North America Chewing Gum Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD5544

December 2024

99

About the Report

North America Chewing Gum Market Overview

- The North America chewing gum market is valued at USD 4.3 billion, primarily driven by the increasing consumer preference for sugar-free and functional chewing gums. The market exhibits steady growth due to advancements in flavor innovations, expanding distribution channels, and rising health consciousness among consumers. Strategic marketing campaigns by leading brands and the introduction of ecofriendly packaging solutions further bolster market expansion, positioning North America as a significant player in the global chewing gum industry.

Major demand centers for chewing gum in North America include the United States, Canada, and Mexico. The United States dominates the market due to its large population, high disposable incomes, and extensive retail networks. Canada's market presence is strengthened by its healthconscious consumer base and strong demand for natural and organic products. Mexico benefits from a growing middle class and increasing urbanization, which enhance the market's growth prospects. These regions lead the market through robust consumer demand, innovative product offerings, and effective distribution strategies.

Major demand centers for chewing gum in North America include the United States, Canada, and Mexico. The United States dominates the market due to its large population, high disposable incomes, and extensive retail networks. Canada's market presence is strengthened by its healthconscious consumer base and strong demand for natural and organic products. Mexico benefits from a growing middle class and increasing urbanization, which enhance the market's growth prospects. These regions lead the market through robust consumer demand, innovative product offerings, and effective distribution strategies. - The U.S. Food and Drug Administration (FDA) regulates the ingredients permissible in chewing gum to ensure consumer safety. According to Title 21 of the Code of Federal Regulations (CFR), Section 172.615, the FDA specifies approved substances for chewing gum base, including natural and synthetic gums, softeners, resins, and antioxidants. For instance, polyvinyl acetate with a minimum molecular weight of 2,000 is permitted as a component of chewing gum base. Manufacturers must adhere to these guidelines to maintain compliance and ensure product safety.

