North America Chlorine Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6085

December 2024

94

About the Report

North America Chlorine Market Overview

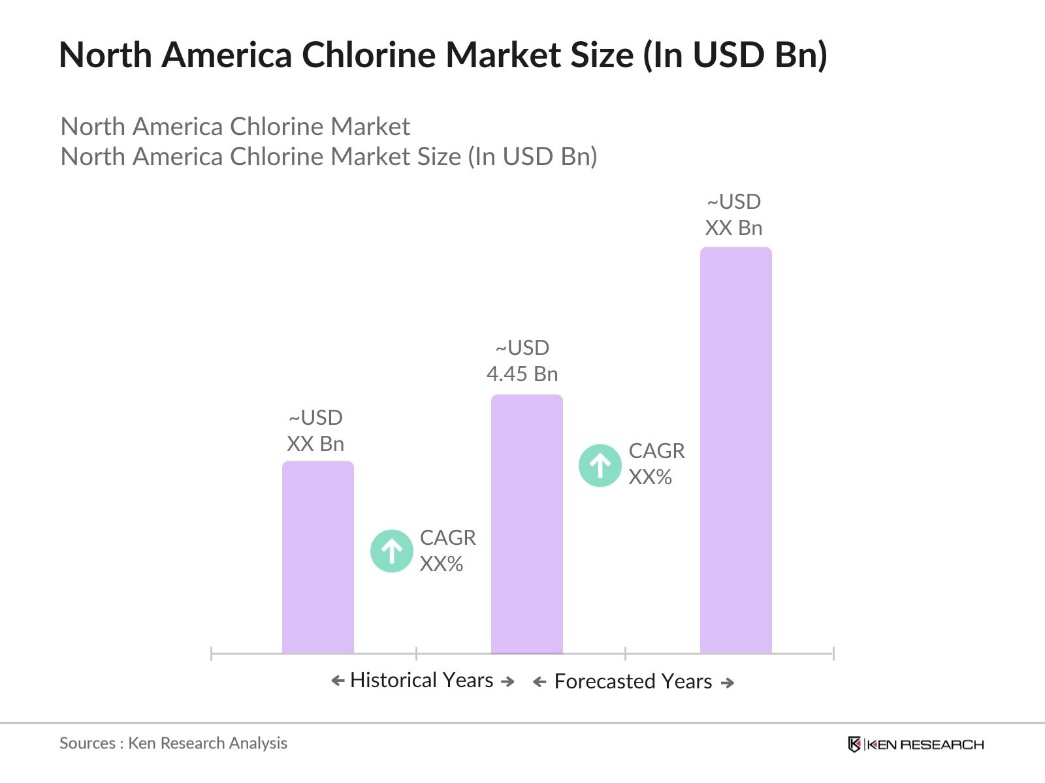

- The North America Chlorine Market is valued at USD 4.45 billion, based on a five-year historical analysis. This substantial market size is primarily driven by the robust demand for chlorine across multiple sectors, including water treatment, pharmaceuticals, and chemical manufacturing. The utilization of chlorine in water purification and disinfection processes, alongside its extensive application in polyvinyl chloride (PVC) production, positions it as a critical commodity for industrial and municipal functions across North America.

- The United States and Canada are the primary drivers of the chlorine market in North America due to their extensive industrial infrastructure and high demand in sectors like chemical manufacturing and water treatment. The United States leads in production capacity with established facilities and investments in chlorine production technology. Canada follows closely, where demand is fueled by water treatment processes and chemical synthesis for agricultural and industrial applications.

- Clean air and water initiatives by North American governments impose stricter regulations on chlorine emissions and wastewater management. In 2024, the Clean Water Act mandated specific effluent limitations for chlorine, impacting industries discharging chlorine-containing wastewater into public water systems. Compliance with these standards necessitates technological investment to mitigate environmental impact, aligning with North Americas broader goals for sustainability and pollution control.

