North America Civil Helicopter Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD9859

November 2024

97

About the Report

North America Civil Helicopter Market Overview

- The North America civil helicopter market is valued at USD 6.5 billion. This market is driven by the increasing demand for helicopter services in emergency medical services (EMS), law enforcement, and oil and gas operations. Advancements in helicopter technology, such as noise reduction and fuel efficiency, are also propelling growth. The market benefits from robust investments in urban air mobility initiatives and a growing emphasis on sustainable aviation technologies. These trends reflect strong demand across key industries, ensuring continued growth.

- The United States dominates the North America civil helicopter market due to its extensive oil and gas exploration activities, advanced EMS infrastructure, and significant investments in urban air mobility. Canada follows, leveraging its vast remote territories where helicopters serve as vital transportation means. Mexico's growing adoption of helicopters in tourism and security sectors also contributes to regional prominence. These countries maintain dominance due to favorable regulatory frameworks and well-developed aviation ecosystems.

- The FAA sets comprehensive guidelines for helicopter operations, covering aspects such as airworthiness standards, pilot certification, and maintenance requirements. The FAA's airworthiness standards for helicopters are primarily outlined in14 CFR Part 27andPart 29. These standards specify the design, performance, and reliability criteria that helicopters must meet to be deemed safe for operation. Compliance with these regulations is mandatory for all operators to ensure safety and operational integrity.

North America Civil Helicopter Market Segmentation

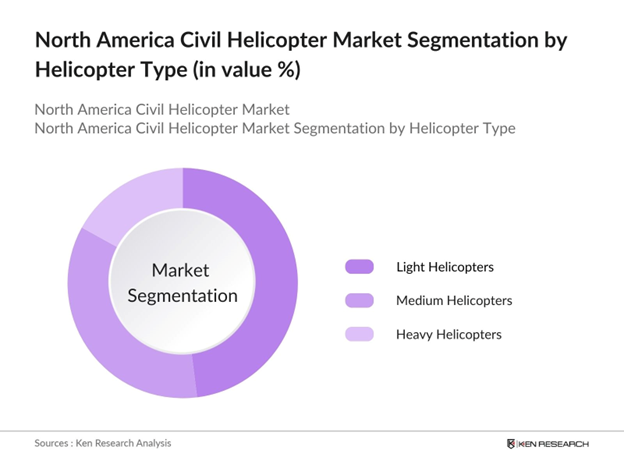

By Helicopter Type: The North America civil helicopter market is segmented by helicopter type into light helicopters, medium helicopters, and heavy helicopters. Light Helicopters dominate the North America civil helicopter market due to their affordability and versatility. Their cost-efficiency makes them the preferred choice for emergency medical services (EMS), tourism, and law enforcement operations. These helicopters are particularly favored for their lower operational costs and ability to perform well in urban and remote settings alike.

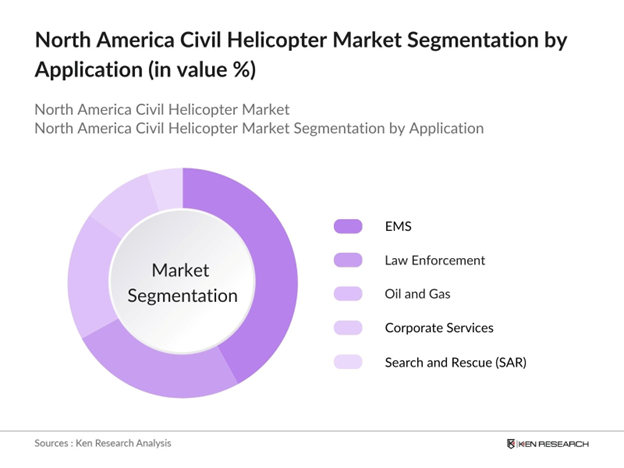

By Application: The market is further segmented by application into EMS, law enforcement, oil and gas, corporate services, and search and rescue (SAR). EMS Helicopters lead the market segment as they address critical care transport needs in both urban and remote areas. Their ability to provide rapid emergency response in life-threatening scenarios makes them indispensable for healthcare services. Growing investments in EMS infrastructure, particularly in densely populated and geographically challenging regions, further solidify their dominance in the market.