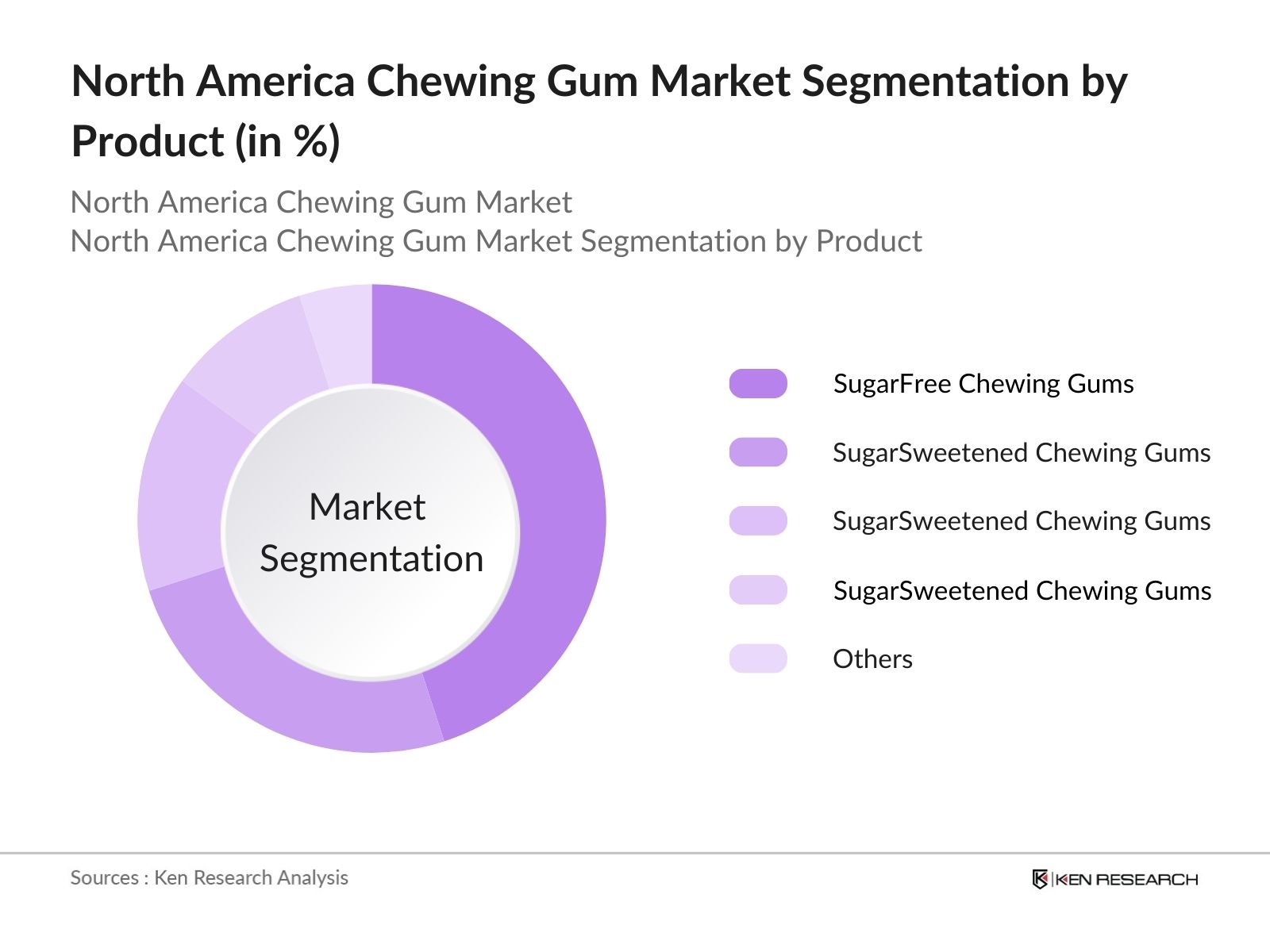

North America Chewing Gum Market Segmentation

- By Product Type: The market is segmented by product type into sugarfree chewing gums, sugarsweetened chewing gums, functional chewing gums, organic/natural chewing gums, and others. Recently, sugarfree chewing gums have secured a dominant market share, primarily due to the increasing health consciousness among consumers and the rising prevalence of dental health issues. Brands like Trident and Extra have capitalized on this trend by offering a variety of flavors and incorporating ingredients that promote oral health, thereby enhancing their market presence. The shift towards healthier alternatives has driven consumers to opt for sugarfree options, reinforcing their dominance in the market.