North America Chlorine Market Segmentation

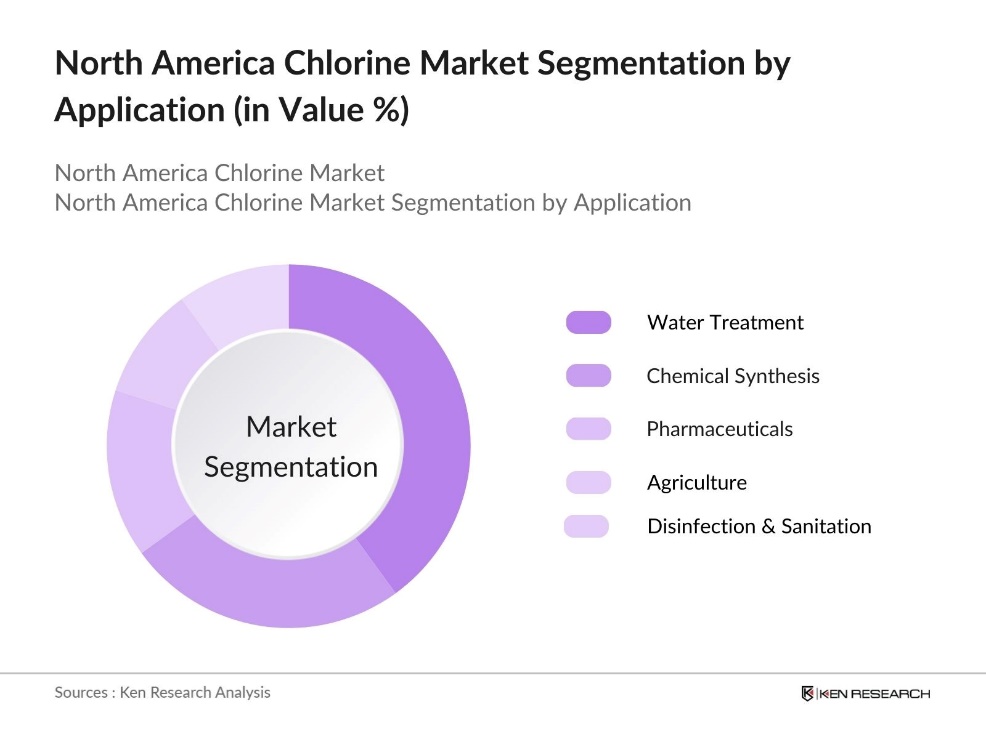

By Application: The market is segmented by application into water treatment, chemical synthesis, pharmaceuticals, agriculture, and disinfection & sanitation. Recently, water treatment has maintained a dominant market share under this segment. This is due to stringent water quality regulations that require the use of chlorine for purification in municipal and industrial sectors, ensuring safe water supply. Chlorine's cost-effectiveness and ability to neutralize pathogens make it indispensable in this area.

