North America Cloud Computing Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD3375

November 2024

96

About the Report

North America Cloud Computing Market Overview

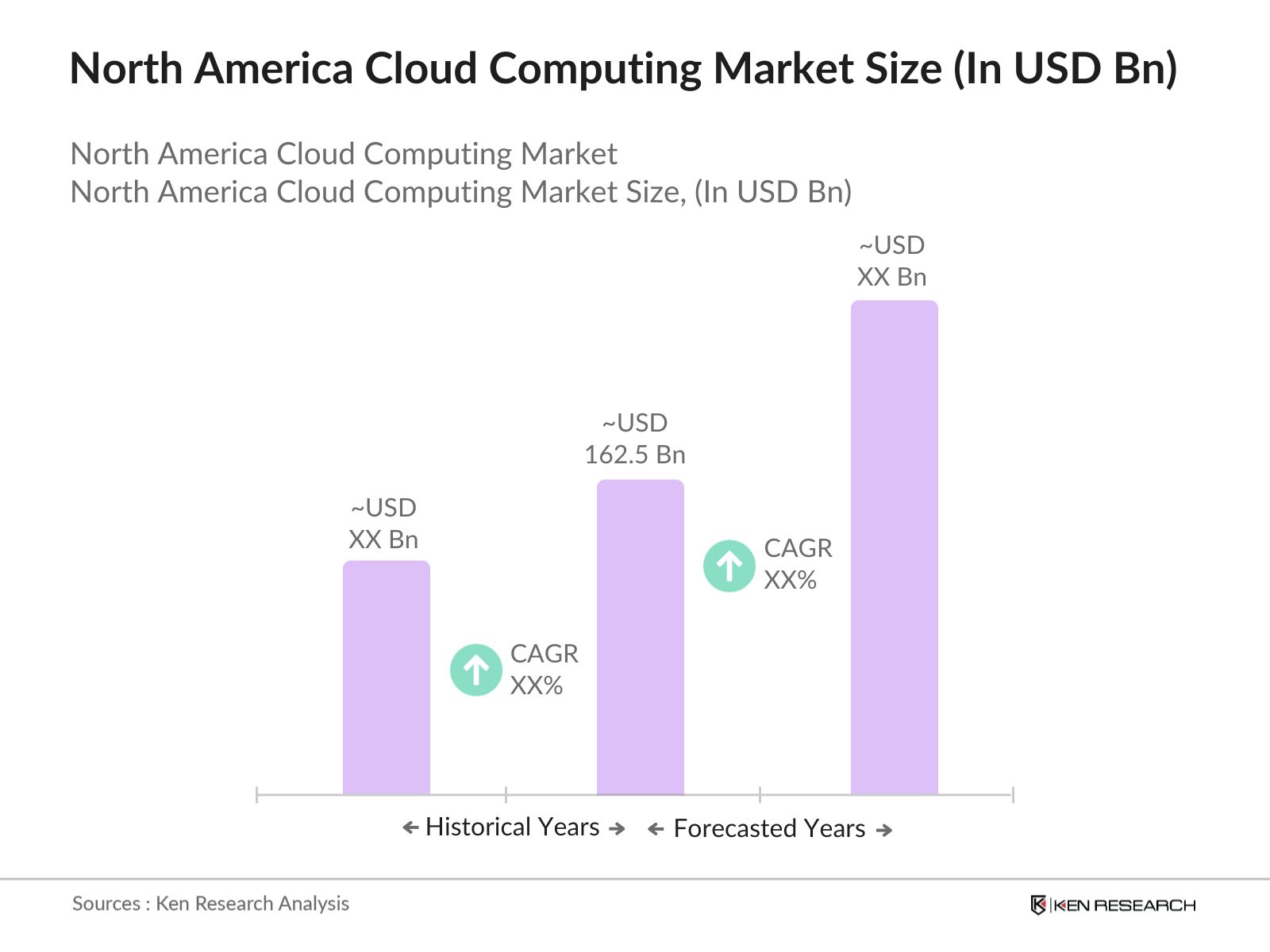

- The North America Cloud Computing market is valued at USD 162.5 billion in 2023, reflecting the rapid expansion in cloud services driven by large-scale digital transformation initiatives. This growth is propelled by widespread enterprise adoption of cloud computing technologies, with businesses seeking operational agility, scalability, and cost-efficiency. Furthermore, hybrid and multi-cloud deployments have gained popularity, enabling organizations to manage complex workloads and optimize IT resource utilization.