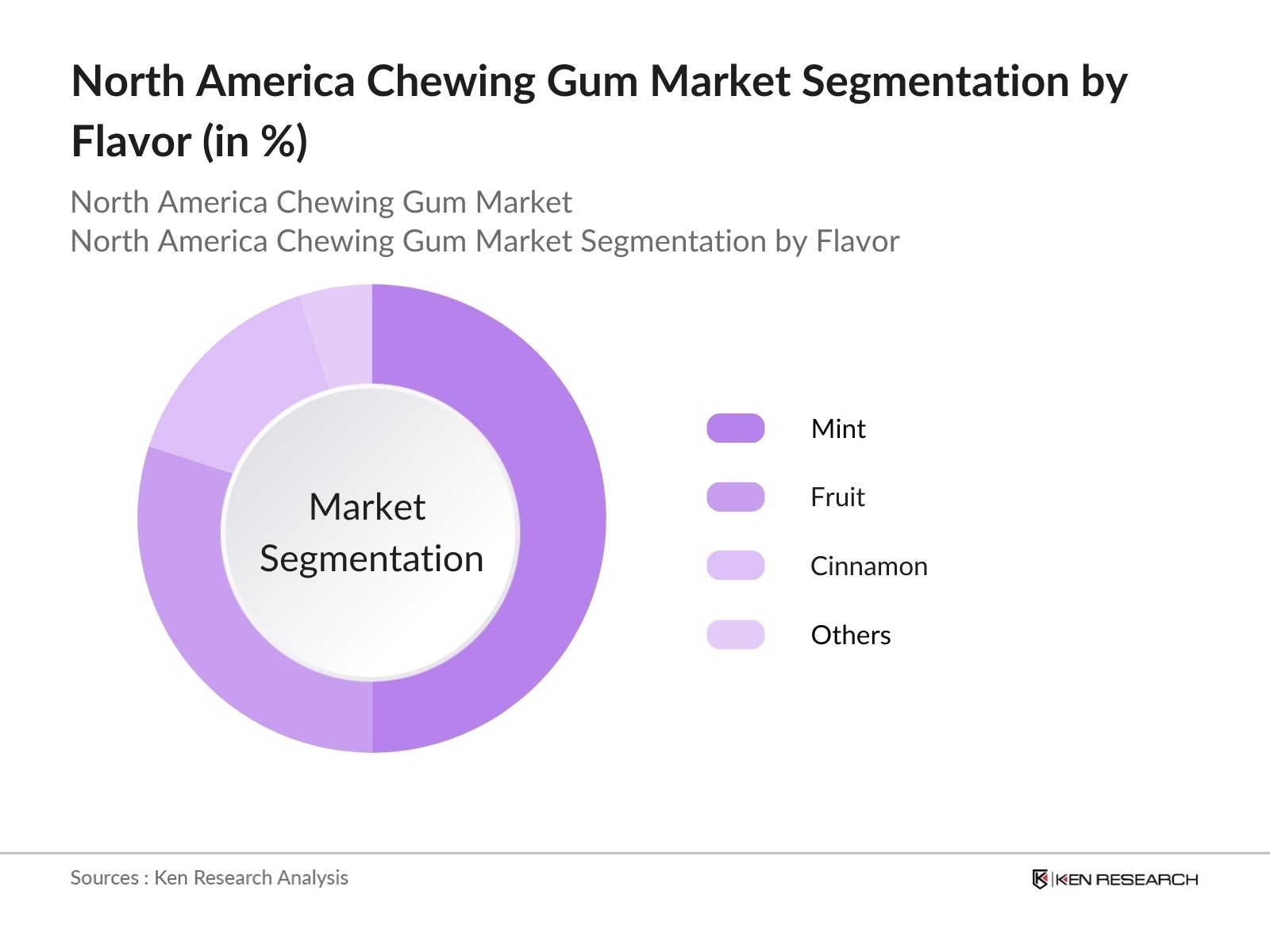

- By Flavor: The market is segmented by flavor into mint, fruit, cinnamon, and others. Mintflavored chewing gums lead the market segmentation, driven by their widespread popularity and association with freshness and oral hygiene. The consistent demand for mint flavors is bolstered by their inclusion in functional gums that offer breathfreshening benefits. Additionally, major brands invest heavily in mint flavor variations to cater to diverse consumer preferences, thereby maintaining their dominant position in the market. The enduring appeal of mint flavors ensures a steady demand, making them the preferred choice among consumers across different USA.

