North America Composite Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD9908

December 2024

94

About the Report

North America Composite Market Overview

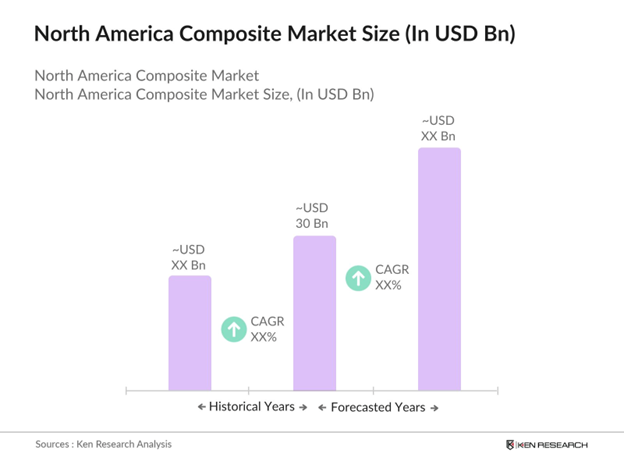

- The North America composite market, valued at USD 30 billion in 2023, is primarily driven by rising demand across industries such as aerospace, automotive, and construction. Increased use of lightweight, high-strength materials has bolstered this market's growth, with composites being favored due to their ability to enhance fuel efficiency, durability, and performance.

- The United States dominates the North American composite market, largely due to its advanced aerospace and defense sectors, as well as its strong automotive manufacturing base. The concentration of major aerospace companies like Boeing and Lockheed Martin in the U.S. has solidified its market leadership. This regional dominance is reinforced by the presence of robust R&D activities and government support for advanced material innovation.

- The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have strict regulations governing the use of materials in aircraft manufacturing, including composites. In 2023, the FAA certified over 200 new composite materials for use in commercial and defense aircraft. These certifications are essential for ensuring the safety and performance of composite materials in high-stress environments. The certification process also involves rigorous testing to meet the regulatory standards set by aviation authorities

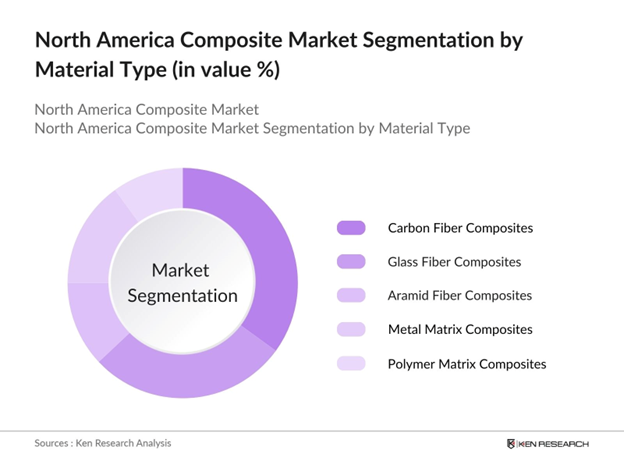

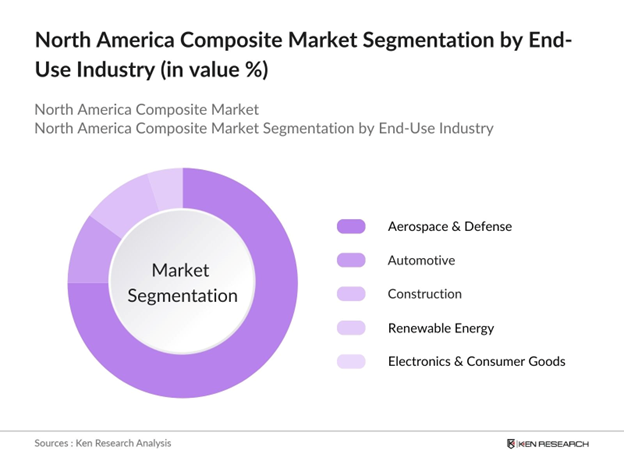

North America Composite Market Segmentation

By Material Type: The North American composite market is segmented by material type into carbon fiber composites, glass fiber composites, aramid fiber composites, metal matrix composites, and polymer matrix composites. Recently, carbon fiber composites have gained a dominant market share under this segmentation. Their superior strength-to-weight ratio, corrosion resistance, and fatigue tolerance make them ideal for use in industries such as aerospace and automotive.