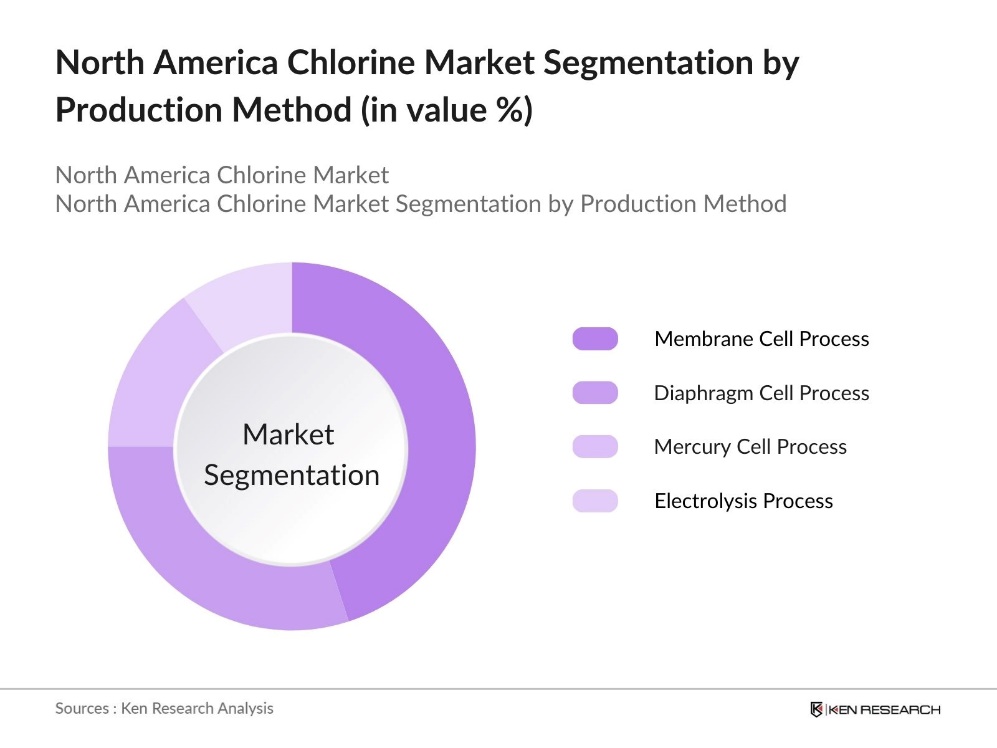

By Production Method: The market is segmented by production method into diaphragm cell process, membrane cell process, mercury cell process, and electrolysis process. The membrane cell process holds the leading share within this segment. This is largely due to its efficiency in producing high-purity chlorine while minimizing environmental impact, which aligns with increasing regulatory pressures to reduce mercury and other pollutants in production processes.

North America Chlorine Market Competitive Landscape

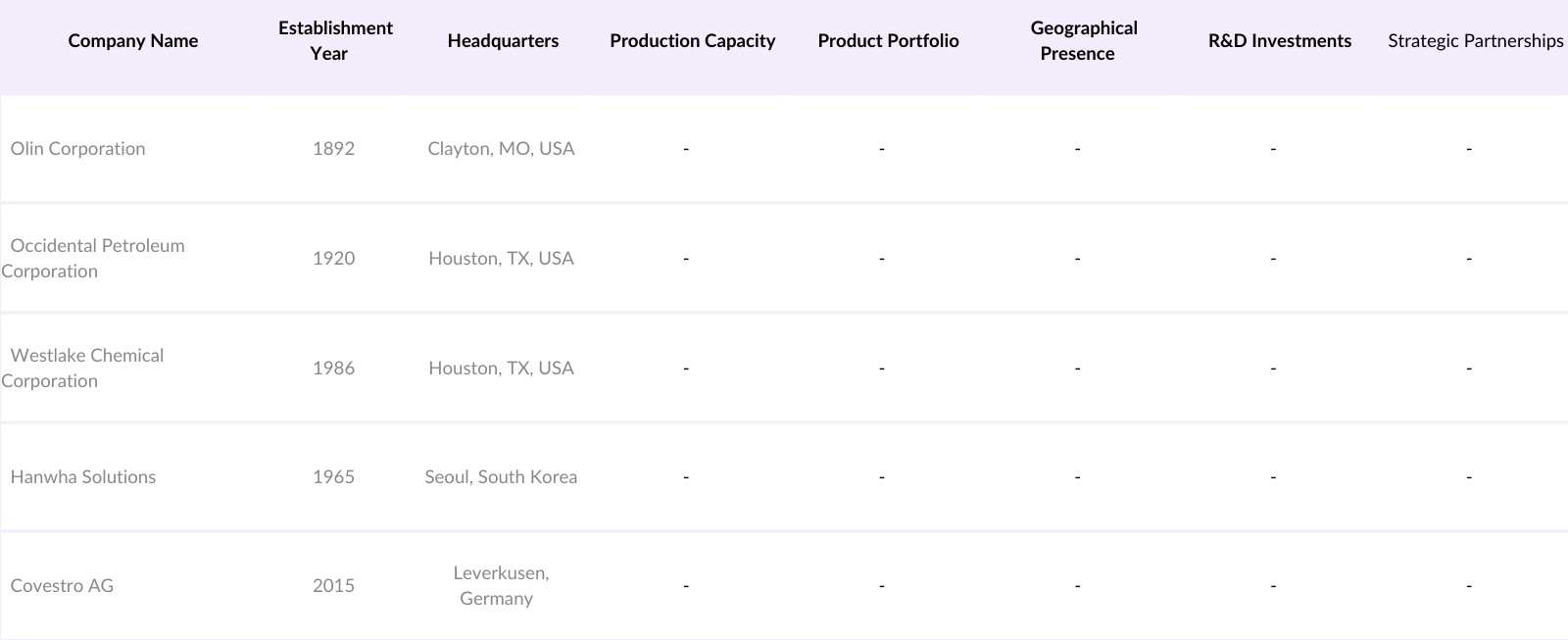

The North America Chlorine Market is characterized by a concentrated landscape, where a few dominant players hold significant influence. Major companies like Olin Corporation and Occidental Petroleum Corporation leverage their vast production capacities and advanced production technologies to maintain a competitive edge.

