North America Construction Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD10274

December 2024

85

About the Report

North America Construction Market Overview

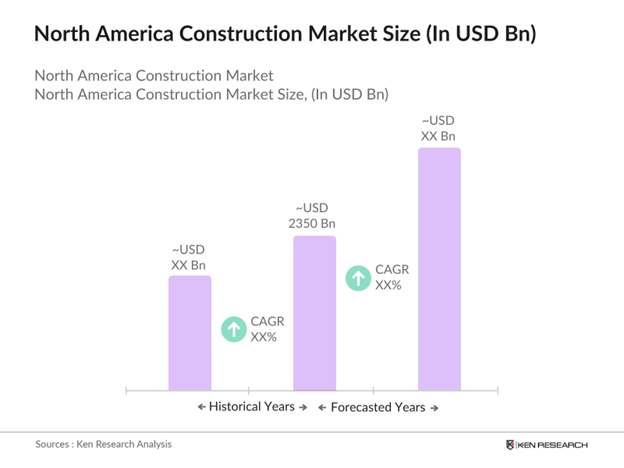

- The North America Construction Market is valued at USD 2350 billion, driven by a steady expansion in infrastructure projects, both in urban areas and rural developments. Key drivers include government investments in infrastructure, private sector contributions, and an increasing focus on sustainable construction practices. Market size is bolstered by substantial public funding in transportation networks, renewable energy projects, and commercial construction, contributing significantly to its growth.

- The United States holds a dominant position within the North America Construction Market due to its advanced construction technologies, substantial federal and private investment, and significant urbanization. Key cities such as New York, Los Angeles, and Houston are pivotal hubs for construction activities, mainly due to their population density, industrial significance, and continuous infrastructure development. Canada also plays a role, especially in renewable energy projects and urban infrastructure.

- Stringent building codes and safety standards govern North American construction to ensure structural integrity and public safety. In 2024, the U.S. implemented the latest ICC Building Codes, affecting nearly 11 million construction projects nationwide. Canada mandates similar codes under its National Building Code, with updates in 2023 to improve seismic resilience. These regulations impact construction design, materials, and project timelines, reinforcing safety and quality.

North America Construction Market Segmentation

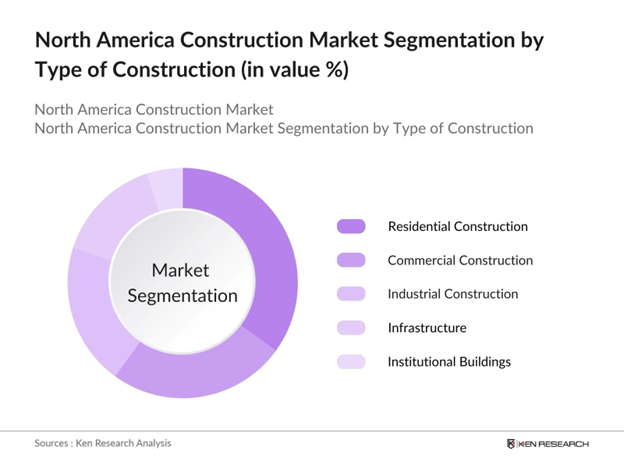

By Type of Construction: The North America Construction Market is segmented by type of construction into Residential, Commercial, Industrial, Infrastructure, and Institutional Buildings. Recently, the residential construction segment has held a dominant position within this segmentation due to a high demand for housing and urban expansion in metropolitan areas. Additionally, rising mortgage approvals and favorable interest rates support the growth of this sector, with residential projects being consistently prioritized.

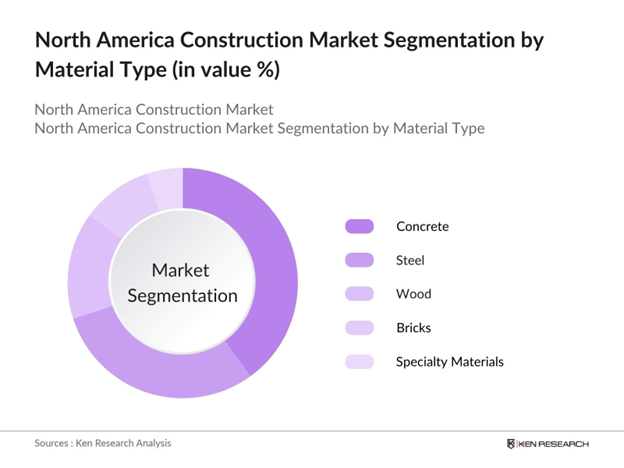

By Material Type: The construction market in North America is also segmented by material type, comprising Concrete, Steel, Wood, Bricks, and Specialty Materials. Concrete is the dominant sub-segment due to its durability, cost-effectiveness, and structural efficiency, making it highly preferable for a wide range of construction projects. Its resilience to harsh weather conditions and adaptability to diverse building requirements further solidify its prominent position in the market.