North America Civil Helicopter Market Competitive Landscape

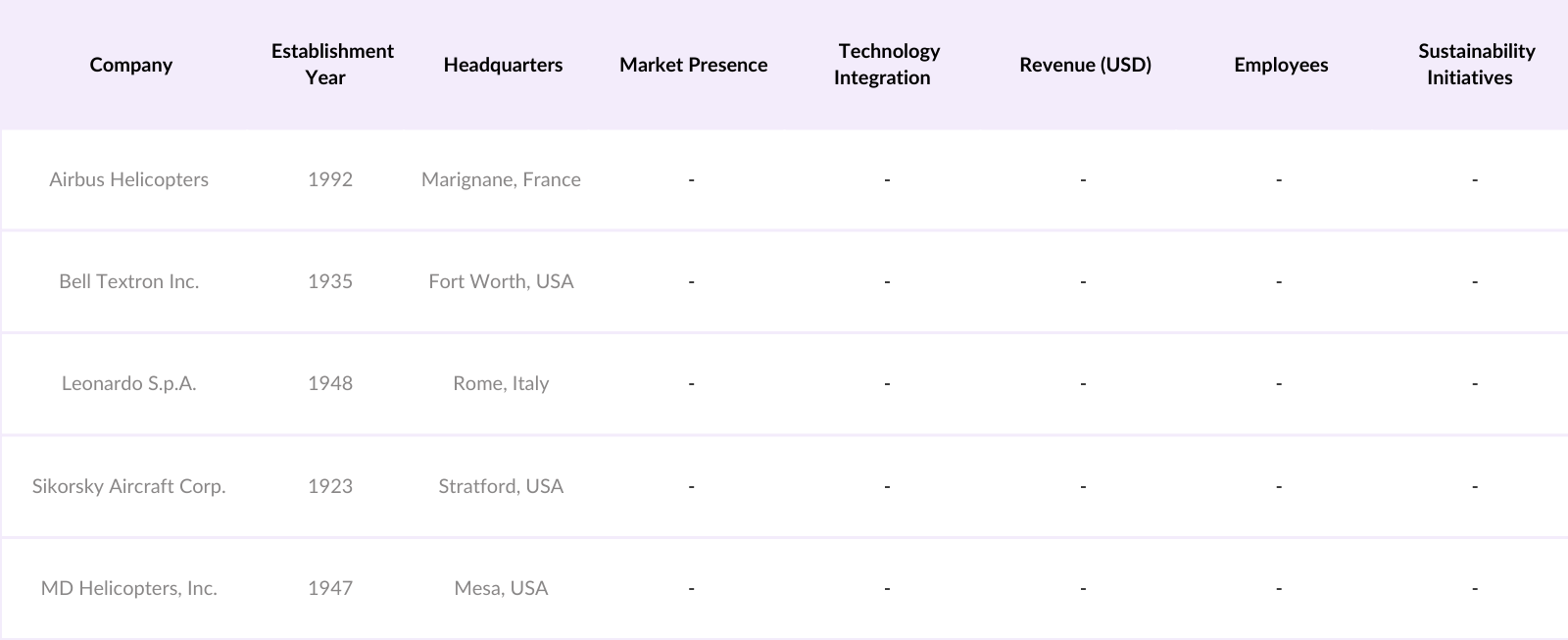

The North America civil helicopter market is characterized by a concentrated landscape with key players dominating due to advanced product offerings, strong distribution networks, and extensive investments in R&D. Companies such as Airbus Helicopters, Bell Textron, and Leonardo S.p.A. hold significant influence, supported by their long-standing market presence and innovative technologies.