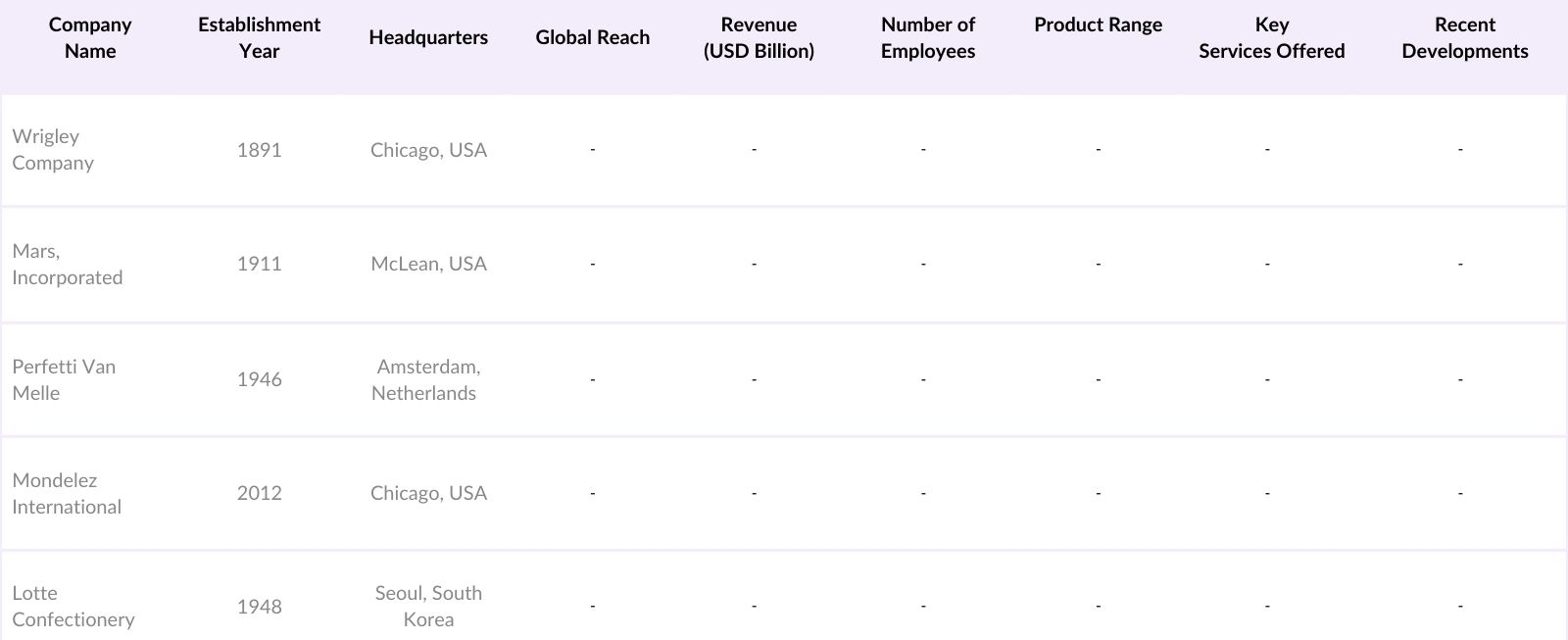

North America Chewing Gum Market Competitive Landscape

The North America chewing gum market is dominated by a few major players, including global giants like Wrigley Company, Mars, Incorporated, and Perfetti Van Melle. This consolidation highlights the significant influence of these key companies, which leverage extensive distribution networks, strong brand equity, and continuous product innovation to maintain their market leadership positions. These companies engage in strategic partnerships and acquisitions to expand their product portfolios and enhance market penetration, thereby reinforcing their dominant positions.

North America Chewing Gum Market Analysis

Growth Drivers

- Increasing Health Consciousness: In 2024, North America has witnessed a significant shift towards health-conscious consumption patterns. The Centers for Disease Control and Prevention (CDC) reports that majority of U.S. adults are classified as obese, leading to heightened awareness about dietary choices. This trend has influenced the chewing gum market, with consumers seeking products that align with healthier lifestyles. The U.S. Department of Agriculture (USDA) notes a substantial increase in demand for low-calorie and sugar-free food products over the past two years, reflecting a broader preference for health-oriented options. This shift is driving manufacturers to innovate and offer healthier chewing gum alternatives.

- Rising Demand for Sugar-Free Options: The American Dental Association (ADA) has endorsed sugar-free chewing gum for its oral health benefits, leading to increased consumer preference for such products. In 2023, the ADA reported that 65% of dentists recommend sugar-free gum to their patients. Additionally, the U.S. Food and Drug Administration (FDA) has approved the use of non-cariogenic sweeteners like xylitol in chewing gums, further boosting consumer confidence. This regulatory support, combined with growing health awareness, has led to a surge in demand for sugar-free chewing gum variants.

- Innovations in Flavors and Packaging: The chewing gum industry has experienced a wave of innovation in flavors and packaging to cater to evolving consumer tastes. The U.S. Patent and Trademark Office (USPTO) recorded over 200 patents related to chewing gum formulations and packaging designs filed between 2022 and 2024. These innovations include the introduction of exotic flavors and eco-friendly packaging materials, aligning with consumer preferences for variety and sustainability. Such developments are enhancing product appeal and driving market growth.

Challenges

- Health Concerns Related to Artificial Sweeteners: Despite the popularity of sugar-free chewing gums, concerns persist regarding the safety of artificial sweeteners. The National Institutes of Health (NIH) has conducted studies indicating potential health risks associated with certain artificial sweeteners, leading to cautious consumer behavior. In 2023, the NIH reported that 30% of surveyed individuals expressed concerns about the long-term effects of artificial sweeteners, impacting their purchasing decisions.

- Intense Competition: The North American chewing gum market is highly competitive, with numerous established brands and new entrants vying for market share. The Federal Trade Commission (FTC) reported that in 2023, over 50 companies were actively competing in the U.S. chewing gum market. This intense competition has led to price wars and increased marketing expenditures, challenging profitability for many players in the industry.

North America Chewing Gum Market Future Outlook

The North America chewing gum market is poised for robust growth, supported by increasing consumer demand for healthoriented and functional chewing gums, continuous product innovation, and expanding distribution channels. Advancements in flavor technologies and the incorporation of natural ingredients are anticipated to attract a broader consumer base. Additionally, the rising trend of ecofriendly packaging and sustainable manufacturing practices will further propel market expansion, catering to environmentally conscious consumers. The integration of digital marketing strategies and ecommerce platforms is expected to enhance market reach and accessibility, driving future growth.

Future Market Opportunities

- Expansion of Functional Chewing Gums: The demand for functional chewing gums that provide additional health benefits, such as stress relief, enhanced focus, and energy boosts, is rapidly gaining traction among health-conscious consumers. According to a 2023 study by the National Center for Complementary and Integrative Health (NCCIH), nearly majority of adults in the United States seek alternative solutions to manage stress and improve cognitive performance. Functional chewing gums infused with ingredients like ashwagandha, caffeine, and B vitamins are emerging as convenient, on-the-go options for these consumers.

