bio-pharma sector raising approximately USD 9.3 billion in 2023 alone. Leading biopharmaceutical companies are directing more capital toward expanding the application of CAR T-cell therapies beyond hematological cancers. This influx of funding supports the commercialization of new CAR T-cell therapies for solid tumors, a key area of development in North America.

Challenges

- Complex Supply Chain and Manufacturing Bottlenecks: The process of manufacturing CAR T-cell therapies is highly complex, involving the harvesting, modification, and reinfusion of a patients own cells. In 2024, delays in cell processing caused by supply chain constraints and limited manufacturing capacity are expected to affect patients. The shortage of production facilities, combined with the need for specialized logistics, has led to long wait times.

- Limited Healthcare Infrastructure: While CAR T-cell therapy has been approved in several regions across North America, not all healthcare facilities are equipped to handle the complexities of administering these therapies. In 2024, fewer than 250 certified centers across the U.S. and Canada can provide CAR T-cell treatments, limiting patient access in rural or underserved regions.

Government Initiatives

- Expansion of the Cancer Moonshot Program: The Biden Cancer Moonshot aims to accelerate progress in cancer research and improve prevention, detection, and treatment. It emphasizes collaboration across various sectors, including federal agencies, healthcare providers, and private companies, focusing on the treatment of solid tumors.

- State-Level Funding for CAR T-Cell Therapy Research: Several states, including California and New York, have announced their own initiatives to fund CAR T-cell therapy research. In 2024, California alone allocated USD 1.2 billion to cancer research, with a portion dedicated to CAR T-cell development. These state-level investments aim to accelerate clinical trials for new therapies, particularly those targeting solid tumors.

North America CAR T-Cell Therapy Market Future Outlook

The CAR T-cell therapy market in North America is expected to grow exponentially. Future growth is expected to be driven by the increasing number of indications approved for CAR T-cell therapies beyond hematological malignancies, potentially targeting solid tumors. Ongoing clinical trials and the potential for personalized medicine approaches will further bolster market expansion over the next five years.

Future Trends

- Expansion of CAR T-Cell Applications to Solid Tumors: By 2028, CAR T-cell therapy will expand beyond hematological cancers to target solid tumors, which account for many new cases in North America. This shift will be driven by ongoing clinical trials, which are expected to receive approval in the next 3-4 years. These therapies will be specifically designed to target antigens found in solid tumors like pancreatic and lung cancer, opening new avenues for treatment.

- Introduction of Multi-Targeting CAR T-Cell Therapies: Multi-targeting CAR T-cell therapies, capable of attacking multiple cancer antigens simultaneously, will become the standard of care for relapsed cancers. Early data from 2024 clinical trials show that these therapies could improve remission rates of traditional single-target therapies. The FDA is expected to grant approval for these therapies within the next five years, marking a significant advancement in cancer treatment.

Scope of the Report

|

By Product Type |

Autologous CAR T-cell Therapy Allogeneic CAR T-cell Therapy |

|

By Therapeutic Application |

Hematological Cancer Solid Tumors Autoimmune Diseases |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Cancer Treatment Centers

Pharmaceutical Companies

Biotechnology Firms

Government Institutions (FDA, NIH)

Insurance Providers

Cancer Research Institutes

CAR T-cell Therapy Manufacturers

Medical Device Companies

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Kite Pharma (Gilead Sciences)

Novartis

Juno Therapeutics (Bristol-Myers Squibb)

Legend Biotech

Autolus Therapeutics

Allogene Therapeutics

Cellectis

Bluebird Bio

Sangamo Therapeutics

Precision Biosciences

Mustang Bio

Celgene Corporation

Gracell Biotechnologies

Poseida Therapeutics

Tmunity Therapeutics

Table of Contents

1.North America CAR T-Cell Therapy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.North America CAR T-Cell Therapy Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.North America CAR T-Cell Therapy Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Cancer Incidence

3.1.2. Advances in CAR T-Cell Therapy Manufacturing

3.1.3. Regulatory Support for Accelerated Approvals

3.1.4. Rising Investment in Immuno-oncology

3.2. Challenges

3.2.1. High Treatment Costs

3.2.2. Complex Supply Chain and Manufacturing Bottlenecks

3.2.3. Limited Healthcare Infrastructure

3.2.4. Patient Eligibility Constraints

3.3. Opportunities

3.3.1. Expansion of CAR T-Cell Applications to Solid Tumors

3.3.2. Introduction of Off-the-Shelf Therapies

3.3.3. AI-Driven Customization of CAR T-Cell Therapies

3.3.4. Multi-Targeting CAR T-Cell Therapies

3.4. Trends

3.4.1. Expansion in Solid Tumor Treatment

3.4.2. Increased Adoption of Allogeneic Therapies

3.4.3. Integration of AI in CAR T-Cell Manufacturing

3.4.4. Clinical Trials Expansion

3.5. Government Regulations

3.5.1. FDAs Breakthrough Therapy Designation Program

3.5.2. Cancer Moonshot Initiative

3.5.3. CAR T-Cell Therapy Access Grants

3.5.4. State-Level Funding for CAR T Research

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4.North America CAR T-Cell Therapy Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Autologous CAR T-Cell Therapy