North America Chlorine Industry Analysis

Growth Drivers

- Demand in Water Treatment (e.g., municipal, industrial): The demand for chlorine in water treatment continues to be a significant growth driver due to the essential need for disinfection in municipal and industrial water supplies. Approximately 45 billion gallons of water are treated daily in the United States alone, with chlorine playing a critical role in removing pathogens. Chlorine-based treatment is highly relied upon in North America, ensuring compliance with standards for potable and industrial water.

- Growth in Chemical Manufacturing (e.g., PVC production, organic synthesis): Chlorine is essential in North American chemical manufacturing, particularly for producing polyvinyl chloride (PVC), which supports a construction sector valued at USD 1.8 trillion. Chlorine derivatives are essential for manufacturing plastics and organic compounds. This demand is reinforced by the expansion of the construction and automotive industries, which rely on durable PVC products.

- Applications in Disinfection and Sanitation (e.g., healthcare, food processing): Chlorine is essential for disinfection in healthcare and food processing, helping reduce infections and prevent microbial contamination. Its role supports strict hygiene standards mandated by regulatory requirements, underscoring chlorines importance in maintaining public health and safety. This application highlights chlorine's critical function in sanitation across North America, ensuring safety in environments where cleanliness is paramount.

Market Challenges

- Stringent Environmental Regulations (e.g., emission limits, hazardous waste): Stringent environmental regulations create challenges for the chlorine market, with agencies enforcing strict controls on emissions and hazardous waste. Manufacturers face high compliance costs, as regulations require advanced technology to limit chlorine by-product emissions, increasing operational expenditures. These regulatory requirements directly impact production output, especially in regions where chlorine manufacturing is concentrated.

- Rising Raw Material Costs (e.g., energy prices): Rising energy prices significantly affect chlorine production, given the high energy demand in the electrolysis process. The fluctuating costs of electricity and natural gas add to operational expenses, influencing the overall production costs and profitability of chlorine manufacturers across North America. These increased costs create additional financial pressures within the industry.

North America Chlorine Market Future Outlook

The North America Chlorine Market is projected to experience steady growth over the next few years. This growth is anticipated to be driven by increased demand in water treatment applications, coupled with innovations in chlorine production technologies that enhance efficiency and sustainability. Regulatory trends favoring environmentally friendly production methods and sustainable waste management practices are expected to further support market expansion.

Market Opportunities

- Advancements in Chlorine Manufacturing Technology: Innovations in chlorine manufacturing, like membrane cell technology, have improved production efficiency by reducing energy consumption and minimizing environmental impact. These advancements enhance operational efficiencies for North American manufacturers, allowing them to remain competitive globally. Additionally, the adoption of sustainable manufacturing practices aligns with national environmental goals and regulatory incentives, promoting a shift toward greener production processes.

- Increasing Use in Renewable Energy Applications (e.g., solar silicon production): Chlorine is increasingly utilized in renewable energy applications, particularly in the production of ultra-pure silicon for solar cells. Its role in the purification process is essential as demand for photovoltaic systems rises, supporting North Americas transition to sustainable energy sources. This growing application underscores chlorines expanding significance within the renewable energy sector, aligning with sustainability trends.

Scope of the Report

|

Production Method |

Diaphragm Cell Process Membrane Cell Process Mercury Cell Process Electrolysis Process |

|

Application |

Water Treatment Chemical Synthesis Pharmaceutical and Medical Use Agriculture Disinfection and Sanitation |

|

End-User Industry |

Chemicals and Petrochemicals Food and Beverage Pharmaceuticals Municipal Sector Pulp and Paper |

|

Distribution Channel |

Direct Sales Distributors Online Channels |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Chemical and Petrochemical Manufacturers

Agricultural Product Manufacturers

Disinfection and Sanitation Product Manufacturers

Pharmaceutical Companies

Government and Regulatory Bodies (Environmental Protection Agency, Occupational Safety and Health Administration)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Olin Corporation

Occidental Petroleum Corporation

Westlake Chemical Corporation

Hanwha Solutions

Covestro AG

Shin-Etsu Chemical Co., Ltd.