North America Civil Helicopter Market Analysis

Growth Drivers

- Increasing Demand for Emergency Medical Services (EMS): The United States has a vast network of over 1,400 air medical transport services, with helicopters playing a crucial role in providing rapid medical assistance, especially in remote or congested areas. In 2022, these services conducted approximately 400,000 air medical transports, highlighting the essential role of helicopters in emergency healthcare.

- Expansion of Offshore Oil and Gas Operations: The Gulf of Mexico remains a significant hub for offshore oil and gas activities, with over 1,800 offshore platforms operating as of 2023. Helicopters are indispensable for transporting personnel and equipment to these platforms, ensuring efficient operations in the energy sector. The Gulf's production environment is characterized by extreme weather events, particularly hurricanes, which pose ongoing operational challenges for the industry.

- Advancements in Helicopter Technology: Recent technological advancements have led to the development of more efficient and safer helicopters. For instance, the introduction of composite materials has reduced aircraft weight, enhancing fuel efficiency and payload capacity. According to the International Air Transport Association (IATA), every kilogram of weight reduction can save up to 3.5 liters of fuel annually, which highlights the economic and environmental benefits of using composites in aircraft design.

Challenges

- High Operational and Maintenance Costs: Operating a civil helicopter involves significant expenses. For instance, the hourly operating cost of a medium-sized helicopter can range from $1,000 to $2,000, depending on factors like fuel prices and maintenance requirements. These high costs can be a barrier for smaller operators and limit market expansion.

- Stringent Regulatory Requirements: The Federal Aviation Administration (FAA) enforces strict regulations on helicopter operations, including maintenance standards, pilot certifications, and operational protocols. Compliance with these regulations requires substantial investment in training and equipment, which can be challenging for operators.

North America Civil Helicopter Market Future Outlook

The North America civil helicopter market is poised for significant growth in the coming years. This expansion is attributed to advancements in hybrid and electric propulsion technologies, increasing demand for EMS helicopters, and heightened investments in urban air mobility projects. Additionally, the adoption of digital avionics and automation in helicopter operations will further enhance operational efficiency and safety, creating new opportunities for growth.

Market Opportunities

- Growth in Urban Air Mobility (UAM) Initiatives: Urban Air Mobility (UAM) is gaining traction as cities explore aerial solutions to alleviate traffic congestion. NASA has partnered with over 30 organizations, including industry leaders like Electra Aero, OverAir, and Supernal, to advance UAM technologies. These partnerships facilitate information exchange and collaborative testing aimed at operational safety and integration into existing airspace systems. This initiative presents opportunities for the civil helicopter market to expand into urban transportation.

- Integration of Unmanned Aerial Systems (UAS): The integration of Unmanned Aerial Systems (UAS) into civil operations is opening new avenues. The FAA has issued over 200,000 remote pilot certificates, indicating a growing acceptance of UAS in various sectors, including infrastructure inspection and aerial photography. This trend offers opportunities for the civil helicopter market to diversify services.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Type |

Light Helicopters (<4.5 Tons) |

|

By Application |

Emergency Medical Services (EMS) |

|

By Engine Type |

Single Engine |

|

By Ownership |

Owned |

|

By Country |

United States |

Products

Key Target Audience

Helicopter Manufacturers

Emergency Medical Service Providers

Oil and Gas Companies

Law Enforcement Agencies

Tourism Operators

Urban Air Mobility Startups

Government and Regulatory Bodies (FAA, Transport Canada, DGAC Mexico)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Airbus Helicopters

Bell Textron Inc.

Leonardo S.p.A.

Sikorsky Aircraft Corporation

MD Helicopters, Inc.