By End-Use Industry: The North American composite market is also segmented by end-use industry into aerospace & defense, automotive, construction, renewable energy, and electronics & consumer goods. The aerospace & defense industry has emerged as a dominant segment, driven by the increasing demand for lightweight materials in aircraft manufacturing. The U.S. governments heavy investments in defense technologies and the need for high-performance, fuel-efficient aircraft have cemented composites importance in this sector.

North America Composite Market Competitive Landscape

The North America composite market is dominated by several key players that have established a strong foothold through extensive R&D, strategic partnerships, and government contracts. Companies like Toray Industries and Hexcel Corporation are at the forefront due to their strong supply chains and wide product portfolios catering to high-demand industries such as aerospace and defense. Additionally, companies are leveraging advancements in manufacturing processes to deliver high-quality composites for next-generation applications.

|

Company Name |

Establishment Year |

Headquarters |

Material Expertise |

Global Footprint |

Revenue (USD Bn) |

Manufacturing Capacity |

R&D Investments |

Market Share |

Partnerships |

|

Toray Industries, Inc. |

1926 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

|

Hexcel Corporation |

1948 |

Stamford, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

Solvay SA |

1863 |

Brussels, Belgium |

- |

- |

- |

- |

- |

- |

- |

|

Owens Corning |

1938 |

Ohio, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

Mitsubishi Chemical Holdings |

2005 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

North America Composite Market Analysis

Growth Drivers

- Rising Demand from Aerospace and Defense Sector: The aerospace and defense sectors are significant consumers of composite materials, driven by their demand for lightweight, high-strength materials. The Federal Aviation Administration (FAA) mandates stringent safety standards, pushing for advanced composite usage in the sector. In 2023, the U.S. Department of Defense budget allocated over $140 billion for aircraft procurement, maintenance, and R&D, which includes composite materials for defense applications. Composites now constitute more than 50,000 tons of materials used annually in aerospace structures.

- Increased Usage in Automotive Lightweighting: With Corporate Average Fuel Economy (CAFE) standards tightening, manufacturers are turning to composites for lighter vehicle structures. In 2022, the U.S. automotive sector produced around 9.2 million cars, with advanced composites being critical for electric vehicle (EV) development. EV sales surged by over 800,000 units in 2023, with lightweight composite materials playing a key role in improving energy efficiency. The U.S. Environmental Protection Agency (EPA) continues to emphasize emission reductions, boosting composite demand .

- Shift Towards Renewable Energy: Wind turbine blades are primarily made from composites due to their strength and durability. In 2023, the U.S. wind energy capacity surpassed 140 GW, with composite materials contributing to the construction of turbines. Each megawatt of wind power requires approximately 7.6 metric tons of composite materials. The Department of Energy (DOE) has committed over $120 million to wind energy projects, spurring further demand for composites in turbine manufacturing .

Challenges

- High Production Costs of Advanced Composites: The production of advanced composites, especially carbon fiber-reinforced polymers, remains cost-intensive, deterring their wider adoption in cost-sensitive industries. For instance, the average cost of carbon fiber per ton in 2023 was approximately $30,000. The high costs are attributed to energy-intensive manufacturing processes and limited scalability. Government subsidies, like the U.S. Advanced Manufacturing Offices $8 million investment, aim to reduce production costs but remain insufficient to completely offset the expense for manufacturers.

- Complex Manufacturing Processes: Manufacturing composite materials is labor-intensive and requires specialized equipment, which limits scalability. In 2022, the average setup cost for advanced composite manufacturing facilities was around $1.5 million, creating barriers for smaller manufacturers. Complex fabrication methods, including autoclaving and hand lay-up, add significant time and labor costs.