Nouryon

INEOS Group

Formosa Plastics Corporation

BASF SE

Table of Contents

1. North America Chlorine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Chlorine Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Chlorine Market Analysis

3.1 Growth Drivers

3.1.1 Demand in Water Treatment (e.g., municipal, industrial)

3.1.2 Growth in Chemical Manufacturing (e.g., PVC production, organic synthesis)

3.1.3 Applications in Disinfection and Sanitation (e.g., healthcare, food processing)

3.2 Market Challenges

3.2.1 Stringent Environmental Regulations (e.g., emission limits, hazardous waste)

3.2.2 Rising Raw Material Costs (e.g., energy prices)

3.2.3 Logistics and Transportation Constraints (e.g., hazardous material handling)

3.3 Opportunities

3.3.1 Advancements in Chlorine Manufacturing Technology

3.3.2 Increasing Use in Renewable Energy Applications (e.g., solar silicon production)

3.3.3 Expansion of Chlorine in Agricultural Products (e.g., pesticide production)

3.4 Trends

3.4.1 Shift to Environmentally-Friendly Processes

3.4.2 Increase in On-Site Chlorine Generation Solutions

3.4.3 Rise in Digitalized Production Monitoring

3.5 Government Regulations

3.5.1 Environmental Protection Agency (EPA) Standards

3.5.2 Occupational Safety and Health Administration (OSHA) Compliance

3.5.3 Clean Air and Water Initiatives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Chlorine Market Segmentation

4.1 By Production Method (In Value %)

4.1.1 Diaphragm Cell Process

4.1.2 Membrane Cell Process

4.1.3 Mercury Cell Process

4.1.4 Electrolysis Process

4.2 By Application (In Value %)

4.2.1 Water Treatment

4.2.2 Chemical Synthesis

4.2.3 Pharmaceutical and Medical Use

4.2.4 Agriculture

4.2.5 Disinfection and Sanitation

4.3 By End-User Industry (In Value %)

4.3.1 Chemicals and Petrochemicals

4.3.2 Food and Beverage

4.3.3 Pharmaceuticals

4.3.4 Municipal Sector

4.3.5 Pulp and Paper

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Distributors

4.4.3 Online Channels

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Chlorine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Olin Corporation

5.1.2 Occidental Petroleum Corporation

5.1.3 Westlake Chemical Corporation

5.1.4 Hanwha Solutions

5.1.5 Nouryon

5.1.6 Shin-Etsu Chemical Co., Ltd.

5.1.7 Covestro AG

5.1.8 INEOS Group

5.1.9 Formosa Plastics Corporation

5.1.10 BASF SE

5.1.11 LG Chem

5.1.12 Tata Chemicals

5.1.13 SABIC

5.1.14 Tosoh Corporation

5.1.15 Reliance Industries

5.2 Cross Comparison Parameters (Production Capacity, Product Portfolio, Revenue, Geographical Presence, R&D Investments, Strategic Alliances, Market Share, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Chlorine Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. North America Chlorine Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Chlorine Future Market Segmentation

8.1 By Production Method (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. North America Chlorine Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research initiates with an ecosystem map of key stakeholders within the North America Chlorine Market. This phase includes secondary research using credible databases to gather industry-level information, focusing on variables influencing market dynamics, such as production technology, regulatory trends, and demand drivers.

Step 2: Market Analysis and Construction

Historical data is analyzed, covering market penetration and revenue generation. An assessment of production capacity, cost structure, and regional distribution is also conducted to verify and reinforce revenue estimates and production trends.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are validated through interviews with industry experts across various companies. This step provides practical insights into operational efficiencies, demand shifts, and competitive pressures, enhancing the market understanding and data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with chlorine manufacturers and key end-users to gather detailed insights on applications, customer preferences, and production processes. This verification step ensures a robust and comprehensive analysis of the North America Chlorine Market.

Frequently Asked Questions

01 How big is the North America Chlorine Market?

The North America Chlorine Market is valued at USD 4.45 billion, driven by increasing demand in water treatment and chemical manufacturing sectors.

02 What are the major drivers of the North America Chlorine Market?

Key drivers in North America Chlorine Market include demand for water treatment solutions, high production in PVC manufacturing, and increasing use in disinfection and sanitation.

03 Who are the leading players in the North America Chlorine Market?

Leading players in North America Chlorine Market include Olin Corporation, Occidental Petroleum Corporation, Westlake Chemical Corporation, Hanwha Solutions, and Covestro AG, known for their production capacities and strong regional presence.

04 What challenges does the North America Chlorine Market face?

Challenges in North America Chlorine Market include stringent environmental regulations, rising raw material costs, and logistical constraints due to the hazardous nature of chlorine.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.