- Key cities and countries dominating the North America Cloud Computing market include the United States, particularly tech hubs such as San Francisco, Seattle, and New York. The U.S. remains the global leader in cloud adoption due to its concentration of leading cloud providers (Amazon Web Services, Microsoft Azure, and Google Cloud), substantial IT budgets, and a highly developed data center ecosystem. Canada's cloud market is also growing, driven by supportive government policies promoting digital transformation and data security regulations, particularly in cities like Toronto and Vancouver.

- In August 2022, IBM announced a partnership with VMware to offer hybrid cloud solutions. The partnership will provide co-engineered cloud solutions aimed at helping companies in industries such as financial services, healthcare, and the public sector reduce the cost and risk of placing mission-critical workloads in a hybrid environment. The partnership is designed to assist organizations in navigating the challenges of migrating and managing their IT workloads across hybrid environments. This is particularly crucial for industries that face stringent regulatory requirements.

North America Cloud Computing Market Segmentation

By Deployment Model: The North America Cloud Computing market is segmented by deployment model into Public Cloud, Private Cloud, and Hybrid Cloud. In 2023, the Public Cloud segment holds the dominant market share, driven by its cost-effectiveness, flexibility, and the increasing trend of remote working. Major enterprises and SMEs alike are migrating workloads to public cloud platforms such as Amazon Web Services (AWS) and Microsoft Azure due to their scalability, low maintenance costs, and access to a wide array of services without heavy infrastructure investments. On the other hand, private cloud is preferred by industries with stringent compliance needs, such as banking and healthcare, while hybrid cloud serves as a bridge for organizations aiming for flexibility and control over sensitive data.