North America Construction Market Competitive Landscape

The North America Construction Market is highly competitive, with several key players leading the industry through extensive project portfolios and technological advancements. Below is an overview of five major companies, including their establishment year, headquarters, and other pertinent details:

North America Construction Market Analysis

Growth Drivers

- Urban Infrastructure Expansion: In 2023, the U.S. government allocated over $89 billion for transit infrastructure, including roads and public transit systems, under the Bipartisan Infrastructure Law (source). Canada has similarly invested $33 billion in its "Investing in Canada Plan," targeting public infrastructure enhancements across its major cities. These commitments respond to an estimated urban population of 296 million people in the region by 2025, further underscoring the need for expansion.

- Technological Advancements in Construction (e.g., BIM, IoT, AI): Technological advancements in construction, especially Building Information Modeling (BIM), Internet of Things (IoT), and Artificial Intelligence (AI), are reshaping construction practices across North America. The U.S. Department of Energy funded $32 million for AI-integrated construction systems in 2023, enhancing project efficiency. BIM usage has increased by 58% since 2022, with 76% of contractors reporting productivity gains. IoT-connected construction sites are predicted to monitor over 400,000 devices by the end of 2025, improving safety and reducing on-site injuries.

- Investment in Renewable Energy Infrastructure: Renewable energy infrastructure projects are gaining momentum as part of North America's commitment to reducing carbon emissions. The U.S. has seen substantial investments in renewable energy since the Inflation Reduction Act (IRA) was enacted, with reports indicating that companies have announced over $121 billion in capital investment for clean energy projects since August 2022, which includes approximately 301 major projects across various statesCanada allocated $5.4 billion for clean energy projects through the "2030 Emissions Reduction Plan".

Challenges

- Regulatory Compliance Costs: The compliance burden on construction companies remains high in North America, with federal and state regulations requiring substantial financial commitments. In 2024, U.S. construction firms spent an estimated $81 billion on regulatory compliance, encompassing environmental, safety, and labor requirements. Canadian firms similarly reported increased compliance costs, with 18% of their budgets allocated to meeting evolving building codes and environmental standards. These costs create financial challenges, especially for small to mid-sized contractors.

- Raw Material Price Volatility: Construction material costs have shown significant volatility, impacting budgeting and planning in the construction sector. In 2023, the price of lumber and steel fluctuated between $400 and $700 per metric ton, creating an unpredictable cost environment. Cement prices also rose by 12% in the same period due to supply constraints and inflationary pressures. Price volatility requires firms to adopt strategic procurement practices, affecting profit margins and potentially delaying projects.

North America Construction Market Future Outlook

Over the next five years, the North America Construction Market is expected to witness sustained growth. This expansion is attributed to increased government spending on public infrastructure, the adoption of green building standards, and the integration of digital technologies such as Building Information Modeling (BIM) and IoT. The push towards sustainability and smart city developments also presents numerous growth opportunities for market players.

Market Opportunities

- Integration of Digital Technologies: Digital technologies such as virtual reality (VR), augmented reality (AR), and digital twins are being integrated into construction processes, improving project management and efficiency. By 2024, 42% of U.S. construction firms have adopted VR/AR tools, with increased project efficiency of up to 25%. Digital twins are becoming popular in Canada, where they support real-time project simulations and resource management, further improving project timelines. Digital transformation opens new operational efficiencies, reducing time and cost overruns.

- Infrastructure Modernization Programs: Modernization initiatives across North America support construction growth by addressing aging infrastructure. The U.S. allocated $72 billion for bridge and highway upgrades in 2024, targeting the repair of over 12,000 miles of highway (source). Canada is investing $2.6 billion in 2023 toward its "Investing in Canada" infrastructure initiative, improving transit systems and public facilities. These modernization efforts are expected to stimulate local economies and create thousands of jobs.

Scope of the Report

Scope Table

|

Segment |

Sub-Segment |

|

Type of Construction |

Residential Construction Commercial Construction Industrial Construction Infrastructure Institutional Buildings |

|

Material Type |

Concrete Steel Wood Bricks Specialty Materials |

|

Technology |

Building Information Modeling (BIM) 3D Printing Prefabrication and Modular Construction Robotics and Automation IoT in Construction |

|

End-User |

Private Sector Public Sector Joint Ventures |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Construction Firms

Building Material Suppliers

Infrastructure Development Agencies

Real Estate Developers

Environmental and Sustainability Organizations

Technology Solution Providers (IoT and BIM software providers)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Housing and Urban Development, Federal Highway Administration)

Companies

Players Mentioned in the Report

Bechtel Corporation

Turner Construction Company

Kiewit Corporation

Fluor Corporation

Jacobs Engineering Group

PCL Constructors Inc.