North America Composite Market Future Outlook

North American composite market is expected to experience robust growth driven by technological advancements and increasing demand in high-growth industries such as aerospace, automotive, and renewable energy. With the growing focus on sustainability and lightweighting, composites will continue to play a vital role in improving energy efficiency in electric vehicles (EVs) and reducing the carbon footprint of manufacturing processes. The development of bio-based composites and advancements in 3D printing technologies are poised to further enhance the material performance and adoption across various sectors.

Market Opportunities

- Increased Adoption in Construction and Infrastructure: The U.S. construction industry, valued at $1.9 trillion in 2023, is gradually adopting composites for bridges, pipelines, and other infrastructure projects. In particular, fiber-reinforced polymers (FRP) are being utilized in bridge construction. The Federal Highway Administration (FHWA) is investing over $10 billion annually in infrastructure development, creating substantial opportunities for composite material applications.

- Development of High-Performance Hybrid Composites: Innovations in hybrid composite materials, combining different fibers and resins, present significant opportunities for the North American composite market. In 2023, several research institutions in the U.S. received $50 million in federal funding to develop high-performance hybrid composites with improved mechanical properties. These materials are particularly attractive for the automotive and aerospace sectors, offering enhanced durability and reduced costs.

Scope of the Report

|

Material Type |

Carbon Fiber Composites Glass Fiber Composites Aramid Fiber Composites Metal Matrix Composites Polymer Matrix Composites |

|

Manufacturing Process |

Layup Process Filament Winding Injection Molding Pultrusion Resin Transfer Molding |

|

End-Use Industry |

Aerospace & Defense Automotive Construction Renewable Energy Electronics & Consumer Goods |

|

Performance |

Structural Composites Functional Composites |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Aerospace and Defense Contractors (e.g., Boeing, Lockheed Martin)

Automotive Manufacturers (e.g., Tesla, General Motors)

Renewable Energy Companies (e.g., Siemens Gamesa, Vestas)

Composite Material Suppliers and Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Defense, FAA)

Electronics & Consumer Goods Manufacturers

Companies

Players Mentioned in the Report

Toray Industries, Inc.

Hexcel Corporation

Solvay SA

Owens Corning

Mitsubishi Chemical Holdings

DuPont de Nemours, Inc.

BASF SE

Teijin Limited

SGL Carbon SE

Gurit Holding AG

Table of Contents

1. North America Composite Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Composite Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Composite Market Analysis (Material Composition, Performance Characteristics, and Manufacturing Processes)

3.1 Growth Drivers

3.1.1 Rising Demand from Aerospace and Defense Sector

3.1.2 Increased Usage in Automotive Lightweighting

3.1.3 Shift Towards Renewable Energy (Wind Turbines)

3.1.4 Rising Adoption in Sporting Goods and Consumer Electronics

3.2 Market Challenges

3.2.1 High Production Costs of Advanced Composites

3.2.2 Complex Manufacturing Processes

3.2.3 Recycling and Sustainability Concerns

3.2.4 Dependence on Raw Material Availability

3.3 Opportunities

3.3.1 Increased Adoption in Construction and Infrastructure

3.3.2 Development of High-Performance Hybrid Composites

3.3.3 Potential for Innovations in Additive Manufacturing

3.3.4 Government Investments in Aerospace and Defense Research

3.4 Trends

3.4.1 Rising Demand for Thermoplastic Composites

3.4.2 Integration of Composite Materials in 3D Printing

3.4.3 Growth of Bio-based Composites

3.4.4 Increased R&D for Improved Mechanical Properties

3.5 Government Regulation

3.5.1 Aerospace Material Certification (FAA, EASA)

3.5.2 Automotive Emission Regulations (CAFE Standards)

3.5.3 Sustainability Standards (Recycling and Waste Management)

3.5.4 Tax Incentives for Renewable Energy Projects

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Composite Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Carbon Fiber Composites