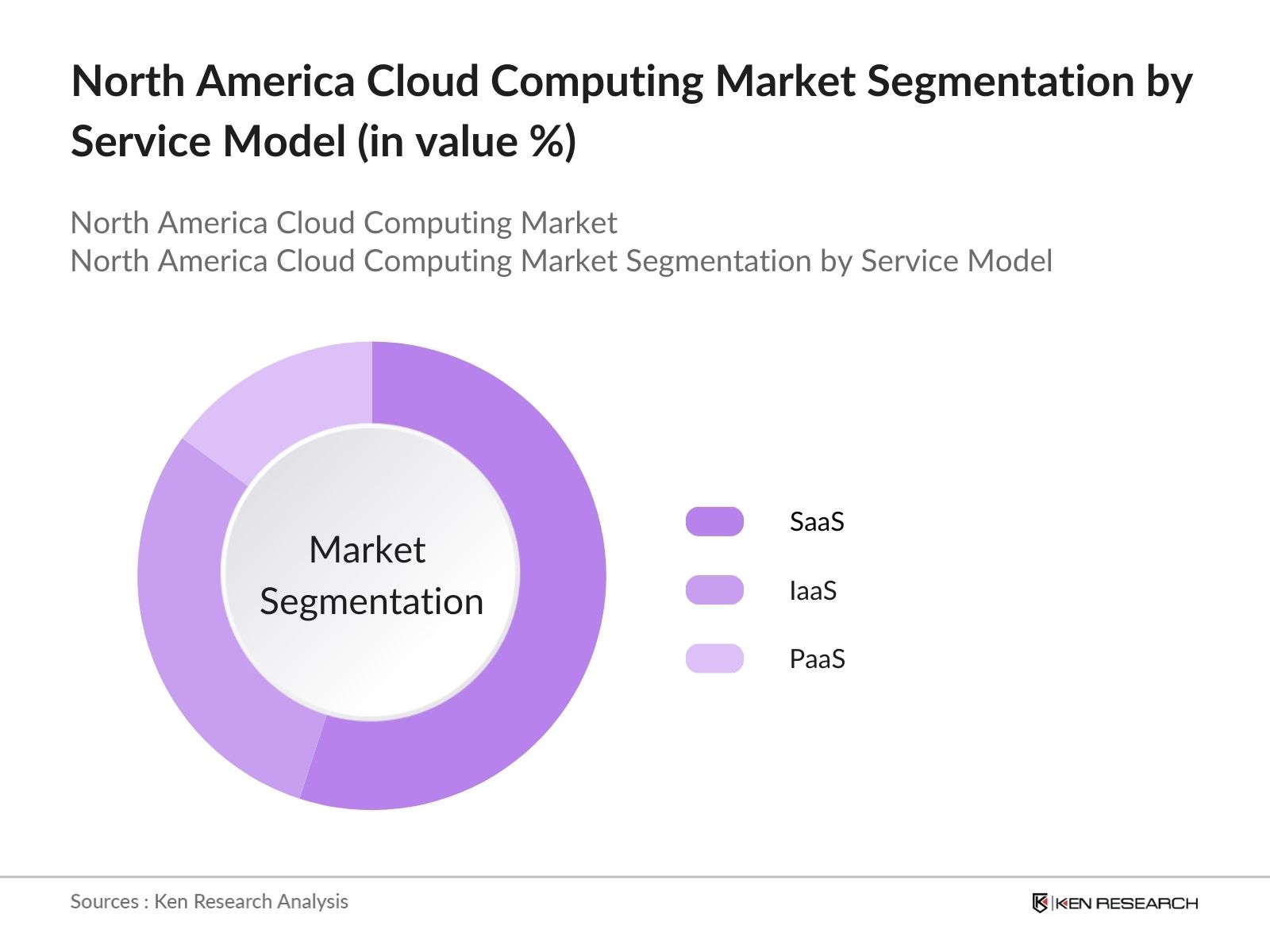

By Service Model: The market is segmented by service model into Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). Software-as-a-Service (SaaS) continues to dominate the market due to its ease of deployment, low upfront costs, and wide applications across industries. Companies increasingly rely on SaaS solutions for CRM, ERP, and collaboration tools, with players like Salesforce, Adobe, and Microsoft leading this segment. IaaS, while accounting for a smaller portion of the market, is growing rapidly as businesses seek scalable cloud infrastructure to run dynamic workloads, reduce hardware costs, and improve disaster recovery capabilities.

North America Cloud Computing Market Competitive Landscape

The North America Cloud Computing market is highly consolidated, with a few major players dominating the landscape. The market's top players include well-established tech giants and cloud-native service providers. Their influence stems from the breadth of their offerings, continuous innovation, and strategic acquisitions.

The competitive landscape is defined by several key players, including:

|

Company Name |

Establishment Year |

Headquarters |

No. of Data Centers |

Cloud Service Offerings |

Cloud Certifications |

Customer Base |

Revenue |

R&D Investments |

Strategic Alliances |

|

Amazon Web Services (AWS) |

2006 |

Seattle, USA |

- |

- |

- |

- |

- |

- |

- |

|

Microsoft Azure |

2010 |

Redmond, USA |

- |

- |

- |

- |

- |

- |

- |

|

Google Cloud |

2008 |

Mountain View, USA |

- |

- |

- |

- |

- |

- |

- |

|

IBM Cloud |

2007 |

Armonk, USA |

- |

- |

- |

- |

- |

- |

- |

|

Oracle Cloud |

2012 |

Redwood Shores, USA |

- |

- |

- |

- |

- |

- |

- |

North America Cloud Computing Market Analysis

Growth Drivers

- Digital Transformation: Digital transformation is driving cloud adoption as over 87 million U.S. workers were in jobs requiring digital skills by 2023. This reflects a significant shift in the job market towards roles that necessitate proficiency in digital technologies, which is a crucial factor driving companies to adopt cloud solutions for enhanced operational efficiency and data management. It is reported that cloud services manage over80% of national digital storage. This statistic highlights the central role of cloud computing in modern data management practices, as organizations increasingly rely on cloud infrastructure to handle their data needs efficiently.

- Hybrid Cloud Demand: Hybrid cloud adoption is growing, with nearly 60% of Fortune 500 companies utilizing hybrid infrastructure by 2024, driven by the need for flexibility, especially in industries like healthcare and finance, contributing to the $25 trillion U.S. GDP in 2023. Additionally, the broader context of cloud computing indicates that the market is rapidly expanding, with significant growth projected in the coming years. For instance,end-user spending on public cloud services is expected to reach nearly $600 billion, indicating a robust shift towards cloud solutions across industries.