AECOM

Skanska USA

Gilbane Building Company

DPR Construction

Table of Contents

1. North America Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Construction Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Construction Market Analysis

3.1. Growth Drivers

3.1.1. Urban Infrastructure Expansion

3.1.2. Public-Private Partnership Projects

3.1.3. Technological Advancements in Construction (e.g., BIM, IoT, AI)

3.1.4. Investment in Renewable Energy Infrastructure

3.2. Market Challenges

3.2.1. Skilled Labor Shortage

3.2.2. Regulatory Compliance Costs

3.2.3. Raw Material Price Volatility

3.2.4. Project Financing and Funding Gaps

3.3. Opportunities

3.3.1. Sustainability Initiatives in Construction

3.3.2. Integration of Digital Technologies

3.3.3. Infrastructure Modernization Programs

3.3.4. Growth in Modular Construction

3.4. Trends

3.4.1. Green Building Standards and Certifications

3.4.2. Rise of Prefabricated Structures

3.4.3. Smart City Projects

3.4.4. Use of Robotics and Automation in Construction

3.5. Government Regulations

3.5.1. Building Codes and Safety Standards

3.5.2. Environmental Compliance Mandates

3.5.3. Labor and Employment Laws

3.5.4. Tax Incentives and Funding for Green Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Construction Market Segmentation

4.1. By Type of Construction (In Value %)

4.1.1. Residential Construction

4.1.2. Commercial Construction

4.1.3. Industrial Construction

4.1.4. Infrastructure (Transportation, Utilities)

4.1.5. Institutional Buildings (Healthcare, Education)

4.2. By Material Type (In Value %)

4.2.1. Concrete

4.2.2. Steel

4.2.3. Wood

4.2.4. Bricks

4.2.5. Other Specialty Materials

4.3. By Technology (In Value %)

4.3.1. Building Information Modeling (BIM)

4.3.2. 3D Printing

4.3.3. Prefabrication and Modular Construction

4.3.4. Robotics and Automation

4.3.5. Internet of Things (IoT) in Construction

4.4. By End-User (In Value %)

4.4.1. Private Sector

4.4.2. Public Sector

4.4.3. Joint Ventures

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Construction Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bechtel Corporation

5.1.2. Turner Construction Company

5.1.3. Kiewit Corporation

5.1.4. Fluor Corporation

5.1.5. Jacobs Engineering Group

5.1.6. PCL Constructors Inc.

5.1.7. AECOM

5.1.8. Skanska USA

5.1.9. Gilbane Building Company

5.1.10. DPR Construction

5.2. Cross Comparison Parameters (Revenue, Regional Presence, Market Share, Project Portfolio, Workforce Size, Innovation Index, Sustainability Initiatives, Digital Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Research and Development Focus

5.8. Technological Advancements

5.9. Sustainability and ESG Initiatives

6. North America Construction Market Regulatory Framework

6.1. Building and Zoning Codes

6.2. Environmental Regulations and Permits

6.3. Construction Safety Standards

6.4. Licensing and Certification Requirements

7. North America Construction Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Construction Future Market Segmentation

8.1. By Type of Construction (In Value %)

8.2. By Material Type (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Construction Market Analysts Recommendations

9.1. Market Entry Strategies

9.2. Key Expansion Opportunities

9.3. Technology Adoption Recommendations

9.4. Risk Mitigation Strategies

Research Methodology

Step 1: Identification of Key Variables

In this phase, a detailed map of the construction markets ecosystem is created to identify all key variables. Research includes gathering data from reliable databases, focusing on factors such as project types, construction materials, and technology adoption in the market.

Step 2: Market Analysis and Construction

Historical data for market growth and sectoral penetration is analyzed to understand the revenue contribution of each segment. This step also includes a comparison of service providers by evaluating their respective market presences and technology integration

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through expert interviews, including top-level executives from construction firms, which provide critical insights into current trends, challenges, and future growth areas within the market.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all gathered insights and statistical data, presenting a comprehensive market analysis. Collaboration with construction firms offers validation, ensuring the report is thorough, credible, and reflective of real-time industry dynamics.

Frequently Asked Questions

01. How big is the North America Construction Market?

The North America Construction Market was valued at USD 2350 billion in 2023, driven by substantial investments in infrastructure and sustainable construction projects.

02. What are the key challenges in the North America Construction Market?

Challenges in North America Construction Market include rising material costs, regulatory compliance issues, and a skilled labor shortage, which impact project timelines and operational costs.

03. Who are the major players in the North America Construction Market?

Key players in North America Construction Market include Bechtel Corporation, Turner Construction Company, Kiewit Corporation, and Jacobs Engineering Group, who lead the market through extensive project portfolios and technological advancements.

05. What are the growth drivers for the North America Construction Market?

Growth drivers in North America Construction Market include increased government investment in infrastructure, adoption of green building standards, and advancements in construction technology such as BIM and IoT.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.