- Sustainable Packaging Solutions: As environmental awareness grows, sustainable packaging solutions are becoming a critical factor in consumer decision-making. According to the Environmental Protection Agency (EPA), the United States generates over 82 million tons of packaging waste annually, with plastic accounting for a significant portion. In response, the chewing gum industry is increasingly adopting eco-friendly materials such as biodegradable and compostable films derived from plant-based sources.

Scope of the Report

|

By Product Type |

SugarFree Chewing Gums |

|

By Flavor |

Mint |

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

By Packaging |

Blister Packs |

|

By Region |

USA |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Food and Drug Administration FDA, Federal Trade Commission FTC)

Major Retail Chains and Distributors

Manufacturers and Suppliers in the Confectionery Sector

Marketing and Advertising Agencies

Corporate Strategy and Business Development Teams

Supply Chain and Logistics Managers

Companies

Players Mentioned in the Report

Wrigley Company

Mars, Incorporated

Perfetti Van Melle

Mondelez International

Lotte Confectionery

Hersheys

Clif Bar & Company

Cadbury

Jolly Rancher

Trident

Eclipse

Mentos

Simply Gum

PUR Gum

Glee Gum

Table of Contents

North America Chewing Gum Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

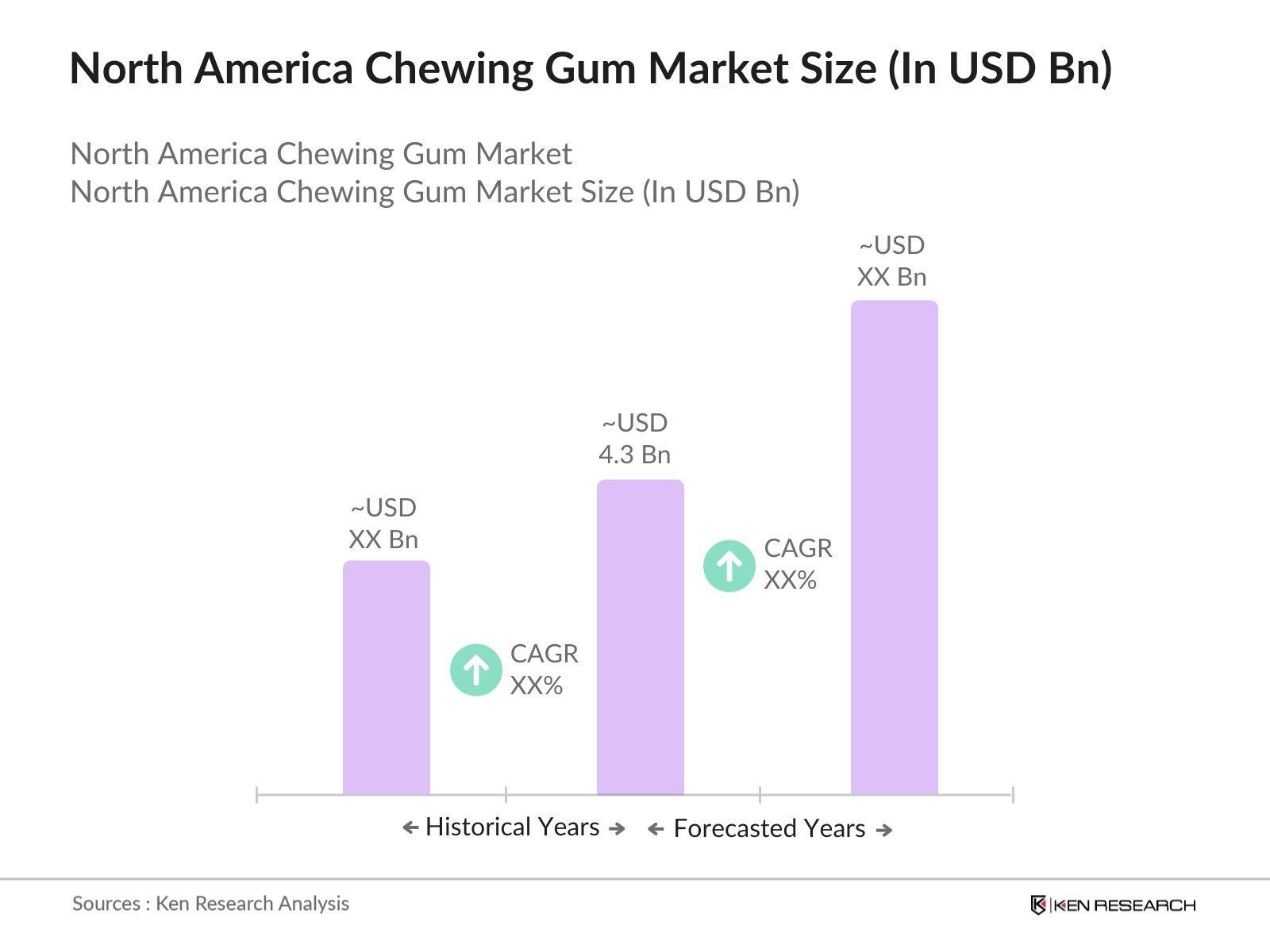

North America Chewing Gum Market Size (In USD Bn)

2.1. Historical Market Size

2.2. YearOnYear Growth Analysis

2.3. Key Market Developments and Milestones

North America Chewing Gum Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Rising Demand for SugarFree Options

3.1.3. Innovations in Flavors and Packaging

3.1.4. Expanding Distribution Channels

3.2. Market Challenges

3.2.1. Health Concerns Related to Artificial Sweeteners

3.2.2. Intense Competition

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Growth in Organic and Natural Chewing Gums

3.3.2. Expansion into Emerging Markets

3.3.3. Technological Advancements in Production

3.4. Trends

3.4.1. EcoFriendly Packaging

3.4.2. Functional Chewing Gums with Added Benefits

3.4.3. Personalized and Customizable Products

3.5. Government Regulation

3.5.1. FDA Guidelines on Ingredients

3.5.2. Labeling and Packaging Standards

3.5.3. Import and Export Regulations

3.5.4. Taxation Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

North America Chewing Gum Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. SugarFree Chewing Gums

4.1.2. SugarSweetened Chewing Gums

4.1.3. Functional Chewing Gums

4.1.4. Organic/Natural Chewing Gums

4.1.5. Others

4.2. By Flavor (In Value %)

4.2.1. Mint

4.2.2. Fruit

4.2.3. Cinnamon

4.2.4. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.3.5. Others

4.4. By Packaging (In Value %)

4.4.1. Blister Packs

4.4.2. Stick Packs

4.4.3. Bulk Packaging

4.4.4. Others