- Government Policies: U.S. federal policies, such as Cloud Smart, are accelerating cloud adoption, with 90% of federal agencies expected to have cloud strategies by 2024. The U.S. allocated $90 billion in 2023 toward IT modernization, reflecting cloud-first initiatives focused on scalability and security. TheCloud Smartpolicy was introduced by the Office of Management and Budget (OMB) to enhance cloud adoption across federal agencies. It focuses on three critical components:security,procurement, andworkforcedevelopment, aiming to address barriers that agencies face in transitioning to cloud technologies.

Market Challenges:

- Data Security Concerns: In 2023, data security continues to pose a significant challenge, with 1,700 breaches exposing 100 million records. This has prompted enterprises to allocate $68 billion to cybersecurity measures, focusing on compliance with regulations like HIPAA and CCPA for securing cloud-stored data. These investments aim to strengthen data protection protocols and mitigate growing cybersecurity threats in North America.

- Legacy Systems: As of 2023, over 45% of medium to large enterprises in North America, particularly in banking, still depend on legacy systems. The high costs, risks, and potential downtime associated with migrating to cloud environments hinder progress. Despite cloud benefits, enterprises struggle to modernize infrastructure, creating challenges for seamless integration and operational efficiency in the evolving cloud computing landscape.

North America Cloud Computing Market Future Outlook

The North America Cloud Computing market is expected to witness substantial growth over the next five years. This growth will be driven by several factors, including the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies, which are being integrated into cloud services to enhance operational efficiencies and decision-making processes. The growing need for edge computing, 5G integration, and real-time data analytics will further expand the cloud market, particularly in industries such as healthcare, retail, and finance.

Market Opportunities:

- AI and ML Integration: Over 65% of North American companies in 2024 are integrating AI/ML into cloud infrastructures, especially in healthcare and retail, where predictive analytics improve decision-making. U.S. investments in AI cloud technologies surpassed $110 billion in 2023.

- Edge Computing: With over 50 million edge devices expected in North America by 2024, edge computing reduces latency, vital for real-time data processing in sectors like manufacturing, fueled by 5G networks projected to cover 70% of the U.S. population by 2024.

Scope of the Report

|

By Deployment Model |

Public Cloud Private Cloud Hybrid Cloud |

|

By Service Model |

IaaS PaaS SaaS |

|

By Industry Vertical |

BFSI Healthcare Retail IT & Telecom Government |

|

By Enterprise Size |

SMEs Large Enterprises |

|

By Region |

United States Canada |

Products

Key Target Audience:

Cloud Service Providers

Large Enterprises (IT/Telecom, BFSI)

Government and Regulatory Bodies (U.S. Department of Defense, Canadian Security Establishment)

Healthcare Providers and Institutions

Investments and Venture Capitalist Firms

SMEs (Retail, E-commerce)

Data Center Providers

Cloud Infrastructure Developers

Companies

Players mentioned in the report:

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud

IBM Cloud

Oracle Cloud

Salesforce

VMware

SAP SE

Rackspace Technology

Workday

ServiceNow

DigitalOcean

Hewlett Packard Enterprise (HPE)

Nutanix

Alibaba Cloud

Table of Contents

1. North America Cloud Computing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Cloud Computing Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Cloud Computing Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation (Cloud adoption)

3.1.2 Hybrid Cloud Demand (Operational flexibility)

3.1.3 Government Policies (Cloud-first strategies)

3.1.4 Enterprise IT Spending (Scalability needs)

3.2 Market Challenges

3.2.1 Data Security Concerns (Compliance risks)

3.2.2 Legacy Systems (Migration challenges)

3.2.3 Vendor Lock-in (Interoperability issues)

3.3 Opportunities

3.3.1 AI and ML Integration (Enhanced services)

3.3.2 Edge Computing (Latency optimization)

3.3.3 Expanding SMB Cloud Adoption (Cost-effective solutions)

3.4 Trends

3.4.1 Multi-cloud Strategies (Cost management)

3.4.2 Serverless Architectures (Operational agility)

3.4.3 DevOps Cloud Integration (CI/CD pipelines)

3.5 Government Regulations

3.5.1 U.S. Cloud Act (Data sovereignty)

3.5.2 GDPR Impact (Cross-border compliance)

3.5.3 Federal Cloud Smart Strategy (Cloud standardization)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Cloud Computing Market Segmentation