Robinson Helicopter Company

Enstrom Helicopter Corporation

Boeing Company

Kaman Corporation

Lockheed Martin Corporation

Table of Contents

1. North America Civil Helicopter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Civil Helicopter Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Civil Helicopter Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Emergency Medical Services (EMS)

3.1.2. Expansion of Offshore Oil and Gas Operations

3.1.3. Advancements in Helicopter Technology

3.1.4. Rising Use in Law Enforcement and Public Safety

3.2. Market Challenges

3.2.1. High Operational and Maintenance Costs

3.2.2. Stringent Regulatory Requirements

3.2.3. Limited Skilled Pilot Availability

3.3. Opportunities

3.3.1. Growth in Urban Air Mobility (UAM) Initiatives

3.3.2. Integration of Unmanned Aerial Systems (UAS)

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Adoption of Hybrid and Electric Propulsion Systems

3.4.2. Increased Focus on Noise Reduction Technologies

3.4.3. Utilization of Advanced Avionics and Automation

3.5. Government Regulations

3.5.1. Federal Aviation Administration (FAA) Guidelines

3.5.2. Environmental Emission Standards

3.5.3. Safety and Certification Requirements

3.5.4. Air Traffic Management Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. North America Civil Helicopter Market Segmentation

4.1. By Type (In Value %)

4.1.1. Light Helicopters (<4.5 Tons)

4.1.2. Medium Helicopters (4.58.5 Tons)

4.1.3. Heavy Helicopters (>8.5 Tons)

4.2. By Application (In Value %)

4.2.1. Emergency Medical Services (EMS)

4.2.2. Law Enforcement

4.2.3. Oil and Gas

4.2.4. Corporate Services

4.2.5. Search and Rescue (SAR)

4.2.6. Others

4.3. By Engine Type (In Value %)

4.3.1. Single Engine

4.3.2. Twin Engine

4.4. By Ownership (In Value %)

4.4.1. Owned

4.4.2. Leased

4.5. By Country (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Civil Helicopter Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Airbus Helicopters

5.1.2. Bell Textron Inc.

5.1.3. Leonardo S.p.A.

5.1.4. Lockheed Martin Corporation

5.1.5. MD Helicopters, Inc.

5.1.6. Robinson Helicopter Company

5.1.7. Sikorsky Aircraft Corporation

5.1.8. Enstrom Helicopter Corporation

5.1.9. Kaman Corporation

5.1.10. Boeing Company

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Civil Helicopter Market Regulatory Framework

6.1. Aviation Safety Standards

6.2. Environmental Compliance

6.3. Certification Processes

7. North America Civil Helicopter Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Civil Helicopter Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Engine Type (In Value %)

8.4. By Ownership (In Value %)

8.5. By Country (In Value %)

9. North America Civil Helicopter Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map of major stakeholders was developed using extensive desk research and proprietary databases to define critical variables driving the civil helicopter market.

Step 2: Market Analysis and Construction

Historical data was analyzed, focusing on helicopter penetration, industry-specific adoption, and revenue generation to construct an accurate market overview.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through interviews with industry experts and stakeholders, ensuring the reliability and accuracy of insights.

Step 4: Research Synthesis and Final Output

Engagement with manufacturers provided insights into helicopter types, technology trends, and application-specific demand, ensuring a comprehensive analysis of the market.

Frequently Asked Questions

01. How big is the North America Civil Helicopter Market?

The North America civil helicopter market is valued at USD 6.5 billion, driven by demand in EMS, law enforcement, and oil and gas sectors.

02. What are the challenges in the North America Civil Helicopter Market?

Key challenges in North America civil helicopter market include high operational costs, regulatory compliance requirements, and the limited availability of skilled pilots, affecting market growth.

03. Who are the major players in the North America Civil Helicopter Market?

Prominent players in North America civil helicopter market include Airbus Helicopters, Bell Textron Inc., Leonardo S.p.A., Sikorsky Aircraft Corporation, and MD Helicopters, Inc., known for their technological advancements and market presence.

04. What are the growth drivers of the North America Civil Helicopter Market?

Growth in North America civil helicopter market is driven by advancements in helicopter technology, increasing EMS usage, and the rising adoption of urban air mobility solutions.

\

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.