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

North America Chewing Gum Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wrigley Company

5.1.2. Mars, Incorporated

5.1.3. Perfetti Van Melle

5.1.4. Mondelez International

5.1.5. Lotte Confectionery

5.1.6. Hersheys

5.1.7. Clif Bar & Company

5.1.8. Cadbury

5.1.9. Jolly Rancher

5.1.10. Trident

5.1.11. Eclipse

5.1.12. Mentos

5.1.13. Simply Gum

5.1.14. PUR Gum

5.1.15. Glee Gum

5.2. Cross Comparison Parameters

(Product Portfolio, Market Share, Revenue, Geographic Presence, Distribution Channels, Pricing Strategy, Innovation & R&D, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Chewing Gum Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

North America Chewing Gum Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Chewing Gum Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging (In Value %)

8.5. By Region (In Value %)

North America Chewing Gum Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Chewing Gum Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industrylevel information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Chewing Gum Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computerassisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple chewing gum manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottomup approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Chewing Gum Market.

Frequently Asked Questions

01. How big is the North America Chewing Gum Market?

The North America Chewing Gum market was valued at USD 4.3 billion, driven by the increasing demand for sugarfree and functional chewing gums. The market's growth is supported by innovations in flavors, expanding distribution channels, and rising health consciousness among consumers.

02. What are the key growth drivers of the North America Chewing Gum Market?

Key growth drivers in the North America Chewing Gum market include the rising demand for sugarfree and functional chewing gums, advancements in flavor and packaging technologies, expanding retail and online distribution channels, and increasing consumer awareness about oral health benefits associated with chewing gum.

03. Who are the major players in the North America Chewing Gum Market?

Major players in the North America Chewing Gum market include Wrigley Company, Mars, Incorporated, Perfetti Van Melle, Mondelez International, and Lotte Confectionery. These companies dominate the market through extensive distribution networks, strong brand presence, and continuous product innovation.

04. What are the challenges faced by the North America Chewing Gum Market?

Challenges in the North America Chewing Gum market include health concerns related to artificial sweeteners, intense competition among brands, and stringent regulatory compliance. Additionally, the rising cost of raw materials and changing consumer preferences pose threats to market profitability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.