4.1 By Deployment Model (In Value %)

4.1.1 Public Cloud

4.1.2 Private Cloud

4.1.3 Hybrid Cloud

4.2 By Service Model (In Value %)

4.2.1 Infrastructure as a Service (IaaS)

4.2.2 Platform as a Service (PaaS)

4.2.3 Software as a Service (SaaS)

4.3 By Industry Vertical (In Value %)

4.3.1 Banking, Financial Services, and Insurance (BFSI)

4.3.2 Healthcare and Life Sciences

4.3.3 Retail and E-commerce

4.3.4 IT and Telecom

4.3.5 Government and Public Sector

4.4 By Enterprise Size (In Value %)

4.4.1 Small and Medium-Sized Enterprises (SMEs)

4.4.2 Large Enterprises

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

5. North America Cloud Computing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amazon Web Services (AWS)

5.1.2 Microsoft Azure

5.1.3 Google Cloud

5.1.4 IBM Cloud

5.1.5 Oracle Cloud

5.1.6 VMware

5.1.7 Salesforce

5.1.8 Alibaba Cloud

5.1.9 SAP SE

5.1.10 Rackspace Technology

5.1.11 Workday

5.1.12 ServiceNow

5.1.13 DigitalOcean

5.1.14 Hewlett Packard Enterprise (HPE)

5.1.15 Nutanix

5.2 Cross Comparison Parameters

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. North America Cloud Computing Market Regulatory Framework

6.1 Data Protection Regulations (HIPAA, CCPA)

6.2 Compliance Requirements (FedRAMP, SOC 2)

6.3 Certification Processes (ISO 27001, NIST Standards)

7. North America Cloud Computing Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Cloud Computing Future Market Segmentation

8.1 By Deployment Model

8.2 By Service Model

8.3 By Industry Vertical

8.4 By Enterprise Size

8.5 By Region

9. North America Cloud Computing Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Go-to-Market Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables affecting the North America Cloud Computing market. This includes an analysis of the regulatory landscape, consumer demand trends, and competitive dynamics. A combination of secondary research, including industry reports, government data, and proprietary databases, forms the foundation of this analysis.

Step 2: Market Analysis and Construction

Historical data from cloud providers, including market penetration rates and service adoption trends, is gathered. Analysis is conducted to measure cloud service usage across various industries, including financial services, retail, and healthcare. Data from annual reports of key companies further informs market projections.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with cloud industry experts via structured interviews ensure the validity of market hypotheses. Insights gathered from leading cloud service providers help refine projections and improve the accuracy of growth estimates for the North American market.

Step 4: Research Synthesis and Final Output

Data from cloud service providers and industry experts is synthesized to create a final market report. This includes both top-down and bottom-up approaches, ensuring comprehensive and validated insights on market trends, opportunities, and challenges in North America.

Frequently Asked Questions

01. How big is the North America Cloud Computing Market?

The North America Cloud Computing market is valued at USD 162.5 billion in 2023. This market is driven by digital transformation initiatives and large-scale adoption of cloud services across multiple industries.

02. What are the key challenges in the North America Cloud Computing Market?

The primary challenges include data security concerns, compliance with evolving regulations, and migration of legacy systems. Moreover, vendor lock-in and interoperability issues are significant hurdles for businesses adopting multi-cloud strategies.

03. Who are the major players in the North America Cloud Computing Market?

The primary challenges include data security concerns, compliance with evolving regulations, and migration of legacy systems. Moreover, vendor lock-in and interoperability issues are significant hurdles for businesses adopting multi-cloud strategies.

04. What drives growth in the North America Cloud Computing Market?

The growth is driven by increasing enterprise demand for scalability, flexibility, and cost-efficiency in IT operations. Additionally, advancements in artificial intelligence, machine learning, and edge computing are pushing cloud adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.