4.1.2. Allogeneic CAR T-Cell Therapy

4.2. By Therapeutic Application (in Value %)

4.2.1. Hematological Cancers

4.2.2. Solid Tumors

4.2.3. Autoimmune Diseases

4.3. By Region (in Value %)

4.3.1. West

4.3.2. North

4.3.3. East

4.3.4. South

5.North America CAR T-Cell Therapy Market Competitive Landscape

5.1. Major Players Profiles

5.1.1. Kite Pharma (Gilead Sciences)

5.1.2. Novartis

5.1.3. Juno Therapeutics (Bristol-Myers Squibb)

5.1.4. Legend Biotech

5.1.5. Autolus Therapeutics

5.2. Cross Comparison Parameters (Establishment Year, Headquarters, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Innovation and Product Development

6.North America CAR T-Cell Therapy Market Future Size (in USD Bn), 2023-2028

6.1. Future Market Size Projections

6.2. Key Factors Driving Future Growth

6.3. Potential Barriers to Growth

7.North America CAR T-Cell Therapy Market Future Segmentation, 2028

7.1. By Product Type (in Value %)

7.2. By Therapeutic Application (in Value %)

7.3. By Region (in Value %)

8.North America CAR T-Cell Therapy Market Analysts' Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Strategic Market Positioning

8.3. White Space Opportunity Analysis

9.North America CAR T-Cell Therapy Market Regulatory Framework

9.1. Compliance Requirements

9.2. Certification Processes

9.3. Future Regulatory Changes

10.North America CAR T-Cell Therapy Market Competitive Landscape (2023-2028)

10.1. Strategic Initiatives

10.2. Mergers and Acquisitions

10.3. Partnerships and Collaborations

11.North America CAR T-Cell Therapy Market Future Trends (2023-2028)

11.1. Expansion in Therapy Applications

11.2. AI-Driven Solutions in CAR T-Cell Therapy

11.3. New Clinical Trials and Approvals

12.North America CAR T-Cell Therapy Market Investment Landscape

12.1. Venture Capital Funding

12.2. Private Equity Investments

12.3. Government Grants and Funding

12.4. R&D Investment Trends

13.North America CAR T-Cell Therapy Market Technological Innovations

13.1. AI and Machine Learning in CAR T-Cell Therapy

13.2. Advances in CAR T-Cell Manufacturing

13.3. CRISPR and Gene Editing Technologies

13.4. Automation in CAR T-Cell Production

14.North America CAR T-Cell Therapy Market Supply Chain Analysis

14.1. CAR T-Cell Harvesting and Manufacturing Processes

14.2. Logistics and Distribution Challenges

14.3. Key Suppliers and Manufacturing Partners

15.North America CAR T-Cell Therapy Market Future Opportunities

15.1. Expansion into Solid Tumor Therapies

15.2. Collaboration with Academic and Research Institutions

15.3. Expansion into Rural and Underserved Markets

15.4. Global Market Expansion and Export Potential

16.North America CAR T-Cell Therapy Market Stakeholder Analysis

16.1. Hospitals and Treatment Centers

16.2. Pharmaceutical and Biotech Companies

16.3. Regulatory Bodies (FDA, NIH)

16.4. Investors and Venture Capital Firms

16.5. Patients and Patient Advocacy Groups

17.North America CAR T-Cell Therapy Market Cross Comparison (By Region)

17.1. West vs East

17.2. North vs South

17.3. Urban vs Rural Adoption Rates

18.North America CAR T-Cell Therapy Market Future Scenario

18.1. Technology Adoption Roadmap

18.2. Impact of Regulatory Changes

18.3. Industry Consolidation Projections

19.North America CAR T-Cell Therapy Market Strategic Recommendations

19.1. Strategic Partnerships and Collaborations

19.2. Investment in Research and Development

19.3. Expansion into New Therapeutic Areas

19.4. Market Penetration and Expansion Strategies

Conclusion

20.1. Summary of Key Findings

20.2. Future Market Outlook

20.3. Analyst Insights

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on CAR T-Cell Therapy market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for CAR T-Cell Therapy market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different CAR T-Cell Therapy companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple CAR T-Cell Therapy Companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from CAR T-Cell Therapy companies.

Frequently Asked Questions

01 How big is North America CAR T-Cell Therapy Market?

The North America CAR T-Cell Therapy market was valued at USD 1.7 billion, driven by rising cancer incidences, advancements in immunotherapy, and regulatory support for new therapies.

02 What are the challenges in North America CAR T-Cell Therapy Market?

Challenges include high treatment costs, complex supply chain and manufacturing processes, limited healthcare infrastructure, and patient eligibility constraints, which restrict access to therapies.

03 Who are the major players in the North America CAR T-Cell Therapy Market?

Key players in the market include Kite Pharma (Gilead Sciences), Novartis, Juno Therapeutics (Bristol-Myers Squibb), Legend Biotech, and Autolus Therapeutics, known for their FDA-approved therapies and strong research and development pipelines.

04 What are the growth drivers of North America CAR T-Cell Therapy Market?

The market is driven by the increasing prevalence of hematological cancers, advancements in CAR T-Cell manufacturing, accelerated regulatory approvals, and rising investments in immuno-oncology research.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.