4.1.2 Glass Fiber Composites

4.1.3 Aramid Fiber Composites

4.1.4 Metal Matrix Composites

4.1.5 Polymer Matrix Composites

4.2 By Manufacturing Process (In Value %)

4.2.1 Layup Process

4.2.2 Filament Winding

4.2.3 Injection Molding

4.2.4 Pultrusion

4.2.5 Resin Transfer Molding

4.3 By End-Use Industry (In Value %)

4.3.1 Aerospace & Defense

4.3.2 Automotive

4.3.3 Construction

4.3.4 Renewable Energy

4.3.5 Electronics & Consumer Goods

4.4 By Performance (In Value %)

4.4.1 Structural Composites

4.4.2 Functional Composites

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Composite Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Toray Industries, Inc.

5.1.2 Hexcel Corporation

5.1.3 Solvay SA

5.1.4 Teijin Limited

5.1.5 Owens Corning

5.1.6 Mitsubishi Chemical Holdings Corporation

5.1.7 SGL Carbon SE

5.1.8 DuPont de Nemours, Inc.

5.1.9 BASF SE

5.1.10 Gurit Holding AG

5.2 Cross Comparison Parameters (Manufacturing Capacity, Innovation Capabilities, Global Footprint, Revenue, Material Expertise, Vertical Integration, R&D Expenditure, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Collaborations

5.8 Government Contracts and Defense Spending

6. North America Composite Market Regulatory Framework

6.1 Environmental Regulations (Greenhouse Gas Emissions, Waste Management)

6.2 Occupational Safety Standards (Material Handling and Exposure)

6.3 Compliance Requirements (ASTM, ISO Standards)

6.4 Certification Processes (Product Testing and Approvals)

7. North America Composite Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Composite Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Manufacturing Process (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Performance (In Value %)

8.5 By Region (In Value %)

9. North America Composite Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

The research process begins with a comprehensive ecosystem mapping that identifies all major stakeholders within the North American composite market. This step leverages both primary and secondary research sources, including government databases and proprietary market data. The goal is to define and analyze the key variables that influence market dynamics such as material demand, manufacturing trends, and regulatory requirements.

Step 2: Market Analysis and Construction

Historical data from credible sources such as government reports and industry white papers are compiled to understand the markets past performance. This involves analyzing the penetration of composite materials in key sectors like aerospace and automotive, and assessing overall revenue generation. Key performance metrics such as manufacturing efficiency and cost reduction strategies are also evaluated to ensure an accurate market outlook.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding future growth trends are validated through interviews with industry experts from leading composite manufacturing companies. These consultations, conducted via telephone and face-to-face interactions, provide valuable insights into production challenges, material innovation, and market opportunities. The information obtained is critical for refining the market forecast.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from all sources, including proprietary databases, expert consultations, and government reports. This information is cross-referenced to ensure accuracy and reliability. The final report is constructed using a top-down and bottom-up approach, providing a comprehensive analysis of the North American composite market, including key trends, growth drivers, and competitive dynamics.

Frequently Asked Questions

01. How big is the North America Composite Market?

The North America composite market is valued at USD 30 billion in 2023, driven by increasing demand in industries such as aerospace, automotive, and renewable energy.

02. What are the challenges in the North America Composite Market?

Key challenges in North America composite market include the high cost of producing advanced composites, complex manufacturing processes, and sustainability concerns related to recycling and waste management.

03. Who are the major players in the North America Composite Market?

Major players in North America composite market include Toray Industries, Hexcel Corporation, Solvay SA, Owens Corning, and Mitsubishi Chemical Holdings, each dominating due to their advanced manufacturing capabilities and strong industry partnerships.

04. What are the growth drivers of the North America Composite Market?

North America composite market is driven by rising demand from the aerospace and defense sectors, the push for lightweight materials in the automotive industry, and the increasing adoption of composites in wind turbines and other renewable energy applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.